Asset-Liability Management in Banking Sector

Asset-Liability Management in Banking Sector

Uploaded by

sukanyaCopyright:

Available Formats

Asset-Liability Management in Banking Sector

Asset-Liability Management in Banking Sector

Uploaded by

sukanyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Asset-Liability Management in Banking Sector

Asset-Liability Management in Banking Sector

Uploaded by

sukanyaCopyright:

Available Formats

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 20, Issue 2. Ver. VIII (February. 2018), PP 01-07

www.iosrjournals.org

An Analysis of Asset-Liability Management in Banking Sector: A

Case Study of Kotak Mahindra Bank

1

Ms. Pragathi K.M.,2 Dr. Veena K.P.

1

Assistant Professor, Dept. Of Commerce & Management, Vidya Vikas First Grade College, Mysuru – 570028,

Karnataka.

2

Associate Professor, Dept. Of Master Of Business Administration (MBA), Visvesvaraya Technological

University, Post Graduation Studies, Mysore Regional Centre, Mysore – 570029, Karnataka.

Corresponding Author: 1Ms. Pragathi K.M

Abstract The Indian Financial System have changing and growing very fast way. Competitive business world

involving both the asset and liabilities with changing interest rates as well as foreign exchange rates has

brought pressure on the management of banks to maintain good profitability.Assets and Liability Management

(ALM) is a systematic and dynamic process of planning, organizing, coordinating and controlling the assets and

liabilities or in the sense management of balance sheet structure in the bank is the biggest opportunity for the

Indian banking system. The main objectives of the study is to understand the theoretical background of assets

liability management and profile of the bank in general and to assess the performance of profitability position in

Kotak Mahindra Bank and also to evaluate the performance of profit and loss account and balance sheet ratios

in Kotak Mahindra Bank. In this paper data has been collected from secondary sources from annual reports of

Kotak Mahindra Bank from the period of 2013-14 to 2017-18.Finally to analyze the performance of assets and

liabilities management has been measured it results the credit deposit ratio, quick ratio, interest expanded to

interest earn, other income to total income and interest spreadthis ratios showing increasing trend from one

year to another year therefore the performance of assets liability management position is satisfactory and better

in Kotak Mahindra Bank.

Key words: Asset Liability Management, risk management, Interest rate risk etc.

----------------------------------------------------------------------------------------------------------------------------- ----------

Date of Submission: 09-02-2018 Date of acceptance: 24-02-2018

----------------------------------------------------------------------------------------------------------------------------- ----------

I. Introduction:

Assets Liability Management (Alm) Is Managing Infrastructure Asset To Minimize The Total Cost Of

Owning And Operating Them While Continuously Delivering The Service Levels Customer’s Desire. It Is A

Comprehensive And Structured Approach To The Long Term Management Of Asset. It Refers To A Systematic

Process Of Effectively Maintaining, Upgrading And Operating Assets, Combining Engineering Principles With

Sound Business Practice And Economic Rational And Providing The Tools To Facilitate A More Organized

And Flexible Approach For Making Decision Necessary To Achieve Expectations Of Stake Holders And The

Public. It Involves The Management Of Assets, Such As Investments Or Property. Liability Management Is The

Flip Side Of The Coin The Management Of Debts, Loans And Mortgages.For Example: Most People And

Indeed Companies Have A Mixture Of Asset And Liabilities In Order To Maximize Their Returns Or Wealth.

Asset Liability Management Has Been A Greater Concern For Banks Due To Uncertainties And

Volatility In The Market And The Influence Of Market Forces Which Are Very Much Unpredictable Due To

The Influence Of Macro Factors Both In Domestic As Well In Global Markets. Technology Advancement, New

Product Innovations, Latest Management Practices Brought In New Private Players And Foreign Banks Adding

Further Stress On The Functioning Of Public Sector Banks. Under These Compelling Situations, Alm Objective

Is To Control Volatility Of Net Interest Income And Net Economic Value Of Respective Banks. The

Supplementary Objectives Is To Cover And Control Volatility Of All Target Accounts, Control Of Liquidity

Risk And Ensure An Acceptable Balance Between Profitability And Growth Rate. The Banking Sector Needs

To Introduce Measures In Order To Compete In A Competitive Environment, So That Risk Can Be Minimized.

The Recent Collapse Of The Banking System And The Systemic Risk Is A Clear Testimonial For Inadequate

Attention Given For Risk Management. The Success Of Banking System Depends On The Appropriate Asset

Liability Management Which In Turn Depends On The Effective Policies, Governance And Risk Management

Practices.Alm Is A Tool Used To Address The Risk Faced By Banks Due To Difference Between Assets And

Liabilities Either Due To Liquidity Or Changes In The Interest Rates. Therefore This Study Has Been Attempt

On Assets Liability Management Of Kotak Mahindra Bank.

