Kuis Akman 2 - 72 - Esay

Kuis Akman 2 - 72 - Esay

Uploaded by

muhammadmakhrojalCopyright:

Available Formats

Kuis Akman 2 - 72 - Esay

Kuis Akman 2 - 72 - Esay

Uploaded by

muhammadmakhrojalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Kuis Akman 2 - 72 - Esay

Kuis Akman 2 - 72 - Esay

Uploaded by

muhammadmakhrojalCopyright:

Available Formats

2

COURSES GROUPS RESOURCES MORE

Your assessment has been submitted.

Management Acctg Kls 7-2: Section 1 Tests/Quizzes

Kuis Essay Ch 13 Submissions Enabled Grade: N/A

My Submissions Test/Quiz Comments

Debbie Intansari Rachmat Submission 1

Pending Review Question 1

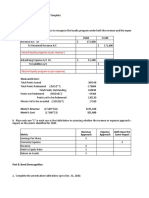

Planet Motors manufactures general and special purpose industrial motors. Planet's management is worried

about increasing competition in its industry as a global industrial motor manufacturer has recently shown a

keen interest in entering the same customer market as served by Planet. The management is most concerned

about the fact that it may lose a significant amount of sales revenue should this competitor make an entry

into Planet's market. A description of Planet's top risk, an inherent risk assessment, three risk response

alternatives, and a residual risk assessment for each response alternative is provided in the chart given

below.

Inherent Risk Risk Response Residual Risk

Impact Impact

Likelihood (on lost Alternatives Likelihood (on lost

Risk revenues) revenues)

A global industrial 50% $76,000,000 A—Sign long-term 25% $66,000,000

sales contracts with its

motor manufacturer has

three biggest customers

recently shown a keen before the competitor

interest in entering the enters the market

same customer market

served by Planet; it

may significantly

impactPlanet's annual

sales revenue.

B—Invest in a new 40% $15,000,000

quality program with

the aim of significantly

increasing the

performance and

quality of its motors so

that the new entrant

could not match with its

quality

C—Take no action in 50% $76,000,000

response to this new

threat

It is estimated by Planet's management thatthat the incremental cost of implementing risk response A is

$15,000,000 and the incremental cost of implementing risk response B is $14,000,000.

Required:

A.) Calculate the inherent risk for Planet Motors.

B.) Calculate the residual risk for Planet Motors associated with each of the three risk response alternatives

A, B, and C.

A.) INHERENT RISK FOR PLANET MOTORS

Inherent risk = impact on lost revenues x likelihood of risk

= $76.000.000 x 50%

= $38.000.000

B.) RESIDUAL RISK FOR EACH OF THE RISK RESPONSE

Risk Response A.

Residual risk = impact on lost revenues x likelihood of risk

= $66.000.000 x 25%

= $16.500.000

Risk Response B

Residual risk = impact on lost revenues x likelihood of risk

= $15.000.000 x 40%

= $6.000.000

Risk Response C

Residual risk = impact on lost revenues x likelihood of risk

= $76.000.000 x 50%

= $38.000.000

Back to assessments

You might also like

- Get Microeconomics Private and Public Choice 16th Edition James D. Gwartney Et Al. PDF ebook with Full Chapters Now100% (6)Get Microeconomics Private and Public Choice 16th Edition James D. Gwartney Et Al. PDF ebook with Full Chapters Now37 pages

- Financial Reporting and Analysis Final OSANo ratings yetFinancial Reporting and Analysis Final OSA9 pages

- Hospitality Industry Accounting GlossaryNo ratings yetHospitality Industry Accounting Glossary26 pages

- FIN 4453 Project 3 Capital Budgeting Analysis TemplateNo ratings yetFIN 4453 Project 3 Capital Budgeting Analysis Template34 pages

- Project:: Form 1 Owner Controlled Insurance Program Insurance Cost Information WorksheetNo ratings yetProject:: Form 1 Owner Controlled Insurance Program Insurance Cost Information Worksheet13 pages

- Sharda University School of Business Studies Probability - Assignment 2No ratings yetSharda University School of Business Studies Probability - Assignment 22 pages

- Seminar 12.2 Outline - Auditing of Group Financial Statements IINo ratings yetSeminar 12.2 Outline - Auditing of Group Financial Statements II6 pages

