0 ratings0% found this document useful (0 votes)

26 viewsRay Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Ray Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Uploaded by

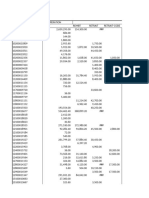

Wam OwnThis payroll summary document provides payroll information for employees from May 6-20, 2017. It lists each employee's ID number, daily rate, number of days worked, gross pay, deductions for taxes, loans and advances, and their net pay. The total gross pay for all employees was $135,016.67 and total deductions were $35,137.90, leaving a total net pay of $99,878.77.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Ray Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Ray Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Uploaded by

Wam Own0 ratings0% found this document useful (0 votes)

26 views1 pageThis payroll summary document provides payroll information for employees from May 6-20, 2017. It lists each employee's ID number, daily rate, number of days worked, gross pay, deductions for taxes, loans and advances, and their net pay. The total gross pay for all employees was $135,016.67 and total deductions were $35,137.90, leaving a total net pay of $99,878.77.

Original Description:

computer finals

Original Title

Comp4 Finals

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This payroll summary document provides payroll information for employees from May 6-20, 2017. It lists each employee's ID number, daily rate, number of days worked, gross pay, deductions for taxes, loans and advances, and their net pay. The total gross pay for all employees was $135,016.67 and total deductions were $35,137.90, leaving a total net pay of $99,878.77.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views1 pageRay Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Ray Jhon Luceñara BSA 4-C Comp 4: Payroll Summary

Uploaded by

Wam OwnThis payroll summary document provides payroll information for employees from May 6-20, 2017. It lists each employee's ID number, daily rate, number of days worked, gross pay, deductions for taxes, loans and advances, and their net pay. The total gross pay for all employees was $135,016.67 and total deductions were $35,137.90, leaving a total net pay of $99,878.77.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

Ray Jhon Luceara BSA 4-C Comp 4

PAYROLL SUMMARY

MAY 6-20, 2017

DEDUCTIONS

EMPLOYEE ID DAILY RATE DAYS WORKED GROSS PAY NET PAY

SSS PHIC HDMF ADVANCES LOAN-T LOAN-H TOTAL

10185108 500.00 13.50 6,750.00 545.00 250.00 100.00 900.00 650.00 2,445.00 4,305.00

10185107 433.33 15.00 6,499.95 482.40 250.00 100.00 650.00 1,482.40 5,017.55

10185100 350.00 14.00 4,900.00 381.50 175.00 100.00 980.00 500.00 1,100.00 3,236.50 1,663.50

10185101 366.67 12.50 4,583.38 399.70 200.00 100.00 350.00 1,500.00 2,549.70 2,033.68

10185112 400.00 15.00 6,000.00 436.00 225.00 100.00 650.00 1,411.00 4,589.00

10185114 400.00 12.50 5,000.00 436.00 225.00 100.00 761.00 4,239.00

10185113 400.00 15.00 6,000.00 436.00 225.00 100.00 761.00 5,239.00

10185109 533.33 14.00 7,466.62 581.40 250.00 100.00 325.00 900.00 2,156.40 5,310.22

10185111 366.67 14.50 5,316.72 399.70 200.00 100.00 550.00 1,249.70 4,067.02

10185110 350.00 14.00 4,900.00 381.50 175.00 100.00 550.00 1,100.00 2,306.50 2,593.50

10185103 450.00 15.00 6,750.00 490.50 250.00 100.00 500.00 1,340.50 5,409.50

10185102 400.00 13.50 5,400.00 436.00 225.00 100.00 615.00 500.00 1,200.00 3,076.00 2,324.00

10185104 350.00 14.50 5,075.00 381.50 175.00 100.00 450.00 1,106.50 3,968.50

10185105 366.67 13.50 4,950.05 399.70 200.00 100.00 450.00 1,149.70 3,800.35

10185106 400.00 12.00 4,800.00 436.00 255.00 100.00 650.00 1,441.00 3,359.00

10185117 400.00 15.00 6,000.00 436.00 225.00 100.00 761.00 5,239.00

10185116 400.00 15.00 6,000.00 436.00 225.00 100.00 761.00 5,239.00

10185115 400.00 13.50 5,400.00 436.00 225.00 100.00 761.00 4,639.00

10185119 350.00 15.00 5,250.00 381.50 175.00 100.00 656.50 4,593.50

10185120 350.00 14.50 5,075.00 381.50 175.00 100.00 500.00 550.00 1,706.50 3,368.50

10185118 400.00 15.00 6,000.00 436.00 225.00 100.00 761.00 5,239.00

10185123 433.33 15.00 6,499.95 436.00 250.00 100.00 450.00 500.00 1,736.00 4,763.95

