0 ratings0% found this document useful (0 votes)

79 viewsACC 111 - Simulative

ACC 111 - Simulative

Uploaded by

Precious Anne CantarosThis document appears to be a practice exam for an accountancy program. It contains 25 multiple choice questions testing fundamental accounting concepts. The questions cover topics such as the accounting equation, fundamental accounting concepts, classification of assets and liabilities, the accounting cycle including source documents, journals, ledgers, and financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

ACC 111 - Simulative

ACC 111 - Simulative

Uploaded by

Precious Anne Cantaros0 ratings0% found this document useful (0 votes)

79 views13 pagesThis document appears to be a practice exam for an accountancy program. It contains 25 multiple choice questions testing fundamental accounting concepts. The questions cover topics such as the accounting equation, fundamental accounting concepts, classification of assets and liabilities, the accounting cycle including source documents, journals, ledgers, and financial statements.

Original Description:

Conceptual Framework and Accounting Standards- Test Bank

Original Title

ACC 111- Simulative

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document appears to be a practice exam for an accountancy program. It contains 25 multiple choice questions testing fundamental accounting concepts. The questions cover topics such as the accounting equation, fundamental accounting concepts, classification of assets and liabilities, the accounting cycle including source documents, journals, ledgers, and financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

79 views13 pagesACC 111 - Simulative

ACC 111 - Simulative

Uploaded by

Precious Anne CantarosThis document appears to be a practice exam for an accountancy program. It contains 25 multiple choice questions testing fundamental accounting concepts. The questions cover topics such as the accounting equation, fundamental accounting concepts, classification of assets and liabilities, the accounting cycle including source documents, journals, ledgers, and financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 13

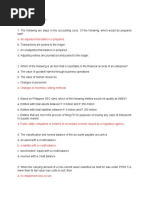

Father Saturnino Urios University

ACCOUNTANCY PROGRAM

Butuan City

SIMULATIVE EXAMINATION

Name: ___________________________________________ Date: _______________

Section: ________________________________________ Score: ______________

Instruction: Shade the letter of the correct answer in the answer sheet.

Strictly no erasures.

1. Which of the following is not a fundamental concept?

a. Entity Concept

b. Periodicity Concept

c. Going Concern

d. Materiality Concept

2. This encompasses the conventions, rules and procedures necessary to define

accepted accounting practice at a particular time.

a. Generally Accepted Accounting Principles

b. Philippine Financial Reporting Standards

c. International Financial Reporting Standards

d. Philippine Accounting Standards

3. This is one of the criteria for general acceptance of an accounting

principle in which the resulting information is not influenced by the

personal bias or judgment of those who furnish it.

a. Relevance

b. Faithful representation

c. Objectivity

d. Feasibility

4. Which of the following is false about the scope of practice of

accountancy?

a. Practice of public accountancy shall constitute in person, be it

his/ her individual capacity, or as a partner or as a staff member

in accounting or auditing firm, holding out himself/ herself as one

skilled in the knowledge, science and practice of accounting, and

as a qualified person to render professional services as a certified

public accountant (CPA); or offering or rendering, or both, to more

than one client of a fee basis or otherwise.

b. Practice in commerce and industry shall constitute in person

involved in decision making requiring professional knowledge in the

science of accounting, or when such employment or position requires

that the holder thereof may be a certified public accountant.

c. Practice in education/ academe shall constitute a person in an

educational institution which involve teaching of accounting,

auditing, management advisory services, finance, business law,

taxation, and other technically related subjects: Provided, that

members of the Integrated Bar of the Philippines may be allowed to

teach business law and taxation subjects.

d. Practice in Government shall constitute in a person who holds, or

is appointed to, a position in an accounting professional group in

government or in government-owned and/ or controlled corporation,

including those performing proprietary functions, where decision

making requires professional knowledge in the science of

accounting, or where a civil service eligibility as a certified

public accountant is required.

5. Created the Accounting Standards Council on November 18, 1981.

a. Junior Philippine Institute of Accountants

b. Philippine Institute of Certified Public Accountants

c. American Institute of Certified Public Accountants

d. Professional Regulations Commission

6. A present economic resource controlled by the entity as a result of past

events. An economic resource is a right that has the potential to produce

economic benefits.

a. Expenses

b. Income

c. Asset

d. Liability

7. Which of the following is not a right that correspond to an obligation of

another party?

a. Rights to receive cash

b. Rights to use intellectual property

c. Rights to receive goods or services

d. Rights to benefit from an obligation of another party to transfer

economic resource if a specified uncertain future events occur.

8. The basic summary device of accounting.

a. T-account

b. Account

c. Journals

d. Ledgers

9. Jovit purchase a fixed asset worth P500,000, a down payment of P100,000

and issued a promissory note for the balance. What is the effect of the

purchase in the accounting equation?

a. Current assets increased.

b. Current liabilities decreased.

c. Noncurrent assets increased.

d. Noncurrent liability decreased.

10. Which of the following is false?

a. Source of Asset transaction refers to as an asset account increases

and the corresponding claims account increases.

b. Exchange of Claims refers to as a claim increases and another claims

increases.

c. Exchange of Assets refers to as one asset account increases and

another asset account decreases.

d. Use of Assets refers to as an asset account decreases and a

corresponding claims account decreases.

11. According to Philippine Accounting Standards (PAS) 1 an entity shall

classify an asset when, except

a. It expects to realize the asset, or intends to sell or consume it,

in its normal operating cycle.

b. It holds the asset primarily for the purpose of trading.

c. It expects to realize the asset within twelve years after the end

of the reporting period.

d. The assets is cash or cash equivalent unless the asset is restricted

from being exchanged or used to settle a liability for at least

twelve months after the reporting period.

