Note 1

Note 1

Uploaded by

Mercy Clapano-Artazo MirandaCopyright:

Available Formats

Note 1

Note 1

Uploaded by

Mercy Clapano-Artazo MirandaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Note 1

Note 1

Uploaded by

Mercy Clapano-Artazo MirandaCopyright:

Available Formats

Note 1

A. Include all goods whether taxpayer tax payer has title or not, provided these goods are actually situated in location/address at the Head Office or Branch

or Facilities (with or without sales activity of the tax payer). Facilities shall include but not limited to place of production, showroom, warehouse, storage

place, leased property, etc. include also goods out on consignment, though not physically present are nonetheless by the tax payer.

B. Use the following codes:

CH Goods on consignment Indicate the name of the consignor in the Remarks column

held by tax payer.

P parked goods or goods Indicate the name of related party/owner in the Remarks Column

Owned by related

O Goods owned by tax payer

Co consignment held in the Indicate the name of the entry in the Remarks column

hands of entity other

Note 2 Indicate Costing Method applied, eg., Standard Costing FIFO, Weighed Average, Specific Identification, etc.

We declare, under the penalties of perjury that this schedule has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

NELIA M. URBIZTONDO

Name and Signature of Authorized

Representative

TIN: 907-481-517

You might also like

- Annex DDocument1 pageAnnex DIdan Aguirre67% (3)

- RMC No. 8-2024 Annex A TemplateDocument2 pagesRMC No. 8-2024 Annex A TemplateELLIE JAMES PLACIONo ratings yet

- Inventory Template Annex ADocument4 pagesInventory Template Annex AMarfin M. Ramos64% (14)

- RMC No. 8-2024 - Annex ADocument1 pageRMC No. 8-2024 - Annex AAnostasia Nemus100% (1)

- Income Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Document1 pageIncome Payee's Sworn Declaration of Gross Receipts - BIR Annex B-2Records Section67% (3)

- Sworn Declaration FormDocument1 pageSworn Declaration FormAnawin FamadicoNo ratings yet

- Inventory List (Annex A)Document82 pagesInventory List (Annex A)ejay nielNo ratings yet

- Annex A C of RMC No. 57 2015Document2 pagesAnnex A C of RMC No. 57 2015Pauline Cabusora100% (6)

- FS5188-DurablePOA ForSecurtiesDocument3 pagesFS5188-DurablePOA ForSecurtiestafilli54100% (2)

- Power of Attorney - MP IncDocument1 pagePower of Attorney - MP IncJosé Ángel FernándezNo ratings yet

- Oath of Master Covering List of Officers On Coastwise VesselDocument1 pageOath of Master Covering List of Officers On Coastwise VesselMercy Clapano-Artazo MirandaNo ratings yet

- V.M.C. Furniture: For Retail / Manufacturing IndustryDocument2 pagesV.M.C. Furniture: For Retail / Manufacturing Industrycristina constantinoNo ratings yet

- Inventory Template Annex ADocument4 pagesInventory Template Annex APadua AnthonyNo ratings yet

- For Retail / Manufacturing IndustryDocument4 pagesFor Retail / Manufacturing IndustryPadua AnthonyNo ratings yet

- For Retail / Manufacturing IndustryDocument4 pagesFor Retail / Manufacturing IndustryJared VesquiraNo ratings yet

- For Retail / Manufacturing IndustryDocument2 pagesFor Retail / Manufacturing Industrycristina constantinoNo ratings yet

- Task - Payment and Invoice - RONAINDA ARITONANG - 2005081039 - AK4BDocument12 pagesTask - Payment and Invoice - RONAINDA ARITONANG - 2005081039 - AK4BRonainda AritonangNo ratings yet

- W'8BEN: Certificate of Status StatesDocument1 pageW'8BEN: Certificate of Status StatesMaloryNo ratings yet

- Commercial-Invoice in CustomsDocument3 pagesCommercial-Invoice in CustomsMafet AlcaldeNo ratings yet

- CIR Vs Manila Mining CorpDocument27 pagesCIR Vs Manila Mining CorpJessNo ratings yet

- Annex (A1)Document1 pageAnnex (A1)Jana Jonathan0% (1)

- Statutory Declaration FormDocument2 pagesStatutory Declaration FormRomil BadamiNo ratings yet

- Main Taxpayer User S Sworn Statement TemplateDocument1 pageMain Taxpayer User S Sworn Statement Templategeil.cererioNo ratings yet