10185121 400.00 12.50 5,000.00 436.00 225.00 100.00 761.00 4,239.00

10185122 400.00 13.50 5,400.00 436.00 225.00 100.00 761.00 4,639.00

TOTAL 135,016.67 10,437.90 5,230.00 2,400.00 6,320.00 6,950.00 3,800.00 35,137.90 99,878.77

You might also like

- T24 - SecuritiesDocument62 pagesT24 - Securitiesdipakmangnani100% (1)

- Employee Credit Card Authorization FormDocument2 pagesEmployee Credit Card Authorization FormLiza wongNo ratings yet

- Authority of Signing OfficialDocument1 pageAuthority of Signing OfficialWam Own100% (1)

- Limited Preview of CFP Study Material of IMS ProschoolDocument96 pagesLimited Preview of CFP Study Material of IMS ProschoolSai Krishna DhulipallaNo ratings yet

- YouuuDocument19 pagesYouuutongyou.p03No ratings yet

- Venta AnualDocument13 pagesVenta AnualLuz MariñosNo ratings yet

- Nombres Julian Fernando Garzon Rozo Diana Marcela Rubio Diaz Ingrid Carolina Gonzalez LopezDocument80 pagesNombres Julian Fernando Garzon Rozo Diana Marcela Rubio Diaz Ingrid Carolina Gonzalez LopezJulian RozoNo ratings yet

- Residential BuildingDocument10 pagesResidential BuildingEdwin MathiusNo ratings yet

- Employes's Name Position Monthly Rate Gross Pay Sss-Ee Phic-Ee Hdmf-Ee Tax Loans Total Deduction Net PayDocument1 pageEmployes's Name Position Monthly Rate Gross Pay Sss-Ee Phic-Ee Hdmf-Ee Tax Loans Total Deduction Net PayBon.AlastoyNo ratings yet

- Martin MBCPayroll CalculatorDocument12 pagesMartin MBCPayroll Calculatoracctg2012No ratings yet

- Nov ClearedDocument13 pagesNov ClearedAra FeiNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Mandatory ContributionsDocument2 pagesMandatory Contributionspao reyesNo ratings yet

- July 2022 - ClearedDocument9 pagesJuly 2022 - ClearedAra FeiNo ratings yet

- Days Deposit Unit Per Lot Lost ValueDocument2 pagesDays Deposit Unit Per Lot Lost ValueMthunzi MthunziNo ratings yet

- St. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesDocument3 pagesSt. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesYlor Noniuq100% (1)

- New - Customer Tariff New2 - (F)Document1 pageNew - Customer Tariff New2 - (F)Collins Mghase100% (1)

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- Feb 2022 - ClearedDocument17 pagesFeb 2022 - ClearedAra FeiNo ratings yet

- SSS Table 2014Document13 pagesSSS Table 2014Adrianne LaxamanaNo ratings yet

- Payroll Olazo MBCDocument8 pagesPayroll Olazo MBCacctg2012No ratings yet

- Concorde Billing May 1-8, 2011Document33 pagesConcorde Billing May 1-8, 2011Rhoda PasardozaNo ratings yet

- 2020 SalaryDocument6 pages2020 SalaryDoging Jalalon BualatNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- 2ND Mandatory-Deduction-For-2023Document2 pages2ND Mandatory-Deduction-For-2023EgieMae GarcesNo ratings yet

- International Air Parcel: RatesDocument1 pageInternational Air Parcel: RatesKool CatzNo ratings yet

- SSS PhilHealth TableDocument3 pagesSSS PhilHealth Tablegwen calluengNo ratings yet

- Pour Commission Credit Mobile de Mai 2023Document6,760 pagesPour Commission Credit Mobile de Mai 2023elkaboss18No ratings yet

- Zone 1 Zone 2 Zone 3 Zone 4 Zone 5 Zone 6 Zone 7 Zone 8 Zone 9Document2 pagesZone 1 Zone 2 Zone 3 Zone 4 Zone 5 Zone 6 Zone 7 Zone 8 Zone 9Ahmad FikriNo ratings yet

- New SSS Pension Calculator 2019Document6 pagesNew SSS Pension Calculator 2019Ernest Jerome MalamionNo ratings yet

- Calculo de CTS y L. MayorDocument10 pagesCalculo de CTS y L. MayorVíctor MioNo ratings yet

- BPS Salary CalculatorDocument5 pagesBPS Salary CalculatorAshfaq0% (2)

- Apa 0811Document2 pagesApa 0811Ciobanu Elena LuizaNo ratings yet

- Fty RTG GHHH HHHHDocument7 pagesFty RTG GHHH HHHHaudicontableNo ratings yet

- 2425 FS 1y IntlDocument1 page2425 FS 1y Intlabubakarshamsudeen2007No ratings yet

- 100 Days Challenge Boom and CrashDocument4 pages100 Days Challenge Boom and CrashIsheanesu MusakwaNo ratings yet

