Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Uploaded by

olafedCopyright:

Available Formats

Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Uploaded by

olafedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Excise Tax: Major Classification of Excisable Articles and Related Codal Section

Uploaded by

olafedCopyright:

Available Formats

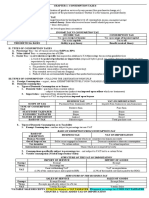

BASIC CONCEPT:

Excise Tax is a tax on the production, sale or

consumption of a commodity in a country.

APPLICABILITY:

EXCISE TAX

On goods manufactured or produced in the Philippines https://www.bir.gov.ph/index.php/tax-information/excise-tax.html

for domestic sale or consumption or for any other MAJOR CLASSIFICATION OF EXCISABLE

disposition; and ARTICLES AND RELATED CODAL SECTION:

On goods imported. PERSONS LIABLE TO EXCISE TAX:

1. Alcohol Products (Sections 141-143)

TYPES OF EXCISE TAX: In General:

a. Distilled Spirits (Section 141)

Specific Tax – refers to the excise tax imposed which is b. Wines (Section 142) a. On Domestic or Local Articles

based on weight or volume capacity or any other c. Fermented Liquors (Section 143)

physical unit of measurement Manufacturer: Producer

2. Tobacco Products (Sections 144-146)

Ad Valorem Tax – refers to the excise tax which is based Owner or person having possession of articles

on selling price or other specified value of the a. Tobacco Products (Section 144) removed from the place of production without the

goods/articles b. Cigars & Cigarettes (Section 145) payment of the tax

c. Inspection Fee (Section 146)

MANNER OF COMPUTATION:

b. On Imported Articles

3. Petroleum Products (Section 148)

Specific Tax = No. of Units/other measurements x

Importer: Owner

Specific Tax Rate 4. Miscellaneous Articles (Section 149-

150) Person who is found in possession of articles

Ad Valorem Tax = No. of Units/other measurements x

which are exempt from excise taxes other than

Selling Price of any specific value per unit x Ad Valorem a. Automobiles (Section 149) those legally entitled to exemption

Tax Rate

b. Non-essential Goods (Section 150)

Others:

5. Mineral Products (Sections 151)

TIME OF PAYMENT:

On Indigenous Petroleum

In General

Local Sale, Barter or Transfer

On domestic products

First buyer, purchaser or transferee

Before removal from the place of

production Exportation

On imported products

Summary Owner, lessee, concessionaire or operator of the

mining claim

Before release from the customs' custody

You might also like

- Excise TaxDocument86 pagesExcise Taxrav dano0% (1)

- Notes On Excise TaxesDocument19 pagesNotes On Excise TaxesLalaine ReyesNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure ProblemsolafedNo ratings yet

- A Big-Muscle Workout Plan For Skinny GuysDocument22 pagesA Big-Muscle Workout Plan For Skinny GuysDopeSquad R3CKNo ratings yet

- TAX-501 (Excise Taxes)Document6 pagesTAX-501 (Excise Taxes)Ryan AllanicNo ratings yet

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- Index For Excise TaxDocument13 pagesIndex For Excise TaxabbelleNo ratings yet

- Excise Tax Notes TabagDocument9 pagesExcise Tax Notes TabagApple Joy SamonteNo ratings yet

- Module 11 Bustaxa ExcisetaxDocument17 pagesModule 11 Bustaxa Excisetaxdennis delrosarioNo ratings yet

- Excise TaxDocument50 pagesExcise TaxQuinnee VallejosNo ratings yet

- Excise Tax SummaryDocument40 pagesExcise Tax SummaryHeva AbsalonNo ratings yet

- Chapter 11 Excise TaxDocument10 pagesChapter 11 Excise TaxAmzelle Diego LaspiñasNo ratings yet

- Chapter11 PDFDocument10 pagesChapter11 PDFAmzelle Diego LaspiñasNo ratings yet

- Tariff and Customs CodeDocument7 pagesTariff and Customs CodeJaylin DizonNo ratings yet