- Mcom 3 Sem Corporate Tax Planning N Management Cgs S 2019No ratings yetMcom 3 Sem Corporate Tax Planning N Management Cgs S 201912 pages

- A Study of Underground Power Cable Installation Methods: EPRI EL-374 (Research Project 7824) ERDA E (49-18) - 1824No ratings yetA Study of Underground Power Cable Installation Methods: EPRI EL-374 (Research Project 7824) ERDA E (49-18) - 1824107 pages

- Q1 2024 Quarterly Investor PresentationNo ratings yetQ1 2024 Quarterly Investor Presentation39 pages

- EX_-_99.2_3Q24_Shareholder_Letter_FinalNo ratings yetEX_-_99.2_3Q24_Shareholder_Letter_Final32 pages

- Open Access C&I RE Market in India - JMK Research & AnalyticsNo ratings yetOpen Access C&I RE Market in India - JMK Research & Analytics2 pages

- 21-61 - IR - Upper Hunter Futures Report - For Release 6 August 2021No ratings yet21-61 - IR - Upper Hunter Futures Report - For Release 6 August 2021180 pages

- Market Assessment For Promoting Energy Efficiency and Renewable Energy Investment in Brazil Through Local Financial InstitutionsNo ratings yetMarket Assessment For Promoting Energy Efficiency and Renewable Energy Investment in Brazil Through Local Financial Institutions201 pages

- Climate Change: ECN105 Contemporary Economic IssuesNo ratings yetClimate Change: ECN105 Contemporary Economic Issues31 pages

- Glentech Manufacturing Is Considering The Purchase of An Automated PartsNo ratings yetGlentech Manufacturing Is Considering The Purchase of An Automated Parts1 page

- Interactive Visualization To Understand COVID Risk Score at A Particular Location Using TableauNo ratings yetInteractive Visualization To Understand COVID Risk Score at A Particular Location Using Tableau10 pages

- INDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 6: Comparison and Selection Among AlternativesNo ratings yetINDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 6: Comparison and Selection Among Alternatives27 pages

- Brookfield Asset Management Investor Day 2023No ratings yetBrookfield Asset Management Investor Day 2023128 pages

- One Click LCA - RICS WLCA V2 and Biodiversity Net GainNo ratings yetOne Click LCA - RICS WLCA V2 and Biodiversity Net Gain9 pages

- Dedicated Application Layer (M-Bus) : ForewordNo ratings yetDedicated Application Layer (M-Bus) : Foreword48 pages

- Kunci Pembahasan Try Out Online 10 Usm Stan Bimbel AksesNo ratings yetKunci Pembahasan Try Out Online 10 Usm Stan Bimbel Akses7 pages

- Gardens Inc. - From Rakes To Riches Am Version 7.01 GH DIP 1.0 - GH - 20130122080726-VELOCITYNo ratings yetGardens Inc. - From Rakes To Riches Am Version 7.01 GH DIP 1.0 - GH - 20130122080726-VELOCITY1 page

- Accounting: Concepts and Conventions: Dr. Rahul KumarNo ratings yetAccounting: Concepts and Conventions: Dr. Rahul Kumar115 pages

- FIRS's Circular On The Tax Implications of The Adoption of The IFRSNo ratings yetFIRS's Circular On The Tax Implications of The Adoption of The IFRS19 pages

- Telecom Billing - Tariff Planning - TutorialspointNo ratings yetTelecom Billing - Tariff Planning - Tutorialspoint4 pages

- Answers To 4 Semester - Advanced Accountancy Fourth SemesterNo ratings yetAnswers To 4 Semester - Advanced Accountancy Fourth Semester4 pages

- Financial Statement Analysis and Strategic Analysis of Dell100% (1)Financial Statement Analysis and Strategic Analysis of Dell21 pages

- Daimler Ir Annualfinancialstatementsentity 2016No ratings yetDaimler Ir Annualfinancialstatementsentity 201651 pages

- Financial Statement Analysis: Ratio Analysis of Nokia and LGNo ratings yetFinancial Statement Analysis: Ratio Analysis of Nokia and LG35 pages

- Accounting For Merchandising Operations: Key Terms and Concepts To KnowNo ratings yetAccounting For Merchandising Operations: Key Terms and Concepts To Know25 pages