Exit Formality

Exit Formality

Uploaded by

hr.singlaCopyright:

Available Formats

Exit Formality

Exit Formality

Uploaded by

hr.singlaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Exit Formality

Exit Formality

Uploaded by

hr.singlaCopyright:

Available Formats

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

Dear Colleague,

In the next few sections of this document, we will be covering various important aspects of Exit Formalities which

will ease the entire exit process without any apprehensions. Therefore, we request you to go through all the

sections that are applicable for you; “right action at right time” will always ease the process and will prevent

unnecessary iterations when any issue arises.

A. Reaching out key stakeholders

Query of Type Employee Status Reachable at

Finance Voice Helpline Resigned – Notice Period Concall – details provided around LWD

Finance Service-now Resigned – Notice Period https://accentureinternal.service-now.com

Finance Email Left payroll.settlements@accenture.com

Relieving Letter Email Left India.hrssc.exit@accenture.com

Amex Card Email Resigned – Notice Period Manjunath.shetty@accenture.com

HR Email Resigned or Left Your HR PA/Case Manager

“Reach to right point for quicker and better response / turnaround”

Exit Formalities – Index B. Key Dates & Forms

Ctrl + Click on respective topic

Finance Checklist Closure LWD minus 2 Working Days

1. Provisional Recoveries

Recovery payment LWD minus 5 Working Days

2. Payroll Proofs Submission

All Checklist closure + 21

2a. Tax Proofs(Online & Offline) Full & Final Settlement

Calendar days

2b. R539 Proofs(Hard Copies)

Gratuity Payment LWD + 30 Calendar days

3. Time & Expense(Hard copies)

4. Car Lease Escalation on Calculations F&F + 15 Calendar days

5. Meal Allowance Form 16 After April

6. Full & Final Settlement

Proofs Submission (Tax, R539, myTE…) LWD minus 7 working days

6a. General

6b. F&F Components

Tax & R539 Proof Submission Form– This Refer Allsec Tax proof

7. Gratuity

Form is MANDATORY(Form 12 BB) submission Page

8. Form 16

9. Provident Fund

Car Lease Foreclosure LWD minus 10 working days

9a. Withdrawal

9b Transfer PF Transfer / withdrawal No commit; Govt Rules

9c. General Tax Free Leave Enc Declrn

10. Amex Card

Declared in AST

11. Tools Accessibility Tax Free Gratuity Declrn

12. Impo

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#1

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

1. Provisional Recoveries

Finance calculates recovery amount towards Shortfall in Notice Period, relocation, Joining Bonus, FBLN,

Excess Leave etc. and the same is uploaded in Allsec Tool.

https://smartpay.allsectech.com/accenturelogin/ -> Utilities -> Fin exit approval

Note: Recovery amount, if any, posted in the above link must be paid by Demand Draft favoring Accenture

Solutions Private Limited, payable at Bangalore and the DD must reach to Finance before five working

days to the Last Working Day.

Accenture Solutions Private Limited

In case of Recovery – Finance will approve the checklist in

Finance Department (Controllership)

st Atlas (AST) after receipt of Demand Draft

Tower B, 1 Floor, Finance Bay

No. 4/1, IBC Knowledge Park In case of no recovery – Finance will approve the checklist

Bannerghatta Main Road, in Atlas (AST) “LWD minus 2 working days”

Bangalore-560029, Karnataka

2. Payroll Proofs Submission

2a Tax Proofs

Investment proofs, if any, for the Financial year 2019-20 should be declared on Allsec Tool &

supporting documents should be uploaded in Allsec(Soft copies) along with Form 12BB

mentioning SAP id on each and every supports which is uploaded in Allsec. However, you

should send hard copies of R539 Supports should reach Finance at the above Address (as

mentioned in Point 1) three days before Last working day.

As per Income Tax Act, 1961; in case of HRA, if annual rent paid by the employee is equal to or

exceeds Rs 1,00,000 (Rs.8,333 per month), it is mandatory for the employee to provide PAN of

the landlord to the employer. If Landlord PAN is not provided exemption towards HRA will

not be given & HRA Receipts will be rejected.

Please note that Rent receipts must be provided till LWD of employee and HRA exemption will

not be given based on any declarations. For that matter, no tax exemption will be extended for

any tax benefit based on declarations.

