Promopedia - MSME Products Special 2020

Promopedia - MSME Products Special 2020

Uploaded by

Ananda ShingadeCopyright:

Available Formats

Promopedia - MSME Products Special 2020

Promopedia - MSME Products Special 2020

Uploaded by

Ananda ShingadeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Promopedia - MSME Products Special 2020

Promopedia - MSME Products Special 2020

Uploaded by

Ananda ShingadeCopyright:

Available Formats

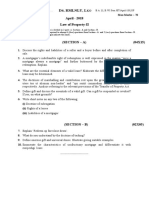

Union bank of India, Staff College Bangalore

Disclaimer: This is purely a voluntary effort for dissemination of knowledge and enabling people to

prepare for promotion test. Best efforts have been put to provide the accurate and updated information.

However, the users are requested to refer relevant circulars and policies of our Bank& RBI for further

clarity –

Updated 25.11.2019

MSME Products Page1

Union Trade

IC 10038 dated 27.8.2014

Eligibility All retail traders, wholesale dealers, supermarkets, malls,

departmental stores, dealers in consumer durables, cooperative

stores etc.

Also service sectors like, restaurants, entertainment etc. who

maintains required stocks/ book debts

Proprietorship, partnership, LLPs, limited companies

Firm registered under VAT/sales/shop & establishment act

Purpose Term loans for acquiring, expansion, additions, repairs, renovation of

premises or infrastructure, Purchase of equipments, computers, OFF,

For purchase of any assets for business

Working Capital needs of business

Quantum Rs. 25 crores w/w TL can be maximum Rs.5 crores

Assessment The working capital limits upto Rs.2 crores can be assessed under

turnover method. Afterwards FBF method is to be utilized

Collateral Min.75%

Security

Margin Working Capital:

Limit upto Rs.10 lakhs: Nil

Limit more than Rs.10 lakhs: 20%

Term Loan: 25%

Drawing Up to Rs.10.00 lakhs: Stock + Book debts (not older than 90 days)

Power Above Rs.10.00 lakhs: Stock + Book debts (not older than 90 days) –

Calculation Sundry creditors - Margin

Interest Collateral Security 75% to <125% of loan amount: 0.50% less than the

Master Table A or Master Table B

Collateral Security ≥125% of loan amount: 1.50% less than the Master

Table A or Master Table B

Rating Model Separate rating model for Union Trade Scheme:

Model I – Limits above Rs.2.00 lakhs and up to Rs.50.00 lakhs

Model II – Above Rs.50.00 lakhs up to Rs.500.00 lakhs

MSME Products Page2

Union Trade Plus

IC 1763-2019 dated 14.11.2019

Eligibility All retail / Whole sale traders, Super markets, Malls, Departmental

Stores, Dealers in Consumer durables, Cooperative stores, etc.

classified as MSE (Service) Enterprises irrespective of constitution

Should be doing business for at least 1 Financial year

Credit rating should be CR-1 to CR-4

CR-5 can be considered by next higher authority

Sole Banking (however exception can be given to those borrowers

availing credit facilities under Channel Financing / Inventory

funding facility from other bank / FI wherein our bank does not

have tie up arrangement with OEM)

It is to be ensured in this case that there is clear cut segregation in

our bank financed stock / inventories

Even Current accounts should not be maintained with other banks

Purpose Term loans for acquiring, expansion, additions, repairs, renovation

of premises or infrastructure, purchase of equipments, computers,

OFF, for purchase of any assets for business

Working Capital needs of business

Quantum Working Capital Limit:

Minimum: above Rs.10 lakh, Maximum Rs.50 crores

w/w Term Loan: Maximum Rs.10 crore

category of branch:

Branch Maximum

Metro/Urban Up to Rs 50.00 crore

Semi Urban/Rural Up to Rs 20.00 crore

Assessment As per norms prescribed in the loan policy i.e. W. Capital limit up

to Rs.5 crores to MSE sector and Rs.1 crore to Non-MSE sector can

be assessed under turnover method. Beyond these, FBF method is

to be applied.

Collateral Min.100%

Security In case of existing TL secured by landed property, the value of

property in excess of 133% of TL o/s may be considered as eligible

collateral under the scheme (Here TL means other than retail

loans)

1.50 times weightage for clearly defined liquid securities may be

considered for the purpose of pricing only

MSME Products Page3

Margin WC & TL: 20%

Drawing Stock up to 4 months + Debtors up to 90 days less creditors

Power

Calculation

Submission of Up to Rs.1 crore: on quarterly basis

Stock & B. Above Rs.1 crore: on monthly basis

debt

Statement

Interest Very Attractive Rate of Interest (Please refer latest circular)

ROI: different for exposure > Rs.25 crore:

With rating up to BBB (0.50% over and above ROI

mentioned in above table)

With rating of BB and unrated (0.90% over and above ROI

mentioned in above table)

For TL, credit risk premium is to be added

Rating Model Credit rating model as applicable for Union Trade Scheme:

Model I – Limits above Rs.2.00 lakh and up to Rs.50.00 lakh

Model II – Above Rs.50.00 lakh

Migration Existing WC limits permitted for migration under UT Plus at the

time of next renewal. Finacle menu for changing the scheme code

is HACXFRSC

Miscellaneous Contact Point Verification, wherever CPV agency is empanelled by

the Bank, is mandatory for coverage under the scheme.

Down gradation of credit rating to CR-5 & below will result in

withdrawal of preferential ROI available under this scheme and

applicable rate as per Union Trade scheme will be recovered.

For non compliance of other eligibility norms of this scheme:

sanctioning authority may permit continuation of preferential ROI

as per the scheme for period not exceeding 3 months for

rectification of non – compliance.

SLCC may permit deviation in current ratio up to 1

WCDL limit may be fixed at 6 times of average monthly turnover on

our Bank’s POS, repayable in 12 monthly installments at

concessional ROI @ MCLR+0.50%, within the overall limits

sanctioned.

