0 ratings0% found this document useful (0 votes)

22 viewsSharma Lease

Sharma Lease

Uploaded by

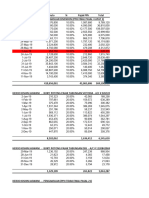

devenderSharma & Company has leased hydraulic excavator and air compressor assets from a supplier under a finance lease obligation. The lease agreement spans 57 months for the excavator and 60 months for the air compressor. Monthly payments are made against the opening lease balance, consisting of principal and interest amounts. The documents show the monthly amortization schedule tracking the reducing lease balances over the term of the agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Sharma Lease

Sharma Lease

Uploaded by

devender0 ratings0% found this document useful (0 votes)

22 views6 pagesSharma & Company has leased hydraulic excavator and air compressor assets from a supplier under a finance lease obligation. The lease agreement spans 57 months for the excavator and 60 months for the air compressor. Monthly payments are made against the opening lease balance, consisting of principal and interest amounts. The documents show the monthly amortization schedule tracking the reducing lease balances over the term of the agreements.

Original Title

SHARMA LEASE.xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Sharma & Company has leased hydraulic excavator and air compressor assets from a supplier under a finance lease obligation. The lease agreement spans 57 months for the excavator and 60 months for the air compressor. Monthly payments are made against the opening lease balance, consisting of principal and interest amounts. The documents show the monthly amortization schedule tracking the reducing lease balances over the term of the agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views6 pagesSharma Lease

Sharma Lease

Uploaded by

devenderSharma & Company has leased hydraulic excavator and air compressor assets from a supplier under a finance lease obligation. The lease agreement spans 57 months for the excavator and 60 months for the air compressor. Monthly payments are made against the opening lease balance, consisting of principal and interest amounts. The documents show the monthly amortization schedule tracking the reducing lease balances over the term of the agreements.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 6

LESSOR SHARMA & COMPANY Dr Cr

ASSET HYDRAULIC EXCAVATOR KAMATSU PC 210 Asset 5,020,000.00

Financie lease obligation 5,020,000.00

Basic GST Total

Cost 5,020,000 903,600 5,923,600 Financie lease obligation 502,000.00

Upfront fee 26,656 4,798 31,454 supplier account 502,000.00

5,046,656 908,398 5,955,054

Less Interest on finance lease 195,806.74

Margin 10% -502,000 -90,360 -592,360 17.10.2018 Financie lease obligation 195,806.74

Net 9,591,312 1,726,436 11,317,748

Financie lease obligation 352,698.00

Financie lease obligation 17.99% supplier account 352,698.00

Month Reporting Opening Interest- Payment Payment Balance Interest- Interest 2

Date Balance 1 Date w/o GST 2

31-Dec-18 5,020,000 -502,000 4,518,000 4,518,000

1 31-Jan-19 4,518,000 33,408 15-Jan-19 -117,566 4,433,842 34,972 68,380 4,468,814

2 28-Feb-19 4,468,814 32,786 15-Feb-19 -117,566 4,384,033 28,095 60,881 4,412,129

3 31-Mar-19 4,412,129 32,417 15-Mar-19 -117,566 4,326,980 34,129 66,546 4,361,109 4,361,108.74

4 30-Apr-19 4,361,109 31,996 15-Apr-19 -117,566 4,275,538 31,615 63,611 4,307,154

5 31-May-19 4,307,154 31,615 15-May-19 -117,566 4,221,203 33,294 64,910 4,254,497

6 30-Jun-19 4,254,497 31,213 15-Jun-19 -117,566 4,168,145 30,821 62,035 4,198,966

7 31-Jul-19 4,198,966 30,821 15-Jul-19 -117,566 4,112,221 32,435 63,256 4,144,656

8 31-Aug-19 4,144,656 30,408 15-Aug-19 -117,566 4,057,497 32,003 62,411 4,089,500

9 30-Sep-19 4,089,500 30,003 15-Sep-19 -117,566 4,001,937 29,592 59,595 4,031,529

10 31-Oct-19 4,031,529 29,592 15-Oct-19 -117,566 3,943,556 31,104 60,697 3,974,660

11 30-Nov-19 3,974,660 29,160 15-Nov-19 -117,566 3,886,254 28,737 57,897 3,914,991

12 31-Dec-19 3,914,991 28,737 15-Dec-19 -117,566 3,826,162 30,178 58,915 3,856,340

13 31-Jan-20 3,856,340 28,292 15-Jan-20 -117,566 3,767,067 29,712 58,005 3,796,779

14 29-Feb-20 3,796,779 27,855 15-Feb-20 -117,566 3,707,068 25,584 53,440 3,732,653

15 31-Mar-20 3,732,653 27,412 15-Mar-20 -117,566 3,642,498 28,730 56,142 3,671,228

16 30-Apr-20 3,671,228 26,934 15-Apr-20 -117,566 3,580,596 26,477 53,411 3,607,073

17 31-May-20 3,607,073 26,477 15-May-20 -117,566 3,515,983 27,732 54,209 3,543,715

18 30-Jun-20 3,543,715 25,999 15-Jun-20 -117,566 3,452,148 25,527 51,525 3,477,675

19 31-Jul-20 3,477,675 25,527 15-Jul-20 -117,566 3,385,636 26,704 52,231 3,412,340

20 31-Aug-20 3,412,340 25,035 15-Aug-20 -117,566 3,319,808 26,185 51,220 3,345,993

21 30-Sep-20 3,345,993 24,548 15-Sep-20 -117,566 3,252,975 24,054 48,602 3,277,029

22 31-Oct-20 3,277,029 24,054 15-Oct-20 -117,566 3,183,517 25,110 49,164 3,208,627

23 30-Nov-20 3,208,627 23,540 15-Nov-20 -117,566 3,114,601 23,031 46,571 3,137,632

24 31-Dec-20 3,137,632 23,031 15-Dec-20 -117,566 3,043,097 24,002 47,033 3,067,099

25 31-Jan-21 3,067,099 22,502 15-Jan-21 -117,566 2,972,035 23,442 45,944 2,995,477

26 28-Feb-21 2,995,477 21,977 15-Feb-21 -117,566 2,899,887 18,584 40,561 2,918,471

27 31-Mar-21 2,918,471 21,443 15-Mar-21 -117,566 2,822,348 22,261 43,704 2,844,609

28 30-Apr-21 2,844,609 20,870 15-Apr-21 -117,566 2,747,913 20,319 41,189 2,768,232

29 31-May-21 2,768,232 20,319 15-May-21 -117,566 2,670,985 21,067 41,386 2,692,053

30 30-Jun-21 2,692,053 19,750 15-Jun-21 -117,566 2,594,237 19,183 38,933 2,613,420

31 31-Jul-21 2,613,420 19,183 15-Jul-21 -117,566 2,515,037 19,837 39,020 2,534,874

32 31-Aug-21 2,534,874 18,597 15-Aug-21 -117,566 2,435,905 19,213 37,810 2,455,118

33 30-Sep-21 2,455,118 18,012 15-Sep-21 -117,566 2,355,564 17,418 35,430 2,372,983

34 31-Oct-21 2,372,983 17,418 15-Oct-21 -117,566 2,272,835 17,927 35,345 2,290,761

35 30-Nov-21 2,290,761 16,806 15-Nov-21 -117,566 2,190,002 16,194 33,000 2,206,196

36 31-Dec-21 2,206,196 16,194 15-Dec-21 -117,566 2,104,823 16,602 32,795 2,121,425

37 31-Jan-22 2,121,425 15,564 15-Jan-22 -117,566 2,019,423 15,928 31,492 2,035,351

38 28-Feb-22 2,035,351 14,933 15-Feb-22 -117,566 1,932,718 12,386 27,318 1,945,103

39 31-Mar-22 1,945,103 14,291 15-Mar-22 -117,566 1,841,829 14,527 28,819 1,856,356

