0 ratings0% found this document useful (0 votes)

50 viewsEconomics Reviewer

Economics Reviewer

Uploaded by

Jei1. The document discusses various economic concepts including monetary policy, fiscal policy, income distribution, poverty, and globalization.

2. It defines key terms like the money supply, types of monetary policy, contractionary and expansionary fiscal policy, and measures of income distribution such as the Lorenz curve and Gini coefficient.

3. The impacts of fiscal policy on the budget and reasons for income mobility are also summarized.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Economics Reviewer

Economics Reviewer

Uploaded by

Jei0 ratings0% found this document useful (0 votes)

50 views5 pages1. The document discusses various economic concepts including monetary policy, fiscal policy, income distribution, poverty, and globalization.

2. It defines key terms like the money supply, types of monetary policy, contractionary and expansionary fiscal policy, and measures of income distribution such as the Lorenz curve and Gini coefficient.

3. The impacts of fiscal policy on the budget and reasons for income mobility are also summarized.

Original Description:

Let review

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1. The document discusses various economic concepts including monetary policy, fiscal policy, income distribution, poverty, and globalization.

2. It defines key terms like the money supply, types of monetary policy, contractionary and expansionary fiscal policy, and measures of income distribution such as the Lorenz curve and Gini coefficient.

3. The impacts of fiscal policy on the budget and reasons for income mobility are also summarized.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

50 views5 pagesEconomics Reviewer

Economics Reviewer

Uploaded by

Jei1. The document discusses various economic concepts including monetary policy, fiscal policy, income distribution, poverty, and globalization.

2. It defines key terms like the money supply, types of monetary policy, contractionary and expansionary fiscal policy, and measures of income distribution such as the Lorenz curve and Gini coefficient.

3. The impacts of fiscal policy on the budget and reasons for income mobility are also summarized.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

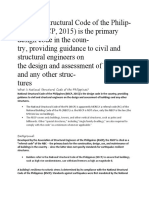

ECONOMICS 1.

Contractionary Fiscal Policy- reducing

government expenditure and raising taxes

Monetary Policy- government/ central bank policy for the 2. Expansionary Fiscal Policy- increase in

control of amount of currency available and rate at which government expenditure and cut taxes

people can borrow money

Drawbacks of Fiscal Policy

Money Devaluation- loss in the value of money 1. Delay

a. Recognition Log- takes some time that

BSP’s Monetary Policy- to promote a loan and stable there is a need to change in fiscal policy

inflation conducive to a balance and sustainable economic b. Decision Log- they already have

growth recognition but it takes time to think

about what revision will they use

Goal of Monetary Policy- to assist the economy on c. Impact Log- they have made the decision

achieving full employment non- inflationary level of total and revision but it takes time to feel the

output effect

2. Political Visibility- voters are likely to respond

Money Supply more favorably to increase in government

- Coins and bills in circulation purchases and cut in taxes

- Demand deposits in bank

- Saving deposits and time deposits Impact of Fiscal Policy

- Deposit substitute 1. Balance Budget- situation where the government

Types of Monetary Policy expenditure and revenues are equal

1. Inflation Targeting- to keep inflation under a 2. Budget Surplus- revenues exceed government

particular definition such as CPI (consumer price expenditure

index); Philippines, Australia, Brazil and Canada 3. Budget deficit- government expenditure exceed

2. Price Level Targeting- similar to inflation targeting revenues

except that CPI growth in one year over or under

the long price term level target; achieve through INCOME DISTRIBUTION AND POVERTY

long period of time

3. Monetary Aggregates- based on total quantity of Personal Income (PI) – the flow of annual income received

money reserved in country by households before payment of personal income taxes.

4. Fixed Exchange Rate- fixed rate on the Personal income includes wages and salaries, corporate dividends,

conversion of currency; Singapore rent, interest, Social Security benefits, welfare payments, and any

5. Gold Standard- based on total quantity of gold other form of money income.

reserved in country for the basis of economic

status In-kind Income – non-money income. These are services

provided by the government such as food stamps, education,

Fiscal Policy- focus on use of government expenditure and medical aid, housing assistance, or any good service that can be

revenue collection (taxes) in influencing the economy consumed.

