Manila Memorial V DSWD

Manila Memorial V DSWD

Uploaded by

Ron ValenzuelaCopyright:

Available Formats

Manila Memorial V DSWD

Manila Memorial V DSWD

Uploaded by

Ron ValenzuelaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Manila Memorial V DSWD

Manila Memorial V DSWD

Uploaded by

Ron ValenzuelaCopyright:

Available Formats

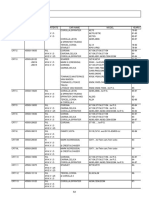

Manila Memorial Park, Inc. and La Funeraria Paz-Sucat, Inc.

v Secretary of Department of Social Welfare and Development

(DSWD) and Department of Finance (DOF)

G.R. No. 175356, 3 December 2013, EN BANC, (Del Castillo, J.)

Police Power as an attribute to promote the common good would be diluted if on the mere plea of some people, that they will suffer some earnings or

losses, a questioned provision would be invalidated.

FACTS: Petitioners assail the constitutionality of Republic Act No. (RA) 7432, as amended by RA9257, and the Implementing

Rules and Regulations (IRR) issued by the Department of Social Welfare and Development (DSWD) and Department of

Finance (DOF) insofar as these allow business establishments to claim the 20% discount given to senior citizens as a tax

deduction.

RA9257 was issued amending the previous provision to include funeral and burial services for the death of senior

citizens. In addition, under Sec. 4 of RA9257, the establishments listed therein may claim the discount as tax deduction based

on the net cost of goods sold or services rendered, provided that the cost of the discount shall be allowed as deduction from

gross income and that the total amount of claimed tax deduction net of VAT shall be included in the gross sales receipts. In

contrast with RA9257 which considers the 20% discount as a tax credit deductible from the tax liability of the said

establishment. The Sec. of DOF and DSWD also issued IRRs to implement the provisions.

The Petitioners assert that the said provision violates Section 4, Article 15 and Section 11, Article 13 of the

Constitution because it shifts the State’s constitutional mandate or duty of improving the welfare of elderly to the private

sector. Under the tax deduction scheme, the private sector shoulders 65% of the discount because only 35% of it is actually

returned by the government.

ISSUE: 1) Whether or not the petition presents and actual case or controversy

2) Whether or not Sec. 4 of RA9257 and the IRRs issued are invalid and unconstitutional.

HELD: Petition DENIED.

There exists an actual case or controversy

An actual case or controversy exists when there is “a conflict of legal rights” or “an assertion of opposite of legal

claims susceptible of judicial resolution”. In this case, the tax deduction scheme challenged by petitioners has a direct adverse

effect on them. Thus, it cannot be denied that there exists an actual case or controversy.

The validity of the 20% senior citizen discount and tax deduction scheme under RA9257, as an exercise of

police power of the State has already been settled in Carlos Superdrug Corporation

The permanent reduction in their total revenues is a forced subsidy corresponding to the taking of private property

for public use or benefit. This constitutes compensable taking for which petitioners would ordinarily become entitled to a just

compensation. A tax deduction does not offer full reimbursement of the senior citizen discount. As such, it would not meet

the definition of just compensation.

Police power as an attribute to promote the common good would be diluted considerably if on the mere plea of

petitioners that they will suffer loss of earnings and capital, the questioned provision is invalidated. Given these, it is incorrect

for petitioners to insist that the grant of the senior citizen discount is unduly oppressive to their business, because petitioners

have not taken time to calculate correctly and come up with a financial report, so that they have not been able to show properly

whether or not the tax deduction scheme really works greatly to their disadvantage.

The subject regulation not an exercise of the power of eminent domain but a police power measure. The obiter in

Central Luzon Drug Corporation describes the 20% discount as an exercise of the power of eminent domain and the tax

credit, under the previous law, equivalent to the amount of discount given as the just compensation therefor. The reason is

that: (1) the discount would have formed part of the gross sales of the establishment were it not for the law prescribing the

20% discount, and (2) the permanent reduction in total revenues is a forced subsidy corresponding to the taking of private

property for public use or benefit. The flaw in this reasoning is in its premise. It presupposes that the subject regulation, which

impacts the pricing and, hence, the profitability of a private establishment, automatically amounts to a deprivation of property

without due process of law. If this were so, then all price and rate of return on investment control laws would have to be

invalidated because they impact, at some level, the regulated establishment’s profits or income/gross sales, yet there is no

provision for payment of just compensation.

