0 ratings0% found this document useful (0 votes)

171 viewsCEMEX

CEMEX

Uploaded by

EmmanuelCEMEX began globalizing in the early 1990s through a series of acquisitions. It first expanded into Spain in 1992 to gain a foothold in Europe in response to growing competition in Mexico from European cement companies. CEMEX developed standardized processes called "The CEMEX Way" to integrate acquisitions while allowing local flexibility. Through continuous acquisitions and integration of best practices, CEMEX became a global leader in building materials with a presence in over 50 countries by 2007.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

CEMEX

CEMEX

Uploaded by

Emmanuel0 ratings0% found this document useful (0 votes)

171 views10 pagesCEMEX began globalizing in the early 1990s through a series of acquisitions. It first expanded into Spain in 1992 to gain a foothold in Europe in response to growing competition in Mexico from European cement companies. CEMEX developed standardized processes called "The CEMEX Way" to integrate acquisitions while allowing local flexibility. Through continuous acquisitions and integration of best practices, CEMEX became a global leader in building materials with a presence in over 50 countries by 2007.

Original Description:

operations management

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

CEMEX began globalizing in the early 1990s through a series of acquisitions. It first expanded into Spain in 1992 to gain a foothold in Europe in response to growing competition in Mexico from European cement companies. CEMEX developed standardized processes called "The CEMEX Way" to integrate acquisitions while allowing local flexibility. Through continuous acquisitions and integration of best practices, CEMEX became a global leader in building materials with a presence in over 50 countries by 2007.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

171 views10 pagesCEMEX

CEMEX

Uploaded by

EmmanuelCEMEX began globalizing in the early 1990s through a series of acquisitions. It first expanded into Spain in 1992 to gain a foothold in Europe in response to growing competition in Mexico from European cement companies. CEMEX developed standardized processes called "The CEMEX Way" to integrate acquisitions while allowing local flexibility. Through continuous acquisitions and integration of best practices, CEMEX became a global leader in building materials with a presence in over 50 countries by 2007.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 10

CEMEX: Globalization “The CEMEX Way” Donald R.

Lessard and Cate Reavis When one

wants to globalize a company, especially when it is from a developing country like Mexico, you

really need to apply more advanced management techniques to do things better. We have seen

many cement companies that use their capital to acquire other companies but without making the

effort to have a common culture or common processes, they get stagnant. 1 —Lorenzo

Zambrano, Chairman and CEO CEMEX On June 7, 2007 Mexico-based CEMEX won a

majority stake in Australia’s Rinker Group. The $15.3 billion takeover, which came on top of the

major acquisition in 2005 of the RMC Corporation – then the world’s largest ready-mix concrete

company and the single largest purchaser of cement – made CEMEX one of the world’s largest

supplier of building materials. This growth also rewarded CEMEX’s shareholders handsomely

through 2007, though its share price had fallen precipitously in 2008 in response to the global

downturn and credit crisis coupled with the substantial financial leverage that had accompanied

the Rinker acquisition. CEMEX’s success over the 15 years from its first international

acquisition in 1992 to the Rinker acquisition in 2007 was not only noteworthy for a company

based in an emerging economy, but also in an industry where the emergence of a multinational

from an emerging economy (EMNE) as a global leader could not be explained by cost arbitrage;

given cement’s low value to weight ratio little product moves across national boundaries. Much

of CEMEX’s success could be attributed to how it looked at acquisitions, and the post-merger

integration (PMI) process that ensued, as an opportunity to drive change, and as a result,

continuously evolve as a corporation. Since it began globalizing its operations in the early 1990s,

the 1 John Barham, “An Intercontinental Mix;” Latin Finance, April 1, 2002. CEMEX:

GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009 2

company had been praised for its ability to successfully integrate its acquisitions by, at one and

the same time, introducing best practices that had been standardized throughout the corporation

and making a concerted effort to learn best practices from the acquired company and implement

them where appropriate. Known internally as the CEMEX Way, CEMEX standardized business

processes, technology, and organizational structure across all countries while simultaneously

granting countries certain operational flexibility, enabling them to react more nimbly to local

operating environments. In addition, CEMEX was known as an innovator, particularly in

operations and marketing, and the CEMEX Way encouraged innovation, particularly if it could

be applied throughout the firm. For CEMEX, the resulting innovation and integration process

was an ongoing effort as it recognized the value of “continuous improvement.” The development

of CEMEX’s growing international footprint and the associated learning process could be

divided into four stages: Laying the Groundwork for Internationalization, Stepping Out, Growing

Up, and Stepping Up. (See Table 1.) This case details how CEMEX has exploited its core

competencies, initially generated at home, and enhanced these with learnings from new

countries, to begin the cycle again. Table 1 CEMEX Internationalization Timeline Year Stage

Key Events Key Steps in Internationalization Process (italics indicate acquisition) Laying the

Groundwork 1982 Mexican crash 1985 Zambrano named CEO 1989 Consolidates Mexican

market position with acquisition of Tolteca 1989 Anti-dumping penalties imposed on exports to

U.S. Stepping Out 1992 Spain 1994 Venezuela, Panama 1995 Mexican recession Dominican

Republic Growing Up 1996 Colombia 1996 Death of CFO PMI applied to Mexico 1997- 1999

Philippines, Indonesia, Egypt, Chile, Costa Rica 1999 NYSE Listing Stepping Up 2000

Southdown US 2005 RMC (UK- based global ready-mix) 2007 Rinker (Australian/US based

global concrete, aggregates) CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R.

Lessard and Cate Reavis March 5, 2009 3 Laying the Groundwork for Internationalization In the

25 years leading up to the Rinker deal, CEMEX had evolved from a small, privately-owned,

cement-focused Mexican company of 6,500 employees and $275 million in revenue to a

publiclytraded, global leader of 65,000 employees with a presence in 50 countries and $21.7

billion in annual revenue in 2007. See Exhibit 1 for financials and Exhibit 2 for market share

information. Well before its first significant step toward international expansion in 1992,

CEMEX had developed a set of core competencies that would shape its later trajectory including

strong operational capabilities based on engineering and IT, and a culture of transparency. It also

had mastered the art of acquisition and integration within Mexico, having grown though

acquisitions over the years.2 Between 1987 and 1989 alone, the company spent $1 billion in

order to solidify its position at home. When the current CEO, Lorenzo Zambrano, assumed this

post in 1985, Mexico had already begun the process of opening up its economy, culminating

with its entry into NAFTA. The 1982 crash undercut the state-led nationally-focused model that

had been predominant in Mexico over the years, and Mexico began the process of entering

GATT, the precursor of the WTO. Recognizing that these events would significantly change the