Two Policies involve in Fiscal Policy

Wealth- market value of assets people own

Size of distribution of income- tells how large a share of

total personal income is received by various households,

grouped by income class.

Distribution by Income Category- households are grouped

by income class – lined up in order of income, with

lowest-income recipients on top and highest-income

recipients at the bottom.

Distribution by Quintiles (Fifths)- divide the total number Poverty Gap- shortfall between actual income and the

of individuals, households, or families (two or more poverty threshold

persons related by birth, marriage or adoption) into five

numerically equal groups, or quintiles, and examine the GLOBALIZATION

percentage of total personal (before-tax) income received

by each quintile. Globalization- process of global integration of the

economies of nations by allowing the unrestricted flow of

Lorenz curve- displays the quintile distribution of personal goods, services, investments and currencies between

income. It is a graphical illustration of the size distribution. countries

Gini Coefficient- numerical measure of the overall Three Major Policies

dispersion of income; the higher the Gini coefficient is, the 1. Liberalization- the reduction and eventual removal

greater the degree of inequality of barriers to the flow of goods, services and

capital from one country to another.

2. Privatization- the total or partial sale of

government-owned or controlled corporations or

institutions to the private sector

3. Deregulation- the removal of government

intervention in settling or regulating the prices of

goods and services regardless of whether this

benefits the consumers or not

Income mobility- movement of individuals or households Characteristics of Globalization

from one income quintile to another over time 1. Denationalization- national boundaries becoming

less relevant.

Reasons for Income Mobility 2. Internationalization- entities cooperating across

1. Education and Training national borders.

2. Gender Discrimination

3. Age Two Forces of Globalization

4. Market Power 1. Falling Barriers to Trade/ Investment

5. Unequal Distribution of Wealth - GATT

6. Luck - WTO

7. Connections 2. Technological Innovation

8. Misfortune

- Internet

9. Rapid Population Growth

- Communication

- Transportation

Poverty- condition in which a person or a family does not

have the means to satisfy basic needs for food, clothing,

World Trade Organization (WTO)- only international

shelter, and transportation

organization dealing with the rules of trade between

nations; goal is to help producers of goods and services,

Causes of Poverty

exporters, and importers conduct their business; main

1. Poor Governance

objective is to open up trade among its member countries

2. Increased Population

by reducing tariffs and quotas on traded products

3. Inequality in Income Distribution

4. Inflation

Two Components

5. Corruption

1. The globalization of markets - that the expansion

6. Unemployment

and access of businesses to all over the world to

reach the needs of the customers internationally

Poverty line or poverty threshold- estimated minimum

2. The globalization of production - refers to the

level of income needed to secure the necessities of life.

sourcing of goods and services from locations

around the globe to take advantage of national

differences in the cost and quality of factors of technologies which increased the number of

production to lower their overall cost structure standards applied globally

and/or improve the quality or functionality of Negative Effects

their product 1. Developed nations have outsourced

Multinational Corporations (MNCs)- companies that manufacturing and white collar jobs.

manufacture and market the products or services in several 2. Globalization has led to exploitation of labor.

countries 3. Job insecurity.

Types of Globalization 4. Terrorists have access to sophisticated weapons

1. Globalization of consumption- the nation in enhancing their ability to inflict damage.

which a product was made becomes independent 5. Companies have set up industries causing

of the nationality of the consumer pollution in countries with poor regulation of

2. Globalization of production/ownership- the pollution.

nationality of the owner and controller of 6. Fast food chains are spreading in the developing

productive assets is independent of the nation world. People are consuming more junk food

housing them from these joints which has an adverse impact on

their health.

