46615bosfnd p1 cp6 U3

46615bosfnd p1 cp6 U3

Uploaded by

Ekshitha ChoudharyCopyright:

Available Formats

46615bosfnd p1 cp6 U3

46615bosfnd p1 cp6 U3

Uploaded by

Ekshitha ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

46615bosfnd p1 cp6 U3

46615bosfnd p1 cp6 U3

Uploaded by

Ekshitha ChoudharyCopyright:

Available Formats

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.

43

UNIT 3 : CONSIGNMENT

LEARNING OUTCOMES

After studying this unit, you will be able to:

w Understand the special features of consignment business, meaning of the terms consignor and

consignee.

w Analyse the difference between the two transactions – sale and consignment and understand that why

consignment is termed as special transaction.

w Practice the accounting treatments for consignment transactions and events in the books of consignor

and consignee.

w Note the variations in accounting when goods are sent at cost and goods are sent above the cost.

w Learn the technique of computing value of consignment inventory lying with the consignee and also

the amount of inventory reserve in it.

w Learn the technique of computing cost of abnormal loss and treatment of insurance claim in relation to

it.

w Understand the distinction between ordinary commission, del-credere commission and over-riding

commission paid to the consignee.

w See the variation of accounting treatment for bad debts when consignee is paid ordinary commission

and when consignee is paid del-credere commission in addition to it.

w Understand the reason of including/excluding various expenditures to cost while valuing the goods

returned by the consignee.

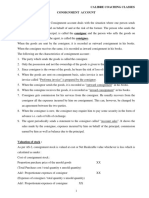

Goods Consigned

Consignor Consignee

Account Sales

Details of Sales made by the

UNIT Inventories of

consignee

consignor

OVERVIEW Expenses incurred on behalf of the

consignor

Commission earned

Unsold Inventories left with the

consignee

Advance payment or security

deposited

Balance due or remitted

© The Institute of Chartered Accountants of India

6.44 PRINCIPLES AND PRACTICE OF ACCOUNTING

3.1 MEANING OF CONSIGNMENT ACCOUNT

To consign means to send. In Accounting, the term “consignment account” relates to accounts dealing with

a situation where one person (or firm) sends goods to another person (or firm) on the basis that the goods

will be sold on behalf of and at the risk of the former. The following should be noted carefully:

(i) The party which sends the goods (consignor) is called principal.

(ii) The party to whom goods are sent (consignee) is called agent.

(iii) The ownership of the goods, i.e., the property in the goods, remains with the consignor or the principal

– the agent or the consignee does not become their owner even though goods are in his possession.

On sale, of course, the buyer will become the owner.

(iv) The consignor does not send an invoice to the consignee. He sends only a proforma invoice, a

statement that looks like an invoice but is really not one. The object of the proforma invoice is only to

convey information to the consignee regarding particulars of the goods sent.

(v) Usually, the consignee recovers from the consignor all expenses incurred by him on the consignment.

This however can be changed by agreement between the two parties.

(vi) It is also usual for the consignee to give an advance to the consignor in the form of cash or a bill of

exchange. It is adjusted against the sale proceeds of the goods.

(vii) For his work, the consignee receives a commission calculated on the basis of gross sale. For ordinary

commission the consignee is not responsible for any bad debt that may arise. If the agent is to be made

responsible for bad debts, he is to be paid a commission called del-credere commission. It is calculated

on total sales, not merely on credit sales until and unless agreed.

(viii) Periodically, the consignees ends to the consignor a statement called Account Sales. It sets out the sales

made by the consignee, the expenses incurred on behalf of the consignor, the commission earned by

the consignee and the balance due to the consignor.

(ix) Firms usually like to ascertain the profit or loss on each consignment or consignments to each consignee.

Consignment Account relates to accounts dealing with such business where one person sends goods to

another person on the basis that such goods will be sold on behalf of and at the risk of the former.

3.2 DISTINCTIONS

3.2.1 CONSIGNMENT AND SALE

S.No. Consignment Sale

1. Ownership of the goods rests with the consignor The ownership of the goods transfers with the

till the time they are sold by the consignee, transfer of goods from the seller to the buyer.

no matter the goods are transferred to the

consignee.

2. The consignee can return the unsold goods to Goods sold are the property of the buyer and

the consignor. can be returned only if the seller agrees.

3. Consignor bears the loss of goods held with the It is the buyer who will bear the loss if any, after

consignee. the transfer of goods.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.45

4. The relationship between the consignor and The relationship between the seller and the

the consignee is that of a principal and agent. buyer is that of a creditor and a debtor.

5. Expenses done by the consignee to receive the Expenses incurred by the buyer are to be borne

goods and to keep it safely are borne by the by the buyer itself after the transfer of goods.

consignor unless there is any other agreement.

3.2.2 DISTINCTION BETWEEN COMMISSION AND DISCOUNT

Commission Discount

Commission may be defined as remuneration The term discount refers to any reduction or

of an employee or agent relating to services rebate allowed and is used to express one of the

performed in connection with sales, following situations:

purchases, collections or other types of

An allowance given for the settlement of a debt

business transactions and is usually based on a

before it is due i.e. cash discount.

percentage of the amounts involved.

Commission earned is accounted for as An allowance given to the whole sellers or bulk

an income in the books of accounts, and buyers on the list price or retail price, known as

commission allowed or paid is accounted for as trade discount. A trade discount is not shown in

an expense in the books of the party availing the books of account separately and it is shown

such facility or service. by way of deduction from cost of purchases.

3.3 ACCOUNTING FOR CONSIGNMENT TRANSACTIONS AND

EVENTS IN THE BOOKS OF THE CONSIGNOR

For ascertaining profit or loss on any transaction (or series of transactions) there is one golden rule; open

an account for the transaction (or series of transactions) and (i) put down the cost of goods and other

expenses incurred or to be incurred on the debit side; and (ii) enter the sale proceeds as also the cost of

goods remaining unsold on the right hand side or the credit side. The difference between the total of the

two sides will reveal profit or loss. There is profit if the credit side is more.

The consignor often dispatches goods to various consignees and he would be interested to ascertain

the profit or loss from each consignment separately. Therefore, a separate consignment account has to

be prepared for each consignment. Each consignment account is a nominal-cum-personal account and

constitutes a profit an loss account in respect of the transactions to which it relates.

The consignor records the following transactions in his book of accounts:

1. When goods are consigned or dispatched: it is to be reiterated that when goods are sent to the

consignee, the transaction does not result in a sale and only the possession of the goods changes.

Therefore, the personal account of consignee is not debited and also sales account is not credited. The

following entry is recorded by the consignor:

Consignment (say to Star trading) Account Dr.

To Goods Sent on Consignment Account

2. Expenses incurred by consignor: when consignor incurs some expenses relating to the consignment

© The Institute of Chartered Accountants of India

6.46 PRINCIPLES AND PRACTICE OF ACCOUNTING

following entry is recorded:

Consignment (say to Star trading) Account Dr.

To Supplier Account/Bank/Cash

Unlike normal practice to debiting expense accounts first and then transferring to profit and loss

account, expenses are directly debited to consignment account.

3. When advance is received from the consignee: The consignee may remit some advance to consignor.

The following entry is recorded:

Bank/Cash Account Dr.

To Consignee’s Personal Account

4. On receipt of account sales from the consignee: Account sales contains details of sales made by

consignee, expenses incurred by consignee. Following entries are recorded

For sales proceeds

Consignee’s Personal Account Dr.

To Consignment Account

For expenses incurred by consignee

Consignment Account Dr.

To Consignee’s Personal Account

5. Cash or cheque or bank draft or bill of exchange/promissory note received from the consignee as

settlement:

Cash/Bank/Bills Receivable Account Dr.

To Consignee’s Personal Account

6. For bad debts: The accounting entry for bad debts will depend on whether del-credere commission is

paid to the consignee

i. When del-credere commission is not paid to the consignee

Consignment Account Dr.

To Consignee’s Personal Account

ii. When del-credere commission is paid to the consignee

No entry is recorded as bad debts is to be borne by consignee.

7. For the goods taken over by the consignee

Consignee’s Personal Account Dr.

To Consignment Account

8. For unsold consignment stock: In case some of the goods sent on consignment are still unsold at the time

of preparing final accounts, the unsold inventory is recorded as consignment stock with followingentry:

Consignment Stock Account Dr.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.47

To Consignment Account

9. For commission payable to consignee

Consignment Account Dr.

