Hiwalah in Shariah and Its Rules and App

Hiwalah in Shariah and Its Rules and App

Uploaded by

Shehzad HaiderCopyright:

Available Formats

Hiwalah in Shariah and Its Rules and App

Hiwalah in Shariah and Its Rules and App

Uploaded by

Shehzad HaiderOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Hiwalah in Shariah and Its Rules and App

Hiwalah in Shariah and Its Rules and App

Uploaded by

Shehzad HaiderCopyright:

Available Formats

Hiwalah in Shariah and its

rules and applications in

Islamic Finance

Mohamad Zaky Bin Jailani

Hiwalah in Shariah and its rules and applications in Islamic Finance

Abstract

_________

This paper seeks to elaborate on the concept of Hiwalah,

covering both the classical definitions as well as the applications

of Hiwalah within contemporary Islamic Finance. We will

compare and contrast the two different types of Hiwalah,

discuss its legality from an Islamic Jurisprudence perspective

and also identify the various pillars associated with this concept.

We also look at what basic rules and conditions are needed to

validate the Hiwalah as well as the exact conditions that

terminate the Hiwalah. Lastly, as we explore the contemporary

applications of Hiwalah, there is also a need to highlight current

issues surrounding such an application.

Mohamad Zaky Jailani

2

Hiwalah in Shariah and its rules and applications in Islamic Finance

Objectives of the research

This paper seeks to elaborate on the concept of Hiwalah in classical jurisprudence

and its applications on contemporary Islamic Finance. The specific objectives of this

paper are as follows:

• Clearly define and explain the concept of Hiwalah

• Elaborate further on the pillars and types of Hiwalah

• State the basic rules and conditions of Hiwalah

• Explain the legal consequences of Hiwalah and associated termination events

• Introduce the various contemporary applications of Hiwalah within Islamic

Finance

• Identify contemporary issues surrounding Hiwalah

Key terms of the research

1. Pillars of Hiwalah 2. Legal Consequences of Hiwalah 3. Termination Events of

Hiwalah 4. Hiwalah Islamic Finance Applications 5. Contemporary Issues

surrounding Hiwalah

Mohamad Zaky Jailani

3

Hiwalah in Shariah and its rules and applications in Islamic Finance

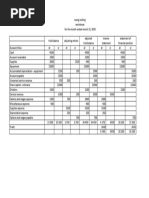

Table of Contents

Abstract ............................................................................................................................... 2

Objectives of the research ..................................................................................................3

Key terms of the research ...................................................................................................3

1.0 Al Hiwalah ......................................................................................................................5

1.1 Definition of Hiwalah ............................................................................................................ 5

1.2 Types of Hiwalah .................................................................................................................... 5

1.3 Legality of Hawalah ................................................................................................................6

1.4 Pillars of Hiwalah ...................................................................................................................6

1.5 Basic Rules and Conditions of Hiwalah ............................................................................... 7

1.6 Legal Consequences of Hiwalah ........................................................................................... 7

1.7 Termination of Hiwalah ........................................................................................................ 7

2.0 Application of Hiwalah in contemporary Islamic Finance ...................................... 8

2.1 Withdrawals from a current account ................................................................................... 8

2.2 Overdrawing from an account or overdraft ......................................................................... 8

2.3 Travellers’ Cheques ................................................................................................................ 8

2.4 Bills of Exchange .................................................................................................................... 8

2.5 Endorsement of a negotiable instrument.............................................................................9

2.6 Transfer of money (remittances) ..........................................................................................9

3.0 Conclusion and findings............................................................................................. 10

4.0 References ................................................................................................................... 11

Mohamad Zaky Jailani

4

Hiwalah in Shariah and its rules and applications in Islamic Finance

1.0 Al Hiwalah

Although various sources have also referred to this concept as Hawalah, Hiwala or

Hawala, for the sake of consistency, this paper will refer to the term Hiwalah

throughout. This paper will expand on the concept of Hiwalah, covering both the

classical definitions as well as the applications of Hiwalah within contemporary

Islamic Finance. We will compare and contrast the different types of Hiwalah,

discuss its legality from an Islamic Jurisprudence perspective and also identify the

various pillars associated with this concept. We will then look at the basic rules and

conditions needed to validate the Hiwalah as well as the exact conditions that

terminate the Hiwalah. Lastly, as we explore the contemporary applications of

Hiwalah, there is also a need to highlight current issues surrounding such an

application.