Four Main of Economic Flows 7. The benefits of globalization is not universal. The

1. Goods and services, e.g., exports plus imports as rich are getting richer and the poor are becoming

a proportion of national income or per capita of poorer.

population 8. Bad aspects of foreign cultures are affecting the

2. Labor/people, e.g., net migration rates; inward or local cultures through TV and the Internet.

outward migration flows, weighted by population 9. Enemy nations can spread propaganda through

3. Capital, e.g., inward or outward direct investment the Internet.

as a proportion of national income or per head of 10. Deadly diseases like HIV/AIDS are being spread

population by travellers to the remotest corners of the globe.

4. Technology, e.g., international research & 11. Local industries are being taken over by foreign

development flows; proportion of populations multinationals.

Effects of Globalization 12. The increase in prices has reduced the

1. Industrialization- emergence of worldwide government ability to sustain social welfare

production markets and broader access to a range schemes in developed countries.

of foreign products for consumers and companies, 13. There is increase in human trafficking.

particularly movement of material and goods 14. Multinatonal Companies and corporations which

between and within national boundaries were previously restricted to commercial activities

2. Financial- emergence of worldwide financial are increasingly influencing political decisions.

markets and better access to external financing for Positive Effects

borrowers 1. Globalization has created the concept of

3. Political- which particularly go along with the outsourcing.

decrease of the importance of the state 2. Increased competition forces companies to

4. Economic- realization of a global common lower prices.

market, based on the freedom of exchange of 3. Increased media coverage draws the attention

goods and capital of the world to human right violations.

5. Cultural- growth of cross-cultural contacts; advent

of new categories of consciousness and identities Drivers of Globalization

which embodies cultural diffusion, the desire to 1. Individual and social needs and aspirations

increase one's standard of living and enjoy foreign 2. Technological innovation

products and ideas, adopt new technology and 3. Reduced technological and economic barriers to

practices, and participate in a "world culture" trade

6. Technical- central aspect of globalization has been

the development of a Global Information System, Globalization Encompasses

and greater trans border data flow, using such 1. Internationalization (trade & investment)

2. Liberalization (freeing markets) due to the necessity of the product they are

3. Universalization (cultural interchange) importing.

4. Westernization (Western cultural dominance)

5. “Deterritorialization” (compression of time and Arguments for the Imposition of Tariff Protection

space)

1. Infant Industry Argument- this arguments

asserts that a temporary imposition of tariff will

International Economics- concerned with the effects upon

cut down imports while local industries learn how

economic activity of international differences in productive

to produce at lw enough costs to compete without

resources and consumer preferences and the institutions

the help of a tariff

that affect them

2. Higher Standard of Living Argument- a tariff

will promote high wages because local industries

International trade- exchange of capital, goods,

cannot provide competition with foreign

and services across international borders or territories

competitors and pay high wages at the same time.

3. Increased Employment Argument- it is also

Theory of International Trade

contended that tariff creates employment

1. Mercantilism (Thomas Munn)- for a nation to be

opportunities for labor.

rich and powerful, it needs to export more and

4. Self-sufficiency Argument- this argument is

import less; the more gold a nation had, the richer

advocated to secure economic independence or

and powerful it was

national self-sufficiency.

2. Theory of Absolute Advantages (Adam Smith)- in

free trade, each nation could specialize in the Foreign Exchange

production of those commodities in which it had

an absolute advantage, and import those • Foreign Exchange Market- organizational

commodities in which it had absolute framework wherein individuals, businesses, and

disadvantage banks buy and sell foreign exchange.

3. Theory of Comparative Advantages (David

Ricardo)- even if a nation had a absolute • Foreign Exchange Rate- price of the Philippine

disadvantage in the production of both peso versus other currencies. The exchange rate is

commodities with respect to other nations, made the same in all markets by arbitrage.

mutually advantageous trade could still take place • Foreign Exchange Arbitrage- buying of a

4. Heckscher- Ohlin (HO) Theory- each nation will currency when its price is low and selling it when

export the commodity intensive in its relative it is high

abundance and cheap factor, and import the

commodity intensive in its relatively scarcity and • Currency Depreciation- when the value of a

expensive factor currency declines because of market forces

Types of Trade Protection • Currency devaluation- when the value of the

currency declines due to legislation

1. Tariff- tax on import products. It raises the costs

to foreign suppliers and reduces their revenues • Floating Exchange Rate- if the government,

thereby reducing the import spending of the particularly the Central Bank, does not intervene

country. in the market to defend the currency against its

2. Quota- fixed limit placed on the quantity of depreciation.

imports allowed into a country.

