0 ratings0% found this document useful (0 votes)

32 viewsAnswers Tax

Answers Tax

Uploaded by

DANICA DIVINAThe document contains multiple choice questions and exercises related to taxation. Some key details include:

- The total capital gains taxes paid by spouses from the sale of shares and land was P310,000.

- The total final taxes withheld on passive income like dividends and interest for the spouses was P13,550.

- One exercise calculated the taxable income of two individuals, Daniel and Kat, as P547,000 and P515,000 respectively.

- Another exercise showed the income tax payable by an individual for 4 quarters, totaling P126,056, along with taxes on passive income of P15,800 and capital gains of P36,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Answers Tax

Answers Tax

Uploaded by

DANICA DIVINA0 ratings0% found this document useful (0 votes)

32 views6 pagesThe document contains multiple choice questions and exercises related to taxation. Some key details include:

- The total capital gains taxes paid by spouses from the sale of shares and land was P310,000.

- The total final taxes withheld on passive income like dividends and interest for the spouses was P13,550.

- One exercise calculated the taxable income of two individuals, Daniel and Kat, as P547,000 and P515,000 respectively.

- Another exercise showed the income tax payable by an individual for 4 quarters, totaling P126,056, along with taxes on passive income of P15,800 and capital gains of P36,000.

Original Description:

taxation answers

Original Title

answers tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document contains multiple choice questions and exercises related to taxation. Some key details include:

- The total capital gains taxes paid by spouses from the sale of shares and land was P310,000.

- The total final taxes withheld on passive income like dividends and interest for the spouses was P13,550.

- One exercise calculated the taxable income of two individuals, Daniel and Kat, as P547,000 and P515,000 respectively.

- Another exercise showed the income tax payable by an individual for 4 quarters, totaling P126,056, along with taxes on passive income of P15,800 and capital gains of P36,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views6 pagesAnswers Tax

Answers Tax

Uploaded by

DANICA DIVINAThe document contains multiple choice questions and exercises related to taxation. Some key details include:

- The total capital gains taxes paid by spouses from the sale of shares and land was P310,000.

- The total final taxes withheld on passive income like dividends and interest for the spouses was P13,550.

- One exercise calculated the taxable income of two individuals, Daniel and Kat, as P547,000 and P515,000 respectively.

- Another exercise showed the income tax payable by an individual for 4 quarters, totaling P126,056, along with taxes on passive income of P15,800 and capital gains of P36,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

I.

Multiple CHoice (pages 43-58)

1. B. one of the special characteristic of tax is it is unlimited in amount.

2. D. neither “a” nor “b”

3. B. only statement 2 is correct

4. C. taxes may be increased in periods of prosperity to curb spending power and halt

inflation or lowered in periods of slump to expand business and ward-off depression.

5. B. taxes may be imposed for the equitable distribution of wealth and income in

society

6. B. lifeblood theory

7. D. b & c

8. D. Imposition of tax

9. B. Levy

10. C. Both statements are correct

11. B. Not Valid because those who did not pay their taxes are favored than those who

have paid their taxes.

12. B. No, because the law is arbitrary in that it takes income that has already been spent.

13. C. No, the BIR is not allowed to reverse its ruling.

14. A. I only

15. B. II only

16. B. When allowed by the constitution

17. A. Only statement 1 is correct

18. B. No; Yes; Yes

19. A. The power to tax is supreme, plenary, comprehensive and without any limit because

the existence of the government is a necessity.

20. B. I and II only

21. C. Prescribing rules of taxation

22. C. Collection of tax

23. D. Statements 1 & 2 are true

24. The strongest of all inherent powers of the state

25. B. The legislative branch of the local government only

26. A. Constitutional grant

27. C. Statement 1 is false but statement 2 is true

28. D. Subject to the approval of the people

29. B. The principle implies that an imposition of lawful regulatory taxes would be

destructive to the taxpayers and business establishments because the government can

compel payment of tax and forfeiture of property through t5he exercise of police power.

