GSTR 3B Excel Format

GSTR 3B Excel Format

Uploaded by

ravibhartia1978Copyright:

Available Formats

GSTR 3B Excel Format

GSTR 3B Excel Format

Uploaded by

ravibhartia1978Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

GSTR 3B Excel Format

GSTR 3B Excel Format

Uploaded by

ravibhartia1978Copyright:

Available Formats

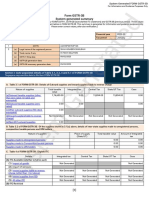

Form GSTR-3B

[ See Rule 61(5)]

Rohan's Tax Services

Year

Month

1 GSTIN

2 Legal name of the registered person

3.1 Detail of Outward Supplies and Inward supplies liable to reverse charges

Nature of Supplies Total Taxable Value Integrated Tax Central Tax State/ UT Tax Cess

1 2 3 4 5 6

( a) Outward taxable supplies (other

than zero rated, nil rated and exempted)

( b) Outward taxable supplies (zero

rated)

( c) Other outward supplies, (Nil rated,

exempted)

( d) Inward supplies (liable to reverse

charge)

( e) Non GST outward supplies

3.2 3.2 Of the supplies shown in 3.1 (a) above, details of inter-State supplies made to unregistered persons,

composition taxable persons and UIN holders

Place of Supply (State/UT) Total Taxable Value Amount of Integrated Tax

1 2 3 4

Supplies made to Unregistered Persons

Supplies made to Composition Taxable

Persons

Supplies made to UIN Holders

4 Eligible ITC

Details Integrated Tax Central Tax State/ UT Tax Cess

1 2 3 4 5

(A) ITC Available (whether in full or

part)

(1) Import of goods

(2) Import of services

(3) Inward supplies liable to reverse

charge (other

than 1 & 2 above)

(4) Inward supplies from ISD

(5) All other ITC

(B) ITC Reversed

(1) As per rules 42 & 43 of CGST Rules

(2) Others

(C) Net ITC Available (A) (B)

(D) Ineligible ITC

(1) As per section 17(5)

(2) Others

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of supplies Inter-State supplies Intra-State supplies

1 2 3

From a supplier under composition scheme,

Exempt and Nil rated supplyt

Non GST supply

6.1 Payment of Tax

Paid through ITC

Tax/Cess

Tax Paid paid in Interes Late

Description Tax payable Integrated Tax Central Tax State/UT tax Cess TDS/TCS cash t Fee

1 2 3 4 5 6 7 8 9 10

Integrated Tax

Central Tax

State/UT Tax

Cess

6.2 TDS/TCS Credit

Details Integrated Tax Central Tax State/ UT Tax

1 2 3 4

TDS

TCS

Verification (by Authorised signatory)

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief

and nothing has been concealed there from.

Instructions:

1) Value of Taxable Supplies = Value of invoices + value of Debit Notes value of credit notes + value of advances received for which

invoices have not been issued in the same month value of advances adjusted against invoices

2) Details of advances as well as adjustment of same against invoices to be adjusted and not shown separately

3) Amendment in any details to be adjusted and not shown separately.

You might also like

- Registration Tax Exemption in Afghanistan Info Sheet February 9 - 2010Document8 pagesRegistration Tax Exemption in Afghanistan Info Sheet February 9 - 2010Hussain MeskinzadaNo ratings yet

- HL Reservation ActDocument7 pagesHL Reservation ActFaisal WaniNo ratings yet

- GSTR 3B NewDocument2 pagesGSTR 3B Newarpit85No ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- Form GSTR 3bDocument2 pagesForm GSTR 3bEasy Renewable Pvt LtdNo ratings yet

- GST File Mail Done.1Document3 pagesGST File Mail Done.1subhashchander8601No ratings yet