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 1 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Profile Of The Bank

Kotakmahindra Bank Establishes In 1985, The Kotak Mahindra Group Has Been One Of India’s Most

Reputed Financial Conglomerates. Today, The Bank Is One Of The Fastest Growing Banks Among The Most

Admired Financial Institutions In India. It Has Set New Benchmarks Of Excellence In Niche Industry By

Achieving Better Operational Efficiency Across Portfolio Of Unique Product And Services. The Bank Has 2.8

Trillion Institution, 44,000 Employees, 1,73,287 Crores Market Capitalization, 1,60,000 Plus Shareholders,

1,369 Bank Branches And 2,163 Atm’s Spread All Over India. The Bank Has An International Presence

Through Its Subsidiaries With Offices In London, Dubai, Mauritius And Singapore That Specialize In Providing

Services To Overseas Investors Seeking To Inverts Into India.

Ratios In Assets Liability Management:

Alm Leads To The Formulation Of Critical Business Policies, Efficient Allocation Of Capital, And

Designing Of Product With Appropriate Pricing Strategies. Theorefore This Study Showcases Those Ratios And

Assets Liability Management On The Profitability Position Of The Banks.

The Calculations Are Based Upon The Following Formulas:

1. Interest Spread: It Is The Difference Between Borrowing And Lending Rates Of Banks In The Financial

Year. It Similar To The Profit Margin. Larger Interest Rate Spread The Earning Will Be More And

Fluctuation In Interest Rate Spread Decrease Income.

2. Adjusted Cash Margin: It Is A Profitability Ratio And It Is Also Called As True Margin.

Income/Net Sales

3. Net Profit Margin: It Is The Percentage Of Revenue Left After All Expenses, Tax And Preference Stock

Have Been Deducted From Sales.

Net Income After Tax/Revenue

4. Adjusted Return On Net Worth: It Is The Method Of Valuating The Value Of A Bank By Using Capital

Value And Surplus Value.

Net Income/ Shareholders Equity

5. Interest Coverage Ratio Used To Calculate Bank Ability To Meet Its Debt Obligations.

Ebit/Total Interest

6. Current Ratio: The Current Ratio Is A Ratio That Measures A Bank Ability To Pay Short-Term

Obligations. The Current Ratio Considers Company Total Current Assets Relative To That Company’s

Current Total Liabilities. The Standard Ratio Is 2:1.

Current Asset/Current Liabilities

7. Quick Ratio: The Quick Ratio Is A Financial Ratio, Also Known As Acid Test Ratio Used To Analyses

The Company’s Liquidity. Quick Ratio Can Be Measure Of Liquidity Of A Bank Than Its Current Ratio.

The Standard Ratio Is 1:1.

8. Capital Adequacy Ratio: Capital Adequacy Ratio Is A Measure Of A Bank's Capital. It Is Expressed As A

Percentage Of A Bank's Risk Weighted Credit Exposures.

Capital Adequacy Ratio= (Tier One Capital + Tier Two Capital)/Risk Weighted Assets

9. Credit Deposit Ratio: Credit Deposit Ratio Is The Ratio With Which It Could Be Analyzed Of How Much

A Bank Lends Out Of The Deposits It Has Mobilized. It Indicates The Financial Strength Of The Bank.

10. Investment Deposit Ratio:Investment Deposit Ratio Mainly Provide Information About How The Bank Is

Using Their Deposits, For Better Investment.

11. Cash Deposit Ratio: Cash Deposit Ratio Indicate The Amount Of Money A Bank Should Have As A

Percentage Of The Total Amount Of Money Its Customers Have Paid Into The Bank.

12. Total Debts To Owner’s Fund: It Can Be Measurement Of A Bank’s Financial Leverage.

The Concept Of Timing And Rate Of Interest In Alm Is A Key Because Managers Need To Know At

What Time The Liability Will Be Paid And To Insure About Availability Of Assets To Pay This Liability To

Minimize Risk Factors In Banking Sectors.

II. Review Of Literature:

There Are Many Attempts Made On From Past Decades The Study Of Asset And Liability

Management In Indian Banking Sectors.

Dash And Pathak (2011), His Survey Proposed On Linear Model For Asset-Liability Assessment. They

Found Public Sector Banks Are Having The Best Asset-Liability Management Positions. In Turn, They Found

That Public Sector Banks Had A Strong Short-Term Liquidity Position, But With Lower Profitability, While

Private Sector Banks Had A Comfortable Short-Term Liquidity Position, Balancing Profitability.

Sayeed (2012), Attempted To Examine The Impact Of Asset And Liability Management On The

Profitability High Profitable And Low Profitable And Private And Public Banks Working In Bangladesh

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 2 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Applying Statistical Cost Accounting (Sca) Methods And Found High Earning Banks Experience Higher

Returns From Their Assets And Lower Returns From Their Liabilities Than The Low Earning Banks

Petraityte (2013),States That "Alm Is A Tool That Combines Several Bank Portfolios - Asset,

Liabilities, And The Difference Between The Banks Received And Interest Paid By The Bank And The Main

Alm Purpose Is To Connect Different Bank Activities Into A Single Unit, Facilitating Liquidity And Balance

Sheet Management".

Kumar, (2014), Studied On Research, The Most Important Factor Which Banks Required To Manage

Now Days Is Liquidity. This Study Analyzed Short Term Liquidity And Maturity Gap Of The Banks In Order

To Decreases Risk In Banking Sector. This Survey Help Banks To Reduce The Risk Which Is Very Essential

For All Financial Institution In India.

