Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Uploaded by

Nayaz EmamaulleeCopyright:

Available Formats

Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Uploaded by

Nayaz EmamaulleeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Exercises and Answers Q1 To 4 - Ledger Account For Accruals and Prepayments

Uploaded by

Nayaz EmamaulleeCopyright:

Available Formats

Exercise 1

A business pays rates $2 500 per annum. In year ending 31 December 2019, amount actually paid by

cheque was to $2 600. There were neither due nor prepaid rates at 1 January 2019. Show the Rates

account.

Dr Rates Account Cr

Date Details Amount Date Details Amount

$ $

31 Dec Bank 2 600 31 Dec Income Statement 2 500

31 Dec Balance c/d - prepaid 100

2 600 2 600

1 Jan Balance b/d - prepaid 100

Exercise 2

A business has incurred electricity amounting to $1 900. In year ending 31 December 2019, only an

amount of $1 600 was paid in cash. There were neither due nor prepaid rates at 1 January 2019. Show

the electricity account.

Dr Electricity Account Cr

Date Details Amount Date Details Amount

$ $

31 Dec Bank 1 600 31 Dec Income Statement 1 900

31 Dec Balance c/d - due 300

1 900 1 900

1 Jan Balance b/d - due 300

Exercise 3

On 1 April 2019, a business had prepaid insurance $120. During the year ended 31 March 2020,

insurance paid by cheque were $2 200. Insurance incurred for the year ended 31 March 2020 amount

to $2 120. Show the Insurance account.

Dr Insurance Account Cr

Date Details Amount Date Details Amount

$ $

1 April 19 Balance b/d - prepaid 120 31 Mar 20 Income Statement 2 120

31 Mar 20 Bank 2 200 31 Mar 20 Balance c/d - prepaid 200

2 320 2 320

1 April 20 Balance b/d - prepaid 200

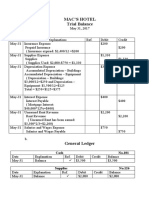

Exercise 4

On 1 January, general expenses due amounted to $50. During the year, amount paid for general

expenses were $1 100 by cheque and $300 in cash. General expenses incurred for the year amounted

to $1 500. Show the General Expenses account.

Dr General Expenses Account Cr

Date Details Amount Date Details Amount

$ $

Dec 31 Bank 1 100 Jan 1 Balance b/d - due 50

Dec 31 Cash 300 Dec 31 Income statement 1 500

Dec 31 Balance c/d - due 150

1 550 1 550

Jan 1 Balance b/d - due 150

You might also like

- 2492493Document7 pages2492493mohitgaba19100% (1)

- Business PlanDocument19 pagesBusiness PlanSimona PatrascuNo ratings yet

- Principles of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankDocument161 pagesPrinciples of Cost Accounting 17Th Edition Edward J Vanderbeck Maria R Mitchell-Test BankAbby Navarro100% (1)

- Chapter 10 AnswersDocument3 pagesChapter 10 AnswersThe Nightwatchmen100% (1)

- ACCA F3 CH#10: Accruals and Prepayments NotesDocument26 pagesACCA F3 CH#10: Accruals and Prepayments NotesMuhammad AzamNo ratings yet

- Worksheet 2 Statement of Financial Position Question With SolutionDocument3 pagesWorksheet 2 Statement of Financial Position Question With SolutionNayaz Emamaullee100% (2)

- IntercompanyDocument48 pagesIntercompanyPritesh Mogane0% (2)

- Other Payables and Other ReceivablesDocument8 pagesOther Payables and Other ReceivablesChaterine AdiwinotoNo ratings yet

- Year 9 (3) 7707Document2 pagesYear 9 (3) 7707ptschl.90No ratings yet

- Grade 10 Poa Section 6Document17 pagesGrade 10 Poa Section 6Princess InnissNo ratings yet

- Accruals and PrepaymentsDocument8 pagesAccruals and PrepaymentsShaikh Ghassan AbidNo ratings yet

- General Journal and LedgerDocument5 pagesGeneral Journal and Ledgersinta agnesNo ratings yet

- Accrual and ProvisionDocument66 pagesAccrual and ProvisionVeronica Bailey100% (1)

