2018 Sav1522 Redemption

2018 Sav1522 Redemption

Uploaded by

douglas jonesCopyright:

Available Formats

2018 Sav1522 Redemption

2018 Sav1522 Redemption

Uploaded by

douglas jonesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

2018 Sav1522 Redemption

2018 Sav1522 Redemption

Uploaded by

douglas jonesCopyright:

Available Formats

For official use only: Customer Name _______________________________________________________ Case No.

____________

FS Form 1522 (Revised November 20 ) OMB No. 1530-0028

Special Form of Request for Payment of

United States Savings and Retirement Securities

Where Use of a Detached Request Is Authorized

IMPORTANT: Follow instructions in filling out this form. Making any false, fictitious, or fraudulent claim or statement to the United States is a crime and

may be prosecuted. Print in ink or type all information.

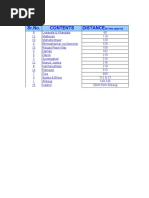

1. DESCRIPTION OF BONDS

I am the owner or person entitled to payment of the securities described below, which bear the name(s) of

_______________________________________________________________________________________________ .

ISSUE DATE SERIAL NUMBER ISSUE DATE SERIAL NUMBER ISSUE DATE SERIAL NUMBER

(If you need more space, attach either FS Form 3500 [see www.treasurydirect.gov] or a plain sheet of paper.)

2. INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

Payee must provide a Social Security Number or Employer Identification Number:

______________________________________ __________________________________________

(Social Security Number of Payee) (Employer Identification Number of Payee)

________________________________________________________________________________________

(Name/Names on the Account)

_________________________________________ Type of Account Checking Savings

(Depositor’s Account No.)

Bank Routing No. (nine digits): _______________________________

___________________________________________________ ______________________________

(Financial Institution’s Name) (Financial Institution’s Phone No.)

FS Form 1522 Department of the Treasury | Bureau of the Fiscal Service 1

3. SIGNATURE

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me); and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal

Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has

notified me that I am no longer subject to backup withholding; and

3. I am a U.S. person (including a U.S. resident alien).

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup

withholding because you have failed to report all interest and dividends on your tax return.

Sign in ink in the presence of a certifying officer and provide the requested information.

Sign

Here: __________________________________________________________________________________________________

_____________________________________________________ ______________________________________________

(Print Name) (Social Security Number)

Home Address ________________________________________ ______________________________________________

(Number and Street or Rural Route) (Daytime Telephone Number)

_____________________________________________________ ______________________________________________

(City) (State) (ZIP Code) (Email Address)

Sign

Here: __________________________________________________________________________________________________

_____________________________________________________ ______________________________________________

(Print Name) (Social Security Number)

Home Address ________________________________________ ______________________________________________

(Number and Street or Rural Route) (Daytime Telephone Number)

_____________________________________________________ ______________________________________________

(City) (State) (ZIP Code) (Email Address)

Instructions to Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed.

2. If a Medallion stamp is used an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that _______________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this ________________ day of ____________________

(Month/Year)

at ___________________________________________________ and signed this form.

(City, State)

________________________________________________________

(Signature and Title of Certifying Officer)

________________________________________________________

(Name of Financial Institution)

________________________________________________________

(Address)

________________________________________________________

(City, State, ZIP code)

________________________________________________________

(Telephone)

FS Form 1522 Department of the Treasury | Bureau of the Fiscal Service 2

Instructions to Certifying Officer: 1. Name(s) of the person(s) who appeared and date of appearance MUST be completed.

2. If a Medallion stamp is used an original signature is required. 3. Person(s) must sign in your presence.

I CERTIFY that _______________________________________________________________________ , whose identity(ies)

(Names of Persons Who Appeared)

is/are known or proven to me, personally appeared before me this ________________ day of ____________________

(Month/Year)

at ___________________________________________________ and signed this form.

(City, State)

________________________________________________________

(Signature and Title of Certifying Officer)

________________________________________________________

(Name of Financial Institution)

________________________________________________________

(Address)

________________________________________________________

(City, State, ZIP code)

________________________________________________________

(Telephone)

INSTRUCTIONS

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds,

and Individual Retirement Bonds.