Mexican cement industry from a national to a global game, Zambrano began preparing the firm

for a global fight. The first step would involve divestitures from non-related businesses and the

disposal of non-core assets. CEMEX also began “exploring” opportunities in foreign markets

through exports, which required a fairly aggressive program of building or buying terminal

facilities in other markets. Finally, the company began laying the groundwork for global

expansion by investing in a satellite communication system, CEMEXNET, in order to avoid

Mexico’s erratic, insufficient and expensive phone service, and allow all of CEMEX’s 11 cement

factories in Mexico to communicate in a more coordinated and fluid way.3 Along with the

communication system, an Executive Information System was implemented in 1990. All

managers were required to input manufacturing data—including production, sales and

administration, inventory and delivery— that could be viewed by other managers. The system

enabled CEO Zambrano to conduct “virtual inspections” of CEMEX’s operations including the

operating performance of individual factories from his laptop computer. Stepping Out In 1989,

CEMEX completed a major step in consolidating its position in the Mexican cement market by

acquiring Mexican cement producer Tolteca, making CEMEX the second largest Mexican

cement producer and putting it on the Top 10 list of world cement producers. At the time of the

acquisition, 2 CEMEX was formed in 1931 from a merger between Cementos Hidalgo and

Cementos Portland Monterrey. Later acquisitions and domestic expansion activity included:

1966, acquisition of Cementos Maya's plants in Merida and Yucatan (South East Mexico) and

construction of new plants in Torreon, Coahuila and Ciudad Valles, San Luis Potosi (Central

Eastern); 1970, acquisition of a plant in Central Mexico; 1976, acquisition of Cementos

Guadalajara's three plants (Central Western); 1987, acquisition of Cementos Anahuac; 1989,

acquisition of Cementos Tolteca (Distrito Federal). 3 Hau Lee and David Hoyt, “CEMEX:

Transforming a Basic Industry,” Stanford Graduate School of Business Case No. GS-33.

CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March

5, 2009 4 CEMEX was facing mounting competition in Mexico. Just three months before the

deal with Tolteca was finalized, Swiss-based Holderbank (Holcim), which held 49% of Mexico’s

third largest cement producer Apasco (19% market share), announced its intention to increase its

cement capacity by 2 million tons.4 This, along with easing foreign investment regulations that

would allow Holderbank to acquire a majority stake in Apasco, threatened CEMEX’s position in

Mexico.5 At the time, CEMEX accounted for only 33% of the Mexican market while 91% of its

sales were domestic. In addition to these mounting threats in its home market, CEMEX was

confronted with trade sanctions in the United States, its largest market outside of Mexico.

Exports to the U.S. market began in the early 1970s, but by the late 1980s, as the U.S. economy

and construction industry were experiencing a downturn, the U.S. International Trade

Commission slapped CEMEX with a 58% countervailing duty on exports from Mexico to the

United States, later reduced to 31%.6 In 1992, CEMEX acquired a majority stake in two Spanish

cement companies, Valenciana and Sanson, for $1.8 billion, giving it a majority market share

(28%) in one of Europe’s largest cement markets.7 The primary motivation for entering Spain

was a strategic response to Holcim’s growing market share in Mexico. As Hector Medina,

CEMEX Executive VP of Planning and Finance, explained, “Major European competitors had a

very strong position in Spain and the market had become important for them.” 8 A further

important reason for the acquisition was that Spain during this time was an investmentgrade

country, having just entered the European Monetary Union, while domestic interest rates in

Mexico were hovering at 40%, and Mexican issuers faced a country risk premium of at least 6%

for offshore dollar financing.9 Operating in Spain enabled CEMEX to tap this lower cost of

capital not only to finance the acquisition of Valenciana and Sanson, but also to fund its growth

elsewhere at affordable rates. (See Exhibit 3 for CEMEX organizational structure.) While this

benefit could have been obtained in any EU country, Spain offered considerable opportunities for

growth and was relatively affordable. In addition, the linguistic and cultural ties between the two

countries made it a sensible strategic move. In order to pay off the debt taken on to fund the

acquisition, CEMEX set ambitious targets for cost recovery. However, it soon discovered that by

introducing its current Mexican-based best practice to the Spanish operation, it was able to

reduce costs and increase plant efficiency to a much greater 4 “Holderbank of Switzerland

Announces Major Investment Plans,” Neue Zuercher Zeitung October 13, 1989. 5 John Barham,

“An Intercontinental Mix,” Latin Finance, April 1, 2002. 6 Pankaj Ghemawat and Jamie L.

Matthews, “The Globalization of CEMEX,” Harvard Business School Case No. 701-017. 7

Pankaj Ghemawat and Jamie L. Matthews, “The Globalization of CEMEX,” Harvard Business

School Case No. 701-017. 8 Joel Podolny and John Roberts, “CEMEX, S.A. de C.V.: Global

Competition in a Local Business,” Stanford University Graduate School of Business, Case No.

S-IB-17. 9 L. Hossie, "Remaking Mexico," The Globe and Mail, February 7, 1990. CEMEX:

GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009 5

extent, with annual savings/benefits of $120 million10 and an increase in operating margins from

7% to 24%.11 Thus, while the primary motive for the Spanish acquisition was to respond to a

competitive European entry in its home market, a major source of value resulting from the

acquisition was the improvement in operating results due to the transfer of best practice from a

supposedly less advanced country to a supposedly more advanced one. Further, although it had

acquired and integrated many firms within Mexico, this acquisition, because of its size and the

fact that it was in a foreign country, forced CEMEX to formalize and codify its Post Merger

Integration (PMI) process. CEMEX also enhanced its capabilities through direct learning from

Spain. The company discovered, for example, that the two Spanish companies were unusually

efficient due to the use of petroleum coke as a main fuel source. Within two years, the vast

majority of CEMEX plants began using petroleum coke as a part of the company’s energy-

efficiency program. 12 Accelerating Internationalization and Consolidating the CEMEX Way

CEMEX’s move into Spain was followed soon after with acquisitions in Venezuela, Colombia,

and the Caribbean in the mid-1990s, and the Philippines, and Indonesia in the late 1990s. These

acquisitions, by and large, could be seen as exploiting CEMEX’s core capabilities, which now

combined learnings from the company’s operations in Mexico and Spain. The PMI process also

underwent a significant change during this period. Attempts to impose the same management

processes and systems used in Mexico on the newly acquired Colombian firm resulted in an

exodus of local talent. As a result of the difficult integration process that ensued, CEMEX

learned that alongside transferring best practices that had been standardized throughout the

company, it needed to make a concerted effort to learn best practices from acquired companies,

implementing them when appropriate. This process became known as the CEMEX Way. The

