Assignment 3: Jayesh Kukreti 63 - Y

Assignment 3: Jayesh Kukreti 63 - Y

Uploaded by

Jayesh KukretiCopyright:

Available Formats

Assignment 3: Jayesh Kukreti 63 - Y

Assignment 3: Jayesh Kukreti 63 - Y

Uploaded by

Jayesh KukretiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Assignment 3: Jayesh Kukreti 63 - Y

Assignment 3: Jayesh Kukreti 63 - Y

Uploaded by

Jayesh KukretiCopyright:

Available Formats

Assignment 3

Jayesh Kukreti

063 Y

Butler Lumber Company

Objective: A short report as a credit officer of the bank processing the loan application of Butler

Lumber Company, granting the loan or rejecting it with reasons.

Key highlights about the company:

Founded in 1981

Mark Butler and his brother in law stark

Butler bought back the share and incorporated the company in 1988

Funded by a bank loan of 70000, to be repaid in 10 instalments

Business model: Procure lumber products at a discount by procuring in bulk and sell at a margin

The critical success factors:

Bulk procurement at a discount

Competitive pricing

Control of operating expenses

Key points of financial analysis of the company:

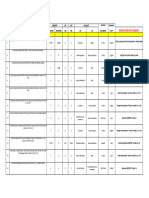

Increase in annual sales and profit: Annual sales of $1,697,000 in 1988, $2,013,000 in 1989, and

$2,694,000 in 1990 yielded after tax profits of $31,000 in 1988, $34,000 in 1989, and $44,000 in 1990.

Rapid increase in receivables and inventory have been responsible

Payment to Mr. Stark

Retained earnings provide only 16% of the funds needed

Major source has been trade credit and bank borrowing

Debt and current ratio is of concern

Increase in accounts and notes payable

Good sales prospects

Expected sales 3.6 million

Cost V/S Benefits

Consider average payable days of 46

Consider 2 percent discount if paid within 10 days

Additional cost of foregoing 2% trade discount

Assume a purchase of Rs.1000

He can pay either 980 in 10 days or 1000 in 46 days

In essence, the supplier is charging 20 for using 980 for 36 days

2.04 % for 36 days and 20.7% annually (approximately)

Anooj Mehta | X 024 | FSA | IFMR B 17

Assumptions:

Two scenarios

With additional bank credit Mr. Butler will reduce his payables period to 10 days

Mr. Butler pays in 46 days

Sales volume for 1991 will be 3.6 million

All purchase discounts will be taken for the period April 1 to December 1991

Issues

Company expanding rapidly

Increase in working capital requirements have outrun the capacity of the company to generate

funds from internal sources

Conclusion

Mr. Butler will need a much larger credit from the bank if he has to take advantage of the discount

The alternatives for Mr. Butler

Negotiate a larger volume of credit

Slow down the projected rate of expansion

Rely more on trade credit (46 days)

Continued expansion at a rate that cannot be financed proportionately from retained earnings will leave

Butler in a more vulnerable financial position and obviously will be high risk policy.

The bank has agreed to give a revolving secured short term 90 day note not to exceed $465,000 on a lien on

inventory and accounts receivables. But for long term borrowing bank has put up some restrictions that has to be

fulfilled by the company to get additional borrowings:

Maintain net working capital at a certain level

Additional investments in fixed assets only with bank's permission

Limitations on the fund withdrawal from banks

Interest would be

set on a floating-rate basis at 2 percentage points above the prime rate

Interest rate is expected to be 10.5%

Jayesh Kukreti| 063 Section - Y | FSA | IFMR B 17

You might also like

- Introduction To IFRS 9edDocument513 pagesIntroduction To IFRS 9edMohammed100% (5)

- Case Solution of Danfurn LLCDocument50 pagesCase Solution of Danfurn LLCAlia80% (5)