12. These are tangible assets that are held by an enterprise for use in the

production or supply of goods or services, or for rental to others, or

for administrative purposes and which are expected or be used during more

than one period.

a. Cash

b. Cash Equivalents

c. Long-term Investments

d. Property, Plant and Equipment

13. Per revised PAS 1, an entity shall classify a liability as current when,

except

a. It expects to settle the liability in its normal operating cycle.

b. It holds the liability primarily for the purpose of trading.

c. The liability is due to be settled within twelve months after the

reporting period

d. The entity have an unconditional right to defer settlement of the

liability for at least twelve months after the reporting period.

14. An entity performed services on account to its clients. What is the effect

if the entity did not record the transaction?

a. Cash is understated

b. Receivable is overstated

c. Revenue is understated

d. Expense is overstated

15. Luffy acquired supplies on account from Zoro, P14,000. What is the effect

of this transaction to its net assets?

a. Increase

b. Decrease

c. No effect

d. Cannot be identified

16. Under double-entry system, what is the value of X if assets, current

liabilities, non-current liabilities and capital are X, P40,000, P60,000

and P350,000 respectively.

a. P250,000 b. P350,000 c. P370,000 d. P450,000

17. Which of the following is correct under double-entry system?

a. Asset amount must be equal to a liability amount.

b. The change in asset must be compensated by a change in liability.

c. The change in a debit-side entry must be compensated by a change in

credit-side entry.

d. An increase in asset must be compensated by a decrease in asset.

18. Which of the following is correct if the sole proprietor of an entity

borrows P90,000 in the name of the entity and deposits it into the entity’s

bank account?

a. The assets of the entity increase by P90,000.

b. The liabilities of the entity decrease by P90,000.

c. The capital of the entity increase by P90,000.

d. The drawings of the entity increase by P90,000.

19. Transaction analysis four basic steps.

Statement I – Identify the transaction from source documents.

Statement II – Ascertain whether each account increased or decreased by

the transaction.

Statement III – Indicate the accounts – either assets, liabilities,

equity, income or expense.

Statement IV – Using the rules of debit and credit, determine whether to

debit or credit the account to record its increase or decrease.

a. I, II, III and IV

b. I, III, II, and IV

c. II, I, III and IV

d. IV, II, III and I

20. These are original written evidences contain information about the nature

and the amounts of the transactions.

a. Accounts

b. Journals

c. Source Documents

d. Ledgers

21. A chronological record of the entity’s transactions.

a. Accounts

b. Journals

c. Source Documents

d. Ledgers

22. The reference book of the accounting system.

a. Accounts

b. Journals

c. Source Documents

d. Ledgers

23. A listing of all the accounts and their account numbers in the ledger.

a. General Journal

b. General Ledger

c. Chart of Accounts

d. Special Journals

24. Which of the following steps in accounting cycle are listed in a logical

order?

a. Prepare the income statement, prepare the statement of financial

position and then prepare a worksheet.

b. Post the journal entries to the ledger accounts, prepare a

worksheet, and then take a trial balance.

c. Journalize the closing entries, post the closing entries, and then

take a post-closing trial balance.

d. Post the closing entries, take a post-closing trial balance, then

journalize the closing entries.

25. Financial statements, except for the cash flows statement, are prepared

using?

a. Cash basis

b. Installment basis

c. Lump-sum basis

d. Accrual basis

26. Expenses are paid but not yet incurred.

a. Accrued revenue

b. Accrued expenses

c. Deferred revenue

d. Prepaid expenses

27. Per 2018 Conceptual Framework, it is the process of capturing for

inclusion in the statement of financial position or statement of financial

performance an item that meets the definition of an asset, liability,

equity, income or expenses.

a. Derecognition

b. Recognition

c. Realization

d. Accumulation

28. The removal of all part of a recognized asset or liability from an entity’s

statement of financial position. This normally occurs when that item no

longer meets the definition of an asset or of liability.

a. Derecognition

b. Recognition

c. Realization

d. Accumulation

29. This kind of adjustment deals with an amount already recorded in a balance

sheet account, the entry, in effect, decreases the balance sheet account

and increases an income statement account.

a. Accrued Expense

b. Accruals

c. Deferred Revenue

d. Deferrals

30. This kind of adjustment deals with an amount unrecorded in any account,

the entry, in effect, increases both a balance sheet and an income

statement account.

a. Accrued Expenses

b. Accruals

c. Deferred Revenue

d. Deferrals

31. Ralph, acquired an insurance for 3 years, P30,000 on January 1. Ralph

made an entry for this transaction debiting prepaid insurance. Ralph made

an appropriate adjusting entry. At the end of the year, which is correct?

a. The balance of insurance at the end of the year is the same at the

beginning of the year.

b. The balance of insurance at the end of the year is higher if expense

method is used.

c. The balance of insurance remain unchanged.

d. The balance of insurance at the end of the year is the same using

either expense or asset method.

32. On January 1, 2018, acquired a building, P1,500,000 with a useful life of

20 years with no residual value. At the end of third year of operations,

what will be the book value of the building?

a. The book value of the building is 225,000 higher than its book value

in the second year.

b. The book value of the building is equal to 85% of the cost.

c. The book value of the building is 150,000 lower than the cost.

d. The book value of the asset is the same as its historical cost.