MSME Products Page4

Union Trade-GST

IC 995-2017 dated 13.10.2017

Eligibility All units classified as MSME (Manufacturing/Service)

Enterprises irrespective of constitution

Valid registration under GST Act which can be either:

Provisional Registration (Form GSTREG-25) or

Final Registration (Form GSTREG-06)

Valid GST Returns certified by CA

There are two kind of returns:

1. GSTR-1 (Regular): it is submitted on monthly basis

2. GSTR-4 (Composition): it is submitted on quarterly basis

In case of GSTR-1, it should have been filed for last 3

months

In case of GSTR-4, it should have been filed for at least one

quarter

Credit rating should be CR- 1 to CR-5

Sole Banking

Even Current accounts should not be maintained with other

banks. Current a/c with other banks, if any, to be closed

within 3 months of sanction of credit facility.

Purpose Working Capital needs of business (No Term Loan)

Quantum Working Capital Limit (FB+NFB):

Minimum: >Rs.10 lakhs, Maximum Rs.2 crores

No Term Loan permitted under the scheme

Assessment Basis of assessment will be turnover specified in GSTR

Returns

No CMA should be insisted upon

In case of GSTR-1: returns for minimum 3 consecutive

months and in case of GSTR-4: returns for minimum 1

quarter are required.

Based upon the average turnover (as per GSTR-1 / GSTR-4)

annual projected turnover for next 12 months is to be

arrived at

The maximum quantum of working capital limit assessed will

be 30% of the projected acceptable turnover.

Once account is running under GST regime for more than 1

year, the projected turnover for assessment will be average

MSME Products Page5

of GSTR-9 (Annual Return).

Collateral Min.100%

Security In case of existing TL secured by landed property, the value

of property

in excess of 133% of TL o/s or

margin stipulated at the time of sanctioning of the term

loan

whichever is higher

may be considered as eligible collateral under the scheme

However, in case of mortgage loan such excess shall be

considered over 200% of loan outstanding.

Open land can’t be accepted

Land having proper boundary can be accepted

Margin 20%

Drawing Power Stock up to 3 months + Debtors up to 90 days less creditors

Calculation

Submission of on quarterly basis

Stock & B.

debt

Statement

Interest Concessional ROI linked with credit rating. This is the same ROI

which is for Union Trade Plus scheme with collateral 100% and

above to <150%.

Rating Model UBI model:

Model I – Limits above Rs.2.00 lakhs and up to Rs.10.00

lakhs

Model II – Above Rs.10.00 lakhs up to Rs.100.00 lakhs

Model II – Above Rs.100.00 lakhs up to Rs.500.00 lakhs

Migration Existing borrowers permitted for migration under this

scheme. Finacle menu for changing the scheme code is

ACXFRSC

Miscellaneous Down gradation of credit rating to CR-6 & below will result

in withdrawal of preferential ROI available under this

scheme and applicable rate as per Union Trade scheme or as

per relevant MSME scheme will be recovered.

SLCC may permit deviation in current ratio upto 1

Deviation in current ratio beyond 1:1 can be considered by

RLCC1

TOL/TNW up to 5:1 (including quasi equity) is permitted

under the scheme (it’s not a deviation)

MSME Products Page6

Union High Pride

IC 00857-2017 dated 30.05.2017

Eligibility MSME Units

Manufacturing or Service activity (Traders not covered)

Credit Rating: UBC-1 to 3 (External Rating: not below BBB, wherever

applicable)

Unit engaged in business activity for minimum 1 financial year and IT

returns submitted thereof.

Units established by close relatives or group concern of our existing

concerns (promoter of existing unit financed by the Bank) with

satisfactory dealing, even established for less than 1 yr will be

eligible.

Sole Banking Arrangements for credit limit upto Rs.5 crores.

Facility Working Capital & Term Loan

Quantum Above Rs.1 crore up to Rs.25 crores

Collateral Minimum 50%

Security Below 50% will be treated as deviation and ZLCC can permit

collateral coverage up to minimum 20%

If any existing TL secured by landed property, the value of property

in excess of 133% of total o/s in TL may be considered as eligible

collateral

However, in case of mortgage loan such excess shall be considered

for 200% of the loan o/s.

Margin 20%

Interest 1% less than the applicable ROI for MSME

1.25% less than the applicable ROI for MSME on compliance of any of

the following conditions:

External rating of BBB and above

100% and above collateral coverage

Others Non Compliance of Eligibility Conditions:

Subsequent down gradation of credit rating from UBC-3 or

equivalent will result in withdrawal of prescribed rate available

under the scheme.

For any other non compliance subsequently: Sanctioning Authority

may permit continuation of preferential rate under the scheme for

period not exceeding 3 months for rectification of non-

compliance.

MSME Products Page7

Standby limit as per norms under SME Plus scheme permitted within

overall exposure ceiling of Rs.25 crores.

However, collateral coverage to be maintained for standby limit

also.

Scheme Code: WC: CCPRD, TL: TLU21

Migration of existing accounts: WC facility at the time of next

renewal may switch over but TL not permitted.

Deviation RLCC-I and above can permit:

in Scheme Internal credit rating of CR-4 subject to minimum collateral

coverage of 100%.

Timeline for obtaining external credit rating not exceeding 3

months

Union Progress

Ref IC 553 – 2016 dated 05.08.2016 and modification vide circular No IC 00775-

2017 dated 23.02.2017

Eligibility All type of micro and small enterprises engaged in manufacturing

and service sector.

All business units irrespective of the constitution belonging to

micro and small category.

Unit should have all statutory approvals/ NOC from respective

departments.

Credit rating of the borrower should not be below CR-4 for

takeover and CR-5 in case of new connections.

All new and existing eligible proposals of micro and small

enterprises except not eligible for CGTMSE coverage.

