Arriesgado College Foundation, Inc

Arriesgado College Foundation, Inc

Uploaded by

Charly Mint Atamosa IsraelCopyright:

Available Formats

Arriesgado College Foundation, Inc

Arriesgado College Foundation, Inc

Uploaded by

Charly Mint Atamosa IsraelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Arriesgado College Foundation, Inc

Arriesgado College Foundation, Inc

Uploaded by

Charly Mint Atamosa IsraelCopyright:

Available Formats

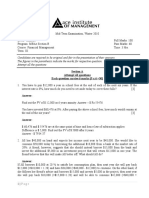

ARRIESGADO COLLEGE FOUNDATION, INC

201 Bonifacio St., Tagum City

Venture Capital

Semi-Final Examination

Charly Mint A. Israel

Name:____________________________________ Date:_____________

I. Problem Solving. Please provide a clear solution in each problem.

A. At the beginning of June 2016, Bitter Ventures has 25,000 shares at P 56 per share.

The venture has earned P 50,000 and the price per share at the end of the period P 55.

Compute for the periodic return. (5 points)

Answer =

B. Supposed the following periodic returns :

June 2017 = Refer to your answer at A

July 2017 = 2.15%

August 2017 = -1.25%

September 2017 = 1.50%

Compute for Compound Return. (5 points)

Answer=

C. The Medison insurance plan has invested in Hoping VC funds. The director of the

insurance plan is preparing his annual report to the Medison board of directors. The

summary is a follows:

Year 2012 2013 2014

Beginning value P 5,000,000 P 3,950,000 P 4,750,000

New investments 250,000 300,000 500,000

Ending Value(before 5,500,000 6,300,000 5,000,000

distribution)

Distribution to LPs 1,000,000 1,000,000 1,000,000

Distribution to GPs 300,000 300,000 300,000

Management Fees 250,000 250,000 250,000

Compute for the following:

Year 2012 2013 2014

Gross Return (3 pts each)

Net Return (3 pts each)

C-2. Compute for Gross compound Return (5 points) Answer =

C-3. Compute for Net Compound Return ( 5 points) Answer =

D. Moveon pension plan has the following data:

Year 2013 2014 2015

Gross return -.90% 1.10% 3.50%

Net Return -1.05% -.95% 3.00%

D-1. Compute for the Gross compound return (5 points) Answer =

D-2. Compute for the Net Compound return. (5 points) Answer =

E. Supply the missing data of Cash flows for X&Ys Fund

Year 1 Year 2 Year 3 Year 4 Year 5

Investments P 15M P 23M P 30M 0

Carried interest 0 0 0 0 0

Distributions to 0 0 P 50M P 37M P 45M

LPs

Cumulative 0 0 P 50M P 132M

distributions to

LPs

Port Value after P 20M P 40M P 75M P 100M P112M

capital

Management P 2M P 2M P 2.5M P 2.25M

Fee

Net Cash flow P 29.75M P 42M

You might also like

- GAAP - Graded Questions - ServiceDocument395 pagesGAAP - Graded Questions - ServicePRECIOUS79% (19)

- Case2 Anadarko Group3 PDFDocument20 pagesCase2 Anadarko Group3 PDFjaiminNo ratings yet

- Solved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Document49 pagesSolved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Abas Acmad83% (6)

- FINAN204-21A - Tutorial 7 Week 10Document6 pagesFINAN204-21A - Tutorial 7 Week 10Danae YangNo ratings yet

- Chapter 11 ExerciseDocument5 pagesChapter 11 ExerciseJoe DicksonNo ratings yet

- Directors Certificate TemplateDocument1 pageDirectors Certificate TemplateRen Irene D MacatangayNo ratings yet

- 12.5 - Practice Test SolutionsDocument15 pages12.5 - Practice Test SolutionsCamilo ToroNo ratings yet

- Assignment - 3Document3 pagesAssignment - 3Aditi RawatNo ratings yet

- Jun18l1-Ep02 QaDocument29 pagesJun18l1-Ep02 Qajuan0% (1)

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- Exercises & Solution FinanceDocument15 pagesExercises & Solution Financemusa_scorpionNo ratings yet

