With Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18

Uploaded by

Allyssa Camille ArcangelCopyright:

Available Formats

With Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18

Uploaded by

Allyssa Camille ArcangelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

With Diclosure On Transition To The Pfrs For Ses, See Below Example in No.18

Uploaded by

Allyssa Camille ArcangelCopyright:

Available Formats

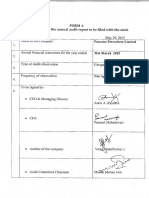

ACYATAN & CO.

CPAS

GUIDELINES FOR PFRS For Small Entities

1 Adoption of PFRS for Ses

Basis of Preparation of Financial Statements

The financial statements as at and for the year ended December 31, 2019 of the Company has been prepared in accordance

First Time Adoption with the Philippines Financial Reporting Standard for Small Entities (PFRS for SEs) as approved by the Financial Reporting

Standards Council, Board of Accountancy, and Securities and Exchange Commission (SEC) which was effective starting

January 1, 2019. The Company financial statements have been prepared on a historical basis.

* With diclosure on Transition to the PFRS for SEs, See Below Example in No.18

Basis of Preparation of Financial Statements

The financial statements as at and for the year ended December 31, 2019 of the Company has been prepared in accordance

Early Adoption with the Philippine Financial Reporting Standard for Small Entities (the “Framework”) as approved by the Financial

Reporting Standards Council, Board of Accountancy, and Securities and Exchange Commission (SEC). The Company adopted

the PFRS for SEs on January 1, 2018, earlier than its mandatory effective date of January 1, 2019, as allowed by the standard

itself and the existing SEC rules and regulations.

* Without the diclosure on Transition to the PFRS for SEs

2 Cash and Cash Equivalents Cash - Use when composition are Petty Cash, Cash on Hand and Cash in Bank

Cash & Cash Equivalents - use when there is moneymarket (3months or below term) included

3 Receivables Accounts Receivable or Trade Receivables - use when purely receivable from customers

Accounts and Other Receivable or Trade and Other Receivables - use when the compositions are receivables from

customers, receivables from employees, etc.

4 Inventory Merchandise Inventory - use when the Company's business industry is trading (supermarket, grocery, etc.)

Inventory - use when the Company's business industry is Manufacturing, or Trading & Manufacturing, or the composition

includes Office supplies inventory

5 Prepayments Prepaid Expenses - use when pertaining only to advance payment of expenses (insurance, rent, etc.

Prepaid Income Tax - use when it pertains only to creditable income tax/overpayment of tax

Prepayments - used when the compositions are prepaid expenses and prepaid (income) taxes

6 Property and Equipment Use "Property, Plant and Equipment" if there is a plant (normally used in manufacturing company) if not " Property and

Equipment" only

Disclose current year (2019) movements of Property and Equipment only no need for the previous year (2018)

Itemize the useful lives of Property and Equipment on the Significant Policy if there are 2 or more classification of P&E

Make sure the account name used in the significant policy is the same in the PPE notes.

7 Other Current Asset & Other Noncurrent Assets Use Other Current Asset/Other Noncurrent Assets if there are two or more composition if not use the account name of the

amount referring to. (e.g. Security Deposit)

8 Payables Trade Payables - used when engaged in Trading Business.

Accounts Payable - use when the composition are payable to supplier of goods and services (e.g. accounting fee, audit fee,

etc.)

Accounts Payable and Accrued Expenses - use when the compsoition are accounts payable and accrual of expenses

Accrued Expenses - use when the composition is purely accrual of expenses.

Accounts Payable and Other Payables - use when the comp0osition are accounts payable, taxes payable (except income tax

payable should be separate line item) and government regulatory payable (e.g. sss, philhealth, HDMF contribution/loan etc.)

9 Related Party Transactions Due from/to related party/ies (afficiates, officers, stockholders) should be presented as separate line item in the statements of

financial position

10 Equity PLEASE check with the client if there were increase in ACS, increase in subscription, dividend. It is UNFORGIVABLE if our

Firm processed the SEC requirement of the client and yet the changes were not reflected in the related account.

Capital Stock or Share Capital, any will do just make sure consistent in using the account name

APIC of Share Premium, any will do just make sure consistent in using the account name (If Share Capital was used, use

Share Premium)

Double Check the number of stockholders with the latest (2019 or 2020) GIS

11 Retained Earnings Check if Excess Retained Earnings.

Disclose appropriations if any with detailed plan.

