0 ratings0% found this document useful (0 votes)

76 viewsFórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Fórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Uploaded by

William Rojas MoralesThe document provides definitions and formulas related to project management terms from the PMBOK. It defines key terms like earned value, planned value, actual cost, budget at completion, cost variance, schedule variance, cost performance index, schedule performance index, and estimate at completion. It also provides formulas for activity duration, variance, standard deviation, expected monetary value, communication channels, final price, net present value, internal rate of return, benefit cost ratio, and payback period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Fórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Fórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Uploaded by

William Rojas Morales0 ratings0% found this document useful (0 votes)

76 views4 pagesThe document provides definitions and formulas related to project management terms from the PMBOK. It defines key terms like earned value, planned value, actual cost, budget at completion, cost variance, schedule variance, cost performance index, schedule performance index, and estimate at completion. It also provides formulas for activity duration, variance, standard deviation, expected monetary value, communication channels, final price, net present value, internal rate of return, benefit cost ratio, and payback period.

Original Title

PMI_AnexoAFormulas.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document provides definitions and formulas related to project management terms from the PMBOK. It defines key terms like earned value, planned value, actual cost, budget at completion, cost variance, schedule variance, cost performance index, schedule performance index, and estimate at completion. It also provides formulas for activity duration, variance, standard deviation, expected monetary value, communication channels, final price, net present value, internal rate of return, benefit cost ratio, and payback period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

76 views4 pagesFórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Fórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Uploaded by

William Rojas MoralesThe document provides definitions and formulas related to project management terms from the PMBOK. It defines key terms like earned value, planned value, actual cost, budget at completion, cost variance, schedule variance, cost performance index, schedule performance index, and estimate at completion. It also provides formulas for activity duration, variance, standard deviation, expected monetary value, communication channels, final price, net present value, internal rate of return, benefit cost ratio, and payback period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

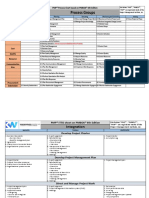

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

EV Earned Value The estimated value of the work completed.

The completed portion of the originally estimated, total value.

PV Planned Value The value of the work planned to be be done by now

AC Actual Cost The current amount spent.

The total cost so far for the work completed.

BAC Budget At Completion The total project budget

How much did we originally expect the total project to cost?

BAC = PV of entire project

CV Cost Variance Value of work accomplished – cost incurred

EV – AC

SV Schedule Variance The value of work completed – The value of work planned to be completed.

EV – PV Work completed – Expected work completed

Negative is behind schedule. Positive is ahead of schedule.

CPI Cost Performance Index We are getting X value out of each $ spent.

EV / AC Also as: “Cumulative CPI” when figures used are costs to date.

SPI Schedule Performance Index We are progressing at X rate originally planned.

EV / PV We are getting X value per original planned value.

EAC Estimate At Completion What we currently expect the total cost to be. Current cost + Bottom up (redone) estimate of remaining

AC + Bottom-up ETC cost. Used when original estimate was flawed.

BAC / CPI Currently, the total cost estimate per (cumulative) performance.

AC + (BAC – EV) Used when there is no variance from BAC. Most common on exam.

AC+[ (BAC-EV)/( CPI*SPI)] Current cost + Remaining work TBD.

PMBOK 5ta Edición - Ernesto Calvo

1

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

TCPI To Complete Performance The remaining work TBD per the remaining money.

Index In order to stay on budget, what remaining performance is needed?

(BAC – EV) / (BAC – AC)

ETC Estimate To Complete How much more will the project cost?

EAC – AC Updated total cost – current cost

Reestimate Reestimating the work from the bottom up.

VAC Variance At Completion How much over/under budget will we be?

BAC – EAC

EAD Expected Activity Duration The most likely estimated is weighed 4 times the pessimistic or optimistic.This and all formulas

( P + 4M + O ) / 6 below can be used for activity time and cost

AV Activity Variance A quantifiable deviation from an expected baseline or estimate. Also equal to standard

[ ( P - O ) / 6 ] ^2 deviation squared.