- GSTR 3b FormatDocument2 pagesGSTR 3b FormatRAHUL AGARWALNo ratings yet

- GSTR 3BDocument3 pagesGSTR 3BShamim AkramNo ratings yet

- 3B April 2024Document2 pages3B April 2024shivshaktiassociates719No ratings yet

- GSTR3B FORM OCT-1Document2 pagesGSTR3B FORM OCT-1Pankaj SinghNo ratings yet

- 3BDocument2 pages3BmnenterprisesknpNo ratings yet

- Chand GSTR 3B 03 2024Document3 pagesChand GSTR 3B 03 2024CHAND DISTRIBUTORNo ratings yet

- 23CAYPD4777M1ZX GSTR3B Feb2024Document3 pages23CAYPD4777M1ZX GSTR3B Feb2024kunalladji158No ratings yet

- GSTR3B Excel Utility V4.8Document10 pagesGSTR3B Excel Utility V4.8Sandip ChakrabortyNo ratings yet

- GSTR - 1 Format 3 Jun 2017Document8 pagesGSTR - 1 Format 3 Jun 2017lokwaderNo ratings yet

- Goods and Services Tax - GSTR-3B Offline UtilityDocument14 pagesGoods and Services Tax - GSTR-3B Offline UtilitymayoorNo ratings yet

- GSTR 1 Format PDFDocument6 pagesGSTR 1 Format PDFmyselfashviinNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document2 pagesForm GSTR-3B (See Rule 61 (5) )GH MOHDNo ratings yet

- Form GSTR-1Document8 pagesForm GSTR-1ssubhrajyoti03No ratings yet

- SPC GST (TDS TCS)Document12 pagesSPC GST (TDS TCS)Aritra BanerjeeNo ratings yet

- Return FormatsDocument56 pagesReturn Formatspuran1234567890No ratings yet

- Indirect Taxes - Transformation in GSTDocument53 pagesIndirect Taxes - Transformation in GSTJogender Chauhan100% (1)

- Form 3b 06aahpv4110b1z6 Mar 2024 BusyDocument4 pagesForm 3b 06aahpv4110b1z6 Mar 2024 Busyasharani7257No ratings yet

- Gstr1 Summary Jul-24Document3 pagesGstr1 Summary Jul-24ShivamNo ratings yet

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Document4 pagesBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537No ratings yet

- GSTR3B 06aanca8458j1z4 022018 PDFDocument3 pagesGSTR3B 06aanca8458j1z4 022018 PDFAnonymous AXsA1iNo ratings yet

- Form Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesDocument2 pagesForm Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesParameshwar RaoNo ratings yet

- Form GSTR 2aDocument2 pagesForm GSTR 2aparam.ginniNo ratings yet

- Sample Format Form GSTR 2aDocument2 pagesSample Format Form GSTR 2aDeepanshu JaiswalNo ratings yet

- GSTR3B 07aasfb3116c1zs 012023Document4 pagesGSTR3B 07aasfb3116c1zs 012023VIKRAMJEET SINGHNo ratings yet

- GSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedDocument8 pagesGSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedsammy shergilNo ratings yet

- Inter IDT - Initial ChaptersDocument73 pagesInter IDT - Initial ChaptersEsha GuptaNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document6 pagesForm GSTR-3B (See Rule 61 (5) )Asma KhanNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3Bhiteshmohakar15No ratings yet

- GSTR3B 07AALCP1900G1ZN 112022 SystemGeneratedDocument7 pagesGSTR3B 07AALCP1900G1ZN 112022 SystemGeneratedChandan KumarNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- GSTR3B 07aasfb3116c1zs 032023Document4 pagesGSTR3B 07aasfb3116c1zs 032023VIKRAMJEET SINGHNo ratings yet

- GSTR - 9 UpdatedDocument11 pagesGSTR - 9 Updatedjaiganerh741No ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BAtul VermaNo ratings yet

- GSTR-5 FormDocument5 pagesGSTR-5 FormAnanya NairNo ratings yet

- GSTR3B 03ajdpk8658g1z5 032023Document4 pagesGSTR3B 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- GSTR3B 24GLPPD7998C1ZL 042024 SystemGeneratedDocument9 pagesGSTR3B 24GLPPD7998C1ZL 042024 SystemGeneratedmihirdonga0000No ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Gstr3b 10ckvpk6948n1zc 042023 SystemgeneratedDocument8 pagesGstr3b 10ckvpk6948n1zc 042023 Systemgeneratedharshitkr1805No ratings yet