- 2307 Jan 2018 ENCS v3Document1 page2307 Jan 2018 ENCS v3cahiligjoyceNo ratings yet

- Mandatory Disclosure Form - SalesDocument2 pagesMandatory Disclosure Form - SalesBrian SotobeNo ratings yet

- 1604-C Guidelines Jan 2018 FinalDocument1 page1604-C Guidelines Jan 2018 FinalFedsNo ratings yet

- Request For Appeal of Offer in CompromiseDocument2 pagesRequest For Appeal of Offer in CompromiseNABEEL CHNo ratings yet

- Contract Agreement FormDocument13 pagesContract Agreement FormJenjuroNo ratings yet

- Matthews Asia Funds Institutional Account Opening FormDocument6 pagesMatthews Asia Funds Institutional Account Opening Formporter siminourNo ratings yet

- 53131BIR Form No. 0901-C (Capital Gain)Document2 pages53131BIR Form No. 0901-C (Capital Gain)jamesNo ratings yet

- CONTENTDocument14 pagesCONTENTSolgrynNo ratings yet

- Form No. II: The Indian Partnership Act, 1932Document1 pageForm No. II: The Indian Partnership Act, 1932sampras1997100% (1)

- RMC 77-21 (Checklist - Business Profits)Document2 pagesRMC 77-21 (Checklist - Business Profits)Hailin QuintosNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Kim Angelli ParcoNo ratings yet

- RMC No 8-2023 - Annexes ADocument2 pagesRMC No 8-2023 - Annexes Aadrian bartolomeNo ratings yet

- Construtive NoticeDocument7 pagesConstrutive NoticeDerrick SibleyNo ratings yet

- VAT264Document1 pageVAT264Simbarashe MarisaNo ratings yet

- SD PDFDocument2 pagesSD PDFdummyanne27No ratings yet

- Tarea 5Document9 pagesTarea 5josefaNo ratings yet

- RR No.7 - 2024Document17 pagesRR No.7 - 2024panesa.miajoycerNo ratings yet

- NYS Resale CertificateDocument1 pageNYS Resale CertificateVanessa HernandezNo ratings yet

- Form 503-General Information (Assumed Name Certificate) : Attorney and Tax SpecialistDocument5 pagesForm 503-General Information (Assumed Name Certificate) : Attorney and Tax SpecialistAshleeNo ratings yet

- ACCOUNTOPENINGFORMDocument9 pagesACCOUNTOPENINGFORMBatayan SarkarNo ratings yet

- Request For QuotationDocument1 pageRequest For QuotationbacnewbataanNo ratings yet

- Annex F RR 11-2018 (Sample)Document2 pagesAnnex F RR 11-2018 (Sample)amara corp100% (1)

- Sworn Statement SampleDocument1 pageSworn Statement Samplecs.szeleeNo ratings yet

- 2306 - 2307Document57 pages2306 - 2307Dearly EnzoNo ratings yet

- Substitute Form W-9Document2 pagesSubstitute Form W-9gopaljiiNo ratings yet

- Form ST-120 - 1 - 11 - Resale Certificate - ST120Document2 pagesForm ST-120 - 1 - 11 - Resale Certificate - ST120lastofalocal ibdonuibdonuNo ratings yet

- SEC 17-C - Formation of A Subsidiary March 2023Document3 pagesSEC 17-C - Formation of A Subsidiary March 2023anne anneNo ratings yet

- BIR POS Sworn StatementDocument2 pagesBIR POS Sworn StatementMax Danugan100% (1)

- RR No. 11-2018 Annex FDocument1 pageRR No. 11-2018 Annex FRegina MontesNo ratings yet

- Contex Vs CirDocument16 pagesContex Vs CirJAMNo ratings yet

- Processing An Export OrderDocument21 pagesProcessing An Export OrderasifanisNo ratings yet

- Request For Appeal of Offer in CompromiseDocument2 pagesRequest For Appeal of Offer in CompromiseRuss TaylorNo ratings yet

- Deed of Sale of Shares of StockDocument2 pagesDeed of Sale of Shares of StockrozechyleNo ratings yet

- Affidavit-1 1Document6 pagesAffidavit-1 1meera agrawalNo ratings yet

- DTI PermitDocument3 pagesDTI PermitErielle Sta. AnaNo ratings yet

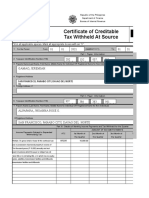

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- CS Form No. 212 Revised Personal Data Sheet LOWENDA MIRANDADocument16 pagesCS Form No. 212 Revised Personal Data Sheet LOWENDA MIRANDAMercy Clapano-Artazo MirandaNo ratings yet

