Neft Rtgs Form Jan 2018

Neft Rtgs Form Jan 2018

Uploaded by

DesikanCopyright:

Available Formats

Neft Rtgs Form Jan 2018

Neft Rtgs Form Jan 2018

Uploaded by

DesikanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Neft Rtgs Form Jan 2018

Neft Rtgs Form Jan 2018

Uploaded by

DesikanCopyright:

Available Formats

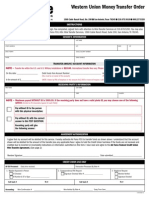

Request for Remittance through NEFT / RTGS

Branch:

(To be filled in by the applicant in BLOCK LETTERS)

Request: NEFT RTGS Cheque is mandatory, if request not provided by customer directly.

DETAILS of the APPLICANT (Remitter)

Title of Account: Account No.:

Branch where account is maintained: Type of Account: Savings Current Cash Credit

Mobile Number: Overdraft NRE NRO

Status: Resident Non-Resident Email Id:

DETAILS of BENEFICIARY BANK

Bank Name: Branch:

City: IFSC Code:

DETAILS of BENEFICIARY

Beneficiary Bank Account Name (As per Beneficiary’s Bank record):

Beneficiary Address:

Beneficiary Bank Account Number: Beneficiary Bank Account Number Re-confirmed:

Type of Account: Savings Current Cash Credit Overdraft NRE NRO

Amount to b e remitted: ` (in figures) (Rupees in words)

Bank Charges: `

Remark for Remittance: (to be captured)

Remit the amount as per above mentioned details, by debiting my / our account or I/we herewith tender cheque no. dated

for ` /- drawn on our account for the amount of remittance plus your charges.

Rupees in words :

TERMS AND CONDITIONS

I/We abide by the following terms and conditions:

1. It is being understood that the remittance is to be sent at my/our own risk and responsibility and on the distinct understanding that no liability whatsoever is

to be attached to the Bank for any loss or damages arising or resulting from delay in transmission, delivery or non-delivery of the message or for any mistake,

exchange or error in transmission or delivery thereof or in deciphering the message for whatsoever cause or from its misinterpretation when received or the

action of the destination Bank or due to RBI (Reserve Bank of India) RTGS / NEFT system not being available or failure of internal communication system at

the recipient bank/branch or incorrect information provided by me/us or any incorrect credit accorded by the recipient bank/branch due to information

provided by me/us or any act or event beyond control or from failure to properly identity the person’s name.

2. I/We understand that the process of RTGS / NEFT request is subject to availability of clear funds in my/our account at the time of processing the request.

3. I/We understand that RTGS / NEFT request submitted after the cut off time will be processed/sent on the next working day.

4. I/We understand that the RTGS / NEFT request is subject to the RBI regulations and guidelines governing the same.

5. I / We agree that the credit will be effected solely on the beneficiary account number information and beneficiary name particulars will not be used for the

same.

Date ________________________________ Signature of account holder/s ______________________________________

FOR BANK USE

435-Ver 1.1-Jan 2014 / M024 / Jan 18 / 2.4

Debited Applicant's A/c. Cheque No. & Date

Request Received Date & Time Cheque Amount

Verified cheque details and Signature Request Processed Date & Time

Signature verified by BOM / BH Cheque verified for stop payment (for NEFT)

RTGS – UTR No. SDC / Transaction No.

NEFT Ref No.

DCB Bank Limited Authorised Signatory (Maker) Authorised Signatory (Checker)

You might also like

- ContractDocument17 pagesContractDakshina Moorthy R KNo ratings yet

- Lettings Valuation LetterDocument4 pagesLettings Valuation Letterd.danielrobinson2014No ratings yet

- Wa0007.Document2 pagesWa0007.daniilmerkulov703No ratings yet

- MT103Document4 pagesMT103vhauamirNo ratings yet

- DocsDocument1 pageDocsanthony.adieze100% (1)

- Test Strategy For Oracle EBS V - 2.1Document24 pagesTest Strategy For Oracle EBS V - 2.1shankar p100% (1)

- Covering Letter For Miscellaneous Remittances - LatestDocument2 pagesCovering Letter For Miscellaneous Remittances - LatestSALE EXECUTIVESNo ratings yet