40 30-Apr-22 1,856,356 13,619 15-Apr-22 -117,566 1,752,409 12,958 26,577 1,765,368

41 31-May-22 1,765,368 12,958 15-May-22 -117,566 1,660,760 13,099 26,057 1,673,859

42 30-Jun-22 1,673,859 12,280 15-Jun-22 -117,566 1,568,573 11,599 23,879 1,580,172

43 31-Jul-22 1,580,172 11,599 15-Jul-22 -117,566 1,474,205 11,628 23,226 1,485,832

44 31-Aug-22 1,485,832 10,901 15-Aug-22 -117,566 1,379,167 10,878 21,779 1,390,045

45 30-Sep-22 1,390,045 10,198 15-Sep-22 -117,566 1,282,677 9,485 19,683 1,292,162

46 31-Oct-22 1,292,162 9,485 15-Oct-22 -117,566 1,184,081 9,339 18,824 1,193,420

47 30-Nov-22 1,193,420 8,756 15-Nov-22 -117,566 1,084,610 8,020 16,776 1,092,630

48 31-Dec-22 1,092,630 8,020 15-Dec-22 -117,566 983,084 7,754 15,774 990,838

49 31-Jan-23 990,838 7,269 15-Jan-23 -117,566 880,541 6,945 14,215 887,486

50 28-Feb-23 887,486 6,511 15-Feb-23 -117,566 776,432 4,976 11,487 781,407

51 31-Mar-23 781,407 5,741 15-Mar-23 -117,566 669,583 5,281 11,023 674,864

52 30-Apr-23 674,864 4,951 15-Apr-23 -117,566 562,249 4,158 9,109 566,407

53 31-May-23 566,407 4,158 15-May-23 -117,566 452,998 3,573 7,731 456,571

54 30-Jun-23 456,571 3,350 15-Jun-23 -117,566 342,355 2,532 5,881 344,886

55 31-Jul-23 344,886 2,532 15-Jul-23 -117,566 229,852 1,813 4,344 231,665

56 31-Aug-23 231,665 1,700 15-Aug-23 -117,566 115,798 913 2,613 116,712

57 30-Sep-23 116,712 856 15-Sep-23 -117,566 2 0 856 2

### -7,203,262 ### ###

LESSOR SHARMA & COMPANY Dr Cr

ASSET AIR COMPRESSOR ATLAS COPCO XA 316 (04 No.) Asset 4,242,000.00

Financie lease obligation 4,242,000.00

Basic GST Total

Cost 4,242,000 763,560 5,005,560 Financie lease obligation 424,200.00

Upfront fee 22,525 4,055 26,580 supplier account 424,200.00

4,264,525 767,615 5,032,140

Less Interest on finance lease 165,471.47

Margin 10% -424,200 -76,356 -500,556 17.10.2018 Financie lease obligation 165,471.47

Net 8,104,850 1,458,873 9,563,723

Financie lease obligation 298,044.00

Financie lease obligation 17.99% supplier account 298,044.00

Month Reporting Opening Interest-1 Payment Payment Balance Interest-2 Interest -1

Date Balance Date w/o GST

31-Dec-18 4,242,000 -424,200 3,817,800 3,817,800

1 31-Jan-19 3,817,800 28,232 15-Jan-19 -99,348 3,746,684 29,554 57,786 3,776,238

2 28-Feb-19 3,776,238 27,706 15-Feb-19 -99,348 3,704,596 23,743 51,449 3,728,339

3 31-Mar-19 3,728,339 27,395 15-Mar-19 -99,348 3,656,386 28,841 56,237 3,685,227 3,685,227.47

4 30-Apr-19 3,685,227 27,039 15-Apr-19 -99,348 3,612,918 26,717 53,756 3,639,635

5 31-May-19 3,639,635 26,717 15-May-19 -99,348 3,567,005 28,136 54,854 3,595,141

6 30-Jun-19 3,595,141 26,378 15-Jun-19 -99,348 3,522,171 26,046 52,424 3,548,217

7 31-Jul-19 3,548,217 26,046 15-Jul-19 -99,348 3,474,915 27,410 53,456 3,502,325

8 31-Aug-19 3,502,325 25,697 15-Aug-19 -99,348 3,428,674 27,045 52,742 3,455,719

9 30-Sep-19 3,455,719 25,355 15-Sep-19 -99,348 3,381,726 25,008 50,362 3,406,733

10 31-Oct-19 3,406,733 25,008 15-Oct-19 -99,348 3,332,393 26,286 51,293 3,358,679

11 30-Nov-19 3,358,679 24,643 15-Nov-19 -99,348 3,283,973 24,285 48,928 3,308,258

12 31-Dec-19 3,308,258 24,285 15-Dec-19 -99,348 3,233,195 25,503 49,788 3,258,698

13 31-Jan-20 3,258,698 23,909 15-Jan-20 -99,348 3,183,259 25,109 49,019 3,208,369

14 29-Feb-20 3,208,369 23,540 15-Feb-20 -99,348 3,132,561 21,621 45,161 3,154,181

15 31-Mar-20 3,154,181 23,165 15-Mar-20 -99,348 3,077,999 24,279 47,444 3,102,278

16 30-Apr-20 3,102,278 22,762 15-Apr-20 -99,348 3,025,691 22,375 45,136 3,048,066

17 31-May-20 3,048,066 22,375 15-May-20 -99,348 2,971,093 23,436 45,811 2,994,528

18 30-Jun-20 2,994,528 21,971 15-Jun-20 -99,348 2,917,151 21,572 43,543 2,938,724

19 31-Jul-20 2,938,724 21,572 15-Jul-20 -99,348 2,860,948 22,567 44,139 2,883,515

20 31-Aug-20 2,883,515 21,157 15-Aug-20 -99,348 2,805,323 22,128 43,285 2,827,451

21 30-Sep-20 2,827,451 20,745 15-Sep-20 -99,348 2,748,849 20,328 41,073 2,769,176

22 31-Oct-20 2,769,176 20,328 15-Oct-20 -99,348 2,690,156 21,220 41,547 2,711,375

23 30-Nov-20 2,711,375 19,894 15-Nov-20 -99,348 2,631,921 19,463 39,356 2,651,384

24 31-Dec-20 2,651,384 19,463 15-Dec-20 -99,348 2,571,499 20,284 39,747 2,591,782

25 31-Jan-21 2,591,782 19,016 15-Jan-21 -99,348 2,511,450 19,810 38,826 2,531,261

26 28-Feb-21 2,531,261 18,572 15-Feb-21 -99,348 2,450,485 15,705 34,277 2,466,190

27 31-Mar-21 2,466,190 18,121 15-Mar-21 -99,348 2,384,963 18,812 36,934 2,403,775

28 30-Apr-21 2,403,775 17,637 15-Apr-21 -99,348 2,322,064 17,171 34,808 2,339,235

29 31-May-21 2,339,235 17,171 15-May-21 -99,348 2,257,059 17,804 34,975 2,274,862

30 30-Jun-21 2,274,862 16,691 15-Jun-21 -99,348 2,192,205 16,211 32,902 2,208,416

31 31-Jul-21 2,208,416 16,211 15-Jul-21 -99,348 2,125,279 16,764 32,975 2,142,044

32 31-Aug-21 2,142,044 15,716 15-Aug-21 -99,348 2,058,412 16,237 31,953 2,074,648

33 30-Sep-21 2,074,648 15,222 15-Sep-21 -99,348 1,990,522 14,720 29,942 2,005,242

34 31-Oct-21 2,005,242 14,720 15-Oct-21 -99,348 1,920,614 15,150 29,869 1,935,763

35 30-Nov-21 1,935,763 14,203 15-Nov-21 -99,348 1,850,618 13,685 27,888 1,864,303

36 31-Dec-21 1,864,303 13,685 15-Dec-21 -99,348 1,778,641 14,030 27,715 1,792,670

