FHBM1214 WK 8 9 Qns - L

FHBM1214 WK 8 9 Qns - L

Uploaded by

Kelvin LeongCopyright:

Available Formats

FHBM1214 WK 8 9 Qns - L

FHBM1214 WK 8 9 Qns - L

Uploaded by

Kelvin LeongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FHBM1214 WK 8 9 Qns - L

FHBM1214 WK 8 9 Qns - L

Uploaded by

Kelvin LeongCopyright:

Available Formats

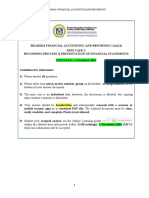

FHBM1214 Financial Accounting

Final Accounts of the Sole Trader (Week 8 & 9)

1. TH Woods Sdn Bhd’s trial balance at 31 December 20X9 shown as below :

Trial Balance as at 31 December 20X9

RM RM

Debit Credit

Capital, 1 Jan 20X9 2,500,000

Stock as at 1 Jan 20X9 1,200,000

Machinery 925,000

Motor vehicles 650,000

Freehold Land 4,500,000

Factory Building 2,455,000

Provision for depreciation:

Machinery 425,000

Motor Vehicles 320,000

Factory Building 325,000

Trade debtors and Trade Creditors 1,910,000 1,540,000

Other debtors 530,000

Other creditors 300,000

Prepaid Insurance 120,000

Return Outwards 2,000

Discounts 40,000 65,000

Motor expenses 52,000

Cash at bank 170,000

Interest expenses 30,000

Electricity and water 550,000

Purchases and sales 8,545,000 15,500,000

Bank overdraft 250,000

Bank Loan at 10% per annum 550,000 Additional

Interest revenue 20,000 information:

Salaries 120,000

21,797,000 21,797,000

(i) Electricity and water bills RM 48,000 still outstanding at the end of the year.

(ii) On 1 December 20X9, David’s Son Sdn Bhd has returned goods amount of RM1,500 due to

wrong specification. This transaction not yet recorded.

(iii) There are bad debts of RM1,000 on debtor balance have not been entered in the ledger.

(iv) The provision for doubtful debt is to be adjusted to 2% of trade debtors’ balance.

(v) The remainder of a full year’s interest on the bank loan is still outstanding.

(vi) A quarter of the prepaid insurance has expired.

UNIVERSITI TUNKU ABDUL RAHMAN 1

CENTRE FOR FOUNDATION STUDIES - ARTS

FHBM1214 Financial Accounting

Final Accounts of the Sole Trader (Week 8 & 9)

(vii) There is interest earned on December 20X9 amounting RM1,500 but have not been received

yet.

(viii) Stock costing RM2,500 was taken out from the business for family uses.

(ix) Depreciation for the year at ended 31 December 20X9 using reducing balance method has yet

to be provided as follows:

Machinery 10%

Motor Vehicles 20%

Factory Building 2%

(x) Stock as at 31 December 20X9 was valued at RM1,100,000.

Required:

(a) Prepare the Income Statement for TH Woods for the year ended 31st December 20X9.

(b) Prepare the Balance Sheet as at 31st December 20X9.

2. Bella Consultant Sdn. Bhd. is a management consultant company has prepared the following trial balance as at 31

December 20X9:

Trial Balance as at 31 December 20X9

RM RM

Debit Credit

Capital, 1 Jan 2009 78,500

Drawings 30,800

Consulting fees revenue 161,700

Land 55,000

Building 146,000

Office Equipment 13,500

Provision for depreciation:

Building 43,800

Office Equipment 6,420

Bank 100,000

Account receivable 9,300

Office supplies 1,980

Account payable 7,800

Unearned Consulting Fees 3,500

Long Term Bank Loan 88,150

Bank Loan (Current Liability) 850

Insurance expense 3,500

Telephone expense 1,200

Salaries 20,000

Electricity expense 860

Interest expense 2,080

Prepaid Salaries 6,500

390,720 390,720

Additional information:

UNIVERSITI TUNKU ABDUL RAHMAN 2

CENTRE FOR FOUNDATION STUDIES - ARTS

FHBM1214 Financial Accounting

Final Accounts of the Sole Trader (Week 8 & 9)

(i) Depreciation of building at 6% per annum on cost and office equipment at office equipment at

30% per annum on net book value.