SD Standard Deviation The square root of the variance. Used to calculate the activity range. EAD +/- SD

(P–O)/6

Activity EAD +/- SD The estimated scope from EAD – Standard Deviation to EAD + Standard Deviation.

Range

Project EAD + EAD + EAD The sum of the EAD’s / PERT estimates

Expected

Duration

Project SD Standard deviation of the Each of the activity variances (AV) on the critical path are calculated individually. The square

projectsqrt root of their sum is the project standard deviation. It is used to calculate the project range.

[AV + AV + AV ...]

Project The project expected duration The sum of the project EADs +/- the project standard deviation.

Range +/- Project SD

PMBOK 5ta Edición - Ernesto Calvo

2

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

EMV Expected Monetary Value EMV = Probability times Impact

EMV = P * I

Communicati [ n (n-1) ] / 2 The number of channels between people. n is the number of people

on Channels

PTA [(CP - TP) / BSR] + TC Point of total assumption.

The amount at which seller pays all additional costs. Used in FPIF contracts.

The margin between the maximum and target prices is divided by the buyer’s portion of the

sharing ratio and added to the target cost

Final Fee FF = (TC – AC) x SSR + Sellers fee/profit is adjusted for cost performance.

TF The target fee is adjusted by adding: target cost – actual cost times the sellers portion of the

sharing ratio

Final Price FP = AC + FF (or CP, Final price equals actual cost plus final fee (or ceiling price)

whichever is lower)

Buy or Lease Purchase Cost + Owning So if something costs $1,000 to buy and $10 / day to maintain but costs $50 / day to rent, how

Cost * Time = Leasing many days does it take to break even? 1,000 + 10 * t = 50 * t The break even point is 25 days.

Cost * Time

Float Float = LF – EF or Late Finish – Early Finish or Late Start – Early Start

LS – ES

Late Finish LS = (LF - Duration + 1)

Early Finish EF = (ES + Duration - 1)

PMBOK 5ta Edición - Ernesto Calvo

3

Fórmulas: PMBOK - PMI

Nombre Valor

Order of Magnitude Estimate -25% - +75% (-50% to +100%)

Budget Estimate -10% - +25%

Definitive Estimate -5% - +10%

Present Value PV FV / (1 + r)^n

Net Present Value Bigger is better (NPV)

Internal Rate of Return Bigger is better (IRR)

Benefit Cost Ratio Bigger is better (Benefit / Cost)

Payback Period Less is better

Point of Total Assumption (PTA) ((Ceiling Price - Target Price)/buyer's Share Ratio) +

Target Cost

1σ = 68.27%

2σ = 95.45%

Sigma σ

3σ = 99.73%

6σ = 99.99985%

PMBOK 5ta Edición - Ernesto Calvo

4

You might also like

- PMP FormulasDocument5 pagesPMP Formulasbhaveshkumar78100% (10)

- PMP Formulas - Cheat Sheet v0.6 PDFDocument2 pagesPMP Formulas - Cheat Sheet v0.6 PDFDildar Saini100% (2)

- Online Job Portal Using PHP, MySQL Project Full ReportDocument31 pagesOnline Job Portal Using PHP, MySQL Project Full ReportSushant More82% (17)

- PMBOK 7th Edition ContentsDocument2 pagesPMBOK 7th Edition ContentsVivaan Singh0% (2)

- PMP 49 ProcessesDocument1 pagePMP 49 ProcessesRai Shaheryar BhattiNo ratings yet

- One Liner PMP NotesDocument13 pagesOne Liner PMP NotesAla'a Abdulla100% (1)

- ACT Customization Guide For SpaceClaimDocument18 pagesACT Customization Guide For SpaceClaimWilliam Rojas MoralesNo ratings yet

- ACT APIs For Mechanical GuideDocument50 pagesACT APIs For Mechanical GuideWilliam Rojas MoralesNo ratings yet

