Test 4

Test 4

Uploaded by

Jayant MittalCopyright:

Available Formats

Test 4

Test 4

Uploaded by

Jayant MittalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Test 4

Test 4

Uploaded by

Jayant MittalCopyright:

Available Formats

www.universeofcommerce.

com

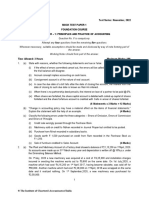

INSTRUCTIONS TO CANDIDATES

Read the following instructions carefully before starting the paper :

1. Read each question carefully.

2. Maximum Marks : 100

3. Total time allotted = 3 hours

4. NOTE : Extra

xtra time of 15 minutes is allotted for reading the question paper.

HOW TO WRITE THE ANSWERS :

STEP 1 : Take a plain paper , write down your FULL NAME and MAIL ID ,and write down Question number

and answer thereafter. Take care of neatness and presenta

presentation.

STEP 2 : Download CAMSCANNER App from Play Store .

STEP 3 : After completing your paper, click a clear photo of your answer sheet with Cam Scanner

Scann app and

scan it and mail us at unicomtestseries@gmail.com

STEP 4 : You can send us your answer sheets within 6 days from the test date i.e. till 11:59 pm on 7 March,

2020 (Saturday).

STEP 5 : Your evaluated answer sheets will be mailed to you at mail address provided by you by 11th

March, 2020

STEP 6 : THESE TEST PAPERS ARE DESIGNED BY FIELD EXPERTS KEEPING IN MIND STUDENT'S INTEREST , Please

Be HONEST and SINCERE while attempting the paper.

paper Give your 100% now and enjoy the fruits of success later.

ALL THE BEST GUYS !!!

1 UNICOM 9057120401 UNICOM CA Foundation

www.universeofcommerce.com

Question 1 is compulsory.

Answer any four questions from remaining five questions.

Answers to questions are to be given in English only.

1. (a) State with reasons, whether the following statements are true or false. (6*2=12 marks marks)

(i) Depreciation is a non-cash

cash expense and does not result in any cash outflow.

(ii) There are two ways of preparing an account current.

(iii) Expenses in connection with obtaining a license for running the Cinema Hall are Revenue Expenditure.

(iv) The Sales book is kept to record both cash and credit sales.

(v) Discount at the time of retirement of a bill is a gain for the drawee

drawee.

(vi) “Salary paid in advance”

ance” is not an expense because it neither reduces assets nor increases liabilities.

1. (b) Change in accounting policy may have a material effect on the items of financial statements.” Explain the

statement with the help of an example. (4 Marks)

1(C) State the advantages of setting Accounting Standards

Standards. (4 Marks)

2. (a) On 31st March 2017, the Bank Pass Book of Namrata showed a balance of ` 1,50,000 to her credit while

balance as per cash book was ` 1,12,050. On scrutiny of the two books, she ascertained the following causes of

difference:

i) She has issued cheques amounting to ` 80,000 out of which only ` 32,000 were presented for payment.

ii) She received a cheque of ` 5,000 which she recorded in her cash book but forgot to deposit in the bank

bank.

iii) A cheque of ` 22,000 deposited by her has not been cleared yet.

iv) Mr. Gupta deposited an amount of ` 15,700 in her bank which has not been recorded by her in Cash Book yet.

v) Bank has credit an interest of ` 1,500 while charging ` 250 as bank cha

charges.

Prepare a bank reconciliation statement. (10 Marks)

2.(b) The following mistakes were located in the books of a concern after its books were closed and a Suspense

Account was opened in order to get the Trial Balance agreed : (10 Marks)

(i) Sales Day Book was overcast by Rs. 1,000.

(ii) A sale of Rs. 5,000 to X was wrongly debited to the Account of Y.

(iii) General expenses Rs. 180 was posted in the General Ledger aas Rs. 810.

(iv) A Bill Receivable for Rs. 1,550 was passed through Bills Payable Book. The Bill was given by P.

(v) Legal Expenses Rs. 1,190 paid to Mrs. Neetu was debited to her personal account.

(vi) Cash received from Ram was debited to Shyam Rs. 1,500.

(vii) While carrying forward the total of one page of the Purchases Book to the next, the amount of Rs. 1,235 was

written as Rs. 1,325.

Find out the nature and amount of the Suspense Account and pass entries ((including

including narration)

narration for the rectification

of the above errors in the subsequent year's books.

books

2 UNICOM 9057120401 UNICOM CA Foundation

www.universeofcommerce.com

3. (a) Shri Ganpath of Nagpur consigns 500 cas

cases

es of goods costing Rs. 1,500 each to Rawat of Jaipur. (10 Marks)

Shri Ganpath pays the following expenses in connection with the consignment:

Particulars Rs.