2b R539 Proofs (Salary Reimbursement)

After receiving “Exit Formalities Mailer - Checklist – Finance” from Finance, if employee has any

R539 claims, the same must be submitted along with Reimbursement Declaration Page and it

should reach Finance at the above Address (as mentioned in Point 1) three days before Last

Working Day.

Note – Please do not drop any proofs in Drop Box post receipt of this communication from

Finance.

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#2

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

3. Time and Expenses (T&E)

T&E is one of the important activities for all Accenture employees. Ignorance of this activity will directly

impact employees’ Financials. All you need to do is-

Check any missing time report at below link and submit any pending Time Reports in MyT&E tool

https://smartpay.allsectech.com/accenturelogin/ -> Utilities -> Fin exit approval

Time report(s), if any, is/ are not submitted will be considered as “Leave without Pay” i.e. the salary for

that particular period will not be paid. Because of this, your F&F runs into negative, even Relieving Letter

will not be issued till the recovery amount is settled by you.

Pending claims (non-payroll), if any, should be claimed before your LWD via “myTE” tool and the proofs

should be submitted to Finance before 7 days from the LWD along with the form duly approved by

Authorized Supervisor at the above address (as mentioned in Point 1). Please ensure proofs are

appropriate as the insufficient proofs may not be paid.

Please do not enter time report after your last working date by modifying work schedule in myTE tool.

th

For example, if your last working day is April 20, then while submitting TR for April 30 time period, the

following steps to be followed

Launch myTE tool (https://myte.accenture.com/)

In the April 30 Time screen, click on Work Schedule

Click on Create Tab against ‘Custom work schedule for this period only’

Remove the standard working hours charged on after April 20, 2018 (here from April 21 to April 30)

Click on Save

Enter Time and Expenses (if any) for days that you were active

Submit the Time Report.

4. Car Lease (applicable to eligible employees only)

This is one of the most important processes to be noted by you (if you have a car lease) as this will have

financial and legal impacts. To make this process smooth, all you need to is-

Please raise a request on https://accentureinternal.service-now.com portal for the outstanding amount.

You will receive a softcopy of the outstanding statement (payable to Leasing Company & Accenture)

within a week’s time.

Kindly obtain Demand Draft(s) in favor of Accenture Solutions Private Limited and/or the leasing

company & the same must reach Finance three day before your LWD at the above Address (as

mentioned in Point 1).

On receiving a confirmation regarding the car foreclosure, finance checklist would be accordingly

approved. Note - Finance checklist will be on hold if we have not received DD as per above timelines and

this matter will be referred to HR. And, no relieving documents will be issued.

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#3

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

Without settling Car Lease arrangement, possession / driving of the car will have a legal impact as the

Car is in the name of Accenture.

5. Meal Allowance

Employees who have opted for Meal Allowance, any unutilized amount lying on the digital meal card

will be carried forward post your Last working day. You can use the card as per your convenience

& the same should be utilized before the expiry date of the card.

6. Full & Final settlement (F&F)

This is the last process of your exit; post this process, final settlement amount will be transferred to your

latest designated Salary Account.

6a. General

Full and Final settlement is the process that settles your final financials with

Accenture. Therefore, it is equally your responsibility to check the calculations and get back to

us if you find discrepancies, if any, in the calculations within 15 days of your settlement. Note –

Finance will not be able to work on any escalations received after 15 days.

RL is issued by AEE team only after closure of all the checklist in AST and Completion of F&F

The F&F is completed within 21 calendar days from the date of all checklist is approved in AST

The F&F statement along with Tax Computation Sheet will be mailed to your personal email id,

if you have updated in AST. Note – Personal email ID is mandatory as it is the mode of

communication between Finance and you.

The final settlement amount will be credited to your designated salary account with Accenture.

Note –All settlement disbursements are transferred via Wire Transfer. Please ensure keeping the

salary account active till you receive F&F amount.

Please ensure submitting your Permanent Account Number (PAN) in Allsec tool if have not yet

submitted as PAN is mandatory requirement of Income Tax Act. If you fail to provide PAN,

Section 206AA will be applied where higher tax as per provisions will be deducted and the Tax

credit will not be given to you though Taxes, if any, have been recovered from your salary. This

may lead to notice from Income Tax Department.