CEMEX Way, also known as internal benchmarking, was the core set of best business practices

with which CEMEX conducted business throughout all of its locations. More a corporate

philosophy than a tangible process, the CEMEX Way was driven by five guidelines: • Efficiently

manage the global knowledge base; • Identify and disseminate best practices; • Standardize

business processes; • Implement key information and Internet-based technologies; 10 J. Duncan,

"CEMEX Wrings Savings from Spanish Purchases," Reuters, March 19, 1993. 11 Joel Podolny

and John Roberts, “CEMEX, S.A. de C.V.: Global Competition in a Local Business,” Stanford

University Graduate School of Business, Case No. S-IB-17. 12 Francisco Chavez, “CEMEX

Takes the High Road,” NYSE Magazine, October/November 2006. CEMEX:

GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009 6

• Foster innovation. As part of the integration phase of the PMI, the CEMEX Way process

involved the dispatch of a number of multinational standardization teams made up of experts in

specific functional areas (Planning Finance, IT, HR), in addition to a group leader, and IT and

HR support. Each team was overseen by a CEMEX executive at the VP level.13 The CEMEX

Way was arguably what made CEMEX’s PMI process so unique. While typically 20% of an

acquired company’s practices were retained, instead of eliminating the 80% in one swift motion

CEMEX Way teams cataloged and stored those practices in a centralized database. Those

processes were then benchmarked against internal and external practices. Processes that were

deemed “superior” (typically two to three per standardization group or 15-30 new practices per

acquisition) became enterprise standards and, therefore, a part of the CEMEX Way. As one

industry observer noted, CEMEX’s strategy sent an important message of, “We are overriding

your business processes to get you quickly on board, but within the year we are likely to take

some part of your process, adapt it to the CEMEX system and roll it out across operations in

[multiple] countries.”14 By some estimates, 70% of CEMEX’s practices had been adopted from

previous acquisitions.15 Furthermore, in just 8 years, CEMEX was able to bring down the

duration of the PMI process from 25 months for the Spanish acquisitions to less than five months

for Texas-based Southdown. Figure 1 Duration of Post-Merger Integration Process Source:

CEMEX. 13 Joel Whitaker and Rob Catalano, “Growth Across Borders,” Corporate Strategy

Board, October 2001. 14 Marc Austin, “Global Integration the CEMEX Way,” Corporate

Dealmaker, February 2004. 15 Joel Whitaker and Rob Catalano, “Growth Across Borders,”

Corporate Strategy Board, October 2001. 0 5 10 15 20 25 30 1992 1994 2000 2002 Months

Spain 11.5MT Southdown 11.0MT Venezuela 4.3MT Puerto Rico 1.1MT CEMEX:

GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009 7

A key feature of the PMI process was the strong reliance that CEMEX placed on middle-level

managers to both diffuse the company’s standard practices and to identify existing capabilities in

the acquired firms that might contribute to the improvement of CEMEX’s current capability

platform. PMI teams were formed ad-hoc for each acquisition. Functional experts in each area

(finance, production, logistics, etc) were selected from CEMEX operations around the world.

These managers were then relieved from their day-to-day responsibilities and sent, for periods

varying from a few weeks to several months, to the country/ies where the newly acquired

company operated. Because these managers were the ones who did at home what they were

teaching newly acquired firm’s managers, they were the best teachers as well as the most likely

CEMEX employees to identify which of the standard practices of the acquired firm might make

a positive contribution if adapted and integrated into the CEMEX Way. On the other hand,

because they were seen as the best and the brightest within CEMEX, these managers had the

legitimacy to propose and advocate for changes in the firm’s operation standards in a way that no

other manager could. Hence, PMI team members were low enough in the organization that they

were in a unique position to identify and evaluate different ways of doing things. At the same

time, however, these managers were high enough in the organization that they could effectively

‘sell’ the value of changing a particular practice to corporate level managers. Drawing key

people from multiple countries to form these teams represented a significant challenge for what

CEMEX referred to as ‘legacy operations.’ Since these positions were not covered with new

hires and lowering performance was not in the realm of possibilities, ongoing operations had to

find ways to do the same work with less people and uncover the capabilities of those that

remained. A significant step in consolidating the CEMEX Way and making “One CEMEX” a

global reality occurred as the result of the tragic death in 1996 of CEMEX’s CFO Gustavo

Caballero. Hector Medina, who at the time was the general manager of Mexican operations, took

over the CFO role, and Francisco Garza, who had been general manager of Venezuela, was

named to head Mexican operations. When Garza took charge of the Mexican operations, he

decided to “PMI Mexico,” to apply the PMI process to Mexico as if it had just been acquired.

Roughly 40 people broken down into 10 functional teams spent between two and three months

dedicated to improving the Mexican operation. Savings of $85 million were identified.16 More

importantly, it clearly established the principle of learning and continuous improvement through

the punctuated PMI process and the continuous CEMEX Way. Improvements resulting from the

CEMEX Way were not limited to operational processes. During the 1990s, CEMEX also

developed a branded cement strategy in Mexico that addressed the specific needs of customers

for bag cement. While bulk cement accounted for roughly 80% of CEMEX’s 16 Joel Podolny

and John Roberts, “CEMEX, S.A. de C.V.: Global Competition in a Local Business,” Stanford

University Graduate School of Business, Case No. S-IB-17. CEMEX: GLOBALIZATION “THE

CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009 8 cement sales in developed

countries, bagged cement represented the same percentage in developing countries like Mexico,

reflecting the fact that many households built their own houses.17 These customers were willing

to pay a premium for known quality and convenient distribution, and CEMEX steadily

introduced value-added features for these customers. Finally, with a growing number of plants

and markets on the Caribbean rim, CEMEX began to actively exploit the capacity for cement

trading to smooth/pool demand, economizing on capacity and raising average utilization rates in

an industry notorious for large swings in output in line with macroeconomic fluctuations. 18

Stepping Up Toward the end of the 1990s, CEMEX found that there were few acquisition targets

that met its criteria of market growth/attractiveness and “closeness” to CEMEX in terms of

institutional stability and culture at a reasonable price, and began to consider diversification into

other activities, among other things. However, in order to “shake up” its strategic thinking, it

made a series of changes in the way it explored potential acquisitions, including asking the

Boston Consulting Group, its long-time strategic advisor, to assign a new set of partners. One

important resulting change was to redefine large markets, such as the United States, into regions.