To Consignee’s Personal Account

We shall illustrate the scheme of entries on the basis of the following information:

? ILLUSTRATION 1

Exe sent on 1st July,2016 to Wye goods costing ` 50,000 and spent ` 1,000 on packing etc. On 3rd July,2016, Wye

received the goods and sent his acceptance to Exe for ` 30,000 payable at 3 months. Wye spent ` 2,000 on freight

and cartage, ` 500 on godown rent and ` 300 on insurance. On 31st December,2016 he sent his Account Sales

(along with the amount due to Exe) showing that 4/5 of the goods had been sold for ` 55,000. Wye is entitled to

a commission of 10%. One of the customers turned insolvent and could not pay ` 600 due from him. Show the

necessary journal entries in the books of consignor. Also prepare ledger accounts.

SOLUTION

Journal Entries in the books of Consignor

` `

1 Open Consignment Account and debit it with the cost of goods and

credit it with “Goods sent on Consignment Account”.

1/7/2016 Consignment to Wye A/c Dr. 50,000

To Goods Sent on Consignment A/c 50,000

2 For the expenses incurred by the consignor,debit Consignment

Account and credit cash or Bank, as the case may be.

1/7/2016 Consignment to Wye A/c Dr. 1,000

To Bank A/c 1,000

3 If the consignee sends an advance, debit Cash(or Bank) or Bills

Receivable and credit the consignee’s personal account

3/7/2016 Bills Receivable A/c Dr. 30,000

To Wye 30,000

(Note: Wye’s account has appeared only now, in the previous

two entries his account did not figure since he is not personally

involved)

4 Wye’s acceptance will mature on 6/10/2016

Assuming it was met, the entry will be:

6/10/2016 Bank A/c Dr. 30,000

To Bills Receivable A/c 30,000

(Note: If such bill is discounted by consignor with the bank before

maturity, pass usual entry for discounting a bill. The discount on

bills may either be treated as consignment expenses and charged to

Consignment A/c or it may be treated as general financial charges

and charged to Profit & Loss Account)

© The Institute of Chartered Accountants of India

6.48 PRINCIPLES AND PRACTICE OF ACCOUNTING

5 On receipt of Account sale

31/12/2016 (a) For sales made by the consignee, debit his personal account and

credit Consignment Account

Wye Dr. 55,000

To Consignment to Wye A/c 55,000

(b) For expenses incurred by the consignee as well as bad debts

suffered by him on behalf of the consignor, debit Consignment

Account and credit Consignee Account

31/12/2016 Consignment to Wye A/c (2,000+500+300+600) Dr. 3,400

To Wye 3,400

(c) For commission due to the consignee, debit Consignment

Account and credit the consignee.

31/12/2016 Consignment to Wye A/c(10% on ` 55,000) 5,500

To Wye 5,500

(d) For the remittance that may accompany the Account Sales, debit

Bank and credit the consignee.

Bank A/c Dr. 16,100

To Wye 16,100

6 For the goods that may remain unsold debit the Consignment Stock

Account and credit Consignment Account.

31/12/2016 Inventories on Consignment A/c Dr. 10,600

To Consignment to Wye A/c 10,600

Note: (i) Cost of Inventories

1/5 of Cost to consignor ` 10,000

1/5 of expense incurred by the consignor ` 200

1/5 of freight (direct exp. Of consignee) ` 400

` 10,600

(ii) Inventories on Consignment Account is an asset; it will be

shown in the balance sheet of the consignor and next year it

will be transferred to the debit of the Consignment Account.

7 At this stage the Consignment Account will reveal profit or loss (see

the account given below). The profit or loss will be transferred to the

Profit and Loss Account of the consignor by debit to the Consignment

Account.

31/12/2016 Consignment to Wye A/c Dr. 5,700

To Profit and Loss A/c 5,700

8 The Goods sent on Consignment Account should be closed by transfer

to the Trading Account debit the former and credit the latter:

31/12/2016 Goods sent on Consignment Account Dr. 50,000

To Trading Account 50,000

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.49

Important Ledger Accounts

Consignment to Wye Account

2016 Particulars ` 2016 Particulars `

1-Jul To Goods sent on Dec. 31 By Wye-sale

Consignment A/c 50,000 Proceeds 55,000

1-Jul To Bank(expenses) 1,000 Dec. 31 By Inventories on

Dec. 31 To Wye-expenses Consignment 10,600

& bad debt 3,400 Account

Dec. 31 To Wye-commission 5,500

Dec. 31 To P&L Account-transfer of profit 5,700

65,600 65,600

Goods sent on consignment account

2016 Particulars ` 2016 Particulars `

Dec. 31 To Trading A/c 50,000 July 1 By Consignment to 50,000

Wye A/c

Inventories on Consignment account

2016 Particulars ` 2016 Particulars `

Dec. 31 To Consignment to Wye 10,600 Dec. 31 By Balance c/d 10,600

A/c

2017

Jan. 1 To Balance b/d 10,600

Wye’s account

2016 ` 2016 `

Dec. 31 To Consignment 3-Jul By Bills Receivable

Wye A/c 55,000 Account 30,000

By Consignment to

Wye A/c –

Expenses & bad debt 3,400

Commission 5,500

By Bank

(balance received) 16,100

55,000 55,000

© The Institute of Chartered Accountants of India

6.50 PRINCIPLES AND PRACTICE OF ACCOUNTING

3.4 VALUATION OF INVENTORIES

The principle is that inventories should be valued at cost or net realizable value whichever is lower, the same

principle as is practised for preparing final accounts. In the case of consignment, cost means not only the

cost of the goods as such to the consignor but also all expenses incurred till the goods reach the premises

of the consignee. Such expenses include packaging, freight, cartage, insurance in transit, octroi, import duty

etc. But expenses incurred after the goods have reached the consignee’s godown (such as godown rent,

insurance of godown, delivery charges,salesman salaries) are not treated as part of the cost of purchase

for valuing inventories on hand. That is why in the case given above, inventories has been valued ignoring

godown rent and insurance.

Note: Sometimes an examination problem states only that the consignor’s expenses amounted

to such amount and that consignee spent so much. If details are not available, then for valuing

inventories the expenses incurred by the consignor should be treated as part of cost while those

incurred by the consignee should be ignored.

If the expected selling price of inventories on hand is lower than the cost, the inventories should be valued

at expected net selling price only, i.e. expected selling price less delivery expenses, etc.

3.5 GOODS INVOICED ABOVE COST

Sometimes the proforma invoice is made out at a value higher than the cost and entries in the books of the

consignor are made out on that basis – even the inventories remaining unsold will initially be valued on the

basis of the invoice price. It must be remembered, however, that the profit or loss can be ascertained only

if sale proceeds (plus) inventories on hand, valued on cost basis, is compared with the cost of the goods

concerned together with expenses. Hence, if entries are first made on invoice basis, the effect of the loading

(i.e., amount added to arrive at the invoice price) must be removed by additional entries. Suppose in the

example given above, if the invoice is cost plus 20%, i.e., ` 60,000 for the goods sent to Wye. The entries will

be initially:

Particulars ` `

(i) Consignment to Wye A/c Dr. 60,000

To Goods sent on Consignment A/c 60,000

(ii) Consignment to Wye A/c Dr. 1,000

To Bank 1,000

(iii) Bills Receivable A/c Dr. 30,000

To Wye 30,000

(iv) Bank A/c Dr. 30,000

To Bills Receivable A/c 30,000

(v) Wye Dr. 55,000

To Consignment to Wye A/c 55,000

(vi) Consignment to Wye A/c Dr. 3,400

To Wye 3,400

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.51

(vii) Consignment to Wye A/c Dr. 5,500

To Wye 5,500

(viii) Bank A/c Dr. 16,100

To Wye 16,100

(ix) Inventories on Consignment A/c Dr. 12,600

To Consignment to Wye A/c 12,600

[1/5 of 60,000 + 1/5 of (1,000 + 2,000)]

[Students will see that except for difference in the amounts in entries (i) and (ix), these and other entries are

the same as those already given.]

Additional entries (before ascertaining profit) to remove the effect of loading:

(a) Goods sent on Consignment A/c Dr. 10,000

To Consignment to Wye A/c 10,000

[Entry (i) reversed to the extent of loading in order to debit the Consignment A/c on cost basis].

(b) Consignment to Wye A/c Dr. 2,000

To Inventory Reserve Account 2,000

(The amount of loading included in the value of the closing Inventories is unrealised profit – hence reserve

is created by debit to the Consignment Account).