Carriage 15,000

Freight 45,000

Loading Charges 15,000

Shri Rawat sells 350 cases at Rs. 2,100 per case and incurs the following expenses:

Clearing charges 18,000

Warehousing and Storage charges 25,000

Packing and selling expenses 7,000

It is found that 50 cases were lost in trans

transit

it and another 50 cases were in transit. Shri Rawat is entitled to a

commission of 10% on gross sales. Draw up the Consignment Account and Rawat’s Account in the books of

shri Ganpath.

3(b) Which subsidiary books are normally used in a business? (5 Marks)

3. (c) Answer any one of the two questions: (5 Marks)

(i) Mr. Alok owes Mr. Chirag Rs. 650

0 on 1st January 2018. From Jan

January

uary to March, the following further transactions

took place between Alok and Chirag :

January 15 Alok buys goods Rs. 1,200

February 10 Alok buys goods Rs. 850

March 7 Alok receives Cash loan Rs. 1,500

Alok pays the whole amount on 31st March, 2018 together with interest @ 6% per annum. Calculate the interest by

average due date method.

OR

(ii) From the following prepare an account current, as sent by Avinash to Bhuvanesh on 31st March, 2018 by means

of products method charging interest @ 5% per annum :

Date Particulars Amount

2018 January 1 Balance due from Bhuvanesh 1,800

January 10 Sold goods to Bhuvanesh 1,500

January 15 Bhuvanesh returned goods 650

February 12 Bhuvanesh paid by cheque 1,000

February 20 Bhuvanesh accepted a bill drawn 1,500

by Avinash for one month

March 11 Sold goods to Bhuvanesh 7720

March 14 Received cash from Bhuvanesh 800

3 UNICOM 9057120401 UNICOM CA Foundation

www.universeofcommerce.com

4. (a) Prepare a bank reconciliation statement from the following particular as on 31st March, 2018. (10 Marks)

Particulars (Rs.)

Debit balance as per bank column of the cash book 18,60,000

Cheque issued to creditors but not yet presented to the

Bank for payment 3,60,000

Dividend received by the bank but not entered in the

Cash book 2,50,000

Interest allowed by the Bank 6,250

Cheques deposited into bank for collection but not

collected by bank up to this date 7,70,000

Bank

ank charges not entered in Cash Book 1,000

A cheque deposited into bank was dishonored, but no

intimation received 1,60,000

Bank paid house tax on our behalf, but no intimation

received from bank in this connection

ction 1,75,000

4.(b) A merchant’s trial balance as on June 30, 2017 did not agree. The difference was put to a Suspense Account.

During the next trading period, the following errors were discovered:

discovered (10 marks)

(i) The total of the Purchases Book of one page, `4,539 was carried forward to the next page as `4,593.

(ii) A sale of `573 was entered in the Sales Book as `753 and posted to the credit of the customer.

(iii) A return to a creditor, `510 was entered in the Returns Inward Book; however, the creditor’s account was

correctly posted.

(iv) Cash received from C. Dass, `620 was posted to the debit of G. Dass.

(v) Goods worth `840 were despatched to a customer before the close of the year but no invoice was made out.

(vi) Goods worth `1,000 were sent on sale or return basis to a customer and entered in the Sales Book.

At the close of the year, the customer still had the option to return the goods. The sale price was 25% above cost.

You are required to give journal entries to rectify the errors in a way so as to show the current year’s profit or loss

correctly.

5. (a) Prepare Journal entries for the following transactions in K. Katrak’s bookbooks. (5 Marks)

(i) Katrak’s acceptance to Basu for Rs. 2,500 discharged by a cash payment of Rs. 1,000 and a new bill for the balance

plus Rs. 50 for interest.

(ii) G. Gupta’s acceptance for Rs. 4,000 which was endorsed by Katrak to M. Mehta was dishonoured. Mehta paid Rs.

20 noting charges. Bill withdrawn against cheque.

(iii) D. Dalal retires a bill for Rs. 2,000 drawn on him by Katrak for Rs. 10 discount.

(iv) Katrak’s acceptance to Patel for Rs. 5,000 discharged by Mody’s acceptance to him (Katrak) for a similar amount.

5. (b) Classify the following expenditures as capital or revenue expenditure: (5 Marks)

(i) Amount spent on making a few more exists in a Cinema Hall to comply with Government orders.