(ii) Office supplies are on hand totaling RM550 at the end of the year.

(iii) Premium insurance for 12-month was purchased on July 1, 20X9 for RM1,200.

(iv) An ordinary salary paid to employees amount of RM5,000 but treated as advance and have

recorded in Prepaid Salaries.

(v) There are bad debts of RM500 on debtor balance have not been entered in the books.

(vi) Electricity and telephone accrued of RM250 and RM180 respectively.

(vii)There is RM250 from unearned consulting fees has already earned.

(viii) Received RM3,600 from customer on May 31, 20X9 for a year services and recorded full

amount in Consulting Fees Revenue.

(ix) Monthly bank loan payment is RM1,000 during year of 20X9. In each payment 15% is attributable

to interest. Monthly payment for December has not been settled yet.

Required:

(a) Prepare the Income Statement for the year ended 31st December 20X9

(b) Prepare the Balance Sheet as at 31st December 20X9.

UNIVERSITI TUNKU ABDUL RAHMAN 3

CENTRE FOR FOUNDATION STUDIES - ARTS

You might also like

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- Step AcquisitionsDocument7 pagesStep AcquisitionsKelvin Leong100% (1)

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Accounting Examples 11Document33 pagesAccounting Examples 11njabuzamaNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- Final AccountDocument4 pagesFinal Accountsakshichaurasia2005No ratings yet

- Balance Sheet CoachingDocument2 pagesBalance Sheet CoachingAbid AhmedNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Fin Acc 2 Assigns 2023Document6 pagesFin Acc 2 Assigns 2023Vinancio ZungundeNo ratings yet

- AC101 Quiz 1Document2 pagesAC101 Quiz 1irene TogaraNo ratings yet

- Osa Jan24 s1 Adbm Business Finance FinalDocument13 pagesOsa Jan24 s1 Adbm Business Finance FinalpzrgftctbxNo ratings yet

- ACC2124 Mid-Term Test S2/17Document2 pagesACC2124 Mid-Term Test S2/17Niz IsmailNo ratings yet

- Financial Reporting and Analysis Final OSADocument12 pagesFinancial Reporting and Analysis Final OSAzikhalia851No ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Bài 4-8 Chapter 12Document12 pagesBài 4-8 Chapter 12anh thư nguyễn thịNo ratings yet

- ASSIGNMENTDocument3 pagesASSIGNMENTDoreen OngNo ratings yet

- Chapter 11 Financial Accounting With Adjustment: Question 1 FuguangDocument15 pagesChapter 11 Financial Accounting With Adjustment: Question 1 FuguangClaudia WongNo ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Far210Document8 pagesFaculty Accountancy 2022 Session 1 - Diploma Far210nafisah rahmanNo ratings yet

- 25 Final AccountDocument1 page25 Final Accountkingred066No ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- Accounting Questions PracticesDocument2 pagesAccounting Questions PracticesSusanna Ng50% (2)

- Tuto - Adjusmnt in PNL & BsDocument4 pagesTuto - Adjusmnt in PNL & BsHana YusriNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- ACC4013 Financial Accounting 1 Tutorial Questions - Revision 3Document2 pagesACC4013 Financial Accounting 1 Tutorial Questions - Revision 3Viknesh GunasegarenNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Additional Tutorial Basic SOPL and SOFP (MID-TERM BREAK HOMEWORKS)Document2 pagesAdditional Tutorial Basic SOPL and SOFP (MID-TERM BREAK HOMEWORKS)azra balqisNo ratings yet

- HBL 26 Jan 24 FSDocument3 pagesHBL 26 Jan 24 FSihsanazizNo ratings yet

- Gr10 Adjustments WSDocument15 pagesGr10 Adjustments WSgangatismail57No ratings yet

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- Unknown Document NameDocument5 pagesUnknown Document NameAnonymous T0RQWuiNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsannieruzedukaNo ratings yet

- Fa5 Nov20Document8 pagesFa5 Nov20Ridzuan SharifNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Assignment/ TugasanDocument21 pagesAssignment/ Tugasanhafiz azuanNo ratings yet