The Consignment Account will now reveal a profit of ` 5,700 the same as before. It will be transferred to the

P&L A/c. Similarly entry given in 8 in the earlier illustration will be made to transfer the balance in the Goods

sent on Consignment Account in the earlier illustration`500,000) after entry in (a) above to the credit of

Trading Account. The accounts (except for Wye whose account will be the same as already shown) are given

below:

Consignment to Wye Account

2016 Particulars ` 2016 Particulars `

1-Jul To Goods sent on Dec. 31 By Wye

Consignment A/c 60,000 Sales proceeds 55,000

To Bank A/c – expenses 1,000 By Inventories on Consignment 12,600

A/c

Dec. 31 To Wye-expenses & bad debt 3,400 By Goods sent on Consignment 10,000

A/c(loading)

“ To Wye-commission 5,500

To Inventory Reserve A/c 2,000

“ To Profit and Loss A/c

transfer of profit 5,700

77,600 77,600

© The Institute of Chartered Accountants of India

6.52 PRINCIPLES AND PRACTICE OF ACCOUNTING

Goods sent on Consignment Account

2016 ` 2016 `

Dec. 31 To Consignment to Wye A/c – 10,000 1-Jul By Consignment to Wye A/c 60,000

loading

To Trading A/c –transfer 50,000

(bal.fig.)

60,000 60,000

Inventories on Consignment Account

2016 ` 2016 `

Dec. 31 To Consignment to Wye A/c 12,600 Dec. 31 By Balance c/d 12,600

2017

Jan. 1 Balance b/d 12,600

Inventory Reserve Account

2016 ` 2016 `

Dec. 31 To Balance c/d 2,000 Dec. 31 By Consignment to Wye A/c 2,000

2017

Jan. 1 By Balance b/d 2,000

The last two accounts will be carried forward to the next year and their balance will then be transferred to

the Consignment Account – ` 12,600 on the debit side and ` 2,000 on the credit. This year in the balance

sheet the net amount of ` 10,600 will be shown on the assets side as shown below:

`

Inventories on consignment 12,600

Less: Inventory Reserve 2,000

10,600

What would be the situation if the commission to Wye includes del-credere commission also?

In that case Wye would not be able to charge the bad debt of ` 600 to Exe; he will have to bear the loss

himself. The student can see that then the profit on consignment will be ` 6,300.

In this regard it is to be noted that when del – credere commission is paid to the consignee, the consignee

account is debited in the books of consignor for both cash and credit sales. But if no such del – credere

commission is paid then consignee account cannot be debited for credit sales and in that case the following

entry is passed in the books of consignor for credit sales.

Consignment Trade receivables A/c Dr.

To Consignment A/c

The difference is because in case del-credere commission is paid to consignee then consignee is responsible

to bear any loss of bad debts and he will have to pay full amount of sales to consigner. Accordingly, in the

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.53

books of consignor, whole amount (cash sales plus credit sales) is shown as receivable from consignee. On

the other hand if del-credere commission is not paid than consignor is responsible to bear loss of bad debts,

therefore, till the time consignee has not received money from customers, it is not shown as receivable from

consignee.

3.6 NORMAL LOSS

If some loss is unavoidable, it would be spread over the entire consignment while valuing inventories.

The total cost plus expenses incurred should be divided by the quantity available after the normal loss to

ascertain the cost per unit. Suppose 10,000 kg of apples are consigned to a wholesaler, the cost being `30

per kg, plus ` 40,000 of freight. It is concluded that a loss of 15% is unavoidable. The cost per kg will be

`3,40,000/8,500 or ` 40. If the unsold inventory is 1,000 kg its value will be ` 40,000.

Accordingly, no entry is recorded for normal loss and same is considered as expense which is considered for

valuation of remaining inventory.

3.7 ABNORMAL LOSS

If any accidental or unnecessary loss occurs, the proper thing to do is to find out the cost of the goods thus

lost and then to credit the Consignment Account and debit the Profit and Loss Account – this will enable the

consignor to know what profit would have been earned had the loss not taken place.

Suppose 1,000 sewing machines costing ` 2,500 each are sent on consignment basis and ` 10,000 are spent

on freight etc. 20 machines are damaged beyond repair. The amount of loss will be:

Cost = 20 × 2500 ` 50,000

Expenses = (20×10,000)/1000 ` 200

` 50,200

This amount should be credited to the Consignment Account and debited to the P&L A/c. If any amount, say,

` 40,000 is received from the insurers, then debit to the P&L A/c will be only ` 10,200. But the credit to the

Consignment Account will still be ` 50,200. ` 40,000 will have been debited to the Bank Account.

Students shall note that abnormal loss is valued just like inventories in hand.

Students should be careful while valuing goods lost in transit and goods lost in consignee’s godown. Both

are abnormal loss but in case of former consignee’s non-recurring expenses are not to be included whereas

it is to be included in latter case.

Further, for the purpose of valuation of inventory in hand, it should be noted that while normal loss is

considered as part of cost of remaining goods, whereas abnormal loss is ignored. In the example given

above assume that 10,000 Kg apples were sent in 10 different trucks and out of which one truck met an

accident and 500Kg apples were destroyed. In such case cost of remaining apples will be computed as

below:

Qty. Amount (`)

Total apples shipped 10,000 3,40,000 (@ `34 per Kg including freight)

Apples lost in accident 500 17,000 (@ `34 per Kg including freight)

Remaining apples 9,500 3,23,000 (@ `34 per Kg including freight)

© The Institute of Chartered Accountants of India

6.54 PRINCIPLES AND PRACTICE OF ACCOUNTING

Normal loss (15%) 1,425 Nil

Remaining saleable apples 8,075 3,23,000 (@ `40 per Kg)

It is clear from above example that abnormal loss will not have impact on per unit cost, however, per unit

cost will change due to normal cost as the remaining quantity will absorb cost of normal loss whereas

abnormal loss will be immediately expensed off to profit or loss.

Distinctions between normal and abnormal loss

Normal loss Abnormal loss

Normal loss occurs due to inherent nature of the Abnormal loss occurs mainly because of unforeseen

goods being shipped e.g. leakage, evaporation, loss events e.g. accident or natural calamity etc.

of perishable goods etc.

Normal loss is not accounted for immediately and is Abnormal loss is accounted for immediately in

loaded on the remaining goods. It gets accounted profit and loss account.

for as cost of remaining goods as and when they are

sold.

As normal loss is added to cost of remaining goods, Abnormal loss does not impact gross profit.

it impact gross profit.

Insurance companies generally do not cover Insurance is generally available for abnormal losses.

normal loss as it is expected to be incurred on each

consignment or storage of goods.

Normal loss is almost certain however it may vary Abnormal loss is because of unforeseen events and

from time to time. is not certain.

Following entry is recorded for abnormal loss:

Abnormal Loss Account Dr.

To Consignment Account

If abnormal loss is recoverable from the insurance company

Insurance Company’s Account Dr.

To Abnormal Loss Account

If abnormal loss is recoverable from the consignee

Consignee’s Personal Account Dr.

To Abnormal Loss Account

If abnormal loss is not recoverable, Abnormal Loss Account is transferred to Profit & Loss Account.

3.8 COMMISSION

Commission is the remuneration paid by the consignor to the consignee for the services rendered to the

former for selling the consigned goods. Three types of commission can be provided by the consignor to the

consignee, as per the agreement, either simultaneously or in isolation. They are:

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.55

3.8.1 Ordinary Commission

The term commission simply denotes ordinary commission. It is based on fixed percentage of the gross

sales proceeds made by the consignee. It is given by the consignor regardless of whether the consignee is

making credit sales or not. This type of commission does not give any protection to the consignor from bad

debts and is provided on total sales.

3.8.2 Del-credere Commission

To increase the sale and to encourage the consignee to make credit sales, the consignor provides an

additional commission generally known as del-credere commission. This additional commission when

provided to the consignee gives a protection to the consignor against bad debts. In other words, after

providing the del-credere commission, bad debts is no more the loss of the consignor. It is calculated on

total sales unless there is any agreement between the consignor and the consignee to provide it on credit

sales only.

3.8.3 Over-riding Commission

It is an extra commission allowed by the consignor to the consignee to promote sales at higher price

then specified or to encourage the consignee to put hard work in introducing new product in the market.

Depending on the agreement it is calculated on total sales or on the difference between actual sales and

sales at invoice price or any specified price. In order to encourage the consignee to earn higher margins, it

can also be in the form of share of additional profits made by consignee on sale of goods.

3.9 RETURN OF GOODS FROM THE CONSIGNEE

Consigned goods can be returned by the consignee because of many reasons like poor quality or not upto

the specimen or destroyed in transit etc. In such a situation, the question arises what is the valuation of

returned goods. Consigned goods returned by the consignee to the consignor are valued at the price at

which it was consigned to the consignee. Expenses incurred by the consignee to send those goods back to

the consignor are not taken into consideration while valuing it because the goods were already in a salable

conditions and location and changing the location back from consignee to consignor is not a cost which

must have to be incurred to sell the goods. This is generally called secondary freight in accounting terms.

