2010 Guarante Export Nordea

2010 Guarante Export Nordea

Uploaded by

Atthippattu Srinivasan MuralitharanCopyright:

Available Formats

2010 Guarante Export Nordea

2010 Guarante Export Nordea

Uploaded by

Atthippattu Srinivasan MuralitharanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

2010 Guarante Export Nordea

2010 Guarante Export Nordea

Uploaded by

Atthippattu Srinivasan MuralitharanCopyright:

Available Formats

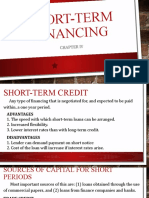

Guarantees for exports

- improving your international trade

Secure against the unexpected. Obtain advance payment

Advance payment is naturally beneficial to you as

the seller, but buyers can be reluctant to pay in

Guarantees are commonly used to cover the risk advance due to the risk of not receiving a refund in

of non-compliance by a contract party to fulfil case of non-delivery.

agreed obligations, e.g. failure to pay or deliver.

Guarantees can be used in open account trade as By offering the buyer an advance payment guarantee

well as a complement to collections and documen- you increase the likelihood of obtaining an advance

tary credits. or partial advance payment, also when you trade

under collections or documentary credits.

Common types of guarantees

Advance payment guarantee Secure the payment

Payment guarantee If you trade on an open account basis or use collec-

Performance guarantee tions, you rely on the buyer being willing and able to

pay as agreed. A payment guarantee in your favour

On demand or accessory securing the buyers payment obligations will provide

On demand guarantees are independent of the you with compensation should the buyer fail to pay.

underlying trade contract and payable directly

upon the beneficiarys claim, while accessory In order for you to further reduce your risk, if you

guarantees are connected to the underlying and your buyer so agree and at the request of your

contract and payable upon the guaranteed partys buyers bank, Nordea can issue* the payment

actual default under the contract. guarantee in your favour. This way your risk is on

Nordea instead of the buyers bank.

*) subject to credit approval.

Nordea Bank AB (publ) Marketing 05.10 (19760003)

How it works In cases of claims for payment under the guaran-

First you and the buyer agree on the terms of the tee, Nordea will check the claim as well as inform

contract (1). In this case your buyer agrees to you, depending on the nature of the guarantee, as

effect advance payment against a direct advance to whether you should effect payment or possibly

payment guarantee. You will then apply for the refuse until your actual contractual default has

guarantee at Nordea (2). Nordea issues the been determined.

requested guarantee based on the information

in the contract between you and your buyer. Welcome to contact us and to find out more about

how we can assist you with your trade finance

The guarantee is then advised to your buyer transactions. You can also find us on the web

directly from Nordea as an original paper version nordea.com/tradefinance

(3) or by SWIFT through a correspondent bank as

a post office (3a & 3b). You are now ready to

start the trade (4).

buyer 1 Agreement

seller

Beneficiary Principal

4 Shipments & Payments

3b Advising

2 Application

3I

ss

ua

nc

e&

Ad

vis

ing

buyers bank

Issuing Bank

3a Issuance

!

Nordea Trade Finance:

Located in Denmark, Finland, Norway and Sweden as well as in China, Estonia,

Latvia, Lithuania, Poland, Russia, Singapore, UK and USA.

Offers a full range of trade finance services including collections, documentary

credits and guarantees as well as trade finance related e-solutions.

Is the largest Trade Finance Bank in the Nordic region.

You might also like

- Financial Model Template by SlidebeanDocument388 pagesFinancial Model Template by SlidebeanAtthippattu Srinivasan MuralitharanNo ratings yet

- Module Strat Mgt.Document128 pagesModule Strat Mgt.BoRaHaE100% (1)

- Itab RevieweerDocument13 pagesItab RevieweerAra PanganibanNo ratings yet

- Loans and Discount FunctionDocument37 pagesLoans and Discount Functionrojon pharmacy80% (5)

- Nordea Import Guarantees Fact Sheet For ImportersDocument2 pagesNordea Import Guarantees Fact Sheet For ImportersAlice ChibaleNo ratings yet

- Standby Letters of Credit: - Improving Your International TradeDocument2 pagesStandby Letters of Credit: - Improving Your International Tradevovica6843No ratings yet