Bastray (2015),Studied On Interest Rate Risk Is Analyzed Through The Use Of Gap Analysis In

Banking Sector And To Fill The Short Term Liquidity Gap, Bank Resort To Market Borrowing At High Rate Of

Interest, This Cause In The Reduction Of Interest Margin And The Profitability Of Bank.

Shetty (2016), Conducted A Study On An Analysis Of Private Banks Exposure To Asset Liability

Management. These Paper Attempts To Assess The Liquidity Risk That All Five Private Sector Banks Are

Exposed To Spread Over A Period From 2011 To 2015. The Finding From The Study Revealed That Banks

Have Been Exposed To Liquidity Risk.The Study Also Indicated That Hdfc Bank And Icici Bank Have Better

Alm Framework In Practice.

Tee(2017), Evaluated On Asset Liability Management And The Profitability Of Listed Banks In

Ghana. The Purpose Of This Paper Is To Assess The Impact Of Asset And Liability Management On The

Profitability Of Listed Banks In Ghana. Multiple Linear Regression Has Been Applied By Taking Roa As The

Dependent Variable, And Tas (The Total Asset) And Tlt (The Total Liability) Representing The Asset And

Liability Mix Of The Banks.

Statement Of The Problem:

Asset And Liability Management Is A New Technique To Build A Framework For Banking Activities

To Perform Better And To Take Best Decisions. Asset And Liabilities Management Become Essential Tools To

Evaluate The Risk Facing By The Bank In Maintaining Asset And Liability To Ensure Profitability Of The

Business. Assessing The Quality Of Assets In Banking Sector Play A Vital Role In Progress And Development

Of Performance Of Banking Sectors, Which May Make A Study Of Alm Is Essential And Significant.

Objectives Of The Study:

The Following Are The Major Objectives Of The Study:

1. To Understand The Theoretical Background Of Assets Liability Management;

2. To Assess The Profitability Positionof Kotak Mahindra Bank;

3. To Evaluate The Performance Of Profit And Loss Account And Balance Sheet Ratios Of The Bank;

4. To Analyze The Performance Of Debt Coverage Ratio Of Kotak Mahindra Bank; And

5. To Give Recommendations And Suggestions For The Study.

III. Research Methodology:

The Present Study Is Predominantly Exploratory In Nature Hence The Secondary Data Is Mainly

Depends On The Financial And Accounting Data Of Kotak Mahindrabank. The Study Covered The Data

Collected From The Major Financial Details Such As Balance Sheets, Annual Reports Of The Kotakmahendra

Bank For The Period Of 2013-14 To 2017-18. In Addition To The Above Sources,Obtained From Published,

Unpublished Sources And Web Data Is Also Used In This Studysome More Information Was Collected From

Different Issues Of Economic Survey Published By The Government Of India, Different Journals And

Websites. The Multivariate Statistical Technique And Ratio Analysis Was Used To Interpret The Financial

Statements And Analyze The Data To Know The Asset And Liability Position Of The Bank.

IV. Data Analysis And Interpretation

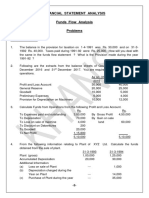

1. The Performance Of Profitability Ratios In Kotak Mahindra Bank:

Table No. 1 Represents The Performance Of Profitability Position In Kotak Mahindra Bank. The

Profitability Ratios Has Been Classified Four Categories Of Ratios Such Has Interest Spread,Return On Equity,

Net Profit Margin, Adjusted Return On Net Worth Etc.The Overall Interest Spread And Return On Equity Was

Recorded The Value Of 43.22 And 68.91 Respectively. This Was Followed The Overall Net Profit Margin And

Adjusted Return On Net Worth Was Recordedthe Value Of 85.25 And 135.14 Respectively. In The Context Of

Interest Spreads Shows Increasing Trend, Was Recorded The Value Of 7.64 To 9.82 From 2013-14 To 2017-

18.Further The Return On Equity Shows The Increasing Trend, Was Recorded The Value Of 14.00% To

15.28% From 2013-14 To 2017-18 Respectively. The Net Profit Margin Shows The Decreasing Trend, Was

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 3 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Recorded The Value Of 19.27 To 16.91 From 2013-14 To 2017-18 Respectively. Lastly The Adjusted Return

On Net Worthshows The Decreasing Trend, Was Recorded The Value Of 47.01 To 14.40 From 2013-14 To

2017-18respectively

Table No.1Profitability Ratio

Year Interest Spread Return On Equity Net Profit Margin Adjusted Return On Net

Worth (%)

2013-14 7.64 14.00 19.27 47.01

2014-15 7.86 14.82 12.75 48.30

2015-16 8.38 11.01 19.19 13.19

2016-17 9.52 13.80 17.13 12.24

2017-18 9.82 15.28 16.91 14.40

Total 43.22 68.91 85.25 135.14

Source: Annual Reports Of Kotak Mahindra Bank.

Graph No.1Profitability Ratio

2. The Performance Of Profit And Loss Account Ratios Of Kotak Mahindra Bank:

Table No. 2 Indicates The Performance Of Profit And Loss Account Ratios Of Kotak Mahindra Bank.