Purpose To meet business related needs including purchase/ construction

of business premises including cyber case, machinery including

gensets, equipments, vehicles and working capital requirements

Nature of Term Loan and/ or Working capital (FB+NFB)

facility

Quantum Maximum limits up to Rs. 1.00 crore can be sanctioned based on

requirements to be assessed as per the lending methods suggested

in loan policy.

Margin 10% for credit limits up to Rs. 10 Lakhs

15% for credit limits above Rs. 10 Lakhs

MSME Products Page8

Interest As per interest rate for Micro and small units

Processing Processing charges-

& other Up to Rs. 10 Lakhs – Nil

charges Above Rs. 10 Lakhs- Rs. 1000.00 flat + GST for Micro units and 50%

of applicable rate for small units.

Documentation and Inspection Charges-

Flat Rs. 500.00 plus actual stamp duty

Security Prime- All assets created out of bank finance shall be charged in

favour of the bank by way of hypothecation/mortgage.

Collateral- All eligible cases CGTMSE shall be covered under

CGTMSE and annual guarantee fee to be payable to credit

guarantee trust to be fully absorbed by the bank for micro units

only.

Where CGTMSE cover is not available such as educational

institutions, SHG/JLGs, collateral security to the extent of

minimum 60% of total credit facility or primary security coverage

of minimum 125% of total credit facility considering the value of

land and building only.

However, no collateral for exposure up to Rs.10 lakh

Repayment Term loan to be repaid within a maximum period of 84 months

including moratorium.

Working Capital- 12 months subject to renewal as per extant

guidelines of the bank.

Union In existing MSE accounts with satisfactory dealing of Minimum 3

Laghu years, FB WC limit up to Rs.10 lakhs can be sanctioned up to 3

Udyami years and a separate card to be issued.

Credit Request for enhancement in limit could be considered at the time

Card of annual review within the ceiling of RS.10 lakhs.

(ULUCC)

Rupay Card Rupay card may be issued by earmarking sanctioned WC limit to

individual borrowers and the proprietor of the proprietorship firm

for business activity:

a) Up to Rs.10 lakhs: 20% of sanctioned limit subject to minimum

of RS.5000/- and maximum of RS.50000/-.

b) Above Rs. 10 lakhs: 5% of the sanctioned limit subject to

maximum of RS.1.00 lakh.

MSME Products Page9

Union Nari shakti

Refer IC 10096 dated 10.11.2014

Highlights A new scheme exclusively for financing women entrepreneurs

Processing charges waived

Rate of interest and other charges reduced substantially

Margin requirement reduced to 5 %

Collateral coverage reduced to 15 %

All eligible cases to be mandatorily to be covered under CGTMSE

scheme

Objectives To extend a helping hand to women entrepreneurs and to tap

vast potential

To cover all service and manufacturing activities under MSE -

women entrepreneurs

To increase the advance portfolio under MSE and achieve the

target under Prime Minister Task Force

All Accounts under this scheme shall be opened with scheme code

CCUNS for CC limit and TLP09 for TL in Finacle.

Scope All women owned and managed Micro and Small enterprises

engaged in manufacture or production, processing or preservation

of goods or enterprises engaged in providing or rendering of

services.

Eligibility Enterprises eligible to be classified under Micro and Small

enterprises as per investment criterion outlined in MSMED Act

2006

Enterprises should be owned and managed by women

entrepreneurs. In case of partnership firm/ Company, majority of

partners/Directors should be women

Proprietary, partnership, limited companies etc are eligible

Units should have in place all necessary approvals/ NOC from

respective authorities

Credit rating as per loan policy

All new as well as exiting accounts can be covered under this

scheme – Sole banking

Purpose CC(H) limits to meet working capital requirements

Term loan for purchases /construction /renovation of

factory/office/shop/godown or purchase of plant & machineries

or other equipments

MSME Products Page10

ROI Concessional ROI depending upon Credit Rating and classification

into Micro and Small sector.

Exposure Minimum Rs 2.00 lakhs, Maximum Rs 100.00 lakhs

Margin For credit limits up to Rs 10 lakhs – 5 %

For credit limits above Rs 10 lakhs – 15 %

Processing Nil

Charges

Collateral In case of exposure up to Rs 10 lakhs no collateral security to be

Security obtained

All eligible cases of CGTMSE to be mandatorily covered under

CGTMSE

Where the CGTMSE cover is not available–minimum collateral is as

under:

Working capital - 25 % of loan value acceptable to Bank

Term loan - 15 % of loan value acceptable to Bank

Composite loan - 15 % of loan value acceptable to Bank

Personal guarantee of directors, proprietor, partners of the

company/firm and of all mortgagors of collateral security

Union Liqui Property

(IC No. 478-2016 dated 06.06.2016)

Eligibility All business enterprises engaged in business activity for

minimum last 2 years irrespective of constitution other than

individuals and HUF.

Units should have all necessary statutory approvals / NOCs

from respective authorities.

Purpose To meet WC requirement

For shoring up of NWC

For purchase /construction /renovation of factory /office

/shop /godown

For purchase of plant and machinery/equipment

Financing repayment of high cost debts

Quantum Minimum Rs. 0.10 crore

Maximum Rs. 10.00 crores

Assessment Term Loan: not exceeding 5 times of average net annual

income of last 3 years based on IT returns along with

MSME Products Page11

depreciation or 50% of the fair market value of the landed

property offered as security whichever is lower.

Overdraft: not exceeding 20% of the annual turnover based

on last audited balance sheet. Cash budget method for limit

above Rs.5.00 crore or 50% of fair market value of the

property offered as security.

Both term loan and WC limits should not exceed 50% of the

market value of the property mortgaged.

Note:

Audited BS is must

20% of turnover based upon last audited BS is to be

calculated

Exp: Based upon FBF limit eligibility comes to Rs.100 lakhs

but based upon sales of Rs.3 crores for last year, 20% comes

to Rs.60 lakhs: Then 60 lakhs can be given under Union Liqui

and remaining 40 lakh can be given under CC(H).