- Liverpool Vs Chelsea - 22 July 2020Document100 pagesLiverpool Vs Chelsea - 22 July 2020Joseph KalaiNo ratings yet

- PMP Formulas Pocket GuideDocument2 pagesPMP Formulas Pocket Guidesantiroes pmp80% (5)

- Key Concept and Formulas For PMP ExamDocument4 pagesKey Concept and Formulas For PMP ExamaaranganathNo ratings yet

- Formulas Math For PMPDocument3 pagesFormulas Math For PMPramorclNo ratings yet

- PMP Quick Reference GuideDocument20 pagesPMP Quick Reference Guidevivek100% (2)

- Formulas - Math For PMPDocument2 pagesFormulas - Math For PMPabhi10augNo ratings yet

- 17 PMP Formulas Mentioned in The PMBOK GuideDocument14 pages17 PMP Formulas Mentioned in The PMBOK GuideStéphane SmetsNo ratings yet

- PMP Formula Pocket GuideDocument1 pagePMP Formula Pocket Guidesunil_v5No ratings yet

- Cracking The PMP Code: Draft PrintDocument5 pagesCracking The PMP Code: Draft PrintMMNo ratings yet

- Exam Flashcards: by Jonathan DonadoDocument520 pagesExam Flashcards: by Jonathan DonadoAndreeaNo ratings yet

- Comparison of 6th & 7th EditionDocument25 pagesComparison of 6th & 7th EditionHsaung Hnin Phyu100% (1)

- PMP Formulas: 1. Number of Communication ChannelsDocument5 pagesPMP Formulas: 1. Number of Communication ChannelsramaiahNo ratings yet

- 14A BONUS 04A Alvin Exam Roadmap To SuccessDocument7 pages14A BONUS 04A Alvin Exam Roadmap To SuccessDileep Kumar MotukuriNo ratings yet

- PMP Exam Maths, Formulas & Equations - Sayed Mohsen-2020-04-03 00 - 50 - 54 PDFDocument48 pagesPMP Exam Maths, Formulas & Equations - Sayed Mohsen-2020-04-03 00 - 50 - 54 PDFMohamed SaaDNo ratings yet

- PMP NotesDocument49 pagesPMP Notesgirishkris100% (1)

- PMP Notes - Rajesh NairDocument42 pagesPMP Notes - Rajesh Nairanurag_0967% (3)

- Midi's Free ITTO SpreadsheetDocument25 pagesMidi's Free ITTO Spreadsheetthepreparedpm100% (1)

- PMP Tools and Techniques in SummaryDocument22 pagesPMP Tools and Techniques in Summaryahmedmoin1159No ratings yet

- Rita 10th Pages Should ReadDocument31 pagesRita 10th Pages Should Readminhan220979No ratings yet

- Process Groups: PMP® Process Chart Based On PMBOK® 6th EditionDocument15 pagesProcess Groups: PMP® Process Chart Based On PMBOK® 6th EditionGaurav100% (2)

- PMP IttoDocument101 pagesPMP IttoAbdul RozlanNo ratings yet

- Velopi PMP Cheat Sheet PDFDocument1 pageVelopi PMP Cheat Sheet PDFtrudiddleNo ratings yet

- Project Management Processes - Knowledge Area-WiseDocument14 pagesProject Management Processes - Knowledge Area-Wisesimahi2607No ratings yet

- Formulas PMP V01Document1 pageFormulas PMP V01Eric AlvarezNo ratings yet

- PMP Exam PrepDocument10 pagesPMP Exam Prepjaisingla100% (1)

- PMP Prep Notes Project LifecycleDocument3 pagesPMP Prep Notes Project LifecycletrudiddleNo ratings yet

- Free PMP Practice QuestionsDocument50 pagesFree PMP Practice QuestionstolentinoveNo ratings yet

- PMP NotesDocument16 pagesPMP Notesvnethi9317100% (2)

- PMP Cheat SheetDocument2 pagesPMP Cheat SheetLukinho De SouzaNo ratings yet

- PMP-IOs Mapping PDFDocument5 pagesPMP-IOs Mapping PDFjdavidzapata100% (1)