30. B. Due process of law

31. B. A graduated tax table in consonance with the statement

32. A. Rule of law that in the performance of its government functions, the state cannot be

estopped by the neglect of its agents and officers

33. C. Statement 1 is false but statement 2 is true

34. A. Political in nature

35. B. A regulatory measure

36. C. Revenue regulations

37. B. Statements 1 is is true but statement 2 is false

38. B. Liberally in favor of the government and taxpayer

39. C. Strictly against the government and liberally In favor of the taxpayer

40. D. None of the above

41. B. III, IV, V and VI only

42. B. Property

43. A. Ad valorem

44. D. Indirect

45. D. Inferior to non-impairment clause in the Constitution

46. B. III and IV only

47. B. Fiscal Adequacy

48. A. Equality and theoretical justice

49. C. Administrative feasibility

50. B. Statement 1 is true but statement 2 is false

51. B. II only

52. A. I and II only

53. B. Exercise of taxation is subject to international comity

54. A. The rule on taxation shall be uniform and equitable

55. D. All of the above

56. A. It is a privilege or freedom from tax burden

57. A. Statements 1 & 2 are false

58. C. III only

59. A. Not declaring all taxable income

60. D. All of the above

61. C. Statement 1 is false but statement 2 is true

62. C. All of the above

63. A. Violates substantive due process

64. A. Statements 1&2 are false

65. A. Yes, since Ligaya is a stock and for profit educational institution.

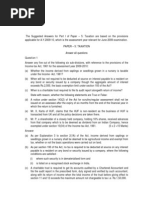

II. Exercise 2-7 (Page 121)

a. Total Capital gains taxes paid by the spouses = P310,000

b. Total final taxes withheld on passive income of the spouses = P13,550

c. Taxable income of Daniel = P547,000

d. Taxable income of Kat = P515,000

Computation:

Sales of shares of domestic corp. Directly to a buyer P10,000

(P100,000 x 5%) + P50,000 x 10%

Capital gain on sale of land in the philippines classified as capital asset 300,000

(P5M x 6%)

Total Capital gains taxes paid by the spouses P310,000

Dividend income from domestic corp. At 10% P4,000

Interest income on Philippine bank deposit 3,400

(3200+2400+8000)/80% x 20%

Interest income on Philippine Bank deposit under FCDU 750

(4000+4000+2000) x 7.5%

Interest income on government bonds 2,000

Royalty -literary 1,000

Royalty - other than literary 2,400

Total final taxes withheld on passive income of the spouses P13,550

Business income P600,000

Rental income of tax (P200,000/95%)/2 100,000

Dividend income from nonresident corp. (P10,000/2) 5,000

Interest income on notes receivable [6,000 + (P2,000/2)] 7,000

Interest on income on bank deposit abroad [5,000 +(5000/2)] 7,500

Capital gain on sale of land abroad (500,000/2) 250,000

Gain on sale of shares-new york stock exchange (P30,000/2) 15,000

Expenses [P350,000 +(75,000/2)] (387,500)

Personal exemption (50,000)

Taxable income of Daniel P547,000

Gross income from practice of profession (P360,000/90%) P400,000

Rental income net of tax (P190,000/95%)/2 100,000

Dividend income from resident corp. 20,000

Dividend income from nonresident corp. (P10,000/2) 5,000

Interest income on notes receivable [P4,000 + (P2,000/2)] 5,000

Interest income on bank deposit abroad [P5,000 + (P5,000/2)] 7,500

Capital gain on sale of land abroad (P500,000/2) 250,000

Gain on sale of shares – New York Stock Exchange P30,000/2 15,000

Expenses [P200,000 +(75,000/2)] (237,000)

Personal exemption (50,000)

Taxable net income of Kat P515,000

III. Exercise 2-8 (Page 122)

a. Income tax payable, first quarter = P32,500

b. Income tax payable, second quarter = P14,500

c. Income tax payable, third quarter = P19,233

d. Income tax payable, fourth quarter = P59,823

e. Total final taxes (for the year) on passive income = P15,800

f. Total capital gains tax = P600,000 x 6% = P36,000

Computation:

1st 2nd 3rd 4th

Gross Profit from sales P300,000 P500,000 P710,000 P980,000

Business expenses (120,000) (262,000) (405,890) (426,700)

Personal exemption (50,000)

Taxable income P180,000 P238,000 P304,110 P503,300

Tax due (Tax table) P32,500 P47,000 P66,233 P126,056

Less: Tax paid

Q1 - (32,500) (32,500) (32,500)

Q2 - (14,500) (14.500)

Q3 - (19.233)

Income tax Payable P32,500 P14,500 P19,233 P59,823

Amount % Tax

Dividend received from domestic corp. 30,000 10 3,000

Interest income from

BPI 16,000 20 3,200

UCPB 18,000 20 3,600

Metrobank 30,000 20 6,000

Total final tax on passive income P15,800

III. Exercise P3.5 (Page 161)

1. a) P165,000 x 50% = P82,500

b) P82,500/68% x 32% = P38,824

2. a) P4.5M x 5% /4 x 50% = P28,125

b) P28,125/68% x 32% = P13,235

3. a) P4.5M

b) P4.5M/68% x 32% = P2,117,647

4. a) P1,200,000

b) P1,200,000/68% x 32% = P564,705

You might also like

- Corick Woods Paystub Mar 11 2024Document1 pageCorick Woods Paystub Mar 11 2024Fake Documents of Simply Jodan's LLCNo ratings yet

