0 ratings0% found this document useful (0 votes)

15 viewsBonds - August 19 2019

Bonds - August 19 2019

Uploaded by

Lisle Daverin BlythThis document provides a summary of South African commodity and bond market figures for August 19, 2019. It includes statistics on total market turnover, foreign client turnover, index levels, individual bond movements, and interest rates. The All Bond Index was down 0.54% month-to-date but up 6.27% year-to-date, while republic of South Africa bonds saw month-to-date yields fall across maturities from 2021 to 2048.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Bonds - August 19 2019

Bonds - August 19 2019

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

15 views3 pagesThis document provides a summary of South African commodity and bond market figures for August 19, 2019. It includes statistics on total market turnover, foreign client turnover, index levels, individual bond movements, and interest rates. The All Bond Index was down 0.54% month-to-date but up 6.27% year-to-date, while republic of South Africa bonds saw month-to-date yields fall across maturities from 2021 to 2048.

Original Description:

Bonds - August 19 2019

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document provides a summary of South African commodity and bond market figures for August 19, 2019. It includes statistics on total market turnover, foreign client turnover, index levels, individual bond movements, and interest rates. The All Bond Index was down 0.54% month-to-date but up 6.27% year-to-date, while republic of South Africa bonds saw month-to-date yields fall across maturities from 2021 to 2048.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views3 pagesBonds - August 19 2019

Bonds - August 19 2019

Uploaded by

Lisle Daverin BlythThis document provides a summary of South African commodity and bond market figures for August 19, 2019. It includes statistics on total market turnover, foreign client turnover, index levels, individual bond movements, and interest rates. The All Bond Index was down 0.54% month-to-date but up 6.27% year-to-date, while republic of South Africa bonds saw month-to-date yields fall across maturities from 2021 to 2048.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

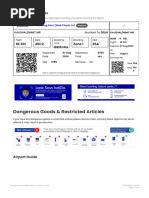

Markets and Commodity figures

19 August 2019

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 883 26.87 bn Rbn 26.05 252 63.22 bn Rbn 59.91

Week to Date 883 26.87 bn Rbn 26.05 252 63.22 bn Rbn 59.91

Month to Date 14,880 597.57 bn Rbn 593.48 4,092 685.92 bn Rbn 669.43

Year to Date 188,740 6,651.78 bn Rbn 6,695.05 57,959 8,526.25 bn Rbn 8,379.19

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 47 3.01 bn Rbn 2.88 22 4.03 bn Rbn 3.75

Current Day Sell 39 2.96 bn Rbn 2.79 -1 -0.04 bn Rbn -0.03

Net 8 0.05 bn Rbn 0.09 23 4.06 bn Rbn 3.78

Buy 47 3.01 bn Rbn 2.88 22 4.03 bn Rbn 3.75

Week to Date Sell 39 2.96 bn Rbn 2.79 -1 -0.04 bn Rbn -0.03

Net 8 0.05 bn Rbn 0.09 23 4.06 bn Rbn 3.78

Buy 1,095 60.56 bn Rbn 60.26 262 55.55 bn Rbn 51.26

Month to Date Sell 1,390 80.72 bn Rbn 79.49 36 9.81 bn Rbn 10.04

Net -295 -20.17 bn Rbn -19.23 226 45.74 bn Rbn 41.21

Buy 13,477 823.32 bn Rbn 831.90 2,808 576.35 bn Rbn 550.42

Year to Date Sell 13,185 829.60 bn Rbn 841.34 803 313.24 bn Rbn 323.72

Net 292 -6.28 bn Rbn -9.45 2,005 263.11 bn Rbn 226.70

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.224%

All Bond Index Top 672.875

20 Composite 675.402 -0.54% 6.27%

GOVI 9.332%Split - 665.738

ALBI20 Issuer Class GOVI 668.354 -0.58% 6.24%

OTHI 8.783%

ALBI20 Issuer Class Split - 700.716

OTHI 702.856 -0.38% 6.41%

CILI15 3.284%

Composite Inflation 262.022

Linked Index Top 15 261.974 0.03% 3.37%

ICOR 3.811%

CILI15 Issuer Class 306.152

Split - ICOR 306.094 0.08% 5.67%

IGOV 3.249%

CILI15 Issuer Class 260.088

Split - IGOV 260.041 0.03% 3.28%

ISOE 4.033%

CILI15 Issuer Class 273.472

Split - ISOE 273.418 0.00% 4.23%

MMI JSE Money Market Index

0 261.315 261.165 0.37% 4.83%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Mar 2021

AFRICA 6.700% 6.700% 6.20% 7.19%

R203 REPUBLIC OF SOUTH

Jan 2023

AFRICA 8.660% 8.610% 8.25% 9.31%

ES18 ESKOM HOLDINGSFebLIMITED

2023 8.490% 8.440% 8.02% 9.22%

R204 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.460% 7.410% 7.08% 8.15%