- PMP TermsDocument62 pagesPMP TermsARVIND ARORANo ratings yet

- Tips To Remember PMP Processes ITTODocument3 pagesTips To Remember PMP Processes ITTOAman Bhel50% (2)

- PMP Study Plan G42Document4 pagesPMP Study Plan G42MidyolNo ratings yet

- Dashboard Design Best Practices: Speaker: Dan BulosDocument38 pagesDashboard Design Best Practices: Speaker: Dan BulosEduardo DuarteNo ratings yet

- PMP Full Process MapDocument14 pagesPMP Full Process MapSIBINNo ratings yet

- PMP Key PointsDocument8 pagesPMP Key PointsironpushaNo ratings yet

- PMP PreparationDocument17 pagesPMP Preparationsherifelshammaa100% (3)

- Project Management Principles: Pmbok Guide 7 EditionDocument35 pagesProject Management Principles: Pmbok Guide 7 EditionNavaneeth PurushothamanNo ratings yet

- Finance in Project ManagementDocument10 pagesFinance in Project ManagementСергей КосмачовNo ratings yet

- Tips For Memorizing IttosDocument4 pagesTips For Memorizing IttosRobincrusoe100% (3)

- Summary Knowledge Areas - ProcessesDocument6 pagesSummary Knowledge Areas - Processestigrot100% (1)

- Mastering PMP ITO PDFDocument15 pagesMastering PMP ITO PDFSamuel ZvimbaNo ratings yet

- PMP Memory SheetsDocument6 pagesPMP Memory SheetsAamirMalik100% (1)

- PMP NotesDocument160 pagesPMP NotesAtul Patil100% (2)

- PMP Practice QuestionsDocument32 pagesPMP Practice QuestionsSatish RaghupathiNo ratings yet

- PMP ITTO Sheet PMBOK Guide 6th EditionDocument35 pagesPMP ITTO Sheet PMBOK Guide 6th EditionpatNo ratings yet

- Rita Process ChartDocument1 pageRita Process Chartaa k100% (1)

- PMP Exam Prep 02-18 Ver 12.1 Student GuideDocument228 pagesPMP Exam Prep 02-18 Ver 12.1 Student GuideCHI LÊ NGỌC KIMNo ratings yet

- PMP TipsDocument13 pagesPMP Tipskumar31052003100% (3)

- PMP NotesDocument84 pagesPMP Notesheament pelodiaNo ratings yet

- PMP Formula CompilationDocument3 pagesPMP Formula CompilationJRNo ratings yet

- PMP Formula Pocket GuideDocument1 pagePMP Formula Pocket Guidenanaba06No ratings yet

- Formulas / Math For PMP: AtypicalDocument3 pagesFormulas / Math For PMP: AtypicalSudhakar Lakshmana RajNo ratings yet

- Key Formulas and Calculations - 2009Document2 pagesKey Formulas and Calculations - 2009Chris SumedcaNo ratings yet

- PMP Exam Formulas Summary: Earned Value Management Name Abbr. Formula NoteDocument6 pagesPMP Exam Formulas Summary: Earned Value Management Name Abbr. Formula NoteTrương ĐịnhNo ratings yet

- PMP Formulae: Earned Value ManagementDocument4 pagesPMP Formulae: Earned Value ManagementOmerZiaNo ratings yet

- ACT Customization Guide For Fluent PDFDocument22 pagesACT Customization Guide For Fluent PDFWilliam Rojas MoralesNo ratings yet

- ACT Customization Guide For Fluent PDFDocument22 pagesACT Customization Guide For Fluent PDFWilliam Rojas MoralesNo ratings yet

- ACT Customization Guide For DesignModelerDocument28 pagesACT Customization Guide For DesignModelerWilliam Rojas MoralesNo ratings yet

- Micon Ic Check SheetDocument3 pagesMicon Ic Check SheetVenkatesh Subramanya0% (1)