Once this was done, the United States, which CEMEX planners had viewed as a slow growing

market with little fit with CEMEX, was transformed into a set of regions, some with growth and

other characteristics more aligned with the rapidly growing markets CEMEX was used to. This

set the foundation for the acquisition of Texas-based Southdown, making CEMEX North

America’s largest cement producer. Another change was to shift the way performance was

measured, from an emphasis on margins, which had made cement appear much more attractive

than concrete or aggregates, to return on investment, which in many cases reversed the apparent

attractiveness of different businesses. With this reframing, other targets were identified, most

importantly RMC, a UK-based, ready-mix concrete global leader. On March 1, 2005, CEMEX

finalized its $5.8 billion acquisition of U.K.-based RMC. This acquisition, which surprised many

in the industry who assumed that RMC would be acquired by a European firm, was CEMEX’s

first acquisition of a diversified multinational. To prevail, CEMEX had to pay a 39%

premium,19 and the financial markets did not respond favorably. CEMEX's share price dropped

10% hours after the announcement, and Moody’s indicated 17 Hau Lee and David Hoyt,

“CEMEX: Transforming a Basic Industry,” Stanford Graduate School of Business Case No. GS-

33. 18 For a description of how CEMEX was able to turn an environmental disadvantage – the

macroeconomic volatility that has characterized the Mexican economy and many of the

emerging markets in which it has invented – into a source of competitive advantage see Lessard

and Lucea (2007). 19 Roy A. Grancher, “U.S. Cement: Development of an Integrated Business,”

Cement Americas, September 1, 2005. CEMEX: GLOBALIZATION “THE CEMEX WAY”

Donald R. Lessard and Cate Reavis March 5, 2009 9 that it was putting CEMEX on credit watch

for a possible downgrade, voicing concern that the size of the RMC acquisition would distract

management from its goal of cutting the company’s debt.20 The acquisition of RMC

significantly changed CEMEX’s business landscape. The deal gave the company a much wider

geographic presence in developed and developing countries alike, most notably France,

Germany, and a number of Eastern European countries. Analysts predicted that as a percent of

product revenue, cement would fall from 72% to 54% and aggregates and ready-mix concrete

would nearly double from 23% to 42%.21 Meanwhile, revenue from CEMEX’s Mexican

operations would fall from 36% prior to the deal to just 17%. Financially, RMC was suffering.

The company recorded a net income loss of over $200 million in 2003, and was trading at six

times EBITDA, compared to industry average of 8.5 to 9 times.22 RMC profit margin of 3.6%

was far below the ready-mix concrete average 6% to 8%. Culturally, RMC was the polar

opposite of CEMEX. RMC was a highly decentralized company with significant differences

across countries in business model, organizational structure, operating processes, and corporate

culture. CEMEX, in contrast, brought the CEMEX Way and a single operating/engineering

culture that connected more readily at the plant and operation level than RMC. And yet, despite

all of RMC’s challenges, CEMEX was able to work its PMI “magic” in a very short period of

time. Within one year, CEMEX had delivered more than the $200 million in the synergy savings

it promised the market and it expected to produce more than $380 million of savings in 2007.23

CEMEX had clearly joined the big leagues, yet the imprint of its early years remained very

strong. In 2007, CEMEX took another major step, acquiring control of the Rinker Corporation.

Rinker did not suffer the same lack of learning processes and cultural integration as RMC and

thus at least some analysts questioned whether CEMEX would be able to work the same magic

once again. 20 Michael Thomas Derham, “The CEMEX Surprise,” LatinFinance, November 1,

2004. 21 Imran Akram, Paul Roger and Daniel McGoey, Global Cement Update: Mexican

Wave, Deutsche Bank, November 26, 2004. 22 Michael Thomas Derham, “The CEMEX

Surprise,” LatinFinance, November 1, 2004. 23 Steven Prokopy, “Merging the CEMEX Way,”

Concrete Products, May 1, 2006. CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald

R. Lessard and Cate Reavis March 5, 2009 10 Exhibit 1a CEMEX Country Sales, EBITDA and

Assets, 2006 Sales Operating Income EBITDA Assets Mexico 3,635 1,235 1,391 5,800 United

States 4,170 919 1,207 7,118 Spain 1,841 471 555 3,089 United Kingdom 2,010 (7) 149 6,249

Rest of Europe 3,644 176 390 6,692 South/Central America & Caribbean 1,586 341 472 3,267

Africa/Middle East 705 136 167 1,251 Asia 346 58 75 861 Other 311 (384) (270) (4,355) Total

18,249 2,945 4,138 29,972 Exhibit 1b CEMEX Select Financials, 1999-2004 (in US$ millions,

except percentages) 1999 2000 2001 2002 2003 2004 2005 2006 Net Sales 4,828 5,621 6,923

6,543 7,143 8,149 15,321 18,249 Operating Income 1,436 1,654 1,653 1,310 1,455 1,851 2,487

2,945 Operating Margin 29.7% 29.4% 23.9% 20.0% 20.3% 22.7% 16.2% 16.1% EBITA 1,791

2,030 2,256 1,917 2,108 2,538 3,557 4,138 EBITA Margin 37.1% 36.1% 32.6% 29.3% 29.4%

31.1% 23.20% 22.7% Net Income 973 999 1,178 520 629 1,307 2,167 2,488 Net Income %

20.2% 17.8% 17.0% 7.9% 8.8% 16.0% 14.1% 13.6% Debt Ratio 45.7% 51.5% 49.8% 56.4%

57.8% 52.7% 61.3% 50.6% Free Cash Flow 860 886 1,145 948 1,143 1,478 2,198 2,689 Source:

CEMEX. CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate

Reavis March 5, 2009 11 Exhibit 2 CEMEX Cement Market Shares vs. Competitors Country

Market Share Rank Main Competitors Western Europe Spain 22% 1 Cementos Portland (16%),

Holcim (12%), Lafarge (9%), Cimpor (8%), Financiera y Minera (6%), Masaveu (6%) North

America United States 15% 1 Holcim (14%), Lafarge (13%), Buzzi (10%), HeidelbergCement

(8%), Ash Grove (7%), Italcementi (5%) Latin America Colombia 35% 2 Argos (52%), Holcim

(35%) Costa Rica 50% 1= Holcim (50%) Dominican Republic 52% 2 Cibao (38%), Holcim

(13%) Jamaica 100% 1 Mexico 53% 1 Holcim (23%), Cruz Azul (15.5%), Monteczuma (6.2%),

Grupo Cemento Chihuahua (2.4%), Lafarge (0.4%) Nicaragua 56% 1 Holcim (44%) Panama

52% 1 Holcim (48%) Trinidad 100% 1 Venezuela 45% 1 CEMEX (45%), Holcim (26%),

Lafarge (23%), Catatumbo (3%), Andino (3%) Africa Egypt 15% 2 Holcim (20%), CEMEX

(15%), Suez (14%), Tourah (10%), National (10%), Cimpor (8%), Beni Suef (8%) Asia

Philippines 21% 3 Lafarge (28%), Holcim (28%) Source: Mike Betts and Robert Crimes,

“Construction and Building Materials Sector,” JP Morgan European Equity Research, August 16,

2004; CEMEX. CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and

Cate Reavis March 5, 2009 12 Exhibit 2 CEMEX Organizational Structure Source: CEMEX.

CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March

5, 2009. 13 Appendix Heavy Building Materials Industry Overview The global heavy building

materials industry was a $63 billion (EBITDA) business of which cement accounted for $27

billion, aggregates $17 billion, ready-mix concrete $9 billion, concrete products $7 billion, and

distribution $3 billion.24 Aggregates and cement were upstream products with high barriers to

entry with initial investments ranging from $50 million for aggregates and $175 million for

cement, long payback periods, and little product differentiation. Concrete and asphalt were

downstream products with few barriers to entry, short payback periods and the ability to

differentiate. Of the four building materials products, cement was the most profitable with 20%

to 25% return on sales while ready-mix concrete was the least profitable with just 6% to 8%

return on sales. (See Exhibit 1 for industry characteristics.) At their inception in the early to mid-

1800s, the concrete and cement industries were fragmented. Local producers served communities

in geographic proximity. The high cost of transportation prevented long distance competition. As

the quality of roads and railway transportation improved, industry consolidation, largely on a

national level, began to take place. For more than a century, there was little industry innovation

and companies competed solely on price. 25 In the 1970s, cement companies began to expand

their operations both regionally and internationally enabling them to create more efficient

operations and protect themselves financially from national and regional economic shocks. 26

However, cement’s low value-to-weight ratio made long distance transport by land exceedingly

expensive, so it remained a highly localized industry. By one estimate, 90% of U.S. production

was sold within 300 miles of the producing plant.27 Producers China was the largest cement

producer in the world, with over 40% of global production followed by India with 6% and the

United States with just under 5%.28 (See Exhibit 2.) China and India consumed the majority of

the cement they produced, exporting less than 1%, while the United States was the world’s

largest importer accounting for 25% of global imports (Exhibit 3). In general, the 24 Imran

Akram, Paul Roger, Daniel McGoey, Global Cement Update: Mexican Wave, Deutsche Bank,

November 26, 2004. 25 Arnoldo C. Hax and Rafel Lucea, CEMEX: A leading company; A study

through the Delta Model, MIT Sloan School of Management Working Paper. 26 Ibid. 27 Joel

Podolny and John Roberts, “CEMEX, S.A. de C.V.: Global Competition in a Local Business,”

Stanford University Graduate School of Business, Case No. S-IB-17. 28 U.S. Geological Survey,

Mineral Commodity Summaries, January 2005. CEMEX: GLOBALIZATION “THE CEMEX

WAY” Donald R. Lessard and Cate Reavis March 5, 2009 14 cement industry was not an export-

driven business. Exported cement accounted for a mere 6% of total global consumption.29 By

2004 the cement industry had consolidated to the point where the six largest cement companies

accounted for 42% of the world’s cement capacity outside of China, up from 9% in 1988.30 (See

Table A). The top players’ earnings straddled both developed and developing markets. While the

majority of CEMEX’s and Holcim’s earnings came from developing markets (73% and 69%,

respectively), earnings for Lafarge and Heidelberg came largely from developed markets (62%

and 69%). (See Exhibit 4.) Table A Six Largest Cement Companies by Capacity Company

Country Capacity 2003 (million tons) Lafarge France 108.0 Holcim Switzerland 94.3 CEMEX

Mexico 64.7 HeidelbergCement Germany 51.1 Italcementi Italy 45.6 Taiheiyo Japan 37.9

Source: Mike Betts and Robert Crimes, “Construction and Building Materials Sector,” JP

Morgan European Equity Research, August 16, 2004. There were, however, a number of “second

tier” players who were beginning to invest outside of their home markets and stirring up the

industry’s competitive dynamics including Italy’s Italcementi and France-based Cimentis

Francais. As Exhibit 5 shows, national players dominated cement markets in Eastern Europe,

Asia and the Middle East. Consumers Asia accounted for 56% of cement consumption followed

by Western Europe with 12% and North America with 6.4%. Since 2002, year-over-year growth

rates of cement consumption had slowed most notably in Asia and Eastern Europe (Exhibit 6).

Developing countries accounted for 69% of cement consumption, a percentage that was expected

to increase to 85% by 2020 (Exhibit 7). In growth rate terms, between 2003 and 2020,

developing countries’ cement consumption was predicted to increase 4.4% per year compared

to .8% for developed countries.31 29 Mike Betts and Robert Crimes, “Construction and Building

Materials Sector,” JP Morgan European Equity Research, August 16, 2004. 30 Ibid. 31 Ibid.

CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March

5, 2009 15 Cement consumption was largely driven by local socio-economic conditions. As GDP

per capita increased above $3,000, cement consumption tended to increase substantially in

response to growing need for improved infrastructure and housing. However, once GDP per

capita exceeded $15,000, consumption tended to level off.32 Weather—heavy rainfall was a

deterrent—and population growth rates and density — higher densities usually demanded taller

buildings—were other variables that affected consumption.33 In 2003, China accounted for 44%

of global cement consumption and industry observers expected the country’s share to increase to

53% by 2020.34 The way in which cement was consumed differed among developing and

developed countries. Developing markets tended to be dominated by individual homebuilders

who purchased bag cement instead of bulk. CEMEX believed that as much as 80% of cement

sales in developed countries were bulk cement compared to the same percentage of bagged

cement in developing countries.35 Thus in these markets companies like CEMEX had to brand

their product through packaging and getting the company name out in front of their customer

base.36 In contrast, cement consumers in developed countries tended to be large construction

companies that bought in bulk and required timeliness to their cement deliveries. State of the art

logistics and technology platforms were paramount to compete. Additionally, cement companies

had to be prepared to meet local preferences. Consumers in Egypt preferred darker cement

believing it was of higher quality whereas Mexicans preferred light colored cement. 32 Mike

Betts and Robert Crimes, “Construction and Building Materials Sector,” JP Morgan European

Equity Research, August 16, 2004. 33 “The Globalization of CEMEX,” Harvard Business

School Case No. 701-017 prepared by Professor Pankaj Ghemawat and Research Associate

Jamie L. Matthews. 34 Mike Betts and Robert Crimes, “Construction and Building Materials

Sector,” JP Morgan European Equity Research, August 16, 2004. 35 “CEMEX: Transforming a

Basic Industry,” Stanford Graduate School of Business Case No. GS-33, prepared by David Hoyt

under the supervision of Professor Hau Lee. 36 “CEMEX: Global Growth Through Superior