- Form GSTR 10Document2 pagesForm GSTR 10Sridharan NagarajanNo ratings yet

- Form GSTR - 9Document21 pagesForm GSTR - 909 AYUSHI TIWARI BCOM 2HNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- PrabhDocument3 pagesPrabhrajNo ratings yet

- GSTR 2Document33 pagesGSTR 2Ram Krishna PandeyNo ratings yet

- Participating in Return Tables 512 No Direct Implication in Return Tables 0Document2 pagesParticipating in Return Tables 512 No Direct Implication in Return Tables 0ROHIT SHARMA DEHRADUNNo ratings yet

- GSTR3B 08afcpv2127g1zi 062018Document3 pagesGSTR3B 08afcpv2127g1zi 062018MANOJNo ratings yet

- Law Subjects RelatedDocument12 pagesLaw Subjects RelatedaakashultraNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BSankar GaneshNo ratings yet

- Gstr3b 09ehmpm8928j1zf 062021 SystemgeneratedDocument6 pagesGstr3b 09ehmpm8928j1zf 062021 SystemgeneratedAnkur mittalNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BRahulNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- GSTR3B - 22-23 MayDocument4 pagesGSTR3B - 22-23 MayLogesh Waran KmlNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3JunnetteTevesPujidaNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- Girdhari Estates PVT - LTD.: NoticeDocument1 pageGirdhari Estates PVT - LTD.: Noticeravibhartia1978No ratings yet

- Airtel - Gautam 19, R.N.Document1 pageAirtel - Gautam 19, R.N.ravibhartia1978No ratings yet

- 27a Cala01174f 26Q Q3 201516Document1 page27a Cala01174f 26Q Q3 201516ravibhartia1978No ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- 90 PDFDocument1 page90 PDFravibhartia1978No ratings yet

- Bhagwati Devcon Private LimitedDocument2 pagesBhagwati Devcon Private Limitedravibhartia1978No ratings yet

- Director Report: To The Members of M/S. Bhagwati Devcon Private LimitedDocument2 pagesDirector Report: To The Members of M/S. Bhagwati Devcon Private Limitedravibhartia1978No ratings yet

- Atlas Jute - Only Rent CapDocument6 pagesAtlas Jute - Only Rent Capravibhartia1978No ratings yet

- Ministry of Corporate Affairs: Receipt G.A.R.7Document1 pageMinistry of Corporate Affairs: Receipt G.A.R.7ravibhartia1978No ratings yet

- S.B.Dandeker & CoDocument3 pagesS.B.Dandeker & Coravibhartia1978No ratings yet

- Lli I: LimitedDocument10 pagesLli I: Limitedravibhartia1978No ratings yet

- SCHEDULE J: Significant Accounting Policies & Notes To AccountsDocument2 pagesSCHEDULE J: Significant Accounting Policies & Notes To Accountsravibhartia1978No ratings yet

- Independent Auditor'S Report: Report On The Financial StatementsDocument3 pagesIndependent Auditor'S Report: Report On The Financial Statementsravibhartia1978No ratings yet

- Gautam Engineers LTDDocument1 pageGautam Engineers LTDravibhartia1978No ratings yet

- Gautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 4606276 4615009Document4 pagesGautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 4606276 4615009ravibhartia1978No ratings yet

- Girdhari Estates Pvt. Ltd. LTDDocument1 pageGirdhari Estates Pvt. Ltd. LTDravibhartia1978No ratings yet

- Girdhari Estates Private Limited: For & On Behalf of Chartered AccountantsDocument25 pagesGirdhari Estates Private Limited: For & On Behalf of Chartered Accountantsravibhartia1978No ratings yet

