Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Wahyu Fee IICopyright:

Available Formats

Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Wahyu Fee IIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Astra Otoparts TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Wahyu Fee IICopyright:

Available Formats

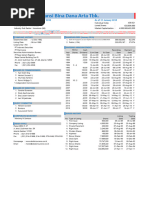

AUTO Astra Otoparts Tbk.

COMPANY REPORT : JANUARY 2019 As of 31 January 2019

Main Board Individual Index : 1,415.303

Industry Sector : Miscellaneous Industry (4) Listed Shares : 4,819,733,000

Industry Sub Sector : Automotive And Components (42) Market Capitalization : 7,542,882,145,000

133 | 7.54T | 0.10% | 88.30%

177 | 1.16T | 0.06% | 95.34%

COMPANY HISTORY SHAREHOLDERS (December 2018)

Established Date : 20-Sep-1991 1. PT Astra International Tbk. 3,855,786,337 : 80.00%

Listing Date : 15-Jun-1998 (IPO Price: 575) 2. Public (<5%) 963,946,663 : 20.00%

Underwriter IPO :

Usaha Bersama Sekuritas DIVIDEND ANNOUNCEMENT

Securities Administration Bureau : Bonus Cash RecordingPayment F/I

PT Raya Saham Registra Year Shares Dividend Cum Date Ex Date Date Date

2001 65.00 11-Jul-02 12-Jul-02 17-Jul-02 31-Jul-02 F

BOARD OF COMMISSIONERS 2002 85.00 11-Jun-03 12-Jun-03 16-Jun-03 30-Jun-03 F

1. Djony Bunarto Tjondro 2003 50.00 11-Jun-04 14-Jun-04 16-Jun-04 30-Jun-04 F

2. Agus Tjahajana Wirakusumah *) 2004 60.00 7-Jun-05 8-Jun-05 10-Jun-05 24-Jun-05 F

3. Angky Utarya Tisnadisastra *) 2005 100.00 6-Jun-06 7-Jun-06 9-Jun-06 23-Jun-06 F

4. Bambang Trisulo *) 2006 15.00 9-Nov-06 10-Nov-06 14-Nov-06 28-Nov-06 I

5. Chiew Sin Cheok 2006 60.00 12-Jun-07 13-Jun-07 15-Jun-07 29-Jun-07 I

6. Gunawan Geniusahardja 2007 30.00 23-Oct-07 24-Oct-07 26-Oct-07 9-Nov-07 I

7. Johannes Loman 2008 115.00 23-Oct-08 24-Oct-08 28-Oct-08 11-Nov-08 I

8. Sudirman Maman Rusdi 2008 179.00 3-Jun-09 4-Jun-09 8-Jun-09 22-Jun-09 F

*) Independent Commissioners 2009 120.00 2-Nov-09 3-Nov-09 5-Nov-09 11-Nov-09 I

2009 478.00 14-Jun-10 15-Jun-10 17-Jun-10 30-Jul-10 F

BOARD OF DIRECTORS 2010 158.00 26-Oct-10 27-Oct-10 29-Oct-10 4-Nov-10 I

1. Hamdani Dzulkarnaen Salim 2010 434.00 23-May-11 24-May-11 26-May-11 10-Jun-11 F

2. Agus Baskoro 2011 30.00 27-Oct-11 28-Oct-11 1-Nov-11 9-Nov-11 I

3. Aurelius Kartika Hadi Tan 2011 75.00 9-May-12 10-May-12 14-May-12 29-May-12 F

4. Kusharijono 2012 87.00 14-May-13 15-May-13 17-May-13 31-May-13 F

5. Lay Agus 2013 22.00 2-Oct-13 3-Oct-13 7-Oct-13 23-Oct-13 I