If we want to give Rs.100 lakhs under Union Liqui only, then

it’s a deviation; sanction the proposal and take approval for

deviation from ZLCC before release of limit.

Financial CR: not below 1.00

benchmark TOL/TNW: not exceeding 6:1

DER: Not exceeding 4:1

Average DSCR not below 1.50:1 with minimum DSCR of

1.20:1

Security EM of residential/commercial/industrial property located at

metro/urban/semi urban only enforceable under SARFASIA.

Open plots may be accepted by delegated authority of ZLCC

and above.

Agricultural land should not be accepted.

In case of leased property (from development authorities),

the unexpired lease period should be at least 5 years longer

than the repayment period and necessary permission/NOC to

be obtained from the development authority.

Repayment Term loan in maximum 120 months inclusive of moratorium

period not exceeding 6 months

The loan repayment must end at least 5 years before the

end of the residual life of the property.

Ratio of repayment period (excluding moratorium) to

MSME Products Page12

number of times of income considered for TL assessment:

Min 2:1

Example:

Average annual income Rs.10 lakh; if TL is given 5 times of

Rs.10 lakhs then repayment must be minimum 10 years (10

yrs is the max repayment permitted under this scheme,

beyond it will be deviation).

For maintaining this 2:1 in this case we can’t give any

moratorium. If we give 6 months moratorium, then

repayment period will come down to 9.5 years with which

ratio will come to 1.90:1. Therefore, in this case either

don’t give any moratorium or extend the repayment period.

Extending repayment period will be a deviation to be

approved by ZLCC. First sanction the proposal and then take

approval for deviation.

If customer wants 4 times of income only, then repayment

period should be minimum 8 years and it can be even 10

years also (including moratorium, if any)

Deviations Deviations in assessment, margin, repayment period, etc

can be permitted by RLCC, ZLCC, CAC

Union Rent

IC 1764-2019 dated 14-11-2019

Eligibility a) Landlords of our Branch/Offices premises (Including

residential flat/houses leased to our Bank.)

b) Owner of property (Commercial/Residential) who have

rented the same to Public Sector Banks, Public Sector

Undertakings, Post Office & Government Departments.

c) Owner of property (Commercial /residential) who have

rented the same to other reputed

companies/MNCs/Institutions/ Private Sector Banks etc.

d) The property leased out should not have any litigation

regarding the title and it should be owned by the

borrower.

e) The loan is not permissible in case where lessor and lessee

belong to the same group. However, in cases where there

are multiple offices/units in a single building and of which

MSME Products Page13

few unit(s) are leased out to firm(s) under the same group

and remaining other unit(s) to other eligible lessees,

financing under the scheme shall be permitted. In such

cases the proportionate rentals from sister concern(s)

should be excluded while arriving at eligible loan amount.

Purpose Loan can be sanctioned for short to medium term needs or

for any other requirements

Quantum Maximum limit per party that can be sanctioned under the

scheme should be calculated considering net rent amount

available to the Bank up to maximum 120 months subject

to:

a. 75% of the net rental income for residual/effective lease

period i.e. Gross Rentals less (Advance rent received +

property tax + TDS + Other statutory dues of lessor)

OR

b. 75% of the value of property

OR

c. Loan that can be recovered / repaid from applicable rent

receivables (Refer to Point on repayment)

whichever is less

[ Securitization of lease rentals and repayment thereof beyond

the unexpired lease period upto 120 months ( up to 180

months , applicable in case of point ‘e’ mentioned earlier

under eligibility.]

Wherever the automatic extension clause in the lease

agreement is available, the securitization of lease rental up

to 120 months ( up to 180 months, applicable in case of

point ‘e’ mentioned earlier under eligibility) can be

considered although the original lease agreement is for

shorter period subject to evaluation of the factors as given

below:

- The lessee is a reputed corporate / PSU entity.

- Financial of lessee are satisfactory.

- The lease agreement provides option for further extension

of lease.

- If substantial amount is spent by the lessee on fit-outs,

MSME Products Page14

furnishing of rental premises, it may be good reason to

presume that lease period would be extended further.

In case of lease agreement of less than 120 months say 36 /60

months, discounting of rental may be considered up to 120

months ( up to 180 months, applicable in case of point ‘e’

mentioned earlier under eligibility) i.e. beyond the effective

lease period.

For considering loan covering the period beyond the period of

effective (Unexpired) lease, it will be considered assuming

that 75% of the area under lease will be occupied at any given

point of time.

CRE and Non-CRE: The portion of loan amount calculated taking into

Non CRE consideration the effective lease period up to the lock-in

Portion period and without exit clause. Further, there should not be a

clause in lease agreement which allows a downward revision

in the rentals.

CRE: The portion of loan amount calculated taking into

consideration the period of lease rental beyond the period of

Non-CRE i.e. Lock-in period as above.

(The CRE portion of loan covering the period beyond the lock-in

period will be treated as Non-CRE under Union Rent Scheme up

to the extension of lock in period, if any on renewal or execution

of fresh lease agreement)

Security Up to Rs.1.00 Lakhs - On Clean basis

Above Rs.1.00 Lakhs - EM of property, in respect of which

rent is charged to the loan. In case the security of the said

property is not available, EM of alternate property is

permitted.

However, It should be ensured that the property:

Have clear & marketable title and there should not be any

litigation of any nature outstanding on the property.

Should be held as free hold and

The value of the alternate property is not less than 150% of

the loan amount.

Other chargeable securities such as NSCs, Bank own deposit,

LIC policies etc. having value sufficient to cover the loan

MSME Products Page15

amount may also be obtained.

ROI Rate of interest depends upon tenor of loan, CRE vs. Non-CRE

portion of loan. Further there is lower ROI for loan against

rent receivables from the premises leased to:

• Our Bank

• Other PSBs/PSUs/Govt. Department

Repayment Up to 120 months or within the unexpired period of lease,

whichever is earlier

Repayment capacity is to be assessed as per amortization

sheet of the available net cash flows.

