0 ratings0% found this document useful (0 votes)

155 views30 - CIR V Botelho Shipping Corp

30 - CIR V Botelho Shipping Corp

Uploaded by

Doel LozanoThis case involves Botelho Shipping Corp. and General Shipping Co., Inc. who purchased vessels from the Reparations Commission of the Philippines. When the vessels arrived in Manila, the Bureau of Customs refused registration unless compensating taxes were paid. Botelho and General Shipping filed petitions challenging this. A new law, RA 3079, was then passed exempting purchasers of reparations goods from compensating tax. However, it did not specify retroactive application. The Court held that Botelho and General Shipping were entitled to the tax exemption because Section 20 of RA 3079 aimed to abolish discrimination between those who purchased before and after June 17, 1961. Tax exemptions can be granted if there is

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

30 - CIR V Botelho Shipping Corp

30 - CIR V Botelho Shipping Corp

Uploaded by

Doel Lozano0 ratings0% found this document useful (0 votes)

155 views2 pagesThis case involves Botelho Shipping Corp. and General Shipping Co., Inc. who purchased vessels from the Reparations Commission of the Philippines. When the vessels arrived in Manila, the Bureau of Customs refused registration unless compensating taxes were paid. Botelho and General Shipping filed petitions challenging this. A new law, RA 3079, was then passed exempting purchasers of reparations goods from compensating tax. However, it did not specify retroactive application. The Court held that Botelho and General Shipping were entitled to the tax exemption because Section 20 of RA 3079 aimed to abolish discrimination between those who purchased before and after June 17, 1961. Tax exemptions can be granted if there is

Original Description:

sfsf

Original Title

30_CIR v Botelho Shipping Corp

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This case involves Botelho Shipping Corp. and General Shipping Co., Inc. who purchased vessels from the Reparations Commission of the Philippines. When the vessels arrived in Manila, the Bureau of Customs refused registration unless compensating taxes were paid. Botelho and General Shipping filed petitions challenging this. A new law, RA 3079, was then passed exempting purchasers of reparations goods from compensating tax. However, it did not specify retroactive application. The Court held that Botelho and General Shipping were entitled to the tax exemption because Section 20 of RA 3079 aimed to abolish discrimination between those who purchased before and after June 17, 1961. Tax exemptions can be granted if there is

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

155 views2 pages30 - CIR V Botelho Shipping Corp

30 - CIR V Botelho Shipping Corp

Uploaded by

Doel LozanoThis case involves Botelho Shipping Corp. and General Shipping Co., Inc. who purchased vessels from the Reparations Commission of the Philippines. When the vessels arrived in Manila, the Bureau of Customs refused registration unless compensating taxes were paid. Botelho and General Shipping filed petitions challenging this. A new law, RA 3079, was then passed exempting purchasers of reparations goods from compensating tax. However, it did not specify retroactive application. The Court held that Botelho and General Shipping were entitled to the tax exemption because Section 20 of RA 3079 aimed to abolish discrimination between those who purchased before and after June 17, 1961. Tax exemptions can be granted if there is

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

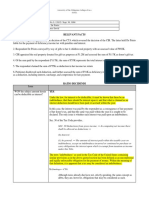

30.

CIR v Botelho Shipping Corp

FACTS:

Reparations Commission of the Phils (“RCP”) & Botelho shipping entered

into a "Contract of Conditional Purchase and Sale of Reparations Goods,"

whereby the former agreed to sell to Botelho for P6.7M the vessel "M/S

Maria Rosello," procured by the Commission from Japan, pursuant to the

provisions of the Philippine-Japanese Reparations Agreement. The

Commission signed a similar contract with General Shipping Co., Inc. —

(“General Shipping “)— for the sale thereto of "M/S General Lim" at the

price of P6.9M. The terms include the ff:

a.) Reparations Commission "retains title to and ownership of the above

described vessel until it is fully paid for and b.) The stipulated purchase

price of the M/S MARIA ROSELLO was to be paid by Botelho to the

Commission under a deferred payment plan in 10 equal yearly installment

Upon arrival of the vessels at the Port of Manila, BOC refused to the

Botelho’s application for registration of the vessels unless compensating

taxes were paid by the buyers (Botelho). Botelho simultaneously filed with

the Court of Tax Appeals their respective petitions for review vs

Commissioner of Customs and the CIR w/ urgent motion for suspension of

the collection of said tax. While said cases were pending, RA 3079 amended

RA 1789 (wherein buyers were subject to compensating tax) — the

Original Reparations Act, under which the aforementioned contracts with

the Buyers had been executed — by exempting buyers of reparations goods

acquired from the Commission, from liability for the compensating tax.