Information Capabilities,” IMD Case No. 134 prepared by Rebecca Chung and Katarina Paddack

under the supervision of Professor Donald A. Marchand. CEMEX: GLOBALIZATION “THE

CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009. 16 Exhibit 1 Heavy

Building Materials Industry Characteristics Aggregates Cement Ready-Mix Concrete Asphalt

Initial investment $50 million $175 million <$10 million >$10 million Entry barriers High High

Low Low Payback period Long Long Short Short Options for vertical integration Downstream

into ready-mix concrete products, decorative aggregates, asphalt Mainly downstream into

readymix Either downstream into blocks, ties or pavers, or upstream into cement Upstream into

aggregates, or downstream into road contracting Return on sales (%) 10-20 15-25 6-8 10-15

Investment to sales (%) <100 >200 80 40 Return on investment (%) 8-10 8-10 8-10 8-10 Product

differentiation Impossible Nearly impossible Can differnentiate from small players on some top-

quality products and can innovate (e.g., high-performance concreate) National players all have

versions of low-noise, smooth surface asphalt Market flexibility in adjusting to over/under

capacity Strong flexibility on exisiting quarries (operations can be stopped and restarted in a few

months) but difficult to open new ones) Can take decades as even 20- year old plants can still

produce cash Normally adjusts in two to four years One to three years Source: Imran Akram,

Paul Roger, Daniel McGoey, Global Cement Update: Mexican Wave, Deutsche Bank,

November 26, 2004. CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard

and Cate Reavis March 5, 2009 17 Exhibit 2 Global Cement Production, 2005 Source: U.S.

Geological Survey, Mineral Commodity Summaries, January 2005. 0 5 10 15 20 25 30 35 40 45

% of Market China India United States Japan South Korea Russia Spain Brazil Italy Egypt

Mexico Thailand Turkey Indonesia Iran Germany Saudi Arabia France Others Global Cement

Production CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate

Reavis March 5, 2009 18 Exhibit 3 World’s Leading Cement Exporters and Importers (by

percentage) (2004) Leading Exporting Nations Leading Importing Nations Ranking Country

2001 2002 2003 Ranking Country 2001 2002 1 Thailand 16.6 16.6 12.1 1 United States 25.9

24.2 2 Turkey 8.6 10.4 10.2 2 Spain 6 7.5 3 Indonesia 9.5 9 7.3 3 Bangladesh 6 6.4 4 Japan 7.6

8.3 9.6 4 Nigeria 6 5.4 5 India 5.2 6.3 5 Hong Kong 3.9 3.9 6 China 6.1 6 6 Vietnam 1.6 3.1 7

Greece 5.9 5.6 7 Netherlands 3.4 3 8 Saudi Arabia 4.7 5.6 8 France 2.1 2.6 9 Canada 5.4 5.5 9

United Kingdom 1.5 2.5 10 Venezuela 2.8 4.1 10 Taiwan 2.3 2.3 11 Taiwan 3.4 3.9 5 11 Kuwait

2.3 1.9 12 Germany 3.9 3.9 12 Ghana 1.7 1.9 13 South Korea 4.6 3.4 3.2 14 Malaysia 2 3 15

Italy 2.6 2.4 16 Egypt 0.1 2.2 6.2 17 Spain 1.4 1.5 18 Iran 2.8 1.4 Source: Mike Betts and Robert

Crimes, “Construction and Building Materials Sector,” JP Morgan European Equity Research,

August 16, 2004. CEMEX: GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and

Cate Reavis March 5, 2009 19 Exhibit 4 Geographical Breakdown of Top Cement Company

Earnings (% of EBITA) (2004) CEMEX Heidelberg Holcim Lafarge Italcementi Cimentis

Francais Total Average Developed markets 27 69 39 62 90 82 53 Western Europe 13 44 18 48

78 69 36 North America 14 25 19 14 12 14 16 Australasia 2 0 Developing markets 73 31 61 38

10 18 47 Eastern Europe 17 10 6 2 3 6 Latin America 64 31 9 0 0 23 Asia 2 11 9 9 3 4 7 Middle

East 1 3 1 Africa 6 4 10 11 5 10 9 Source: Mike Betts and Robert Crimes, “Construction and

Building Materials Sector,” JP Morgan European Equity Research, August 16, 2004. CEMEX:

GLOBALIZATION “THE CEMEX WAY” Donald R. Lessard and Cate Reavis March 5, 2009

20 Exhibit 5 Multinational Cement Companies’ Market Shares by Region, 2004 Source: Mike

Betts and Robert Crimes, “Construction and Building Materials Sector,” JP Morgan European

Equity Research, August 16, 2004. 0 10 20 30 40 50 60 70 80 90 100 North America Latin

America Africa Europe Western Australasia Europe Eastern Asia Middle East Region %

National player Mutlinational cement companies CEMEX: GLOBALIZATION “THE CEMEX

WAY” Donald R. Lessard and Cate Reavis March 5, 2009. 21 Exhibit 6a Cement Demand by

Region (million tons), 2000-2005E 2002 2003 2004E 2005E 2006E Asia 990.6 1,048.8 1,114.6

1,184.3 1,259.0 Western Europe 224.9 229.2 232.6 236.2 238.9 North America 116.7 121.2

125.9 128.3 129.6 Latin America 93.2 90.0 94.5 99.4 103.7 Eastern Europe 75.6 83.1 87.3 91.7

96.5 Africa 56.7 58.1 59.7 61.9 64.0 Japan 64.6 60.1 56.5 54.8 54.8 Middle East 9.8 9.6 10.0

10.5 10.9 Australasia 8.6 9.1 9.3 9.5 9.6 TOTAL 1,803.3 1,878.6 1,967.7 2,062.6 2,162.0

Source: Mike Betts and Robert Crimes, “Construction and Building Materials Sector,” JP

Morgan European

What makes growing internationally attractive to CEMEX rather than keeping its business within

Mexico?

Why doesnt cemex keep operating in Mexico?

What core strengths does CEMEX bring to a new acquisition?

How do you evaluate the CEMEX Way? What keeps other firms from doing the same thing?