6b. F&F Components

Depending on your eligibility, the following components would be considered while computing the

final settlement amount

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#4

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

Salary due

Leave encashment up to vacation balance of 270 hours for IDC & BPO and 240 hours for ICF &

IDB. Note – Leave Encashment can be paid as tax free up to the limits prescribed by the Income

Tax Act, 1961 from time to time. Tax exemption as per Act is available for entire service; the

exemption limit is not for each organization. Leave Encashment is paid on Fixed Pay and the

calculation is Fixed Pay ÷ No. of Standard Hours in a year x No. of hours accumulated subject to

max of 270 or 240 hours (as applicable)

Salary reimbursements (R539)

Unclaimed salary reimbursements (R539) as an Ex-gratia

Any amount payable/recoverable as per HR input (Note 1)

Pending myTE expense claims (based on the input from MYTE team)

Note:

Any specific amount payable / recoverable should be updated by the HR on the AST

In case of short notice period– please ensure your HR put right comments in the AST. They

are aware of the appropriate comments.

7. Gratuity

Gratuity is a retiral benefit as per the Gratuity Act, 1972. As per provisions of the Act, employees completing

4 years and 240 days continuous service in India are eligible for gratuity payment; GCP periods is considered

for this purpose.

The gratuity calculation is – “Last Drawn Basic Salary x 15 ÷ 26” for every completed year of service. The

maximum limit of Gratuity is INR 20 lacs. There are other terms and conditions which will be shared by

Gratuity Team to all the eligible employees. Gratuity is paid via wire transfer to your designated salary

account within 30 days from the Last Working Day. A covering letter containing the calculation would be

sent through mail. Note – Gratuity can be paid as tax free up to the limits prescribed by the Income

Tax Act, 1961, provided attached declaration is submitted as the tax exemption is for overall service

in lifetime and not for each organization/Declared in AST while raising the exit request.

8. Form-16

Please note the form-16 for the period 2019-20 would be generated after closure of financial year and will

be mailed to your personal email ID during subsequent financial year. Please do not delete the email

received from Finance. We will not be able to send duplicate mailer. For duplicate mailer, you need to

submit Indemnity on stamp paper.

For the current year income / tax details, Tax computation sheet will be mailed to you after the completion

of Full and Final settlement which can be used to submit it to your new employer while declaring previous

employer income details for the purpose of calculating annual tax.

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#5

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

Note – It is advised that it is always right to provide previous employer details in the new employment to

calculate annual taxes to avoid penalties, if any.

9. Provident Fund

9a. Withdrawal

You can withdraw your PF after leaving the company - After two months of resignation. In case no

of employment. PF withdrawals forms would be sent along with the relieving letters by the AEE

team after the settlement is completed. Duly filled PF withdrawal application can be

couriered/submitted to the below mentioned address only after 60 days from the LWD as

mentioned in the relieving letter.

Accenture Solutions Private Limited As per the provisions of PF Act, the employees whose

India Finance Center-Bay 49 (PF Forms), service is less than 6 months will not be paid the Pension

Plant 3, Godrej & Boyce complex, Fund amount. However this provision will not apply for

Pirojshanagar, LBS Marg, PF Transfer. Note – While withdrawing PF, it is wholly and

Vikhroli (West) solely your responsibility to adheres to Rules and

Mumbai - 400 079 Regulations of Provident Fund Scheme

9b. Transfer

If you are joining other organization, you can transfer your PF from Accenture to your new

organization. Your new employer will provide to requisite Forms for transferring the PF. to be

filled. Please get in touch with him.

9c. General

If the PF amount with Accenture’s PF Office is not withdrawn or is not transferred within 3 years,

the balance in your PF account will not earn any interest.

Please note that Employees’ PF is maintained by Regional Provident Fund Commissioner (Govt

of India) and we will not be having any control on their SLAs. Company’s responsibility will be

of submitting the form to RPFC.

Please write to the following id for queries related to PF - Eb.Socialsecurity@accenture.com.

10. Amex (American Express) Credit Card

Outstanding amount, if any, on the card should be cleared before your LWD at Accenture. After clearing the

dues, cancel/hotlist the card by sending an email mail to manjunath.shetty@accenture.com, Note - If you do

not settle the Credit Card, the outstanding amount, if any, will be recovered from your F&F. If the F&F amount

is not sufficient to recover the dues, the F&F will be on hold and there is an impact on your relieving letter.

