Comprehensive Problem

Uploaded by

Celine FloranzaComprehensive Problem

Uploaded by

Celine FloranzaCA5101

COMPREHENSIVE PROBLEM

ACCOUNTING CYCLE FOR MERCHANDISING BUSINESS

The account of NQ Company as of December 1, 2018 are listed below:

Cash 214,000

Accounts Receivable 338,000

Merchandise Inventory 426,000

Short-term Investment 500,000

Office Supplies 31,000

Prepaid Insurance 48,000

Land 370,000

Building 900,000

Accum. Depreciation - Bldg. 250,000

Equipment 800,000

Accum. Depreciation - Equip. 200,000

Accounts Payable 172,000

Mortgage Payable 1,200,000

NQ, Capital 1,805,000

3,627,000 3,627,000

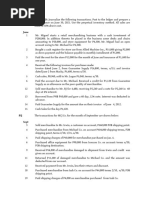

The following transactions occurred during the month of December 2018:

Dec. 1 Settled the accounts payable of P115,000 less 2% discount.

3 Collected the accounts receivable of P180,000 less 3% discount.

4 Sold merchandise on account to PPC Supplies, P210,000. Terms: FOB destination,

3/10, n/30. PPC Supplies paid the freight for P3,000.

5 Received returns from PPC Supplies, P25,000.

7 Purchased merchandise from OTQ Products, P232,000. Terms: FOB shipping point,

2/10, n/30. NQ Company paid P2,000 for the transportation cost.

9 Returned goods to OTQ Products, P12,000.

10 Paid interest on mortgage payable, P8,000.

11 Received payment from PPC Supplies for the amount due.

12 Sold merchandise to Oani Shoppers, P330,000. Terms: FOB shipping point, 3/10, n/30.

18 Received payment from Oani Shoppers.

19 Sold merchandise to NVL Shop, P242,000. Terms: FOB shipping point, 3/10, n/30.

NQ Company paid P5,000 for the freight.

20 Paid P9,000 for representation expense.

29 Received from NVL Shop returned merchandise in the amount of P18,000 from the

December 19 sales.

30 The owner, Genevieve, withdrew merchandise for personal use. Cost - P20,000;

Selling price - P30,000.

Additional information:

(1) Salaries in the amount of P73,000 have accrued on December 31.

(2) Insurance coverage with premium of P2,000 has expired at month-end.

(3) Depreciation on the building and on the equipment for the month amounted to P3,000

and P4,500, respectively.

(4) Office supplies on hand at month-end amounted to P7,000.

(5) Interest of P2,800 had accrued.

(6) Short-term investment earned an unrecorded investment income amounting to P15,000.

(7) A count of the inventory amounted to P453,000 on December 31, 2018.

Required:

1. Journalize the transactions during December 2018. (Use periodic inventory system)

2. Prepare the Unadjusted Trial Balance.

3. Prepare the adjusting journal entries.

4. Prepare the worksheet reflecting the adjusted trial balance.

5. Prepare the functional form Income Statement, Statement of Changes in Owner's Equity

and Statement of Financial Position.

6. Prepare the closing entries.

7. Prepare the Post-Closing Trial Balance.

8. Prepare the reversing entries.

You might also like

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test Bank50% (4)Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test Bank32 pages

- Fundamental Accounting Principles 25th Edition PDFNo ratings yetFundamental Accounting Principles 25th Edition PDF14 pages

- Accounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)100% (3)Accounting Made Simple - Accounting Explained in 100 Pages or Less (PDFDrive)119 pages

- The 10K SideHustle - Ebook - JPLynn - 2017100% (4)The 10K SideHustle - Ebook - JPLynn - 2017204 pages

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?100% (1)Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?206 pages

- Credit Repair Secrets - Learn Fast The Basic Strategies To Repair Bad Credit and Fix Your Bad Debt To Improve Your Score, Business, and Personal Finance. 609 Letter Template Included.67% (3)Credit Repair Secrets - Learn Fast The Basic Strategies To Repair Bad Credit and Fix Your Bad Debt To Improve Your Score, Business, and Personal Finance. 609 Letter Template Included.91 pages

- University of Caloocan City: Name: Score: Course/Year & Section: Date0% (1)University of Caloocan City: Name: Score: Course/Year & Section: Date3 pages

- How To Start Your Own House Flipping Business100% (4)How To Start Your Own House Flipping Business17 pages

- Logistics Management IN Nestlé Company: A Project Report OnNo ratings yetLogistics Management IN Nestlé Company: A Project Report On40 pages

- Module 7 - Completing The Accounting CycleNo ratings yetModule 7 - Completing The Accounting Cycle6 pages

- GENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableNo ratings yetGENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The Scannable7 pages

- BAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDFNo ratings yetBAC 1 Lesson8CompletingtheAccountingProcessforaServiceBusiness PDF21 pages

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit Credit0% (1)Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit Credit12 pages

- CHAPTER 5 Adjusting The Accounts (Module)No ratings yetCHAPTER 5 Adjusting The Accounts (Module)19 pages

- Handout 6 Accounting For Service Merchandising and Manufacturing BusinessesNo ratings yetHandout 6 Accounting For Service Merchandising and Manufacturing Businesses8 pages

- Orca Share Media1605010109407 6731900321930361605No ratings yetOrca Share Media1605010109407 673190032193036160537 pages

- Elimination Questions Elimination QuestionsNo ratings yetElimination Questions Elimination Questions4 pages

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The Philippines100% (1)Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The Philippines19 pages

- Par Cor Accounting Cup - Average Round QuestionsNo ratings yetPar Cor Accounting Cup - Average Round Questions6 pages

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualNo ratings yet(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution Manual9 pages

- Activity - Preparation of Financial StatementsNo ratings yetActivity - Preparation of Financial Statements4 pages

- Sole Proprietorship Accounting TransactionsNo ratings yetSole Proprietorship Accounting Transactions17 pages

- Abigail Santos Boutique, Financial Statement For Merchandising100% (1)Abigail Santos Boutique, Financial Statement For Merchandising9 pages

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3No ratings yetComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-34 pages

- Schedule of Assessment NextStepFunded Valid 17.11.2023No ratings yetSchedule of Assessment NextStepFunded Valid 17.11.202314 pages

- FIN 004 - Table of Specifications Final Exam CoverageNo ratings yetFIN 004 - Table of Specifications Final Exam Coverage1 page

- Cooperate Planning and Implementationan Influence To Business ActivityNo ratings yetCooperate Planning and Implementationan Influence To Business Activity2 pages

- Invoice: Orange Bio Science Products Private Limited Bill ToNo ratings yetInvoice: Orange Bio Science Products Private Limited Bill To1 page

- Delay Claims in Road Construction: Best Practices For A Standard Delay Claims Management SystemNo ratings yetDelay Claims in Road Construction: Best Practices For A Standard Delay Claims Management System6 pages

- GPF Annual Accounts Statement 2021-2022 M.S.O (T) 81: A/c No: NameNo ratings yetGPF Annual Accounts Statement 2021-2022 M.S.O (T) 81: A/c No: Name1 page

- The Rush For Corporate Rebranding in India: Rejuvenation With A Rationale or Irrational Exuberance?No ratings yetThe Rush For Corporate Rebranding in India: Rejuvenation With A Rationale or Irrational Exuberance?12 pages

- Microtex Energy Private Limited - Google Local 2No ratings yetMicrotex Energy Private Limited - Google Local 21 page

- Competition To Enter Shoe Market in EgyptNo ratings yetCompetition To Enter Shoe Market in Egypt4 pages