37 31-Jan-22 1,792,670 13,153 15-Jan-22 -99,348 1,706,475 13,461 26,613 1,719,936

38 28-Feb-22 1,719,936 12,619 15-Feb-22 -99,348 1,633,207 10,467 23,086 1,643,674

39 31-Mar-22 1,643,674 12,077 15-Mar-22 -99,348 1,556,404 12,277 24,354 1,568,681

40 30-Apr-22 1,568,681 11,509 15-Apr-22 -99,348 1,480,842 10,951 22,460 1,491,793

41 31-May-22 1,491,793 10,951 15-May-22 -99,348 1,403,395 11,070 22,021 1,414,465

42 30-Jun-22 1,414,465 10,378 15-Jun-22 -99,348 1,325,495 9,802 20,180 1,335,297

43 31-Jul-22 1,335,297 9,802 15-Jul-22 -99,348 1,245,751 9,826 19,628 1,255,578

44 31-Aug-22 1,255,578 9,212 15-Aug-22 -99,348 1,165,442 9,193 18,405 1,174,635

45 30-Sep-22 1,174,635 8,618 15-Sep-22 -99,348 1,083,905 8,015 16,634 1,091,921

46 31-Oct-22 1,091,921 8,015 15-Oct-22 -99,348 1,000,588 7,893 15,908 1,008,481

47 30-Nov-22 1,008,481 7,399 15-Nov-22 -99,348 916,532 6,778 14,177 923,310

48 31-Dec-22 923,310 6,778 15-Dec-22 -99,348 830,739 6,553 13,330 837,292

49 31-Jan-23 837,292 6,143 15-Jan-23 -99,348 744,087 5,869 12,013 749,957

50 28-Feb-23 749,957 5,502 15-Feb-23 -99,348 656,111 4,205 9,707 660,316

51 31-Mar-23 660,316 4,852 15-Mar-23 -99,348 565,820 4,463 9,315 570,283

52 30-Apr-23 570,283 4,184 15-Apr-23 -99,348 475,119 3,513 7,698 478,633

53 31-May-23 478,633 3,513 15-May-23 -99,348 382,798 3,019 6,533 385,818

54 30-Jun-23 385,818 2,831 15-Jun-23 -99,348 289,300 2,139 4,970 291,440

55 31-Jul-23 291,440 2,139 15-Jul-23 -99,348 194,231 1,532 3,671 195,763

56 31-Aug-23 195,763 1,436 15-Aug-23 -99,348 97,852 772 2,208 98,623

57 30-Sep-23 98,623 724 15-Sep-23 -99,348 -1 -0 724 -1

924,184 -6,087,036 920,851 1,845,035

LESSOR SHARMA & COMPANY Dr Cr

ASSET AIR COMPRESSOR ATLAS COPCO XA 216 (04 No.) Asset 4,242,000.00

Financie lease obligation 4,242,000.00

Basic GST Total

Cost 4,242,000 763,560 5,005,560 Financie lease obligation 424,200.00

Upfront fee 22,525 4,055 26,580 supplier account 424,200.00

4,264,525 767,615 5,032,140

Less Interest on finance lease 165,471.47

Margin 10% -424,200 -76,356 -500,556 17.10.2018 Financie lease obligation 165,471.47

Net 8,104,850 1,458,873 9,563,723

Financie lease obligation 298,044.00

Financie lease obligation 17.99% supplier account 298,044.00

Month Reporting Opening Interest-1 Payment Payment Balance Interest-2 Interest -1

Date Balance Date w/o GST

31-Dec-18 4,242,000 -424,200 3,817,800 3,817,800

1 31-Jan-19 3,817,800 28,232 15-Jan-19 -99,348 3,746,684 29,554 57,786 3,776,238

2 28-Feb-19 3,776,238 27,706 15-Feb-19 -99,348 3,704,596 23,743 51,449 3,728,339

3 31-Mar-19 3,728,339 27,395 15-Mar-19 -99,348 3,656,386 28,841 56,237 3,685,227 3,685,227.47

4 30-Apr-19 3,685,227 27,039 15-Apr-19 -99,348 3,612,918 26,717 53,756 3,639,635

5 31-May-19 3,639,635 26,717 15-May-19 -99,348 3,567,005 28,136 54,854 3,595,141

6 30-Jun-19 3,595,141 26,378 15-Jun-19 -99,348 3,522,171 26,046 52,424 3,548,217

7 31-Jul-19 3,548,217 26,046 15-Jul-19 -99,348 3,474,915 27,410 53,456 3,502,325

8 31-Aug-19 3,502,325 25,697 15-Aug-19 -99,348 3,428,674 27,045 52,742 3,455,719

9 30-Sep-19 3,455,719 25,355 15-Sep-19 -99,348 3,381,726 25,008 50,362 3,406,733

10 31-Oct-19 3,406,733 25,008 15-Oct-19 -99,348 3,332,393 26,286 51,293 3,358,679

11 30-Nov-19 3,358,679 24,643 15-Nov-19 -99,348 3,283,973 24,285 48,928 3,308,258

12 31-Dec-19 3,308,258 24,285 15-Dec-19 -99,348 3,233,195 25,503 49,788 3,258,698

13 31-Jan-20 3,258,698 23,909 15-Jan-20 -99,348 3,183,259 25,109 49,019 3,208,369

14 29-Feb-20 3,208,369 23,540 15-Feb-20 -99,348 3,132,561 21,621 45,161 3,154,181

15 31-Mar-20 3,154,181 23,165 15-Mar-20 -99,348 3,077,999 24,279 47,444 3,102,278

16 30-Apr-20 3,102,278 22,762 15-Apr-20 -99,348 3,025,691 22,375 45,136 3,048,066

17 31-May-20 3,048,066 22,375 15-May-20 -99,348 2,971,093 23,436 45,811 2,994,528

18 30-Jun-20 2,994,528 21,971 15-Jun-20 -99,348 2,917,151 21,572 43,543 2,938,724

19 31-Jul-20 2,938,724 21,572 15-Jul-20 -99,348 2,860,948 22,567 44,139 2,883,515

20 31-Aug-20 2,883,515 21,157 15-Aug-20 -99,348 2,805,323 22,128 43,285 2,827,451

21 30-Sep-20 2,827,451 20,745 15-Sep-20 -99,348 2,748,849 20,328 41,073 2,769,176

22 31-Oct-20 2,769,176 20,328 15-Oct-20 -99,348 2,690,156 21,220 41,547 2,711,375

23 30-Nov-20 2,711,375 19,894 15-Nov-20 -99,348 2,631,921 19,463 39,356 2,651,384

24 31-Dec-20 2,651,384 19,463 15-Dec-20 -99,348 2,571,499 20,284 39,747 2,591,782

25 31-Jan-21 2,591,782 19,016 15-Jan-21 -99,348 2,511,450 19,810 38,826 2,531,261

26 28-Feb-21 2,531,261 18,572 15-Feb-21 -99,348 2,450,485 15,705 34,277 2,466,190

27 31-Mar-21 2,466,190 18,121 15-Mar-21 -99,348 2,384,963 18,812 36,934 2,403,775

28 30-Apr-21 2,403,775 17,637 15-Apr-21 -99,348 2,322,064 17,171 34,808 2,339,235

29 31-May-21 2,339,235 17,171 15-May-21 -99,348 2,257,059 17,804 34,975 2,274,862

30 30-Jun-21 2,274,862 16,691 15-Jun-21 -99,348 2,192,205 16,211 32,902 2,208,416

31 31-Jul-21 2,208,416 16,211 15-Jul-21 -99,348 2,125,279 16,764 32,975 2,142,044

32 31-Aug-21 2,142,044 15,716 15-Aug-21 -99,348 2,058,412 16,237 31,953 2,074,648