3.10 ACCOUNT SALES

An account sale is the periodical summary statement sent by the consignee to the consignor. It contains

details regarding –

(a) sales made,

(b) expenses incurred on behalf of the consignor,

(c) commission earned,

(d) unsold inventories left with the consignee,

(e) advance payment or security deposited with the consignor and the extent to which it has been adjusted,

(f ) balance payment due or remitted.

It is a summary statement and is different from Sales Account.

© The Institute of Chartered Accountants of India

6.56 PRINCIPLES AND PRACTICE OF ACCOUNTING

3.11 ACCOUNTING IN THE BOOKS OF THE CONSIGNEE

The consignee is not concerned when goods are consigned to him or when the consignor incurs expenses.

He is concerned only when he sends an advance to the consignor, makes a sale, incurs expenses on the

consignment and earns his commission. He debits or credits the consignor for all these as the case may be.

Following entries are recorded in the books of consignee:

1. On making sales

Cash/Bank Account/Debtors Dr.

To Consignor’s Personal Account

2. For expenses incurred and his commission

Consignor’s Personal Account Dr.

To Bank Account

3. For advance paid to consignor

Consignor’s Personal Account Dr.

To Bank Account

4. For recording bad debts

Bad Debts Account Dr.

To Customer’s Account

5. For writing off bad debts

(a) When del-credere commission is not allowed

Consignor’s Personal Account Dr.

To Bad Debts Account

(b) When del-credere commission is allowed

Commission Account Dr.

To Bad Debts Account

? ILLUSTRATION 2

Exe sent on 1st July, 2016 to Wye goods costing ` 50,000 and spent ` 1,000 on packing etc. On 3rd July,2016, Wye

received the goods and sent his acceptance to Exe for ` 30,000 payable at 3 months. Wye spent ` 2,000 on freight

and cartage, ` 500 on godown rent and ` 300 on insurance. On 31st December,2016 he sent his Account Sales

(along with the amount due to Exe) showing that 4/5 of the goods had been sold for ` 55,000. Wye is entitled to

a commission of 10%. One of the customers turned insolvent and could not pay ` 600 due from him. Show the

necessary journal entries in the consignee’s book.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.57

SOLUTION

Journal Entries in the books of Consignee

Particulars ` `

1 On sending the acceptance to Exe

2016 July 3 Exe Dr. 30,000

To Bills Payable A/c 30,000

2 On meeting expenses on the consignment:

2016 July 3 Exe Dr. 2,800

To Bank 2,800

3 On meeting his acceptance:

2016 Oct. 6 Bills payable Dr. 30,000

To Bank 30,000

4 On sales being effected:

Trade receivables/Bank Dr. 55,000

To Exe 55,000

5 On there being a bad debt:

Exe Dr. 600

To Trade receivables 600

6 On earning the commission:

Exe Dr. 5,500

To Commission Earned A/c 5,500

7 On settling the account to Exe:

Exe Dr. 16,100

To Bank 16,100

If the commission includes del-credere commission also, he would not be able to debit Exe for the bad debt.

In that case the debit should be to the Commission Earned Account whose net balance will then be `4,900

and he will have to pay `16,700 to Exe.

3.12 ADVANCE BY THE CONSIGNEE VS SECURITY AGAINST THE

CONSIGNMENT

Generally the consignor insist the consignee for some advance payment for the goods consigned at the

time of delivery of goods. This advance payment is adjusted in full against the amount due by the consignee

on account of the goods sold.

But if the advance money deposited by the consignee is in the form of security against the goods consigned

then the full amount is not adjusted against the amount due by the consignee to the consignor on account

of goods sold if, there is any unsold inventory left with the consignee. In that case proportionate security

in respect of unsold goods is carried forward till the time the respective goods held with the consignee are

sold.

© The Institute of Chartered Accountants of India

6.58 PRINCIPLES AND PRACTICE OF ACCOUNTING

? ILLUSTRATION 3

Miss Rakhi consigned 1,000 radio sets costing `900 each to Miss Geeta, her agent on 1st July,2016. Miss Rakhi

incurred the following expenditure on sending the consignment.

Freight ` 7,650

Insurance ` 3,250

Miss Geeta received the delivery of 950 radio sets. An account sale dated 30th November,2016 showed that 750

sets were sold for `9,00,000 and Miss Geeta incurred `10,500 for carriage.

Miss Geeta was entitled to commission 6% on the sales effected by her. She incurred expenses amounting to

`2,500 for repairing the damaged radio sets remaining in the inventories.

Miss Rakhi lodged a claim with the insurance company which was admitted at `35,000. Show the Consignment

Account and Miss Geeta’s Account in the books of Miss Rakhi.

SOLUTION

In the books of Miss Rakhi

Consignment Account

Particulars ` Particulars `

To Goods sent on By Miss Geeta 9,00,000

Consignment A/c 9,00,000 By Insurance Co. 35,000

By Profit & Loss A/c

To Cash abnormal loss(net) 10,545

Freight 7,650 By Consignment

Insurance 3,250 10,900 Inventories 1,84,391

To Miss Geeta

Carriage 10,500

Repairs 2,500

Commission 54,000 67,000

To Profit & Loss A/c 1,52,036

11,29,936 11,29,936

Miss Geeta’s Account

Particulars ` Particulars ` `

To Consignment A/c 9,00,000 By Consignment A/c

(Sales) Expenses:

Carriage 10,500

Repairs 2,500

Commission 54,000 67,000

By Bank(bal. fig.) 8,33,000

9,00,000 9,00,000

Note: It is assumed that the agent has remitted the amount due from her.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.59

Working Notes:

1. Abnormal loss :

Cost to the consignor: 50 sets @ ` 900 45,000

50 × 10,900

Add: Proportionate expenses incurred by the consignor

1,000 545

Gross abnormal loss 45,545

Less: Insurance claim (35,000)

Net abnormal loss 10,545

2. Valuation of Inventories

200 sets @ ` 900 1,80,000

200 × 10,900 2,180

Add: Proportionate expenses of the consignor

1,000

Add: Carriage and customs duty paid by the consignee 200 × 10,500

2,211

950

1,84,391

? ILLUSTRATION 4

Vikram Milk Foods Co. Ltd. of Vikrampur sent to Sunder Stores, Sonepuri 5,000 kgs of baby food packed in 2,000

tins of net weight 1 kg and 6,000 packets of net weight 1/2 kg for sale on consignment basis. The consignee’s

commission was fixed at 5% of sale proceeds. The cost price and selling price of the product were as under:

1 kg. tin 1/2 kg. packet

` `

Cost Price 10 6

Selling Price 15 7

The consignment was booked on freight “To Pay” basis, and freight charges came to 2% of selling value. One case

containing 50 (1kg. tins) was lost in transit and the transport carrier admitted a claim of `450.

At the end of the first half-year, the following information is gathered from the “Account Sales” sent by the

consignee:

(i) Sale proceeds: 1,500 1 kg. tins

4,000 1/2 kg. packets

(ii) Store rent and insurance charges ` 600.

Find out the value of closing inventory on consignment.

Show the Consignment A/c and the Consignee’s A/c in the books of Vikram Milk Food Co. Ltd. assuming that the

consignee had paid the amount due from him.

© The Institute of Chartered Accountants of India

6.60 PRINCIPLES AND PRACTICE OF ACCOUNTING

SOLUTION

Vikram Milk Foods Co. Ltd.

Consignment to Sonepuri Account

Particulars ` Particulars `

To Goods sent on By Sunder Stores

Consignment A/c

2,000 1 kg. tins @ ` 10 20,000 1,500 1 kg. tins @ ` 15 22,500

6,000 1/2 kg. pkts. @ ` 6 36,000 56,000 4,000 1/2 kg. pkts. @ ` 7 28,000 50,500

To Sunder Stores: By Insurance - Claim 450

Freight 1,440 By Profit & Loss A/c -

Rent and insurance 600 abnormal loss(Net) 65

Commission 2,525 4,565 By Inventory on 16,915

consignment A/c

To Profit & Loss A/c – 7,365

Profit

67,930 67,930

Sunder Stores, Sonepuri

Particulars ` Particulars `

To Consignment to Sonepuri By Consignment to

Account - Sales Proceeds 50,500 Sonepuri Account -

Freight 1,440

Rent & Insurance 600

Commission 2,525

By Bank(Bal. fig) 45,935

50,500 50,500

Working Notes:

(i) Sale value of total consignment:

2,000 1 kg. tins @ ` 15 30,000

6,000 1/2 kg. pkts. @ ` 7 42,000

72,000

(ii) Freight @ 2% of above 1,440

(iii) Inventories at the end:

450 1 kg. tins @ ` 10 (Selling Price ` 6,750) 4,500

2,000 1/2 kg. pkts. @ ` 6 (Selling Price ` 14,000) 12,000

16,500

Add: Freight 2% of (Selling Price ` 20,750) 415

16,915

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.61

(iv) Loss in transit:

Cost of 50 1 kg. tins @ ` 10 500

Freight @ 2% of Selling Price ` 750 15

Gross abnormal Loss 515

Less : Claim (450)

Net abnormal Loss 65

? ILLUSTRATION 5

Shri Mehta of Mumbai consigns 1,000 cases of goods costing ` 1,000 each to Shri Sundaram of Chennai. Shri

Mehta pays the following expenses in connection with consignment:

`

Carriage 10,000

Freight 30,000

Loading charges 10,000

Shri Sundaram sells 700 cases at ` 1,400 per case and incurs the following expenses:

Clearing charges 8,500

Warehousing and storage 17,000

Packing and selling expenses 6,000

It is found that 50 cases have been lost in transit and 100 cases are still in transit.