- 09 - Cuadro Pago ProfesoresDocument3 pages09 - Cuadro Pago Profesorescanelonesc4654No ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- Anthem GroupDocument3 pagesAnthem GroupRebuild BoholNo ratings yet

- Anthem GroupDocument3 pagesAnthem GroupRebuild BoholNo ratings yet

- Details of Existing WallDocument3 pagesDetails of Existing WallChenam Tshering YonzonNo ratings yet

- Details of Existing WallDocument3 pagesDetails of Existing WallChenam Tshering YonzonNo ratings yet

- Accountant Hotel and Restaurant: Week Beginning: Dec. 07, 2020Document8 pagesAccountant Hotel and Restaurant: Week Beginning: Dec. 07, 2020Arielson CalicaNo ratings yet

- Contribution TableDocument2 pagesContribution TableAnonymous 0xWRQNv9MNo ratings yet

- SSS Table 2021Document2 pagesSSS Table 2021Ding CostaNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Loan Type Definition 2018Document1 pageLoan Type Definition 2018Johayr TasilNo ratings yet

- 2021 TrancheDocument1 page2021 TranchealmirajaneguceNo ratings yet

- 2021 TrancheDocument1 page2021 TranchealmirajaneguceNo ratings yet

- Book 1Document13 pagesBook 1Bea Dela PeniaNo ratings yet

- SSS Contribution CalculatorDocument3 pagesSSS Contribution Calculatorcool08coolNo ratings yet

- Detailed Guidelines 2024dfsgDocument2 pagesDetailed Guidelines 2024dfsg0xessenceNo ratings yet

- Dec ClearedDocument11 pagesDec ClearedAra FeiNo ratings yet

- Apa 0111Document2 pagesApa 0111Ciobanu Elena LuizaNo ratings yet

- JytgfdDocument9 pagesJytgfdzjpunjheNo ratings yet

- Aug 2022 - ClearedDocument11 pagesAug 2022 - ClearedAra FeiNo ratings yet

- Embankment Settlement Eng-TipsDocument9 pagesEmbankment Settlement Eng-Tipsshadabg04No ratings yet

- Statement AccDocument1 pageStatement AccSzymon KrawczykNo ratings yet

- School Canteen Records v2 TemplateDocument34 pagesSchool Canteen Records v2 TemplateYeshua Yesha100% (1)

- Makauno Co.: Semi-Monthly Payroll August 1-15, 2020Document11 pagesMakauno Co.: Semi-Monthly Payroll August 1-15, 2020Chincel G. ANINo ratings yet

- Payroll For MedLab Emp-TemplateDocument8 pagesPayroll For MedLab Emp-TemplateAries VeeNo ratings yet

- SSS TableDocument1 pageSSS Tablegmangalo95% (22)

- Challenge Ahorro Nacional-Cuanto Puedes Ahorrar de Aquí A Diciembre?Document1 pageChallenge Ahorro Nacional-Cuanto Puedes Ahorrar de Aquí A Diciembre?Niurka Alexandra ʚïɞNo ratings yet

- Agency May Be Extinguished by Accomplishment of The Object or Purpose of AgencyDocument1 pageAgency May Be Extinguished by Accomplishment of The Object or Purpose of AgencyWam OwnNo ratings yet

- Naay Challenge Manufacturing Corporation Worksheet For The Year Ended December 31, 2013Document1 pageNaay Challenge Manufacturing Corporation Worksheet For The Year Ended December 31, 2013Wam OwnNo ratings yet

- Practical AccountingDocument1 pagePractical AccountingWam OwnNo ratings yet

- Table of ContentsDocument10 pagesTable of ContentsWam OwnNo ratings yet

- Site Inspection-Affidavit - Water Supply SystemDocument1 pageSite Inspection-Affidavit - Water Supply SystemWam OwnNo ratings yet

- Estate TaxDocument2 pagesEstate TaxWam OwnNo ratings yet

- Michael Evan Aguelo: Educational BackgroundDocument3 pagesMichael Evan Aguelo: Educational BackgroundWam OwnNo ratings yet

- Mas Practice Standards and Ethical RequirementsDocument15 pagesMas Practice Standards and Ethical RequirementsWam OwnNo ratings yet

- Introduction To Managerial AccountingDocument8 pagesIntroduction To Managerial AccountingWam OwnNo ratings yet

- Edited 5Document1 pageEdited 5Wam OwnNo ratings yet

- Formulation, Implementation, and Control of Competitive StrategyDocument11 pagesFormulation, Implementation, and Control of Competitive StrategyWam OwnNo ratings yet

- Romel Written Sa LawDocument1 pageRomel Written Sa LawWam OwnNo ratings yet

- CpasDocument13 pagesCpasWam OwnNo ratings yet

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- Final Assignment - ProblemsDocument7 pagesFinal Assignment - ProblemsWam OwnNo ratings yet

