Partnership and Corporation Problem Example

Partnership and Corporation Problem Example

Uploaded by

Gabrielle Ruthe LaoCopyright:

Available Formats

Partnership and Corporation Problem Example

Partnership and Corporation Problem Example

Uploaded by

Gabrielle Ruthe LaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Partnership and Corporation Problem Example

Partnership and Corporation Problem Example

Uploaded by

Gabrielle Ruthe LaoCopyright:

Available Formats

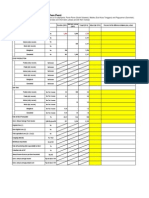

PARTNERSHIP AND CORPORATION ACCOUNTING

Problem F: DGB and DSP are partners engaged in an export-import business. Several transactions

during 2018 affected the partners’ capital accounts, which are summarized as follows:

DGP DSP

Debit Credit Debit Credit

Balance, Jan. 1 ₱600,000.00 ₱800,000.00

Mar. 1 ₱100,000.00

Apr. 1 ₱200,000.00

May 1 ₱100,000.00

Jun. 30 ₱150,000.00

Aug. 30 ₱100,000.00

Oct. 1 ₱150,000.00

Oct. 31 ₱125,000.00 ₱50,000.00

At the end of the year, the Income Summary account has a credit balance of ₱180,000.00.

6. If profits and losses are divided using the average capital ratio, how much is the share of DGB

in the profit?

RATIO OF AVERAGE CAPITAL BALANCES

Investments & Capital Average

PARTNERS Date Month Year Month

Withdrawals Balance Capital

Balance, Jan. 1 ₱600,000.00 ₱600,000.00 2 12 ₱100,000.00

Mar. 1 (₱100,000.00) ₱500,000.00 2 12 ₱83,333.33

DGB May 1 ₱100,000.00 ₱600,000.00 5 12 ₱250,000.00

Oct. 1 ₱150,000.00 ₱750,000.00 1 12 ₱62,500.00

Oct. 31 (₱125,000.00) ₱625,000.00 2 12 ₱104,166.67

12

DGB's Average Capital ₱600,000.00

Balance, Jan. 1 ₱800,000.00 ₱800,000.00 3 12 ₱200,000.00

Apr. 1 ₱200,000.00 ₱1,000,000.00 3 12 ₱250,000.00

DSP Jun. 30 (₱150,000.00) ₱850,000.00 2 12 ₱141,666.67

Aug. 30 (₱100,000.00) ₱750,000.00 2 12 ₱125,000.00

Oct. 31 ₱50,000.00 ₱800,000.00 2 12 ₱133,333.33

12

DSP's Average Capital ₱850,000.00

Total Average Capital ₱1,450,000.00

Net Income Ave. Cap. Total Ave. Cap. Profit Share

DGB ₱180,000.00 ₱600,000.00 ₱1,450,000.00 ₱74,482.76

DSP ₱180,000.00 ₱850,000.00 ₱1,450,000.00 ₱105,517.24

₱180,000.00

7. Assume that the partners agreed on the following interest on average capital at 8%; salaries of

₱24,000 and ₱48,000 to DGB and DSP respectively; bonus to DGB at 20% of profit after deducting

interest and salaries but before deducting bonus; and any remaining amount divided equally. How

much is the share of DSP in profit?

Interests

DGB ₱600,000.00 0.08 ₱48,000.00

DSP ₱850,000.00 0.08 ₱68,000.00

TOTAL INTERESTS ₱116,000.00

DGB DSP TOTAL

Salaries ₱24,000.00 ₱48,000.00 ₱72,000.00

Interests ₱48,000.00 ₱68,000.00 ₱116,000.00

Bonus ₱0.00 ₱0.00 ₱0.00

Remaining (₱4,000.00) (₱4,000.00) (₱8,000.00)

SHARE IN

PROFIT

₱68,000.00 ₱112,000.00 ₱180,000.00

*Note: Bonus is profit-based. There would be no bonus allowed if the total salaries and interests

exceed the net income after the deduction of salaries and interest.

“The bonus is computed on the basis of partnership profit as the concept of ‘partnership profit’ is

generally understood in accounting practice. Partners may, however, intend for salaries and interest

allowances to be deducted in determining the base for computing the bonus. In such case, no bonus

is allowed if there is insufficient profit after distribution of salaries and interests.” (Tolentino-

Baysa, G. J., & Lupisan, M. C. Y. 2018. Accounting for Partnership and Corporation. 2018th Ed.

Mandaluyong City, Philippines: Millenium Books, Inc.)