There was no express provision for the retroactivity of the exemption,

established by RA 3079 re: compensating tax. Botelho invoked sec.20 of

said act and applied for the renovation of their utilizations contracts with the

commission -GRANTED

Per tax court : EXEMPT from compensating tax sought to be assessed

CIR: Botelho shipping (the buyers)is liable for payment of compensating

taxes on the vessels M/S Maria Rosello" and "M/S General Lim."

CTA: Reversed

ISSUE: Whether or not Botelho is entitled to be granted exemption from

liability for the compensating tax

HELD: YES. Botelho must be exempted from paying the compensating tax

assessed by the BOC. There is no constitutional injunction against granting

tax exemptions to particular persons belonging to a particular class. In fact,

it is not unusual to grant legislative franchises to specific individuals or

entities, conferring tax exemptions thereto. In the same way as other

statutory commands, its avowed purpose is some public benefit or interest,

which the law-making body considers sufficient to offset the monetary loss

entitled in the grant of the exemption. Section 20 of RA 3079 seeks, not to

discriminate or to create an exemption or exception, but to abolish the

discrimination, exemption or exception that would otherwise result, in favor

of the end-user who bought after June 17, 1961 and against one who bought

prior thereto. In this case, the vessels were bought in 1960 after the

amendment of said statute took place, after the contracts involved in these

appeals had been perfected and partly consummated, but, also, after the

corresponding compensating tax had become due and payment demandable.

Hence, Botelho shipping is entitled exemption from liability for the

compensating taxes from reparation goods.

DOCTRINE : Every tax exemption implies a waiver of the right to collect

what otherwise would be due to the Government, and, in this sense, is

prejudicial thereto. No tax exemption, however, is given without any reason

therefor. In much the same way as other statutory commands, its avowed

purpose is some public benefit or interest, which the law-making body

considers sufficient to offset the monetary loss entailed in the grant of

exemption. Sec 20 of RA 3079 seeks to abolish the discrimination, exemption

or exception that would otherwise result, in favor of the end user who

bought after June 17, 1961 and against one who bought prior thereto.

You might also like

- BC BondDocument1 pageBC BondJohn Wallace88% (58)

- Sample Petition For Registration of Unregistered LandDocument3 pagesSample Petition For Registration of Unregistered LandElden Cunanan Bonilla78% (9)

- City of Ozamis V LumapasDocument3 pagesCity of Ozamis V LumapasViolet ParkerNo ratings yet

- Northern Mini Hydro v. CIRDocument3 pagesNorthern Mini Hydro v. CIRPaul Joshua SubaNo ratings yet

- Atlas Consolidated Mining Development Corp. v. CIRDocument1 pageAtlas Consolidated Mining Development Corp. v. CIRIsh50% (2)

- Presentation On Conceptual Understanding of Human RightsDocument14 pagesPresentation On Conceptual Understanding of Human RightsMarla DiazNo ratings yet

- Pol 123 PDFDocument214 pagesPol 123 PDFabhijeet100% (1)

- Chapter Ii Definitions Art. 212. Definitions.: Labor RelationsDocument7 pagesChapter Ii Definitions Art. 212. Definitions.: Labor RelationsCris AnonuevoNo ratings yet

- Cir v. BotelhoDocument2 pagesCir v. BotelhorobbyNo ratings yet

- CIR v. Gotamco Sons - DigestDocument3 pagesCIR v. Gotamco Sons - DigestLizzette Dela PenaNo ratings yet