R207 REPUBLIC OF SOUTH

Nov 2023

AFRICA 8.890% 8.840% 8.53% 9.70%

R208 REPUBLIC OF SOUTH

Aug 2025

AFRICA 9.920% 9.875% 9.48% 10.64%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.640% 9.595% 9.20% 10.19%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.420% AFRICA 8.375% 7.98% 8.94%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.120% 9.070% 8.61% 9.47%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.360% 9.305% 8.80% 9.58%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.500% 9.450% 8.95% 9.69%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 11.025% 10.975% 10.53% 11.10%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.790% 9.740% 9.24% 9.84%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.785% 9.735% 9.27% 9.80%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.910% 9.850% 9.38% 9.92%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 10.045% 9.975% 9.51% 10.05%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 10.035% 9.970% 9.54% 10.04%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.375% 11.310% 10.88% 11.38%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 10.090% 10.015% 9.58% 10.09%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 10.065% 10.000% 9.55% 10.07%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.340% 6.340% 6.34% 6.60%

JIBAR1 JIBAR 1 Month 6.658% 6.658% 6.66% 6.98%

JIBAR3 JIBAR 3 Month 6.833% 6.833% 6.83% 7.16%

JIBAR6 JIBAR 6 Month 7.325% 7.325% 7.30% 7.75%

RSA 2 year retail bond 7.50% 0 0 0

RSA 3 year retail bond 7.75% 0 0 0

RSA 5 year retail bond 8.50% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Bonds - September 26 2018Document3 pagesBonds - September 26 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 12 2019Document3 pagesBonds - August 12 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 19 2018Document3 pagesBonds - September 19 2018Tiso Blackstar GroupNo ratings yet

- Bonds - November 6 2018Document6 pagesBonds - November 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 7 2018Document6 pagesBonds - September 7 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - October 2 2018Document3 pagesBonds - October 2 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 7 2019Document3 pagesBonds - August 7 2019Lisle Daverin BlythNo ratings yet

- Bonds - October 2 2019Document3 pagesBonds - October 2 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 10 2018Document3 pagesBonds - September 10 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 25 2018Document3 pagesBonds - September 25 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 20 2018Document3 pagesBonds - September 20 2018Tiso Blackstar GroupNo ratings yet

- Bonds - October 8 2019Document3 pagesBonds - October 8 2019Lisle Daverin BlythNo ratings yet

- Bonds - September 13 2018Document3 pagesBonds - September 13 2018Tiso Blackstar GroupNo ratings yet

- Bonds - July 8 2019Document3 pagesBonds - July 8 2019Lisle Daverin BlythNo ratings yet

- Bonds - March 11 2019Document3 pagesBonds - March 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - August 27 2019Document3 pagesBonds - August 27 2019Lisle Daverin BlythNo ratings yet

- Bonds - September 26 2019Document3 pagesBonds - September 26 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 18 2019Document3 pagesBonds - September 18 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 11 2019Document3 pagesBonds - July 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 22 2019Document3 pagesBonds - September 22 2019Tiso Blackstar GroupNo ratings yet

- Bonds - October 18 2018Document3 pagesBonds - October 18 2018Tiso Blackstar GroupNo ratings yet

- Bonds - November 1 2018Document3 pagesBonds - November 1 2018Tiso Blackstar GroupNo ratings yet

- Bonds - October 10 2019Document3 pagesBonds - October 10 2019Anonymous DmAspukuNo ratings yet

- Bonds - September 25 2019Document3 pagesBonds - September 25 2019Tiso Blackstar GroupNo ratings yet

- Bonds - November 1 2019Document3 pagesBonds - November 1 2019Anonymous jP4lPgNo ratings yet

- Bonds - May 13 2019Document3 pagesBonds - May 13 2019Lisle Daverin BlythNo ratings yet

- Bonds - May 12 2019Document3 pagesBonds - May 12 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 5 2018Document3 pagesBonds - April 5 2018Tiso Blackstar GroupNo ratings yet

- Bonds - March 7 2018Document6 pagesBonds - March 7 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 12 2018Document3 pagesBonds - September 12 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 13 2018Document6 pagesBonds - April 13 2018Tiso Blackstar GroupNo ratings yet

- Bonds - November 8 2019Document3 pagesBonds - November 8 2019Anonymous p8S2pBOpbNo ratings yet

- Bonds - September 24 2019Document3 pagesBonds - September 24 2019Tiso Blackstar GroupNo ratings yet

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupNo ratings yet

- Bonds - March 12 2019Document3 pagesBonds - March 12 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 16 2019Document3 pagesBonds - September 16 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 11 2019Document3 pagesBonds - September 11 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - August 3 2018Document3 pagesBonds - August 3 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 16 2019Document3 pagesBonds - September 16 2019Lisle Daverin BlythNo ratings yet

- Bonds - July 30 2019Document3 pagesBonds - July 30 2019Lisle Daverin BlythNo ratings yet

- Bonds - September 5 2019Document3 pagesBonds - September 5 2019Lisle Daverin BlythNo ratings yet