33 30-Sep-21 2,074,648 15,222 15-Sep-21 -99,348 1,990,522 14,720 29,942 2,005,242

34 31-Oct-21 2,005,242 14,720 15-Oct-21 -99,348 1,920,614 15,150 29,869 1,935,763

35 30-Nov-21 1,935,763 14,203 15-Nov-21 -99,348 1,850,618 13,685 27,888 1,864,303

36 31-Dec-21 1,864,303 13,685 15-Dec-21 -99,348 1,778,641 14,030 27,715 1,792,670

37 31-Jan-22 1,792,670 13,153 15-Jan-22 -99,348 1,706,475 13,461 26,613 1,719,936

38 28-Feb-22 1,719,936 12,619 15-Feb-22 -99,348 1,633,207 10,467 23,086 1,643,674

39 31-Mar-22 1,643,674 12,077 15-Mar-22 -99,348 1,556,404 12,277 24,354 1,568,681

40 30-Apr-22 1,568,681 11,509 15-Apr-22 -99,348 1,480,842 10,951 22,460 1,491,793

41 31-May-22 1,491,793 10,951 15-May-22 -99,348 1,403,395 11,070 22,021 1,414,465

42 30-Jun-22 1,414,465 10,378 15-Jun-22 -99,348 1,325,495 9,802 20,180 1,335,297

43 31-Jul-22 1,335,297 9,802 15-Jul-22 -99,348 1,245,751 9,826 19,628 1,255,578

44 31-Aug-22 1,255,578 9,212 15-Aug-22 -99,348 1,165,442 9,193 18,405 1,174,635

45 30-Sep-22 1,174,635 8,618 15-Sep-22 -99,348 1,083,905 8,015 16,634 1,091,921

46 31-Oct-22 1,091,921 8,015 15-Oct-22 -99,348 1,000,588 7,893 15,908 1,008,481

47 30-Nov-22 1,008,481 7,399 15-Nov-22 -99,348 916,532 6,778 14,177 923,310

48 31-Dec-22 923,310 6,778 15-Dec-22 -99,348 830,739 6,553 13,330 837,292

49 31-Jan-23 837,292 6,143 15-Jan-23 -99,348 744,087 5,869 12,013 749,957

50 28-Feb-23 749,957 5,502 15-Feb-23 -99,348 656,111 4,205 9,707 660,316

51 31-Mar-23 660,316 4,852 15-Mar-23 -99,348 565,820 4,463 9,315 570,283

52 30-Apr-23 570,283 4,184 15-Apr-23 -99,348 475,119 3,513 7,698 478,633

53 31-May-23 478,633 3,513 15-May-23 -99,348 382,798 3,019 6,533 385,818

54 30-Jun-23 385,818 2,831 15-Jun-23 -99,348 289,300 2,139 4,970 291,440

55 31-Jul-23 291,440 2,139 15-Jul-23 -99,348 194,231 1,532 3,671 195,763

56 31-Aug-23 195,763 1,436 15-Aug-23 -99,348 97,852 772 2,208 98,623

57 30-Sep-23 98,623 724 15-Sep-23 -99,348 -1 -0 724 -1

924,184 -6,087,036 920,851 1,845,035

LESSOR SHARMA & COMPANY Dr Cr

ASSET AIRROC D40SH (04 No.) Asset 13,736,000.00

Financie lease obligation 13,736,000.00

Basic GST Total

Cost 13,736,000 2,472,480 16,208,480 Financie lease obligation 1,373,600.00

Upfront fee 72,938 13,129 86,067 supplier account 1,373,600.00

13,808,938 2,485,609 16,294,547

Less Interest on finance lease 535,774.19

Margin 10% -1,373,600 -247,248 -1,620,848 17.10.2018 Financie lease obligation 535,774.19

Net 26,244,276 4,723,970 30,968,246

Financie lease obligation 965,070.00

Financie lease obligation 17.99% supplier account 965,070.00

Month Reporting Opening Interest-1 Payment Payment Balance Interest-2 Interest -3

Date Balance Date w/o GST

31-Dec-18 13,736,000 -1,373,600 12,362,400 12,362,400

1 31-Jan-19 12,362,400 91,413 15-Jan-19 -321,690 12,132,123 95,690 187,103 12,227,813

2 28-Feb-19 12,227,813 89,710 15-Feb-19 -321,690 11,995,833 76,875 166,585 12,072,708

3 31-Mar-19 12,072,708 88,702 15-Mar-19 -321,690 11,839,720 93,384 182,086 11,933,104 11,933,104.19

4 30-Apr-19 11,933,104 87,548 15-Apr-19 -321,690 11,698,962 86,507 174,055 11,785,469

5 31-May-19 11,785,469 86,507 15-May-19 -321,690 11,550,286 91,101 177,608 11,641,387

6 30-Jun-19 11,641,387 85,407 15-Jun-19 -321,690 11,405,104 84,334 169,741 11,489,438

7 31-Jul-19 11,489,438 84,334 15-Jul-19 -321,690 11,252,082 88,749 173,083 11,340,832

8 31-Aug-19 11,340,832 83,202 15-Aug-19 -321,690 11,102,344 87,568 170,771 11,189,912

9 30-Sep-19 11,189,912 82,095 15-Sep-19 -321,690 10,950,317 80,971 163,066 11,031,288

10 31-Oct-19 11,031,288 80,971 15-Oct-19 -321,690 10,790,570 85,109 166,080 10,875,679

11 30-Nov-19 10,875,679 79,790 15-Nov-19 -321,690 10,633,779 78,630 158,420 10,712,409

12 31-Dec-19 10,712,409 78,630 15-Dec-19 -321,690 10,469,349 82,576 161,206 10,551,925

13 31-Jan-20 10,551,925 77,415 15-Jan-20 -321,690 10,307,650 81,300 158,715 10,388,950

14 29-Feb-20 10,388,950 76,219 15-Feb-20 -321,690 10,143,479 70,005 146,224 10,213,483

15 31-Mar-20 10,213,483 75,005 15-Mar-20 -321,690 9,966,798 78,612 153,617 10,045,410

16 30-Apr-20 10,045,410 73,699 15-Apr-20 -321,690 9,797,419 72,446 146,145 9,869,865

17 31-May-20 9,869,865 72,446 15-May-20 -321,690 9,620,621 75,881 148,327 9,696,502

18 30-Jun-20 9,696,502 71,139 15-Jun-20 -321,690 9,445,951 69,847 140,986 9,515,798

19 31-Jul-20 9,515,798 69,847 15-Jul-20 -321,690 9,263,955 73,068 142,915 9,337,023

20 31-Aug-20 9,337,023 68,501 15-Aug-20 -321,690 9,083,835 71,648 140,149 9,155,482

21 30-Sep-20 9,155,482 67,170 15-Sep-20 -321,690 8,900,962 65,817 132,987 8,966,779

22 31-Oct-20 8,966,779 65,817 15-Oct-20 -321,690 8,710,907 68,706 134,523 8,779,613

23 30-Nov-20 8,779,613 64,412 15-Nov-20 -321,690 8,522,335 63,018 127,430 8,585,352

24 31-Dec-20 8,585,352 63,018 15-Dec-20 -321,690 8,326,680 65,676 128,693 8,392,355

25 31-Jan-21 8,392,355 61,571 15-Jan-21 -321,690 8,132,236 64,142 125,713 8,196,378

26 28-Feb-21 8,196,378 60,133 15-Feb-21 -321,690 7,934,821 50,850 110,983 7,985,671

27 31-Mar-21 7,985,671 58,673 15-Mar-21 -321,690 7,722,655 60,911 119,585 7,783,566

28 30-Apr-21 7,783,566 57,104 15-Apr-21 -321,690 7,518,980 55,598 112,703 7,574,579

29 31-May-21 7,574,579 55,598 15-May-21 -321,690 7,308,487 57,645 113,243 7,366,132