- Marubeni Corporation v. CIRDocument2 pagesMarubeni Corporation v. CIRBrylle Garnet DanielNo ratings yet

- Esso Standard Eastern, Inc Vs CirDocument2 pagesEsso Standard Eastern, Inc Vs CirCeresjudicata100% (1)

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- CIR v. LednickyDocument2 pagesCIR v. LednickyBananaNo ratings yet

- Commissioner V Duberstein DigestDocument2 pagesCommissioner V Duberstein DigestKTNo ratings yet

- China Banking Corp V CIRDocument2 pagesChina Banking Corp V CIRWayne Michael NoveraNo ratings yet

- CIR vs. Pascor RealtyDocument3 pagesCIR vs. Pascor RealtyZyrilla Jeoville De LeonNo ratings yet

- Mun of San Fernando Vs Sta RomanaDocument1 pageMun of San Fernando Vs Sta RomanaKara AgliboNo ratings yet

- Republic of The Philippines vs. Central Azucarera Del Danao, G.R. No. L-19842, December 26, 1969Document3 pagesRepublic of The Philippines vs. Central Azucarera Del Danao, G.R. No. L-19842, December 26, 1969MariaHannahKristenRamirezNo ratings yet

- CIR vs. San Miguel Corp Tax DigestDocument2 pagesCIR vs. San Miguel Corp Tax DigestCJ100% (3)

- Bano v. Bachelor ExpressDocument4 pagesBano v. Bachelor Expressmisterdodi100% (1)

- First National Bank of Portland v. NobleDocument2 pagesFirst National Bank of Portland v. NoblePat NaffyNo ratings yet

- 9 City of Ozamis V LumapasDocument1 page9 City of Ozamis V LumapasJackie Canlas100% (1)

- CIR v. Gatamco DigestDocument1 pageCIR v. Gatamco DigestJomar TenezaNo ratings yet

- CIR vs. Lednicky (1964)Document1 pageCIR vs. Lednicky (1964)Emil BautistaNo ratings yet

- Smith-Bell Co. Vs CIRDocument1 pageSmith-Bell Co. Vs CIRAthena SantosNo ratings yet

- John Hay Sez v. Lim, 414 Scra 356Document1 pageJohn Hay Sez v. Lim, 414 Scra 356Scrib LawNo ratings yet

- c.11. Filipinas Synthetic Fiber Corp v. CADocument1 pagec.11. Filipinas Synthetic Fiber Corp v. CAArbie LlesisNo ratings yet

- Kepco Philippines v. CIRDocument4 pagesKepco Philippines v. CIRamareia yapNo ratings yet

- Escover - TAN v. Mun of PAGBILAODocument2 pagesEscover - TAN v. Mun of PAGBILAOChuck Norris100% (1)

- Western Minolco v. CommissionerDocument2 pagesWestern Minolco v. CommissionerEva TrinidadNo ratings yet

- Part H 2 - CIR vs. Procter GambleDocument2 pagesPart H 2 - CIR vs. Procter GambleCyruz TuppalNo ratings yet

- Pennoyer Vs DuboisDocument2 pagesPennoyer Vs DuboisClaudine Allyson DungoNo ratings yet

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Document3 pagesCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- CIR V Vda. de PrietoDocument2 pagesCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- Digest - CIR v. Visayan ElectricDocument1 pageDigest - CIR v. Visayan Electrickater_cris100% (1)

- CD - 81. Allied Banking v. Quezon CityDocument2 pagesCD - 81. Allied Banking v. Quezon CityCzarina CidNo ratings yet

- Iloilo Bottlers V City of IloiloDocument2 pagesIloilo Bottlers V City of IloiloJaz Sumalinog100% (2)

- People Vs Musa JRDocument2 pagesPeople Vs Musa JRMarlouis U. PlanasNo ratings yet

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- TranspoDocument2 pagesTranspoCzarina AureNo ratings yet

- Fitness Vs CIR - Powers of The CIRDocument3 pagesFitness Vs CIR - Powers of The CIRCarl MontemayorNo ratings yet