- Workshop Week 9 SolutionsDocument9 pagesWorkshop Week 9 SolutionsAssessment Help SolutionsNo ratings yet

- RUBRICs TLEDocument1 pageRUBRICs TLEDhang Nario De TorresNo ratings yet

- Theo The NightwalkerDocument2,358 pagesTheo The NightwalkerNkululo SbongaNo ratings yet

- Question BankDocument71 pagesQuestion BankchandrulesNo ratings yet

- OZ8953 O2MicroDocument32 pagesOZ8953 O2Microluka2stojanovic-10% (1)

- Effects of A 12 Week SAQ Training Programme On Agility With and Without The Ball Among Young Soccer PlayersDocument7 pagesEffects of A 12 Week SAQ Training Programme On Agility With and Without The Ball Among Young Soccer Playerskang soon cheolNo ratings yet

- Vmware Interview Questions and AnswersDocument41 pagesVmware Interview Questions and Answersmanga47075% (4)

- ResumeAsimMohinuddin PDFDocument6 pagesResumeAsimMohinuddin PDFJenniferNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingDbNo ratings yet

- NR-500 - Operator-Programming Manual v1.11Document237 pagesNR-500 - Operator-Programming Manual v1.11Matthys StrydomNo ratings yet

- Client-Counsellor Feedback FormDocument1 pageClient-Counsellor Feedback FormsadiaghantyNo ratings yet

- TIA-222F Structural Standards For Steel Antenna Towers and Antenna Supporting StructuresDocument120 pagesTIA-222F Structural Standards For Steel Antenna Towers and Antenna Supporting Structuresjucag66No ratings yet

- Science: First Quarter - Module 4A Unsaturated SolutionDocument23 pagesScience: First Quarter - Module 4A Unsaturated SolutionMher Buenaflor100% (1)

- Extensor Tendon Injury ProtocolDocument11 pagesExtensor Tendon Injury ProtocoltasneempichoriNo ratings yet

- Essentialism Vs Social ConstructionismDocument10 pagesEssentialism Vs Social ConstructionismRegia AndiNo ratings yet

- GQB in PDFDocument592 pagesGQB in PDFckvirtualize100% (7)

- Assignment As 1 Intro To Anatomy: A. Give Your Responses To The FollowingDocument8 pagesAssignment As 1 Intro To Anatomy: A. Give Your Responses To The FollowingNINA NORELLE GALVEZNo ratings yet

- RAYANAIR CASE STUDY1 - CompressedDocument20 pagesRAYANAIR CASE STUDY1 - Compressedyasser massryNo ratings yet

- Grammar Exercises Unit3 Unit4 B1Document4 pagesGrammar Exercises Unit3 Unit4 B1WinstonNo ratings yet

- Dy23 2, Dy27 2, Ep5754aDocument30 pagesDy23 2, Dy27 2, Ep5754anijosoNo ratings yet

- Determination of Copper (Ii) Concentration by Colorimetric MethodDocument6 pagesDetermination of Copper (Ii) Concentration by Colorimetric MethodCherryAnnEspanto100% (2)

- EnzymologyDocument47 pagesEnzymologyTererai Lalelani Masikati Hove100% (1)

- US4661747Document7 pagesUS4661747Lee FarrandNo ratings yet

- Learning Activity Sheet (Q3)Document9 pagesLearning Activity Sheet (Q3)Marlyn LotivioNo ratings yet

- 4ch1 1c Que 20230523Document32 pages4ch1 1c Que 20230523faisal.756009No ratings yet

- Hexion Vodnye Otverditeli I Smoly EngDocument6 pagesHexion Vodnye Otverditeli I Smoly EngCloudy DayNo ratings yet

- "Feasibility of Coir Fibers As An Air Filtration Device": Presenters: Andrew Cayat Dominic Sison John SolisDocument12 pages"Feasibility of Coir Fibers As An Air Filtration Device": Presenters: Andrew Cayat Dominic Sison John SolisBasal JonathanNo ratings yet