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#6

respond to employees’ query from this ID. This ID has an option of sending emails only

ACCENTURE SOLUTIONS PRIVATE LTD, INDIA ACN/Payroll/01

Exit Formalities Mailer - Checklist – Finance 01st Dec, 2019

11. Payroll Tools Access

All payroll tools get blocked on your last working. Therefore, it is suggested to take print of

all your relevant documents

12. Important Points to Remember:

Please keep all the payslips, form 16, reward communication etc. well before your LWD

Please make a note of your Provident Fund (PF/UAN) number for further references in future.

Make sure to update personnel email ID & contact number in Allsec and AST portals.

Keep latest tax calculation sheet which you receive after F&F settlement as you need to submit Form

12B to your new employer for tax.

Keep PAN and Bank Account Number handy.

Please submit Form 12BB along with Tax proof, if case the same is not submitted Tax proof will not be

considered.

We wish you all the Best….Payroll Team

This document is sent from Mailer.exit@accenture.com. Please note that we do not

Page#7

respond to employees’ query from this ID. This ID has an option of sending emails only

You might also like

- Personal Current Account StatementDocument12 pagesPersonal Current Account StatementMedina SmajliNo ratings yet

- Kra 3Document1 pageKra 3whitneykasudi42No ratings yet

- Spectrum News: Service From 02/14/22 Through 03/13/22 Details On Following PagesDocument4 pagesSpectrum News: Service From 02/14/22 Through 03/13/22 Details On Following PagesMuti Ur Rehman100% (1)

- 3295 S Tamarac DR DENVER, CO, 80231 Liza ScoobiDocument1 page3295 S Tamarac DR DENVER, CO, 80231 Liza Scoobisimo100% (3)

- PASTEL Accounting Training Programme - WindhoekDocument6 pagesPASTEL Accounting Training Programme - Windhoekishe banda100% (2)

- PER Confirmation FormDocument2 pagesPER Confirmation FormMahmozNo ratings yet

- TD Mar 2021Document8 pagesTD Mar 2021James FranklinNo ratings yet

- Aln Group Clearance Form - v4 - Seadweller CorpDocument4 pagesAln Group Clearance Form - v4 - Seadweller CorpJomar FrogosoNo ratings yet

- Employee Final Settlement - Maria SabadoDocument1 pageEmployee Final Settlement - Maria SabadoZeeshan MirzaNo ratings yet

- HRD - No-8 Final SettlementDocument1 pageHRD - No-8 Final SettlementHOSAM HUSSEINNo ratings yet

- Letter of Appointment Date: 27/08/2022 To, Smith KevadiyaDocument6 pagesLetter of Appointment Date: 27/08/2022 To, Smith KevadiyaS'MITH KEVADIYANo ratings yet

- Appointment Letter - Mahesh ShuklaDocument4 pagesAppointment Letter - Mahesh ShuklaRamesh GiriNo ratings yet

- Beneficiary Designation FormDocument1 pageBeneficiary Designation FormSaqib RodriguezNo ratings yet

- TallyDocument1 pageTallyAvichi KrishnanNo ratings yet

- OML Vendor Registration Form New 07.07.2017 - Vendor Info FormDocument1 pageOML Vendor Registration Form New 07.07.2017 - Vendor Info FormArjun PrabhakarNo ratings yet

- Ratios For CMA Report and Bank Funding - Taxguru - inDocument4 pagesRatios For CMA Report and Bank Funding - Taxguru - inShreeRang Consultancy100% (1)

- Payroll Brochure For Prospective ClientsDocument2 pagesPayroll Brochure For Prospective Clientsanon-414607100% (3)

- Cashpor ProfileDocument4 pagesCashpor Profileamartya tiwariNo ratings yet

- Offer LetterDocument3 pagesOffer LetterNAVNEET SHARMANo ratings yet

- Letter of Job Confirmation 198Document1 pageLetter of Job Confirmation 198Winbox IndiaNo ratings yet