6. Wanny Wijaya 2013 83.50 21-May-14 22-May-14 26-May-14 11-Jun-14 F

7. Yusak Kristian Solaeman 2014 24.00 9-Oct-14 10-Oct-14 14-Oct-14 28-Oct-14 I

2014 72.00 27-Apr-15 28-Apr-15 30-Apr-15 22-May-15 F

AUDIT COMMITTEE 2015 10.00 30-Sep-15 1-Oct-15 5-Oct-15 16-Oct-15 I

1. Angky Utarya Tisnadisastra 2015 17.00 28-Apr-16 29-Apr-16 3-May-16 25-May-16 F

2. Purnama Setiawan 2016 9.00 30-Sep-16 3-Oct-16 5-Oct-16 17-Oct-16 I

3. Thomas H. Secukusumo 2017 33.00 20-Apr-18 23-Apr-18 25-Apr-18 11-May-18 F

2018 15.00 5-Oct-18 8-Oct-18 10-Oct-18 22-Oct-18 I

CORPORATE SECRETARY

Wanny Wijaya ISSUED HISTORY

Listing Trading

HEAD OFFICE No. Type of Listing Shares Date Date

Jl. Raya Pegangsaan Dua Km. 2,2, Kelapa Gading 1. First Issue 75,000,000 15-Jun-98 15-Jun-98

Jakarta 14250 2. Company Listing 674,930,280 T: 15-Jun-98 : 29-Jan-99

Phone : (021) 460-3550, 460-7025 3. Option Conversion II 9,792,000 T: 17-Jun-03 : 20-Aug-04

Fax : (021) 460-3563, 460-7009 4. Option Conversion II & III 339,500 21-Jan-04 21-Jan-04

Homepage : www.component.astra.co.id 5. Conversion Option III 11,095,500 T: 8-Oct-04 : 12-May-05

Email : contact@component.astra.co.id 6. Stock Split 3,084,629,120 24-Jun-11 24-Jun-11

investor@component.astra.co.id 7. Right Issue 963,946,600 15-May-13 15-May-13

TRADING ACTIVITIES

Closing Price* and Trading Volume

Astra Otoparts Tbk. Closing PriceFreq.Volume Value

Day

Closing Price* Volume (Mill. Sh)

4,200 January 2015 - January 2019 160 MonthHighLow Close(X) (Thou. Sh.) (Million Rp)

Jan-15

4,125 3,700 3,730 823 11,946 45,648 21

Feb-15 3,910 3,695 3,700 1,341 21,361 80,574 19

3,675 140 Mar-15 3,700 3,300 3,600 1,859 6,793 24,324 22

Apr-15 3,560 2,995 3,105 1,936 11,082 35,725 21

3,150 120 May-15 3,100 2,850 2,920 873 19,211 56,456 19

Jun-15 2,920 2,300 2,500 1,741 1,863 4,701 21

2,625 100 Jul-15 2,460 2,100 2,400 886 6,525 15,275 19

Aug-15 2,400 1,300 1,480 2,184 12,607 18,990 20

2,100 80 Sep-15 1,600 1,450 1,550 734 10,861 16,687 21

Oct-15 1,870 1,500 1,695 3,717 44,969 70,804 21

1,575 60 Nov-15 1,850 1,600 1,650 1,735 23,240 38,379 21

Dec-15 1,675 1,600 1,600 678 24,970 40,868 19

1,050 40

Jan-16

1,630 1,510 1,620 897 22,925 35,447 20

525 20 Feb-16 1,825 1,550 1,795 795 28,231 47,259 20

Mar-16 1,950 1,730 1,910 432 10,764 19,730 21

Apr-16 2,050 1,850 1,990 368 30,015 57,602 21

Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 May-16 1,970 1,750 1,815 451 15,259 28,999 20

