Syllabus Grad SCH Public Fiscal Administration

Syllabus Grad SCH Public Fiscal Administration

Uploaded by

ANGELITA U. ALONZOCopyright:

Available Formats

Syllabus Grad SCH Public Fiscal Administration

Syllabus Grad SCH Public Fiscal Administration

Uploaded by

ANGELITA U. ALONZOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Syllabus Grad SCH Public Fiscal Administration

Syllabus Grad SCH Public Fiscal Administration

Uploaded by

ANGELITA U. ALONZOCopyright:

Available Formats

UNIVERSIDAD DE MANILA

SCHOOL OF PUBLIC MANAGEMNT IN GOVERNMENT

COURSE SYLLABUS

PUBLIC FISCAL ADMINISTRATION

I. COURSE DESCRIPTION:

The course is a study of the various aspects of tax administration, government budgeting,

accounting and auditing, debt management, treasury management and supply

management. It is about the principles and practices of Philippine public finance, fiscal

policy and financial administration in public sector.

The course examines policy options with strategic trade-offs and operational implications,

for the design and implementation of public finance and public policy.in both high income

countries as well as developing and transitional economies.

II. COURSE OBJECTIVES

Public finance issues are central to economic and political discourse worldwide, as one of

the primary functions of the governments is to generate resources from its people to spend

money improving the lives of its people.

At the end of the course, students are expected to :

a.) Have acquired the essential and necessary knowledge and demonstrate competence by

which they can search, assess, evaluate and analyse the strengths and weaknesses of

the prevailing organizations, processes, methods and techniques as well as other

management tools employed by the Government in managing its financial affairs.

b.) Have discovered and be able to formulate suitable and workable solutions to the

problems and weaknesses besetting the prevailing system of public fiscal administration

as well as to study measures to improve the prevailing system.

III. COURSE OUTLINE

A. Introduction to the study of Public Fiscal Administration

1.) Democracy, people and governance

2.) Development and fiscal administration

3.) Evolution of Philippine financial system

B. Public Fiscal Management

1.) Meaning, Role, and Scope of Public Finance Management and Public Policy

2.) Evaluation of the present Philippine Public Finance Management and

Administration

3.) Constitutional and Legal basis of Public Finance and Fiscal Administration in the

Philippines.

C. National Development and Expenditures

1.) The Philippine Resource Generation System, Taxation and Roles of BIR and BOC

2.) Financing National government, local government and public corporation

3.) Processes, methods and Patterns of Public Expenditures

D. Public Finance Cycle

1.) Planning and Budgeting

2.) Implementation, Controlling and Reporting

3.) Public Accountability

- Rationale What> Why>

- Constitutional Mandate and its Operationalization

- Tools, Techniques and Methods

E. Role of the following:

1.) NEDA 4.) BSP 7.) DBM

2.) DOF 5.) MONETARY BOARD

3.) BIR, BOC, EARNIGN AGENCIES 6.) DBCC

F. Public Budgeting System

1.) Theories, Types and Application

2.) Budget Organization and Processes Philippine Style

3.) Current Approaches in Budgeting

G. State Accounting in the Philippines

1.) Government Accounting System

2.) Latest Development in Phil Gov’t Accounting System

3.) Issues and Problems of Government Accounting

H. State Auditing in the Philippines

1.) State Audit System

2.) Latest Development in Philippine Gov’t Audit Miles

3.) Issues and Problems in Government Audit

I. Public Borrowings and Public Debt

1.) Theories of Public Borrowings

2.) Latest Philippine Experience in Public Borrowing

3.) Solutions to Problems

J. State Owned and Controlled Corporation (Public Enterprise)

1.) Definition, Rationale, Nature, Scope and Controls

2.) The Present and Future of Public Corporations

3.) State Ownership vs. Privatization PPP

IV. COURSE REQUIREMENT:

a.) Class Interaction

b.) Group/Individual issue Presentation

c.) Individual Research Paper

d.) Final Exams

V. PRESENTATION AND DISCUSSION OF INDIVIDUAL RESEARCH PAPER

Public Money Scam and Public Audit

Conversion and Technical Malversation

Who Audits COA?