- Sabya BhaiDocument6 pagesSabya BhaiamanNo ratings yet

- Honda RoverDocument2 pagesHonda RoverSanvi KguNo ratings yet

- Kota Fibres, LTD.: BY Ashish Dhanani Mudit Garg Nitin PhogatDocument21 pagesKota Fibres, LTD.: BY Ashish Dhanani Mudit Garg Nitin PhogatAshish Dhanani100% (1)

- Harrington Mar 2012Document38 pagesHarrington Mar 2012Petro PetropoulosNo ratings yet

- The Butler Lumber Company - AH1Document6 pagesThe Butler Lumber Company - AH1shaluxlriNo ratings yet

- Receivables ManagementDocument27 pagesReceivables ManagementAbhijay GoyalNo ratings yet

- Accessing Financial FuturesDocument24 pagesAccessing Financial FuturesKumar VikasNo ratings yet

- HarringtonDocument8 pagesHarringtonMsrk SmithNo ratings yet

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Receivables ManagementDocument22 pagesReceivables Managementshayan.53260No ratings yet

- Butler Lumber Company Case SolutionDocument18 pagesButler Lumber Company Case SolutionNabab Shirajuddoula75% (8)

- Kota Fibres IncDocument20 pagesKota Fibres IncMuhamad FudolahNo ratings yet

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Kawsar Vai PPT & PDFDocument11 pagesKawsar Vai PPT & PDFsha972obayedNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH20 PPTDocument45 pagesRoss Fundamentals of Corporate Finance 13e CH20 PPTKhánh HuyềnNo ratings yet

- Fin242 Chapter 7 Ac Receivables MGTDocument16 pagesFin242 Chapter 7 Ac Receivables MGTseriainnur0No ratings yet

- The Objectives of Accounts Receivable ManagementDocument14 pagesThe Objectives of Accounts Receivable ManagementAjay Kumar TakiarNo ratings yet

- NPA Management and Recovery Strategies: K K JindalDocument47 pagesNPA Management and Recovery Strategies: K K Jindalbansi2kkNo ratings yet

- IB Bm2tr 3 Resources Answers6Document3 pagesIB Bm2tr 3 Resources Answers6Gabriel FungNo ratings yet

- Case 3 - Group 5, Section 2Document8 pagesCase 3 - Group 5, Section 2sd_tataNo ratings yet

- Non Performing AssetsDocument13 pagesNon Performing AssetsVinayaka McNo ratings yet

- Mob NpaDocument44 pagesMob NpaParthNo ratings yet

- Session 6Document10 pagesSession 6Talha JavedNo ratings yet

- Case Study Kota FiberDocument24 pagesCase Study Kota FiberHeniNo ratings yet

- Initial Public Offerings, Investment Banking, & Financial Restructuring 1Document19 pagesInitial Public Offerings, Investment Banking, & Financial Restructuring 1faezaNo ratings yet

- Management OF Non-Performing AssetsDocument31 pagesManagement OF Non-Performing AssetsPrashant RaiNo ratings yet

- Article Review On Non Performing Asset IN BanksDocument22 pagesArticle Review On Non Performing Asset IN BanksShrikant GuptaNo ratings yet

- Why Organisations Hold CashDocument13 pagesWhy Organisations Hold CashAjay Kumar TakiarNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH20Document45 pagesRoss Fundamentals of Corporate Finance 13e CH20Mỹ Dung Hoàng NguyễnNo ratings yet

- Group 5 Accounts Receivable Management CityShopsDocument34 pagesGroup 5 Accounts Receivable Management CityShopsJ. BartNo ratings yet

- External Factors:-: Willful DefaultsDocument8 pagesExternal Factors:-: Willful Defaultsm_dattaiasNo ratings yet

- Session 27 - 28 - Bank Credit - IIDocument31 pagesSession 27 - 28 - Bank Credit - IIArun KumarNo ratings yet