Jun-16 1,870 1,750 1,870 274 1,286 2,370 22

Jul-16 2,070 1,835 1,945 589 1,143 2,143 16

Aug-16 2,650 1,945 2,300 2,281 8,615 20,395 22

Sep-16 2,390 2,050 2,340 610 43,021 97,490 21

Oct-16 2,450 2,160 2,220 766 25,871 59,303 21

Closing Price*, Jakarta Comp

Nov-16 21

Miscellaneous Industry Index 2,260 2,000 2,060 241 8,237 17,631

January 2015 - January 2019 20

Dec-16 2,220 1,920 2,050 483 8,606 17,711

45%

Jan-17 2,160 2,000 2,160 450 10,263 20,729 21

Feb-17 2,800 2,000 2,800 724 21,325 47,262 19

30%

24.6% Mar-17 2,900 2,440 2,800 1,016 12,123 30,758 22

Apr-17 2,800 2,630 2,670 449 13,446 39,868 17

15%

11.2%

May-17 2,650 2,350 2,420 483 12,324 29,647 20

- Jun-17 2,590 2,330 2,590 190 9,496 23,162 15

Jul-17 2,730 2,350 2,600 853 5,021 12,568 21

-15% Aug-17 2,800 2,400 2,790 405 2,258 5,718 22

Sep-17 2,780 2,380 2,400 526 4,921 12,134 19

-30% Oct-17 2,500 2,330 2,340 416 6,097 14,766 22

Nov-17 2,400 2,170 2,310 378 2,597 5,923 22

-45% Dec-17 2,350 2,020 2,060 433 1,767 3,931 18

-60% Jan-18

-61.4% 2,130 1,945 1,950 2,231 17,504 34,845 22

Feb-18

2,000 1,700 1,750 5,042 12,093 22,169 19

-75% Mar-18 1,810 1,555 1,585 14,235 63,185 110,706 21

Jan 15 Apr-18 1,935 1,535 1,725 45,872 280,212 485,365 21

Jan 16 Jan 17 Jan 18 Jan 19

May-18 1,755 1,550 1,585 21,009 94,129 155,096 20

Jun-18 1,650 1,420 1,450 8,378 86,648 136,923 13

Jul-18 1,505 1,325 1,460 5,319 42,820 63,044 22

SHARES TRADED 2015 2016 2017 2018 Jan-19 Aug-18 1,580 1,390 1,455 5,286 16,574 24,464 21

Volume (Million Sh.) 195 204 102 701 21 Sep-18 1,460 1,330 1,430 2,414 10,829 13,755 19

Value (Billion Rp) 448 406 246 1,161 33 Oct-18 1,525 1,405 1,440 3,207 21,899 31,690 23

Frequency (Thou. X) 19 8 6 121 5 Nov-18 1,520 1,430 1,475 2,991 20,181 29,471 21

Days 244 245 238 240 22 Dec-18 1,645 1,460 1,470 4,591 34,456 53,649 18

Price (Rupiah) Jan-19 1,680 1,470 1,565 5,364 21,048 33,219 22

High 4,125 2,650 2,900 2,130 1,680

Low 1,300 1,510 2,000 1,325 1,470

Close 1,600 2,050 2,060 1,470 1,565

Close* 1,600 2,050 2,060 1,470 1,565

PER (X) 24.21 26.13 18.01 12.83 13.66

PER Industry (X) 0.95 13.86 4.78 16.15 17.64

PBV (X) 0.76 0.96 0.92 0.65 0.69

* Adjusted price after corporate action

Financial Data and Ratios Book End : December

Public Accountant : Tanudiredja, Wibisana, Rintis, & Partners

BALANCE SHEET Dec-14Dec-15Dec-16Dec-17Sep-18 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(in Million Rp, except Par Value) Assets Liabilities

Cash & Cash Equivalents 1,275,050 977,854 914,635 6,799,161 933,275 16,250

Receivables 1,784,332 1,686,745 1,813,229 2,004,141 2,460,484

Inventories 1,718,663 1,749,263 1,823,884 2,168,781 2,234,552 13,000

Current Assets 5,138,080 4,796,770 4,903,902 5,228,541 6,214,107

9,750

Fixed Assets 3,305,968 3,507,217 3,599,815 3,526,867 3,464,415

Other Assets 549,667 474,023 335,457 259,183 327,951

6,500

Total Assets 14,380,926 14,339,110 14,612,274 14,762,309 15,890,613

Growth (%) -0.29% 1.91% 1.03% 7.64%

3,250

Current Liabilities 3,857,809 3,625,907 3,258,146 3,354,487 4,279,316

-

Long Term Liabilities 386,560 569,777 817,570 961,731 648,939 2014201520162017Sep-18

Total Liabilities 4,244,369 4,195,684 4,075,716 4,316,218 4,928,255

Growth (%) -1.15% -2.86% 5.90% 14.18%

TOTAL EQUITY (Bill. Rp)