- Financial Reporting and Analysis Supplementary OSADocument10 pagesFinancial Reporting and Analysis Supplementary OSAbalungilebonke.bmNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingManish KushwahaNo ratings yet

- Day 19 Dissolution of PartnershipDocument10 pagesDay 19 Dissolution of Partnershipriteshbari8444No ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- AccountingDocument5 pagesAccountingIhsan UllahNo ratings yet

- Past Mid-Term QuestionDocument2 pagesPast Mid-Term Questionkhangcm.cfaaNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Assignment Final AccountsDocument9 pagesAssignment Final Accountsjasmine chowdhary50% (2)

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- Questions - Final Account of Sole ProprietorDocument3 pagesQuestions - Final Account of Sole Proprietorwiafelawrence03No ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Course Plan: Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and Management (Fam)Document22 pagesCourse Plan: Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and Management (Fam)Kelvin LeongNo ratings yet

- Tutorial 3 MFRS8 Q PDFDocument3 pagesTutorial 3 MFRS8 Q PDFKelvin LeongNo ratings yet

- Tutorial 5 Basic Group AccountingDocument5 pagesTutorial 5 Basic Group AccountingKelvin LeongNo ratings yet

- Tutorial 3 MFRS8 Q PDFDocument3 pagesTutorial 3 MFRS8 Q PDFKelvin LeongNo ratings yet

- Tutorial QDocument6 pagesTutorial QKelvin LeongNo ratings yet

- Detecting Financial Statement Fraud: Best Known For Committing Accounting FraudDocument11 pagesDetecting Financial Statement Fraud: Best Known For Committing Accounting FraudKelvin LeongNo ratings yet

- Old Ib Tutorial AnsDocument6 pagesOld Ib Tutorial AnsKelvin LeongNo ratings yet

- Chap 003Document52 pagesChap 003Kelvin LeongNo ratings yet

- B&SDocument7 pagesB&SKelvin LeongNo ratings yet

- FHBM1214 Week 2 SDocument48 pagesFHBM1214 Week 2 SKelvin LeongNo ratings yet

- Fhbm1214 Week 3 SDocument62 pagesFhbm1214 Week 3 SKelvin LeongNo ratings yet

- FHBM1214 Week 1 SDocument76 pagesFHBM1214 Week 1 SKelvin LeongNo ratings yet

- Break-Even Analysis: Cost-Volume-Profit AnalysisDocument64 pagesBreak-Even Analysis: Cost-Volume-Profit AnalysisKelvin LeongNo ratings yet

- Fhmm1314 Chapter 1a SDocument72 pagesFhmm1314 Chapter 1a SKelvin LeongNo ratings yet

- Lecture 1Document2 pagesLecture 1Kelvin LeongNo ratings yet

- TQ 2013Document29 pagesTQ 2013Kelvin LeongNo ratings yet

- FHEL 1014 BE Lecture Parts of Speech SCDocument4 pagesFHEL 1014 BE Lecture Parts of Speech SCKelvin LeongNo ratings yet

- Test Bank For Financial Institutions Markets and Money 11th Edition by KidwellDocument7 pagesTest Bank For Financial Institutions Markets and Money 11th Edition by KidwellKelvin Leong0% (1)

- Lecture 1 PDFDocument24 pagesLecture 1 PDFKelvin Leong100% (1)

- FHMM1314 IntroductionDocument16 pagesFHMM1314 IntroductionKelvin Leong100% (1)

- Tax 3 TutorialQ - 2013Document29 pagesTax 3 TutorialQ - 2013Kelvin LeongNo ratings yet

- TQ 2013Document29 pagesTQ 2013Kelvin LeongNo ratings yet

- Chapter 12 Inventory and Production Cycle: Learning ObjectivesDocument16 pagesChapter 12 Inventory and Production Cycle: Learning ObjectivesKelvin LeongNo ratings yet

- Lecture 2 - Public Speaking Part 1Document43 pagesLecture 2 - Public Speaking Part 1Kelvin LeongNo ratings yet

- Topic 6Document18 pagesTopic 6Kelvin Leong100% (1)

- LCC FormulaDocument3 pagesLCC Formulasomapala88No ratings yet

- Agricultural Bank of ChinaDocument288 pagesAgricultural Bank of ChinaDomen SolinaNo ratings yet