You might also like

- Serving The PeopleDocument8 pagesServing The PeopleDäv Oh100% (1)

- Philippine Corporate LawDocument3 pagesPhilippine Corporate LawAnonymous KgOu1VfNyBNo ratings yet

- White Light CorporationDocument2 pagesWhite Light CorporationJeddel Grace CortezNo ratings yet

- Matling Industrial and Commercial Corporation VsDocument5 pagesMatling Industrial and Commercial Corporation VsAnonymous hbUJnBNo ratings yet

- 30 Borjal V CA 1992Document3 pages30 Borjal V CA 1992Remuel TorresNo ratings yet

- Gamboa Vs Teves 2012Document1 pageGamboa Vs Teves 2012Hoven MacasinagNo ratings yet

- Zabal vs. DuterteDocument154 pagesZabal vs. DuterteToni LorescaNo ratings yet

- Disini, Jr. v. The Secretary of Justice, G.R. No. 203335: FactsDocument4 pagesDisini, Jr. v. The Secretary of Justice, G.R. No. 203335: FactsAsbNo ratings yet

- Us vs. SamonteDocument2 pagesUs vs. SamonteEarl NuydaNo ratings yet

- 2 3 CompilationDocument11 pages2 3 CompilationCristine Mendez TulangNo ratings yet

- Case Digest ConstiDocument27 pagesCase Digest ConstiAchilles Neil EbronNo ratings yet

- Compilation of Equal Protection Case DigestsDocument21 pagesCompilation of Equal Protection Case DigestsEra Yvonne KillipNo ratings yet

- Imbong Vs OchoaDocument16 pagesImbong Vs OchoaPatricia RodriguezNo ratings yet

- Oposa vs. FactoranDocument3 pagesOposa vs. FactoranShyla CadangenNo ratings yet

- 25 International Academy of Management and Economics Vs Litton and Company IncDocument10 pages25 International Academy of Management and Economics Vs Litton and Company InckwonpenguinNo ratings yet

- Political Law DigestDocument95 pagesPolitical Law DigestAnonymous IobsjUatNo ratings yet

- 11 Salvatierra Vs GarlitosDocument4 pages11 Salvatierra Vs GarlitosRyan SuaverdezNo ratings yet

- Based From Our Last File (And Old Sequencing) It Ended With de Mesa, That's Why Real Security Starts With MagsaysayDocument67 pagesBased From Our Last File (And Old Sequencing) It Ended With de Mesa, That's Why Real Security Starts With MagsaysayMark Evan GarciaNo ratings yet

- International Catholic Migration Commison VDocument2 pagesInternational Catholic Migration Commison VCharmaine Reyes FabellaNo ratings yet

- 41 2012-Saez v. Macapagal-ArroyoDocument12 pages41 2012-Saez v. Macapagal-ArroyoRoyce Ann Pedemonte100% (1)

- Republic Act No 8049Document2 pagesRepublic Act No 8049Victoria AlexanderNo ratings yet

- Disbursement Acceleration ProgramDocument3 pagesDisbursement Acceleration Programarellano lawschoolNo ratings yet

- Legal Research - Case DigestDocument5 pagesLegal Research - Case DigestMA. TRISHA RAMENTONo ratings yet

- Celedonio Manubag Jr. Case Digests Compilation Summer 2017 (Atty. Maligon)Document349 pagesCeledonio Manubag Jr. Case Digests Compilation Summer 2017 (Atty. Maligon)Celedonio ManubagNo ratings yet

- IPL Cases - August 8, 2023Document32 pagesIPL Cases - August 8, 2023kairene diaoNo ratings yet

- Nepotism Is Based On Favour Granted To Relatives in Various Fields Particularly in TheDocument1 pageNepotism Is Based On Favour Granted To Relatives in Various Fields Particularly in TheAra100% (1)

- Funa v. MECODocument1 pageFuna v. MECOJORLAND MARVIN BUCUNo ratings yet

- PVT vs. CIR - Torio vs. FontanillaDocument183 pagesPVT vs. CIR - Torio vs. FontanillaRollie AngNo ratings yet

- 4 People VS VillacorteDocument8 pages4 People VS VillacorteJudy Ann MaderazoNo ratings yet

- The United States Vs Torcuata Gomez and Ramon CoronelDocument2 pagesThe United States Vs Torcuata Gomez and Ramon CoroneljohnmiggyNo ratings yet

- Consti CaseDocument129 pagesConsti CaseNhardz BrionesNo ratings yet

- White Light Corporation Vs City of Manila DigestDocument1 pageWhite Light Corporation Vs City of Manila Digestcess5655No ratings yet