You might also like

- Cemex InternlessardDocument21 pagesCemex InternlessardSohan GoelNo ratings yet

- Case Study CEMEXDocument2 pagesCase Study CEMEXkristine contrerasNo ratings yet

- CEMEX Case StudyDocument27 pagesCEMEX Case StudyJoanaNo ratings yet

- Cemex Case Study 1 Part 1Document8 pagesCemex Case Study 1 Part 1Ngoc HuynhNo ratings yet

- CEMEX AnalysisDocument9 pagesCEMEX AnalysisJeff Ray SanchezNo ratings yet

- CEMEX Case Study 2 v2 (No Appendix)Document9 pagesCEMEX Case Study 2 v2 (No Appendix)Thư VũNo ratings yet

- CEMEX Group Discussion QuestionsDocument6 pagesCEMEX Group Discussion Questionsjacklee1918No ratings yet

- CemexDocument2 pagesCemexBearBDSMNo ratings yet

- The Cemex WayDocument10 pagesThe Cemex WayMfalme MugabunielaNo ratings yet

- Cemex CaseDocument1 pageCemex CaseManuj KumarNo ratings yet

- Global Advantage Across Multiple Countries. Explain The Primary Sources of AdvantageDocument9 pagesGlobal Advantage Across Multiple Countries. Explain The Primary Sources of AdvantageCarla Mairal MurNo ratings yet

- The Cemex Way PDFDocument21 pagesThe Cemex Way PDFLis Bueno Saavedra100% (1)

- Case Study 2Document21 pagesCase Study 2abrham zebergaNo ratings yet

- Cemex CaseDocument4 pagesCemex CaseSaif Ul Islam100% (1)

- Eiteman 0321408926 IM ITC2 C16Document15 pagesEiteman 0321408926 IM ITC2 C16Ulfa Hawaliah HamzahNo ratings yet

- Cemex Case StudyDocument3 pagesCemex Case Studyabraam100% (1)

- Assignment 2Document7 pagesAssignment 2Anum ImranNo ratings yet

- The Abstract or OutlineDocument3 pagesThe Abstract or OutlineDennis Vigil CaballeroNo ratings yet

- Raw Material SeekerDocument15 pagesRaw Material SeekerNurbayah SubohNo ratings yet

- What Developing-World Companies Teach Us About Innovation - HBS Working KnowledgeDocument3 pagesWhat Developing-World Companies Teach Us About Innovation - HBS Working KnowledgefarktardNo ratings yet

- wHY DIVERSITY MATTERS PDFDocument3 pageswHY DIVERSITY MATTERS PDFTrevor MathabathaNo ratings yet

- Innovation Based Change ManagementDocument7 pagesInnovation Based Change ManagementasrabatoolNo ratings yet

- Imf IntroductionDocument21 pagesImf Introductionapi-270480976No ratings yet

- What Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationDocument1 pageWhat Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationParisa Minouchehr0% (1)

- Unit 6 Essay Assignment Corporate Framework On Strategic Auditing Dolores Bell 3.31.19Document13 pagesUnit 6 Essay Assignment Corporate Framework On Strategic Auditing Dolores Bell 3.31.19JaunNo ratings yet

- Case Study CEMEX Students)Document6 pagesCase Study CEMEX Students)Alvin Amos100% (1)

- Chapter 14 - Organisational CultureDocument7 pagesChapter 14 - Organisational CultureCarol YapNo ratings yet

- Cemexshiftwp The Roi of Cemex ShiftDocument8 pagesCemexshiftwp The Roi of Cemex ShiftJesus ChavezNo ratings yet

- Improving Organisational PerformanceDocument19 pagesImproving Organisational PerformanceIkin NoraNo ratings yet

- Kouzes and Posner's Five Practices of Exemplary LeadershipDocument1 pageKouzes and Posner's Five Practices of Exemplary LeadershipCraig D'SouzaNo ratings yet

- OrganisationalBehavior MB005 QuestionDocument19 pagesOrganisationalBehavior MB005 QuestionAiDLo0% (1)

- Final Report - International Marketing: Institute of Management Technology Nagpur Trimester V / PGDM (2008-10) / IMDocument6 pagesFinal Report - International Marketing: Institute of Management Technology Nagpur Trimester V / PGDM (2008-10) / IMHemant KumarNo ratings yet

- Team Diversity ManagementDocument44 pagesTeam Diversity ManagementmxiixmNo ratings yet

- Case Study On CemexDocument4 pagesCase Study On CemexAniket PatilNo ratings yet

- Strategic Trade TheoryDocument2 pagesStrategic Trade TheoryLalitkumar BholeNo ratings yet

- 3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentsDocument12 pages3 Case Lombardo 2011 - Cross-Cultural Challenges For A Global Maritime Enterprise - StudentshussainNo ratings yet

- Cemex Case StudyDocument9 pagesCemex Case StudyPrerna NarayanNo ratings yet

- The Gap Analysis of Graduate EmployeesDocument5 pagesThe Gap Analysis of Graduate EmployeesRizal ChanNo ratings yet

- Ch03 Competing in Global MarketsDocument31 pagesCh03 Competing in Global MarketsRamandeep SinghNo ratings yet

- Primary and Secondary ResearchDocument3 pagesPrimary and Secondary Researchapi-535005301No ratings yet

- Trade War Between US&ChinaDocument21 pagesTrade War Between US&ChinaRosetta RennerNo ratings yet

- Assignment On Leadership Style and Assessing TheirDocument19 pagesAssignment On Leadership Style and Assessing Theirgagan100% (1)

- Strategic Leadership and Direction Setting (2) Fall 2009Document18 pagesStrategic Leadership and Direction Setting (2) Fall 2009Yvette Pauline JovenNo ratings yet

- Ethical Leadership in Contemporary Corpo PDFDocument11 pagesEthical Leadership in Contemporary Corpo PDFAhmad ShahrulNo ratings yet

- Creating The Climate For Change PDFDocument5 pagesCreating The Climate For Change PDFEsteban Rodríguez SánchezNo ratings yet

- Organisational BehaviorDocument6 pagesOrganisational BehaviorIlamurugu PorchelvanNo ratings yet

- Democratic Leaderships StyleDocument6 pagesDemocratic Leaderships StyleAinunNo ratings yet

- Organization Ethics and Advanced Communication: Name: Daeem Shanazzer Id: BB-5872 Course Code: EGL-502Document8 pagesOrganization Ethics and Advanced Communication: Name: Daeem Shanazzer Id: BB-5872 Course Code: EGL-502Daeem shanazzerNo ratings yet

- 21st Century Management ChallengesDocument61 pages21st Century Management ChallengesballsNo ratings yet

- Emerging EconomiesDocument5 pagesEmerging EconomiesSumbal GulNo ratings yet

- Cemex Case Q&ADocument5 pagesCemex Case Q&Apixie1980No ratings yet

- Cemex Transforming A Basic Industry CompanyDocument5 pagesCemex Transforming A Basic Industry CompanyManoj Doley0% (1)

- Environmental Dimensions Affecting IndustriesDocument8 pagesEnvironmental Dimensions Affecting IndustriesSarah Mangay-ayam HernandezNo ratings yet

- Case Study of Listo SystemDocument4 pagesCase Study of Listo Systemsuraj_simkhadaNo ratings yet