Accounting and Auditing Contacted Out to Private Sector

Debt Service and Government Public Service

New Government Accounting System (EGAS and PPSAS) An evaluation

Organizational Structures of Accounting Services and Auditing Services

BIR-BOC Issues/Problems

Privatization

Graft and Corruption and its Impact on Government Operations and Public

Development

VI. REFERENCES:

You might also like

- Public Fiscal Administration HandoutDocument32 pagesPublic Fiscal Administration HandoutRonna Faith Monzon96% (28)

- Philippine Public Fiscal Administration Leonor Magtolis Briones PDFDocument1 pagePhilippine Public Fiscal Administration Leonor Magtolis Briones PDFRonald Abaya67% (24)

- Issues and Problems in Public Fiscal AdministrationDocument2 pagesIssues and Problems in Public Fiscal AdministrationYeah Seen Bato Berua89% (45)

- Public FiscalDocument26 pagesPublic FiscalRojanie Estuita71% (24)

- MPA Comprehensive ExamDocument10 pagesMPA Comprehensive ExamSarah Jane Usop100% (2)

- Fiscal Policy in The PhilippinesDocument21 pagesFiscal Policy in The PhilippinesOliver Santos100% (2)

- National College of Public Administration and GovernanceDocument8 pagesNational College of Public Administration and GovernanceRegi PonferradaNo ratings yet

- Theory and PracticeDocument27 pagesTheory and PracticeJulynna Victoria Sodsod Belleza86% (7)

- History of Public Fiscal AdministrationDocument13 pagesHistory of Public Fiscal AdministrationRonna Faith Monzon100% (1)

- Local Fiscal AdministrationDocument37 pagesLocal Fiscal AdministrationEliza Flores100% (8)

- Philippine Public Fiscal AdministrationDocument51 pagesPhilippine Public Fiscal Administrationjeffrey catacutan flores90% (48)

- Module in Introduction To Public AdministrationDocument116 pagesModule in Introduction To Public AdministrationRommel Rios Regala100% (10)

- Letter Head SMEDocument16 pagesLetter Head SMERanjita KumariNo ratings yet

- Lesson 2 - Public Fiscal AdministrationDocument8 pagesLesson 2 - Public Fiscal AdministrationTristan Jade Corpuz Valdez100% (4)

- Syllabus Fiscal AdminDocument5 pagesSyllabus Fiscal AdminEnrico_Larios100% (4)

- General Principles of Public Fiscal AdministrationDocument19 pagesGeneral Principles of Public Fiscal AdministrationJonathan Rivera84% (31)

- PA 201 Course SyllabusDocument9 pagesPA 201 Course SyllabusFayyaz DeeNo ratings yet

- Module in Globalization and Public AdministrationDocument105 pagesModule in Globalization and Public AdministrationRommel Rios Regala100% (1)

- SITXFIN004 Assessment 3 - ProjectDocument9 pagesSITXFIN004 Assessment 3 - Projectdaniela castilloNo ratings yet

- Public-Policy-And-Program-Management SYLLABUSDocument2 pagesPublic-Policy-And-Program-Management SYLLABUSJacqueline Carbonel100% (2)

- Introduction of Public Fiscal AdministrationDocument5 pagesIntroduction of Public Fiscal Administrationmitzi samson100% (1)

- Public Fiscal Administration AssignmentDocument14 pagesPublic Fiscal Administration AssignmentJonathan Rivera100% (6)

- 2019 Public Policy and Program AdministrationDocument9 pages2019 Public Policy and Program AdministrationCzar Jose Benavente100% (2)

- Theory and Practice of Public Administration SyllabusDocument17 pagesTheory and Practice of Public Administration SyllabusRonald Quinto100% (6)

- Policy Making Process in Public AdministrationDocument9 pagesPolicy Making Process in Public Administrationvenusww100% (1)

- State Audit in The PhilippinesDocument49 pagesState Audit in The PhilippinesArlyn Drance100% (12)

- Public Administration: Key Issues Challenging PractitionersFrom EverandPublic Administration: Key Issues Challenging PractitionersNo ratings yet

- Policy and Program Administration in The Philippines A Critical DiscourseDocument6 pagesPolicy and Program Administration in The Philippines A Critical DiscourseMacxie Baldonado Quibuyen100% (1)

- Syllabus OBE PA 107 Public Fiscal Adm.Document8 pagesSyllabus OBE PA 107 Public Fiscal Adm.lunafuntanilla3No ratings yet

- Presentation For Public Fiscal Administration For Batch 1Document16 pagesPresentation For Public Fiscal Administration For Batch 1Jeffrey Limsic100% (1)