(ii) Travelling expenses of the directors for trips abroad for purchase of capital assets.

(iii) Amount spent to reduce working expenses.

(iv) Amount paid for removal of stock to a new site.

(v) Cost of repairs on second-hand

hand car purchased to bring it into working condition.

4 UNICOM 9057120401 UNICOM CA Foundation

www.universeofcommerce.com

5. (c) Miss Rakhi consigned

igned 1,000 radio sets costing `900 each to Miss Geeta, her agent on 1st July,2016. Miss

Rakhi incurred the following expenditure on sending the consignment. (10 marks)

Freight Rs. 7,650

Insurance Rs. 3,250

Miss Geeta received the delivery of 950 radio sets. An account sale dated 30th November,2016 showed that 750

sets were sold for `9,00,000

000 and Miss Geeta incurred `10,500 for carriage.

Miss Geeta was entitled to commission 6% on the sales effected by her. She incurred expenses amounting to `2,500

for repairing the damaged radio sets remaining in the inventories.

Miss Rakhi lodged a claim with the insurance company which was admitted at `35,000. Show the Consignment

Account and Miss Geeta’s Account in the books of Miss Rakhi

Rakhi.

6. (a) The following errors were committed by the Accountant of Geete Dye-Chem.

Dye (5 Marks)

(i) Credit sale of ` 400 to Trivedi & Co. was posted to the credit of their account.

(ii) Purchase of ` 420 from Mantri & Co. passed through Sales Day Book as ` 240

How would you rectify the errors assumingg that :

(a) they were detected before preparation of Trial Balance.

(b) they were detected after preparation of Trial Balance but before preparing Final Accounts, the

difference was taken to Suspense A/c.

(c) they were detected after preparing Final Accounts.

6.(b) Stock taking of XYZ Stores for the year ended 31st March,

March,2019 was completed by 10th April, (5 marks)

2019, the valuation of which showed a stock figure of ` 1,67,500 at cost as on the completion date. After the

end of the accounting year and till the date of completion of stock taking, sales for the next year were made

for ` 6,875, profit margin being 33.33 percent on cost. Purchases for the next year included in the stock

amounted to ` 9,000 at cost less trade discount 10 percent. During this period, goods were added to stock of

the mark-upup price of ` 300 in respect of sales returns. After stock taking it was found that there were certain

very old slow moving items costing ` 1,125 which should be taken at ` 525 to ensure disposal to an int interested

customer. Due to heavy floods, certain goods costing ` 1,550 were received from the supplier beyond the

delivery date of customer. As a result, the customer refused to take delivery and net realizable value of the

goods was estimated to be ` 1,250 on 31st March, 2019.

You are required to calculate the value of stock for inclusion in the final accounts for the year ended 31st March,

2019. Closing stock is valued by XYZ Stores on generally accepted accounting principles.

5 UNICOM 9057120401 UNICOM CA Foundation

www.universeofcommerce.com

6. (c) Sales of goods on approval or return basis (5 marks)

X supplied goods on sale or return basis to customers, the particulars of which are as under:

Date of dispatch Party's name Amount Rs. Remarks

10.12.2019 M/s ABC Co. 10,000 No information till 31.12.2019

12.12.2019 M/s DEF Co 15,000 Returned on 16.12.2019

15.12.2019 M/s GHI Co 12,000 Goods worth Rs. 2,000 returned on

20.12.2019

20.12.2019 M/s DEF Co 116,000

6,000 Goods Retained on 24.12.2019

25.12.2019 M/s ABC Co 11,000 Good Retained on 28.12.2019

30.12.2019 M/s GHI Co 13,000 No information till 31.12.2019

Goods are to be returned within 15 days from the dispatch, failing which it will be treated as sales. The books of X

are closed on the 31st December, 2019. Prepare the follow

following account in the books of 'X':

Goods on ''sales

ales or return, sold and returned day books".

Goods on sales or return total account.

6. (d) M/s. Green Channel purchased a second-hand

second hand machine on 1st January, 2015 for ` 1,60,000.

1,60,000 (5 marks)

Overhauling and erection charges amounted to ` 40,000. Another machine was purchased for ` 80,000 on 1st July,

2015.

On 1st July, 2017, the machine installed on 1st January, 2015 was sold for ` 1,00,000. Another machine amounted to

` 30,000 was purchased and was installed on 30th September, 2017.

Under the existing practice the company provides depreciation @ 10% p.a. on original cost. However, from the year

2018 it decided to adopt WDV method and to charge depreciation @ 15% p.a.