- Test 2 - PracticalDocument3 pagesTest 2 - Practicalapi-285058949No ratings yet

- Attendance Format - Daily WagesDocument1 pageAttendance Format - Daily WagesChandan RaiNo ratings yet

- Axis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Document6 pagesAxis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Ragul0042No ratings yet

- MyntraDocument3 pagesMyntraJayaraj Kristal100% (2)

- Accounts Receivable: Chartered Institute of Internal AuditorsDocument7 pagesAccounts Receivable: Chartered Institute of Internal AuditorsClarice GuintibanoNo ratings yet

- Meghna Petroleum Limited: Chart of AccountsDocument21 pagesMeghna Petroleum Limited: Chart of AccountsAbu Shahadat Muhammad SayeemNo ratings yet

- Irjet V7i7216Document11 pagesIrjet V7i7216Albacore EnterprisesNo ratings yet

- Nikhil Sinha: Work Experience SkillsDocument1 pageNikhil Sinha: Work Experience SkillsNikhil SinhaNo ratings yet

- Creating Payment Reminder Templates For CustomersDocument5 pagesCreating Payment Reminder Templates For CustomersJenn TorrenteNo ratings yet

- Form 16 ADocument1 pageForm 16 AJigar GutkaNo ratings yet

- InfoCepts Policy For Salary Advances LoansDocument10 pagesInfoCepts Policy For Salary Advances Loansmanish.sinhaNo ratings yet

- Taxguru - In-Checklist For Internal Audit of GSTDocument2 pagesTaxguru - In-Checklist For Internal Audit of GSTRonak DesaiNo ratings yet

- Dry Ice Care: Business PlanDocument39 pagesDry Ice Care: Business Planمحمد ابوبكر0% (1)

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document52 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeanieNo ratings yet

- MCB Bank LimitedDocument3 pagesMCB Bank LimitedAhmad Bilal0% (1)

- Byjus Offer LetterDocument5 pagesByjus Offer LetterYash JainNo ratings yet

- Job Offer Letter TemplateDocument2 pagesJob Offer Letter TemplatePAULO GUIBORNo ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Osmotech Ict Business ProposalDocument17 pagesOsmotech Ict Business ProposalTlholohelo HatlaneNo ratings yet

- SBI Compensation Policy 2018Document21 pagesSBI Compensation Policy 2018fictional worldNo ratings yet

- Down Payment Invoices ProcessDocument7 pagesDown Payment Invoices ProcessPedro ArroyoNo ratings yet

- Airpay Clients ProductDocument29 pagesAirpay Clients ProductKunal GroverNo ratings yet

- Final Report of BPODocument39 pagesFinal Report of BPOgaurav_81515No ratings yet

- Fixed Assets - RevisedDocument6 pagesFixed Assets - RevisedPiyush MundadaNo ratings yet

- Product Brochure BUSY 18Document2 pagesProduct Brochure BUSY 18KishanNo ratings yet

- Konstruksi Indonesia 2010 - Exhibition Contract FormDocument2 pagesKonstruksi Indonesia 2010 - Exhibition Contract FormYudith Bdoel AbdullahNo ratings yet

- Po 3000124556 PDFDocument22 pagesPo 3000124556 PDFJitendra Kumar YadavNo ratings yet

- Tcs-Offer-Letterpdf OCRDocument18 pagesTcs-Offer-Letterpdf OCRChethan VNo ratings yet

- Amex Offer Terms INDocument3 pagesAmex Offer Terms INRajNo ratings yet

- NGO Registration FormDocument4 pagesNGO Registration Formrachit-malviya-421367% (6)

- Profit and Loss Forecast v1.0Document4 pagesProfit and Loss Forecast v1.0Jessica AngelinaNo ratings yet

- Berger Paints India Limited Job DescriptionDocument3 pagesBerger Paints India Limited Job DescriptionChitesh SanoriaNo ratings yet

- Akth Technical ReportDocument20 pagesAkth Technical Reportibraheemyusuf04No ratings yet

- Raj Bhala: Rice Distinguished Professor, The University of Kansas School of Law, Lawrence, KansasDocument28 pagesRaj Bhala: Rice Distinguished Professor, The University of Kansas School of Law, Lawrence, KansasmarufhossainnilNo ratings yet

- Debtor-Creditor Cicularization FormateDocument1 pageDebtor-Creditor Cicularization FormateChristopher TateNo ratings yet