30 30-Jun-21 7,366,132 54,042 15-Jun-21 -321,690 7,098,484 52,489 106,531 7,150,973

31 31-Jul-21 7,150,973 52,489 15-Jul-21 -321,690 6,881,772 54,279 106,768 6,936,051

32 31-Aug-21 6,936,051 50,887 15-Aug-21 -321,690 6,665,248 52,571 103,458 6,717,819

33 30-Sep-21 6,717,819 49,286 15-Sep-21 -321,690 6,445,414 47,660 96,946 6,493,074

34 31-Oct-21 6,493,074 47,660 15-Oct-21 -321,690 6,219,044 49,052 96,712 6,268,096

35 30-Nov-21 6,268,096 45,986 15-Nov-21 -321,690 5,992,392 44,310 90,296 6,036,703

36 31-Dec-21 6,036,703 44,310 15-Dec-21 -321,690 5,759,323 45,426 89,736 5,804,749

37 31-Jan-22 5,804,749 42,587 15-Jan-22 -321,690 5,525,645 43,583 86,170 5,569,228

38 28-Feb-22 5,569,228 40,859 15-Feb-22 -321,690 5,288,397 33,891 74,749 5,322,288

39 31-Mar-22 5,322,288 39,105 15-Mar-22 -321,690 5,039,702 39,750 78,855 5,079,452

40 30-Apr-22 5,079,452 37,266 15-Apr-22 -321,690 4,795,028 35,456 72,722 4,830,484

41 31-May-22 4,830,484 35,456 15-May-22 -321,690 4,544,250 35,842 71,299 4,580,093

42 30-Jun-22 4,580,093 33,602 15-Jun-22 -321,690 4,292,005 31,737 65,339 4,323,741

43 31-Jul-22 4,323,741 31,737 15-Jul-22 -321,690 4,033,788 31,816 63,553 4,065,604

44 31-Aug-22 4,065,604 29,827 15-Aug-22 -321,690 3,773,742 29,765 59,592 3,803,507

45 30-Sep-22 3,803,507 27,905 15-Sep-22 -321,690 3,509,721 25,952 53,857 3,535,673

46 31-Oct-22 3,535,673 25,952 15-Oct-22 -321,690 3,239,936 25,555 51,507 3,265,490

47 30-Nov-22 3,265,490 23,957 15-Nov-22 -321,690 2,967,758 21,945 45,902 2,989,702

48 31-Dec-22 2,989,702 21,945 15-Dec-22 -321,690 2,689,957 21,217 43,161 2,711,174

49 31-Jan-23 2,711,174 19,891 15-Jan-23 -321,690 2,409,375 19,004 38,894 2,428,378

50 28-Feb-23 2,428,378 17,816 15-Feb-23 -321,690 2,124,504 13,615 31,431 2,138,119

51 31-Mar-23 2,138,119 15,709 15-Mar-23 -321,690 1,832,138 14,451 30,160 1,846,589

52 30-Apr-23 1,846,589 13,548 15-Apr-23 -321,690 1,538,447 11,376 24,923 1,549,823

53 31-May-23 1,549,823 11,376 15-May-23 -321,690 1,239,508 9,776 21,152 1,249,285

54 30-Jun-23 1,249,285 9,165 15-Jun-23 -321,690 936,760 6,927 16,092 943,687

55 31-Jul-23 943,687 6,927 15-Jul-23 -321,690 628,924 4,961 11,887 633,884

56 31-Aug-23 633,884 4,651 15-Aug-23 -321,690 316,845 2,499 7,150 319,344

57 30-Sep-23 319,344 2,343 15-Sep-23 -321,690 -3 -0 2,343 -3

2,992,358 -19,709,930 2,981,569 5,973,927

LESSOR SHARMA & COMPANY Dr Cr

ASSET SCHWING STETTER CONCRETE MIXER Asset 842,200.00

Financie lease obligation 842,200.00

Basic GST Total

Cost 842,200 151,596 993,796 Financie lease obligation 84,220.00

Upfront fee 4,472 805 5,277 supplier account 84,220.00

846,672 152,401 999,073

Less Interest on finance lease 29,386.60

Margin 10% -84,220 -15,160 -99,380 17.10.2018 Financie lease obligation 29,386.60

Net 1,609,124 289,642 1,898,766

Financie lease obligation 59,178.00

Financie lease obligation 18.25% supplier account 59,178.00

Month Reporting Opening Interest-1 Payment Payment Balance Interest-2 Interest 5

Date Balance Date w/o GST

10-Jan-19 842,200 -84,220 757,980 757,980

1 31-Jan-19 757,980 1,895 15-Jan-19 -19,726 740,149 5,920 7,814 746,068

2 28-Feb-19 746,068 5,550 15-Feb-19 -19,726 731,892 4,756 10,306 736,649

3 31-Mar-19 736,649 5,488 15-Mar-19 -19,726 722,411 5,778 11,266 728,189 728,188.60