For loans having both CRE and Non-CRE portion, the Non-CRE

portion will generally be liquidated first. However, interest is

to be paid as and when due for both CRE and Non-CRE

portion.

The CRE and Non-CRE component of loan should be

mentioned and separate accounts should be opened in the

system for CRE and Non-CRE portion of Loan for operational

convenience and proper classification.

In case of large commercial projects like IT parks, Malls,

properties in industrial area/SEZ etc. where investments

made by the promoter are large, the expected returns from

these types of properties are spread over the year. In such

cases, securitization of lease rentals may be considered up to

180 months.

For lease rent discounting above 120 months, Debt Service

Reserve Account (DSRA) of 3 months to be created.

Where repayment period is more than 120 months, sensitivity

analysis to be carried out on the following parameters.

Increase in interest rate by 100 bps.

Decrease realizable value of property by 10% &

Decrease in rental receipt by 10%

MSME Products Page16

Union Enterprise

(IC 1762-2019 dated 14.11.2019)

Eligibility All MSME units engaged in Manufacturing and Service activities

(other than trade).

Existing and new unit proposed to be established by

promoter(s) having good market standing as per due diligence

report.

All business units irrespective of constitution

Credit rating should be CR-1 to CR-4

CR-5 can be considered by next higher authority

Maximum age 70 years in case of Individual and proprietorship

Sole Banking (however exception to be given to those

borrowers availing credit facilities under Channel financing

/TReDS /Inventory funding facility from other bank/FI wherein

our Bank doesn’t have tie-up arrangement with OEM)

Even Current accounts should not be maintained with other

banks. Relaxation may be permitted by CAC-III & above on case

to case basis.

In case of existing accounts being migrated to this scheme, all

terms and conditions of last sanction to be complied with.

Purpose Term loans for purchase/ construction / renovation of factory /

offices / shop / godown / plant & machinery / equipment etc

for business activities

Working Capital needs of business

Quantum Minimum: above Rs.10 lakh, Maximum Rs.50 crores

Assessmen As per norms prescribed in the loan policy

t

Security In this scheme, the concept is ‘Security Coverage’

Coverage Security Coverage: Min.75%

Security coverage and valuation in terms of Land & Building to

be calculated on the basis of entire Land & Building charged to

the bank at the time of sanction & renewal both Prime and

Collateral security and other Liquid security as collateral.

In case of existing TL secured by landed property, the value of

property in excess of 200% of TL o/s may be considered as

eligible collateral under the scheme. (this will be useful in case

of existing TL which can not be migrated under the scheme)

MSME Products Page17

P&M not to be considered as collateral security

1.50 times weightage for clearly defined liquid securities may

be considered for the purpose of pricing only

Guarantee Personal guarantee of promoters/promoter directors of

Company / partners of the firm must.

Margin Term Loan:

o Plant & Machinery:25%

o L&B and Civil construction:35%

o Outright purchase of Building/Shop for commercial purpose

for service industries - 30% (Maximum allowed for such

purpose is Rs.5.00 crore only)

FBWC: 20%

Non Fund Based Limit: For limits having security coverage of

minimum 100%, minimum margin of 15% in the form of Cash

Margin/Term Deposit to be obtained. Accounts with security

coverage less than 100%, minimum 25% in form of cash margin/

DRIC only.

Further relaxation in margin shall not be permitted.

Drawing Stock up to 3 months + Debtors up to 3 months less creditors

Power

Calculatio

n

Submissio Up to Rs.1 crore: on quarterly basis

n of Stock Above Rs.1 crore: on monthly basis

& B. debt

Statement

Financial As per Loan Policy

Benchmar Further SLCC & above may permit deviation in the following

ks cases:

Current ratio:

SLCC up to 1:1 with justification.

Any relaxation/deviation beyond this level can be

considered by RLCC-I on case to case basis.

TOL/TNW ratio (Including quasi equity in TNW) is within the

benchmark level

Interest Very attractive rate of interest (please refer latest circular)

(same ROI as applicable for Union Trade Plus scheme)

For TL, credit risk premium is to be added

MSME Products Page18

Repayment TL: Maximum Door to Door repayment shall be 7 years

including moratorium period not exceeding 12 months

Scheme Code CC: CCENT

TL: TL016

Migration Existing WC limits permitted for migration at the time

of next renewal subject to satisfactory compliance of

the Terms and condition of previous sanction. TL not

permitted for migration.

Top Up Loan Branches/Sanctioning authority may sanction In-built

top up loan maximum up to 20% of assessed amount

(both Term Loan, NFB/FB working capital).

Maximum limit allowed including in-built top up not to

exceed Rs.5.00 crores.

This will be used only for purchase of equipment and

Commercial vehicles (under Union Parivahan Scheme) to

be used for existing business purpose.

This facility may also be extended to enterprises for

need based purchase of Plant & Machinery after

satisfactory operation of minimum one year with the

bank.

Mortgage to be created for total amount including both

assessed and in-built top up amount.

However, processing charges to be recovered for

assessed amount only and whenever the in-built top up

amount will be utilized applicable processing charges

only to the extent of top up sanction amount utilized

will be recovered.

Sanction letter to the borrowers/guarantors should

mention all the above conditions and proper

acknowledgement of sanction letter to be obtained.

Collateral coverage of minimum 100% along with top up

amount to be ensured.

Original Assessed limit should be without deviation in

benchmark ratio, then only Top Up loan can be

considered. Deviation to this may be approved by RLCC-

I.

Note:- While releasing the top up amount branch to ensure

the following :

i. All sanction terms and conditions are complied with.

ii. End use of existing Term Loan and working capital limit

is ensured.

MSME Products Page19

iii. There is no overdue in the accounts and operation in

all facility extended is regular.

iv. No negative observations made on the borrower.

v. This facility is available to the borrower for a period of

six months subject to further revalidation of the top up

limit for next six months by sanctioning authority.

vi. Bank charges with RTO and applicable authority to be

ensured.

vii. For releasing the Top up amount branches to seek

permission from sanctioning authority confirming

satisfaction of above, after which sanctioning authority

will allow them to disburse and send a request to LAS,

DIT to allow the branch to make disbursement.