Shri Sundaram is entitled to a commission of 10% on gross sales. Draw up the Consignment Account and

Sundaram’s Account in the books of Shri Mehta.

SOLUTION

In the books of Shri Mehta

Consignment to Sundaram of Chennai Account

Particulars ` Particulars `

To Goods sent on By Sundaram (Sales) 9,80,000

Consignment 10,00,000 By Loss in Transit 50 cases 52,500

@ `1,050 each

To Bank (Expenses) 50,000 By Consignment Inventories

To Sundaram (Expenses) 31,500 In hand 150 @ ` 1,060 each 1,59,000

To Sundaram (Commission) 98,000 In transit 100 @ ` 1,050 1,05,000 2,64,000

each

To Profit on Consignment to 1,17,000

Profit & Loss A/c

12,96,500 12,96,500

© The Institute of Chartered Accountants of India

6.62 PRINCIPLES AND PRACTICE OF ACCOUNTING

Sundaram’s Account

Particulars ` Particulars `

To Consignment to Chennai A/c 9,80,000 By Consignment A/c

(Expenses) 31,500

By Consignment A/c

(Commission) 98,000

By Balance c/d 8,50,500

9,80,000 9,80,000

Working Notes:

(i) Consignor’s expenses on 1,000 cases amounts to `50,000; it comes to `50 per case. The cost of cases lost

will be computed at `1,050 per case.

(ii) Sundaram has incurred ` 8,500 on clearing 850 cases, i.e., `10 per case; while valuing closing inventories

with the agent `10 per case has been added to cases in hand with the agent.

(iii) It has been assumed that balance of `8,50,500 is not yet paid.

? ILLUSTRATION 6

Ajay of Mumbai consigned to Vijay of Delhi, goods to be sold at invoice price which represents 125% of cost. Vijay

is entitled to a commission of 10% on sales at invoice price and 25% of any excess realised over invoice price. The

expenses on freight and insurance incurred by Ajay were `10,000. The account sales received by Ajay shows that

Vijay has effected sales amounting to `1,00,000 in respect of 75% of the consignment. His selling expenses to be

reimbursed were ` 8,000. 10% of consignment goods of the value of `12,500 were destroyed in fire at the Delhi

godown and the insurance company paid `12,000 net of salvage. Vijay remitted the balance in favour of Ajay.

Prepare consignment account and the account of Vijay in the books of Ajay along with the necessary calculations.

SOLUTION

Books of Ajay

Consignment to Vijay Account

Particulars ` Particulars `

To Goods sent on 1,25,000 By Goods sent on 25,000

Consignment A/c Consignment A/c (Loading)

To Cash A/c 10,000 By Abnormal Loss 11,000

To Vijay(Expenses) 8,000 By Vijay (Sales) 1,00,000

To Vijay(Commission) 10,938 By Inventories on 20,250

Consignment A/c

To Inventories Reserve A/c 3,750 By General Profit & Loss A/c 1,438

1,57,688 1,57,688

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.63

Vijay’s Account

Particulars ` Particulars `

To Consignment A/c 1,00,000 By Consignment A/c 8,000

By Consignment A/c 10,938

By Bank A/c 81,062

1,00,000 1,00,000

Working Notes:

1. Calculation of value of goods sent on consignment:

Abnormal Loss at Invoice price = ` 12,500.

Abnormal Loss as a percentage of total consignment = 10%.

Hence the value of goods sent on consignment = ` 12,500 X 100/ 10 = ` 1,25,000.

Loading of goods sent on consignment = ` 1,25,000 X 25/125 = ` 25,000.

2. Calculation of abnormal loss (10%):

Abnormal Loss at Invoice price = ` 12,500.

Abnormal Loss at cost = ` 12,500 X 100/125 = ` 10,000

Proportionate expenses of Ajay (10 % of `10,000) = ` 1,000

` 11,000

3. Calculation of closing Inventories (15%):

Ajay’s Basic Invoice price of consignment = ` 1,25,000

Ajay’s expenses on consignment = ` 10,000

` 1,35,000

Value of closing Inventories = 15% of ` 1,35,000 = ` 20,250

Loading in closing Inventories = `25,000 X 15/100 = ` 3,750

Where `18,750 (15% of `1,25,000) is the basic invoice price of the goods sent on consignment remaining

unsold.

4. Calculation of commission:

Invoice price of the goods sold = 75% of ` 1,25,000 = ` 93,750

Excess of selling price over invoice price = ` 6,250 ( ` 1,00,000- ` 93,750)

Total commission = 10% of ` 93,750 + 25% of ` 6,250

= ` 9,375 + ` 1,562.50

= ` 10,937.50 OR 10,938

Note:

1. It has been assumed that final payment received from Vijay.

2. Abnormal loss is always calculated at cost even if invoice price of goods is given.

3. Value of inventories always valued at invoice price if invoice price is given.

© The Institute of Chartered Accountants of India

6.64 PRINCIPLES AND PRACTICE OF ACCOUNTING

SUMMARY

w In Consignment one person (consignor) sends goods to another person (consignee) to be sold on

behalf of and at the risk of the former.

w In the case of consignment, cost means not only the cost of the goods as such to the consignor but

also all expenses incurred till the goods reaches the premises of the consignee. Such expenses include

packaging, freight, cartage, insurance in transit, octroi, etc.

w Expenses incurred after the goods have reached the consignee’s godown (such as godown rent,

insurance of godown, delivery charges) are not treated as part of the cost of purchase for valuing

inventories on hand.

w If the expected selling price of inventories on hand is lower than the cost, the value put on the

inventories should be expected net selling price only, i.e. expected selling price less delivery expenses,

etc.i.e. expenses necessary for sales.

w Proforma invoice is made to show the high value of goods consigned than the cost and entries in the

books of the consignor are made out on that basis. Even the inventories remaining unsold will initially

be valued on the basis of the invoice price.

w Hence, if entries are first made on invoice basis, the effect of the loading (i.e., amount added to arrive at

the invoice price) must be removed by additional entries to ascertain profit or loss.

w Abnormal loss is valued just like inventories in hand. Students should be careful while valuing goods

lost in transit and goods lost in consignee’s godown. Both are abnormal loss but in case of former

consignee’s non-recurring expenses are not to be included whereas it is to be included in case of latter.

w Normal loss, is an unavoidable loss and be spread over the entire consignment while valuing inventories.

The total cost plus expenses incurred should be divided by the quantity available after the normal loss

to ascertain the cost per unit.

w Commission is the remuneration paid by the consignor to the consignee for the services rendered to the

former for selling the consigned goods. Three types of commission can be provided by the consignor to

the consignee, as per the agreement, either simultaneously or in isolation. They are:

ª Ordinary commission

ª Del-credere commission

ª Over-riding commission

w For accounting of consignee, he is concerned only when he sends an advance to the consignor, makes a

sale, incurs expenses on the consignment and earns his commission. He debits or credits the consignor

for all these as the case may be.

w It has been assumed that final payment received from Vijay.

w Abnormal loss is always calculated at cost even if invoice price of goods is given.

w Value of inventories always valued at invoice price if invoice price is given.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.65

TEST YOUR KNOWLEDGE

Multiple Choice Questions

1 P of Delhi sends out 1,000 boxes of toothpaste costing ` 200 each. Each box consist of 12 packets. 600

boxes were sold by consignee at ` 20 per packet. Amount of sale value will be:

(a) ` 1,44,000 (b) ` 1,20,000 (c) `1,32,000

2 X of Kolkata sends out 2,000 boxes to Y of Delhi costing ` 100 each. Consignor’s expenses ` 5,000.

1/10th of the boxes were lost in consignee’s godown and treated as normal loss. 1,200 boxes were sold

by consignee. The value of consignment Inventories will be:

(a) ` 68,333 (b) ` 61,500 (c) ` 60,000

3 Which of the following statement is not true:

(a) If del-credere commission is allowed, bad debt will not be recorded in the books of consignor

(b) If del-credere commission is allowed, bad debt will be debited in consignment account

(c) Del-credere commission is provided by consignor to consignee

4 X of Kolkata sent out 2,000 boxes costing 100 each with the instruction that sales are to be made at cost

+ 45%. X draws a bill on Y for an amount equivalent to 60% of sales value. The amount of bill will be:

(a) ` 1,74,000 (b) ` 2,00,000 (c) ` 2,90,000

5 Which of the following statement is wrong:

(a) Consignor is the owner of the consignment Inventories

(b) Del-credere commission is allowed by consignor to protect himself from bad debt

(c) All proportionate consignee’s expenses will be added up for valuation of consignment Inventories.