4 30-Apr-19 728,189 5,417 15-Apr-19 -19,726 713,879 5,353 10,770 719,232

5 31-May-19 719,232 5,353 15-May-19 -19,726 704,859 5,638 10,991 710,497

6 30-Jun-19 710,497 5,285 15-Jun-19 -19,726 696,056 5,219 10,505 701,276

7 31-Jul-19 701,276 5,219 15-Jul-19 -19,726 686,769 5,493 10,712 692,262

8 31-Aug-19 692,262 5,150 15-Aug-19 -19,726 677,685 5,420 10,570 683,106

9 30-Sep-19 683,106 5,082 15-Sep-19 -19,726 668,461 5,012 10,094 673,474

10 31-Oct-19 673,474 5,012 15-Oct-19 -19,726 658,760 5,269 10,281 664,029

11 30-Nov-19 664,029 4,940 15-Nov-19 -19,726 649,243 4,868 9,808 654,111

12 31-Dec-19 654,111 4,868 15-Dec-19 -19,726 639,253 5,113 9,981 644,366

13 31-Jan-20 644,366 4,793 15-Jan-20 -19,726 629,433 5,034 9,828 634,468

14 29-Feb-20 634,468 4,720 15-Feb-20 -19,726 619,461 4,335 9,055 623,797

15 31-Mar-20 623,797 4,645 15-Mar-20 -19,726 608,716 4,869 9,514 613,584

16 30-Apr-20 613,584 4,564 15-Apr-20 -19,726 598,423 4,487 9,052 602,910

17 31-May-20 602,910 4,487 15-May-20 -19,726 587,671 4,700 9,188 592,371

18 30-Jun-20 592,371 4,407 15-Jun-20 -19,726 577,052 4,327 8,734 581,379

19 31-Jul-20 581,379 4,327 15-Jul-20 -19,726 565,980 4,527 8,854 570,507

20 31-Aug-20 570,507 4,244 15-Aug-20 -19,726 555,025 4,439 8,683 559,464

21 30-Sep-20 559,464 4,162 15-Sep-20 -19,726 543,900 4,078 8,240 547,978

22 31-Oct-20 547,978 4,078 15-Oct-20 -19,726 532,330 4,258 8,336 536,588

23 30-Nov-20 536,588 3,992 15-Nov-20 -19,726 520,854 3,906 7,897 524,759

24 31-Dec-20 524,759 3,906 15-Dec-20 -19,726 508,939 4,071 7,976 513,009

25 31-Jan-21 513,009 3,816 15-Jan-21 -19,726 497,100 3,976 7,792 501,075

26 28-Feb-21 501,075 3,727 15-Feb-21 -19,726 485,077 3,152 6,880 488,229

27 31-Mar-21 488,229 3,637 15-Mar-21 -19,726 472,140 3,776 7,414 475,917

28 30-Apr-21 475,917 3,540 15-Apr-21 -19,726 459,731 3,447 6,988 463,178

29 31-May-21 463,178 3,447 15-May-21 -19,726 446,900 3,574 7,022 450,474

30 30-Jun-21 450,474 3,351 15-Jun-21 -19,726 434,099 3,255 6,606 437,354

31 31-Jul-21 437,354 3,255 15-Jul-21 -19,726 420,883 3,366 6,621 424,249

32 31-Aug-21 424,249 3,156 15-Aug-21 -19,726 407,679 3,261 6,417 410,940

33 30-Sep-21 410,940 3,057 15-Sep-21 -19,726 394,271 2,956 6,013 397,227

34 31-Oct-21 397,227 2,956 15-Oct-21 -19,726 380,458 3,043 5,999 383,501

35 30-Nov-21 383,501 2,853 15-Nov-21 -19,726 366,627 2,749 5,602 369,377

36 31-Dec-21 369,377 2,749 15-Dec-21 -19,726 352,400 2,819 5,568 355,218

37 31-Jan-22 355,218 2,642 15-Jan-22 -19,726 338,135 2,704 5,347 340,839

38 28-Feb-22 340,839 2,535 15-Feb-22 -19,726 323,649 2,103 4,639 325,752

39 31-Mar-22 325,752 2,427 15-Mar-22 -19,726 308,453 2,467 4,894 310,920

40 30-Apr-22 310,920 2,313 15-Apr-22 -19,726 293,507 2,201 4,514 295,708

41 31-May-22 295,708 2,201 15-May-22 -19,726 278,182 2,225 4,426 280,407

42 30-Jun-22 280,407 2,086 15-Jun-22 -19,726 262,767 1,970 4,056 264,738

43 31-Jul-22 264,738 1,970 15-Jul-22 -19,726 246,982 1,975 3,946 248,957

44 31-Aug-22 248,957 1,852 15-Aug-22 -19,726 231,083 1,848 3,700 232,932

45 30-Sep-22 232,932 1,733 15-Sep-22 -19,726 214,938 1,612 3,344 216,550

46 31-Oct-22 216,550 1,612 15-Oct-22 -19,726 198,436 1,587 3,199 200,023

47 30-Nov-22 200,023 1,488 15-Nov-22 -19,726 181,785 1,363 2,851 183,148

48 31-Dec-22 183,148 1,363 15-Dec-22 -19,726 164,785 1,318 2,681 166,103

49 31-Jan-23 166,103 1,236 15-Jan-23 -19,726 147,612 1,181 2,416 148,793

50 28-Feb-23 148,793 1,107 15-Feb-23 -19,726 130,174 846 1,953 131,020

51 31-Mar-23 131,020 976 15-Mar-23 -19,726 112,270 898 1,874 113,168

52 30-Apr-23 113,168 842 15-Apr-23 -19,726 94,284 707 1,549 94,991

53 31-May-23 94,991 707 15-May-23 -19,726 75,972 608 1,315 76,579

54 30-Jun-23 76,579 570 15-Jun-23 -19,726 57,423 431 1,000 57,854

55 31-Jul-23 57,854 431 15-Jul-23 -19,726 38,558 308 739 38,867

56 31-Aug-23 38,867 289 15-Aug-23 -19,726 19,430 155 445 19,585

57 30-Sep-23 19,585 146 15-Sep-23 -19,726 5 0 146 5

181,653 -1,208,602 184,754 366,407

LESSOR SHARMA & COMPANY Dr Cr

ASSET SCHWING STETTER SHOT CRETE PUMP TSR 30.14 Asset 14,342,000.00

Financie lease obligation 14,342,000.00

Basic GST Total

Cost 14,342,000 2,581,560 16,923,560 Financie lease obligation 1,434,200.00

Upfront fee 76,156 13,708 89,864 supplier account 1,434,200.00

14,418,156 2,595,268 17,013,424

Less Interest on finance lease 159,905.28

Margin 10% -1,434,200 -258,156 -1,692,356 17.10.2018 Financie lease obligation 159,905.28

Net 27,402,112 4,932,380 32,334,492

Financie lease obligation 1,007,604.00

Financie lease obligation 19.36% supplier account 1,007,604.00

Month Reporting Opening Interest-1 Payment Payment Balance Interest-2 Interest -183,286

Date Balance Date w/o GST

- -

1 15-Jan-19 - - - -

2 6-Mar-19 14,342,000 - 15-Feb-19 -2,105,936 12,236,064 - 12,236,064

3 31-Mar-19 12,236,064 58,414 15-Mar-19 -335,868 11,958,610 101,492 159,905 12,060,101 12,060,101.28

4 30-Apr-19 12,060,101 95,148 15-Apr-19 -335,868 11,819,382 94,041 189,189 11,913,422

5 31-May-19 11,913,422 94,041 15-May-19 -335,868 11,671,595 99,056 193,096 11,770,651

6 30-Jun-19 11,770,651 92,865 15-Jun-19 -335,868 11,527,648 91,720 184,584 11,619,367

7 31-Jul-19 11,619,367 91,720 15-Jul-19 -335,868 11,375,219 96,540 188,260 11,471,759

8 31-Aug-19 11,471,759 90,507 15-Aug-19 -335,868 11,226,398 95,277 185,784 11,321,675

9 30-Sep-19 11,321,675 89,323 15-Sep-19 -335,868 11,075,130 88,119 177,442 11,163,249

10 31-Oct-19 11,163,249 88,119 15-Oct-19 -335,868 10,915,500 92,639 180,758 11,008,139

11 30-Nov-19 11,008,139 86,849 15-Nov-19 -335,868 10,759,120 85,605 172,454 10,844,725

12 31-Dec-19 10,844,725 85,605 15-Dec-19 -335,868 10,594,461 89,914 175,519 10,684,376

13 31-Jan-20 10,684,376 84,295 15-Jan-20 -335,868 10,432,802 88,542 172,837 10,521,345

14 29-Feb-20 10,521,345 83,008 15-Feb-20 -335,868 10,268,485 76,254 159,263 10,344,739

15 31-Mar-20 10,344,739 81,701 15-Mar-20 -335,868 10,090,572 85,638 167,339 10,176,210

16 30-Apr-20 10,176,210 80,285 15-Apr-20 -335,868 9,920,628 78,933 159,219 9,999,561

17 31-May-20 9,999,561 78,933 15-May-20 -335,868 9,742,626 82,685 161,618 9,825,311

18 30-Jun-20 9,825,311 77,517 15-Jun-20 -335,868 9,566,960 76,119 153,636 9,643,079

19 31-Jul-20 9,643,079 76,119 15-Jul-20 -335,868 9,383,331 79,636 155,755 9,462,966

20 31-Aug-20 9,462,966 74,658 15-Aug-20 -335,868 9,201,756 78,095 152,753 9,279,851

21 30-Sep-20 9,279,851 73,214 15-Sep-20 -335,868 9,017,197 71,745 144,959 9,088,942

22 31-Oct-20 9,088,942 71,745 15-Oct-20 -335,868 8,824,819 74,895 146,641 8,899,714

23 30-Nov-20 8,899,714 70,215 15-Nov-20 -335,868 8,634,061 68,697 138,911 8,702,758

24 31-Dec-20 8,702,758 68,697 15-Dec-20 -335,868 8,435,586 71,592 140,289 8,507,178

25 31-Jan-21 8,507,178 67,118 15-Jan-21 -335,868 8,238,428 69,919 137,036 8,308,347

26 28-Feb-21 8,308,347 65,549 15-Feb-21 -335,868 8,038,028 55,427 120,976 8,093,455

27 31-Mar-21 8,093,455 63,954 15-Mar-21 -335,868 7,821,541 66,381 130,335 7,887,922

28 30-Apr-21 7,887,922 62,232 15-Apr-21 -335,868 7,614,286 60,583 122,815 7,674,869

29 31-May-21 7,674,869 60,583 15-May-21 -335,868 7,399,584 62,800 123,383 7,462,383