Special condition For new account under the scheme, salary accounts of

all the employees, current/savings accounts of

promoters/ proprietor/ directors are to be opened with

Union Bank of India at the earliest.

In case of migration of existing account to the scheme

salary accounts of the employees, current/savings

accounts of promoters/proprietor/directors are to be

opened with Union Bank of India within six month of

migration.

Separate flag/labeling to be created for each

connection under the scheme.

The same will be reviewed by the sanctioning authority

at the time of review/renewal.

Above condition will be mentioned in the sanction letter

invariably.

Branches to actively canvass other loan, retail loan,

third party product, PoS machine, Aadhar Pay, to the

promoters/ proprietor/directors, employees of the unit

/ enterprise.

Miscellaneous Preferably, constructed property should be obtained

under the scheme as collateral. The acceptance of open

land as collateral as far as possible should be avoided.

However, in exceptional cases, the same may be

considered by next Higher Authority only by taking

additional precautions like:

It should be easily identifiable,

There should be clear cut demarcation,

Should have free access to the property

In case of Lease holds property, unexpired lease period

MSME Products Page20

should be at least 5 years longer than the repayment

period.

Further, agriculture property, tenanted premises (other

than those to PSUs, PSBs, MNCs), property with

statutory claims are not preferred collateral and hence

should be avoided.

Enterprises engaged in Speculative Activities/Real

Estate activities are not eligible for finance under this

scheme.

No deviation from the norms other than those

specifically defined under the scheme is permitted.

Standing instruction for deduction of interest and

installment of Term Loan from CC/CD account is

mandatory.

At any point account’s turnover to commensurate with

sales.

MUDRA (PMMY):

IC 1391-2018 dated 01.11.2018

To garner more quality business existing ‘MUDRA’ scheme has been reviewed

and named as ‘Union Mudra’

Eligibility All micro enterprises are eligible

(manufacturing/service/trading etc.)

Allied agriculture activities are also eligible (excluding

crop loans, land improvement such as canals, irrigation

wells)

In case of individual and proprietary concerns, their

relatives i.e. spouse, father, mother, son, daughter etc.

(relative as defined in Loan Policy) may join as co-

borrower

Facility Working Capital / OD / TL

o OD limit may be allowed when obtaining stock statement

is not feasible e.g. in cases of OD limits are given to

professionals etc.

Quantum Maximum: Rs.10.00 lakh as per Shishu / Kishore / Tarun

category

Margin 5% for ‘Shishu’ category and 10% for Kishore & Tarun

MSME Products Page21

categories

Interest rate ROI duffers as per Shishu, Kishore or Tarun category

Security Primary: Assets created out of bank finance

Collateral: NIL

No 3rd party guarantee: a/c to be covered under CGFMU

Repayment TL to be repaid in maximum 84 months inclusive of

maximum moratorium of 6 months.

Repayment in EMI (Equated Monthly Installments)

Delegation As per existing scheme of delegation of loaning powers

Others Nil processing charges

Credit rating applicable for exposure more than Rs.2 lakh

Income proof like ITR/Balance sheet may not be insisted

upon unless otherwise available.

Financial projections for term loan may be obtained for 1

year, which may be extrapolated for remaining tenor of

the loan.

MUDRA card will be issued (which will work on Rupay

platform) by earmarking sanctioned working capital

limit: 20% of sanctioned limit subject to minimum

Rs.5000/ and maximum Rs.50,000/-. Two accounts for

working capital i.e. one for MUDRA Card limit and other

OD/CC limit will be opened.

Scheme code: W. Capital- CCMUD, Overdraft- ODMUD, TL

– TLU41

All agriculture accounts eligible to be classified as

MUDRA accounts to be opened under their existing

scheme codes and to be flagged as ‘PMMY’.

Check list of papers to be obtained under different

category of MUDRA loans given as Annexure I of the

circular

One undertaking to be obtained from borrower /

guarantor is given as Annexure II of the circular.

MSME Products Page22

Wish you

All the Best!!

MSME Products Page23

You might also like

- Sheriff'S Notice of Extra-Judicial SaleDocument1 pageSheriff'S Notice of Extra-Judicial SaleVAT CLIENTS100% (1)

- Commercial Lease AgreementDocument2 pagesCommercial Lease AgreementAndreea ConstantinNo ratings yet

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshNo ratings yet

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDocument5 pagesSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13No ratings yet

- Business Loan: Normal Current AccountDocument16 pagesBusiness Loan: Normal Current AccountUthaiah CmNo ratings yet

- Bank PromotionDocument3 pagesBank PromotionSwetabh BhartiNo ratings yet

- AdvancesDocument174 pagesAdvancests pavanNo ratings yet

- Eligibility Criteria EngDocument5 pagesEligibility Criteria EngUjwal BarmanNo ratings yet

- Ticket Mukesh AhmedabadDocument26 pagesTicket Mukesh AhmedabadSURANA1973No ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyNo ratings yet

- SME 2012 QuestionsDocument7 pagesSME 2012 QuestionsraviNo ratings yet

- Cent Stand Up IndiaDocument42 pagesCent Stand Up IndiaPritish MandalNo ratings yet

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- SBIDocument45 pagesSBILakisha GriffinNo ratings yet

- Role of Sidbi - 2019Document16 pagesRole of Sidbi - 2019Kiran KesariNo ratings yet

- Scheme For Sustainable Structuring of Stressed AssetsDocument9 pagesScheme For Sustainable Structuring of Stressed Assetssumit pamechaNo ratings yet

- Series TEN - Day TwoDocument5 pagesSeries TEN - Day TwoMaghesh BishtNo ratings yet