- Inflationary Gap - WikipediaDocument15 pagesInflationary Gap - WikipediaKush KumarNo ratings yet

- 2281 Economics: MARK SCHEME For The May/June 2015 SeriesDocument14 pages2281 Economics: MARK SCHEME For The May/June 2015 SeriessalNo ratings yet

- Practice-Problem ServiceDocument2 pagesPractice-Problem Servicequaresmarenzel715No ratings yet

- Budget and Budgetary DeficitDocument17 pagesBudget and Budgetary DeficitSnehal AherNo ratings yet

- Verlando Company Had The Following Account Balances and Information AvailableDocument1 pageVerlando Company Had The Following Account Balances and Information AvailableTaimour HassanNo ratings yet

- Allied Banking v. Lim Sio WanDocument3 pagesAllied Banking v. Lim Sio WanJayson Gabriel SorianoNo ratings yet

- Financial Risk - Monitoring Sovereign, Currency and Banking Sector RiskDocument9 pagesFinancial Risk - Monitoring Sovereign, Currency and Banking Sector RiskjimmiilongNo ratings yet

- Bir Ruling No. JV-187-21Document4 pagesBir Ruling No. JV-187-21Ren Mar CruzNo ratings yet

- Quarterly Physical Report of Operation For The Quarter EndingDocument7 pagesQuarterly Physical Report of Operation For The Quarter EndingGerfel CabanlitNo ratings yet

- NCBADocument16 pagesNCBAJOLLYBEL ROBLES100% (1)

- Midterm LTTC CLCDocument6 pagesMidterm LTTC CLCMỹ Hạnh Đinh ThịNo ratings yet

- UBI FullStatement PDFDocument2 pagesUBI FullStatement PDFsamarth agrawal0% (1)

- NAME: - YR & SEC: - CompetencyDocument10 pagesNAME: - YR & SEC: - CompetencyGMACAPAGAL, ASHLEY NICOLE B.No ratings yet

- Inside Job - The Documentary That Cost $20,000,000,000,000 To ProduceDocument30 pagesInside Job - The Documentary That Cost $20,000,000,000,000 To ProduceForeclosure Fraud100% (6)

- Principles Seifu Work SheetDocument5 pagesPrinciples Seifu Work SheetYonas85% (13)

- Jun2021 Zip 44391907 TD Fil4Document9 pagesJun2021 Zip 44391907 TD Fil4sachin singhNo ratings yet

- Reviewer - Revaluation and ImpairmentDocument5 pagesReviewer - Revaluation and Impairmenthyunsuk fhebieNo ratings yet

- Dividend Decision - by Dr. Suresh VaddeDocument34 pagesDividend Decision - by Dr. Suresh VaddeSuresh VaddeNo ratings yet

- Chapter 4: Change in Capital Structure: Withdrawal, Retirement, Death or Inacapacity of A Partner. TheoriesDocument7 pagesChapter 4: Change in Capital Structure: Withdrawal, Retirement, Death or Inacapacity of A Partner. TheoriesXelamae BigorniaNo ratings yet

- CA Foundation Accounts A MTP 2 Dec 2022Document11 pagesCA Foundation Accounts A MTP 2 Dec 2022shagana212005No ratings yet

- Kase Fund Letter To Investors-Q1 14Document4 pagesKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- Malabar Midcap Fund Monthly Factsheet - April 2024Document1 pageMalabar Midcap Fund Monthly Factsheet - April 2024Suleiman HaqNo ratings yet

- QpayDocument24 pagesQpaySindhu ThomasNo ratings yet

- Chapter 9 Stocks and Their ValuationDocument24 pagesChapter 9 Stocks and Their ValuationHammad KamranNo ratings yet

- Cash Flow - QuestionsDocument7 pagesCash Flow - Questionsleribe.thubelaNo ratings yet

- Soa Abgor0pl00000057xxxx 04072023 1688456734739-1Document5 pagesSoa Abgor0pl00000057xxxx 04072023 1688456734739-1Om PrakashNo ratings yet

- Opening of Bank Account - NewDocument2 pagesOpening of Bank Account - NewGanesh medisettiNo ratings yet

- Correction of ErrorsDocument3 pagesCorrection of ErrorsJess SiazonNo ratings yet