- Revision Question Final - 1 - AnswerDocument6 pagesRevision Question Final - 1 - AnswerCrew's GamingNo ratings yet

- Basic CMPD CalculationsDocument33 pagesBasic CMPD CalculationsShubham Jha0% (1)

- Treasury Operations - Front Office, Back OfficeDocument28 pagesTreasury Operations - Front Office, Back Officeshrikant shinde80% (20)

- Sample QuestionsDocument10 pagesSample QuestionsduongcamnhoNo ratings yet

- 5-Handout Five - Capital Budgeting Techniques-Chapter ThirteenDocument12 pages5-Handout Five - Capital Budgeting Techniques-Chapter ThirteenSharique KhanNo ratings yet

- Online Corporate Finance I Practice Exam 1 SolutionDocument14 pagesOnline Corporate Finance I Practice Exam 1 SolutionTien DuongNo ratings yet

- Solution Assignment 1Document2 pagesSolution Assignment 1Juno Eron TalamayanNo ratings yet

- Quiz 1Document27 pagesQuiz 1K L YEONo ratings yet

- Assignment 2Document10 pagesAssignment 2নীল জোছনাNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- Mendoza 1 1 ProbSet5Document8 pagesMendoza 1 1 ProbSet5Marilyn M. MendozaNo ratings yet

- 4 Cash Flow Diagram Equation of ValueDocument3 pages4 Cash Flow Diagram Equation of ValueKarl FaderoNo ratings yet

- FINMAN1 Module5Document10 pagesFINMAN1 Module5Jayron NonguiNo ratings yet

- Module 5Document9 pagesModule 53 stacks100% (1)

- TVM-Practical QuestionsDocument6 pagesTVM-Practical Questionsparag nimjeNo ratings yet

- Chapters 11 and 12 EditedDocument13 pagesChapters 11 and 12 Editedomar_geryes0% (1)

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- A212 - Topic 3 - Annuity Perpetuity - Part Ii (Narration)Document34 pagesA212 - Topic 3 - Annuity Perpetuity - Part Ii (Narration)Teo ShengNo ratings yet

- Time Value of Money Illustrations UpdatedDocument51 pagesTime Value of Money Illustrations Updatedveer_sNo ratings yet

- Week 1Document15 pagesWeek 1AILIN SONGNo ratings yet

- Final AssignmentDocument20 pagesFinal AssignmentTabish KhanNo ratings yet

- 2021 Corporate Finance M1 Final Exam Correction For Students Final VersionDocument9 pages2021 Corporate Finance M1 Final Exam Correction For Students Final Versionadrien.graffNo ratings yet

- 31 Calculator TutorialDocument9 pages31 Calculator TutorialRose PeresNo ratings yet

- Midterm 1 Spring 13 Answer KeyDocument4 pagesMidterm 1 Spring 13 Answer KeyLoan Nguyễn BíchNo ratings yet

- Exercise 2-3:: Project Management The Managerial Process 5 Edition Larson & GrayDocument2 pagesExercise 2-3:: Project Management The Managerial Process 5 Edition Larson & GrayMotshedisi GraceNo ratings yet

- Lecture 1 (Ch4) - NCBA&EDocument182 pagesLecture 1 (Ch4) - NCBA&EdeebuttNo ratings yet

- Ch.4 - 13ed TVMMasterDocument111 pagesCh.4 - 13ed TVMMasterAfolabi Eniola AbiolaNo ratings yet

- Mid TermAnswersDocument9 pagesMid TermAnswersMoulee DattaNo ratings yet

- Finance Lesson 5Document21 pagesFinance Lesson 5Phoebe PerezNo ratings yet

- Practice Questions Capital Budgeting AnswersDocument5 pagesPractice Questions Capital Budgeting AnswersԼիլիթ ՆազարյանNo ratings yet

- Week 1 Problem Set (Solutions)Document5 pagesWeek 1 Problem Set (Solutions)hollandnguyenNo ratings yet

- Corporate FinanceDocument11 pagesCorporate FinanceShamsul HaqimNo ratings yet

- Practice Bonds and Stocks ProblemsDocument6 pagesPractice Bonds and Stocks ProblemsKevin DayanNo ratings yet