1.1 Definition of Hiwalah

The ISRA Compendium for Islamic Financial Terms (2010) states the literal

translation of Hiwalah as a derivation of tahwil: to shift from one place to another;

the reflexive form being tahawwala, meaning to move oneself from one place to

another. Lahsasna (2012) categorises Hiwalah under contracts of security (Uqud al-

Tawthiqat). A creditor through these contracts is able to confirm his right to get his

debts returned to him, thus removing the risk of losing it. Similarly, according to

Iqbal and Mirakhor (2011), Hiwalah entails transferring debt or obligation from one

debtor to another, releasing the original debtor from that debt or obligation. This is

different from kifalah where the principal debtor is not released from the obligation.

Historically, Hiwalah was transferred to Europe and other regions by Jewish scholars

and merchants throughout the Jewish Diaspora and via Spain through trade and

scholastic borrowing from Islamic sources.

1.2 Types of Hiwalah

The ISRA Compendium (2010) breaks down the types of Hiwalah into conditional

debt transfer (Hiwalah Muqayadah) and unconditional debt transfer (Hiwalah

Mutlaqah, this is strictly based on the Hanafi view). A conditional transfer is a

contract in which payment is restricted to the property of the transferor that is a

liability of the transferee. This type of Hiwalah is divided, based on the type of

liability, into a transfer limited to either a debt, a deposit or a loan secured by a

physical asset. On the other hand, an unconditional debt transfer is a contract in

which the transferee unconditionally agrees to pay the debt whether or not the debt

Mohamad Zaky Jailani

5

Hiwalah in Shariah and its rules and applications in Islamic Finance

exceeds what the transferee owes the transferor. It is not necessary for the

transferee to be indebted to the transferor, nor is it necessary that payment be made

from the wealth of the transferor in the possession of the transferee.

Additionally according to Hussin (2011), there are a further two categories within

Hiwalah muqayaddah, namely:

i. Hiwalah al-haqq: the replacement of a creditor with another creditor, basically

a transfer or right to claim from one person to the other.

ii. Hiwalah al-dayn: the replacement of a debtor with another debtor, which

essentially means the transfer of a debt from an obligation of a person to

another person’s obligation.

The difference between these two categories is defined by the specific party

stepping out of the transaction, one the creditor and the other, the debtor.

1.3 Legality of Hawalah

This method of paying debt was adopted from the Prophet’s (SAW) practice. The

proof is in Sahih al Bukhari and Muslim, where Abu Hurayrah (RA) reported the

Prophet (SAW) to have said, “Default on the payment by a solvent debtor is unjust

and if anyone of you is transferred to a solvent person, he must accept the transfer.”

Similarly, he (SAW) is also reported by al-Bayhaqi to have said, “Default by such

debtors is a form of transgression, so if one of you has his debt transferred to a rich

person, let him accept the transfer of debt.” (Hussin, 2011). The majority of jurists

infer from this hadith that it is preferred to accept the transfer of debt, but it does

not form an obligation. On the other hand, the Zahiris and Imam Ahmad ruled that

the text of the hadith includes an order that makes it obligatory to accept the

transfer of debt, where the transferee is rich (Mansuri, 2001).

1.4 Pillars of Hiwalah

Dusuki (2011) adopts a two pronged approach to explain the pillars of Hiwalah.