12 Sales/Revenue/Income You may use "Rental Income" if purely earned from leased-out of properties

Use single statement of "Statements of income and Retained Earnings", if the only changes to equity in the current period or

13 Statements of Income and Retained Earnings any comparative period presented in the financial statements arise from profit or loss, payment of dividends, corrections of

prior period errors, and changes in accounting policy

14 Income Tax Use Tax Payable method

Disclose the NOLCO in the Notes to FS but don't recognized the DTA.

Make sure to include the NOLCO in the AITR

Double check the computation of Income Tax specially for Sole Proprietorship

Please observe the new recognition and measurement of lease.

15 Leases Recognition of Rental Income - A lessor shall recognize all lease receipts as income in profit or loss in the period in which

they are earned.

Recognition of Rental Expense - A lessee shall recognize all lease payments as expense in profit or loss in the period in which

they are incurred.

Please observe proper presentation.

15 Statements of Cash Flows the amount should be " Net Income before Tax" not " Net Income for the year/ Net Income after Tax"

the amount should be "Income tax Paid" not "Income tax Payable"

16 Statements of Changes in Equity Do not show the Authorized Capital Stock, Par Value, Number of Shares.

This should just be disclosed in the Notes to FS.

Please avoid unnecessary disclosures. Do not include an accounting policy when there is no such account in the FS.

17 Excessive Disclosures

Exception: Retirement Benefits , Related Party Transactions and Relationships and Provisions and Contingencies.

Transition to the PFRS for Small Entities (SEs)

Transition Diclosure if no Reconciling item, however, if have The Company’s date of transition to the PFRS for SEs is at January 1, 2019. The Company prepared its opening PFRS for SEs

reconciling items, diclose the effects in the Notes, before Statement of Financial Position at that date.

18 Supplementary Information RR-15-2010.

The Company’s transition from PFRS for SMEs to PFRS for SEs did not have any significant effect on the Company’s Equity at

January 1, 2018 and December 31, 2018, and on the Net Income/(Loss) for the year ended December 31, 2018, hence, no

reconciliation is presented.

You might also like

- Norman G. Fosback - Stock Market Logic - A Sophisticated Approach To Profits On Wall Street-Dearborn Financial Publishing, Inc. (1991)100% (27)Norman G. Fosback - Stock Market Logic - A Sophisticated Approach To Profits On Wall Street-Dearborn Financial Publishing, Inc. (1991)396 pages

- HO 3 - Qualified Audit Report - Scope LimitationNo ratings yetHO 3 - Qualified Audit Report - Scope Limitation3 pages

- Credit Sales AR and Equity Chapters QuestionsNo ratings yetCredit Sales AR and Equity Chapters Questions4 pages

- Commissioner of G.R. No. 163345 Internal Revenue,: Chairperson, - Versus - CHICO-NAZARIONo ratings yetCommissioner of G.R. No. 163345 Internal Revenue,: Chairperson, - Versus - CHICO-NAZARIO70 pages

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsNo ratings yetPhilippine Accounting Standard No. 1: Presentation of Financial Statements58 pages

- Chapter 1 - Overview of Government AcctgNo ratings yetChapter 1 - Overview of Government Acctg21 pages

- Auditing in Specialized Industries CompressNo ratings yetAuditing in Specialized Industries Compress10 pages

- AP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - EncryptedNo ratings yetAP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - Encrypted5 pages

- Auditor's Report On Financial StatementsNo ratings yetAuditor's Report On Financial Statements10 pages

- Philippine Standards On Auditing 220 RedraftedNo ratings yetPhilippine Standards On Auditing 220 Redrafted20 pages

- Audit Evidence Procedures and DocumentationNo ratings yetAudit Evidence Procedures and Documentation46 pages

- Audit of Income and Expenditure Account 1.1100% (1)Audit of Income and Expenditure Account 1.127 pages

- MSC-Audited FS With Notes - 2014 - CaseNo ratings yetMSC-Audited FS With Notes - 2014 - Case12 pages

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020No ratings yetReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-202033 pages

- Chapter 12 Assurance and Non Assurance EngagementsNo ratings yetChapter 12 Assurance and Non Assurance Engagements14 pages