30 30-Jun-21 7,462,383 58,875 15-Jun-21 -335,868 7,185,390 57,170 116,045 7,242,560

31 31-Jul-21 7,242,560 57,170 15-Jul-21 -335,868 6,963,863 59,102 116,272 7,022,965

32 31-Aug-21 7,022,965 55,408 15-Aug-21 -335,868 6,742,504 57,223 112,631 6,799,727

33 30-Sep-21 6,799,727 53,647 15-Sep-21 -335,868 6,517,506 51,856 105,503 6,569,363

34 31-Oct-21 6,569,363 51,856 15-Oct-21 -335,868 6,285,351 53,343 105,200 6,338,694

35 30-Nov-21 6,338,694 50,009 15-Nov-21 -335,868 6,052,835 48,159 98,169 6,100,995

36 31-Dec-21 6,100,995 48,159 15-Dec-21 -335,868 5,813,286 49,337 97,496 5,862,623

37 31-Jan-22 5,862,623 46,253 15-Jan-22 -335,868 5,573,008 47,298 93,551 5,620,306

38 28-Feb-22 5,620,306 44,342 15-Feb-22 -335,868 5,328,779 36,745 81,087 5,365,524

39 31-Mar-22 5,365,524 42,398 15-Mar-22 -335,868 5,072,055 43,046 85,444 5,115,101

40 30-Apr-22 5,115,101 40,356 15-Apr-22 -335,868 4,819,589 38,347 78,703 4,857,936

41 31-May-22 4,857,936 38,347 15-May-22 -335,868 4,560,415 38,704 77,051 4,599,118

42 30-Jun-22 4,599,118 36,285 15-Jun-22 -335,868 4,299,535 34,209 70,494 4,333,744

43 31-Jul-22 4,333,744 34,209 15-Jul-22 -335,868 4,032,086 34,220 68,429 4,066,306

44 31-Aug-22 4,066,306 32,081 15-Aug-22 -335,868 3,762,519 31,932 64,013 3,794,451

45 30-Sep-22 3,794,451 29,936 15-Sep-22 -335,868 3,488,519 27,756 57,693 3,516,276

46 31-Oct-22 3,516,276 27,756 15-Oct-22 -335,868 3,208,164 27,227 54,984 3,235,391

47 30-Nov-22 3,235,391 25,526 15-Nov-22 -335,868 2,925,049 23,273 48,799 2,948,322

48 31-Dec-22 2,948,322 23,273 15-Dec-22 -335,868 2,635,727 22,369 45,642 2,658,096

49 31-Jan-23 2,658,096 20,971 15-Jan-23 -335,868 2,343,200 19,887 40,858 2,363,086

50 28-Feb-23 2,363,086 18,644 15-Feb-23 -335,868 2,045,862 14,107 32,751 2,059,969

51 31-Mar-23 2,059,969 16,278 15-Mar-23 -335,868 1,740,379 14,770 31,048 1,755,150

52 30-Apr-23 1,755,150 13,847 15-Apr-23 -335,868 1,433,129 11,403 25,250 1,444,531

53 31-May-23 1,444,531 11,403 15-May-23 -335,868 1,120,066 9,506 20,909 1,129,572

54 30-Jun-23 1,129,572 8,912 15-Jun-23 -335,868 802,616 6,386 15,298 809,002

55 31-Jul-23 809,002 6,386 15-Jul-23 -335,868 479,520 4,070 10,456 483,589

56 31-Aug-23 483,589 3,815 15-Aug-23 -335,868 151,537 1,286 5,101 152,823

57 30-Sep-23 152,823 1,206 15-Sep-23 -335,868 -181,839 -1,447 -241 -183,286

3,009,761 -20,578,676 3,043,629 6,053,390

You might also like

- Setoff BondDocument1 pageSetoff BondMichael Kovach96% (46)

- Price Parallelism High PDFDocument55 pagesPrice Parallelism High PDFAqib khanNo ratings yet

- الإعلام وحقوق الإنسان - الدكتور مسعود حسين الشائب PDFDocument224 pagesالإعلام وحقوق الإنسان - الدكتور مسعود حسين الشائب PDFرائد العودةNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch19Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch19Kevin Molly KamrathNo ratings yet

- PDIC v. Stockholder of Intercity Savings and Loan BankDocument2 pagesPDIC v. Stockholder of Intercity Savings and Loan BankGirlie Sandigan100% (4)

- Gaby Tatiana PagosDocument25 pagesGaby Tatiana PagosDiego ChávezNo ratings yet

- AnujDocument452 pagesAnujAmar VamanNo ratings yet

- 23 03 Resumen Ingresos y EgresosDocument138 pages23 03 Resumen Ingresos y EgresosjustoNo ratings yet

- HDB CalculationDocument11 pagesHDB CalculationMuhammad Sufian RamliNo ratings yet

- USD Period Installment Installment Breakdown From To USD Interst Payment Date A-B Payment To MulsDocument4 pagesUSD Period Installment Installment Breakdown From To USD Interst Payment Date A-B Payment To MulsCA Jitender PratapNo ratings yet

- Fix 5thn, Tenor 10thn, 2.3mDocument1 pageFix 5thn, Tenor 10thn, 2.3mLuki Ariani LNo ratings yet

- 11 Interest Calculation On DepositsDocument3 pages11 Interest Calculation On DepositsAbhishek Kumar SinghNo ratings yet

- Pt. Cahaya Buana Kemala Rekonsiliasi Pelunasan Piutang Dagang Januari - Oktober 2019Document3 pagesPt. Cahaya Buana Kemala Rekonsiliasi Pelunasan Piutang Dagang Januari - Oktober 2019Gigih PrakosoNo ratings yet

- Microsoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Document31 pagesMicrosoft Excel Sheet For Calculating EMI (Equated Monthly Installment) (TYPE 1)Vikas Acharya100% (1)

- Produksi Litologi Dan KapasitasDocument6 pagesProduksi Litologi Dan KapasitasIGOO PLGNo ratings yet

- 2018 JFC Stock PriceDocument5 pages2018 JFC Stock PriceTrish SaleNo ratings yet

- Exchange Gain Loss WorkingDocument1 pageExchange Gain Loss WorkingfaheemNo ratings yet

- Sl. No Date Bill No Agency DetailsDocument8 pagesSl. No Date Bill No Agency DetailsVV CommunicationsNo ratings yet

- CryptoDocument11 pagesCryptoWeavemanila Inc Ann HernandezNo ratings yet

- Os Etrans 240424Document14 pagesOs Etrans 240424Ambar WahyuNo ratings yet

- Canara Bank StatementDocument65 pagesCanara Bank StatementEr Md AamirNo ratings yet

- ScalpingDocument9 pagesScalpingrogelio tenienteNo ratings yet

- MATL LC Statement Report 2022Document3 pagesMATL LC Statement Report 2022Zakir HossenNo ratings yet

- Annexure-F - Full Payment Receipt - Plot No - 232Document1 pageAnnexure-F - Full Payment Receipt - Plot No - 232Arindam MitraNo ratings yet

- 01 May 2024Document21 pages01 May 2024aziz.sediqi2017No ratings yet

- Water Report FTP July 2021-2Document2 pagesWater Report FTP July 2021-2Ronald BelistaNo ratings yet

- Stock Analysis 2Document62 pagesStock Analysis 2Rajarshi DaharwalNo ratings yet

- Max GainDocument509 pagesMax GainJosh JoshiNo ratings yet

- Data Jurnal MuisDocument7 pagesData Jurnal MuisAhmad AbdulNo ratings yet

- Wa0061Document5 pagesWa0061rsamleti1No ratings yet

- Fuel Agt23Document8 pagesFuel Agt23Wahyu AdrianNo ratings yet

- GT AssighnmnetDocument18 pagesGT AssighnmnetMd AsifNo ratings yet

- TSR Natsu Tower Penthouse ADocument1 pageTSR Natsu Tower Penthouse AWayne LimNo ratings yet