3. Government Regulations- forms of protection Two types of Flexible Exchange Rates

arising from health and safety standards and

preservation of the environment • Manage Float- the BSP will intervene in the

4. Exchange Controls- the Bangko Sentral ng market to smooth out short- run fluctuations in

Pilipinas restricts the sale dollars (and other forms the foreign exchange market without affecting the

of currency) to importers. Only those importers long- run movement of the exchange rate.

who have permits are allowed to obtain dollars

• Dirty Float- a country will artificially keep their

currency low to induce their exports.

Fixed Exchange Rate System – the CB allows the

exchange rate to move within a range of values, and

permits that rate to fluctuate in that range.

Two Types of Fixed Exchange rate

• Adjustable Peg System – the CB will setup a

maximum and minimum value of currency.

• Crawling Peg System – the pegged exchange

rate is changed often according to discretion of

the CB or some economic indicators.

Balance of Payment- summary of information about

the country’s exports, imports, earnings by domestic

residents on properties located abroad or outside the

country, earnings on domestic assets owned by foreign

residents, international capital movements between

countries, and official transaction by Bangko Sentral

ng Pilipinas and governments.

The balance payment is listed in four sections:

1. The Current- Account Balance- summarizes the

difference between total exports of goods and

services and the total imports.

Current account deficit- export of goods and

services fall short of imports of goods and services

plus net unilateral transfer.

2. The Capital Account- records all transaction

pertaining to private foreign investments, grants

and loans, such as capital movements.

3. Statistical Discrepancy- net sum of all

unrecorded transactions.

4. Official Monetary Reserve or Cash Account-

assets of Central Bank in the form of gold

reserves, currency reserves and international

“paper gold” or SDRs.

Exports- sales of goods and services to people and firms

of other countries

Imports- purchases of goods and services from people

and firms of other countries.

Net Exports- the balance of international trade, equals

export minus imports.

You might also like

- The Data Science of The Quantified SelfDocument46 pagesThe Data Science of The Quantified SelfVithaya SuharitdamrongNo ratings yet

- Economics Defined: Production of GoodsDocument22 pagesEconomics Defined: Production of GoodsSoniya Omir VijanNo ratings yet

- Assignment Business EconomicsDocument6 pagesAssignment Business EconomicsChetan GoyalNo ratings yet

- Index Basics of Economy: Sr. Chapters Page NoDocument4 pagesIndex Basics of Economy: Sr. Chapters Page NoNani ParveshNo ratings yet

- EconomicsDocument23 pagesEconomicsSHANTANU SETHNo ratings yet

- Geoffrey M.B. TootellDocument14 pagesGeoffrey M.B. TootellAr RoNo ratings yet

- Economics NotesDocument5 pagesEconomics NotesNaghul MxNo ratings yet

- ADB Economics Working Paper SeriesDocument52 pagesADB Economics Working Paper SeriesAmy AdamsNo ratings yet

- Behavioral Economics and Tax PolicyDocument21 pagesBehavioral Economics and Tax Policydivyakohli1985No ratings yet

- Chapter 4: Value Chain AnalysisDocument30 pagesChapter 4: Value Chain AnalysisRakib HasanNo ratings yet

- Basic Economics SB-webDocument80 pagesBasic Economics SB-webstreptomicinNo ratings yet

- Economics of AlcoholDocument15 pagesEconomics of AlcoholPulkit BajpaiNo ratings yet