33. Which of the following is deducted to arrive at the depreciable amount of

straight-line method of depreciation?

a. Acquisition Cost

b. Useful life

c. Market Value

d. Residual Value

34. The liability of an entity for an advance receipt of cash for services

not yet performed or goods not yet delivered.

a. Accounts Payable

b. Accounts Receivable

c. Unearned Revenue

d. Notes Payable

35. On October 1, 2017, Jev Company, pays P50,000 to Beb Company for the goods

to be delivered on January 1, 2018. Jev Company appropriately recorded the

transaction it its books. Beb recorded the transaction on January as debit

to cash and credit to sales. What is the effect of non-recording of

transaction by Beb in 2017 statement of financial position?

a. Assets are overstated

b. Liabilities are understated

c. Income is overstated

d. Proper accounting was made

36. On November 30, 2016, end of the fiscal year 2015-2016, the entity

overlooked the 4 days salaries of 2 employees. The employees are paid a

monthly rate of P17,600 for 22 working days. Which is correct?

a. The salaries expense is understated by P35,200.

b. The net profit for fiscal year 2015-2018 is understated by P35,200.

c. The liabilities are understated P6,400.

d. The net profit for the fiscal year 2015-2016 is overstated by

P3,200.

37. At the beginning of second year, Throy Company has liabilities totaling

to P500,000. The liabilities are composed of Accounts Payable, Notes

Payable (5%), and Notes Payable (8%) with balances of P100,000; P200,000

and P200,000 respectively. The 5% note is payable in full, principal plus

interest, on third year – the note is dated January 1, of the second year.

The 8% note is dated July 1, of the first year, interest is payable every

July 1 and January 1. What will be the balance of Throy’s Liabilities in

the balance sheet at the end of the second year?

a. The balance of the liabilities will be 8,000 higher than the

beginning caused by the incurrence of interest.

b. The ending balance is the same with the beginning balance.

c. The ending balance of liabilities is 3.6% higher than the beginning

balance.

d. The ending balance of the liabilities is 2% higher than the

beginning balance as a result of interest expense.

38. Racecars Company made credit sales of P 1,000,000 in 2017, the fourth

year of operations. Company’s policy provided that 2% of the total credit

sales will be the estimated uncollectible accounts. If the entity made an

appropriate journal entry to reflect the adjustments, which is not correct?

a. Operating Expenses increased by 20,000.

b. Accounts Receivable net realizable value is 20,000 lower than its

last updated balance.

c. Allowance for uncollectible accounts equals to 20,000 if there’s no

beginning balance.

d. Allowance for doubtful accounts ending balance is the same, in all

circumstances, either percent of sales of percent of receivables is

used.

39. Statement I – Enter the account balances in the unadjusted trial balance

columns and total the amounts.

Statement II – Compute each account’s adjusted balances and enter the

adjusted amounts in the adjusted trial balance.

Statement III – Extend the balance sheet and income statement accounts’

balances and total the amounts.

Statement IV – Enter the adjusting entries in the adjustment columns and

total the amounts.

Statement V – Compute for profit or loss for income statement and column

totals for the balance sheet.

What is the correct order in the preparation of worksheet?

a. I,IV, V, II, III

b. I, IV, II, III, V

c. I, III, II, IV, V

d. I, II, IV, III, V

40. Akame and Kurome, partners in AK Guns and Swords Company, hired you as

their accountant. At the end of the year, you have created a comprehensive

worksheet, in the income statement columns you find that the debit balance

is lower than the credit balance. This indicates that

a. When closing temporary accounts, the Income Summary’s net balance

is debit.

b. Company’s total expenses is relatively higher than its income.

c. The company incurs losses for the period.

d. When closing temporary accounts, the Income Summary’s net balance

is credit.

41. This component of financial statement provides a narrative description or

disaggregation of items presented in the statements and information about

items that do not qualify recognition in the statements.

a. Statement of Financial Position

b. Statement of Financial Performance

c. Notes to Financial Statements

d. Statement of Changes in Equity

42. At the end of the first year of operations, as an accountant, you have

been tasked to compile and prepare a statement of financial position. What

will be the best format of presentation for the statement?

a. Report format, since it’s for reporting purposes.

b. Account format, since this will be used internally by the

management.

c. Neither report format nor account format, you can present the

financial statement in whatever style you want.

d. The standard does not prescribe the order or format in which an

entity present items in the statement of financial position.

43. Which of the following are the method of presenting the statement of cash

flows?

a. Direct or Indirect Method

b. Gross or Net Method

c. Allowance or Direct Write-off Method

d. Liquidity or Solvency Method

44. Which of the following is not a cash outflow from operating activities?

a. Payments to employees.

b. Payments for taxes.

c. Payments to acquire property, plant and equipment.

d. Payments for other operating expenses.

45. Which of the following will qualify as Financing Activity?

a. Cash receipts from sale of property, plant and equipment.

b. Cash payments to acquire debt or equity securities.

c. Cash receipts from issuance of notes payable.

d. Cash payments to make loans to others generally in the form of notes

receivable.

46. Which of the following statements is/ are true?

I – The income statement reports all income and expenses during the period.

The profit or loss is the final figure in this statement.

II – The statement of changes in equity considers the profit or loss figure

from the income statement as one of the determining factors that explains

the change in owner’s equity.

III – The statement of financial position reports the ending owner’s

equity, taken directly from the statement of changes in equity.

a. I only

b. II only

c. I and III only

d. I, II, and III

47. It is the exact opposite of a related adjusting entry made at the end of

the period.

a. Adjusting Entries

b. Closing Entries

c. Reversing Entries

d. Correcting Entries

48. A formal notice to the debtor detailing the accounts already due.

a. Official Receipt

b. Statement of Account

c. Bill of lading

d. Receiving report

49. Which of the following is not a source document found in the purchase

transaction?

a. Purchase Requisition

b. Purchase Order

c. Sales Invoice

d. Receiving Report

50. In credit terms 5/10, n/30, the 30 represents

a. The discount period.

b. The discount rate.

c. The due date of account.

d. The last date to avail discount.