The Profit And Loss Account Ratios Has Been Classified Three Categories Of Ratios Such As, Interest

Expended To Interest Earned, Other Income To Total Income, Operating Expenses To Total Income Etc.The

Overall Interest Expended To Interest Earned Ratio And Other Income To Total Income And Also Operating

Expenses To Total Income, Was Recorded The Value Of 286,23, 73.82 And 124.46 Respectively. In The

Context Of Interest Expended To Interest Earned Ratio Shows Increasing Trend, Was Recorded The Value Of

54.09 To 60.14 From 2013-14 To 2017-18 Respectively. Further The Other Income To Total Income Shows

The Decreasing Trend, Was Recorded The Value Of 16.42 To 12.61 From 2013-14 To 2017-18 Respectively.

The Operating Expenses To Total Incomeshows The Decreasing Trendwas Recorded The Value Of 25.16 To

22.57 From 2013-14 To 2017-18 Respectively.It Indicates Bank Is Not Quite Safe And It Does Indicate

Inefficiency.

Table No.2 Profit And Loss Account Ratio

Year Interest Expended To Other Income To Total Operating Expenses To Total

Interest Earned Income Income

2013-14 54.09 16.42 25.16

2014-15 57.88 13.75 27.29

2015-16 56.55 17.27 26.06

2016-17 57.57 13.77 23.38

2017-18 60.14 12.61 22.57

Total 286.23 73.82 124.46

Source: Annual Reports Of Kotak Mahindra Bank.

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 4 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Graph No.2 Profit And Loss Account Ratio

3. The Performance Of Balance Sheet Ratios Of Kotak Mahindra Bank:

Table No. 3 Depicts That Performance Of Balance Sheet Ratios Of Kotak Mahindra Bank. The

Balance Sheet Ratio Has Been Measured Three Categories Of Ratios Such As, Capital Adequacy Ratio,Current

Ratio And Quick Ratio Etc.The Overall Capital Adequacy Ratio And Current Ratio And Also Quick Ratio, Was

Recorded The Value Of 85.16, 0.22 And 84.87 Respectively. In The Context Of Capital Adequacy Ratio Shows

The Decreasing Trend, Was Recorded The Value Of 16.77 To 16.05 From 2013-14 To 2017-18 Respectively.

Further The Current Ratio Shows, The Decreasing Trend, Was Recorded The Value Of 0.06 To 0.04 From

2013-14 To 2017-18 Respectively. The Quick Ratio Shows,The Increasing Trendwas Recorded The Value Of

18.09 To 18.95 From 2013-14 To 2017-18 Respectively.

Table No.3 Balance Sheet Ratio

Year Capital Adequacy Ratio Current Ratio Quick Ratio

2013-14 16.77 0.06 18.09

2014-15 16.34 0.07 15.61

2015-16 17.17 0.02 14.83

2016-17 18.83 0.03 17.39

2017-18 16.05 0.04 18.95

Total 85.16 0.22 84.87

Source: Annual Reports Of Kotak Mahindra Bank.

Graph No.3 Balance Sheet Ratio

4. The Performance Of Debt Coverage Ratio In Kotak Mahindra Bank:

Table No. 4 Depicts That Performance Of Debt Coverage Ratios Of Kotak Mahindra Bank. The Debt

Coverage Ratio Has Been Measured Three Categories Of Ratios Such As,Credit Deposit Ratio, Cash Deposit

Ratio And Total Debt To Owner Fund. The Overall Credit Deposit Ratio And Cash Deposit Ratio And Also

Total Debt To Owner Fund, Was Recorded The Value Of 451.83, 24.46 And 32.69 Respectively. In The

Context Of Credit Deposit Ratio, Shows The Increasing Trend, Was Recorded The Value Of 86.04 To 97.75

From 2013-14 To 2017-18 Respectively. Further Thecash Deposit Ratio Shows, The Decreasing Trend, Was

Recorded The Value Of 4.86 To 4.72 From 2013-14 To 2017-18 Respectively. The Total Debt To Owner Fund

Shows,The Increasing Trendwas Recorded The Value Of 6.46 To 7.56 From 2013-14 To 2017-18 Respectively.

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 5 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Table No.4 Debt Coverage Ratio

Year Credit Deposit Ratio Cash Deposit Ratio Total Debt To Owner Fund

2013-14 86.04 4.86 6.46

2014-15 86.57 5.07 6.66

2015-16 88.99 5.13 6.15

2016-17 92.18 4.68 5.86

2017-18 97.75 4.72 7.56

Total 451.53 24.46 32.69

Source: Annual Reports Of Kotak Mahindra Bank.

Graph No.4 Debt Coverage Ratio

V. Findings Of The Study:

The Following Are The Major Findings Of The Study:.

The Overall Interest Spread And Return On Equity Was Recorded The Value Of 43.22 And 68.91

Respectively.

The Overall Net Profit Margin And Adjusted Return On Net Worth Was Recorded The Value Of 85.25 And

135.14 Respectively.

In The Context Of Interest Spreads Shows Increasing Trend, Was Recorded The Value Of 7.64 To 9.82

From 2013-14 To 2017-18.