WHO MAY COMPLETE – This form may be completed by the owner, coowner, surviving beneficiary, or legal

representative of the estate of a deceased or incompetent owner, persons entitled to the estate of a deceased registrant, or

such other persons who may be entitled to payment under the regulations governing United States Savings Bonds. A minor

may sign this form if, in the opinion of the certifying officer, he or she is of sufficient competency to understand the nature of

the transaction. An incompetent person may not sign this form.

COMPLETION OF FORM – Print clearly in ink or type all information requested.

ITEM 1. DESCRIPTION OF BONDS – Provide the name(s) of the person(s) shown in the inscription of the bonds for which

payment is requested. Describe the bonds by issue date and serial number.

ITEM 2. INSTRUCTIONS FOR DIRECT DEPOSIT PAYMENT

The payee's Taxpayer Identification Number must be provided. Furnish the Social Security Number if the payee is an

individual. If an estate, trust, or other entity is involved and IRS has assigned an Employer Identification Number, provide

that number. Furnish the name(s) on the account, the account number, the type of account, and the financial institution's

name, the routing/transit number which identifies the institution, and the institution's phone number. You may need to

contact the financial institution to obtain the routing number.

Please verify account information for accuracy and legibility to avoid a delay in deposit.

ITEM 3. SIGNATURE

The person(s) requesting payment of the bonds must sign the form in ink, print his or her name, and provide his or her

address, daytime telephone number, and if applicable, e-mail address. If the name of a person requesting payment has

been changed by marriage or in any other legal manner from the name in the inscription of the bonds, the signature to the

request for payment must show both names and the manner in which the change was made; for example, "Miss Mary T.

Jones now by marriage Mrs. Mary T. Smith.”

FS Form 1522 Department of the Treasury | Bureau of the Fiscal Service 3

CERTIFICATION – Each person whose signature is required must appear before and establish identification to the

satisfaction of an authorized certifying officer. The signatures to the form must be signed in the officer's presence. The

certifying officer must affix the seal or stamp which is used when certifying requests for payment. Authorized certifying

officers are available at financial institutions, including credit unions, in the United States. Certification by a notary isn’t

acceptable. Examples of acceptable seals and stamps:

• The financial institution’s official seal or stamp, including: Signature Guaranteed seal or stamp; Endorsement

Guaranteed seal or stamp; Corporate seal or stamp (a corporate resolution isn’t required); or Issuing or paying

agent seal or stamp (including name, location, and four-digit identification number or nine-digit routing number)

• The seal or stamp of Treasury-recognized Signature Guarantee Programs or other Treasury-approved Medallion

Programs

WHERE TO SEND – Unless otherwise instructed, send this form and the bonds, as well as any other appropriate forms and

evidence, to the address below. Legal evidence or documentation you submit cannot be returned.

Treasury Retail Securities Site

PO Box 214

Minneapolis, MN 55480-0214

(Phone: 844-284-2676--toll free)

NOTICE UNDER THE PRIVACY AND PAPERWORK REDUCTION ACTS

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt

of the United States. The furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue

Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process

transactions, make payments, identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the

information is voluntary; however, without the information, the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323)

and the Privacy Act. This information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for

litigation purposes; others entitled to distribution or payment; agents and contractors to administer the public debt; agencies or entities

for debt collection or to obtain current addresses for payment; agencies through approved computer matches; Congressional offices in

response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or regulation.

We estimate it will take you about 15 minutes to complete this form. However, you are not required to provide information requested

unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the

Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV 26106-1328. DO NOT SEND completed form to the above

address; send to the correct address shown in "WHERE TO SEND" above.

FS Form 1522 Department of the Treasury | Bureau of the Fiscal Service 4

You might also like

- Fetish Fashion Sex Power - Valerie SteeleDocument428 pagesFetish Fashion Sex Power - Valerie SteeleDaniela Piña100% (7)

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jones100% (2)

- Bar GlassesDocument31 pagesBar GlassesLyka Gazmin100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jones100% (1)

- C L P L: Ommon AW Roperty IENDocument5 pagesC L P L: Ommon AW Roperty IENdouglas jones100% (2)

- Cannon FOIA ScreenshotsDocument252 pagesCannon FOIA ScreenshotsJ Bamberg100% (1)

- Special Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is AuthorizedDocument4 pagesSpecial Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is Authorizedpoetdracul100% (1)

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMister Nobody0% (1)