Authorized Capital 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 10,962

10,537 10,759

Paid up Capital 481,973 481,973 481,973 481,973 481,973 10,13710,143

Paid up Capital (Shares) 4,820 4,820 4,820 4,820 4,820

Par Value 100 100 100 100 100

Retained Earnings 5,479,455 5,504,997 5,837,234 6,114,854 6,313,646

Total Equity 10,136,557 10,143,426 10,536,558 10,759,076 10,962,358

Growth (%) 0.07% 3.88% 2.11% 1.89%

INCOME STATEMENTS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18

Total Revenues 12,255,427 11,723,787 12,806,867 13,549,857 11,500,591

Growth (%) -4.34% 9.24% 5.80%

2015 2016 2017Sep-18

Cost of Revenues 10,500,112 9,993,047 10,954,051 11,793,778 10,133,894 2014

Gross Profit 1,755,315 1,730,740 1,852,816 1,756,079 1,366,697

TOTAL REVENUES (Bill. Rp)

Expenses (Income) 647,260 1,297,144 1,203,909 1,044,143 778,123 13,550

Operating Profit - - 648,907 711,936 588,574

12,807

Growth (%) 9.71% 12,255

11,724 11,501

Other Income (Expenses) - - - - -

Income before Tax 1,108,055 433,596 648,907 711,936 588,574

Tax 151,646 110,895 165,486 164,155 142,386

Profit for the period 956,409 322,701 483,421 547,781 446,188

Growth (%) -66.26% 49.80% 13.31%

Period Attributable 871,659 318,567 418,203 551,406 414,158

Comprehensive Income 1,150,174 279,235 522,056 452,879 469,246 2014201520162017Sep-18

Comprehensive Attributable 1,067,480 276,827 455,076 464,727 436,716

RATIOS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 PROFIT FOR THE PERIOD (Bill. Rp)

Current Ratio (%) 133.19 132.29 150.51 155.87 145.21

956

Dividend (Rp) 96.00 27.00 9.00 33.00 15.00

EPS (Rp) 180.85 66.10 86.77 114.41 85.93

BV (Rp) 2,103.14 2,104.56 2,186.13 2,232.30 2,274.47

DAR (X) 0.30 0.29 0.28 0.29 0.31 548

483

DER(X) 0.42 0.41 0.39 0.40 0.45 446

ROA (%) 6.65 2.25 3.31 3.71 2.81 323

ROE (%) 9.44 3.18 4.59 5.09 4.07

GPM (%) 14.32 14.76 14.47 12.96 11.88

OPM (%) - - 5.07 5.25 5.12

NPM (%) 7.80 2.75 3.77 4.04 3.88

2014201520162017Sep-18

Payout Ratio (%) 53.08 40.85 10.37 28.84 17.46

Yield (%) 2.29 1.69 0.44 1.60 1.05

*US$ Rate (BI), Rp 12,436 13,794 13,436 13,548 14,929

You might also like

- History of Local Government Units in The PhilippinesDocument110 pagesHistory of Local Government Units in The PhilippinesHannahAgas87% (91)

- Write Right 1 Paragraph To Essay Teacher's GuideDocument41 pagesWrite Right 1 Paragraph To Essay Teacher's GuideTạ Thị Ánh Hồng 6A-20100% (1)

- Auto PDFDocument3 pagesAuto PDFLailatul MusyarrofahNo ratings yet

- Astra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesAstra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018adjipramNo ratings yet

- Astra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesAstra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Nyoman ShantiyasaNo ratings yet

- Laporan Keuangan ASSIDocument3 pagesLaporan Keuangan ASSITiti MuntiartiNo ratings yet

- Aali PDFDocument3 pagesAali PDFroy manchenNo ratings yet

- Astra Agro Lestari TBKDocument3 pagesAstra Agro Lestari TBKsalmunNo ratings yet

- ScmaDocument3 pagesScmaParas FebriayuniNo ratings yet

- LapasiDocument3 pagesLapasiWenny MellanoNo ratings yet

- Auto PDFDocument3 pagesAuto PDFyohannestampubolonNo ratings yet

- Tunas Baru Lampung TBKDocument3 pagesTunas Baru Lampung TBKRomziNo ratings yet

- Bank Central Asia TBKDocument3 pagesBank Central Asia TBKTheodorus GilbertoNo ratings yet

- BbcaDocument3 pagesBbcaMahasidhiNo ratings yet

- Indf 1Document4 pagesIndf 1Asri ArdianaNo ratings yet

- Unilever Indonesia TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesUnilever Indonesia TBK.: Company Report: January 2018 As of 31 January 2018Siti NuraminahNo ratings yet