- Loans To Smes and Msmes Collateral Free LoansDocument3 pagesLoans To Smes and Msmes Collateral Free LoansShatir LaundaNo ratings yet

- Credit Monitoring Policy For 2020 ExamDocument8 pagesCredit Monitoring Policy For 2020 ExamSrikanth TanguturuNo ratings yet

- The Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsDocument37 pagesThe Preferred Partner in Prosperity: One Stop Solution For All Banking NeedsvelankanniamNo ratings yet

- PR 1Document16 pagesPR 1Faixan HashmeeNo ratings yet

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- MSME SchemesDocument53 pagesMSME SchemesKalyani BorkarNo ratings yet

- Credit Policy Pre Promotion 08.01.2022Document42 pagesCredit Policy Pre Promotion 08.01.2022tvmanhastvNo ratings yet

- 10.1 MUDRA SchemeDocument13 pages10.1 MUDRA Schemedesh1endlaNo ratings yet

- CGTMSEDocument9 pagesCGTMSEWasim AkramNo ratings yet

- MSME Overview PNBDocument29 pagesMSME Overview PNBshobhita_9No ratings yet

- Sme WC AssessmentDocument8 pagesSme WC Assessmentvalinciamarget72No ratings yet

- SME Products: Baroda Vidyasthali LoanDocument17 pagesSME Products: Baroda Vidyasthali LoanRavi RanjanNo ratings yet

- Financial Inclusion of Street Vendors Promotion of Micro EnterprisesDocument10 pagesFinancial Inclusion of Street Vendors Promotion of Micro EnterprisesNaman AgrawalNo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- Asset Backed LendingDocument3 pagesAsset Backed LendingPreeti KherwaNo ratings yet

- DSA Business Loans PolicyDocument28 pagesDSA Business Loans PolicyS GothamNo ratings yet

- Introduction To MSME ProductSDocument24 pagesIntroduction To MSME ProductSPraveen TiwariNo ratings yet

- Non Performing Assets: Shrawanthi Amruthwar-3 Arun Aggarwal-13 Aniket Kurup-22 Shruti Pai-35Document17 pagesNon Performing Assets: Shrawanthi Amruthwar-3 Arun Aggarwal-13 Aniket Kurup-22 Shruti Pai-35Arun HariharanNo ratings yet

- JLR Special Scheme For Salaried CustomersDocument5 pagesJLR Special Scheme For Salaried CustomersJay ShahNo ratings yet

- Credit Guranatee Fund Trust Scheme For MicroDocument4 pagesCredit Guranatee Fund Trust Scheme For MicroAnitha GirigoudruNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- Revenue Leakage - PPTDocument18 pagesRevenue Leakage - PPTpalakrajput463No ratings yet

- Affin Home Flexi Plus: Product Disclosure SheetDocument6 pagesAffin Home Flexi Plus: Product Disclosure SheetPoi 3647No ratings yet

- Section - 2: Financial Norms ofDocument12 pagesSection - 2: Financial Norms ofwqsdNo ratings yet

- Crm on Tools Mcs FinalDocument30 pagesCrm on Tools Mcs Finalishky manoharNo ratings yet

- Allahabad Bank For SMALLDocument12 pagesAllahabad Bank For SMALLThaiongrui MogNo ratings yet

- Bank of BarodaDocument28 pagesBank of BarodaElora NandyNo ratings yet

- SBI Advance Related Service ChargesDocument10 pagesSBI Advance Related Service Chargesdhiraj.pudaleNo ratings yet

- Short Term LoansDocument4 pagesShort Term LoansHarsh MehtaNo ratings yet

- NBFC-Key Regulation and UpdateDocument2 pagesNBFC-Key Regulation and UpdateVikram Kumar SinghNo ratings yet

- Regulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachiDocument25 pagesRegulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachialiNo ratings yet

- 41 New Products of SBI (As On 30.09.2010)Document10 pages41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatNo ratings yet

- COVIDDocument11 pagesCOVIDSatishNo ratings yet

- MFB'SDocument14 pagesMFB'S25zahraanisNo ratings yet

- SecuritisationGuidelines ICRA 090512Document4 pagesSecuritisationGuidelines ICRA 090512Melissa Jane Rafols YuNo ratings yet

- September 2022Document19 pagesSeptember 2022Harshit SinghalNo ratings yet

- FAQs On SBL (Secured Business Loan)Document10 pagesFAQs On SBL (Secured Business Loan)Kiran Kumar JhaNo ratings yet

- CGTMSE Scheme Session 1Document10 pagesCGTMSE Scheme Session 1selling2829No ratings yet

- Eligibility Criteria EngDocument4 pagesEligibility Criteria EngumashankarsinghNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V Meshram0% (1)

- Sbi Smart Products For SmeDocument30 pagesSbi Smart Products For SmeRAJEEV THAKURNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Joint Liab Scheme Take A Test - Joint Liability Scheme Test Results NotificationDocument1 pageJoint Liab Scheme Take A Test - Joint Liability Scheme Test Results NotificationAnanda ShingadeNo ratings yet

- SHG Take A Test - Self Help Group Test Results NotificationDocument1 pageSHG Take A Test - Self Help Group Test Results NotificationAnanda ShingadeNo ratings yet

- Union Bank of India E-Learning PBOD-USSA Quiz Test Results NotificationDocument1 pageUnion Bank of India E-Learning PBOD-USSA Quiz Test Results NotificationAnanda ShingadeNo ratings yet

- Rabd & Fid: Inf. Cir. No. 04976 - 2019 2.8.2019Document2 pagesRabd & Fid: Inf. Cir. No. 04976 - 2019 2.8.2019Ananda ShingadeNo ratings yet

- 1110190357final - Maharastra Unit Cost 2019-20Document21 pages1110190357final - Maharastra Unit Cost 2019-20Ananda ShingadeNo ratings yet

- RABD-Kisan Tatkal Scheme RABD-kisan Tatkal Scheme Quiz Test Results NotificationDocument1 pageRABD-Kisan Tatkal Scheme RABD-kisan Tatkal Scheme Quiz Test Results NotificationAnanda ShingadeNo ratings yet