6 Out of the following at which point the treatment of “Sales” and “Consignment” is same:

(a) Ownership transfer.

(b) Money receive.

(c) Inventories outflow.

7 If del-credere commission is allowed for bad debt, consignee will debit the bad debt amount to:

(a) Commission Earned A/c

(b) Consignor’s A/c

(c) Trade receivables (Customers) A/c

8 A proforma invoice is sent by:

(a) Consignee to Consignor

(b) Consignor to Consignee

(c) Customer/Debtors to Consignee

© The Institute of Chartered Accountants of India

6.66 PRINCIPLES AND PRACTICE OF ACCOUNTING

9 Which of the following statement is correct:

(a) Consignee will pass a journal entry in his books at the time of receiving goods from consignor.

(b) Consignee will not pass any journal entry in his books at the time of receiving goods from consignor.

(c) The ownership of goods will be transferred to consignee at the time of receiving the goods.

10 Consignment Inventories will be recorded in the balance sheet of consignor on asset side at:

(a) Invoice Value

(b) At Invoice value less Inventories reserve

(c) At lower than cost price

11 Which of the following expenses of consignee will be considered as non-selling expenses:

(a) Advertisement

(b) Insurance on freight inward

(c) Selling Expenses

12 The consignment accounting is made on the following basis:

(a) Accrual

(b) Realisation

(c) Cash Basis

13 Which of the following item is not credited to consignment account?

(a) Cash sales made by consignee

(b) Credit sales made by consignee

(c) Inventories Reserve on closing consignment Inventories

Theory Questions

Q1. Write short notes on:

(i) Del-credere commission.

(ii) Account sales.

(iii) Over-riding commission.

Q2. Distinguish between:

(i) Consignment sale and Normal sale.

(ii) Commission and Discount.

Practical Questions

Q1. X of Delhi purchased 10,000 metres of cloth for `2,00,000 of which 5,000 metres were sent on

consignment to Y of Agra at the selling price of ` 30 per metre. X paid ` 5,000 for freight and ` 500 for

packing etc.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.67

Y sold 4,000 metre at ` 40 per metre and incurred ` 2,000 for selling expenses. Y is entitled to a

commission of 5% on total sales proceeds plus a further 20% on any surplus price realised over ` 30

per metre. 3,000 metres were sold at Delhi at ` 30 per metre less ` 3,000 for expenses and commission.

Owing to fall in market price, the inventories of cloth in hand is to be reduced by 10%.

Prepare the Consignment Account and Trading and Profit & Loss Account in books of X.

Q2. D of Delhi appointed A of Agra as its selling agent on the following terms:

Goods to be sold at invoice price or over.

A to be entitled to a commission of 7.5% on the invoice price and 20% of any surplus price realized over

invoice price

The principals to draw on the agent a 30 days bill for 80% of the invoice price.

On 1st February, 2016, 1,000 cycles were consigned to A, each cycle costing ` 640 including freight and

invoiced at ` 800.

Before 31st March, 2016, (when the principal’s books are closed) A met his acceptance on the due date;

sold off 820 cycles at an average price of ` 930 per cycle, the sale expenses being ` 12,500; and remitted

the amount due by means of Bank draft.

Twenty of the unsold cycles were shop-spoiled and were to be valued at a depreciation of 50% of cost.

Show by means of ledger accounts how these transactions would be recorded in the books of A and

find out the value of closing inventory with A to be recorded in the books of D at cost.

Q3. Mr. Y consigned 800 packets of toothpaste, each packet containing 100 toothpastes. Cost price of each

packet was ` 900. Mr. Y Spent ` 100 per packet as cartage, freight, insurance and forwarding charges.

One packet was lost on the way and Mr. Y lodged claim with the insurance company and could get `570

as claim on average basis. Consignee took delivery of the rest of the packets and spent ` 39,950 as other

non-recurring expenses and ` 22,500 as recurring expenses. He sold 740 packets at the rate of ` 12 per

toothpaste. He was entitled to 2% commission on sales plus 1% del-credere commission.

You are required to prepare Consignment Account. Calculate the cost of inventories at the end, abnormal

loss and profit or loss on consignment.

Q4 A of Agra sent on consignment goods valued ` 1,00,000 to B of Mumbai on 1st March, 2016. He incurred

the expenditure of ` 12,000 on freight and insurance. A’s accounting year closes on 31st December. B

was entitled to a commission of 5% on gross sales plus a del-credere commission of 3%. B took delivery

of the consignment by incurring expenses of ` 3,000 for goods consigned.

On 31.12.2016, B informed on phone that he had sold all the goods for ` 1,50,000 by incurring selling

expenses of ` 2,000. He further informed that only ` 1,48,000 had been realized and rest was considered

irrecoverable, and would be sending the cheque in a day or so for the amount due along with the

accounts sale.

On 5.1.2017, A received the cheque for the amount due from B and incurred bank charges of ` 260 for

collecting the cheque. The amount was credited by the bank on 9.1.2017.

Write up the consignment account finding out the profit/loss on the consignment, B’s account, Provision

for expenses account and Bank account in the books of the consignor, recording the transactions upto

the receipt and collection of the cheque.

© The Institute of Chartered Accountants of India

6.68 PRINCIPLES AND PRACTICE OF ACCOUNTING

ANSWERS/HINTS

MCQs

1 2 3 4 5 6 7 8 9 10 11 12 13

(a) (b) (b) (a) (c) (c) (a) (b) (b) (b) (b) (a) (c)

Theoretical Questions

1 (i) Del-credere commission is an additional commission paid by the consignor to the consignee

for undertaking responsibility of collection of debts. Generally, the consignee gets ordinary

commission for sales made by him as a percentage of gross sales, over and above, he may get del-

credere commission for the additional responsibility of debt collection. Sometimes it is agreed that

del-credere commission shall be allowed on credit sales only. However, in the absence of any such

agreement the consignor allows del-credere commission on total sales and not merely on credit

sales. If the consignee is entitled to del-credere commission, he has to bear the bad debts; if any,

arising, out of credit sale of consignment goods.

(ii) Account sales is a periodic statement furnished by the consignee to the consignor stating therein,

the quantity sold, price charged, expenses incurred on behalf of the consignee and commission

payable to him in respect of a particular consignment, and the net amount due from him and

remittance received if any. It also shows the details of quantity of goods received, destroyed, if any,

and still held as stock.

(iii) Over-riding commission is an extra commission allowed to the consignee in addition to the normal

commission. Such additional commission is generally allowed:-

To provide additional incentive to the consignee for the purpose of introducing and creating a

market for a new product.

To provide incentive for supervising the performance of other agents in a particular area.

To provide incentive for ensuring that the goods are sold by the consignee at the highest possible

price.

2. (i) In case of consignment, the property in the goods remains with the consignor until the goods are

actually sold. The consignee acts only as a custodian of goods sent by consignor. In consignment,

the ownership of goods does not pass on to the consignee in any case. In case of ordinary sale, the

ownership of goods passes to the buyer immediately after sale. In case of consignment, the risk

attached to the goods remain with the consignor even after sending the goods to the consignee.

However, in case of ordinary sale, as soon as the property in the goods passes on to the buyers, the

risk attached to the goods also passes at the same time. The relationship between consignor and

consignee is that of principal and agent. In case of credit sale, the relationship between the buyer

and the seller is that of a debtor and a creditor.

(ii) Commission may be defined as remuneration of an employee or agent relating to services

performed in connection with sales, purchases, collections or other types of business transactions

and is usually based on a percentage of the amounts involved.

Commission earned is accounted for as an income in the books of accounts, and commission

allowed or paid is accounted for as an expense in the books of the party availing such facility or

service.