- Revenue ProjectionDocument1 pageRevenue ProjectionFadhil ChiwangaNo ratings yet

- Engineering Economics (MS-291) : Lecture # 6Document34 pagesEngineering Economics (MS-291) : Lecture # 6samad100% (1)

- Es301 - Lesson 3 NotesDocument6 pagesEs301 - Lesson 3 NotesChristian Mayol SalvañaNo ratings yet

- Paper14 SolutionDocument21 pagesPaper14 SolutionJabir AghadiNo ratings yet

- 2024 Time Value of Money Notes & Revision Questions & SolutionsDocument27 pages2024 Time Value of Money Notes & Revision Questions & SolutionsntsakovuqueiaNo ratings yet

- Corporate Finance Mock Exam AnswerDocument7 pagesCorporate Finance Mock Exam AnswerTrang Huong100% (1)

- FAslides_s8Document32 pagesFAslides_s8rohith roshanNo ratings yet

- MF Chap 5 PDFDocument98 pagesMF Chap 5 PDFRebecca Fady El-hajjNo ratings yet

- Bus Fin Mod 6Document33 pagesBus Fin Mod 6taebearNo ratings yet

- Capital Budgeting April2021Document28 pagesCapital Budgeting April2021MikhailNo ratings yet

- FIN 440: Individual Assignment Total: 50Document12 pagesFIN 440: Individual Assignment Total: 50ImrAn KhAnNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- 2019 CorrigeDocument7 pages2019 Corrigeadrien.graffNo ratings yet

- Gen - Math G11 Q2 Wk2 Compound-InterestDocument9 pagesGen - Math G11 Q2 Wk2 Compound-InterestHababa AziwazaNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument13 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- Step - Term AssignmentDocument8 pagesStep - Term Assignmentfarah tahirNo ratings yet

- IAPMDocument26 pagesIAPMNeelesh ReddyNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Activity Sheets: Many Pics One WordDocument2 pagesActivity Sheets: Many Pics One WordCharly Mint Atamosa IsraelNo ratings yet

- Objective 2Document1 pageObjective 2Charly Mint Atamosa IsraelNo ratings yet

- Results-Based Performance Management System (RPMS) PortfolioDocument1 pageResults-Based Performance Management System (RPMS) PortfolioCharly Mint Atamosa IsraelNo ratings yet

- SF2 Belgium Wellness Massage FebDocument2 pagesSF2 Belgium Wellness Massage FebCharly Mint Atamosa IsraelNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthCharly Mint Atamosa IsraelNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- Weekly Home Learning Plan Fabm1Document2 pagesWeekly Home Learning Plan Fabm1Charly Mint Atamosa Israel100% (2)

- Department of Education: Reflection in Module 3aDocument1 pageDepartment of Education: Reflection in Module 3aCharly Mint Atamosa IsraelNo ratings yet

- Which of The Following Market Pertains To The People Who Have Not Yet Purchased The Product But Are Considering ItDocument51 pagesWhich of The Following Market Pertains To The People Who Have Not Yet Purchased The Product But Are Considering ItCharly Mint Atamosa IsraelNo ratings yet

- Contemporary 3rdDocument4 pagesContemporary 3rdCharly Mint Atamosa IsraelNo ratings yet

- Valediction Sa HillcrestDocument4 pagesValediction Sa HillcrestCharly Mint Atamosa IsraelNo ratings yet

- Empowerment Technologies: Lesson 2: Online Safety, Security and Rules of NetiquetteDocument8 pagesEmpowerment Technologies: Lesson 2: Online Safety, Security and Rules of NetiquetteCharly Mint Atamosa IsraelNo ratings yet

- Male and Female Reproductive Organs: Sexual ReproductionDocument1 pageMale and Female Reproductive Organs: Sexual ReproductionCharly Mint Atamosa IsraelNo ratings yet

- How Reproductive Systems Work: Reproductive System Genital SystemDocument1 pageHow Reproductive Systems Work: Reproductive System Genital SystemCharly Mint Atamosa IsraelNo ratings yet

- Marketing The Small BusinessDocument16 pagesMarketing The Small BusinessCharly Mint Atamosa IsraelNo ratings yet