- 2015 Interior FOIA LogDocument39 pages2015 Interior FOIA LogaaronweNo ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Why You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Document682 pagesWhy You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Sovereignty Education and Defense Ministry (SEDM)100% (9)

- Affidavit of Denial of US CitizenshipDocument1 pageAffidavit of Denial of US Citizenshipdouglas jones100% (4)

- Consent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageConsent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- Private Surety BondDocument1 pagePrivate Surety BondJulie Hatcher-Julie Munoz Jackson100% (9)

- Reserve Bank and Serial Number Relationship Table 2 PDFDocument1 pageReserve Bank and Serial Number Relationship Table 2 PDFdouglas jonesNo ratings yet

- OPPT Commercial BillDocument6 pagesOPPT Commercial BillBZ Riger88% (8)

- List of IEC StandardsDocument5 pagesList of IEC Standardspratik100% (9)

- Checklist On Directors ReportDocument17 pagesChecklist On Directors ReportAmish DalalNo ratings yet

- 2018 Sav1455 RedemptionDocument5 pages2018 Sav1455 Redemptiondouglas jones100% (1)

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMr McBride100% (1)

- New Fresno Fax NumberDocument3 pagesNew Fresno Fax Numberfitness255100% (1)

- Banker's Confirmation Request Form: Personal BankingDocument1 pageBanker's Confirmation Request Form: Personal BankingArsalan Hafeez100% (1)

- 326 ParcelLabelingGuideDocument49 pages326 ParcelLabelingGuidelianqiang caoNo ratings yet

- Application For AssistanceDocument13 pagesApplication For Assistanceapi-242882048No ratings yet

- VN 04 Credit Cards FaqDocument5 pagesVN 04 Credit Cards FaqdhakaeurekaNo ratings yet

- Ach Payment - Facebook-Discharge Debt LetterDocument2 pagesAch Payment - Facebook-Discharge Debt LetterJohnson DamitaNo ratings yet

- The Music People! Credit ApplicationDocument4 pagesThe Music People! Credit ApplicationTim StoelNo ratings yet

- FW 8 BeneDocument8 pagesFW 8 Benecaptkc100% (1)

- Car Personal LoanDocument2 pagesCar Personal LoanAnkur AgarwalNo ratings yet

- Promissory Note TemplateDocument1 pagePromissory Note TemplateelenaNo ratings yet

- Post Office Saving Bank Account Project-01Document13 pagesPost Office Saving Bank Account Project-01vivek jadhav100% (2)

- Five Star Application FormDocument5 pagesFive Star Application Formkamran1983No ratings yet

- Form of Protest Which May in Terms of Section Ninety-Eight ofDocument3 pagesForm of Protest Which May in Terms of Section Ninety-Eight ofJohn KronnickNo ratings yet

- I1099msc DFTDocument11 pagesI1099msc DFTVa Kho100% (1)

- Main Wire Transfer FormDocument2 pagesMain Wire Transfer FormThierry Nhamo100% (1)

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- Negotiable International Promissory Note 2 Deatrice)Document4 pagesNegotiable International Promissory Note 2 Deatrice)j7462119No ratings yet

- MIL SF-30 Contract Change OrderDocument2 pagesMIL SF-30 Contract Change Ordernoman888No ratings yet

- Wire TransfersDocument4 pagesWire TransfersWilliam Donaldson100% (1)

- SPC Niffpoa PDFDocument2 pagesSPC Niffpoa PDFJae RowanNo ratings yet

- Eviction Notice To Quit Template FormDocument3 pagesEviction Notice To Quit Template Form5rprjnsd2bNo ratings yet

- Security AgreementDocument3 pagesSecurity AgreementStephen MonaghanNo ratings yet

- f1040v 2010 Demanded Payment TempateDocument2 pagesf1040v 2010 Demanded Payment TempatekawasakimanNo ratings yet

- 183033Document3 pages183033Elisabeth JohnsonNo ratings yet

- Sav 1980Document2 pagesSav 1980Michael100% (3)

- The Adhesive Postage StampDocument27 pagesThe Adhesive Postage Stampflmm09No ratings yet

- VouchersDocument9 pagesVouchersRaviSankar100% (2)

- Empire Ucc1 NEWREZ, LLCDocument1 pageEmpire Ucc1 NEWREZ, LLChoward avigdor rayford lloyd elNo ratings yet