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.69

The term discount refers to any reduction or rebate allowed and is used to express one of the

following situations:

An allowance given for the settlement of a debt before it is due i.e. cash discount.

An allowance given to the whole sellers or bulk buyers on the list price or retail price, known as

trade discount. A trade discount is not shown in the books of account separately and it is shown by

way of deduction from cost of purchases.

Practical Questions

ANSWER 1

In the books of Mr. X

Consignment Account

Particulars Amount ` Particulars Amount `

To Goods sent on

Consignment Account 1,50,000 By Y’s account: (Sales) 1,60,000

To Bank account: Freight and 5,500 By Goods sent on consignment 50,000

packing etc. (Cancellation of loading)

To Y’s account: By Inventories on consignment 28,990

(W.N.2)

Selling expenses 2,000

Commission (W.N.1) 16,000

To Inventories Reserve (W.N.3) 10,000

To Profit and loss account (profit 55,490

on consignment transferred)

2,38,990 2,38,990

Trading and Profit and Loss Account

for the year ended……..

Particulars Amount ` Particulars Amount `

To Purchases 2,00,000 By Sales 90,000

To Gross profit c/d 26,000 By Goods sent on consignment 1,00,000

By Inventories in hand Cost ` 40,000

Less: 10% 4,000 36,000

2,26,000 2,26,000

To Expenses and commission 3,000 By Gross profit b/d 26,000

To Net profit 78,490 By Consignment A/c

(profit on consignment) 55,490

81,490 81,490

© The Institute of Chartered Accountants of India

6.70 PRINCIPLES AND PRACTICE OF ACCOUNTING

Working Notes:

i. Calculation of commission payable to Y: `

Total sale proceeds of Y 1,60,000

Surplus proceeds realised over ` 30 per metre

[4,000 x ` (40-30)] 40,000

Commission:

5% of total sale proceeds (5% of ` 1,60,000) 8,000

20% of surplus (20% of ` 40,000) 8,000

16,000

ii. Inventories on Consignment: `

Cost of consignment Inventories (1000 mtrs@ ` 30) 30,000

Add: Expenses of consignor(5,500X1/5) 1,100

31,100

Less: Reduction of 10% in cost due to fall in market price (20,000+1,100) x 10% 2,110

28,990

iii. Loading ( `10 x 1,000 mtrs) 10,000

ANSWER 2

D’s Account

2016 ` 2016 `

Feb. 1 To Bills payable A/c 6,40,000 Mar. 31 By Cash/Bank A/c (820x `930) 7,62,600

(80% of ` 8,00,000)

Mar. 31 To Cash A/c (expenses) 12,500

To Commission earned A/c 70,520

To Bank A/c 39,580 _______

7,62,600 7,62,600

Bills Payable Account

2016 ` 2016 `

Mar. 4 To Cash/Bank A/c 6,40,000 Feb. 1 By D’s A/c 6,40,000

6,40,000 6,40,000

Value of closing inventory with A

`

160 cycles at ` 640 (cost price including freight) 1,02,400

20 cycles (shop-spoiled) at 50% of the cost i.e. at ` 320 each 6,400

Value of closing inventory with A i.e. the amount (net effect of the loading) at which D _______

will account for in his books on 31st March, 2016

1,08,800

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.71

Working Note:

CALCULATION OF COMMISSION:

`

7.5 % on the invoice price amount (820x ` 800) i.e. ` 6,56,000 49,200

20% on the surplus price amount (820 x ` 130) ` 1,06,600 21,320

70,520

2.

`

Abnormal loss:

Cost of packet lost during transit 900

Add: Expenses incurred by Y 100

Gross Abnormal loss 1,000

Less: Insurance claim received (570)

Net Abnormal loss 430

3. COST OF INVENTORIES AT THE END:

`

59 packets @ ` 900 53,100

Add: Expenses incurred by Y (59x `100) 5,900

Add: Proportionate (non-recurring) expenses incurred by the consignee

(59/799x `39,950) 2,950

61,950

4.

Closing inventories No. of packets

Packets consigned 800

Less: Packet lost in transit (1)

799

Less: Packets sold 740

59

© The Institute of Chartered Accountants of India

6.72 PRINCIPLES AND PRACTICE OF ACCOUNTING

ANSWER 3

Consignment Account

` `

To Goods sent on consignment A/c 7,20,000 By Consignee’s A/c-Sales 8,88,000

(800x ` 900) (740x100x `12)

To Cash A/c 80,000

(expenses 800x `100) By Abnormal Loss Cash A/c 570

(insurance claim)

To Consignee’s A/c: By Profit and loss account 430

Recurring expenses 22,500 (abnormal loss)

Non-recurring expenses 39,950 By Consignment stock A/c 61,950

Commission @ 2% on ` 8,88,000 17,760

Del-credere commission @ 1% on 8,880

` 8,88,000

To Profit and loss A/c 61,860

(profit on consignment)

9,50,950 9,50,950

ANSWER 4

In the books of Mr. A

Consignment to Mumbai Account

2016 ` 2016 `

March 1 To Goods sent on consignment A/c 1,00,000 Dec. 31 By B’s A/cs 1,50,000

To Cash A/c (freight and insurance) 12,000

To B’s A/c:

Clearance expenses 3,000

Selling expenses 2,000

Commission

@ 5% on ` 1,50,000 7,500

Del-credere commission @3% on 17,000

` 1,50,000 4,500

Dec. 31 To Provision for expenses 260

(bank charges)

To Profit and loss A/c 20,740

(profit on consignment)

1,50,000 1,50,000

© The Institute of Chartered Accountants of India

ACCOUNTING FOR SPECIAL TRANSACTIONS 6.73

B’s Account

2016 ` 2016 `

Dec. 31 To Consignment A/c 1,50,000 Dec. 31 By Consignment A/c-

Clearance expenses 3,000

Selling expenses 2,000

Commission 7,500

Del-credere commission 4,500 17,000

By Balance c/d 1,33,000

1,50,000 1,50,000

2017 2017

Jan. 1 To Balance b/d 1,33,000 Jan. 5 By Bank A/c 1,33,000

Bank Account

2017 ` 2017 `

Jan. 5 To B’s account 1,33,000 Jan. 5 By Bank charges 260

Jan. 5 By Balance c/d 1,32,740

1,33,000 1,33,000

Provision for Expenses Account

2017 ` 2017 `

Jan. 5 To Bank charges 260 Jan. 1 By Balance b/d 260

260 260

© The Institute of Chartered Accountants of India

You might also like

- Acct For ConsignmnetDocument12 pagesAcct For Consignmnetsamuel debebe100% (2)

- Hotel Confirmation VougfhgcherDocument2 pagesHotel Confirmation Vougfhgcherprakash1580No ratings yet

- ConsignmentDocument15 pagesConsignmentRajesh Nangalia100% (4)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Unit 3: Consignment: Learning OutcomesDocument35 pagesUnit 3: Consignment: Learning OutcomesDurga Prasad HNo ratings yet

- CH 06 Unit 03Document31 pagesCH 06 Unit 03ASIFNo ratings yet

- Unit - 3 Consignment: Learning OutcomesDocument36 pagesUnit - 3 Consignment: Learning OutcomesPrathamesh KambleNo ratings yet

- Semester - 1 Financial Accounting Chapter 2 - Consignment: (I) (Ii) (Iii)Document11 pagesSemester - 1 Financial Accounting Chapter 2 - Consignment: (I) (Ii) (Iii)Shrinidhi.k.joisNo ratings yet

- 645e3cb1e4b003b879fda54c OriginalDocument9 pages645e3cb1e4b003b879fda54c OriginalPiyush RajNo ratings yet

- Specialised Accounting Unit 1 - ConsignmentDocument24 pagesSpecialised Accounting Unit 1 - Consignmentnidhi71002No ratings yet

- ConsignmentDocument71 pagesConsignmentHarneet KaurNo ratings yet

- Consignment: Fundamentals of AccountingDocument71 pagesConsignment: Fundamentals of AccountingMahi KapseNo ratings yet

- Accounting For ConsignmentDocument9 pagesAccounting For Consignmentmakhijanetra821No ratings yet

- Chapter 1 (Cansingnment Account)Document24 pagesChapter 1 (Cansingnment Account)Bravish GowardhanNo ratings yet

- ConsignmentDocument71 pagesConsignmentAnmol Mahajan0% (1)

- 28900cpt Fa SM Cp7 Part1Document112 pages28900cpt Fa SM Cp7 Part1Lenin KumarNo ratings yet

- Consignment ConceptDocument3 pagesConsignment ConceptMark BrianNo ratings yet

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Consignment SalesDocument7 pagesConsignment SalesfrondagericaNo ratings yet