- Documentary Credit BrochureDocument8 pagesDocumentary Credit BrochurehabchiNo ratings yet

- International Guarantees: - A Quest Ion of Compensat IonDocument3 pagesInternational Guarantees: - A Quest Ion of Compensat Ionpallab1983No ratings yet

- Latter of Credit and Other FinaciDocument57 pagesLatter of Credit and Other FinaciHaresh RajputNo ratings yet

- Bank Guarantee BrochureDocument46 pagesBank Guarantee BrochureVictoria Adhitya0% (1)

- International Trade Instruments: DR (Prof) Sandeep ParmarDocument48 pagesInternational Trade Instruments: DR (Prof) Sandeep ParmarAbhijeet BhattacharyaNo ratings yet

- Inbt 211Document5 pagesInbt 211iftinay8197antNo ratings yet

- Ibt Prefi TopicDocument11 pagesIbt Prefi TopicGrecy Mitch L. PatosaNo ratings yet

- LC SRS-2Document20 pagesLC SRS-2puku90No ratings yet

- Unit 3 4Document28 pagesUnit 3 4manjarisingh2502No ratings yet

- TRADEDocument114 pagesTRADERavi BabuNo ratings yet

- Miscellaneous Banking ActivitiesDocument20 pagesMiscellaneous Banking ActivitiessaktipadhiNo ratings yet

- Case Study On Letter of CreditDocument9 pagesCase Study On Letter of CreditPrahant KumarNo ratings yet

- Assignment 2 LC, CAD and Documentation.Document12 pagesAssignment 2 LC, CAD and Documentation.TaddesseNo ratings yet

- Chapter 7 Trade FinanceDocument25 pagesChapter 7 Trade FinancedhitalkhushiNo ratings yet

- Assignment On Writing A Letter of CreditDocument13 pagesAssignment On Writing A Letter of CreditZim-Ud -Daula0% (2)

- LC ProjectDocument101 pagesLC ProjectZubair ChNo ratings yet

- Case Study 2 Banker Acceptance ANSWERDocument3 pagesCase Study 2 Banker Acceptance ANSWERsittal muthuvairuNo ratings yet

- Cash Flow CorrelationDocument18 pagesCash Flow CorrelationopulencefinservNo ratings yet

- UPDATED What Are Usance Letters of Credit TFG 2022 Usance LC GuideDocument12 pagesUPDATED What Are Usance Letters of Credit TFG 2022 Usance LC GuideAnil ShahNo ratings yet

- Sell More With A Buyer Credit GuaranteeDocument2 pagesSell More With A Buyer Credit GuaranteeSalah AyoubiNo ratings yet

- I.B AssignmentDocument5 pagesI.B Assignmentkhanzadaali717No ratings yet

- Standby Letter Credit ExplanationDocument8 pagesStandby Letter Credit Explanationanujanair3146100% (1)

- TOPICDocument17 pagesTOPICSolgrynNo ratings yet

- Lecture 5 - Banker AcceptancesDocument14 pagesLecture 5 - Banker AcceptancesYvonne100% (2)

- Terms of PaymentDocument14 pagesTerms of PaymentAnkit VermaNo ratings yet

- Letter of Credit Case StudyDocument9 pagesLetter of Credit Case StudyLiz KallistaNo ratings yet

- Lml4807 Examination PackDocument43 pagesLml4807 Examination Packkarabo MkhontoNo ratings yet

- Bill of Exchange MaybankDocument3 pagesBill of Exchange MaybankBuayaz GamingNo ratings yet

- Factoring and ForfaitingDocument21 pagesFactoring and Forfaitingnishadhar100% (1)

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)

- Sources of Finance CA Snehal KamdarDocument50 pagesSources of Finance CA Snehal KamdarGaurav SukhijaNo ratings yet

- What Is A Letter of Credit?Document29 pagesWhat Is A Letter of Credit?Varun DagaNo ratings yet

- Letter of CreditDocument35 pagesLetter of CreditYash AdukiaNo ratings yet

- Objectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcDocument8 pagesObjectives of Receivables Management: Standards, Length of Credit Period, Cash Discount, Discount Period EtcRekha SoniNo ratings yet