- Dealing With Fiscal AdministrationDocument19 pagesDealing With Fiscal AdministrationJaylyn Joya Ammang100% (1)

- Syllabus in PA 114 - Politics and AdministrationDocument9 pagesSyllabus in PA 114 - Politics and AdministrationJoseph Panaligan100% (4)

- National College of Public Administration and Governance University of The PhilippinesDocument5 pagesNational College of Public Administration and Governance University of The PhilippinesKathleen Ebilane PulangcoNo ratings yet

- (Module10) PUBLIC FISCAL ADMINISTRATIONDocument9 pages(Module10) PUBLIC FISCAL ADMINISTRATIONJam Francisco100% (2)

- Local Fiscal Administration: Gilbert R. HufanaDocument27 pagesLocal Fiscal Administration: Gilbert R. Hufanagilberthufana44687775% (4)

- MODULE 1 Overview of Public Fiscal AdministrationDocument8 pagesMODULE 1 Overview of Public Fiscal AdministrationRica GalvezNo ratings yet

- Lesson 2 Fiscal AdministrationDocument10 pagesLesson 2 Fiscal Administrationmitzi samsonNo ratings yet

- Financing Philippine Local GovernmentDocument33 pagesFinancing Philippine Local GovernmentJUDY ANN GASPARNo ratings yet

- Introduction To Fiscal AdministrationDocument10 pagesIntroduction To Fiscal Administrationcharydel.oretaNo ratings yet

- Public Policy and Program Administration SyllabusDocument12 pagesPublic Policy and Program Administration SyllabusKarl Lenin Benigno100% (2)

- Public Fiscal Administration TestDocument7 pagesPublic Fiscal Administration TestApril Dominguez-Benzon100% (2)

- PA 131 Sample Syllabus 2018Document4 pagesPA 131 Sample Syllabus 2018mitzi samsonNo ratings yet

- Local Fiscal AdministrationDocument20 pagesLocal Fiscal AdministrationMarie Reyes71% (14)

- Module4 - Public Policy and Program AdministrationDocument10 pagesModule4 - Public Policy and Program AdministrationChristian Damil-Tobilla100% (2)

- Fiscal AdministrationDocument34 pagesFiscal AdministrationBon Carlo Medina Melocoton100% (5)

- Public Personnel AdministrationDocument5 pagesPublic Personnel AdministrationJenny Rose MacedaNo ratings yet

- Fetalver ABPA3 (PA 317 Public Accounting and Budgeting) PDFDocument38 pagesFetalver ABPA3 (PA 317 Public Accounting and Budgeting) PDFEMMANUELNo ratings yet

- Accounting and Auditing in The PhilippinesDocument15 pagesAccounting and Auditing in The Philippinesman leeNo ratings yet

- Philippine Administrative System Course OutlineDocument3 pagesPhilippine Administrative System Course OutlineVinci Juvahib0% (1)

- Public Fiscal AdministrationDocument119 pagesPublic Fiscal AdministrationWilson King B. SALARDA100% (2)

- Issues & Problems in Public AdministrationDocument12 pagesIssues & Problems in Public AdministrationRosalvie Dante89% (9)

- Constitutional Bases of Public Finance in The Philippines (Taxation)Document23 pagesConstitutional Bases of Public Finance in The Philippines (Taxation)DARLENE100% (1)

- Fiscal Approaches and Techniques in BudgetingDocument93 pagesFiscal Approaches and Techniques in BudgetingYeah Seen Bato Berua100% (10)

- Pa 236-Personnel AdministrationDocument5 pagesPa 236-Personnel Administrationtheblacknote100% (1)

- Reaction Paper Public Fiscal AdministrationDocument25 pagesReaction Paper Public Fiscal AdministrationLeigh LynNo ratings yet

- Fiscal Administration For LgusDocument54 pagesFiscal Administration For LgusALBERT100% (4)

- In Elec111 - Government Accounting & Budgeting Padm 107 - Public Accounting & Budgeting)Document36 pagesIn Elec111 - Government Accounting & Budgeting Padm 107 - Public Accounting & Budgeting)Erika MonisNo ratings yet

- Public Finance Cycle in The PhilippinesDocument21 pagesPublic Finance Cycle in The PhilippinesLin100% (4)

- Legal Bases of Public Fiscal AdministrationDocument18 pagesLegal Bases of Public Fiscal AdministrationMa Abegail Calayag Carangan100% (1)