- Evaluating and Monitoring The Socio-Economic Impact of Investment in Research InfrastructuresDocument23 pagesEvaluating and Monitoring The Socio-Economic Impact of Investment in Research InfrastructuresJovele OctobreNo ratings yet

- Economics 4Document16 pagesEconomics 4Armeen KhanNo ratings yet

- Examining Friedman Hypothesis On Political, Civil and Economic Freedom For Saarc Countries: A Dynamic Panel Data AnalysisDocument21 pagesExamining Friedman Hypothesis On Political, Civil and Economic Freedom For Saarc Countries: A Dynamic Panel Data AnalysiszkNo ratings yet

- EconomicsDocument6 pagesEconomicsArafatNo ratings yet

- Money and Banking: Chapter - 8Document32 pagesMoney and Banking: Chapter - 8Kaushik NarayananNo ratings yet

- Business Organization and ManagementDocument18 pagesBusiness Organization and ManagementShin PetsNo ratings yet

- New Economics - Alternative Economics - Schumacher CollegeDocument4 pagesNew Economics - Alternative Economics - Schumacher Collegekasiv_8No ratings yet

- EconomicsDocument10 pagesEconomicsjohnNo ratings yet

- Economics NcertDocument17 pagesEconomics NcertJana MakNo ratings yet

- Data Science For AgricultureDocument5 pagesData Science For AgriculturesmartguykrishNo ratings yet

- EconomicsDocument5 pagesEconomicsFahad Afzal CheemaNo ratings yet

- Economics: Sample Question Paper - IDocument13 pagesEconomics: Sample Question Paper - IkaliNo ratings yet

- Feminist EconomicsDocument8 pagesFeminist EconomicsOxfamNo ratings yet

- Feminist EconomicsDocument8 pagesFeminist EconomicsOxfamNo ratings yet

- M.A EconomicsDocument21 pagesM.A EconomicsDivakar DevanathanNo ratings yet

- III Sem. BA Economics - Micro EconomicsDocument16 pagesIII Sem. BA Economics - Micro EconomicsKamalesh Narayan NairNo ratings yet

- Economics SyllabusDocument9 pagesEconomics Syllabusblazinlyfe42No ratings yet

- Aw©Emòã: Eco Nom IcsDocument7 pagesAw©Emòã: Eco Nom IcsDeepak KumarNo ratings yet

- Law and EconomicsDocument12 pagesLaw and Economicsthe Spoiled LawyerNo ratings yet

- Statistical Computing-Data Science (Field of Study Code MTSP (183) ) ADocument32 pagesStatistical Computing-Data Science (Field of Study Code MTSP (183) ) ATomNo ratings yet

- Syllabus Data Science and AiDocument14 pagesSyllabus Data Science and AiJYOTI PHADATARENo ratings yet

- Feminist EconomicsDocument8 pagesFeminist EconomicsOxfamNo ratings yet

- Model Test Papers 2011 12 B.A. Part III, Economics II: Short Answer Type QuestionsDocument6 pagesModel Test Papers 2011 12 B.A. Part III, Economics II: Short Answer Type QuestionsGuruKPONo ratings yet

- EconomicsDocument23 pagesEconomicsImran Ahmed KhanNo ratings yet

- Data Science - A Kaggle Walkthrough - Introduction - 1 PDFDocument5 pagesData Science - A Kaggle Walkthrough - Introduction - 1 PDFTeodor von BurgNo ratings yet

- Economics Assignment PESTELDocument15 pagesEconomics Assignment PESTELAlvish Sutton0% (2)

- EconomicsDocument21 pagesEconomicsKashif Ur RehmanNo ratings yet

- Advocates of Sexuality EducationDocument2 pagesAdvocates of Sexuality EducationMasuri MasoodNo ratings yet

- Economics and NatureDocument8 pagesEconomics and NatureChintaan PatelNo ratings yet

- Introduction To Big Data PDFDocument16 pagesIntroduction To Big Data PDFAurelle KTNo ratings yet