- NPA NotesDocument33 pagesNPA NotesAdv Sheetal SaylekarNo ratings yet

- SFM Case 1 Group 3Document7 pagesSFM Case 1 Group 3Subodh JoshiNo ratings yet

- Butler Lumber Case DiscussionDocument3 pagesButler Lumber Case DiscussionJayzie Li100% (1)

- Session 17Document41 pagesSession 17Priyanshi PaliwalNo ratings yet

- 10 Working Capital Part CDocument51 pages10 Working Capital Part Cp24rohithbNo ratings yet

- Receivables & Paybles ManagementDocument9 pagesReceivables & Paybles Managementf4farhansiddiqui17No ratings yet

- Chapter 3 FinmanDocument11 pagesChapter 3 FinmanJullia BelgicaNo ratings yet

- CF Unit 2Document30 pagesCF Unit 2Saravanan ShanmugamNo ratings yet

- Butler Lumber Company: Anthony Corcoran Nazanin Mirshahi Robert Brackmann Peiman Vahdati Eric ShumannDocument4 pagesButler Lumber Company: Anthony Corcoran Nazanin Mirshahi Robert Brackmann Peiman Vahdati Eric ShumannPeyman VahdatiNo ratings yet

- 03.working Capital Management Paper 03Document6 pages03.working Capital Management Paper 03Hashan DasanayakaNo ratings yet

- Factors For Rise in NpasDocument10 pagesFactors For Rise in NpasRakesh KushwahNo ratings yet

- Accounting For Business: Chapter 7: Ratio Analysis 2: Liquidity, Working Capital and Long-Term Financial StabilityDocument24 pagesAccounting For Business: Chapter 7: Ratio Analysis 2: Liquidity, Working Capital and Long-Term Financial StabilityegNo ratings yet

- Accounts Receivable ManagementDocument14 pagesAccounts Receivable ManagementJay-ar Castillo Watin Jr.No ratings yet

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- MA REV 2 - Midterm Exam Wit Ans KeyDocument14 pagesMA REV 2 - Midterm Exam Wit Ans Keylouise carinoNo ratings yet

- Accounts Receivable ManagementDocument14 pagesAccounts Receivable ManagementJay-ar Castillo Watin Jr.100% (1)

- Account Receivable Management Class PresentationDocument10 pagesAccount Receivable Management Class Presentationbalochbrother869No ratings yet

- 2. Installment Sales MethodDocument18 pages2. Installment Sales MethodImee Nichole BaloNo ratings yet

- Fasset Discussion Class Jun 2021 Pastel - All Regions - Class Version - Session 2Document69 pagesFasset Discussion Class Jun 2021 Pastel - All Regions - Class Version - Session 2yusuf swabuNo ratings yet

- Fundamentals of Bookkeeping: Ucpb Savings Bank Operations DivisionDocument71 pagesFundamentals of Bookkeeping: Ucpb Savings Bank Operations DivisionJames ToNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDoris Yee33% (3)

- FM Management NotesDocument96 pagesFM Management NotesGovindh200180% (10)

- The Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesFrom EverandThe Art of Persuasion: Cold Calling Home Sellers for Owner Financing OpportunitiesNo ratings yet

- RBC CaseAnswers Group13Document2 pagesRBC CaseAnswers Group13Jayesh KukretiNo ratings yet

- Hilton Hotels: Brand Differentiation Through CRMDocument4 pagesHilton Hotels: Brand Differentiation Through CRMJayesh KukretiNo ratings yet

- Percentage Defecation in Open in India Is Approx. 48%: Some Outcome Measures AreDocument2 pagesPercentage Defecation in Open in India Is Approx. 48%: Some Outcome Measures AreJayesh KukretiNo ratings yet

- DemoDocument3 pagesDemoJayesh KukretiNo ratings yet

- RBC CaseAnswers Group13Document4 pagesRBC CaseAnswers Group13Jayesh KukretiNo ratings yet