- ASSIGNMENT 407 - Audit of InvestmentsDocument3 pagesASSIGNMENT 407 - Audit of InvestmentsWam OwnNo ratings yet

- ASSIGNMENT 404 - Audit of InventoriesDocument3 pagesASSIGNMENT 404 - Audit of InventoriesWam OwnNo ratings yet

- Assignment - Audit of Ppe1Document4 pagesAssignment - Audit of Ppe1Wam OwnNo ratings yet

- MoaDocument2 pagesMoaWam OwnNo ratings yet

- Overview of MASDocument6 pagesOverview of MASDonna AmbaganNo ratings yet

- Durham Business School Masters Guide 2025Document44 pagesDurham Business School Masters Guide 2025songguitongNo ratings yet

- TLE 10 NotesDocument5 pagesTLE 10 NotesscrthhNo ratings yet

- Airtel - Broadband - 4G - DTH Services DecemberDocument1 pageAirtel - Broadband - 4G - DTH Services Decemberrohit.sanerNo ratings yet

- Uses of Bank FundsDocument10 pagesUses of Bank Fundsদেবব্রত নাথNo ratings yet

- Business Trade & CommerceDocument6 pagesBusiness Trade & Commerceincredible meNo ratings yet

- Policy ScheduleDocument1 pagePolicy ScheduleDinesh nawaleNo ratings yet

- Student's and Teachers Manual Semester Genap 2022 2023Document30 pagesStudent's and Teachers Manual Semester Genap 2022 2023REYHAN BERLIAN ANUGERAHNo ratings yet

- Business Plan QuestionnaireDocument4 pagesBusiness Plan Questionnaireshantanu_malviya_1No ratings yet

- South Africa Profile Financial Institution FinalDocument26 pagesSouth Africa Profile Financial Institution FinalBilal RajaNo ratings yet

- Volatility Arbitrage in The Black Scholes WorldDocument18 pagesVolatility Arbitrage in The Black Scholes WorldJaime Maihuire IrigoyenNo ratings yet

- Taher - CA-CC - PGDTM - MBS - BBS (Accounting) - UpdatedDocument2 pagesTaher - CA-CC - PGDTM - MBS - BBS (Accounting) - Updatedabu taherNo ratings yet

- Priority-Q-A-18 12 22Document64 pagesPriority-Q-A-18 12 22specilist officer marketingNo ratings yet

- B Com Gen WEF 2016 17 Admitted BatchDocument32 pagesB Com Gen WEF 2016 17 Admitted BatchRamana ReddyNo ratings yet

- Deepak Resume New Updated-1Document3 pagesDeepak Resume New Updated-1Deepak BNo ratings yet

- Quiz No. 5: SET BAAC (CCE, Receivables, Inventories, and Investments)Document7 pagesQuiz No. 5: SET BAAC (CCE, Receivables, Inventories, and Investments)Joovs JoovhoNo ratings yet

- Financial Planning and Strategy of Maruti Udyog LTD ProjectDocument99 pagesFinancial Planning and Strategy of Maruti Udyog LTD ProjectSonu PradhanNo ratings yet

- Analisis Kelayakan Finansial Pengembangan Usahatani Labu Madu Di Kabupaten Pandeglang Provinsi Banten Khaerul SalehDocument11 pagesAnalisis Kelayakan Finansial Pengembangan Usahatani Labu Madu Di Kabupaten Pandeglang Provinsi Banten Khaerul SalehAditya PutraNo ratings yet

- Financial Accounting I Revision NotesDocument1 pageFinancial Accounting I Revision Notessrajaratnam25No ratings yet

- Introducing Financial Statements and Transaction AnalysisDocument64 pagesIntroducing Financial Statements and Transaction AnalysisHazim AbualolaNo ratings yet

- Venture CapitalDocument135 pagesVenture CapitalBarath NarayanaswamyNo ratings yet

- Wiley Cmaexcel Learning System Exam Review 2015: Part 1: Financial Reporting, Planning, Performance, and ControlDocument31 pagesWiley Cmaexcel Learning System Exam Review 2015: Part 1: Financial Reporting, Planning, Performance, and Controlvipul_khemkaNo ratings yet

- Final Project On Service Tax 2017Document21 pagesFinal Project On Service Tax 2017ansh patelNo ratings yet

- Economic Value Added: Calculating EVADocument3 pagesEconomic Value Added: Calculating EVAsanjaycrNo ratings yet

- JP MorganDocument12 pagesJP MorganAbhinandan GolchhaNo ratings yet

- Pratik Poddar BTech2010 IITBombayDocument1 pagePratik Poddar BTech2010 IITBombayAmeya KannamwarNo ratings yet