- Resignation LetterDocument3 pagesResignation LetterMercy Clapano-Artazo MirandaNo ratings yet

- Hon. Prospero "Butch" A. Pichay, Jr. and Madam Maria Carla L. PichayDocument2 pagesHon. Prospero "Butch" A. Pichay, Jr. and Madam Maria Carla L. PichayMercy Clapano-Artazo MirandaNo ratings yet

- September 16, 2019Document5 pagesSeptember 16, 2019Mercy Clapano-Artazo MirandaNo ratings yet

- Oral Language/First Quarter Oral Language/First Quarter: Old Curriculum Enhanced CurriculumDocument10 pagesOral Language/First Quarter Oral Language/First Quarter: Old Curriculum Enhanced CurriculumMercy Clapano-Artazo MirandaNo ratings yet

- Core ValuesDocument2 pagesCore ValuesMercy Clapano-Artazo MirandaNo ratings yet

- Omicron Zeta Phi Fraternity & Sorority Smc/Sdssu Cantilan Chapter Cantilan, Surigao Del SurDocument2 pagesOmicron Zeta Phi Fraternity & Sorority Smc/Sdssu Cantilan Chapter Cantilan, Surigao Del SurMercy Clapano-Artazo MirandaNo ratings yet

- JECAR ResumeDocument5 pagesJECAR ResumeMercy Clapano-Artazo MirandaNo ratings yet

- Attendance Sheet: Magasang, Cantilan, Surigao Del SurDocument2 pagesAttendance Sheet: Magasang, Cantilan, Surigao Del SurMercy Clapano-Artazo MirandaNo ratings yet

- Names SignatureDocument2 pagesNames SignatureMercy Clapano-Artazo MirandaNo ratings yet

- A Detailed Lesson Plan: Content StandardDocument8 pagesA Detailed Lesson Plan: Content StandardMercy Clapano-Artazo Miranda0% (1)

- Sworn Declaration: Annex DDocument1 pageSworn Declaration: Annex DMercy Clapano-Artazo MirandaNo ratings yet

- SPA C ForCandidatesDocument1 pageSPA C ForCandidatesMercy Clapano-Artazo Miranda0% (1)

- Research in Readings in The Philippine History: Jessa Mae E. Abueva Submitted By: Zenaida V. Loren Submitted ToDocument6 pagesResearch in Readings in The Philippine History: Jessa Mae E. Abueva Submitted By: Zenaida V. Loren Submitted ToMercy Clapano-Artazo MirandaNo ratings yet

- Dilg RequirementDocument2 pagesDilg RequirementMercy Clapano-Artazo MirandaNo ratings yet

- + 2 Xy + X X - 2y - 1 X X + 2y + 1 X X + 2y - 1 X X - 2y + 1 600 X 96 X 150 X 42 X 654 X 6 X 6 X 8 X 4 X 2 X 32 32 2 2Document2 pages+ 2 Xy + X X - 2y - 1 X X + 2y + 1 X X + 2y - 1 X X - 2y + 1 600 X 96 X 150 X 42 X 654 X 6 X 6 X 8 X 4 X 2 X 32 32 2 2Mercy Clapano-Artazo MirandaNo ratings yet

- References: District Office Leadership Practices' Impact On Principal Job SatisfactionDocument10 pagesReferences: District Office Leadership Practices' Impact On Principal Job SatisfactionMercy Clapano-Artazo MirandaNo ratings yet

- Name: Position: Tin Number: Sss Number: Birthday: Height: CM Blood Type Weight in Case of Emergency: Name: Address: Tel No. RelationshipDocument2 pagesName: Position: Tin Number: Sss Number: Birthday: Height: CM Blood Type Weight in Case of Emergency: Name: Address: Tel No. RelationshipMercy Clapano-Artazo MirandaNo ratings yet

- BoysDocument1 pageBoysMercy Clapano-Artazo MirandaNo ratings yet

- Audited Financial StatementsDocument1 pageAudited Financial StatementsMercy Clapano-Artazo MirandaNo ratings yet

- December 5, 2018Document8 pagesDecember 5, 2018Mercy Clapano-Artazo MirandaNo ratings yet

- Godolivo Arreza Urbiztondo 12345Document2 pagesGodolivo Arreza Urbiztondo 12345Mercy Clapano-Artazo MirandaNo ratings yet