51. The cash discount on the buyer’s viewpoint.

a. Purchase Returns

b. Sales Returns

c. Purchase Discount

d. Sales Discount

52. Assume that an invoice for P300,000 with terms 2/10, n/30, is to be paid

within the discount period with money borrowed for the remaining 20 days

of the credit period. The borrowed money with 18% interest will be repaid

on the 20th day starting from the date of availment. Which is correct (use

360 days)?

a. The entity will borrow an amount of P300,000.

b. The entity will have a net savings of P3,060.

c. The entity will incur an interest expense of P54,000.

d. The entity will not benefit from the borrowing.

53. Statement I – There is no trade discount account and there is no special

accounting entry for this discount.

Statement II – All accounting entries are based on the invoice price which

is obtained by subtracting the trade discount from the list price..

Which is correct?

a. Statement I is false.

b. Statement II is false.

c. Both Statements are false.

d. Neither of the statements are false.

54. VIVA LGBTQ+ Company acquired machinery from ABCDE Company. Based on their

negotiation, VIVA LGBTQ+ will be granted with 10% and 20% trade discount

aside from the cash discount of 2/10, n/30. The entity paid within the

discount period amounting to P626,265.864. What is the amount of list

price of the machinery?

a. The list price is unnecessary for computing the invoice price,

therefore, list price should not be computed.

b. The list price is equal to 900,000 gross of deductions.

c. The list price is equal to the cash payment divided by 70.56%.

d. The list price is equal to invoice price plus cash discounts and

trade discounts.

55. On February 1, 2018, Justin Company, purchased merchandise inventory on

account from Selena Company, P100,000 with terms 2/10, n/30 – FOB shipping

point. The goods were shipped on March 1, 2018. The entry record the

payment of account within the discount period will typically include

a. Debit to Purchases, P100,000 if periodic inventory system is used.

b. Debit to Accounts Payable, P100,000 either periodic or perpetual

inventory system is used.

c. Credit to Accounts Payable P100,000.

d. Credit to Cash, P100,000.

56. Lyn-lyn Company acquired merchandise inventory worth P50,000 with terms

of 2/10, n/30 FOB shipping point, freight prepaid. Freight amounted to

P2,000. The freight is not recorded by the seller. Is the seller correct

in non-recording of freight?

a. No, since he is the seller, he should record the freight.

b. Yes, since the obligation to pay is on the seller but is not

appropriate to record because the amount is immaterial.

c. No, the seller should record the freight since the term is FOB

shipping point.

d. Yes, the seller should not be the one paying the freight, still

will record an entry to recognize a receivable from the buyer.

57. Velasco Company is a manufacturing entity. During the year, the company

acquired a machinery worth P90,000 with a residual value of P10,000 and a

useful life of 8 years. Velasco Company made an appropriate adjusting

journal entry at the end of the year. What expense recognition principle

was observed by the company in recording the adjustments?

a. Going Concern

b. Immediate Recognition

c. Cause and effect association

d. Systematic and rational allocation

58. PJ Company, a leading merchandising entity, forecasted an increase of 30%

in unit sales for the next year of operation. Current net income shows an

amount equal to P75,000,000. Selling price is P250 and the cost is P150

per unit. The operating expenses is expected to increase to 15% from the

current year’s 10%. The next year’s operating expenses is expected to be

20% of sales, 25% higher than current year. Which is correct?

a. Net sales for the current year is P300,000,000.

b. The expected net income for the next year is 108 1/3% of the current

year’s net income.

c. The net income for the next year would be P97,500,000.

d. The Cost of goods sold for the current year equals to 243,750,000.

59. I – Gross margin is understated if sales is understated.

II – Gross margin is overstated if Cost of Goods sold in understated.

III – Net income is overstated if the ending inventory is overstated.

IV – Net income is understated if the operating expenses is understated.

a. I, II and IV are false

b. I, III, and IV are true

c. I, II, and III are true

d. I, III and IV are false

60. The optional step in accounting cycle.

a. Closing Entries

b. Post-closing trial balance

c. Reversing Entries

d. Adjusting Entries

61. Which is false?

a. Input tax increased the amount to be paid but has no effect on the

cost of purchases.

b. Output tax increase the amount collected but not necessarily, the

sales figure.

c. Value-added tax payable is the excess of output tax over input tax.

d. Input tax and output tax are contra-purchase and contra-sales

account respectively.

62. Saitama Company is a VAT registered Wholesaler of goods. During the

current year, he had a total purchases of P6,720,000 and a total sales of

P12,320,000. Can Saitama claim an input VAT?

a. No, since he is a wholesaler.

b. Yes, either retailer or wholesaler he can claim input VAT.

c. No, he cannot claim because his purchases is less than 10,000,000.

d. Yes, a VAT registered entity can claim input VAT.

63. The largest single expense in the income statement.

a. Operating Expenses

b. Finance Cost

c. Cost of sales

d. Administrative and Selling Expenses

64. Urnym,CPA, accountant of FirLas Company, encountered problems about the

records of the past accountant. Company used perpetual inventory system

in accounting its inventories. In 2018, before closing the books, Urnym

found out that the past accountant did not record cost of sales entry for

every sale transaction. The sales mark-up is 25% on cost. What will be the

appropriate step Urnym should perform?

a. Cost of sales should be established, based on the cost of sales

ratio, to have a proper matching of expenses to revenues.

b. Urnym will just copy the last year’s cost of sales for simplicity.

c. Urnym will resign to avoid problems of the company.

d. Cost of sales is also an expense therefore it can be presented as

one line item together with operating expenses.

65. Which of the following items can lead to a difference between values of

profit and gross profit?

a. Sales returns

b. Transportation in

c. Purchase returns

d. Transportation out

66. Lyndon Company had an inventory balance of P300,000 on January 1. At the

end of the year the balance of inventory per physical count amounted to

P200,000. Lyndon uses periodic inventory system. If the entity used an

adjusting entry method to establish the ending inventory balance, an entry

will typically include?

a. Debit Merchandise Inventory, beginning P200,000.

b. Credit Income Summary, P300,000.

c. Credit Merchandise Inventory, ending P200,000.

d. Debit Income Summary, P300,000.

67. These are journals of original entry that are designed for recording

specific types of transactions of a similar nature.

a. General Journal

b. General Ledger

c. Special Journal

d. Subsidiary Journal

68. Which of the following uses of special journal is mismatched?

a. Sales journal is used in recording the sale of merchandise on

account.

b. Cash receipts journal is used in recording receipts of cash.

c. Purchases journal is used to record credit purchases of merchandise

and other items.

d. General journal is used to record entries of daily transactions.

69. Adjunct account of purchases.

a. Purchase returns

b. Purchase discounts

c. Freight-in

d. Freight-out

70. Inventories should be measured at

a. Cost

b. Net Realizable Value

c. Lower of cost or net realizable value

d. Fair market value

71. Revenue is recognized at the point of collection. The amount of revenue

is determined by multiplying the gross profit rate by the amount of

collections.

a. Installment Method

b. Cost recovery Method

c. Cash Method

d. Percentage of Collection method

72. Revenue is recognized at the point of production.

a. Sunk cost method

b. Cash Method

c. Production method

d. Percentage of completion

73. Revenue is recognized when received regardless of when earned.

a. Cost recovery method

b. Cash method

c. Accrual method

d. Percentage of completion

74. When the outcome of a construction contract can be estimated reliably,

contract revenue and contract costs associated with the construction

contract shall be recognized as revenue and expenses, respectively, by

reference to the stage of completion of the contract activity.

a. Cost recovery method

b. Accrual Method

c. Cash Method

d. Percentage of completion

75. Which of the following does pertain to the conditions for the recognition

of revenue from sale of goods?

a. The amount of revenue can be measured reliably.

b. The entity retains neither continuing managerial involvement nor

effective control over the goods sold.

c. The cost incurred or to be incurred can be measured reliably.

d. All of the above

76. Which of the following does pertain to the conditions for the recognition

of revenue from rendering of services?

a. The amount of revenue can be measured reliably.

b. It is probable that the economic benefits associated with the

transaction will flow to the entity.

c. The stage of completion of the transaction at the end of the

reporting period can be measured reliably.

d. All of the above.

77. Strict matching principle

a. Cause and effect association

b. Systematic and rational allocation

c. Immediate recognition

d. Matching type

78. When the economic benefits are expected to arise over several accounting

periods and the association with income can be broadly or indirectly

determined, expenses are recognized on the basis of systematic and

allocation procedures.

a. Cause an effect association

b. Systematic and rational allocation

c. Immediate recognition

d. Cost constraint

79. The cost incurred is expensed outright because of uncertainty of future

economic benefits or difficulty of reliability associating certain costs

with future revenue.

a. Cause and effect association

b. Systematic and rational allocation

c. Immediate recognition

d. Cost principle

80. The amount of cash or cash equivalent paid or fair value of the

consideration given to acquire an asset at the time of acquisition.

a. Past purchase exchange price

b. Current purchase exchange price

c. Current sale exchange price

d. Future Exchange price

81. The discounted value of the future net cash inflows that the item is

expected to generate in the normal course of business.

a. Past purchase exchange price

b. Current purchase exchange price

c. Current sale exchange price

d. Future Exchange price

82. The amount of cash or cash equivalent that could currently be obtained by

selling the asset in an orderly disposal.

a. Past purchase exchange price

b. Current purchase exchange price

c. Current sale exchange price

d. Future Exchange price

83. The amount of cash or cash equivalent that would have to be paid if the

same or equivalent asset was acquired currently.

a. Past purchase exchange price

b. Current purchase exchange price

c. Current sale exchange price

d. Future Exchange price

84. The process of determining the monetary amounts at which the elements of

the financial statements are to be recognized and carried in the statement

of financial position and Income statement.

a. Measurement

b. Recognition

c. Classification

d. Interpretation

85. Its main function is to establish and improve accounting standards that

will be generally accepted in the Philippines.

a. International Financial Reporting Standards Council

b. International Accounting Standards Board

c. Financial Reporting Standards Council

d. Accounting Standards Council

86. Its role is to prepare interpretations of PFRS for approval by the FRSC

and in the context of conceptual framework, to provide timely guidance on

financial reporting issues not specifically addressed in current PFRS.

a. International Financial Reporting Interpretations Committee

b. Standing Interpretations Committee

c. International Interpretation Committee

d. Philippine Interpretation Committee

87. Statement I – To formulate and publish in the public interest accounting

standards to be observed in the presentation of financial statements and

to promote their worldwide acceptance and observance.

Statement II – To work generally for the imprisonment and harmonization

of regulations, accounting standards and procedures relating to the

presentation of financial statements.

Statement III - To provide financial information about the reporting

entity that is useful to existing and potential investors, lenders and

other creditors in making decisions about providing resources to the

entity.

Statement IV - To provide quantitative financial information about a

business that is useful to statement users particularly owners and

creditors, in making economic decisions.

Which is true?

a. Statements I and III pertain to objectives of financial reporting

b. Statements II and IV pertain to objectives of IASC

c. Statements I and II pertain to objectives of IASC

d. Statements III and IV pertain to objectives of financial reporting

88. IASC: IASB: IFRS; ASC: FRSC:

a. GAAP

b. PSA

c. FRSC

d. PFRS

89. Statement I – In the past years, most of the Philippine standards issued

are based on American accounting standards.

Statement II – Presently, the Financial Reporting Standards Council has

adopted in their entirety all International Accounting Standards and

International Financial Reporting Standards.

Statement III – In formulating accounting standards that is generally

accepted in the Philippines, the Board of Accountancy together with the

Professional Regulation Commission created standards.

Which is true?

a. Statement I is false

b. Statement II is false

c. Statement III is false

d. Neither of the statements is false

90. The following are statements concerning the factors considered in totally

moving to International Accounting Standards, which is not?

a. Support of international accounting standards by Philippine

organizations, such as the Philippine SEC, Board of Accountancy and

PICPA.

b. Increasing recognition of international accounting standards by the

World Bank, Asian Development Bank and World Trade Organization.

c. Increasing internalization of business which has heightened

interest in a common language for financial reporting.

d. Improvement of Philippine Accounting Standards or removal of free

choices of accounting.

91. A series of pronouncements of standards issued by the Financial Reporting

Standards Council.

a. Philippine Standards on Auditing

b. Government Accounting Manual

c. Philippine Financial Reporting Standards

d. International Financial Reporting Standards

92. Which is not included in the Philippine Financial Reporting Standards?

a. Philippine Interpretations which correspond to Interpretations of

the IFRIC and the Standing Interpretations Committee, and

Interpretations developed by the Philippine Interpretations

Committee.

b. Philippine Accounting Standards which correspond to International

Accounting Standards.

c. Philippine Financial Reporting Standards which correspond to

International Financial Reporting Standards.

d. International Financial Reporting Standards and Interpretations

formulated by the Board of Accountancy and in the provision of RA

9298.

93. The basic notions or fundamental premises on which the accounting process

is based.

a. Accounting Policies

b. Accounting entity assumption

c. Accounting Assumptions

d. Accounting Estimates

94. Assumption or assumptions mentioned in the Conceptual Framework.

a. Going concern, accounting entity, time period, and monetary unit

b. Going concern and Time period

c. Going Concern only

d. Going concern, monetary unit and time period

95. Mr. Gatchalian is engaged into trading business. On January 1, 2018, he

purchased equipment costing P600,000. The equipment has a useful life of

5 years and residual value of P100,000. In the same date, he recorded the

transaction in his journal debiting Equipment account and crediting cash

at cost. What accounting assumption did Mr. Gatchalian observed in

recording the transaction?

a. Going Concern assumption

b. Time period assumption

c. Monetary unit assumption

d. Accounting entity assumption

96. Ms. Yutiamco is a proprietor of a merchandising business. It was

established on January 1, 2008 with a capital investment of P3,000,000.00

and used calendar year for its reporting. On December 30, 2012, Ms.

Yutiamco purchase from Mr. Moscatiles merchandise costing P350,000, FOB

shipping point. The merchandise arrived on January 5, 2013 and recorded

the purchase. What accounting assumption is violated in the situation?

a. Going Concern assumption

b. Time period assumption

c. Monetary unit assumption

d. Accounting entity assumption

97. Ms. Korina Rodriguez is a proprietor of a manufacturing business. Raw

materials were purchased from Mr. Jib. Later on the current year, Ms.

Rodriguez received a birthday gift from Mr. Vincent, a check worth P25,000.

The transaction was recorded by the entity by debiting cash and crediting

income. What accounting assumption was violated in the situation?

a. Going Concern assumption

b. Time period assumption

c. Monetary unit assumption

d. Accounting entity assumption

98. Ms. Crismundo, branch accountant of Syria’s Bullets and Guns Company – an

international company, encountered an importation transaction from its

parent company. The transaction involves equipment worth $300,000 when the

exchange rate was P40 to $1. As an accountant she debited Equipment and

credited cash amounting to P12, 000,000. After three years, the current

market price of Equipment is P45 to $1. However, since the entity has a

policy about using a revaluation method in subsequently measuring its

property, plant and equipment. Therefore, as an accountant, Ms. Crismundo

adjusted the Equipment account balance. What accounting assumption was

observed by Ms. Crismundo?

a. Going concern assumption

b. Time period assumption

c. Monetary unit assumption

d. Accounting entity assumption

99. Depicts the effects of transactions and other events and circumstances on

an entity’s economic resources and claims in the periods in which those

effects occur even if the resulting cash receipts and payments occur in a

different period.

a. Cash method accounting

b. Output method accounting

c. Accrual accounting

d. Crop basis accounting

100. Which of the following is not a limitation of financial reporting?

a. General purpose financial reports can provide all of the information

that existing and potential investors, lenders and other creditors

need.

b. General purpose financial reports are not designated to show the

value of an entity but the reports provide information to help the

primary users estimate the value of the entity.

c. General purpose financial reports are intended to provide common

information to users and cannot accommodate every request for

information.

d. To a large extent, general purpose financial reports are based on

estimate and judgement rather than exact depiction.

You might also like

- Basic Everyday Journal EntriesDocument2 pagesBasic Everyday Journal EntriesMary73% (15)

- Intermediate Accounting 1 Review MaterialsDocument24 pagesIntermediate Accounting 1 Review MaterialsGIRLNo ratings yet

- In Partial Fulfillment of The Requirements For The SubjectDocument44 pagesIn Partial Fulfillment of The Requirements For The SubjectPrecious Anne Cantaros100% (11)

- Exam 1 - Prelims - Key AnswersDocument16 pagesExam 1 - Prelims - Key AnswersClint AbenojaNo ratings yet

- Theory of Accounts With AnswersDocument14 pagesTheory of Accounts With Answersralphalonzo100% (1)

- Cfas Q1Document8 pagesCfas Q1elvis cadungogNo ratings yet

- Qualifying Reviewer Questions CFASDocument9 pagesQualifying Reviewer Questions CFASReinalyn Larisma MendozaNo ratings yet

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- Standard, The Conceptual Framework Overrides That StandardDocument6 pagesStandard, The Conceptual Framework Overrides That StandardwivadaNo ratings yet

- New and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDocument13 pagesNew and Old Conceptual Framework, Accounting Principles, Accounting Process, PAS 18 - RevenueDennis VelasquezNo ratings yet

- Pa48b6epp Prelim ExaminationDocument16 pagesPa48b6epp Prelim ExaminationJames CastañedaNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Cfas Overview To Pas 28Document31 pagesCfas Overview To Pas 28Miss ANo ratings yet

- Cfas StodocuDocument31 pagesCfas StodocuRosemarie Cruz100% (1)

- Practice Problems Far Chap 1-5Document13 pagesPractice Problems Far Chap 1-5Micah Danielle S. TORMONNo ratings yet

- MOCK PHINMA Part 1 PrintDocument12 pagesMOCK PHINMA Part 1 PrintBea EuniceNo ratings yet

- Basic Acc CFAS ANSWERSDocument13 pagesBasic Acc CFAS ANSWERSEzra CalayagNo ratings yet

- 7086 - FAR Preweek Lecture TheoryDocument6 pages7086 - FAR Preweek Lecture TheorypompomNo ratings yet

- Abo Royce Stephen Cfas Activities AnswersDocument37 pagesAbo Royce Stephen Cfas Activities Answerscj gamingNo ratings yet

- CFASDocument15 pagesCFASCamille Anne GalvezNo ratings yet

- ANS AlagangWency-2nd-quizDocument13 pagesANS AlagangWency-2nd-quizJazzy MercadoNo ratings yet

- CFAS - Activity No. 1Document7 pagesCFAS - Activity No. 1Ronel CaagbayNo ratings yet

- Quiz - 1 - Overview of AccountingDocument4 pagesQuiz - 1 - Overview of AccountingBritnys NimNo ratings yet

- ACC 2nd-QuizDocument12 pagesACC 2nd-QuizJazzy MercadoNo ratings yet

- Problems: Problem I: True or FalseDocument75 pagesProblems: Problem I: True or FalseRosemarie Cruz100% (1)

- Written Revalida Cae6Document24 pagesWritten Revalida Cae6Pinky BandoquilloNo ratings yet

- Prelim Exam Set A AkDocument9 pagesPrelim Exam Set A AkPrincess Eve Totañes TorralbaNo ratings yet

- Long Quiz Overview Pas23 ReviewerDocument15 pagesLong Quiz Overview Pas23 ReviewerHassanhor Guro Bacolod100% (1)

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Seeds of The Nations Review-MidtermsDocument9 pagesSeeds of The Nations Review-MidtermsMikaela JeanNo ratings yet

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- Practice ExaminationDocument11 pagesPractice Examinationeternalretard621No ratings yet

- 1styear - Basicaccosqe.2013 1 - 1Document11 pages1styear - Basicaccosqe.2013 1 - 1Darlene VenturaNo ratings yet

- Midterm 112Document3 pagesMidterm 112Mae Ann AvenidoNo ratings yet

- Cfas 1 QuizDocument7 pagesCfas 1 QuizGraciasNo ratings yet

- 1st Year QuestionnairesDocument6 pages1st Year Questionnaireswivada100% (1)

- CFAS - Prelims Exam With AnsDocument12 pagesCFAS - Prelims Exam With AnsAbarilles, Sherinah Mae P.No ratings yet

- CFAS Testbank Answer KeyDocument14 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- CFASDocument7 pagesCFASchoigyu031301No ratings yet

- EXERCISES - Chapters 2 and 3: Part I True or FalseDocument4 pagesEXERCISES - Chapters 2 and 3: Part I True or FalseCaroline BagsikNo ratings yet

- Reviewer in FARDocument7 pagesReviewer in FARshezcas012No ratings yet

- Accounting ExercisesDocument5 pagesAccounting Exercisesjj100% (2)

- Funac Reviewer 1-2-3Document9 pagesFunac Reviewer 1-2-3Allan AntonioNo ratings yet

- Principles of AccountingDocument12 pagesPrinciples of AccountingEliza Mae SumangilNo ratings yet

- Financial AccountingDocument5 pagesFinancial Accountingimsana minatozakiNo ratings yet

- Midterm Exam in Conceptual Framework and Accounting Standards Source: CPA Review SchoolsDocument18 pagesMidterm Exam in Conceptual Framework and Accounting Standards Source: CPA Review Schoolslana del rey100% (1)

- WEEK 1 QUIZZER Basic ConceptsDocument6 pagesWEEK 1 QUIZZER Basic Conceptsmaa.jelynmNo ratings yet

- CFAS Testbank Answer KeyDocument15 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- CFASDocument17 pagesCFASKie Magracia BustillosNo ratings yet

- Quiz 1-CfasDocument8 pagesQuiz 1-CfasRizelle ViloriaNo ratings yet

- Cfas Finals ManifestingDocument5 pagesCfas Finals Manifestingjoyandna1231No ratings yet

- Exam 1 - PrelimsDocument13 pagesExam 1 - PrelimsGeraldine MayoNo ratings yet

- Valix MCQ Chapt 9 10 11 14 PDFDocument26 pagesValix MCQ Chapt 9 10 11 14 PDFRengeline LucasNo ratings yet

- FAR 01 - Accountancy Profession and Conceptual FrameworkDocument3 pagesFAR 01 - Accountancy Profession and Conceptual FrameworkLorreine MartinezNo ratings yet

- Quiz Bee QuestionsDocument19 pagesQuiz Bee QuestionsBelen VergaraNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- ACCTG-101A Midterm-Exams 09.06.19Document5 pagesACCTG-101A Midterm-Exams 09.06.19Ma. Kristine Laurice Amancio100% (1)

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Accounting: Things You Should Know (Questions and Answers)From EverandAccounting: Things You Should Know (Questions and Answers)No ratings yet

- IA 2 Quiz#2 - Reclassification of FA - Investment Property - Answer KeyDocument7 pagesIA 2 Quiz#2 - Reclassification of FA - Investment Property - Answer KeychingchongNo ratings yet

- Tax Review MidtermDocument12 pagesTax Review MidtermPrecious Anne CantarosNo ratings yet

- Bonifacio's SummaryDocument3 pagesBonifacio's SummaryPrecious Anne Cantaros100% (1)

- Obligation: Liability That Is A Consequence of A Criminal OffenseDocument7 pagesObligation: Liability That Is A Consequence of A Criminal OffensePrecious Anne CantarosNo ratings yet

- Ais Expenditure Activity 2Document3 pagesAis Expenditure Activity 2Precious Anne CantarosNo ratings yet

- Investment DrillDocument2 pagesInvestment DrillPrecious Anne Cantaros0% (1)

- AIS James Hall Chapter 5 Problem 8 Answer KeyDocument3 pagesAIS James Hall Chapter 5 Problem 8 Answer KeyPrecious Anne Cantaros100% (1)

- Capital Structure and LeverageDocument43 pagesCapital Structure and LeveragePrecious Anne CantarosNo ratings yet

- Tax Review MidtermDocument12 pagesTax Review MidtermPrecious Anne CantarosNo ratings yet

- Partnership Hot BurgerDocument4 pagesPartnership Hot BurgerApik Siv LotdNo ratings yet

- Cancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98Document2 pagesCancelled Check of Nice Corporation Returned With The Sept. Bank Statement of Nile Corporation and Recorded Thereon: Br. 98zemen tadesseNo ratings yet

- MCQ JournalDocument4 pagesMCQ JournalKanika BajajNo ratings yet

- Top-Level Management: Core CharacteristicsDocument2 pagesTop-Level Management: Core CharacteristicsZach YolkNo ratings yet

- SME 100 List Unveiled: Rules of EngagementDocument3 pagesSME 100 List Unveiled: Rules of EngagementDiana Elena ChiribasaNo ratings yet

- Company Name: Mcdonald'S Corporation Group Members: Ali Naeem 308 Hafiz Ahsan 313 Ahsan Ashraf 324 Ahmed Zaheer 328 M.Haseeb Talib 333Document21 pagesCompany Name: Mcdonald'S Corporation Group Members: Ali Naeem 308 Hafiz Ahsan 313 Ahsan Ashraf 324 Ahmed Zaheer 328 M.Haseeb Talib 333M Haseeb TalibNo ratings yet

- 04 Overheads DistributionDocument15 pages04 Overheads DistributionDevesh BahetyNo ratings yet

- CV Marketing Communications Manager ResumeDocument2 pagesCV Marketing Communications Manager Resumesky456100% (1)

- Strategic Management AssignmentDocument4 pagesStrategic Management AssignmentEmran NoyanNo ratings yet

- PMP 123 Short Version2Document151 pagesPMP 123 Short Version2LindaBalboulNo ratings yet

- Lean 2Document12 pagesLean 2mdkhandaveNo ratings yet

- Global Capitalism: Loquez, Erick P. 1-23 2 GroupDocument13 pagesGlobal Capitalism: Loquez, Erick P. 1-23 2 GroupRowly Pearl Iradiel NedicNo ratings yet

- 01 AC212 Lecture 1-Material PDFDocument30 pages01 AC212 Lecture 1-Material PDFsengpisalNo ratings yet

- Session 1 NPF Overview & Introduction PDFDocument32 pagesSession 1 NPF Overview & Introduction PDFRico SamuelNo ratings yet

- PII Bahan Ajar Administrasi Kontrak 01aDocument27 pagesPII Bahan Ajar Administrasi Kontrak 01aTaufiq AkbarNo ratings yet

- Resturant Plan - Final ProjectDocument10 pagesResturant Plan - Final ProjectUniqeah100% (2)

- Financial AccountingDocument455 pagesFinancial AccountingKalGeorgeNo ratings yet

- NRM Specialist - 13-SepDocument5 pagesNRM Specialist - 13-SepMohammad Asif WardakNo ratings yet

- AB Legal Banking For BOB Clerical To Officer Promotion Exam PDFDocument37 pagesAB Legal Banking For BOB Clerical To Officer Promotion Exam PDFNarayanan RajagopalNo ratings yet

- Supply Chain Management Homework 4Document2 pagesSupply Chain Management Homework 4Tuấn Dũng TrươngNo ratings yet

- Complaints.: by Rights Issue Hout WithDocument4 pagesComplaints.: by Rights Issue Hout WithRocking lifeNo ratings yet

- Company Profile: PT Integritas Solusi IndonesiaDocument21 pagesCompany Profile: PT Integritas Solusi IndonesiaDiana puri LestariNo ratings yet

- SWOT ANALYSIS - Docx PearlDocument6 pagesSWOT ANALYSIS - Docx PearlPamela Joyce RiambonNo ratings yet

- Sap MM Plants Roll Out Project DocumentsDocument1 pageSap MM Plants Roll Out Project DocumentsRohit Gantayat75% (4)

- Lyft Marketing PlanDocument21 pagesLyft Marketing Planapi-534492172100% (1)

- FRIDAY GROUP Comments SuggestionsDocument7 pagesFRIDAY GROUP Comments SuggestionsDafhny Guinto PasionNo ratings yet

- Selling Smarter Not Harder EbookDocument32 pagesSelling Smarter Not Harder Ebooknumikhan.eeNo ratings yet

- Tutorial Letter 101/3/2014: Applications of Management Accounting TechniquesDocument39 pagesTutorial Letter 101/3/2014: Applications of Management Accounting Techniquesngoni mutumeNo ratings yet

- Amul Ice Cream2Document24 pagesAmul Ice Cream2Anuj KhandelwalNo ratings yet