- Btax302 Lesson7 ExcisetaxesanddstDocument18 pagesBtax302 Lesson7 ExcisetaxesanddstJr Reyes PedidaNo ratings yet

- Excise Tax and DSTDocument2 pagesExcise Tax and DSTgeraldjohn.mondejarNo ratings yet

- TAX-501 (Excise Taxes - Part 1)Document4 pagesTAX-501 (Excise Taxes - Part 1)lyndon delfinNo ratings yet

- TAX-501 (Excise Taxes)Document4 pagesTAX-501 (Excise Taxes)VKVCPlaysNo ratings yet

- Tax Code - Part 6 Excise TaxDocument34 pagesTax Code - Part 6 Excise TaxMary MandamientoNo ratings yet

- Excise TaxDocument7 pagesExcise TaxKezNo ratings yet

- Bustax Chapters 1 4Document6 pagesBustax Chapters 1 4Naruto UzumakiNo ratings yet

- Excise Tax BIR FinalDocument11 pagesExcise Tax BIR FinalmixxNo ratings yet

- TAX-501: Excise Taxes: - T R S ADocument4 pagesTAX-501: Excise Taxes: - T R S AShiela Marie Sta AnaNo ratings yet

- Chapter 11Document3 pagesChapter 11kjudani1207No ratings yet

- Exist TaxDocument13 pagesExist TaxKim Jung UnNo ratings yet

- Title Vi Excise Tax On Certain GoodsDocument9 pagesTitle Vi Excise Tax On Certain GoodsAna Janine AmbataNo ratings yet

- Title Vi Excise Tax On Certain GoodsDocument10 pagesTitle Vi Excise Tax On Certain GoodsjasonNo ratings yet

- ConceptsDocument1 pageConceptsRyan Dheil BacudNo ratings yet

- Handouts Vat On ImportationDocument2 pagesHandouts Vat On ImportationAldrin Giray MagpayoNo ratings yet

- Excise TaxDocument3 pagesExcise TaxsahitariosoNo ratings yet

- VAT On ImportationDocument24 pagesVAT On ImportationShamae Duma-anNo ratings yet

- TAX REV CASES HeheDocument78 pagesTAX REV CASES HeheEmiaj Francinne MendozaNo ratings yet

- Basic ConceptDocument15 pagesBasic ConceptRits MonteNo ratings yet

- PWC Tax Seminar Excise TaxesDocument48 pagesPWC Tax Seminar Excise TaxesravlaineNo ratings yet

- Importation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident SellersDocument1 pageImportation Refers To The Purchase of Goods or Services by The Philippine Residents From Non-Resident Sellersfrancis dungcaNo ratings yet

- Concept MapDocument9 pagesConcept MapMuadz HassanNo ratings yet

- Excise Tax ReviewerDocument7 pagesExcise Tax ReviewerRoland SaligumbaNo ratings yet

- Concept of Consumption and Consumption Taxes and Vat On ImportationDocument4 pagesConcept of Consumption and Consumption Taxes and Vat On ImportationJamaica DavidNo ratings yet

- Tariff ReviewerDocument12 pagesTariff ReviewerKris TleNo ratings yet

- Part 4Document17 pagesPart 4Marc Lester Hernandez-Sta AnaNo ratings yet

- Excise TaxDocument15 pagesExcise TaxRenalyn PentecostesNo ratings yet

- Anti DumpingDocument7 pagesAnti DumpingMARIA CRISTINA LIMPAGNo ratings yet

- Excise Tax: Basic ConceptDocument9 pagesExcise Tax: Basic ConceptJessNo ratings yet

- Excise NotesDocument35 pagesExcise NotesRica BalajadiaNo ratings yet

- 1 Excise-Tax 03 22 2022Document50 pages1 Excise-Tax 03 22 2022Cherry ursuaNo ratings yet

- Excise Tax - ReportingDocument64 pagesExcise Tax - ReportingFiliusdeiNo ratings yet

- Title ViDocument23 pagesTitle ViErica Mae GuzmanNo ratings yet

- Petitioner Respondent.: Second DivisionDocument7 pagesPetitioner Respondent.: Second DivisionKempetsNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxMhaybelle JovellanoNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- Tax 2 NotesDocument2 pagesTax 2 NotesMark LapidNo ratings yet