Hanafi scholars state the pillars as an offer (ijab) from the transferor (al-muhil) and an

acceptance (qabul) from the transferee (al-muhal) and the payer (al-muhal ‘alayh). On

the other hand, the jumhur ulama break the pillars of Hiwalah into the following:

i. The transferor (al-muhil)

ii. The transferee (al-muhal)

iii. The payer (al-muhal ‘alayh)

iv. The debt (al-muhal bih)

v. The offer and acceptance (al-sighah)

Mohamad Zaky Jailani

6

Hiwalah in Shariah and its rules and applications in Islamic Finance

1.5 Basic Rules and Conditions of Hiwalah

The AAOIFI Shariah Standards (2004) clearly entail the conditions that govern the

validity of a Hiwalah. The consent of all parties involved such as the transferor, the

transferee and the payer; must be obtained. The transferor must also be a debtor to

the transferee. If it is a non-debtor that transfers another, it is actually an agency

contract for debt collection and not a transfer of debt. However, the payer does not

necessarily need to be a debtor to the transferor, this is permissible and merely

indicates an unrestricted Hiwalah. All parties must also be legally competent to act

independently and the transferred debt and the debt to be settled must be known

and transferable. Lastly, for restricted Hiwalah, the transferred debt must be equal

to the debt owed in terms of kind, type, quality and amount. However, it is possible

for the transferor to transfer a lesser amount of debt owed to the transferee to be

settled from a larger amount owed by the transferor on condition that the transferee

be entitled only to the equivalent amount of debt.

1.6 Legal Consequences of Hiwalah

The debtor will be discharged from the debts he owes to the creditor. However, we

must bear in mind that if the acceptance of the transfer was based on the condition

that the assignee must be solvent, then the transferee will have a right to recourse to

the transferor. The transfer of debt also establishes the creditor’s right to demand

payment of the debt from the assignee. (Mansuri, 2001)

1.7 Termination of Hiwalah

A Hiwalah contract can be subjected to a termination event that renders the

contract as void. Dusuki (2011) lists four different scenarios that would effectively

terminate a Hiwalah contract:

i. Mutual Agreement between contracting parties to end the Hiwalah

contract. This returns all the parties to the status quo prior to entering

the Hiwalah contract. Hence, the transferee is entitled to claim the

debt from the transferor and not the payer.

ii. When the debt is effectively settled via full payment by the payer to

the transferee.

iii. When the payer dies and the transferee inherits his property.

iv. When the debt has been written off by the transferee.

Mohamad Zaky Jailani

7

Hiwalah in Shariah and its rules and applications in Islamic Finance

2.0 Application of Hiwalah in contemporary Islamic Finance

Now that we have looked at the classical definitions and theoretical structure of the

Hiwalah contract, we will explore how this concept has been integrated into modern

financial transactions. As per the elaborations below, unless otherwise stated,

AAOIFI (2004) lists and explains the various contemporary applications that

integrate the Hiwalah concept.

2.1 Withdrawals from a current account

An issuance of a cheque against a current account is a form of Hiwalah if the

beneficiary is a creditor of the issuer or the account holder for the amount of the

cheque, in which case the issuer, the bank and the beneficiary are the transferor, the

payer and the transferee respectively. If the beneficiary is not the creditor to the

issuer of the cheque, then this is not a Hiwalah transaction because a Hiwalah

cannot be in place without an existing debt. In the absence of the debt, the

transaction becomes an agency contract for recovery of the amount of the debt on

behalf of the transferor, which is lawful in the Shari’ah.

2.2 Overdrawing from an account or overdraft

According to Hasan (2011), an overdraft occurs when someone withdraws from a

bank account and exceeds the available balance. If the beneficiary of the amount of a

cheque is a creditor to the issuer, then issuing a cheque against the account of the

issuer without a balance is unrestricted transfer of debt if the bank accepts the

overdraft. If the bank rejects the overdraft, then this is not considered a transfer of

debt, in which case the potential beneficiary may have recourse to the issuer.

2.3 Travellers’ Cheques

The holder of a travellers’ cheque, the value of which has been assigned by him to

the issuing institution, is a creditor to such an institution. If the holder of the

travellers’ cheques endorses the cheque in favour of his creditor, it becomes a

transfer of debt in favour of a third party against the issuing institution that is a

debtor to the holder of the travellers’ cheque. This is a restricted transfer of debt

and the amount of the debt is the exact value of the cheque for which the institution

received payment.