- How To Apply For Food StampsDocument1 pageHow To Apply For Food Stampsjkrier531No ratings yet

- Describe The Functions Performed by Federal Reserve BanksDocument3 pagesDescribe The Functions Performed by Federal Reserve BanksShandyNo ratings yet

- Deposit Slip PDFDocument2 pagesDeposit Slip PDFLalit PardasaniNo ratings yet

- Bank Instructions Application PDFDocument2 pagesBank Instructions Application PDFSanjeet BoroNo ratings yet

- Federal Deposit Insurance Corporation v. Avery Cashion, III, 4th Cir. (2013)Document33 pagesFederal Deposit Insurance Corporation v. Avery Cashion, III, 4th Cir. (2013)Scribd Government Docs100% (1)

- Owners AffidavitDocument1 pageOwners AffidavitAnneortizNo ratings yet

- Garnishhment DocuDocument5 pagesGarnishhment DocuKRISHNA RAONo ratings yet

- Signature Name AffidavitDocument1 pageSignature Name Affidavitrty100% (1)

- Non Retirement Withdrawal Request Form Jhi PDFDocument3 pagesNon Retirement Withdrawal Request Form Jhi PDFKshama AgrawalNo ratings yet

- Acknowledgement of Debt TemplateDocument2 pagesAcknowledgement of Debt TemplateBrien Jefferson100% (1)

- Donation Form 2018Document1 pageDonation Form 2018Herwindo NathanaelNo ratings yet

- BMW Financial Services: Consumer Credit ApplicationDocument2 pagesBMW Financial Services: Consumer Credit ApplicationMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- Receipt and Remittance of TreasureDocument11 pagesReceipt and Remittance of Treasuremevrick_guy100% (1)

- Veale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Document6 pagesVeale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- STANDARD MORTGAGE POLICIES (London Property Financing) GeneralDocument5 pagesSTANDARD MORTGAGE POLICIES (London Property Financing) GeneralSonam Yeedzin PNo ratings yet

- Sav PDP 0051Document6 pagesSav PDP 0051MichaelNo ratings yet

- US Internal Revenue Service: I1099gi - 2004Document19 pagesUS Internal Revenue Service: I1099gi - 2004IRSNo ratings yet

- 1071 Substitute Sav4239 RedemptionDocument3 pages1071 Substitute Sav4239 Redemptiondouglas jones100% (3)

- DEBT Tutoria BankingDocument21 pagesDEBT Tutoria BankingJennifer100% (1)

- 3rd Part of Negotiable InstrumentDocument5 pages3rd Part of Negotiable InstrumentKazi Shafiqul Azam0% (1)

- Constitution of the State of Minnesota — Republican VersionFrom EverandConstitution of the State of Minnesota — Republican VersionNo ratings yet

- GN 03325 Verification of SSNDocument8 pagesGN 03325 Verification of SSNTheplaymaker508No ratings yet

- Envelope TemplateDocument1 pageEnvelope Templatedouglas jones100% (1)

- Envelope Template 3Document1 pageEnvelope Template 3douglas jones100% (1)

- Expatriation & Divorse From U.S.: Emancipation From The GovernmentDocument1 pageExpatriation & Divorse From U.S.: Emancipation From The Governmentdouglas jonesNo ratings yet

- PROBABLE CAUSE Updated EnabledDocument1 pagePROBABLE CAUSE Updated Enableddouglas jones100% (2)

- Stepparent Adoption, Family. Code Section 9001Document1 pageStepparent Adoption, Family. Code Section 9001douglas jonesNo ratings yet

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageSuperior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- Reserve Bank and Serial Number Relationship Table 2 PDFDocument1 pageReserve Bank and Serial Number Relationship Table 2 PDFdouglas jones100% (1)

- ACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / MoDocument1 pageACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / Modouglas jones100% (2)

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243Document2 pagesSuperior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243douglas jonesNo ratings yet

- Certificated SecurityDocument1 pageCertificated Securitydouglas jones100% (1)

- Account Identification & Collection, by ExecutorDocument3 pagesAccount Identification & Collection, by ExecutorArthur Freeman100% (1)

- Recording Cover PageDocument1 pageRecording Cover Pagedouglas jonesNo ratings yet