You might also like

- Sample Motion To Quash Service For California Under Code of Civil Procedure Section 418 10Document4 pagesSample Motion To Quash Service For California Under Code of Civil Procedure Section 418 10christina giangola100% (2)

- Adult Specialist Care 3edDocument345 pagesAdult Specialist Care 3edmjp.monierNo ratings yet

- Trade Your Way To Financial Freedom PDFDocument23 pagesTrade Your Way To Financial Freedom PDFPolinNo ratings yet

- Partnership Formation ExercisesDocument8 pagesPartnership Formation ExercisesMarjorie NepomucenoNo ratings yet

- Comprehensive Review For CorporationDocument25 pagesComprehensive Review For CorporationJoemar Santos Torres100% (3)

- Paid and Not Currently Matched With EarningsDocument46 pagesPaid and Not Currently Matched With EarningsBruce SolanoNo ratings yet

- Prelim AFAR 1Document6 pagesPrelim AFAR 1Chris Phil Dee75% (4)

- Partnership and CorporationDocument6 pagesPartnership and CorporationShaira Nicole Vasquez50% (2)

- Answers in Exercise For Partnership FormationDocument9 pagesAnswers in Exercise For Partnership FormationAllen Gonzaga100% (2)

- AE 13 Partnership Corp. Acctg 2019 2020 PDFDocument6 pagesAE 13 Partnership Corp. Acctg 2019 2020 PDFMaebell P. ValdezNo ratings yet

- Runaway by Peter MayDocument3 pagesRunaway by Peter MayQuercus Books0% (1)

- Praise of Folly by Erasmus Translated by Betty Radice PDFDocument213 pagesPraise of Folly by Erasmus Translated by Betty Radice PDFBellatrix67% (3)

- Chapter 4Document15 pagesChapter 4nicole bancoro100% (1)

- PartnershipDocument24 pagesPartnershipEthan75% (4)

- Theories ProblemsDocument9 pagesTheories ProblemsKristine Esplana ToraldeNo ratings yet

- 1.2. Partnership Operations and Distributions of Profits or LossesDocument4 pages1.2. Partnership Operations and Distributions of Profits or LossesKPoPNyx EditsNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- Accounting For PartnershipDocument46 pagesAccounting For PartnershipRejean Dela Cruz100% (2)

- Financial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaDocument41 pagesFinancial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaEthan Manuel Del ValleNo ratings yet

- Account Description Debit CreditDocument2 pagesAccount Description Debit Creditpamela dequillamorte100% (1)

- Parcor CaseletsDocument13 pagesParcor CaseletsErika delos Santos100% (2)

- Lesson 3 Partnership DissolutionDocument80 pagesLesson 3 Partnership DissolutionmarkNo ratings yet

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Activity Partnership DissolutionDocument2 pagesActivity Partnership DissolutionKaren Joy Jacinto ElloNo ratings yet

- Untitled Document 6Document7 pagesUntitled Document 6lee doroNo ratings yet

- Instructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Document10 pagesInstructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Nicole Fidelson0% (1)

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Parcor 001Document16 pagesParcor 001Vincent Larrie Moldez0% (2)

- Acct102 Midterm NotesDocument15 pagesAcct102 Midterm NotesWymple Kate Alexis FaisanNo ratings yet

- Exercises - Partnership CombinepdfDocument8 pagesExercises - Partnership CombinepdfRiana CellsNo ratings yet

- CHAPTER 2 PartnershipDocument17 pagesCHAPTER 2 PartnershipLAZARO, Jaspher S.No ratings yet

- Parcor Proj (Version 1)Document45 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- ParcorDocument12 pagesParcoreys shop100% (1)

- Simulated Midterm Exam. Far1 PDFDocument11 pagesSimulated Midterm Exam. Far1 PDFDyosang BomiNo ratings yet

- Partnership Operation Practice Problems PDFDocument11 pagesPartnership Operation Practice Problems PDFMeleen TadenaNo ratings yet

- Accounting For Corporation Reviewer 1 PDFDocument27 pagesAccounting For Corporation Reviewer 1 PDFKrisha SaltaNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- Problem 1 Accrual of Interest ExpenseDocument1 pageProblem 1 Accrual of Interest ExpenseJhanin BuenavistaNo ratings yet

- Partnership Exercise 2Document5 pagesPartnership Exercise 2nikNo ratings yet

- PARTNERSHIP1Document27 pagesPARTNERSHIP1Christine Mae Mata100% (3)

- Basic Accounting With Basic Corporate Accounting (ACCT 101)Document24 pagesBasic Accounting With Basic Corporate Accounting (ACCT 101)Harvy TorreburgerNo ratings yet

- MODULE 5 - Partnership Nature and FormationDocument31 pagesMODULE 5 - Partnership Nature and FormationFRANCES JEANALLEN DE JESUS100% (1)

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Partnership Dissolution ActivitiesDocument9 pagesPartnership Dissolution Activitieschrstncstllj100% (1)

- SiwaloDocument18 pagesSiwaloLaina Recel NavarroNo ratings yet

- PartnershipDocument9 pagesPartnershipChariz Audrey100% (1)

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDocument15 pagesPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- 1 Lecture Notes DissolutionDocument17 pages1 Lecture Notes DissolutionMaybelle Espenido0% (2)

- Multiple-Choice-Questions FinalDocument3 pagesMultiple-Choice-Questions FinalFreann Sharisse AustriaNo ratings yet