- Gautam Engineers Limited: (Gross TDS - Rs.15,74,410/ - P.Y. - Rs. 14,76,409/-)Document38 pagesGautam Engineers Limited: (Gross TDS - Rs.15,74,410/ - P.Y. - Rs. 14,76,409/-)ravibhartia1978No ratings yet

- Girdhari Estates Pvt. Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 563542 642542Document3 pagesGirdhari Estates Pvt. Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 563542 642542ravibhartia1978No ratings yet

- SLW CLASS X Sectors of Indian Economy 2024Document6 pagesSLW CLASS X Sectors of Indian Economy 2024anushka.sinha965No ratings yet

- Systems of Linear EquationsDocument82 pagesSystems of Linear Equationsmatematica1319No ratings yet

- GD Public Vs Private SectorDocument4 pagesGD Public Vs Private SectorKNOWLEDGE CREATORS100% (3)

- Cv-Anita Amir AliDocument2 pagesCv-Anita Amir AliNASEER ULLAHNo ratings yet

- O-Engineers Nov 2017Document56 pagesO-Engineers Nov 2017Enpak ArsalanNo ratings yet

- Resume IBD WSO StyleDocument1 pageResume IBD WSO StyleTesticleElephantitisNo ratings yet

- Hunar Se Rozgar TakDocument70 pagesHunar Se Rozgar TakSunil KumarNo ratings yet

- OD329578490438637100Document1 pageOD329578490438637100shivakumarparvatham38No ratings yet

- MicroDocument3 pagesMicroYashNo ratings yet

- 1آليات الهندسة المالية كآلية لإدارة مخاطر الصكوك الإسلامية لحلو بخاري ووليد عايبDocument20 pages1آليات الهندسة المالية كآلية لإدارة مخاطر الصكوك الإسلامية لحلو بخاري ووليد عايبBZDRNo ratings yet

- Buying - And.selling.a.home - Ebook EEnDocument369 pagesBuying - And.selling.a.home - Ebook EEndwdgNo ratings yet

- Hotelspro - MetglobalDocument13 pagesHotelspro - MetglobalNicoleta VoicuNo ratings yet

- Act 433 Merdeka Stadium Corporation Act 1963Document14 pagesAct 433 Merdeka Stadium Corporation Act 1963Adam Haida & CoNo ratings yet

- Slovenia SA Newsletter Zima - Winter 2012Document20 pagesSlovenia SA Newsletter Zima - Winter 2012Institute for Slovenian Studies of Victoria Inc.No ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- Lean CTR TrainingDocument36 pagesLean CTR TrainingSanjib KumarNo ratings yet

- Data Base SH PrambananDocument56 pagesData Base SH PrambananRadita MahendraNo ratings yet

- Annual Work Plan & Budget - Part 1 Narrative TemplateDocument4 pagesAnnual Work Plan & Budget - Part 1 Narrative TemplateIFAD Vietnam100% (2)

- Advantages and Disadvantages of Investing in IndiaDocument3 pagesAdvantages and Disadvantages of Investing in Indiaharshan_ag100% (2)

- FM AssignmentDocument3 pagesFM Assignmentjeaner2008No ratings yet

- IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSDocument27 pagesIMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSece_shreyas100% (2)

- The Heckscher-Ohlin Model IBMDocument15 pagesThe Heckscher-Ohlin Model IBMPhalit GuptaNo ratings yet

- 497 CostcoDocument20 pages497 CostcoDitya Kusmana Putra100% (1)

- Professional Practice and EthicsDocument20 pagesProfessional Practice and EthicsHarshene Krishnamurhty100% (1)

- Indus PlasticDocument21 pagesIndus PlasticLatest Hit MoviesNo ratings yet

- Assumptions of Cardinal ApproachDocument2 pagesAssumptions of Cardinal ApproachMohsin Khan100% (2)

- Structure Final Test-CompleteDocument6 pagesStructure Final Test-CompleteYuniarso Adi NugrohoNo ratings yet

- Key Points:: Case Study: Rent Control in The Short Run and The Long RunDocument2 pagesKey Points:: Case Study: Rent Control in The Short Run and The Long Runnasper34No ratings yet