- Fa HW 3Document4 pagesFa HW 3Phạm Châu Thuý KiềuNo ratings yet

- Acct101-3 - (Your Name)Document9 pagesAcct101-3 - (Your Name)Vedanshi BihaniNo ratings yet

- Trail Balance 0 Ledger AccountsDocument8 pagesTrail Balance 0 Ledger AccountsMohamed AliNo ratings yet

- CH3 Assign3Document2 pagesCH3 Assign3Rosa Julia LawrenceNo ratings yet

- Accrual & PrepaymentsDocument4 pagesAccrual & PrepaymentsronstarcaristaNo ratings yet

- Assignment 1 Principles of AccountingDocument13 pagesAssignment 1 Principles of AccountingMmonie MotseleNo ratings yet

- Assignment No. 2 PCF and BANK RECONCILIATION1Document4 pagesAssignment No. 2 PCF and BANK RECONCILIATION1Elaine Antonio100% (1)

- 13.prepayment and Accruals ExpenseDocument5 pages13.prepayment and Accruals ExpenseDave ChowtieNo ratings yet

- Writing Up Ledger AccountsDocument13 pagesWriting Up Ledger AccountsLearnJa Online SchoolNo ratings yet

- Adilah Aprilia - 4122201115 - AkuntansiDocument11 pagesAdilah Aprilia - 4122201115 - AkuntansiDava SyafriandanaNo ratings yet

- REVIEW Chap 1 - 2 - 3Document9 pagesREVIEW Chap 1 - 2 - 3Khánh AnNo ratings yet

- September 12th, 2024 - Trial BalanceDocument3 pagesSeptember 12th, 2024 - Trial Balancesahil.rambarose001No ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- Chapter 7 WorksheetsDocument13 pagesChapter 7 Worksheetslaila hazariNo ratings yet

- Prepare Adjusting Entry - Accounting in ActionDocument3 pagesPrepare Adjusting Entry - Accounting in ActionJabbar aqwanNo ratings yet

- Test2 - Accounting - Rahmatullah NaimiDocument12 pagesTest2 - Accounting - Rahmatullah NaimiRahmat NimiNo ratings yet

- Provision For Doubtful DebtsDocument28 pagesProvision For Doubtful DebtsGeneva GomezNo ratings yet

- Attachment 1Document10 pagesAttachment 1S Nur ApriyaniNo ratings yet

- Account FormatDocument13 pagesAccount Formatpro663633No ratings yet

- May 2018 and 2017 SolutionsDocument43 pagesMay 2018 and 2017 SolutionsgNo ratings yet

- Topic 2A & B - Adjustments - Prepaid and Accrued Expenses & IncomeDocument15 pagesTopic 2A & B - Adjustments - Prepaid and Accrued Expenses & IncomeVarsha GhanashNo ratings yet

- Topic 8 Tutorial SolutionDocument4 pagesTopic 8 Tutorial SolutionMitchell BylartNo ratings yet

- The Rules and Principles of Double EntryDocument2 pagesThe Rules and Principles of Double EntrySheraz AhmadNo ratings yet

- Date Account Titles and Explanation Ref. Debit Credit 2020 Adjusting EntriesDocument6 pagesDate Account Titles and Explanation Ref. Debit Credit 2020 Adjusting Entriesnguyenthituyet0983191523No ratings yet

- ACC 201 Assesment #1 FALL 2020Document2 pagesACC 201 Assesment #1 FALL 2020Bj RootsNo ratings yet

- Unit 5: Account Current: Learning OutcomesDocument16 pagesUnit 5: Account Current: Learning OutcomessajedulNo ratings yet

- Accruals and PrepaymentsDocument28 pagesAccruals and Prepaymentsvpq7qcwszyNo ratings yet

- Module 9 - Accounts and Financial ServicesDocument4 pagesModule 9 - Accounts and Financial ServicesAshleigh JarrettNo ratings yet

- Graciani Puc - Financial Statement 2.Document7 pagesGraciani Puc - Financial Statement 2.Graciani PucNo ratings yet

- Handout 7.studentDocument6 pagesHandout 7.studentVikrant KapoorNo ratings yet

- Tom Pryor Formed A Management Consulting FirmDocument5 pagesTom Pryor Formed A Management Consulting FirmAimes AliNo ratings yet