- Partner DissolutionDocument12 pagesPartner DissolutionFionna Rei DeGaliciaNo ratings yet

- HandOut No. 3 ParCor Partnership DissolutionDocument9 pagesHandOut No. 3 ParCor Partnership Dissolutionnatalie clyde matesNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- ACC 121C-Financial Accounting & Reporting II:: Vergil Joseph I. Literal, DBA, CPADocument8 pagesACC 121C-Financial Accounting & Reporting II:: Vergil Joseph I. Literal, DBA, CPAhsjhsNo ratings yet

- Nayve, Kimberly IDocument113 pagesNayve, Kimberly IKim Nayve50% (10)

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Partnership Formation - : Individuals With NO Existing Business Formed A PartnershipDocument16 pagesPartnership Formation - : Individuals With NO Existing Business Formed A PartnershipFrancis SantosNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Blades Pty - LTD Blades Pty - LTD: A Case Study in Cash BudgetingDocument3 pagesBlades Pty - LTD Blades Pty - LTD: A Case Study in Cash BudgetingYesi Nadia SemanNo ratings yet

- SC BladesDocument3 pagesSC Bladesxiaotuling117No ratings yet

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanNo ratings yet

- Chapter 2 (Prob.1-10) - Partnership and Corp.Document10 pagesChapter 2 (Prob.1-10) - Partnership and Corp.Andrea Joy ReyNo ratings yet

- Journal I ZingDocument30 pagesJournal I ZingDelfa CastillaNo ratings yet

- Bir Revenue RegulationDocument140 pagesBir Revenue RegulationMartin EspinosaNo ratings yet

- General Knowledge QA-1Document15 pagesGeneral Knowledge QA-1Bashir PukhtoonyarNo ratings yet

- A Meeting Planner's Guide To Catered EventsDocument26 pagesA Meeting Planner's Guide To Catered EventsjaykumariyerNo ratings yet

- Gi A Kì Test 12Document3 pagesGi A Kì Test 12Trần Anh KhoaNo ratings yet

- The EnemyDocument15 pagesThe EnemyPRATHAM CHATURVEDI 9906No ratings yet

- Codepixel GIZ DevelopmentDocument1 pageCodepixel GIZ DevelopmentLiliia MirgasimovaNo ratings yet

- Gsr313e 10511Document5 pagesGsr313e 10511ModuNo ratings yet

- RHCSA Exam Dump PaperDocument9 pagesRHCSA Exam Dump PapermanojbarphaniNo ratings yet

- Barangay Sports FestDocument6 pagesBarangay Sports FestAlliah MatozaNo ratings yet

- Questionnaire Balai Attach (IP-505+IP-509)Document6 pagesQuestionnaire Balai Attach (IP-505+IP-509)Erigas EkaputraNo ratings yet

- Land Relations in The Tribal Societies of Meghalaya: Changing Patterns of Land Use and OwnershipDocument20 pagesLand Relations in The Tribal Societies of Meghalaya: Changing Patterns of Land Use and OwnershipnikhilNo ratings yet

- Asm Science 243126Document2 pagesAsm Science 243126Kalyan MukhopadhyayNo ratings yet

- Accreditation Public PracticeDocument36 pagesAccreditation Public Practicejanpeters0n100% (1)

- Hsys9 Install Config TroubleshootDocument106 pagesHsys9 Install Config TroubleshootpraswerNo ratings yet

- Manual Ball Valves PLDocument23 pagesManual Ball Valves PLrirodrig139No ratings yet

- A Handbook Jammu and Kashmir StateDocument91 pagesA Handbook Jammu and Kashmir StateIftikhar Gilani0% (1)

- Film's Plot Pitch Deck by SlidesgoDocument40 pagesFilm's Plot Pitch Deck by SlidesgoRohan JEETOONo ratings yet

- Home Broadband Till Feb 2022Document1 pageHome Broadband Till Feb 2022Aishu NaiduNo ratings yet

- Philosophy of History, A Guide For Students - M. C. LemonDocument478 pagesPhilosophy of History, A Guide For Students - M. C. LemonVincent ParraNo ratings yet

- AF208 Revision Package S2 2019Document30 pagesAF208 Revision Package S2 2019Navin N Meenakshi ChandraNo ratings yet

- Port Railway Cikarang-Kalibaru Train Terminal Urgent - IndIIDocument2 pagesPort Railway Cikarang-Kalibaru Train Terminal Urgent - IndIITeddy HarmonoNo ratings yet

- Sinners in The Hands of An Angry God BackgroundDocument3 pagesSinners in The Hands of An Angry God BackgroundAnnarose HilhorstNo ratings yet

- WLP Q4 W2 HgfeDocument9 pagesWLP Q4 W2 HgfeHannah Grace EataNo ratings yet

- 16 PMK 03 2010 (English) PDFDocument7 pages16 PMK 03 2010 (English) PDFoktovianshNo ratings yet