2.4 Bills of Exchange

El Diwany (2010) mentions that the Hiwalah contract can be seen to be applied in a

bill of exchange in which it is a settlement of debt between one person and another

Mohamad Zaky Jailani

8

Hiwalah in Shariah and its rules and applications in Islamic Finance

through the medium of a third person. It is similar to instructing a third party to pay

a supplier on sight or some time in the future.

A bill of exchange is a form of Hiwalah if the beneficiary is a creditor to the drawer.

The drawer is, in this case, the transferor who gives orders for the paying bank to pay

a certain sum of money at a specified date to the defined beneficiary. The party

executing payment of such amount of money is the payer whereas the beneficiary

(holder of the bill) is the transferee. If the beneficiary is not a creditor of the drawer,

then the issuance of the bill of exchange becomes an agency contract to recover or

collect the amount of the bill of of exchange on behalf of the drawer. In the absence,

of a debt obligation between the drawer and the paying bank, the issuance of a bill of

exchange becomes an unrestricted Hiwalah.

2.5 Endorsement of a negotiable instrument

A negotiable instrument is a document guaranteeing the payment of a specific

amount of money, either or demand or on a set time. Negotiable instruments are

written orders or unconditional promises to pay a fixed sum of money on demand or

at a specific time. Negotiable instruments may be transferred (Hasan, 2011).

Examples of negotiable instruments include promissory notes, bills of exchange,

checks, drafts and certificates of deposits.

An endorsement of a negotiable instrument in a manner that transfers title to its

value to the beneficiary is a form of Hiwalah if the beneficiary is a creditor to the

endorser. If the beneficiary is not a creditor to the endorser, the endorsement

becomes one of agency contract for collection of the amount of debt. An

endorsement of a bill of exchange on behalf of a client who requires the institution

to transfer, after collection, the amount of instrument into his account is not a

Hiwalah. This is a contract of agency that is permissible with or without

consideration. It is permissible for the first beneficiary from a bill of exchange to

endorse it in favour of any other party. The second beneficiary may also endorse

such a bill of exchange in favour of a third party and so on, in which case the

subsequent endorsements are a form of successive Hiwalah which is permissible in

Shariah.

2.6 Transfer of money (remittances)

The request of a customer for the institution to transfer a certain amount of money

in the same currency from his current account to a particular beneficiary is a transfer

of debt if the applicant is a debtor to such a beneficiary. The fee that the institution

Mohamad Zaky Jailani

9

Hiwalah in Shariah and its rules and applications in Islamic Finance

gains from this transaction is consideration for the delivery of the money and it is

not an additional amount gained by the institution over the amount transferred.

However, if a remittance is to take place in a currency different from that presented

by the applicant for the transfer, then the transaction consists of a combination of

currency exchange and a transfer of money that is permissible.

3.0 Conclusion and findings

As illustrated in the previous section on contemporary application of Hiwalah it is

clear that this concept is embedded within multiple contemporary financial practices.

While majority of these examples occur within the traditional banking system, there

is one particular application which stands out due to the fact that it takes place

outside of conventional finance, namely money remittance or the informal value

transfer system.

Ballard (2003) points out that the informal value transfer system has grown due to a

rapid growth in the number immigrants from the third world living and working in

Europe and North America, who send large sums of money as remittances to their

families back home; as well as an equally rapid growth in business and manufacturing

activity in South, East, and South East Asia, where formal restrictions on foreign

exchange are restrictive; and thirdly the replacement of the old-fashioned telegram

with far speedier – and far cheaper – means of data transmission via fax and the

internet. Taken together, these developments have enabled Asian financial

entrepreneurs to put together an alternative system of international value

transmission albeit much easier to access, far swifter, significantly less expensive and

just as reliable as those provided by the formal banking system.

However, due to the anonymous nature of Hiwalah, Bowers (2009) asks if it is a

valuable remittance tool or a national security threat. He concludes that it is both

and this duality –an affordable remittance option to the uneducated and potential

funding vehicle for terrorists and money launderers – that makes regulation both so

tricky and so unattractive to politicians. There is, understandably, reluctance in

poorer countries to close the tap through which vital monies flow.