The Overall Interest Expended To Interest Earned Ratio And Other Income To Total Income And Also

Operating Expenses To Total Income, Was Recorded The Value Of 286.23, 73.82 And 124.46

Respectively.

In The Context Of Interest Expended To Interest Earned Ratio Shows Increasing Trend, Was Recorded The

Value Of 54.09 To 60.14 From 2013-14 To 2017-18 Respectively.

Further The Other Income To Total Income Shows The Decreasing Trend, Was Recorded The Value Of

16.42 To 12.61 From 2013-14 To 2017-18 Respectively.

The Overall Capital Adequacy Ratio And Current Ratio And Also Quick Ratio, Was Recorded The Value

Of 85.16, 0.22 And 84.87 Respectively. I

In The Context Of Capital Adequacy Ratio Shows The Decreasing Trend, Was Recorded The Value Of

16.77 To 16.05 From 2013-14 To 2017-18 Respectively.

Further The Current Ratio Shows, The Decreasing Trend, Was Recorded The Value Of 0.06 To 0.04 From

2013-14 To 2017-18 Respectively.

The Overall Credit Deposit Ratio And Cash Deposit Ratio And Also Total Debt To Owner Fund, Was

Recorded The Value Of 451.83, 24.46 And 32.69 Respectively.

In The Context Of Credit Deposit Ratio, Shows The Increasing Trend, Was Recorded The Value Of 86.04

To 97.75 From 2013-14 To 2017-18 Respectively.

Further The Cash Deposit Ratio Shows, The Decreasing Trend, Was Recorded The Value Of 4.86 To 4.72

From 2013-14 To 2017-18 Respectively.

VI. Suggestions For The Study:

The Following Are The Major Suggestions For The Study:

The Bank Should Maintain Consistency In Net Profit Margin, Other Income To Total Income, Loans Funds

Percentage And Cash Reserve Ratio.

The Bank Has To Increases Revenue Earnings, Operating Expenses, And Current Ratio Because The Ratio

Indicates Decreases Every Year.

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 6 | Page

An Analysis Of Asset-Liability Management In Banking Sector: A Case Study Of Kotak Mahindra ..

Bank Should Be Taken Better Management Towards Current Assets And Current Liabilities Which

Indicating Week Positive Correlation.

The Study Suggests Much Scope For Banks To Improve Profitability By Monitoring And Reducing Short

Term Liquidity.

To Fill The Short Term Liquidity Gap, Banks Resort To Market Borrowings At Higher Rate Of Interest

Which Reduces Interest Margin And Profitability Of Banks.

VII. Conclusion:

Asset-Liability Management Play Very Important Role In Management And Planning Of Assets And

Liabilities Of Banks, Against The Risk Exposed Due To The Changing Environment In The Bank Business.

Banking Regulators Require A Minimum Capital Adequacy, Net Worth And Capital Deposit Ratio Thus, Banks

Today Need To Match Their Assets And Liabilities And At The Same Time Balancing Their Objectives Of

Profitability, Liquidity And Risk. This Attempt Was To Evaluate And Matching Assets And Liability Of The

Kotakmahendra Bank. After Calculating The Various Ratios And Critically Analyzing Them, It Is Evident That

Bank Performing Satisfactorily In Terms Of Credit Deposit Ratio, Quick Ratio, Interest Expanded To Interest

Earn, Other Income To Total Income And Interest Spreadbecause This Ratios Showing Increasing Trend From

One Year To Another Year.Thefore Its Needed To Improve And Maintain Consistency In Net Profit Margin

And Total Income Of Kotak Mahindra Bank.

References:

[1]. Dash, M. And Pathak, R. (2011).“A Linear Programming Model For Assessing Asset-Liability Management In Banks,” Icfai

Journal Of Risk Management.

[2]. Chaudhary, K., Sharma, M. (2011). “To Compare The Performance Of Public And Private Banks Of India And To Find Out

Trends” In Npa Level International Journal Of Innovation, Management And Technology, Vol.2, No. 3, June 2011.

[3]. Corsaro, S., De Angelis, P.L., Marino, Z., Perla, F., Zanetti, P (2010). “On Parallel Asset-Liability Management In Life Insurance:

A Forward Risk-Neutral Approach”.Vol 36, Pg 390–402.

[4]. Https://M.Rbi.Org.In.

[5]. Dr. N Kavitha (2012). “An Assessment On Asset And Liability Management Of Scheduled Commercial Banks In India” Volume 2

Issue 4

[6]. Metz, Piakronistedt (2007). “The Swedish Market For Balancing Liquidity”, Asset Liability Management In Banks: Emerging

Challenges, Pg.136-161.

[7]. Evans Tee(2017). , “Asset Liability Management And The Profitability Of Listed Banks In Ghana”.Iosr Journal Of Economics And

Finance (Iosr-Jef) E-Issn: 2321-5933, P-Issn: 2321-5925.Volume 8, Issue 3 Ver. Iv (May - June 2017), Pp 09-14

Www.Iosrjournals.Org

[8]. Rbi Guidelines On Asset Liability Management Practices In Banks, Http://Www.Rbi.Org.