- Letter of CreditsDocument35 pagesLetter of CreditsAstha NautiyalNo ratings yet

- Letters of Credit: Idex December 2003 Teacher: Fernando HinojosaDocument17 pagesLetters of Credit: Idex December 2003 Teacher: Fernando Hinojosavaibhav_aaav11No ratings yet

- Credit Collection Module 2Document9 pagesCredit Collection Module 2Crystal Jade Apolinario Refil100% (2)

- Discounting, Factoring & Forfaiting in Financial ServicesDocument57 pagesDiscounting, Factoring & Forfaiting in Financial ServicesdrskirubadeviNo ratings yet

- EID Unit-3Document19 pagesEID Unit-3richasoni98765No ratings yet

- Chapter 5Document15 pagesChapter 5Nicole LasiNo ratings yet

- 02 Credit System - PDFDocument49 pages02 Credit System - PDFsharmaine gonzagaNo ratings yet

- Lu 4 FinalDocument32 pagesLu 4 FinalPhetho MachiliNo ratings yet

- Trade FinanceDocument6 pagesTrade Financeponyo5490No ratings yet

- Factoring, Forfaiting & Bills DiscountingDocument3 pagesFactoring, Forfaiting & Bills DiscountingkrishnadaskotaNo ratings yet

- Letters of CreditDocument12 pagesLetters of CreditPrince McGershonNo ratings yet

- Tahir KhanDocument10 pagesTahir KhantahirkkkNo ratings yet

- Letter of CreditDocument35 pagesLetter of Credithunt_pgNo ratings yet

- Financial GuaranteeDocument2 pagesFinancial Guaranteejeet_singh_deepNo ratings yet

- CNC Report OutlineDocument12 pagesCNC Report OutlineDhiann AlboresNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Letters of Credit and Documentary Collections: An Export and Import GuideFrom EverandLetters of Credit and Documentary Collections: An Export and Import GuideRating: 1 out of 5 stars1/5 (1)

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- (Sample) Overall Comparative AnalysisDocument21 pages(Sample) Overall Comparative AnalysisAtthippattu Srinivasan MuralitharanNo ratings yet

- காமகோடி AUG-2023Document151 pagesகாமகோடி AUG-2023Atthippattu Srinivasan MuralitharanNo ratings yet

- TN Guidance Cell ProposalDocument7 pagesTN Guidance Cell ProposalAtthippattu Srinivasan MuralitharanNo ratings yet

- சென்னை தினத்தந்தி 24-8-23Document14 pagesசென்னை தினத்தந்தி 24-8-23Atthippattu Srinivasan MuralitharanNo ratings yet

- Timesheet With Value: Resource Name Resource Budget % Budget Hours in MonthDocument8 pagesTimesheet With Value: Resource Name Resource Budget % Budget Hours in MonthAtthippattu Srinivasan MuralitharanNo ratings yet

- Mobility and Handoff Management in Wireless Networks: Chapter ManuscriptDocument26 pagesMobility and Handoff Management in Wireless Networks: Chapter ManuscriptAtthippattu Srinivasan MuralitharanNo ratings yet

- Timesheet Template 04Document4 pagesTimesheet Template 04Atthippattu Srinivasan MuralitharanNo ratings yet

- Non Disclosure Agreement - 3Document3 pagesNon Disclosure Agreement - 3Atthippattu Srinivasan MuralitharanNo ratings yet

- Ak BG HSBC Romantik - Doc-1Document13 pagesAk BG HSBC Romantik - Doc-1Atthippattu Srinivasan MuralitharanNo ratings yet

- Final Model PPADocument168 pagesFinal Model PPAAtthippattu Srinivasan MuralitharanNo ratings yet

- Consultant Letter Pure EnviroDocument2 pagesConsultant Letter Pure EnviroAtthippattu Srinivasan MuralitharanNo ratings yet

- Loi - 44+2 - BG - Uk V.2 DPDocument17 pagesLoi - 44+2 - BG - Uk V.2 DPAtthippattu Srinivasan MuralitharanNo ratings yet

- AFFIDAVIT For Legal Heir Certificate.184210346Document1 pageAFFIDAVIT For Legal Heir Certificate.184210346Atthippattu Srinivasan MuralitharanNo ratings yet