- Bonds - April 3 2018Document3 pagesBonds - April 3 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 30 2019Document3 pagesBonds - September 30 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 1 2019Document3 pagesBonds - May 1 2019Lisle Daverin BlythNo ratings yet

- Bonds - January 21 2019Document3 pagesBonds - January 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 14 2019Document3 pagesBonds - May 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - October 11 2018Document3 pagesBonds - October 11 2018Tiso Blackstar GroupNo ratings yet

- Bonds - September 11 2018Document3 pagesBonds - September 11 2018Tiso Blackstar GroupNo ratings yet

- Bonds - October 13 2020Document3 pagesBonds - October 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - September 9 2019Document3 pagesBonds - September 9 2019Lisle Daverin BlythNo ratings yet

- Bonds - October 1 2019Document3 pagesBonds - October 1 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 6 2022Document1 pageLiberty - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 23 2022Document1 pageFuel Prices - November 23 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- ETSI TS 138 521-3: Technical SpecificationDocument879 pagesETSI TS 138 521-3: Technical SpecificationOscar Elena VarelaNo ratings yet

- Hocheng Phil. Corp Vs FarralesDocument2 pagesHocheng Phil. Corp Vs Farraleslovekimsohyun8967% (3)

- Crime Vocabulary Game B1-B2Document4 pagesCrime Vocabulary Game B1-B2Sandra CierockaNo ratings yet

- Animal SacrificeDocument2 pagesAnimal SacrificeLawbuzz CornerNo ratings yet

- Investors Urge McDonald's Board To Improve Oversight of Child LaborDocument4 pagesInvestors Urge McDonald's Board To Improve Oversight of Child LaborComunicarSe-ArchivoNo ratings yet

- Registry of DeedsDocument3 pagesRegistry of DeedsRM organiqueNo ratings yet

- Mobile Applications and SetupDocument48 pagesMobile Applications and SetupvaldirsaraujoNo ratings yet

- Gist of Vacancies As On 22nd Jan 2024Document24 pagesGist of Vacancies As On 22nd Jan 2024Maunik ParikhNo ratings yet

- Addis Ababa University Addis Ababa Institute of Technology School of Electrical and Computer EngineeringDocument5 pagesAddis Ababa University Addis Ababa Institute of Technology School of Electrical and Computer EngineeringErmias MesfinNo ratings yet

- Malayan Insurance Vs Philippine First InsuranceDocument2 pagesMalayan Insurance Vs Philippine First InsuranceIan Luigie100% (2)

- Air India Web Booking Eticket (YEX8J) - TripathiDocument2 pagesAir India Web Booking Eticket (YEX8J) - Tripathiashwin tripathiNo ratings yet

- ESales (TP-JA) Annex CDocument27 pagesESales (TP-JA) Annex Cgrini gunayanNo ratings yet

- Lenders Handbook VA Pamphlet 26-7 W-ChangesDocument713 pagesLenders Handbook VA Pamphlet 26-7 W-ChangesJason WNo ratings yet

- A Social Science and Philosophy of TheDocument13 pagesA Social Science and Philosophy of TheIsidoro ThessNo ratings yet

- We The State - Issue 10 Vol 2Document12 pagesWe The State - Issue 10 Vol 2wethestateNo ratings yet

- Briggs & Stratton Engines Model 12H8022032B1 Parts ManualDocument35 pagesBriggs & Stratton Engines Model 12H8022032B1 Parts Manualmoutsy100% (1)

- Potsdam Village Police Dept. Blotter Feb. 16, 2016Document3 pagesPotsdam Village Police Dept. Blotter Feb. 16, 2016NewzjunkyNo ratings yet

- Rice Cooker ManualDocument48 pagesRice Cooker ManualMongoose CiviqueNo ratings yet

- 8 RavindraDocument13 pages8 RavindraRudejane TanNo ratings yet

- Inventory ManagementDocument15 pagesInventory ManagementAnna Lyssa BatasNo ratings yet

- Nimit Web CheckinDocument2 pagesNimit Web Checkinmitul_rana8200No ratings yet

- Practice Set 1 ABC-3Document3 pagesPractice Set 1 ABC-3reiNo ratings yet

- The Impact of International Trade Law On EnvironmentDocument9 pagesThe Impact of International Trade Law On EnvironmenthoneyNo ratings yet

- Bbob Current AffairsDocument28 pagesBbob Current AffairsGangwar AnkitNo ratings yet

- AccountDocument47 pagesAccountAshwani KumarNo ratings yet

- US Vs Gregorio (Digest)Document2 pagesUS Vs Gregorio (Digest)Stephen Michael Ben CañeteNo ratings yet

- I. ALFREDO S. RAMOS v. CHINA SOUTHERN AIRLINESDocument11 pagesI. ALFREDO S. RAMOS v. CHINA SOUTHERN AIRLINESKaloi GarciaNo ratings yet

- Saudi Arabia Criminal Procedure Law (1422)Document43 pagesSaudi Arabia Criminal Procedure Law (1422)Social Media Exchange AssociationNo ratings yet

- ReportDocument19 pagesReportEESUOLA100% (1)