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- ANSWERS Post Test Regular Income Taxation For PartnershipsDocument8 pagesANSWERS Post Test Regular Income Taxation For Partnershipslena cpa100% (1)

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Business and Transfer Taxation 6th Edition by Valencia Roxas Suggested AnswerDocument143 pagesBusiness and Transfer Taxation 6th Edition by Valencia Roxas Suggested AnswerTerces100% (5)

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- 2807-Corporations PPT PDFDocument61 pages2807-Corporations PPT PDFMay Grethel Joy Perante100% (1)

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- Tax Answer Key Updated Lecture Notes 5 CompressDocument7 pagesTax Answer Key Updated Lecture Notes 5 CompressHI HelloNo ratings yet

- Income Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument11 pagesIncome Taxes of Estates & Trusts: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersAudette AquinoNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Exercises in Corporation SolutionsDocument6 pagesExercises in Corporation Solutionsdiane camansagNo ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Answer Key 2016 Edition Income Tax LTDocument5 pagesAnswer Key 2016 Edition Income Tax LTFirst ShinNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- P6 3Document5 pagesP6 3Neil RyanNo ratings yet

- 2 CORPORATE INCOME TAXATION - FCDUs AND EFCDUsDocument11 pages2 CORPORATE INCOME TAXATION - FCDUs AND EFCDUsIvy ObligadoNo ratings yet

- TAX Final Preboard SolutionDocument25 pagesTAX Final Preboard SolutionLaika Mae D. CariñoNo ratings yet

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- TaxDocument24 pagesTaxAnonymous aRheeMNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- TAX Preweek Lecture (B42) - December 2021 CPALEDocument16 pagesTAX Preweek Lecture (B42) - December 2021 CPALEkdltcalderon102No ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Income Taxation - Chapter 2 - Individual TaxpayersDocument5 pagesIncome Taxation - Chapter 2 - Individual TaxpayerscurlybambiNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Tax 1st Preboard A LUDocument9 pagesTax 1st Preboard A LUAnonymous 7HGskNNo ratings yet

- Quiz - Income Tax For CorporationsDocument3 pagesQuiz - Income Tax For Corporationskim mindoroNo ratings yet

- 17267pcc Sugg Paper June09 5Document18 pages17267pcc Sugg Paper June09 5nbaghrechaNo ratings yet

- 1 Taxation PreweekDocument25 pages1 Taxation PreweekJc Quismundo100% (1)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Interim 7 Consolidation AFAR1Document7 pagesInterim 7 Consolidation AFAR1Bea Tepace PototNo ratings yet

- Transfer and Business TaxationDocument131 pagesTransfer and Business TaxationMr.AccntngNo ratings yet

- Quiz Tax On IndividualsDocument2 pagesQuiz Tax On IndividualsAirah Shane B. DianaNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Instruction: Write The Letter of Your Choice On The Space Provided Before The NumberDocument4 pagesInstruction: Write The Letter of Your Choice On The Space Provided Before The NumberASDDD100% (2)

- Items of IncomeDocument23 pagesItems of IncomeIzuki ShikiNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- ReSA B45 TAX First PB Exam - Questions, Answers - SolutionsDocument13 pagesReSA B45 TAX First PB Exam - Questions, Answers - Solutionsciafrancisco47No ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Taxation Material 2Document7 pagesTaxation Material 2Shaira BugayongNo ratings yet

- Final Examination TaxDocument2 pagesFinal Examination Taxjeffersam31No ratings yet

- 3rd Quizzer TAX 2nd Sem SY 2019 2020Document4 pages3rd Quizzer TAX 2nd Sem SY 2019 2020Ric John Naquila CabilanNo ratings yet

- Chapter 7 Regular Income Tax Activity Valdez KJ PDFDocument5 pagesChapter 7 Regular Income Tax Activity Valdez KJ PDFBisag Asa60% (5)

- Income Taxation Chap. 4 & 6Document1 pageIncome Taxation Chap. 4 & 6curlybambiNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Compensation Lecture Notes 3 4 CompressDocument3 pagesCompensation Lecture Notes 3 4 CompressKristine Nicole T. SalvadorNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- Income Taxation FinalsDocument3 pagesIncome Taxation Finalsnicole bancoroNo ratings yet