- AFFIDAVIT FOR Legal Heir Certificate.184210346Document8 pagesAFFIDAVIT FOR Legal Heir Certificate.184210346Atthippattu Srinivasan Muralitharan0% (1)

- Blo!'/Out Preventer: Kooi/) Ey Coi'ItrolDocument46 pagesBlo!'/Out Preventer: Kooi/) Ey Coi'ItrolHamid Reza Babaei100% (1)

- Form 10Document2 pagesForm 10SanjoysaharoudraNo ratings yet

- CodingBootcamps E PDFDocument58 pagesCodingBootcamps E PDFjohanmulyadi007No ratings yet

- Board of Trustees v. VelascoDocument1 pageBoard of Trustees v. VelascoRAINBOW AVALANCHENo ratings yet

- Asian Paint & Berger Paints Company InfoDocument16 pagesAsian Paint & Berger Paints Company InfoSoniya DhyaniNo ratings yet

- Icl7611 Icl764xDocument26 pagesIcl7611 Icl764xNguyen ThangNo ratings yet

- C4 Bronze 4Document18 pagesC4 Bronze 4Betty MakharinskyNo ratings yet

- A State-Independent Linear Power Flow Model With Accurate Estimation of Voltage MagnitudeDocument11 pagesA State-Independent Linear Power Flow Model With Accurate Estimation of Voltage MagnitudeMichelle Maceas HenaoNo ratings yet

- Healthcare Pharmacies New Staff Pension ArrangementswithdisclaimerDocument43 pagesHealthcare Pharmacies New Staff Pension Arrangementswithdisclaimersaramahgob1989No ratings yet

- Deegan FAT3e TestBank Chapter 10Document17 pagesDeegan FAT3e TestBank Chapter 10Kamal sama100% (2)

- Lopez Vs PLATCODocument2 pagesLopez Vs PLATCOJessamine OrioqueNo ratings yet

- Example of Intrinsic Motivation StrategiesDocument3 pagesExample of Intrinsic Motivation StrategiesdotdotPindotNo ratings yet

- Als Dmea Q3 Cy 2023Document91 pagesAls Dmea Q3 Cy 2023Nilo ZolinaNo ratings yet

- Ebook Edge Computing 101Document20 pagesEbook Edge Computing 101nelson_esplugaNo ratings yet

- EBS Pre Built Content UPKDocument205 pagesEBS Pre Built Content UPKthiagoom100% (1)

- Advantages of Prestressed ConcreteDocument9 pagesAdvantages of Prestressed ConcreteKuruNo ratings yet

- Ebook 1 Call Center 101Document44 pagesEbook 1 Call Center 101Teddy Simei Ruano Lopez100% (1)

- Design Calculation of Single-Phase Permanent Slip Capacitor Induction Motor Used in Washing MachineDocument8 pagesDesign Calculation of Single-Phase Permanent Slip Capacitor Induction Motor Used in Washing MachineSeshu BabuNo ratings yet

- Ammonia Plant Safety & Related Facilities: × 11 Format, ISBN 0-8169-0878-8Document2 pagesAmmonia Plant Safety & Related Facilities: × 11 Format, ISBN 0-8169-0878-8Rodrigo CondarcoNo ratings yet

- Salty Sole - Case Study - FinancialDocument10 pagesSalty Sole - Case Study - FinancialEugene GaraninNo ratings yet

- Vae 311 PDFDocument3 pagesVae 311 PDFransinghNo ratings yet

- Scarabeo 125-200ie Workshop PDFDocument207 pagesScarabeo 125-200ie Workshop PDFFabio Lugato100% (1)

- Schemes For FarmersDocument5 pagesSchemes For FarmerssunnytataNo ratings yet

- Amsafe Seatbelt Airbag: First-Responder Reference GuideDocument10 pagesAmsafe Seatbelt Airbag: First-Responder Reference GuideAngel MogrovejoNo ratings yet

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDocument14 pages(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- Modul Ajar - MariaDocument5 pagesModul Ajar - MariaYeri KristiawanNo ratings yet

- Centrifugal ExtractorDocument5 pagesCentrifugal ExtractorShivaniNo ratings yet

- Leadership Principles and PracticesDocument6 pagesLeadership Principles and PracticesTaylor100% (1)