- CP MSME Updates-August 2019Document4 pagesCP MSME Updates-August 2019Ananda ShingadeNo ratings yet

- Lok Adalat CRLD - Lok Adalat Test Results NotificationDocument1 pageLok Adalat CRLD - Lok Adalat Test Results NotificationAnanda ShingadeNo ratings yet

- Wa0017Document94 pagesWa0017Ananda ShingadeNo ratings yet

- Deccan Education Society-Institute of Management Development and Research - IMDRDocument2 pagesDeccan Education Society-Institute of Management Development and Research - IMDRAnanda ShingadeNo ratings yet

- India Post Payment BankDocument3 pagesIndia Post Payment BankAnanda ShingadeNo ratings yet

- MSME Schemes Key Points 16.01Document6 pagesMSME Schemes Key Points 16.01Ananda ShingadeNo ratings yet

- Eticket: Bangalore Sunday, August 4, 2019Document2 pagesEticket: Bangalore Sunday, August 4, 2019Ananda ShingadeNo ratings yet

- Shri Umesh Babaji Kamble 3. 42 Male: 20-Jul-1977 Date of BirthDocument1 pageShri Umesh Babaji Kamble 3. 42 Male: 20-Jul-1977 Date of BirthAnanda ShingadeNo ratings yet

- Chapter 4 - Financial IntermediationDocument4 pagesChapter 4 - Financial IntermediationPaupauNo ratings yet

- Entrepreneurship 100 ASSIGNMENT - Semi-Final-Week 3 Understanding The Basics of Accounting and FinanceDocument2 pagesEntrepreneurship 100 ASSIGNMENT - Semi-Final-Week 3 Understanding The Basics of Accounting and FinanceAlinor PadayaoNo ratings yet

- Sarfaesi: Dr. Sujata Bali Associate Professor, UPES School of Law, Dehradun Sbali@ddn - Upes.ac - inDocument27 pagesSarfaesi: Dr. Sujata Bali Associate Professor, UPES School of Law, Dehradun Sbali@ddn - Upes.ac - inTC-6 Client Requesting sideNo ratings yet

- Asset Backed LendingDocument3 pagesAsset Backed LendingPreeti KherwaNo ratings yet

- 17277Document48 pages17277alicewilliams83nNo ratings yet

- Absa Bank LTD V Moore and Another 2017 (1) SA 255 (CC) OriginalDocument19 pagesAbsa Bank LTD V Moore and Another 2017 (1) SA 255 (CC) OriginalkautharNo ratings yet

- Course Outline in Sales, Agency and Credit TransactionsDocument8 pagesCourse Outline in Sales, Agency and Credit TransactionsShanna Cielo Jean BerondoNo ratings yet

- Oppt Public Notice TemplateDocument3 pagesOppt Public Notice TemplateHelen Walker Private Person100% (1)

- Objective Review of Literature Research Methodology Limitations To Research Introduction To BankingDocument54 pagesObjective Review of Literature Research Methodology Limitations To Research Introduction To BankingLakshyay RawatNo ratings yet

- Pahal Pe FAQ GuideDocument3 pagesPahal Pe FAQ GuideSachin ForeverNo ratings yet

- Porter 5 Force Analysis BankingDocument2 pagesPorter 5 Force Analysis BankingM.K Ravi100% (1)

- 03 Issue of Debentures Notes by Sachin PareekDocument272 pages03 Issue of Debentures Notes by Sachin PareekSachin PareekNo ratings yet

- SOLID HOMES, INC., PETITIONER, v. SPOUSES ARTEMIO JURADO AND CONSUELO O. JURADODocument2 pagesSOLID HOMES, INC., PETITIONER, v. SPOUSES ARTEMIO JURADO AND CONSUELO O. JURADOabbywinster100% (1)

- Global Dominion Finance Inc. Cavsouth: Outright To CollectDocument4 pagesGlobal Dominion Finance Inc. Cavsouth: Outright To CollectJabords BetNo ratings yet

- 6 Ball.b Vi SemDocument7 pages6 Ball.b Vi SemAfzal MohhamadNo ratings yet

- LandMark Judgements of Supreme Court (Part-I)Document11 pagesLandMark Judgements of Supreme Court (Part-I)Gaurav guptaNo ratings yet

- GMR Airports LimitedDocument7 pagesGMR Airports LimitedSaranNo ratings yet

- CT Pret 2Document1 pageCT Pret 2Ablo AblaNo ratings yet

- The Lehman Brothers Bankruptcy: The Global ContagionDocument32 pagesThe Lehman Brothers Bankruptcy: The Global ContagionWildana -No ratings yet

- 3 Module BMFDocument45 pages3 Module BMFbeena antuNo ratings yet

- Leni For President 2022Document35 pagesLeni For President 2022Kent Zirkai CidroNo ratings yet

- TransUnion PraveenDocument53 pagesTransUnion Praveendennisjeff20No ratings yet

- 02 - Siva ShankerDocument30 pages02 - Siva ShankerHafiz FadzilNo ratings yet

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet

- Chapter 5 Non-Current Liabilities-Kieso IfrsDocument67 pagesChapter 5 Non-Current Liabilities-Kieso IfrsAklil TeganewNo ratings yet

- Installment Sales Reviewer Problems and Solutions 2021 2022Document44 pagesInstallment Sales Reviewer Problems and Solutions 2021 2022Roland CatubigNo ratings yet

- GR 11 Module in Fundamentals of Accountancy and Business Management 1Document35 pagesGR 11 Module in Fundamentals of Accountancy and Business Management 1tallerrayallen4100% (1)

- Abacus Real Estate Development Center, Inc. v. Manila Banking CorporationDocument3 pagesAbacus Real Estate Development Center, Inc. v. Manila Banking Corporationnicole5anne5ddddddNo ratings yet