- Module 1.1 - VAT Review Notes and ExercisesDocument19 pagesModule 1.1 - VAT Review Notes and ExercisesJann Exequiel FranciscoNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Tax 2 Cases - Estate TaxDocument48 pagesTax 2 Cases - Estate TaxRoxanne PeñaNo ratings yet

- Business and Transfer Taxation Chapter 11 Discussion Questions AnswerDocument3 pagesBusiness and Transfer Taxation Chapter 11 Discussion Questions AnswerKarla Faye LagangNo ratings yet

- Value Added Tax On ImportationDocument3 pagesValue Added Tax On ImportationAnna CynNo ratings yet

- CMTA NotesDocument8 pagesCMTA NotesFrances Abigail BubanNo ratings yet

- VAT No. 2Document5 pagesVAT No. 2Elmer Baguio AquinoNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument14 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsdasdsadsadasdasdNo ratings yet

- VAT On Importation NotesDocument1 pageVAT On Importation NotesSelene DimlaNo ratings yet

- It Is Zero-Rated If The Seller Is VAT-registered PersonDocument8 pagesIt Is Zero-Rated If The Seller Is VAT-registered PersonKenneth MatabanNo ratings yet

- Only To Luke's, Appeased Her Troubling HeartDocument3 pagesOnly To Luke's, Appeased Her Troubling HeartolafedNo ratings yet

- Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesIncome Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersolafedNo ratings yet

- Anastasia ReportDocument1 pageAnastasia ReportolafedNo ratings yet

- St. Scholastica'S College Manila: A. Mao Zedong D. Sun Yat-SenDocument2 pagesSt. Scholastica'S College Manila: A. Mao Zedong D. Sun Yat-SenolafedNo ratings yet

- Types & FunctionsDocument2 pagesTypes & FunctionsolafedNo ratings yet

- Overview of Cost AccountingDocument39 pagesOverview of Cost AccountingolafedNo ratings yet

- Accounting For Labor: 2 Compositions of Factory PayrollDocument33 pagesAccounting For Labor: 2 Compositions of Factory PayrollolafedNo ratings yet

- Finacc 3 Empleo Sol ManDocument10 pagesFinacc 3 Empleo Sol ManolafedNo ratings yet

- Ch3 Supply and Demand Testbank PDFDocument42 pagesCh3 Supply and Demand Testbank PDFolafedNo ratings yet

- Natl NGAS AnnexesDocument85 pagesNatl NGAS AnnexesolafedNo ratings yet

- Business Transfer Taxes LitonjuaDocument11 pagesBusiness Transfer Taxes LitonjuaolafedNo ratings yet

- DocDocument31 pagesDocolafedNo ratings yet

- Income Tax: Individual CorporateDocument1 pageIncome Tax: Individual CorporateolafedNo ratings yet

- Finance - PH EconomyDocument3 pagesFinance - PH EconomyolafedNo ratings yet

- Econ hw2Document3 pagesEcon hw2olafedNo ratings yet

- BH Ffm13 Webapp TB Ch05aDocument6 pagesBH Ffm13 Webapp TB Ch05aolafedNo ratings yet

- Philippines Economic OutlookDocument3 pagesPhilippines Economic OutlookolafedNo ratings yet

- Philippines Finds Semirara Mining's Coal Project Technically Sound'Document1 pagePhilippines Finds Semirara Mining's Coal Project Technically Sound'olafedNo ratings yet

- Electricity Rates Go Down in September Lower Transmission Charge Offsets Increase in Generation ChargeDocument1 pageElectricity Rates Go Down in September Lower Transmission Charge Offsets Increase in Generation ChargeolafedNo ratings yet

- Atlas of Approaches in Neurosurgery - J.FischerDocument7 pagesAtlas of Approaches in Neurosurgery - J.FischerZdravko Heinrich0% (1)