- Company Financial Salaries For An Employee Wages Deductions: Payroll TaxesDocument4 pagesCompany Financial Salaries For An Employee Wages Deductions: Payroll TaxesMallika ShounikNo ratings yet

- Candidate Declaration FormDocument8 pagesCandidate Declaration FormDon RajuNo ratings yet

- Petroleum Licence Application Form PDFDocument10 pagesPetroleum Licence Application Form PDFnicholas idungafa100% (1)

- Company Profile FormatDocument17 pagesCompany Profile Formatmysorabh3533No ratings yet

- Bank Account Opening FormDocument5 pagesBank Account Opening FormBhushan PatilNo ratings yet

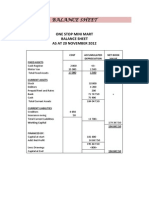

- Balance Sheet: One Stop Mini Mart Balance Sheet As at 20 November 2012Document1 pageBalance Sheet: One Stop Mini Mart Balance Sheet As at 20 November 2012Naomi HugginsNo ratings yet

- Umesh Kumar-Offer LetterDocument2 pagesUmesh Kumar-Offer LetterUMESH KUMARNo ratings yet

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyFrom EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyRating: 5 out of 5 stars5/5 (1)

- I.K. Gujral Punjab Technical University: NoticeDocument3 pagesI.K. Gujral Punjab Technical University: NoticeAnowar MollaNo ratings yet

- Taxation in IndiaDocument72 pagesTaxation in IndiaEmmanuel franksteinNo ratings yet

- PESCO ONLINE BILL ZeeshanDocument1 pagePESCO ONLINE BILL ZeeshanSyed Muhammad ZeeshanNo ratings yet

- Address Proof ACT Bill PDFDocument2 pagesAddress Proof ACT Bill PDFThulasi Ram0% (1)

- Gov. Walz 2013 Tax Returns - RedactedDocument17 pagesGov. Walz 2013 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- World Bank FPS Australia NPP Case StudyDocument45 pagesWorld Bank FPS Australia NPP Case StudyimshwetaNo ratings yet

- TORONTO01Document2 pagesTORONTO01itrcentre07No ratings yet

- Summary Uk Payment Markets 2021 FinalDocument8 pagesSummary Uk Payment Markets 2021 FinalvetemNo ratings yet

- 365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsDocument3 pages365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsMihir HareetNo ratings yet

- New Generation Banks: Presentation By, Mahesh M S3 Mba NO: 32Document16 pagesNew Generation Banks: Presentation By, Mahesh M S3 Mba NO: 32sameerNo ratings yet

- Bank Recon and CC and PCF ProblemsDocument5 pagesBank Recon and CC and PCF ProblemsCruxzelle BajoNo ratings yet

- Saniah InvoiceDocument1 pageSaniah InvoiceLiyana ShahiminNo ratings yet

- Sample of Bank StatementDocument62 pagesSample of Bank StatementEneji ClementNo ratings yet

- Yo QCCB C7 Yj 0 H7 C 8Document1 pageYo QCCB C7 Yj 0 H7 C 8shital dilip bhavsarNo ratings yet

- Non Resident Account: Tax InvoiceDocument2 pagesNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿNo ratings yet

- City of Watertown Tax Sale Notice June 2020Document7 pagesCity of Watertown Tax Sale Notice June 2020NewzjunkyNo ratings yet

- KPMG Budget Analysis 2022Document25 pagesKPMG Budget Analysis 2022raymanNo ratings yet

- Passenger: Booking Number: R43AB3Document3 pagesPassenger: Booking Number: R43AB3eniNo ratings yet

- Fact Sheet - Home Renovation Loan: MaybankDocument2 pagesFact Sheet - Home Renovation Loan: MaybankLissa ChooNo ratings yet

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- Example Income Statement:: Gross SalesDocument2 pagesExample Income Statement:: Gross Salesabdirahman YonisNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- District Health Society, Lakhimpur Invoice-100420 PDFDocument1 pageDistrict Health Society, Lakhimpur Invoice-100420 PDFsadiq shaikNo ratings yet

- Module 4 - December2020 - Pacs008Document26 pagesModule 4 - December2020 - Pacs008Arul SelvanNo ratings yet