- Silkair v. CIR, G.R. No. 184398 - Case DigestDocument4 pagesSilkair v. CIR, G.R. No. 184398 - Case Digestrodel talabaNo ratings yet

- 10 Wise Co v. MeerDocument2 pages10 Wise Co v. MeerkresnieanneNo ratings yet

- Gutierrez v. CIR - SubaDocument1 pageGutierrez v. CIR - SubaPaul Joshua SubaNo ratings yet

- Northern Motors Vs Prince LineDocument2 pagesNorthern Motors Vs Prince LineLiana AcubaNo ratings yet

- Alhambra Cigar V CIRDocument1 pageAlhambra Cigar V CIRRaymond PanotesNo ratings yet

- Versoza V LimDocument2 pagesVersoza V LimKylie Kaur Manalon Dado100% (1)

- Eisner V Macomber DigestDocument1 pageEisner V Macomber DigestKTNo ratings yet

- Banking SamplexDocument7 pagesBanking SamplexzippyNo ratings yet

- Gutierrez Vs CollectorDocument2 pagesGutierrez Vs CollectorBenedict AlvarezNo ratings yet

- 38 Tan vs. Municipality of PagbilaoDocument4 pages38 Tan vs. Municipality of PagbilaoSara Andrea SantiagoNo ratings yet

- Taxation 1 ReviewerDocument10 pagesTaxation 1 ReviewerRey ObnimagaNo ratings yet

- CIR Vs Next MobileDocument2 pagesCIR Vs Next Mobilegeorge almedaNo ratings yet

- FAY V WitteDocument2 pagesFAY V WitteKeith Ivan Ong MeridoresNo ratings yet

- Digest BPI vs. de Coster GR No. 23181Document4 pagesDigest BPI vs. de Coster GR No. 23181Mazaya VillameNo ratings yet

- Taxation I Case DigestsDocument11 pagesTaxation I Case DigestsJay RibsNo ratings yet

- Soriano Vs Secretary of FinanceDocument6 pagesSoriano Vs Secretary of FinancePio MathayNo ratings yet

- Case Digests No. 45-52Document9 pagesCase Digests No. 45-52Auvrei MartinNo ratings yet

- Constantino vs. Heirs of ConstantinoDocument3 pagesConstantino vs. Heirs of ConstantinoJesh RadazaNo ratings yet

- CIR v. Botelbo Shipping Corp. 20 SCRA 487Document2 pagesCIR v. Botelbo Shipping Corp. 20 SCRA 487Pat EspinozaNo ratings yet

- CIR V Botelho Shipping Corp. 20 SCRA 487Document2 pagesCIR V Botelho Shipping Corp. 20 SCRA 487Kyle DionisioNo ratings yet

- Cir Vs BotelhoDocument4 pagesCir Vs BotelholawdiscipleNo ratings yet

- CIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.Document2 pagesCIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.preiquency100% (1)

- CIR Vs Phil Ace LinesDocument2 pagesCIR Vs Phil Ace LinesIsabella LinNo ratings yet

- Application For Release On RecognizanceDocument2 pagesApplication For Release On RecognizanceDoel Lozano100% (1)

- Brondial Tips Remedial LawDocument109 pagesBrondial Tips Remedial LawDoel Lozano100% (3)

- Bar Examination Questionnaire For Remedial LawDocument7 pagesBar Examination Questionnaire For Remedial LawDoel LozanoNo ratings yet

- Special Proceeding Cases, Escheat To Trustees Full Text and DoctrinesDocument37 pagesSpecial Proceeding Cases, Escheat To Trustees Full Text and DoctrinesDoel LozanoNo ratings yet

- Labor Relations Law Outline 2017Document55 pagesLabor Relations Law Outline 2017Doel LozanoNo ratings yet

- Rem1 No DigestsDocument108 pagesRem1 No DigestsDoel LozanoNo ratings yet

- Wills and Succession Atty Abugan AUSL, General Principles CasesDocument87 pagesWills and Succession Atty Abugan AUSL, General Principles CasesDoel LozanoNo ratings yet