- 998 UjjjDocument12 pages998 Ujjjovais kanojeNo ratings yet

- Acc Ledger LatesDocument14 pagesAcc Ledger LatesVinayak SinghNo ratings yet

- Precios Medios Estacionales MEM y TDF 2019 2024 WEBDocument5 pagesPrecios Medios Estacionales MEM y TDF 2019 2024 WEBEduardo lopez garciaNo ratings yet

- Target Bulan Depan Rate Target AtasDocument3 pagesTarget Bulan Depan Rate Target Atasanto donlotNo ratings yet

- Production of Sagarika Bottle and Packing Industries LTD Production & Delivery Report of BottlesDocument1 pageProduction of Sagarika Bottle and Packing Industries LTD Production & Delivery Report of Bottleskalam23No ratings yet

- Manual de Ingeniería Económica Simulación para Amortizar Creditoe en U.V.R. Cuota Fija en Uvr Amortizacion Constante A Capital en U.V.RDocument25 pagesManual de Ingeniería Económica Simulación para Amortizar Creditoe en U.V.R. Cuota Fija en Uvr Amortizacion Constante A Capital en U.V.RAníbal dario Rodríguez RamírezNo ratings yet

- N2+o2 01.03.2023Document83 pagesN2+o2 01.03.2023anNo ratings yet

- JGPKJG (KLDocument14 pagesJGPKJG (KLjdgregorioNo ratings yet

- GL Transaction ReportDocument13 pagesGL Transaction Reportkanta duttaNo ratings yet

- Name of The Party: M/s ABC & Co. Gstin: 03aaaaaaaaaaDocument3 pagesName of The Party: M/s ABC & Co. Gstin: 03aaaaaaaaaaRehana shahNo ratings yet

- Sample IAS 29 COS ComputationDocument29 pagesSample IAS 29 COS ComputationShingirai CynthiaNo ratings yet

- Loan Calculator: Enter Values Loan SummaryDocument12 pagesLoan Calculator: Enter Values Loan SummaryKosakhiPasapugazhNo ratings yet

- 1770 2019 Heroo - R01Document46 pages1770 2019 Heroo - R01Imam SantosoNo ratings yet

- SALES REGISTERDocument7 pagesSALES REGISTERindikafabrics5No ratings yet

- 2024 07 5 19 34 11 EMIloanDocument3 pages2024 07 5 19 34 11 EMIloansp10702001No ratings yet

- SSPS P & L Mar 23Document6 pagesSSPS P & L Mar 23Deep SanghaniNo ratings yet

- Tresbomm - Entrada, Saídas E SaldosDocument18 pagesTresbomm - Entrada, Saídas E SaldosGabriel ChagasNo ratings yet

- Financial Progress of AMIT BANSAL Till FEB 2020Document4 pagesFinancial Progress of AMIT BANSAL Till FEB 2020mchkppNo ratings yet

- Assignment 1Document5 pagesAssignment 1Shubham MukherjeeNo ratings yet

- 29 Mar SD 30 Apr 2017Document52 pages29 Mar SD 30 Apr 2017Chandra C ManurungNo ratings yet

- Data Tamu Ota 2024Document13 pagesData Tamu Ota 2024FaizinNo ratings yet

- SalesDocument5 pagesSalesGlennNo ratings yet

- Data Tamu Ota 2023Document11 pagesData Tamu Ota 2023FaizinNo ratings yet

- GST 310319Document66 pagesGST 310319Himmy PatwaNo ratings yet

- Date Settled Ment Price Open InterestDocument22 pagesDate Settled Ment Price Open InterestAdnan KamalNo ratings yet

- New Seher Gross Margin Sheet Oct-2024 (2)(1) (Autosaved)(1) 21 Oct (7)Document2,475 pagesNew Seher Gross Margin Sheet Oct-2024 (2)(1) (Autosaved)(1) 21 Oct (7)HaF EeZNo ratings yet

- Working Sales Tax With PartiesDocument116 pagesWorking Sales Tax With Parties0911khanNo ratings yet

- Paint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacDocument8 pagesPaint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacKhushboo RajNo ratings yet

- Cooper Companies Inc (Coo) Exxon MobilDocument44 pagesCooper Companies Inc (Coo) Exxon MobilMateen AsifNo ratings yet

- PL AgustusDocument6 pagesPL Agustusfajar indahNo ratings yet

- Data For Cases FBCounty GraphicsDocument1 pageData For Cases FBCounty GraphicsBobby BelinskiNo ratings yet

- Abdul, Sherene M. Bsa 2Document1 pageAbdul, Sherene M. Bsa 2Abdul ShereneNo ratings yet

- Offer Letter Construction Helper PDFDocument3 pagesOffer Letter Construction Helper PDFik932693No ratings yet

- Seic Template-At 221108Document6 pagesSeic Template-At 221108sarifulislamsajib5No ratings yet

- Contract of GuaranteeDocument15 pagesContract of GuaranteeRishab Jain 2027203No ratings yet

- Regulatory Framework For Merger and AcquisitionDocument5 pagesRegulatory Framework For Merger and AcquisitionkavitaNo ratings yet

- 1st Part SAP - ERP.Sales - And.distributionDocument100 pages1st Part SAP - ERP.Sales - And.distributionKiran BharatiNo ratings yet

- Anti Corruption PolicyDocument1 pageAnti Corruption PolicyMuhammad AshrafuddowlaNo ratings yet

- Chapter-5-Accounting For Partnerships in EthiopiaDocument17 pagesChapter-5-Accounting For Partnerships in EthiopiaYasin100% (2)

- Astm E433 71 - PT NDTDocument6 pagesAstm E433 71 - PT NDTbaladiroyaNo ratings yet

- Trip To The Beach Word SearchDocument3 pagesTrip To The Beach Word SearchSiti Hajar Azlina Idris100% (1)

- Kinds of ObligationsDocument5 pagesKinds of ObligationsSheen Hezel MagbanuaNo ratings yet

- Jardin vs. National Labor Relations Commission 326 SCRA 299, February 23, 2000 Case DigestDocument2 pagesJardin vs. National Labor Relations Commission 326 SCRA 299, February 23, 2000 Case DigestAnna Bea Datu GerongaNo ratings yet

- Test Questions Ines.docxDocument3 pagesTest Questions Ines.docxAlicia Caro OrtizNo ratings yet

- Other LawsDocument33 pagesOther LawsAmeen AhmadNo ratings yet

- Real Estate Agency - Strata TitleDocument22 pagesReal Estate Agency - Strata TitleIrmanza SariNo ratings yet

- Memorandum of AgreementDocument23 pagesMemorandum of AgreementCza VerwinNo ratings yet

- Competition LawDocument42 pagesCompetition LawTanisha SolankiNo ratings yet

- Strategic Alliance Dev. Corp vs. Radstock Securities LTDDocument1 pageStrategic Alliance Dev. Corp vs. Radstock Securities LTDenan_intonNo ratings yet

- 04 List of Insurance CompaniesDocument4 pages04 List of Insurance CompaniesAbhijit SinhaNo ratings yet

- Kinds of ObligationsDocument24 pagesKinds of Obligationsfreya cuevasNo ratings yet

- Alternative and Facultative ObligationsDocument26 pagesAlternative and Facultative ObligationsJose Cristobal Cagampang LiwanagNo ratings yet

- Iso 3763Document2 pagesIso 3763sarannkumar126100% (1)

- Dacion en PagoDocument2 pagesDacion en PagoJOHN GIMENO100% (4)

- Case LawsDocument10 pagesCase LawsAbhishek JainNo ratings yet

- MATH1 Q4 SLM Wk4Document13 pagesMATH1 Q4 SLM Wk4Leceil Oril PelpinosasNo ratings yet