- Jayesh BitstreamDocument3 pagesJayesh BitstreamJayesh KukretiNo ratings yet

- BM Lesson05 Buying and Selling DiscountsDocument9 pagesBM Lesson05 Buying and Selling DiscountsMa. Concepcion Agatha De CastroNo ratings yet

- Financial Accounting Assignment - 1Document17 pagesFinancial Accounting Assignment - 1Yosef MitikuNo ratings yet

- MCLR Historical Data - SBI Corporate WebsiteDocument2 pagesMCLR Historical Data - SBI Corporate WebsiteSyed AhmedNo ratings yet

- Navao vs. CA 251 SCRA 545Document2 pagesNavao vs. CA 251 SCRA 545Darlyn Bangsoy100% (1)

- Summer Reviewer: A C B O 2007 Civil LawDocument46 pagesSummer Reviewer: A C B O 2007 Civil LawMiGay Tan-Pelaez90% (20)

- QUESTION 3-5 TutorialDocument3 pagesQUESTION 3-5 TutorialFaiz Ghazali100% (1)

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Bank of India Project VINAYDocument83 pagesBank of India Project VINAYanchalharjai100% (1)

- Motion To ConsolidateDocument51 pagesMotion To ConsolidatePositiveMagazineNo ratings yet

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BoseNo ratings yet

- CH 2-Project Planning & Control - PPT (Compatibility Mode) (Repaired)Document49 pagesCH 2-Project Planning & Control - PPT (Compatibility Mode) (Repaired)N-aineel DesaiNo ratings yet

- The Lean Startup Quiz AnswerDocument6 pagesThe Lean Startup Quiz AnswerKiran Rimal100% (2)

- Acefmgt Assignment 1Document7 pagesAcefmgt Assignment 1Michael SanchezNo ratings yet

- Gambar Rencana Instalasi Pipa Gas Rusun Rawa Buaya - Kop PGN - Daftar IsiDocument1 pageGambar Rencana Instalasi Pipa Gas Rusun Rawa Buaya - Kop PGN - Daftar IsiSurya ManaluNo ratings yet

- The Union Budget of India Also Referred As Annual Financial Statement As Per Article 112 Is As FollowsDocument1 pageThe Union Budget of India Also Referred As Annual Financial Statement As Per Article 112 Is As FollowsShivani DharmadhikariNo ratings yet

- TPA - Report - 27-01-2023Document8 pagesTPA - Report - 27-01-2023Madhav UnnithanNo ratings yet

- Mercado de TestaccioDocument5 pagesMercado de TestaccioFrancisco Antonio Matamala Cortes100% (1)

- Qatar Tax Law 2009Document18 pagesQatar Tax Law 2009Jitendra NagvekarNo ratings yet

- Personal FinanceDocument52 pagesPersonal FinanceAditya Maheshwari100% (4)

- Interim Order in The Matter of Progress Cultivation Limited.Document12 pagesInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderNo ratings yet

- Decree 136.2015.NDCPDocument58 pagesDecree 136.2015.NDCPMinh LinhTinhNo ratings yet

- Debt Owed by The Central BanksDocument8 pagesDebt Owed by The Central Bankskaren hudesNo ratings yet

- JSW Steel IR 2018-19 Final PDFDocument424 pagesJSW Steel IR 2018-19 Final PDFSweta SinhaNo ratings yet

- National Income and Its AggregatesDocument34 pagesNational Income and Its AggregatesProfessor Tarun DasNo ratings yet

- Motilal Discovery - Investment Idea: Varun BeveragesDocument5 pagesMotilal Discovery - Investment Idea: Varun Beveragesvikalp123123No ratings yet

- Transaction AccDocument2 pagesTransaction AccxuanylimNo ratings yet

- Bakery Business Plan SampleDocument15 pagesBakery Business Plan SampleZhan HaoNo ratings yet

- International Public Sector Accounting StandardsDocument17 pagesInternational Public Sector Accounting StandardsTijani Kehinde HusseinNo ratings yet