- Department of Education, Culture and Sports vs. San Diego (Police Power) PDFDocument9 pagesDepartment of Education, Culture and Sports vs. San Diego (Police Power) PDFLorna PaghunasanNo ratings yet

- Tablarin vs. Gutierrez DigestDocument1 pageTablarin vs. Gutierrez DigestManuel DancelNo ratings yet

- Matienzo V AbelleraDocument1 pageMatienzo V AbelleraMarion Nerisse KhoNo ratings yet

- Disini v. Secretary of JusticeDocument2 pagesDisini v. Secretary of JusticeNickoNo ratings yet

- Tupas V. Nha GR No L-49677 May 4 1989: (9) B. Civil Service Commission Section 2Document2 pagesTupas V. Nha GR No L-49677 May 4 1989: (9) B. Civil Service Commission Section 2Gin FernandezNo ratings yet

- Maria Carolina P. Araullo Et. AlDocument3 pagesMaria Carolina P. Araullo Et. AlClaire SilvestreNo ratings yet

- Political Law CasesDocument49 pagesPolitical Law CasesCharmila SiplonNo ratings yet

- 154 in Re GarciaDocument1 page154 in Re GarciaJulius Geoffrey TangonanNo ratings yet

- Special CourtsDocument20 pagesSpecial CourtsRZ ZamoraNo ratings yet

- 7.Ermita-Malate Hotel and Motel Operators Association, Inc. vs. City Mayor of Manila 20 SCRA 849, July 31, 1967, No. L-24693Document1 page7.Ermita-Malate Hotel and Motel Operators Association, Inc. vs. City Mayor of Manila 20 SCRA 849, July 31, 1967, No. L-24693Almer TinapayNo ratings yet

- D. Antolin vs. DomondonDocument1 pageD. Antolin vs. DomondonShinji NishikawaNo ratings yet

- City of Manila vs. Tan TeDocument10 pagesCity of Manila vs. Tan TeJamNo ratings yet

- Equal Protection Case DigestsDocument6 pagesEqual Protection Case Digestsarsalle2014No ratings yet

- 11.mirasol Vs DPWHDocument3 pages11.mirasol Vs DPWHchatmche-06No ratings yet

- Federal and Unitary GovtDocument10 pagesFederal and Unitary GovtRoyal Raj Alig100% (1)

- Constitutional Law II Case Digests2Document30 pagesConstitutional Law II Case Digests2Hansel Jake B. PampiloNo ratings yet

- Safe Spaces ActDocument7 pagesSafe Spaces ActNgum Jak TongNo ratings yet

- Vivares Vs STC PDFDocument4 pagesVivares Vs STC PDFKJPL_1987No ratings yet

- Marcos vs. Manglapus, 177 SCRA 668, September 15, 1989 Case DigestDocument2 pagesMarcos vs. Manglapus, 177 SCRA 668, September 15, 1989 Case DigestElla Kriziana CruzNo ratings yet

- Rubi vs. Provincial Board of MindoroDocument2 pagesRubi vs. Provincial Board of MindoroMichaelNo ratings yet

- Cruz V NCIP (Digest)Document9 pagesCruz V NCIP (Digest)Faith TangoNo ratings yet

- People Vs Butawan FinalDocument6 pagesPeople Vs Butawan Finalermeline tampusNo ratings yet

- Carlos Superdrug Corp v. DSWDDocument7 pagesCarlos Superdrug Corp v. DSWDPatricia Bautista0% (1)

- Enactment, Such Is An Unauthorized Exercise of Police PowerDocument2 pagesEnactment, Such Is An Unauthorized Exercise of Police PowerReena Alekssandra AcopNo ratings yet

- Philippine Virginia Tabaco Adm vs. CIR (G.R. No.l-32052, July 25, 1975)Document2 pagesPhilippine Virginia Tabaco Adm vs. CIR (G.R. No.l-32052, July 25, 1975)PAOLO ABUYONo ratings yet

- Republic Planters Bank Vs CA (1992)Document3 pagesRepublic Planters Bank Vs CA (1992)Francis MasiglatNo ratings yet

- People vs. Sandiganbayan Third DivisionDocument16 pagesPeople vs. Sandiganbayan Third DivisionatiffaneeNo ratings yet

- CASE DIGEST Manila Memorial ParkDocument32 pagesCASE DIGEST Manila Memorial ParkALMIRA PEGADNo ratings yet

- Assignment 5 HRLDocument6 pagesAssignment 5 HRLandalchiara4No ratings yet

- 2024 07 09 04 29 46 F4 13J 2023 Lecturer (Male) MathematicsDocument8 pages2024 07 09 04 29 46 F4 13J 2023 Lecturer (Male) Mathematicsghulammursaline462No ratings yet