- Sec Memo No. 2, s2012 - Guidelines On Securities Deposit of Branch Offices of Foreign CorporationsNo ratings yetSec Memo No. 2, s2012 - Guidelines On Securities Deposit of Branch Offices of Foreign Corporations7 pages

- INTACC 3.1LN Presentation of Financial StatementsNo ratings yetINTACC 3.1LN Presentation of Financial Statements9 pages

- Philippine Standards On Quality Control (PSQC) (PSQC1, PSA 220)No ratings yetPhilippine Standards On Quality Control (PSQC) (PSQC1, PSA 220)17 pages

- PSA-706 Emphasis On Matter Paragraphs & Other Matter Paragraphs in The Independent Auditor's ReportNo ratings yetPSA-706 Emphasis On Matter Paragraphs & Other Matter Paragraphs in The Independent Auditor's Report14 pages

- NC Iii-Bookkeeping Coverage and ReviewerNo ratings yetNC Iii-Bookkeeping Coverage and Reviewer4 pages

- Ais Quizzes Accounting Information System Chapter Quiz - CompressNo ratings yetAis Quizzes Accounting Information System Chapter Quiz - Compress22 pages

- Montenegro Tabular Schedule of Standards and Interpretations 2019No ratings yetMontenegro Tabular Schedule of Standards and Interpretations 20196 pages

- Tax Audit Program: Area of Verification Done BY 1) 2) 3) 4) Credit Note 5)No ratings yetTax Audit Program: Area of Verification Done BY 1) 2) 3) 4) Credit Note 5)4 pages

- ##1) An Overview of Insurance Audit in Bangladesh (No ratings yet##1) An Overview of Insurance Audit in Bangladesh (10 pages

- Auditing Theory Review Notes (AT-3) Page 1 of 13: Industry ConditionsNo ratings yetAuditing Theory Review Notes (AT-3) Page 1 of 13: Industry Conditions13 pages

- Lecture 14 Audit of Specialised Industries 1 .Pptx-1No ratings yetLecture 14 Audit of Specialised Industries 1 .Pptx-110 pages

- Module I. Business Combination Date of Acquisition NANo ratings yetModule I. Business Combination Date of Acquisition NA13 pages

- DSWD NCR - Audit Program Semi Expendable and PPENo ratings yetDSWD NCR - Audit Program Semi Expendable and PPE4 pages

- Chapter 2-Audits of Financial Statements PDF100% (1)Chapter 2-Audits of Financial Statements PDF23 pages

- FULL PFRS - Unqualified Auditors Report (Capital Deficiency)No ratings yetFULL PFRS - Unqualified Auditors Report (Capital Deficiency)3 pages

- Consolidated Ind as Illustrative Financial StatementsNo ratings yetConsolidated Ind as Illustrative Financial Statements97 pages

- Financial Year 2016 E.C - Tax Planning Tips - Hima ExpressNo ratings yetFinancial Year 2016 E.C - Tax Planning Tips - Hima Express5 pages

- Week 5 Topic 7 Share Capital Types, Shares and Shareholders' RightsNo ratings yetWeek 5 Topic 7 Share Capital Types, Shares and Shareholders' Rights34 pages

- Introduction To Financial Services Marketing100% (1)Introduction To Financial Services Marketing14 pages

- case-study-cash-flow-12--13-05122024-112145pmNo ratings yetcase-study-cash-flow-12--13-05122024-112145pm4 pages

- Documents - Ienergizer Admission Document 27 8 101 PDFNo ratings yetDocuments - Ienergizer Admission Document 27 8 101 PDF120 pages

- Alabama Last Will and Testament TemplateNo ratings yetAlabama Last Will and Testament Template5 pages

- Articles of Incorporation by Laws Javier and Lara CorporationNo ratings yetArticles of Incorporation by Laws Javier and Lara Corporation9 pages

- 2014 - Nyamasege - Effect of Asset Structure On Value PDFNo ratings yet2014 - Nyamasege - Effect of Asset Structure On Value PDF8 pages

- Fe 9 Reviewer: Sir Xerez Singson InvestmentNo ratings yetFe 9 Reviewer: Sir Xerez Singson Investment10 pages

- BBA VIth Sem Financial Instituion & MarketNo ratings yetBBA VIth Sem Financial Instituion & Market2 pages

- CA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam OnlyNo ratings yetCA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam Only28 pages