- Bad Debts and Provision For Doubtful Debts (Edited Version)Document8 pagesBad Debts and Provision For Doubtful Debts (Edited Version)Mantiki QhobosheaneNo ratings yet

- Topic: Adjustments To The Income Statement: Subtopic: Prepaid Income ObjectivesDocument2 pagesTopic: Adjustments To The Income Statement: Subtopic: Prepaid Income ObjectivesFungaiNo ratings yet

- Cambridge, 2nd Ed. - Other Payables and ReceivableDocument3 pagesCambridge, 2nd Ed. - Other Payables and ReceivableShannen LyeNo ratings yet

- 'O' Level Accounts Vacation-1Document21 pages'O' Level Accounts Vacation-1mtisinyasha23No ratings yet

- FNDTN Accounts 1 Chap 1 Test - 9 SuggestedDocument6 pagesFNDTN Accounts 1 Chap 1 Test - 9 SuggestedcashivanshsharmaNo ratings yet

- Tugas Pengantar Akuntansi 6Document1 pageTugas Pengantar Akuntansi 6Almira MahsaNo ratings yet

- (Financial Accounting) : Assignment TitleDocument11 pages(Financial Accounting) : Assignment TitleRandy KyawNo ratings yet

- 25 NOTES Wk7 DebtorsDocument7 pages25 NOTES Wk7 Debtorsmbathajackson55No ratings yet

- RtgsDocument3 pagesRtgsFungaiNo ratings yet

- Accruals and Deferral Chapter 4 ExercisesDocument6 pagesAccruals and Deferral Chapter 4 ExercisesSiraj KabbaraNo ratings yet

- September 9th, 2024 - Practice WorkDocument4 pagesSeptember 9th, 2024 - Practice Worksahil.rambarose001No ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Soal Quiz PA1Document4 pagesSoal Quiz PA1sbntqqb4z8No ratings yet

- Accounting Ledger AssignmentDocument6 pagesAccounting Ledger AssignmentIzkaan ShinanNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument4 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs JoovhoNo ratings yet

- Coursebook Chapter 11 AnswersDocument4 pagesCoursebook Chapter 11 AnswersAhmed Zeeshan100% (10)

- Abdulla YounisDocument4 pagesAbdulla Younisashwani singhaniaNo ratings yet

- Usa Ma 21Document9 pagesUsa Ma 21Usama17No ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Short Jumuah Khutbah - SwalaahDocument2 pagesShort Jumuah Khutbah - SwalaahNayaz EmamaulleeNo ratings yet

- Short Jumuah Khutbah - TaqwaDocument2 pagesShort Jumuah Khutbah - TaqwaNayaz EmamaulleeNo ratings yet

- Short Jumuah Khutbah - Forthcoming RamadwaanDocument2 pagesShort Jumuah Khutbah - Forthcoming RamadwaanNayaz EmamaulleeNo ratings yet

- Short Jumuah Khutbah - Trust AllahDocument2 pagesShort Jumuah Khutbah - Trust AllahNayaz EmamaulleeNo ratings yet

- Education in IslamDocument1 pageEducation in IslamNayaz EmamaulleeNo ratings yet

- GreetingsDocument2 pagesGreetingsNayaz EmamaulleeNo ratings yet

- Allah Tests Whom He LovesDocument2 pagesAllah Tests Whom He LovesNayaz EmamaulleeNo ratings yet

- Double Entry Exercises Set DDocument1 pageDouble Entry Exercises Set DNayaz EmamaulleeNo ratings yet

- Allah's Mercy v2Document1 pageAllah's Mercy v2Nayaz EmamaulleeNo ratings yet

- Worked Example Financial StatementDocument2 pagesWorked Example Financial StatementNayaz EmamaulleeNo ratings yet

- Double Entry Exercises Set EDocument1 pageDouble Entry Exercises Set ENayaz EmamaulleeNo ratings yet

- Crossword On Accounting Terms NewDocument2 pagesCrossword On Accounting Terms NewNayaz EmamaulleeNo ratings yet

- Format of Statement of Financial PositionDocument1 pageFormat of Statement of Financial PositionNayaz EmamaulleeNo ratings yet