- Micro EconomicsDocument40 pagesMicro Economicspavan ambatiNo ratings yet

- Data Mining-Spatial Data MiningDocument8 pagesData Mining-Spatial Data MiningRaj EndranNo ratings yet

- Economics of HappinessDocument5 pagesEconomics of HappinessGRK MurtyNo ratings yet

- Pentaho Predictive AnalyticsDocument4 pagesPentaho Predictive AnalyticsBigDataPaulNo ratings yet

- Difference Between Business Economics and EconomicsDocument8 pagesDifference Between Business Economics and EconomicsDiya GuptaNo ratings yet

- Unit 6: Risk For Financial Institutions and Their ManagementDocument65 pagesUnit 6: Risk For Financial Institutions and Their ManagementDeepak PokhrelNo ratings yet

- MA-Economics UOSDocument44 pagesMA-Economics UOSAtifNo ratings yet

- Business EconomicsDocument9 pagesBusiness EconomicsHarsh BallavNo ratings yet

- Economics Essay PredictionsDocument4 pagesEconomics Essay PredictionsLSAT PrepNo ratings yet

- EconomicsDocument62 pagesEconomicsGauravsir TradeniftyNo ratings yet

- Impact of Fringe Benefits On Employee Productivity: Under The Guidance Of: Prepared byDocument57 pagesImpact of Fringe Benefits On Employee Productivity: Under The Guidance Of: Prepared byjaspreet raghuNo ratings yet

- Engineering Economics 1Document17 pagesEngineering Economics 1Ashwani SekharNo ratings yet

- Agricultural EconomicsDocument19 pagesAgricultural EconomicsBrian MazorodzeNo ratings yet

- Economics Department: Syllabus For M. Sc. in Applied EconomicsDocument25 pagesEconomics Department: Syllabus For M. Sc. in Applied EconomicsAzhaan AkhtarNo ratings yet

- Evaluation of BIRCH Clustering Algorithm For Big DataDocument5 pagesEvaluation of BIRCH Clustering Algorithm For Big DataInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ACCA BT Topic 4 NotesDocument5 pagesACCA BT Topic 4 Notesعمر اعظمNo ratings yet

- Macroeconomics Final Examination 1Document3 pagesMacroeconomics Final Examination 1eumague.136515090273No ratings yet

- Me Reviewer AkDocument2 pagesMe Reviewer Akalexa.madronioNo ratings yet

- Current EventsDocument28 pagesCurrent EventsJeiNo ratings yet

- Sociology - The Scientific Study of Human Social Life, Groups and SocietiesDocument14 pagesSociology - The Scientific Study of Human Social Life, Groups and SocietiesJeiNo ratings yet

- Tanggapan NG Kalihim: IT "'1 Kagawaran NG Pagawain at Lansangang PambayanDocument1 pageTanggapan NG Kalihim: IT "'1 Kagawaran NG Pagawain at Lansangang PambayanJeiNo ratings yet

- ReadingDocument3 pagesReadingJeiNo ratings yet

- Agents of SocializationDocument3 pagesAgents of SocializationJeiNo ratings yet

- Digital Citizenship in 21st Century EducationDocument92 pagesDigital Citizenship in 21st Century EducationZarlina Mohd ZamariNo ratings yet

- Location StrategyDocument12 pagesLocation StrategyAnonymous MdzIa8No ratings yet

- The Determinants of Lifelong LearningDocument13 pagesThe Determinants of Lifelong LearningAladdin PrinceNo ratings yet

- AI - Deloitte-Nl-Data-Analytics-Artificial-Intelligence-Whitepaper-Eng PDFDocument34 pagesAI - Deloitte-Nl-Data-Analytics-Artificial-Intelligence-Whitepaper-Eng PDFDeep PNo ratings yet

- Commissioning ActivitiesDocument1 pageCommissioning ActivitiesthinkpadNo ratings yet

- Foundation University Dumaguete CityDocument13 pagesFoundation University Dumaguete CityHezelkiah KitaneNo ratings yet