[9]. Annual Reports Of Kotak Mahindra Bank.

IOSR Journal of Business and Management (IOSR-JBM) is UGC approved Journal with Sl.

No. 4481, Journal no. 46879.

Ms. Pragathi K.M "An Analysis of Asset-Liability Management in Banking Sector: A Case

Study of Kotak Mahindra Bank "IOSR Journal of Business and Management (IOSR-JBM) 20.2

(2018): 01-07.

DOI: 10.9790/487X-2002080107 www.iosrjournals.org 7 | Page

You might also like

- Fly by Night CaseDocument3 pagesFly by Night CaseRaghadShawaheen0% (1)

- Lego Group Nurturing Loyalty Among Customers With Engagement and Interaction PDFDocument4 pagesLego Group Nurturing Loyalty Among Customers With Engagement and Interaction PDFsukanyaNo ratings yet

- 2019 Caf-7 Far-IiDocument137 pages2019 Caf-7 Far-IiMuhammad YahyaNo ratings yet

- Assets and Liabilities ReportDocument81 pagesAssets and Liabilities ReportSai ChaitanyaNo ratings yet

- Merchant Banking in IndiaDocument61 pagesMerchant Banking in IndiarimpyanitaNo ratings yet

- The Role of Commercial Banks Funding On The Development of SmallDocument11 pagesThe Role of Commercial Banks Funding On The Development of Smallbhanu matiNo ratings yet

- An Analysis On Uses of Plastic Money in KodaguDocument97 pagesAn Analysis On Uses of Plastic Money in KodaguBhavaniNo ratings yet

- Retail Banking: by Prof Santosh KumarDocument30 pagesRetail Banking: by Prof Santosh KumarSuraj KumarNo ratings yet

- Microsoft Word - Project Report On Financial Savings Through Fixed Asset Management For Ispat FinalDocument100 pagesMicrosoft Word - Project Report On Financial Savings Through Fixed Asset Management For Ispat FinalRohan ShirdhankarNo ratings yet

- Assets Management Liabilities in Bank PDFDocument61 pagesAssets Management Liabilities in Bank PDFHoàng Trần Hữu100% (1)

- Master of Commerce YEAR 2020-2021: C.C.S. University, MEERUTDocument59 pagesMaster of Commerce YEAR 2020-2021: C.C.S. University, MEERUTMɽ HʋŋteɽNo ratings yet

- Uma Industry Assets and Liabilities MGTDocument80 pagesUma Industry Assets and Liabilities MGTKirthi KshatriyasNo ratings yet

- "Retail Banking": A Project ReportDocument72 pages"Retail Banking": A Project ReportneanaoNo ratings yet

- E-Billing and Invoice SystemDocument1 pageE-Billing and Invoice SystemSripal SinghNo ratings yet

- Bachelor of Business Administration (BCOM) : K Sai KiranDocument72 pagesBachelor of Business Administration (BCOM) : K Sai Kiranpranav proNo ratings yet

- Financial Statement Analysis of Private Banks Ltd.-2025Document57 pagesFinancial Statement Analysis of Private Banks Ltd.-2025Zannatul Ferdousi Alam YameemNo ratings yet

- Integrated Online Feedback SystemDocument52 pagesIntegrated Online Feedback SystemIliyas AhamedNo ratings yet

- Certificate: A Project Report On "Retail Banking"Document27 pagesCertificate: A Project Report On "Retail Banking"Parag MogarkarNo ratings yet

- 03 Literature ReviewDocument15 pages03 Literature ReviewPraveen PuliNo ratings yet

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocument57 pagesProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- Cash Management Analysis ProjectDocument93 pagesCash Management Analysis ProjectShailesh NewalkarNo ratings yet

- Problems Faced by Micro Finance Institutions and Measures To Solve ItDocument62 pagesProblems Faced by Micro Finance Institutions and Measures To Solve ItArpit PatelNo ratings yet

- Main ProjectDocument23 pagesMain ProjectEkta chodankarNo ratings yet

- Further Scope of The Study Regarding Investment BankingDocument3 pagesFurther Scope of The Study Regarding Investment BankingMehedi HassanNo ratings yet

- Mutual FundDocument53 pagesMutual FundBhavesh PatelNo ratings yet

- Introduction of Banking SectorDocument6 pagesIntroduction of Banking SectorPatel Binny50% (2)

- A Study On "Training and Development" With Reference To BHEL-HPVP, VISHAKAPATNAMDocument107 pagesA Study On "Training and Development" With Reference To BHEL-HPVP, VISHAKAPATNAMSk Mobiles100% (1)

- A Study of Management of Assets and Liabilities in Relation To Performance and Profitability in ICICI BankDocument116 pagesA Study of Management of Assets and Liabilities in Relation To Performance and Profitability in ICICI BankdadismyheroNo ratings yet

- Retail Banking in Suko Bank SNDDocument43 pagesRetail Banking in Suko Bank SNDhasanNo ratings yet