- Tunas Baru Lampung TBKDocument3 pagesTunas Baru Lampung TBKFebriyantiNo ratings yet

- Unilever Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesUnilever Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Georgius Edo Sriputra PratamaNo ratings yet

- Darya-Varia Laboratoria TBKDocument3 pagesDarya-Varia Laboratoria TBKArsyitaNo ratings yet

- Indofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesIndofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Aryanto ArNo ratings yet

- Blta PDFDocument3 pagesBlta PDFyohannestampubolonNo ratings yet

- Ramayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesRamayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Bank Mandiri (Persero) TBKDocument3 pagesBank Mandiri (Persero) TBKmasrurin sNo ratings yet

- ABDADocument3 pagesABDAerikNo ratings yet

- LapKeu Bank BCA PDFDocument4 pagesLapKeu Bank BCA PDFWearWinoNo ratings yet

- Bank Central Asia TBK.: January 2014Document4 pagesBank Central Asia TBK.: January 2014yohannestampubolonNo ratings yet

- BfinDocument3 pagesBfinjonisugandaNo ratings yet

- Kalbe Farma TBKDocument3 pagesKalbe Farma TBKK-AnggunYulianaNo ratings yet

- H.M. Sampoerna TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesH.M. Sampoerna TBK.: Company Report: January 2018 As of 31 January 2018Sarlince SandyNo ratings yet

- TSPC PDFDocument3 pagesTSPC PDFFITRA PEBRI ANSHORNo ratings yet

- Perusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesPerusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Muhammad Anfaza FirmanzaniNo ratings yet

- Semen Indonesia (Persero) TBKDocument3 pagesSemen Indonesia (Persero) TBKFarah DarmaNo ratings yet

- Indocement Tunggal Prakarsa TBKDocument3 pagesIndocement Tunggal Prakarsa TBKRika SilvianaNo ratings yet

- 1 PDFDocument3 pages1 PDFRohmat TullohNo ratings yet

- Fast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesFast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019marrifa angelicaNo ratings yet

- 11 PDFDocument3 pages11 PDFRohmat TullohNo ratings yet

- AKR Corporindo Tbk. (S) : Company Report: February 2013 As of 28 February 2013Document3 pagesAKR Corporindo Tbk. (S) : Company Report: February 2013 As of 28 February 2013Agung arinandaNo ratings yet

- Asgr PDFDocument3 pagesAsgr PDFyohannestampubolonNo ratings yet

- Bank Mandiri (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesBank Mandiri (Persero) TBK.: Company Report: January 2017 As of 31 January 2017Brigita Ika MaharsiNo ratings yet

- Bumi Resources TBKDocument3 pagesBumi Resources TBKadjipramNo ratings yet

- TgkaDocument3 pagesTgkaWira WijayaNo ratings yet

- Gudang Garam TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGudang Garam TBK.: Company Report: January 2019 As of 31 January 2019LiuKsNo ratings yet

- BRNADocument3 pagesBRNAdennyaikiNo ratings yet

- Adira Dinamika Multi Finance TBKDocument3 pagesAdira Dinamika Multi Finance TBKrofiqsabilalNo ratings yet

- CMNP SumDocument3 pagesCMNP SumadjipramNo ratings yet

- Mustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Febrianty HasanahNo ratings yet

- Mrat PDFDocument3 pagesMrat PDFHENI OKTAVIANINo ratings yet

- Abda PDFDocument3 pagesAbda PDFyohannestampubolonNo ratings yet

- TinsDocument3 pagesTinsIman Nurakhmad FajarNo ratings yet

- Charoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesCharoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019ayyib12No ratings yet

- Indofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesIndofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- PgasDocument3 pagesPgasMateriNo ratings yet

- Antm PDFDocument3 pagesAntm PDFyohannestampubolonNo ratings yet

- RalsDocument3 pagesRalsulffah juliandNo ratings yet

- Mayora Indah TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesMayora Indah TBK.: Company Report: January 2018 As of 31 January 2018ulfaNo ratings yet

- Lap Keu SMCBDocument3 pagesLap Keu SMCBDavid Andriyono AchmadNo ratings yet

- Indofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesIndofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Asri ArdianaNo ratings yet

- CE 218 SYL-Lecture - Spring 2014Document3 pagesCE 218 SYL-Lecture - Spring 2014Amber DavisNo ratings yet