- PEOPLE v. JOSELITO ESCARDADocument9 pagesPEOPLE v. JOSELITO ESCARDAChatNo ratings yet

- Arming SlavesDocument383 pagesArming SlavesJavier Diwakar Sadarangani Leiva100% (5)

- Ibanez de Aldecoa v. Hongkong & Shanghai Banking Corp., 246 U.S. 621 (1918)Document5 pagesIbanez de Aldecoa v. Hongkong & Shanghai Banking Corp., 246 U.S. 621 (1918)Scribd Government DocsNo ratings yet

- IIAC Vacancy CircularDocument5 pagesIIAC Vacancy CircularRajeshNo ratings yet

- If God Won The War, Why Isn't It Over?: Title PageDocument65 pagesIf God Won The War, Why Isn't It Over?: Title PageJoe DonatiNo ratings yet

- Tawasul FullDocument24 pagesTawasul FullWidia NurjanahNo ratings yet

- Memorial Appellant (3rd RGNUL National Moot Court Competition, 2014)Document30 pagesMemorial Appellant (3rd RGNUL National Moot Court Competition, 2014)Aman Uniyal71% (7)

- Regional Prosecutors of The PhilippinesDocument30 pagesRegional Prosecutors of The PhilippinesAmil MacalimbonNo ratings yet

- Blood & Guts 2 - Battlefield Unit Combat System (Print)Document10 pagesBlood & Guts 2 - Battlefield Unit Combat System (Print)Gon_1313No ratings yet

- The Future of Political TheologyDocument24 pagesThe Future of Political TheologygabyNo ratings yet

- Codes - Standard Club - Anchoring ProceduresDocument8 pagesCodes - Standard Club - Anchoring ProceduresSetiadi MargonoNo ratings yet

- High Strength Hexagon Bolts (JIS B1186)Document4 pagesHigh Strength Hexagon Bolts (JIS B1186)Mario HanamiciNo ratings yet

- Economic OffencesDocument69 pagesEconomic OffencesvinayaNo ratings yet

- Civil Appeal 35 of 2015Document7 pagesCivil Appeal 35 of 2015wanyamaNo ratings yet

- Aliquot 2008Document3 pagesAliquot 2008KMK1983No ratings yet

- Gantrail 1116 15 DS-0421Document2 pagesGantrail 1116 15 DS-0421eyas12hNo ratings yet

- Asia Brewery, Inc. v. Equitable PCI Bank, G.R. No. 190432, April 25, 2017Document11 pagesAsia Brewery, Inc. v. Equitable PCI Bank, G.R. No. 190432, April 25, 2017Iris MendiolaNo ratings yet

- Agatha Christie's Unexpected DenouementDocument2 pagesAgatha Christie's Unexpected DenouementUmendra TripathiNo ratings yet

- Macke and ChandlerDocument10 pagesMacke and ChandlerRina TravelsNo ratings yet

- MTS Extent-1Document36 pagesMTS Extent-1sivakumarNo ratings yet

- Matrix - Ogcc Opinion and Conrev Plus Board ResolutionsDocument12 pagesMatrix - Ogcc Opinion and Conrev Plus Board ResolutionsEzi AngelesNo ratings yet

- Assumption of Mortgage....Document1 pageAssumption of Mortgage....kardel sharpeyeNo ratings yet

- ACFE Fraud Examination Report (Short)Document8 pagesACFE Fraud Examination Report (Short)Basit Sattar100% (1)

- Karachi Customs Agents Association: Complete Member's Information (Alphabet Sequence "W ")Document10 pagesKarachi Customs Agents Association: Complete Member's Information (Alphabet Sequence "W ")Meraj HussainNo ratings yet

- CTR Rack EndDocument13 pagesCTR Rack EndTan JaiNo ratings yet

- Writers Guild of America, West, Inc. Et Al. v. WME Entertainment, Et Al.Document6 pagesWriters Guild of America, West, Inc. Et Al. v. WME Entertainment, Et Al.THROnlineNo ratings yet

- Mystery Babylon The Great and The Mysteries and Catholicism by PEMBER, G. H.Document160 pagesMystery Babylon The Great and The Mysteries and Catholicism by PEMBER, G. H.Drew CullinanNo ratings yet

- Take NO PRISONERS ! Manual of FreedomDocument29 pagesTake NO PRISONERS ! Manual of Freedomsdlucky13b100% (10)