- Project Report On To Evaluate Consumer Perceptions To Various Promotional OffersDocument55 pagesProject Report On To Evaluate Consumer Perceptions To Various Promotional OffersAbhishek Saxena50% (2)

- Comparative Analysis of Home Loans Across Different Banks inDocument55 pagesComparative Analysis of Home Loans Across Different Banks inShikha Wadwa0% (1)

- Npa Cbs ProjectDocument56 pagesNpa Cbs ProjectChirag GugnaniNo ratings yet

- Aurobindo PharmaceuticalsDocument7 pagesAurobindo Pharmaceuticalsitsvijay100% (1)

- Comparative Study Between Private Sectors Bank and Public Sector BanksDocument36 pagesComparative Study Between Private Sectors Bank and Public Sector BanksjudeNo ratings yet

- Literature Review NPADocument2 pagesLiterature Review NPAVarun JalanNo ratings yet

- Credit Risk ManagementDocument57 pagesCredit Risk ManagementP. RaghurekhaNo ratings yet

- Mis PBL (Group 5)Document29 pagesMis PBL (Group 5)Prince SinghNo ratings yet

- Gurleen Internship Report-6Document74 pagesGurleen Internship Report-6Joshua LoyalNo ratings yet

- A Study On Retail BankingDocument66 pagesA Study On Retail Bankingshreyshaw210% (1)

- Mis Report: A Project Report OnDocument107 pagesMis Report: A Project Report OnAbhishek VichhiNo ratings yet

- Y.ramu Npa Project WorkDocument62 pagesY.ramu Npa Project WorkBALAJEENo ratings yet

- Customer Satisfaction Towards J& K Bank With Special Reference To Car LoansDocument64 pagesCustomer Satisfaction Towards J& K Bank With Special Reference To Car LoansBilal Ah Parray0% (1)

- Ratio AnalysisDocument33 pagesRatio AnalysisSamNo ratings yet

- Sbi SynopsisDocument7 pagesSbi SynopsisvenkibgvNo ratings yet

- Financial Management - HDFCDocument7 pagesFinancial Management - HDFCmohammed khayyumNo ratings yet

- Advertising Impact On Customer - TVSDocument16 pagesAdvertising Impact On Customer - TVSMohmmedKhayyumNo ratings yet

- Master of Business Administration: A Study On Ratio Analysis With Reference To Jocil LimitedDocument97 pagesMaster of Business Administration: A Study On Ratio Analysis With Reference To Jocil LimitedSakhamuri Ram'sNo ratings yet

- Meaning of Cash Reserve Ratio and Statutory Liquidity....Document7 pagesMeaning of Cash Reserve Ratio and Statutory Liquidity....Radhey JangidNo ratings yet

- Financial Management-ICICIDocument10 pagesFinancial Management-ICICIKhaisarKhaisarNo ratings yet

- Project Report On "A Comparative Analysis of HDFC Bank Fixed Deposit"Document76 pagesProject Report On "A Comparative Analysis of HDFC Bank Fixed Deposit"shhubham yadavNo ratings yet

- A Study On Risk Analysis On Personal Loans at Vijaya BankDocument90 pagesA Study On Risk Analysis On Personal Loans at Vijaya BankChethan.sNo ratings yet

- Rushikesh ProjectDocument45 pagesRushikesh Projectshrikrushna javanjalNo ratings yet

- A Project Report On "Customer Behaviour in Stock Market": (A Case Study of ICICI Securities, Jaipur)Document80 pagesA Project Report On "Customer Behaviour in Stock Market": (A Case Study of ICICI Securities, Jaipur)Ganesh ShettyNo ratings yet

- A Study On Customer Prefernces Towards Credit Cards in HDFC BankDocument40 pagesA Study On Customer Prefernces Towards Credit Cards in HDFC BankSharath100% (1)

- Kotak Mahindra Bank 121121123739 Phpapp02Document112 pagesKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNo ratings yet

- Group-Project Final Documentation2Document59 pagesGroup-Project Final Documentation2tarun nanduriNo ratings yet

- Financial Sector Reforms Impacting Banking Sector WRT Basel Compliance in HDFC BankDocument29 pagesFinancial Sector Reforms Impacting Banking Sector WRT Basel Compliance in HDFC BankHyndavi VemulaNo ratings yet

- Impact of Non Performing Assets On Profitability For Public and Private SecDocument143 pagesImpact of Non Performing Assets On Profitability For Public and Private SecBiswaranjan SatpathyNo ratings yet

- Anand Final ReportDocument89 pagesAnand Final ReportAnand Mishra100% (1)

- Thesis On Financial Analysis of BanksDocument6 pagesThesis On Financial Analysis of Bankstonyacartererie100% (2)

- 1 Background To The StudyDocument4 pages1 Background To The StudyNagabhushanaNo ratings yet

- SusiDocument23 pagesSusiK MadhuNo ratings yet

- Report FinalDocument28 pagesReport Finalrkpc.owsNo ratings yet

- Asset-Liability-Management - A Comparative Study of A Public andDocument10 pagesAsset-Liability-Management - A Comparative Study of A Public andsukanyaNo ratings yet

- International Human Resource ManagementDocument41 pagesInternational Human Resource ManagementsukanyaNo ratings yet