- Indemnity Bond Form No.3762 To Get Duplicate LIC Policy Bond PDFDocument2 pagesIndemnity Bond Form No.3762 To Get Duplicate LIC Policy Bond PDFPurushothama Rao Nalamati80% (10)

- Actg101: Fundamentals of Accounting Theory and Practice 1A Quiz 1Document24 pagesActg101: Fundamentals of Accounting Theory and Practice 1A Quiz 1Jett Manuel100% (2)

- Bank CertificateDocument1 pageBank CertificateUCO BANKNo ratings yet

- KYC Form (Final)Document1 pageKYC Form (Final)plr.postNo ratings yet

- Eft0012019103113450019 10Document1 pageEft0012019103113450019 10Bryan BalebuNo ratings yet

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan0% (1)

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan50% (2)

- Commercial Letter of Credit Application Form: Applicant BeneficiaryDocument2 pagesCommercial Letter of Credit Application Form: Applicant BeneficiaryUMgNo ratings yet

- Fund TransferDocument2 pagesFund TransferQaiser KhalilNo ratings yet

- Instructions: Sender'S InformationDocument2 pagesInstructions: Sender'S InformationmeariclusNo ratings yet

- Funds Transfer Application and Agreement: Q Q Q Q QDocument2 pagesFunds Transfer Application and Agreement: Q Q Q Q QAlejandro L GonzalezNo ratings yet

- CertificatDocument1 pageCertificatFrancu AlinNo ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- Standard Chartered BankDocument56 pagesStandard Chartered BankTarekNo ratings yet

- Arduino GPRS ShieldDocument32 pagesArduino GPRS ShieldOnofre Enriquez Fercito LeitoNo ratings yet

- Remittance Application Form MAR2022 E - Form PDFDocument2 pagesRemittance Application Form MAR2022 E - Form PDFAlldyNo ratings yet

- CertDocument2 pagesCertapi-3728882No ratings yet

- Deed of Agreement-MOUDocument2 pagesDeed of Agreement-MOUshishirchemNo ratings yet

- Online Funds TransferDocument2 pagesOnline Funds TransferKarthi kk mobileNo ratings yet

- DCB RTGSDocument2 pagesDCB RTGSBharat VardhanNo ratings yet

- For More Details Contact:: Fill The From BelowDocument2 pagesFor More Details Contact:: Fill The From Belowsuar90No ratings yet

- Certification Oath For ProbateDocument1 pageCertification Oath For Probateapi-3728882No ratings yet

- Cocacola Winning Notification UKDocument3 pagesCocacola Winning Notification UKLakshay MalkaniNo ratings yet

- Attorney General Mandate Authorization Letter For WillieDocument1 pageAttorney General Mandate Authorization Letter For Willieapi-3728882No ratings yet

- En US Funds Redemption FxddmaltaDocument1 pageEn US Funds Redemption Fxddmaltaariefato_341200971No ratings yet

- CIS TEMPLATE With Bank Coordinates 2Document4 pagesCIS TEMPLATE With Bank Coordinates 2MavisNo ratings yet

- Ghana Commercial BankDocument1 pageGhana Commercial Bankapi-3728882100% (2)

- Certificate of Deposit: Add-On CdsDocument4 pagesCertificate of Deposit: Add-On CdsmercatuzNo ratings yet

- ECS Authorization Cum Banker's Certificate (To Be Filled by Supplier/FirmDocument1 pageECS Authorization Cum Banker's Certificate (To Be Filled by Supplier/FirmRebecca Grant100% (1)

- Chinese Letter of ProbateDocument2 pagesChinese Letter of Probateapi-3728882No ratings yet

- Service Request FormDocument2 pagesService Request FormKowshik ChakrabortyNo ratings yet

- 21-04-09 Amicus Brief Walter CopanDocument30 pages21-04-09 Amicus Brief Walter CopanFlorian MuellerNo ratings yet

- Ticket Number: (C12PYUK7122) Ballot Number: (UK: Office No:: Dear Guaranteed Award WinnerDocument4 pagesTicket Number: (C12PYUK7122) Ballot Number: (UK: Office No:: Dear Guaranteed Award WinnerJanardhan SuryaNo ratings yet

- ChForm HTMLDocument1 pageChForm HTMLAkmal SannanNo ratings yet

- VCS Project Registration Process Version 1Document26 pagesVCS Project Registration Process Version 1scribb1No ratings yet