- Accounting Terms Crossword - BeginnersDocument1 pageAccounting Terms Crossword - BeginnersNayaz EmamaulleeNo ratings yet

- Accounts of Clubs and SocietiesDocument10 pagesAccounts of Clubs and SocietiesNayaz EmamaulleeNo ratings yet

- Statement of Financial Position/ Balance Sheet Format For A Sole TraderDocument1 pageStatement of Financial Position/ Balance Sheet Format For A Sole TraderNayaz Emamaullee50% (2)

- The Gaap and IfrsDocument2 pagesThe Gaap and IfrsAlan Cheng100% (1)

- Bond Issue 2017 W InstDocument6 pagesBond Issue 2017 W Instapi-259988620No ratings yet

- Income Distribution and Poverty in The PhilippinesDocument14 pagesIncome Distribution and Poverty in The PhilippinesEd Leen Ü100% (6)

- Bonds CallableDocument52 pagesBonds CallablekalyanshreeNo ratings yet

- MA QB September 2020-August 2021 As at 15 April 2020 FINALDocument301 pagesMA QB September 2020-August 2021 As at 15 April 2020 FINALOlha L100% (1)

- Chaman Lal Setia Exports LTD - Initiating Coverage - 14.05.2021Document14 pagesChaman Lal Setia Exports LTD - Initiating Coverage - 14.05.2021flying400No ratings yet

- Chapter 3Document16 pagesChapter 3Dayanat Aliyev50% (2)

- Chapter 16 The Market and MarketingDocument3 pagesChapter 16 The Market and MarketingRomero SanvisionairNo ratings yet

- Loonkaran Sethiya and Ors Vs Ivan E John and OrsDocument13 pagesLoonkaran Sethiya and Ors Vs Ivan E John and OrsAnonymous USJooflFNo ratings yet

- The Turks in IndiaDocument326 pagesThe Turks in IndiaRohitNo ratings yet

- 128574361X 459054 PDFDocument23 pages128574361X 459054 PDFPines MacapagalNo ratings yet

- FM SM Test 3 FM 6 8 SM 12 May 2024 Solution 1703755429Document14 pagesFM SM Test 3 FM 6 8 SM 12 May 2024 Solution 1703755429nitishgarg818No ratings yet

- Chapter - 7 - Pay Back PeriodDocument15 pagesChapter - 7 - Pay Back PeriodAhmed freshekNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- Book-Keeping and Accounts Level 2/series 2-2009Document13 pagesBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- Taranveer-Wk 1-Quiz 1-Man EcoDocument16 pagesTaranveer-Wk 1-Quiz 1-Man EcoaksNo ratings yet

- Week 2 Quiz Federal TaxDocument4 pagesWeek 2 Quiz Federal TaxLatosha James-ChisholmNo ratings yet

- 04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Document25 pages04 - IP - UK - Development - of - Centre - For - Wellness - and - AYUSH - Treatment - (AYUSH Gram)Rupally Sharma0% (1)

- Harbor City Health SpaDocument8 pagesHarbor City Health Spaazhar hussainNo ratings yet

- Jpia FundDocument53 pagesJpia FundCharlie LebecoNo ratings yet

- VP Director Integrated Marketing in Miami Fort Lauderdale FL Resume Ray KnightDocument2 pagesVP Director Integrated Marketing in Miami Fort Lauderdale FL Resume Ray KnightRayKnight2No ratings yet

- Taxation PresentationDocument10 pagesTaxation Presentationmhilet_chiNo ratings yet

- A. Classification OF Individual TaxpayersDocument7 pagesA. Classification OF Individual TaxpayersShiela Marie Sta AnaNo ratings yet

- Novartis DF 2006Document236 pagesNovartis DF 2006JORGENo ratings yet

- LECTURE 10 Dealings in PropertiesDocument33 pagesLECTURE 10 Dealings in PropertiesJeane Mae Boo100% (1)

- Congressional Record: March 27,1943, Page 2580Document10 pagesCongressional Record: March 27,1943, Page 2580Luis A del MazoNo ratings yet

- Types of Tariffs and Trade BarriersDocument4 pagesTypes of Tariffs and Trade Barrierssubbu2raj3372No ratings yet