- Invest in Your Success: Strategic Planning For Small BusinessDocument10 pagesInvest in Your Success: Strategic Planning For Small BusinessCharly Mint Atamosa IsraelNo ratings yet

- Dance Architecture and FilmDocument4 pagesDance Architecture and FilmCharly Mint Atamosa IsraelNo ratings yet

- Marketing The Small BusinessDocument2 pagesMarketing The Small BusinessCharly Mint Atamosa IsraelNo ratings yet

- SONS Accounting Tutorial Bank Recon and Proof of Cash Handout PDFDocument4 pagesSONS Accounting Tutorial Bank Recon and Proof of Cash Handout PDFArrow KielNo ratings yet

- Nigerian AMCON UpdateDocument7 pagesNigerian AMCON UpdateOluwatosin AdesinaNo ratings yet

- Midterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Document24 pagesMidterm Examination in Corporation Law Leoniel A. Teraza J.D. 3Ian Ray PaglinawanNo ratings yet

- Bank Management: PGDM Iimc 2020 Praloy MajumderDocument40 pagesBank Management: PGDM Iimc 2020 Praloy MajumderLiontiniNo ratings yet

- Caf 7 Far2 STDocument690 pagesCaf 7 Far2 STMuhammad YousafNo ratings yet

- Sales Agency AccountingDocument11 pagesSales Agency AccountingJade MarkNo ratings yet

- 2017-08-03 Bobulinski Email To CEFCDocument21 pages2017-08-03 Bobulinski Email To CEFCChuck Ross100% (2)

- 2020 11 09 PH e Nikl PDFDocument7 pages2020 11 09 PH e Nikl PDFJNo ratings yet

- Financial Distress (2008)Document24 pagesFinancial Distress (2008)Ira Putri100% (2)

- Better Ventures Case Study PDFDocument24 pagesBetter Ventures Case Study PDFRahul BajajNo ratings yet

- Internal Control Weaknesses and Evidence of Real Activities ManipulationDocument12 pagesInternal Control Weaknesses and Evidence of Real Activities ManipulationMuhammad FathoniNo ratings yet

- The Option To Delay!: Aswath Damodaran 26Document24 pagesThe Option To Delay!: Aswath Damodaran 26ratenmozenNo ratings yet

- An Exchange Ratio Determination ModelDocument6 pagesAn Exchange Ratio Determination Modelmr.rahulgoyalNo ratings yet

- ECN4001 - Tutorial 4 - QuestionsDocument6 pagesECN4001 - Tutorial 4 - QuestionsShann BevNo ratings yet

- Updates On Open Offer (Company Update)Document70 pagesUpdates On Open Offer (Company Update)Shyam SunderNo ratings yet

- Vodafone Vs AirtelDocument13 pagesVodafone Vs AirtelMuhammad Irfan ZafarNo ratings yet

- SS 3 CF CostOfCapitalDocument22 pagesSS 3 CF CostOfCapitalmanish guptaNo ratings yet

- Cadence Wealth Management PDFDocument25 pagesCadence Wealth Management PDFYizhenNo ratings yet

- Perdisco Solution - Transactions - Week 2Document11 pagesPerdisco Solution - Transactions - Week 2My Assignment GuruNo ratings yet

- Acquisition of BusinessDocument14 pagesAcquisition of BusinessTholai Nokku [ தொலை நோக்கு ]No ratings yet

- Artem Vasilyev: Finance Analyst June 2019 - June 2020Document2 pagesArtem Vasilyev: Finance Analyst June 2019 - June 2020Artem VasilyevNo ratings yet

- Marathon Notes 5 - 8041054Document9 pagesMarathon Notes 5 - 8041054jdeconomic06No ratings yet

- Compare Genp KLKDocument4 pagesCompare Genp KLKJing Sheng QuakNo ratings yet

- Accountancy PPT Death-Of-partnerDocument41 pagesAccountancy PPT Death-Of-partnervelammalanddirectorerodeNo ratings yet

- Financial Accounting and Reporting ReviewerDocument48 pagesFinancial Accounting and Reporting ReviewerKeana Drew AysonNo ratings yet

- Project On Icici 123Document28 pagesProject On Icici 123hazaribag vigilanceNo ratings yet