- Module 2 CRDocument67 pagesModule 2 CRsukanyaNo ratings yet

- Risk From An Individual's Perception: If Ganesh, An Investor Invests in EquityDocument100 pagesRisk From An Individual's Perception: If Ganesh, An Investor Invests in EquitysukanyaNo ratings yet

- A Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloreDocument73 pagesA Project Report On Working Capital Assessment at Canara Bank, Circle Office, BangaloresukanyaNo ratings yet

- Setting Up of A Small Business EnterpriseDocument36 pagesSetting Up of A Small Business EnterprisesukanyaNo ratings yet

- MactDocument21 pagesMactsukanyaNo ratings yet

- Want To Improve Your Strategy Implementation Simon Says LeversDocument10 pagesWant To Improve Your Strategy Implementation Simon Says Leverssukanya100% (1)

- Company: Maruti Suzuki: Suzuki Global Environment CharterDocument2 pagesCompany: Maruti Suzuki: Suzuki Global Environment ChartersukanyaNo ratings yet

- The Always On Enterprise Mobilizing The HR Workplace ConnectionDocument12 pagesThe Always On Enterprise Mobilizing The HR Workplace ConnectionsukanyaNo ratings yet

- A Comparative Study Between Equity Investment & Mutual Fund: A Project Report OnDocument68 pagesA Comparative Study Between Equity Investment & Mutual Fund: A Project Report OnAkanksha SengarNo ratings yet

- Report On Investment Bank in BangladeshDocument31 pagesReport On Investment Bank in BangladeshMd Rayhan Uddin100% (1)

- Annual Report 2014Document86 pagesAnnual Report 2014Баянмөнх МөнхбаярNo ratings yet

- 1.2 HW (Conceptual Framework) - Part 2Document8 pages1.2 HW (Conceptual Framework) - Part 2Jazehl Joy ValdezNo ratings yet

- Full Report Ubs Group Ag Consolidated 3q23Document120 pagesFull Report Ubs Group Ag Consolidated 3q23José Guilherme MeloNo ratings yet

- BANKINGDocument49 pagesBANKINGGrace Sytio IINo ratings yet

- Informe en Inglés Escuela de Contabilidad 2023 - IIDocument10 pagesInforme en Inglés Escuela de Contabilidad 2023 - IIDeivid Jârëd BrönčånōNo ratings yet

- Cycle 2 Capital Market Albarico 3.1BSBAFM-PmDocument10 pagesCycle 2 Capital Market Albarico 3.1BSBAFM-PmCharlot Auguis AlbaricoNo ratings yet

- Exam Financial ManagementDocument5 pagesExam Financial ManagementMaha MansoorNo ratings yet

- Engineering Projects (India) LTDDocument80 pagesEngineering Projects (India) LTDआदित्य रॉयNo ratings yet

- Global Ime Bank 2013Document34 pagesGlobal Ime Bank 2013Keshab PandeyNo ratings yet

- Mr. Juice Wallahs Dilemma - Tiffany Versus WalmartDocument7 pagesMr. Juice Wallahs Dilemma - Tiffany Versus WalmartManish Agarwal0% (1)

- Module 6Document50 pagesModule 6rohit saini75% (4)

- MSC Accounting Seminar PaperDocument15 pagesMSC Accounting Seminar PaperElias Samuel UnekwuNo ratings yet

- Frontline AR 2009Document136 pagesFrontline AR 2009Shawn LaiNo ratings yet

- Final ExamDocument13 pagesFinal ExamNamor OnisaNo ratings yet

- Amar ProjectDocument35 pagesAmar ProjectSaurabh PhaleNo ratings yet

- Kaushik Jain - 30 ProjectDocument45 pagesKaushik Jain - 30 ProjectKAUSHIK JAINNo ratings yet

- DBB2104 Unit-09Document24 pagesDBB2104 Unit-09anamikarajendran441998No ratings yet

- FM Beginner Module Book Abhishek ManiDocument179 pagesFM Beginner Module Book Abhishek ManijaivaibhavNo ratings yet

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- Financial Statement Analysis Probs On Funds Flow Analysis PDFDocument15 pagesFinancial Statement Analysis Probs On Funds Flow Analysis PDFSAITEJA ANUGULANo ratings yet

- Act 330 Chapter 15Document71 pagesAct 330 Chapter 15Taaz TaassinNo ratings yet

- Zica t1 Financial AccountingDocument363 pagesZica t1 Financial Accountinglord100% (2)

- SITXFIN005 Manage Physical Assets-Assessment 2-ProjectDocument20 pagesSITXFIN005 Manage Physical Assets-Assessment 2-ProjectRAMANdeep kaurNo ratings yet

- Amity School of Business:, 4 Semester Financial Management 2Document40 pagesAmity School of Business:, 4 Semester Financial Management 2Divya VishwanadhNo ratings yet

- Kibo Finall ResearchDocument83 pagesKibo Finall Researchsamuel kenetoNo ratings yet

- SIP Is A Method of Investing A Fixed Sum SynopsisDocument23 pagesSIP Is A Method of Investing A Fixed Sum SynopsisPochender vajrojNo ratings yet