- Philippine Budget System EfportilloDocument47 pagesPhilippine Budget System Efportilloenaportillo13100% (9)

- General Principles of Public Fiscal Administration: Submitted By: Jonathan A. RiveraDocument14 pagesGeneral Principles of Public Fiscal Administration: Submitted By: Jonathan A. RiveraRomel Torres89% (9)

- Mc-Sse 8 Macroeconomics Group V : Fiscal PolicyDocument35 pagesMc-Sse 8 Macroeconomics Group V : Fiscal PolicyMaria Cristina Importante100% (1)

- Job Vacancies at The PDIC As of 2014Document7 pagesJob Vacancies at The PDIC As of 2014Liza AmargaNo ratings yet

- NFJPIA Constitution and by Laws 2008Document20 pagesNFJPIA Constitution and by Laws 2008Lei Co100% (1)

- Perpajakan SingapurDocument22 pagesPerpajakan SingapurDio PatraNo ratings yet

- Budget Cycle in IndiaDocument8 pagesBudget Cycle in Indianoushiyabanu3456No ratings yet

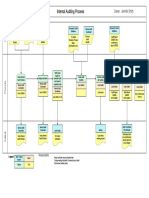

- Audit - Visio-Template Process MapDocument1 pageAudit - Visio-Template Process MapPurushothama Nanje GowdaNo ratings yet

- PFR Volume IDocument327 pagesPFR Volume IMaria WebbNo ratings yet

- Governance Summary 1 9Document9 pagesGovernance Summary 1 9Ivy Claire SemenianoNo ratings yet

- Advanced Accounting IDocument265 pagesAdvanced Accounting Iadityakamble070103No ratings yet

- Backflush Costing/Activity Based CostingDocument14 pagesBackflush Costing/Activity Based CostingEilen Joyce BisnarNo ratings yet

- GTAG 4 2nd EditionDocument20 pagesGTAG 4 2nd EditionaluqueroNo ratings yet

- Letter Template-1Document21 pagesLetter Template-1QwertyNo ratings yet

- Roto Pumps Annual Report 2017-18Document127 pagesRoto Pumps Annual Report 2017-18Puneet367No ratings yet

- Form 1840sdi-2 - Substantive Procedures Guide - Banking and Finance - LoansDocument17 pagesForm 1840sdi-2 - Substantive Procedures Guide - Banking and Finance - LoanswellawalalasithNo ratings yet

- Tosin Final Project EditedDocument69 pagesTosin Final Project EditedAnyam Terza-gwaNo ratings yet

- Kern County Grand Jury Report: City of California CityDocument8 pagesKern County Grand Jury Report: City of California CityAnthony WrightNo ratings yet

- Auditing - A Risk-Based ApproachDocument22 pagesAuditing - A Risk-Based ApproachSaeed AwanNo ratings yet

- Manac Project Ver 2Document25 pagesManac Project Ver 2Akhil ManglaNo ratings yet

- Interview QuestionsDocument9 pagesInterview QuestionsEll EssNo ratings yet

- Samridhi Seth: Finance and OperationDocument3 pagesSamridhi Seth: Finance and OperationAsshaNo ratings yet

- Cover Letter For Accounts Payable Position With No ExperienceDocument8 pagesCover Letter For Accounts Payable Position With No ExperiencewhcnteegfNo ratings yet

- Guideline Standards Practice Complete PDFDocument21 pagesGuideline Standards Practice Complete PDFNavanayan ghimireNo ratings yet

- Activity-Based Costing: Helping Small and Medium-Sized Firms Achieve A Competitive Edge in The Global MarketplaceDocument22 pagesActivity-Based Costing: Helping Small and Medium-Sized Firms Achieve A Competitive Edge in The Global MarketplaceMarissaNo ratings yet

- List of Accounting Thesis TitleDocument4 pagesList of Accounting Thesis Titlejencloudcleveland100% (2)

- Mir 075Document1 pageMir 075MCCIN L&WNo ratings yet

- 3317C 8 Materiality SummaryDocument2 pages3317C 8 Materiality SummaryShahi AlamNo ratings yet

- Overview of ValuationDocument41 pagesOverview of ValuationMadhusudan PoddarNo ratings yet

- Night AuditDocument5 pagesNight AuditGabriela ThomasNo ratings yet

- Global Management Accounting PrinciplesDocument56 pagesGlobal Management Accounting PrinciplesNetrananda100% (2)