- CeLaw CaseDocument7 pagesCeLaw CaseErwin ManansalaNo ratings yet

- CHAPTER 8 - Internal Audit Tools and Techniques STDTDocument39 pagesCHAPTER 8 - Internal Audit Tools and Techniques STDTNor Syahra AjinimNo ratings yet

- Trinita Beata Academy, Inc.: Narrative Report Presented To The Faculty of College EducationDocument16 pagesTrinita Beata Academy, Inc.: Narrative Report Presented To The Faculty of College EducationCandido Marife JeanNo ratings yet

- A Survey of Terrorist and Rebel Attacks On Petroleum InfrastructureDocument51 pagesA Survey of Terrorist and Rebel Attacks On Petroleum InfrastructureOla WamNo ratings yet

- IGCSE 0470 Paper 2 TOV 2005 Mark Scheme PDFDocument9 pagesIGCSE 0470 Paper 2 TOV 2005 Mark Scheme PDFshakeel shahulNo ratings yet

- Adoption of Stephanie GarciaDocument1 pageAdoption of Stephanie GarciaValerie San MiguelNo ratings yet

- Customer Relationship Management (CRM)Document21 pagesCustomer Relationship Management (CRM)Alok KumarNo ratings yet

- TTL 2 Lesson 13Document21 pagesTTL 2 Lesson 13Ronie ObiasNo ratings yet

- Department of Education: Insights/Key Take Away/Learning Clarifications/ QuestionsDocument6 pagesDepartment of Education: Insights/Key Take Away/Learning Clarifications/ Questionsnoel bandaNo ratings yet

- Build Your Audience Workbook (Teachable)Document14 pagesBuild Your Audience Workbook (Teachable)Ashish DixitNo ratings yet

- Confidential Project Team Member Peer Evaluation FormDocument1 pageConfidential Project Team Member Peer Evaluation Formfbarreram0% (1)

- What Is National Structural Code of The Philippines?Document3 pagesWhat Is National Structural Code of The Philippines?ChumpNo ratings yet

- Final AssignmentDocument42 pagesFinal AssignmentDaniel InbarajNo ratings yet

- ĐA Đề ĐX DHBB Anh 11 DHBB Trường THPT Chuyên Trần Phú Hải PhòngDocument10 pagesĐA Đề ĐX DHBB Anh 11 DHBB Trường THPT Chuyên Trần Phú Hải PhòngDương LêNo ratings yet

- Building Permit Requirement Checklist To Do ListDocument1 pageBuilding Permit Requirement Checklist To Do ListAndrea Mae Sanchez0% (1)

- Differentiated Instruction in General ChemistryDocument8 pagesDifferentiated Instruction in General ChemistryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Solicited ProposalDocument12 pagesSolicited ProposalBernie D. TeguenosNo ratings yet

- The Negative Effects of Social NetworkinDocument17 pagesThe Negative Effects of Social NetworkinAmrosy Bani BunsaNo ratings yet

- Journey of Achyut Kanvinde - ReportDocument42 pagesJourney of Achyut Kanvinde - ReportMeme Chauhan100% (1)

- MSC Carbon Capture and Storage: WWW - Ed.Ac - UkDocument2 pagesMSC Carbon Capture and Storage: WWW - Ed.Ac - UkHaritsari DewiNo ratings yet

- TTP MODULE 2 Historical and Legal Foundations of Teaching in The PhilippinesDocument3 pagesTTP MODULE 2 Historical and Legal Foundations of Teaching in The Philippinesczarina mae nacorNo ratings yet

- LecturePlus LSM Feb 2021 - TranscriptDocument6 pagesLecturePlus LSM Feb 2021 - Transcriptماتو اریکاNo ratings yet

- 2 - Parallel Computer Architecture - 1Document26 pages2 - Parallel Computer Architecture - 1SNo ratings yet

- SS ZG526 Ec-2m Second Sem 2019-2020Document1 pageSS ZG526 Ec-2m Second Sem 2019-2020Kesavanand ChavaliNo ratings yet