- Private LTD Company DocumentsDocument3 pagesPrivate LTD Company DocumentsCA Kapil AgarwalNo ratings yet

- Electronic Transfer Dept, 6, Sansad Marg, Janpath, H.O. 110001-NEW DELHIDocument3 pagesElectronic Transfer Dept, 6, Sansad Marg, Janpath, H.O. 110001-NEW DELHIAnonymous VNeqfGegJNo ratings yet

- Bank of Baroda: Account Opening Form For Non-IndividualsDocument6 pagesBank of Baroda: Account Opening Form For Non-IndividualsCoolGamer RoshNo ratings yet

- About Purchase Bank DraftDocument14 pagesAbout Purchase Bank DraftSudershan ThaibaNo ratings yet

- Loan Guarantee FormDocument2 pagesLoan Guarantee Formshrutika agarwalNo ratings yet

- Citibank IntDocument2 pagesCitibank Intspj20No ratings yet

- Debit Card Application FormDocument2 pagesDebit Card Application FormDeep Chh100% (1)

- Axis BankDocument2 pagesAxis BankAyush LohiaNo ratings yet

- Remarking SubbiahDocument1 pageRemarking SubbiahBernard SubbiahNo ratings yet

- Proof of Payment BhamDocument1 pageProof of Payment BhamMokotedi PhosaNo ratings yet

- Contrato de Compra Venta de BitcoinsDocument9 pagesContrato de Compra Venta de BitcoinsRicardo Pedraza100% (1)

- Tokio Marine - Epayment Reg FormDocument2 pagesTokio Marine - Epayment Reg FormCaddyTanNo ratings yet

- Satrix ETF Form 2 Additional Investments (Lump Sums Only) Aug 2013 - Listing DocumentsDocument5 pagesSatrix ETF Form 2 Additional Investments (Lump Sums Only) Aug 2013 - Listing Documents0796105632No ratings yet

- Romelo Online101 - 6 Digits - 2022 - EricDocument15 pagesRomelo Online101 - 6 Digits - 2022 - EricFredrick GordonNo ratings yet

- MANDATEDocument5 pagesMANDATEDarpan Ashokrao SalunkheNo ratings yet

- Pos To ??Document18 pagesPos To ??Jhon Dik muhammadNo ratings yet

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDocument2 pagesUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- COINS - ESCROW-AGRMT - FOR SPA - VII.1-1b-BTC-EIBACCT-EACHAD-XXBUYEROEG-XXSELLANT-040523Document7 pagesCOINS - ESCROW-AGRMT - FOR SPA - VII.1-1b-BTC-EIBACCT-EACHAD-XXBUYEROEG-XXSELLANT-040523semih karakuşNo ratings yet

- Barclays Funds Release FormDocument3 pagesBarclays Funds Release FormrsusyantiNo ratings yet

- NEFT RTGS FormDocument1 pageNEFT RTGS FormSalasar BuilderNo ratings yet

- DCB Neft RTGSDocument1 pageDCB Neft RTGSRAGHAVA NAIDU .KNo ratings yet

- DCB Neft FormDocument1 pageDCB Neft Formsandeeppatil22No ratings yet

- Indian Overseas Bank Application Form For Funds Transfer Under RtgsDocument2 pagesIndian Overseas Bank Application Form For Funds Transfer Under Rtgsabhishek bakhlaNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Form 35Document1 pageForm 35Desikan0% (2)

- Demat FormDocument22 pagesDemat FormDesikanNo ratings yet

- Account Opening Forms PDFDocument11 pagesAccount Opening Forms PDFDesikanNo ratings yet

- Corporate Re Kyc FormDocument3 pagesCorporate Re Kyc FormDesikanNo ratings yet

- Children Education AllowanceDocument1 pageChildren Education AllowanceDesikanNo ratings yet

- Canara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDocument3 pagesCanara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- Surety FormDocument1 pageSurety FormDesikanNo ratings yet

- Request For Cancellation of SIP-STP-SWPDocument2 pagesRequest For Cancellation of SIP-STP-SWPDesikanNo ratings yet

- Nurse Lic Ver Request InfoDocument1 pageNurse Lic Ver Request InfoDesikanNo ratings yet