You are required

quired to prepare Machinery account for the years 2015 to 2018.

6 UNICOM 9057120401 UNICOM CA Foundation

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- F005 Test 5 StudentsDocument6 pagesF005 Test 5 StudentsbhumikaaNo ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Fe - Accountancy Xi Set ADocument6 pagesFe - Accountancy Xi Set AAntariksh SainiNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- Ca - Foundation: Principles and Practice AccountingDocument7 pagesCa - Foundation: Principles and Practice Accountingritikkumarsharmash9499No ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- CFN 9340 Accounts Question PaperDocument8 pagesCFN 9340 Accounts Question PaperManan JainNo ratings yet

- AtibhaDocument7 pagesAtibhaAangry VermaNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Accounting Question 16.05.2023Document5 pagesAccounting Question 16.05.2023Shreedhara KhandalNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- XI Pre-BoardDocument7 pagesXI Pre-BoardSamar Singh Rathore0% (1)

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDocument53 pagesBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationsDocument4 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationsSkans R&DNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Class 11 AccoutancyDocument5 pagesClass 11 AccoutancyRavikumar BalasubramanianNo ratings yet

- Test 5 Principles and Practice of AccountingDocument6 pagesTest 5 Principles and Practice of Accountingshreya shettyNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Sample Paper Commerce Class 11th CBSEDocument6 pagesSample Paper Commerce Class 11th CBSEShreyansh DhruwNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- Test (Single Entry System)Document3 pagesTest (Single Entry System)SarthakNo ratings yet

- Foundation Accounting QP - Full 2Document7 pagesFoundation Accounting QP - Full 2ritubhattar8No ratings yet

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Document4 pages650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004No ratings yet

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocument3 pagesAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- FDN - Account WT 5 - VCR 1&2 J25 Exam - QueDocument4 pagesFDN - Account WT 5 - VCR 1&2 J25 Exam - QueAUTO TECH GAMINGNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- AccountancyDocument8 pagesAccountancyAnkit KumarNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDeepak YadavNo ratings yet

- Good Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Document4 pagesGood Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Aaryaman ModiNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- Q. Accounting Paper 1Document5 pagesQ. Accounting Paper 1Aryan JainNo ratings yet

- Accountancy Sample Paper Final ImportantDocument18 pagesAccountancy Sample Paper Final ImportantChitra Vasu100% (1)

- ACC XI SEE QP For RevisionDocument31 pagesACC XI SEE QP For Revisionvarshitha reddyNo ratings yet

- Gps Annual 11 19-2020 21Document8 pagesGps Annual 11 19-2020 21Amit NeemaNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- ACCOUNTANCYDocument7 pagesACCOUNTANCYbhavyaagarwal1910No ratings yet

- Cbse Class 11 Accountancy Sample Paper Set 2 QuestionsDocument6 pagesCbse Class 11 Accountancy Sample Paper Set 2 QuestionsNishtha 3153No ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- QClass 11 AccountancyDocument4 pagesQClass 11 AccountancyMirayamahikaNo ratings yet

- CA Foundation MTP 2020 Paper 1 QuesDocument6 pagesCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Accounting StandardsDocument60 pagesAccounting Standardspajowah498No ratings yet

- 5 6323318773231124699 PDFDocument35 pages5 6323318773231124699 PDFJayant Mittal100% (2)

- 5 6176969343167889793 PDFDocument57 pages5 6176969343167889793 PDFJayant MittalNo ratings yet

- Chapter - 3 Vocabulary: WWW - Escholars.inDocument15 pagesChapter - 3 Vocabulary: WWW - Escholars.inJayant Mittal100% (1)

- Gurukul Institute: Ca Foundation N. Business and Commercial KnowledgeDocument7 pagesGurukul Institute: Ca Foundation N. Business and Commercial KnowledgeJayant MittalNo ratings yet

- Organisations Facilitating BusinessDocument5 pagesOrganisations Facilitating BusinessJayant MittalNo ratings yet

- CS Ebook For Foundation - Executive - Professional PDFDocument24 pagesCS Ebook For Foundation - Executive - Professional PDFJayant MittalNo ratings yet

- H P I S T: IRE Urchase and Nstallment ALE RansactionsDocument46 pagesH P I S T: IRE Urchase and Nstallment ALE RansactionsJayant MittalNo ratings yet

- AEIST Syllabus Group1-1Document1 pageAEIST Syllabus Group1-1Jayant MittalNo ratings yet