- V.-Accounts ReceivableDocument4 pagesV.-Accounts Receivableby ScribdNo ratings yet

- Consignment Chapter-Full ConceptsDocument9 pagesConsignment Chapter-Full Conceptsguptapranav980No ratings yet

- Consignment AccountsDocument10 pagesConsignment AccountsVirencarpediemNo ratings yet

- BCOM FA Unit-2Document44 pagesBCOM FA Unit-2Kavitha aradhya100% (1)

- Consignment SalesDocument16 pagesConsignment Salesjkgala14No ratings yet

- MEI Consignment Accounts (Mei) ConsignmentDocument17 pagesMEI Consignment Accounts (Mei) Consignmentspeed racerNo ratings yet

- Consignment Accounting Journal EntriesDocument22 pagesConsignment Accounting Journal EntriesRashid HussainNo ratings yet

- Consignment Accounts: Consignment-What Is It?Document6 pagesConsignment Accounts: Consignment-What Is It?neeraj goyal100% (1)

- Acc 103 - Day 24 - TGDocument9 pagesAcc 103 - Day 24 - TGleisky3.07No ratings yet

- Acc 103 - Day 24 - TGDocument9 pagesAcc 103 - Day 24 - TGMJ RoxasNo ratings yet

- Accounting For ConsignmentDocument7 pagesAccounting For ConsignmentsmlingwaNo ratings yet

- Reflection Paper-Ba233N IFTransactionDocument7 pagesReflection Paper-Ba233N IFTransactionJoya Labao Macario-BalquinNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingdeepsmindNo ratings yet

- Chapter 2 InventoriesDocument10 pagesChapter 2 Inventoriesvea domingoNo ratings yet

- Consignment Account Doc 2Document13 pagesConsignment Account Doc 2subhankar fc100% (1)

- Consignment Accounts: 2.0 ObjectiveDocument16 pagesConsignment Accounts: 2.0 ObjectivevasanthaNo ratings yet

- ConsignmentDocument10 pagesConsignmentshreyu14796No ratings yet

- merchandising-operationsDocument14 pagesmerchandising-operationsCharisse AbordoNo ratings yet

- Advanced Financial Accounting Volume 01Document162 pagesAdvanced Financial Accounting Volume 01KeziaNo ratings yet

- ISC Accounts ConsignmentDocument4 pagesISC Accounts Consignmentbcom100% (3)

- Financial Accounting NotesDocument12 pagesFinancial Accounting Notesmathiaschacha21No ratings yet

- Consignment AccountsDocument3 pagesConsignment Accountsabdulhadiqureshi80% (10)

- IAS 18 Part B RevenueDocument10 pagesIAS 18 Part B RevenueKatreena Mae ConstantinoNo ratings yet

- Consignment Account With Del Credere Clause: by Nikhil BabuDocument8 pagesConsignment Account With Del Credere Clause: by Nikhil BabuVarsha ThimmaiahNo ratings yet

- Consignment AccountDocument9 pagesConsignment AccountGamers 4 lyfNo ratings yet

- BA 114.1 - Module2 - Receivables - Handout PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Handout PDFKurt OrfanelNo ratings yet

- Consignment Accounts by Prof. Bharat GuptaDocument9 pagesConsignment Accounts by Prof. Bharat GuptaZENITH EDUSTATIONNo ratings yet

- Factoring & Forfaiting: Junior Level Presentation Compiled by V.V.S. RaoDocument21 pagesFactoring & Forfaiting: Junior Level Presentation Compiled by V.V.S. RaoVvs RaoNo ratings yet

- Accounting ReviewerDocument16 pagesAccounting ReviewerJannine SebastianNo ratings yet

- Consignment MaterialDocument8 pagesConsignment MaterialSrikanth SiripuramNo ratings yet

- Class Notes of Consignor & ConsigneeDocument13 pagesClass Notes of Consignor & ConsigneeDb100% (1)

- Consignment AccountsDocument8 pagesConsignment AccountsAAPCC CollegeNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Textbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterNo ratings yet

- Understanding Commercial Real Estate Contracts: Commercial Real Estate Transactions Guide, #2From EverandUnderstanding Commercial Real Estate Contracts: Commercial Real Estate Transactions Guide, #2No ratings yet

- Indotronix Benefits Offerings For W2 Contract Employees: Excellence in IT SolutionsDocument1 pageIndotronix Benefits Offerings For W2 Contract Employees: Excellence in IT SolutionsEkshitha ChoudharyNo ratings yet

- PDFDocument3 pagesPDFEkshitha ChoudharyNo ratings yet

- Kadambala Ekshitha Chowdri PDFDocument1 pageKadambala Ekshitha Chowdri PDFEkshitha ChoudharyNo ratings yet

- Interview LetterDocument2 pagesInterview LetterEkshitha ChoudharyNo ratings yet

- 10 Roxas V Cta 23 Scra 276Document1 page10 Roxas V Cta 23 Scra 276Gabe RuaroNo ratings yet

- How Much Should A Corporation Borrow?: Principles of Corporate FinanceDocument35 pagesHow Much Should A Corporation Borrow?: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- The Economic Strangulation of Bihar: Mohan Guruswamy Abhishek KaulDocument22 pagesThe Economic Strangulation of Bihar: Mohan Guruswamy Abhishek KaulD KNo ratings yet

- Rane Brake Lining FactsheetDocument3 pagesRane Brake Lining Factsheetharshilshah76760% (1)

- Cost Accounting 21Document3 pagesCost Accounting 21aromalsolteroNo ratings yet

- Quester KMJ 2Document2 pagesQuester KMJ 2Mauwd Ngejhar Jhet0% (1)

- Maths Literacy QUESTION BANK-Paper 1-Question 2Document14 pagesMaths Literacy QUESTION BANK-Paper 1-Question 2Molelekoa LebonaNo ratings yet

- CFP Mock Test Introduction To Financial PlanningDocument7 pagesCFP Mock Test Introduction To Financial PlanningDeep ShikhaNo ratings yet

- PPPC Pub Brochure Feb 2018Document36 pagesPPPC Pub Brochure Feb 2018Rheneir MoraNo ratings yet

- Appointment Contract - ChakmaDocument9 pagesAppointment Contract - ChakmaThe London Free PressNo ratings yet

- JioDocument2 pagesJioMadhur Raj NNo ratings yet

- VLPK PF StatementDocument1 pageVLPK PF StatementhariveerNo ratings yet

- Commissioner of Internal Revenue V Burroughs Limited and The Court of Tax AppealsDocument1 pageCommissioner of Internal Revenue V Burroughs Limited and The Court of Tax AppealsJohn YeungNo ratings yet

- Economies of ScaleDocument18 pagesEconomies of Scalesinghanshu21No ratings yet

- Notes For Fundamental of PartnershipDocument13 pagesNotes For Fundamental of Partnershipalphalegend9234No ratings yet

- ACP 311.-ACP 311: Corporate Liquidation-01Document3 pagesACP 311.-ACP 311: Corporate Liquidation-01v.ragasa.138521.tcNo ratings yet

- NP 286 (3) Mediterranean and AfricaDocument20 pagesNP 286 (3) Mediterranean and AfricaNishant PushpamNo ratings yet

- HW1 FDDocument3 pagesHW1 FDJatin NegiNo ratings yet

- Expense Form For Company January SampleDocument1 pageExpense Form For Company January Samplejacob.colstonNo ratings yet

- Multi-Modal Transport Networks and LogisticsDocument12 pagesMulti-Modal Transport Networks and LogisticsornotNo ratings yet

- About HGSDocument3 pagesAbout HGSNagnath B HalgondeNo ratings yet

- Chapter#1: Bannu Woolen Mills LTDDocument55 pagesChapter#1: Bannu Woolen Mills LTDNajeeb khan100% (2)

- Chapter 1 ReviewerDocument16 pagesChapter 1 Revieweranon_879788236No ratings yet

- Iepf 2016Document1,776 pagesIepf 2016Sohan SoNuNo ratings yet

- Disbursement Voucher 2Document1 pageDisbursement Voucher 2janseninsta insta100% (1)

- Tugas AkmenDocument3 pagesTugas AkmenGhifari Agung DarmawanNo ratings yet

- Jpmorgan Chase Quant Finance Mentorship Case Study 2024Document25 pagesJpmorgan Chase Quant Finance Mentorship Case Study 2024anshikamittal2626No ratings yet

- Question Chapter1 Final 1Document11 pagesQuestion Chapter1 Final 1Mạnh Đỗ ĐứcNo ratings yet

- RBI PublicationsDocument33 pagesRBI PublicationsJuned YaseerNo ratings yet