We have thus shown that the concept of Hiwalah has been incorporated into the

banking system, both conventional as well as Islamic. Hiwalah has also been utilized

by informal networks as a vehicle for value transfer. The impact on contemporary

Mohamad Zaky Jailani

10

Hiwalah in Shariah and its rules and applications in Islamic Finance

finance is fairly significant, especially in cases where there are restrictions on

currency mobility or where it is impractical and unsafe to carry large sums of money.

However, there is also a significant security interest in favour of regulating informal

remittance channels in order to prevent money laundering or financing of illegal

activities.

4.0 References

Bowers, C. (2009). Hawala,money laundering, and terrorism finance: micro-lending as an

end to illicit remittance. Denver Journal of International Law and Policy - Vol. 37 Nbr.

3, Summer 2009.

Ballard, R. (2003). A background report on the Operation of informal value Transfer systems

(hawala).

Iqbal, Z., Mirakhor, A. (2011). An Introduction to Islamic Finance: Theory and Practice

Second Edition. Singapore: John Wiley & Sons.

Lahsasna, A. (2012). A Mini Guide to Islamic Contracts in Financial Services. Kuala

Lumpur: CERT Publications.

Dusuki, A. W. (2011). Islamic Finance: Principles and Operations. Kuala Lumpur: ISRA.

Accounting and Auditing Organization for Islamic FInancial Institutions. (2004).

Shari'a Standards. Manama: AAOIFI.

International Shariah Research Academy. (2010). ISRA Compendium for Islamic

Financial Terms: Arabic-English. Kuala Lumpur: ISRA.

Hussin, M. H. (2011). Understanding Shariáh and its application in Islamic Finance. Kuala

Lumpur: IBFIM.

Mansuri, M. T. (2001). Islamic Law of Contracts and Business Transactions. Islamabad:

Shariah Academy International Islamic University.

Hasan, A. (2011). Fundamentals of Shari'ah in Islamic Finance. Kuala Lumpur: IBFIM.

El-Diwany, T. (2010). Islamic Banking and Finance: What it is and what it could be.

United Kingdom: 1st Ethical Charitable Trust education.

Mohamad Zaky Jailani

11

You might also like

- Fin250 Pyq AnalysisDocument16 pagesFin250 Pyq Analysis2022458936100% (1)

- Acc406 AssignmentDocument17 pagesAcc406 Assignmentanon_27933068285% (13)

- Far 210Document6 pagesFar 210Noor Salehah92% (13)

- Current Issues in Istisna & Tijarah (Final)Document12 pagesCurrent Issues in Istisna & Tijarah (Final)Hasan Irfan Siddiqui100% (1)

- AAOIFI Standards For Istisna'ADocument19 pagesAAOIFI Standards For Istisna'AAshraf FarhadNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyShehzad HaiderNo ratings yet

- Mysticism Science RevelationDocument153 pagesMysticism Science RevelationShehzad Haider0% (1)

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- 1.0 Background of The Institution 1.1 RHB Islamic Bank: OSK Holdings BHDDocument15 pages1.0 Background of The Institution 1.1 RHB Islamic Bank: OSK Holdings BHDSaidatul AzellaNo ratings yet

- WadiahDocument22 pagesWadiahazmi_rahman0% (2)

- Group Assignment Dec 2020Document7 pagesGroup Assignment Dec 2020shahira amirNo ratings yet

- Sale of Goods (Sales of Goods Act 1957)Document5 pagesSale of Goods (Sales of Goods Act 1957)Yee Zhi XuanNo ratings yet

- Case of Bank Islam Malaysia BHD V Adnan Bin OmarDocument10 pagesCase of Bank Islam Malaysia BHD V Adnan Bin Omarrajes wariNo ratings yet

- With Regards To Expiration Date Futures Contracts: CardsDocument4 pagesWith Regards To Expiration Date Futures Contracts: CardsChin Yee LooNo ratings yet

- Chapter 7Document22 pagesChapter 7anis abdNo ratings yet

- Nature of The Case: Kopeks Holdings SDN BHD v. Bank Islam Malaysia BHD (2009) 1 LNS 785Document2 pagesNature of The Case: Kopeks Holdings SDN BHD v. Bank Islam Malaysia BHD (2009) 1 LNS 785Mohamad Alif IdidNo ratings yet