- Name: - Score: - Track & Section: - DateDocument1 pageName: - Score: - Track & Section: - DateAniah AniahNo ratings yet

- The Brighter Life ApproachDocument130 pagesThe Brighter Life ApproachJovelyn ArgeteNo ratings yet

- Thesis Ideas For Computer EngineeringDocument4 pagesThesis Ideas For Computer EngineeringNeedSomeoneWriteMyPaperIndianapolis100% (2)

- Udise CodeDocument39 pagesUdise CodeAkshay HarekarNo ratings yet

- Blue Eye Seminar ReportDocument23 pagesBlue Eye Seminar ReportPriyankaMathurNo ratings yet

- J.U. Rees Article List Soldiers' Food (1775 To The Modern-Era)Document12 pagesJ.U. Rees Article List Soldiers' Food (1775 To The Modern-Era)John U. Rees100% (1)

- C0ca ColaDocument20 pagesC0ca Colashashank kumarNo ratings yet

- 01 Bar Schedule Pile Cap & ColumnDocument7 pages01 Bar Schedule Pile Cap & Columnorode franklynNo ratings yet

- ECE 272 Xilinx TutorialDocument20 pagesECE 272 Xilinx TutorialvlsishekarNo ratings yet

- Chapter 7777Document10 pagesChapter 7777nimnimNo ratings yet

- A Century of Nobel Prize Recipients Chemistry, Physics, and Medicine TQW - DarksidergDocument380 pagesA Century of Nobel Prize Recipients Chemistry, Physics, and Medicine TQW - DarksidergGeorgiana Duma100% (1)

- Xi Science Holiday Homework 2324Document44 pagesXi Science Holiday Homework 2324piyushdua01No ratings yet

- MaxSignal Total Aflatoxin ELISA Test Kit ManualDocument10 pagesMaxSignal Total Aflatoxin ELISA Test Kit ManualbicarbonatNo ratings yet

- Tutorial 3 Answer Scheme TutorialDocument17 pagesTutorial 3 Answer Scheme Tutorialfiqah BatrisyiaNo ratings yet

- WIRIDULLATIFDocument2 pagesWIRIDULLATIFDjati DiriNo ratings yet

- Cutaneous SensationDocument16 pagesCutaneous Sensationhadiqaasif01No ratings yet

- WGeologos 17 3 ReijersDocument30 pagesWGeologos 17 3 ReijersBobby WskNo ratings yet

- Steve Jobs Research Paper ThesisDocument8 pagesSteve Jobs Research Paper Thesisowynqovcf100% (1)

- BFS & DFSDocument83 pagesBFS & DFSFaiza RajpootNo ratings yet

- 01 Heart of Jesus Son of The Eternal Father FR Ricardo ClareyDocument3 pages01 Heart of Jesus Son of The Eternal Father FR Ricardo ClareyRenata SenaNo ratings yet

- 2 Fibonacci Sequence and The Golden RatioDocument3 pages2 Fibonacci Sequence and The Golden RatioRafael Jotojot Jr.No ratings yet

- Florida Bar Leonard Clark, Request For Review TFB File No. 2013-10,271 (13E)Document20 pagesFlorida Bar Leonard Clark, Request For Review TFB File No. 2013-10,271 (13E)Neil GillespieNo ratings yet

- 69.Cadiao-Palacios V People, 582 SCRA 713 PDFDocument9 pages69.Cadiao-Palacios V People, 582 SCRA 713 PDFaspiringlawyer12340% (1)

- The Dialectical Behavior Therapy Skills Workbook for Shame Powerful DBT Skills to Cope with Painful Emotions and Move Beyond Shame Alexander L. Chapman download pdfDocument60 pagesThe Dialectical Behavior Therapy Skills Workbook for Shame Powerful DBT Skills to Cope with Painful Emotions and Move Beyond Shame Alexander L. Chapman download pdfgrayerjuanp100% (7)

- Glass in Ancient India Excavations at KoDocument24 pagesGlass in Ancient India Excavations at Kojoholo1375No ratings yet

- GAFTA Documentary CreditsDocument3 pagesGAFTA Documentary CreditsromandawNo ratings yet

- Lil Tecca (English Homework)Document3 pagesLil Tecca (English Homework)dhuyvetterkoen5450No ratings yet