- Course Outline On Election LawDocument28 pagesCourse Outline On Election LawDoel LozanoNo ratings yet

- Natural Resources and Environmental Law Constitutional Law IPRA Regalian DoctrineDocument6 pagesNatural Resources and Environmental Law Constitutional Law IPRA Regalian DoctrineDoel LozanoNo ratings yet

- Arbit AgreeDocument52 pagesArbit AgreeDoel LozanoNo ratings yet

- Law On Public OfficersDocument3 pagesLaw On Public OfficersDoel LozanoNo ratings yet

- Management Programme (MP) Term-End Examination June,: No. of Printed Pages: 8Document8 pagesManagement Programme (MP) Term-End Examination June,: No. of Printed Pages: 8Niladri SenNo ratings yet

- The Euromissiles Crisis and The End of The Cold War, 1977-1987Document1,607 pagesThe Euromissiles Crisis and The End of The Cold War, 1977-1987The Wilson Center100% (2)

- Contract AdministrationDocument17 pagesContract AdministrationseymourwardNo ratings yet

- One Chamber or TwoDocument14 pagesOne Chamber or TwoAna Dias TorresNo ratings yet

- Third DivisionDocument30 pagesThird DivisionEllis LagascaNo ratings yet

- Baloch Insurgencies 1948Document24 pagesBaloch Insurgencies 1948Muhammad YaseenNo ratings yet

- BUS708 Case Study Tri 3 17Document2 pagesBUS708 Case Study Tri 3 17EngrAbeer ArifNo ratings yet

- Amanda CarpoDocument1 pageAmanda Carpoapi-257870058No ratings yet

- The Three Leaders of TerrorDocument2 pagesThe Three Leaders of TerrorBob CooperNo ratings yet

- U.S. vs. Ang Tang HoDocument1 pageU.S. vs. Ang Tang HoMike TeeNo ratings yet

- Anti Drunk DrivingDocument10 pagesAnti Drunk DrivingTeoti Navarro ReyesNo ratings yet

- Why Invest in BhutanDocument3 pagesWhy Invest in Bhutanvishal chhetriNo ratings yet

- Acejas III V People of The Philippines G.R. No. 156643Document28 pagesAcejas III V People of The Philippines G.R. No. 156643Apay GrajoNo ratings yet

- 9 People-v-CapalacDocument1 page9 People-v-CapalacAnonymous fL9dwyfekNo ratings yet

- Decano V EduDocument2 pagesDecano V EduColee StiflerNo ratings yet

- AP PRC 2010 Intentive Allowance To Teachers and Armed PoliceDocument2 pagesAP PRC 2010 Intentive Allowance To Teachers and Armed PoliceSEKHARNo ratings yet

- Dr. K Pol 155 Unit 5Document19 pagesDr. K Pol 155 Unit 5samuel bamfoNo ratings yet

- 1 Eo BDC Barangay Development CouncilDocument2 pages1 Eo BDC Barangay Development CouncilOremor RemerbNo ratings yet

- Cancellation and ConversionDocument188 pagesCancellation and ConversionKimberly Mae Galleta100% (1)

- Understanding Northern IrelandDocument4 pagesUnderstanding Northern Irelandapi-427106949No ratings yet

- Health Policy and Planning: by Ahmed-Nor Mohamed AbdiDocument21 pagesHealth Policy and Planning: by Ahmed-Nor Mohamed Abdiahmednor2012No ratings yet

- Chapter 14 - Respecting Employee Rights and Managing DisciplineDocument10 pagesChapter 14 - Respecting Employee Rights and Managing DisciplineAntonetteNo ratings yet

- Complaint and Demand For Jury TrialDocument28 pagesComplaint and Demand For Jury TrialWXYZ-TV Channel 7 DetroitNo ratings yet

- African Centered Perspective On White SupremacyDocument21 pagesAfrican Centered Perspective On White Supremacyosanyaolu100% (2)

- 5.1 The Dawn of The Victorian Age: Queen VictoriaDocument12 pages5.1 The Dawn of The Victorian Age: Queen VictoriamicoleNo ratings yet