- Artigo - Five Step To Leading Your Team in The Virtual COVID19-WorkplaceDocument11 pagesArtigo - Five Step To Leading Your Team in The Virtual COVID19-Workplaceorquidia jaquimNo ratings yet

- How Organizational Culture Shapes CompetitiveDocument14 pagesHow Organizational Culture Shapes CompetitiveHao Wu100% (1)

- BP-Case AnalysisDocument3 pagesBP-Case AnalysisShrey TanejaNo ratings yet

- Analysis of Organisational Culture and Management of SamsungDocument4 pagesAnalysis of Organisational Culture and Management of SamsungEun AhNo ratings yet

- The US-China Trade WarDocument7 pagesThe US-China Trade WarEbad KhanNo ratings yet

- Business Improvement Districts: An Introduction to 3 P CitizenshipFrom EverandBusiness Improvement Districts: An Introduction to 3 P CitizenshipNo ratings yet

- The Halala Are The Westernmost Tribe of Indigenous AboriginesDocument2 pagesThe Halala Are The Westernmost Tribe of Indigenous AboriginesEmmanuelNo ratings yet

- What Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationDocument2 pagesWhat Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationEmmanuelNo ratings yet

- The Phases Are in The Following OrderDocument1 pageThe Phases Are in The Following OrderEmmanuelNo ratings yet

- The Best Strategic Option Available To CEMEX Is A Strategic AcquisitionDocument2 pagesThe Best Strategic Option Available To CEMEX Is A Strategic AcquisitionEmmanuelNo ratings yet

- Question# 1 Provide An Example of A in Which You Would Recommend A Reactive Needs AnalysisDocument1 pageQuestion# 1 Provide An Example of A in Which You Would Recommend A Reactive Needs AnalysisEmmanuelNo ratings yet

- The Social Ecological ModelDocument1 pageThe Social Ecological ModelEmmanuelNo ratings yet

- Assume That You Work As An Analyst Team Lead at KRAFTDocument1 pageAssume That You Work As An Analyst Team Lead at KRAFTEmmanuelNo ratings yet

- Online MBA Programs Significantly Reduce The Cost To Existing Managers of Obtaining An MBADocument1 pageOnline MBA Programs Significantly Reduce The Cost To Existing Managers of Obtaining An MBAEmmanuelNo ratings yet

- Case StudyDocument1 pageCase StudyEmmanuelNo ratings yet

- A) Focused Differentiation StrategyDocument2 pagesA) Focused Differentiation StrategyEmmanuelNo ratings yet

- Type of Follower Type of LeaderDocument2 pagesType of Follower Type of LeaderEmmanuelNo ratings yet

- Chapter 2Document10 pagesChapter 2Lady FrancescaNo ratings yet

- 17 Text: Lecture 1 Summary - Review, Readings, & More - CS198.1x Courseware - Edx PDFDocument4 pages17 Text: Lecture 1 Summary - Review, Readings, & More - CS198.1x Courseware - Edx PDFManuel De Luque MuntanerNo ratings yet

- Worksheet 1Document2 pagesWorksheet 1Sa KimNo ratings yet

- Llano, Janet v. (Assignment 1)Document6 pagesLlano, Janet v. (Assignment 1)jvllanoNo ratings yet

- TicketDocument1 pageTickethimadri swainNo ratings yet

- Ledger SolutionDocument2 pagesLedger SolutionDoh ChanyeolNo ratings yet

- Guide To Pavement TechnologyDocument22 pagesGuide To Pavement TechnologyArdi Yoga Pratomo67% (3)

- FM (4th) May2019Document2 pagesFM (4th) May2019DISHU GUPTANo ratings yet

- PMIC02-5 Examination Overview 20-04-2023Document34 pagesPMIC02-5 Examination Overview 20-04-2023khahlisochabalalaNo ratings yet

- 4 Week RuleDocument7 pages4 Week RuleLoli LilaNo ratings yet

- MGMT2023 Lecture 9. Capital Budgeting Part 2 PDFDocument45 pagesMGMT2023 Lecture 9. Capital Budgeting Part 2 PDFIsmadth2918388No ratings yet

- Swing in Killer StrategyDocument8 pagesSwing in Killer StrategyrethabileNo ratings yet

- Zoom Contact Apr 2024Document3 pagesZoom Contact Apr 2024theblackbucks430No ratings yet

- Econ 100b Old FinalDocument9 pagesEcon 100b Old Finalheathermgardner0% (1)

- UntitledDocument88 pagesUntitledNisa Kumar100% (1)

- Holcim Company Analysis - Market Leadership and BBB ProgramDocument3 pagesHolcim Company Analysis - Market Leadership and BBB ProgramDana MichelleNo ratings yet

- A Conceptual Framework of The Impact of Arabic Spring OnDocument15 pagesA Conceptual Framework of The Impact of Arabic Spring Onayatabdelghane97No ratings yet

- Module 06 - Workshop Activity - Nick Minghella - WorkbookDocument4 pagesModule 06 - Workshop Activity - Nick Minghella - Workbookxiaoxi liNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsaman khatriNo ratings yet

- Types of InsuranceDocument5 pagesTypes of Insurancebeena antuNo ratings yet

- How Much Growth Can A Firm Afford?: Robert C. HigginsDocument11 pagesHow Much Growth Can A Firm Afford?: Robert C. HigginsFrancisco López-HerreraNo ratings yet

- Chapter 14Document40 pagesChapter 14Phương Anh VũNo ratings yet

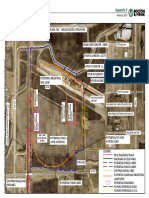

- Potential Willmar Rail Park On 145 Acres in The Willmar Industrial ParkDocument1 pagePotential Willmar Rail Park On 145 Acres in The Willmar Industrial ParkWest Central TribuneNo ratings yet

- Jamucy 202 The Hindu Neushoper: Czude Otk, Rl4Imy Product AtautDocument185 pagesJamucy 202 The Hindu Neushoper: Czude Otk, Rl4Imy Product Atautrich electronicsNo ratings yet

- Entrep Mind Lesson 4Document33 pagesEntrep Mind Lesson 4geraldineeder009No ratings yet

- Economics Q PaperDocument7 pagesEconomics Q PaperSristi RayNo ratings yet

- AML Guidelines 2021Document30 pagesAML Guidelines 2021ludivineNo ratings yet

- 05 Activity 3Document2 pages05 Activity 3GTABORADA,JOVELITA S.No ratings yet

- ELA CAPDEV Presentation 2022Document85 pagesELA CAPDEV Presentation 2022aeron antonioNo ratings yet

- Session 5 Customer Experience Journey MapDocument33 pagesSession 5 Customer Experience Journey Map曹旅瀚No ratings yet