- Assignment-1 CNDocument1 pageAssignment-1 CNcarryNo ratings yet

- ZTE UR16 SW Version FNI Proposal V1 20170918Document44 pagesZTE UR16 SW Version FNI Proposal V1 20170918nazilaNo ratings yet

- Project: (A Case Study of Kanpur Nagar)Document42 pagesProject: (A Case Study of Kanpur Nagar)RAHULTIWARINo ratings yet

- Electronic Floor Pedal WM 526Document2 pagesElectronic Floor Pedal WM 526Juan Diego Sarango100% (1)

- Creating An Effective PowerPointDocument81 pagesCreating An Effective PowerPointJane Tricia Dela Peña - Nuqui100% (1)

- LJAG September 08Document2 pagesLJAG September 08Loughborough JunctionNo ratings yet

- Unit 1 Marketing ManagementDocument33 pagesUnit 1 Marketing Managementmr.sakshamthakur18No ratings yet

- 3aua0000004591 RevdDocument32 pages3aua0000004591 RevdOrlandoNo ratings yet

- SM-A-1.0-X5.0-Electric Four-Wheel Forklift-202211-EN-CEDocument109 pagesSM-A-1.0-X5.0-Electric Four-Wheel Forklift-202211-EN-CEMirko CoppiniNo ratings yet

- PTSPDocument55 pagesPTSPdunde.venu5393No ratings yet

- Actividad 17 y 18 Cultura InglesaDocument4 pagesActividad 17 y 18 Cultura InglesaDANIELANo ratings yet

- Samsung Monitor P2270HDDocument72 pagesSamsung Monitor P2270HDTeewyyNo ratings yet

- Little Mermaid 2024 ScoreDocument68 pagesLittle Mermaid 2024 ScoreJulia ZusiNo ratings yet

- Sale of Boarded Motor Vehicles, Tender No. SH/01/2018-2019Document14 pagesSale of Boarded Motor Vehicles, Tender No. SH/01/2018-2019State House KenyaNo ratings yet

- FSED 60F TSRO Checklist Diagram Rev.00Document3 pagesFSED 60F TSRO Checklist Diagram Rev.00Victor Ryan DellosaNo ratings yet

- GUIA122738 0 SignedDocument2 pagesGUIA122738 0 SignedJessi QuindeNo ratings yet

- Case Study EtradeDocument28 pagesCase Study EtradeZulnaim RamziNo ratings yet

- San Juan de Dios v. NLRC (Case Digest)Document2 pagesSan Juan de Dios v. NLRC (Case Digest)Czarina Louise NavarroNo ratings yet

- Inclusive Development From A Gender Perspective in Small Scale FisheriesDocument6 pagesInclusive Development From A Gender Perspective in Small Scale FisheriesKodem JohnsonNo ratings yet

- Entertainment and Media Outlook Perspectives 2020 2024Document28 pagesEntertainment and Media Outlook Perspectives 2020 2024Nairit Mondal100% (1)

- The Dilemma of The Last FilipinoDocument12 pagesThe Dilemma of The Last FilipinoEunice Delos SantosNo ratings yet

- Floating Roof Tank ProcedureDocument7 pagesFloating Roof Tank ProcedureNithin GNo ratings yet

- Class x Science Exampler Solution Chapter 10 – Light Reflection and RefractionDocument49 pagesClass x Science Exampler Solution Chapter 10 – Light Reflection and RefractionarulrajasivamNo ratings yet

- EFX-MKVI Manual 10xeDocument36 pagesEFX-MKVI Manual 10xeBruno De OliveiraNo ratings yet

- Chapter 3 - Information Systems and HR PlanningDocument16 pagesChapter 3 - Information Systems and HR Planningfatematuj johoraNo ratings yet

- N.I.D.A. AccountDocument3 pagesN.I.D.A. AccountZainab HasanNo ratings yet

- Budgeted Lesson in Tle 6Document3 pagesBudgeted Lesson in Tle 6AlmarieSantiagoMallabo100% (1)

- Department of Labor: w-234Document2 pagesDepartment of Labor: w-234USA_DepartmentOfLaborNo ratings yet