- Nurse Lic Ver Request InfoDocument1 pageNurse Lic Ver Request InfoDesikanNo ratings yet

- LIC500Document2 pagesLIC500DesikanNo ratings yet

- Mandate Form For Payment of Pension Annuity - LICDocument3 pagesMandate Form For Payment of Pension Annuity - LICDesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- New APPS Mandate Form Final - 796381968Document2 pagesNew APPS Mandate Form Final - 796381968DesikanNo ratings yet

- Request For Issue of Duplicate PasswordDocument1 pageRequest For Issue of Duplicate PasswordDesikanNo ratings yet

- Notice of Change of Nomination (Form No. 3750) PDFDocument3 pagesNotice of Change of Nomination (Form No. 3750) PDFDesikan100% (2)

- Division "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document281 pagesDivision "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54mktg.seagullshippingNo ratings yet

- Revision1 2 3Document4 pagesRevision1 2 3Diệu QuỳnhNo ratings yet

- SMPBPO102 - 002 v2014 QCCIDocument27 pagesSMPBPO102 - 002 v2014 QCCIMico AlcalaNo ratings yet

- Toyota Term and Conditions-IndirectDocument44 pagesToyota Term and Conditions-IndirectanludfiNo ratings yet

- Senior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemDocument13 pagesSenior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemJaye Ruanto100% (1)

- Gordon College College of Business and Accountancy Financial Accounting TheoriesDocument15 pagesGordon College College of Business and Accountancy Financial Accounting TheoriesKylie Luigi Leynes BagonNo ratings yet

- Core Banking Project On Union BankDocument36 pagesCore Banking Project On Union Bankkushal8120% (1)

- AudProb Test BankDocument18 pagesAudProb Test BankKarina Barretto AgnesNo ratings yet

- Multiple Choice QuestionDocument3 pagesMultiple Choice QuestionEka FerranikaNo ratings yet

- SubcontractingDocument15 pagesSubcontractingPriyank Patel100% (2)

- Account Statement From 1 Jan 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument13 pagesAccount Statement From 1 Jan 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePalette CommunicationsNo ratings yet

- Contoh File Impor MYOBDocument4 pagesContoh File Impor MYOBAldoNo ratings yet

- R - GL Account Automatic ClearingDocument6 pagesR - GL Account Automatic Clearingvemulapallisunil26No ratings yet

- This Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersDocument8 pagesThis Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersFunny idolNo ratings yet

- CHAPTER 8 Issue of Debentures - 24106080Document39 pagesCHAPTER 8 Issue of Debentures - 24106080Krish BhargavaNo ratings yet

- Metropolitan Waterworks and Sewerage System, vs. Court of AppealsDocument6 pagesMetropolitan Waterworks and Sewerage System, vs. Court of AppealsRheaNo ratings yet

- Askari Bank Report Final VUDocument60 pagesAskari Bank Report Final VUkamilbismaNo ratings yet

- Karnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008Document6 pagesKarnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008ಲೋಕೇಶ್ ಎಂ ಗೌಡNo ratings yet

- Reviewer 1ST PPT (Fabm)Document15 pagesReviewer 1ST PPT (Fabm)Jihane TanogNo ratings yet

- Project SystemDocument45 pagesProject Systemprashanti shetty50% (2)

- Supreme Ledger 19-20 FinalDocument1 pageSupreme Ledger 19-20 FinalKripa Shankar MishraNo ratings yet

- Accounting Viva Question & AnsDocument11 pagesAccounting Viva Question & AnsSakib Ahmed AnikNo ratings yet

- FabmDocument26 pagesFabmErica Napigkit100% (1)

- Chapter - Iv Fund Flow AnalysisDocument22 pagesChapter - Iv Fund Flow AnalysisThanga DuraiNo ratings yet

- Unit 3 Ledger Posting and Trial Balance PDFDocument46 pagesUnit 3 Ledger Posting and Trial Balance PDFPankaj VishwakarmaNo ratings yet

- Chapter 39 - Teacher's ManualDocument14 pagesChapter 39 - Teacher's ManualHohoho100% (1)

- CH 2 With Back ExerciseDocument17 pagesCH 2 With Back ExerciseParth GargNo ratings yet

- Accounting TermsDocument15 pagesAccounting TermsAyaanNo ratings yet