- Football Recruit LetterDocument1 pageFootball Recruit Letterdouglas jonesNo ratings yet

- List of CollateralDocument5 pagesList of Collateraldouglas jones100% (3)

- Appoint Fiduciary Eric ThorsonDocument2 pagesAppoint Fiduciary Eric Thorsondouglas jones75% (4)

- Ssa-Withdrawal-521 FormDocument2 pagesSsa-Withdrawal-521 Formdouglas jones100% (3)

- Documents For Proof of Ownership For FundsDocument2 pagesDocuments For Proof of Ownership For Fundsdouglas jones100% (2)

- OPPT Invoice US Letter 6p00Document1 pageOPPT Invoice US Letter 6p00douglas jonesNo ratings yet

- ECE131 Unit6 Part1 K2Document66 pagesECE131 Unit6 Part1 K2abhi shekNo ratings yet

- ENT MCQsDocument13 pagesENT MCQsSheikha100% (2)

- Application Form General TemplateDocument2 pagesApplication Form General TemplateAlex Efimenko100% (1)

- CV RomanWAWDocument2 pagesCV RomanWAWRoman WawrzynowiczNo ratings yet

- Effect of Degumming Conditions On Removal and Quality of Soybean LecithinDocument8 pagesEffect of Degumming Conditions On Removal and Quality of Soybean LecithinSivia RamadhaniNo ratings yet

- Fansubbers The Case of The Czech Republic and PolandDocument9 pagesFansubbers The Case of The Czech Republic and Polandmusafir24No ratings yet

- HIVDocument35 pagesHIVtejaswi71117No ratings yet

- Breakout Nations 3Document4 pagesBreakout Nations 3PearlNo ratings yet

- Ignoranti Facti ExcusatDocument3 pagesIgnoranti Facti ExcusatBalram JhaNo ratings yet

- (Free Scores - Com) - Dave Padgett Scarborough Fair 37622Document2 pages(Free Scores - Com) - Dave Padgett Scarborough Fair 37622Arthur IgitkhanyanNo ratings yet

- AFSCME's Prohibited Practice ComplaintDocument8 pagesAFSCME's Prohibited Practice ComplaintRiley SnyderNo ratings yet

- SR - No. Distance: (In Kms - Approx)Document43 pagesSR - No. Distance: (In Kms - Approx)Rakshit KothariNo ratings yet

- JKR Schedule of Rate 2007Document51 pagesJKR Schedule of Rate 2007Alex Chin100% (1)

- SLA (1.2) IntroductionDocument10 pagesSLA (1.2) IntroductionNenden Sri FujiyaNo ratings yet

- MarEng - Intermediate - Unit 8 - Answer KeyDocument4 pagesMarEng - Intermediate - Unit 8 - Answer KeyYasin BalabanNo ratings yet

- CV Europass 20200124 Pieri enDocument3 pagesCV Europass 20200124 Pieri enapi-496281656No ratings yet

- Faculty Development ProgrammeDocument6 pagesFaculty Development ProgrammeMutharasu SNo ratings yet

- Temples IIT MadrasDocument17 pagesTemples IIT Madrasviswanath2006No ratings yet

- Mercado v. RealDocument3 pagesMercado v. RealMarianeHernandezNo ratings yet

- Ateneo Graduate School of Business: Group Assignment Just in TimeDocument6 pagesAteneo Graduate School of Business: Group Assignment Just in TimeSneezypandaNo ratings yet

- Holi StoryDocument4 pagesHoli StoryMNo ratings yet

- E1.1 Introduction To Anatomy and PhysiologyDocument6 pagesE1.1 Introduction To Anatomy and PhysiologyhzntrpNo ratings yet

- AGRI 9 QTR2 M1 - WEEK 1 AND 2 PassedDocument13 pagesAGRI 9 QTR2 M1 - WEEK 1 AND 2 Passedajsantocildes20No ratings yet

- Sample Closing RemarksDocument7 pagesSample Closing RemarksArnold Onia100% (1)

- Huawei BTS Power Consumption Monitoring v2 PDFDocument14 pagesHuawei BTS Power Consumption Monitoring v2 PDFtestato123No ratings yet

- 2022 Dragons EOY Lunch and AwardsDocument68 pages2022 Dragons EOY Lunch and AwardsPeter McCurdyNo ratings yet