- Fin546 Islamic Finance Soalan Final SampleDocument7 pagesFin546 Islamic Finance Soalan Final Samplehazra fazreendaNo ratings yet

- Maybank Islamic Personal Financing-IDocument2 pagesMaybank Islamic Personal Financing-Iathirah jamaludin0% (1)

- MudharabahDocument17 pagesMudharabahShyla92No ratings yet

- IjarahDocument23 pagesIjarahProf. Dr. Mohamed Noorullah100% (2)

- Wadi'ahDocument20 pagesWadi'ahMahyuddin Khalid100% (2)

- Legal Framework of Islamic Capital MarketDocument21 pagesLegal Framework of Islamic Capital MarketMahyuddin Khalid100% (2)

- Riba Vs ProfitDocument15 pagesRiba Vs Profit✬ SHANZA MALIK ✬83% (6)

- Assignment WakalahDocument21 pagesAssignment WakalahZulaikha Meseri40% (5)

- Al Wadiah (Uitm)Document20 pagesAl Wadiah (Uitm)Lydia HassanNo ratings yet

- Other ServicesDocument15 pagesOther ServicesMahyuddin KhalidNo ratings yet

- Fiqh Muamalah: Al-HiwalahDocument15 pagesFiqh Muamalah: Al-HiwalahnadeemuzairNo ratings yet

- Risk Management Practices of Bank Islam Malaysia BerhadDocument15 pagesRisk Management Practices of Bank Islam Malaysia BerhadLydia Hassan100% (1)

- AFS2033 Lecture 10 Salam AccountingDocument22 pagesAFS2033 Lecture 10 Salam AccountingAna FienaNo ratings yet

- Fin250 Group Assignment 2Document14 pagesFin250 Group Assignment 2amiranatasyasya66No ratings yet

- Islamic Accepted BillDocument14 pagesIslamic Accepted Billsadique_home100% (6)

- Bay' Al-DaynDocument9 pagesBay' Al-DaynmhfxtremeNo ratings yet

- MudharabahDocument21 pagesMudharabahMahyuddin Khalid100% (2)

- Law of Partnership: NatureDocument39 pagesLaw of Partnership: Natureschafieqah100% (1)

- Accounting For Istisna and Parallel IstisnaDocument6 pagesAccounting For Istisna and Parallel IstisnaSuazhari IbrahimNo ratings yet

- Fin242 - Chapter 3 - ProformaDocument15 pagesFin242 - Chapter 3 - ProformaAin ShafikahNo ratings yet

- CTU351Document13 pagesCTU351Angeline TanNo ratings yet

- Tutorial 8 Agency BL1AnsDocument4 pagesTutorial 8 Agency BL1AnsStanley StanleyNo ratings yet

- Chapter 2 - Introduction To Takaful - Dpn1023Document35 pagesChapter 2 - Introduction To Takaful - Dpn1023Shafiq AbdullahNo ratings yet

- Final Assessment Fin546 (Template Answer)Document6 pagesFinal Assessment Fin546 (Template Answer)NOR IZZATI BINTI SAZALI100% (1)

- Sales of Good (SOGA)Document10 pagesSales of Good (SOGA)Luna latrisya100% (3)

- Assignment Law416Document6 pagesAssignment Law416Olivia RinaNo ratings yet

- Chapter 7: Business Contracts in Islam: 4PM-7PM FST-BK 6.3 Group 5Document23 pagesChapter 7: Business Contracts in Islam: 4PM-7PM FST-BK 6.3 Group 5iman zainuddinNo ratings yet

- Baitulmal InstitutionDocument18 pagesBaitulmal InstitutionSyed Ktwenty100% (3)

- Islamic Financial - Bai Al-IstinaDocument18 pagesIslamic Financial - Bai Al-IstinaDaud Farook IINo ratings yet

- Practice Question On Capital BudgetingDocument4 pagesPractice Question On Capital BudgetingTekNo ratings yet

- Sales of Good (Answer SC (1) (1ii) )Document4 pagesSales of Good (Answer SC (1) (1ii) )zizul86100% (4)

- Question Employment IncomeDocument7 pagesQuestion Employment IncomehannaniNo ratings yet

- This Study Resource Was: Murabahah QuizDocument4 pagesThis Study Resource Was: Murabahah QuizMuhammad Abdullah100% (1)

- Ah Thian V Government of MalDocument3 pagesAh Thian V Government of MalMoganaJS100% (4)

- Case Kopeks Holdings SDN BHD Vs Bank Islam Malaysia Berhad. S-02-1480-2009Document14 pagesCase Kopeks Holdings SDN BHD Vs Bank Islam Malaysia Berhad. S-02-1480-2009Cindy Iqbalini Fortuna100% (1)

- Ijarah Operating Ijarah Financial IjarahDocument1 pageIjarah Operating Ijarah Financial IjarahSK LashariNo ratings yet

- FIN546 GROUP 7 Assignment 1Document19 pagesFIN546 GROUP 7 Assignment 1ZAINOOR IKMAL MAISARAH MOHAMAD NOORNo ratings yet

- BBA and MurabahDocument26 pagesBBA and Murabahgeena1980No ratings yet

- Bank Rakyat Law CaseDocument17 pagesBank Rakyat Law CaseDeena YosNo ratings yet

- Difference Between Family Takaful and General TakafulDocument2 pagesDifference Between Family Takaful and General TakafulIbn Bashir Ar-Raisi100% (5)

- CH 3 Accounting For Mudharabah Financing 1Document32 pagesCH 3 Accounting For Mudharabah Financing 1Yusuf Hussein50% (6)

- Final Assessment: Faculty of Business Management Diploma in Banking (Ba119) Business Law (Law 299)Document19 pagesFinal Assessment: Faculty of Business Management Diploma in Banking (Ba119) Business Law (Law 299)Khadijah MisfanNo ratings yet

- Islamic Micro Finance ReportDocument30 pagesIslamic Micro Finance ReportRajeev Singh BhandariNo ratings yet

- Implication of Awālah in Islamic Finance PracticeDocument11 pagesImplication of Awālah in Islamic Finance PracticeBrendan LanzaNo ratings yet

- Topic: Essay 1: A Comment About Hawalah Based On Shariah StandardDocument14 pagesTopic: Essay 1: A Comment About Hawalah Based On Shariah StandardWU YONG / UPMNo ratings yet

- Fin AllDocument11 pagesFin AllCool AdiNo ratings yet

- 2008 PLC 293Document10 pages2008 PLC 293Shehzad HaiderNo ratings yet

- Application ABL Vs DiamondDocument11 pagesApplication ABL Vs DiamondShehzad Haider0% (1)

- Memorandum 1Document5 pagesMemorandum 1Shehzad HaiderNo ratings yet

- P L D 1995 Supreme Court 66Document502 pagesP L D 1995 Supreme Court 66Shehzad HaiderNo ratings yet

- 2010 P T D 2552Document9 pages2010 P T D 2552Shehzad HaiderNo ratings yet

- 1981 SCMR 494Document10 pages1981 SCMR 494Shehzad HaiderNo ratings yet

- Representation Naghma AdeebDocument3 pagesRepresentation Naghma AdeebShehzad HaiderNo ratings yet

- Attachment 2 PDFDocument1 pageAttachment 2 PDFShehzad Haider100% (1)

- Guide To Obtaing A Letter of Intent For Construction of A Power Plant in PakistanDocument10 pagesGuide To Obtaing A Letter of Intent For Construction of A Power Plant in PakistanShehzad HaiderNo ratings yet

- PLD 1996 Lahore 349Document10 pagesPLD 1996 Lahore 349Shehzad HaiderNo ratings yet

- 2017 y L R Note 7Document19 pages2017 y L R Note 7Shehzad HaiderNo ratings yet

- Disputed Facts in WritDocument8 pagesDisputed Facts in WritShehzad HaiderNo ratings yet

- Law of PrecedentDocument7 pagesLaw of PrecedentShehzad HaiderNo ratings yet

- Mco Unit 4 Vocab Worksheet Managing Your MoneyDocument3 pagesMco Unit 4 Vocab Worksheet Managing Your Moneynathanaeladefiranye68No ratings yet

- PHD Thesis Lene Gilje JustesenDocument161 pagesPHD Thesis Lene Gilje JustesenAdama GuilaoNo ratings yet

- 2013 Dow Watson Shea IAEDocument16 pages2013 Dow Watson Shea IAEChamunorwa MunemoNo ratings yet

- Matching Principle Concept - AccountingDocument1 pageMatching Principle Concept - AccountingClauie BarsNo ratings yet

- Final Project of 100 MarksDocument70 pagesFinal Project of 100 Marksprasad250790100% (2)

- Prevention of NPAs A Comparative Study On Indian BanksDocument6 pagesPrevention of NPAs A Comparative Study On Indian BanksPurandhara ReddyNo ratings yet

- Types of CheckDocument2 pagesTypes of CheckRoberto UbosNo ratings yet

- Stock Analysis PointersDocument49 pagesStock Analysis PointershareshpkNo ratings yet

- NC-3REVISED ExampleDocument2 pagesNC-3REVISED ExampleStephanie Cruz100% (1)

- CC & MA B.Com Sem-6Document1 pageCC & MA B.Com Sem-6farrajabdulrabNo ratings yet

- Assignment 2Document9 pagesAssignment 2Dư Trà MyNo ratings yet

- EyyyyDocument48 pagesEyyyyYsabel ApostolNo ratings yet

- Company Analysis ReDocument21 pagesCompany Analysis ReDarshan JainNo ratings yet

- Changes of Ownership - PART CDocument49 pagesChanges of Ownership - PART Csikute kamongwaNo ratings yet

- Kotak Mahindra Bank Financial AnalysisDocument25 pagesKotak Mahindra Bank Financial Analysisheena siddiquiNo ratings yet

- The Effect of Book Keeping On The Performance of Finanacial InstitutionsDocument15 pagesThe Effect of Book Keeping On The Performance of Finanacial InstitutionsJamil KamaraNo ratings yet

- P4 1Document1 pageP4 1Arnalistan Eka100% (1)

- Digital Payment SystemDocument2 pagesDigital Payment SystemShuja NaikNo ratings yet

- Defi: Redefining The Future of Finance: APRIL 2021Document10 pagesDefi: Redefining The Future of Finance: APRIL 2021Long ThaiNo ratings yet

- Lesson 7 Annuities: ContextDocument15 pagesLesson 7 Annuities: ContextMohammad Farhan SafwanNo ratings yet

- Acct Statement - XX3459 - 20082022 PDFDocument4 pagesAcct Statement - XX3459 - 20082022 PDFsiddhesh yewaleNo ratings yet

- 1 Registration Process: BUET Post Graduate Registration SystemDocument5 pages1 Registration Process: BUET Post Graduate Registration SystemBit bitNo ratings yet

- SAPM TYBBI Internal Exam - Google FormsDocument6 pagesSAPM TYBBI Internal Exam - Google Formsshraddha shuklaNo ratings yet

- Equity Lecture 9 - Notes On MortgagesDocument27 pagesEquity Lecture 9 - Notes On Mortgagesedwinagyapong123No ratings yet

- Trial BalanceDocument4 pagesTrial BalanceSushank Kumar 7278No ratings yet

- Intrest Rate StructureDocument12 pagesIntrest Rate StructureMohit KumarNo ratings yet

- Pay Card Application FormDocument1 pagePay Card Application FormMARIBEL LENDIONo ratings yet

- CreditReport Piramal - Anil Kumar - 2023 - 02 - 25 - 13 - 57 - 43.pdf 25-Feb-2023Document7 pagesCreditReport Piramal - Anil Kumar - 2023 - 02 - 25 - 13 - 57 - 43.pdf 25-Feb-2023Rabbul RahmanNo ratings yet

- Study Fiancial Statement of ICICI BankDocument36 pagesStudy Fiancial Statement of ICICI BankYuvaraj PatilNo ratings yet

- Account StatementDocument4 pagesAccount Statementayandanene260No ratings yet