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Income Taxation 2015 Edition Solman PDFDocument53 pagesIncome Taxation 2015 Edition Solman PDFPrincess AlqueroNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Skid Steer CaseDocument2 pagesSkid Steer CaseDANICA DIVINANo ratings yet

- SILO Mentality: Create A Scenario For Quality, Cost, Delivery, and Customer ServiceDocument2 pagesSILO Mentality: Create A Scenario For Quality, Cost, Delivery, and Customer ServiceDANICA DIVINA0% (1)

- Examples of EatertainmentDocument6 pagesExamples of EatertainmentDANICA DIVINANo ratings yet

- Nutrition Facts 1111Document6 pagesNutrition Facts 1111DANICA DIVINANo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Presentation On Income TaxDocument9 pagesPresentation On Income TaxUnnati GuptaNo ratings yet

- Or Gciq476511997908Document1 pageOr Gciq476511997908Patrizzia Ann Rose OcbinaNo ratings yet

- CA Final Paper 4 Direct Tax Laws & International Taxation ABC AnalysisDocument3 pagesCA Final Paper 4 Direct Tax Laws & International Taxation ABC Analysisathulyasuresh14No ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Income NotesDocument6 pagesIncome NotesJessica Estolloso GoyagoyNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1vighnarthaagency2255No ratings yet

- STF 2023-02-11 1676146727550 PDFDocument10 pagesSTF 2023-02-11 1676146727550 PDFJohnNo ratings yet

- Hours & EarningsDocument1 pageHours & EarningsAmmara AhmedNo ratings yet

- MyGlamm Invoice 1690610462-31-1Document1 pageMyGlamm Invoice 1690610462-31-1nitinmiglani122No ratings yet

- Invoice: Number Date Reference Payment Method VAT NumberDocument1 pageInvoice: Number Date Reference Payment Method VAT NumberJordan Javier Párraga CedeñoNo ratings yet

- Stamp Duty For OPEMAL Success LTD View Invoice - ReceiptDocument2 pagesStamp Duty For OPEMAL Success LTD View Invoice - ReceiptAyinla4sure1No ratings yet

- Final Exam - Tax 312Document3 pagesFinal Exam - Tax 312NJ TamdangNo ratings yet

- 1st Freshmen Tutorial Activity 1Document2 pages1st Freshmen Tutorial Activity 1Stephanie Diane SabadoNo ratings yet

- Mid Sem TaxationDocument6 pagesMid Sem Taxationakash tiwariNo ratings yet

- Tax Invoice: OMSB140421040012059 Credit CardDocument1 pageTax Invoice: OMSB140421040012059 Credit CardHoseinNo ratings yet

- Invoice INV 20435Document2 pagesInvoice INV 20435Nannys AppNo ratings yet

- Your BillDocument2 pagesYour Billsnandakishore21No ratings yet

- 1702-EX June 2013 Pages 1 To 2 PDFDocument2 pages1702-EX June 2013 Pages 1 To 2 PDFJulio Gabriel AseronNo ratings yet

- Compliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.Document4 pagesCompliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.shakiraNo ratings yet

- New Tax Regime vs Old Calculator by AssetYogiDocument4 pagesNew Tax Regime vs Old Calculator by AssetYogiShubhamVermaNo ratings yet

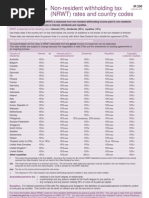

- Non-Resident Withholding Tax (NRWT) Rates and Country CodesDocument2 pagesNon-Resident Withholding Tax (NRWT) Rates and Country CodessamsujNo ratings yet

- Week 3 Tutorial Solutions - Fiancial AcountingDocument13 pagesWeek 3 Tutorial Solutions - Fiancial AcountingMi ThaiNo ratings yet

- Payslip MatrimonyDocument2 pagesPayslip MatrimonyPuneeth KumarNo ratings yet

- Bills Factory (Pakistan)Document2 pagesBills Factory (Pakistan)mnaveedashraf980No ratings yet

- SD - Formulas de Cálculo de ImpostoDocument83 pagesSD - Formulas de Cálculo de ImpostoThaís DalanesiNo ratings yet

- XUV700 PRICE LIST - BS6-FEB'22 Wef 02.02Document1 pageXUV700 PRICE LIST - BS6-FEB'22 Wef 02.02SathishKumarNo ratings yet

- 6-3. Corporation Tax - LossDocument26 pages6-3. Corporation Tax - LossDharshan KumarNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet