Acca f6 2020 Lecture Notes

Acca f6 2020 Lecture Notes

Uploaded by

Mili sarkarCopyright:

Available Formats

Acca f6 2020 Lecture Notes

Acca f6 2020 Lecture Notes

Uploaded by

Mili sarkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Acca f6 2020 Lecture Notes

Acca f6 2020 Lecture Notes

Uploaded by

Mili sarkarCopyright:

Available Formats

lOMoARcPSD|3616636

ACCA F6 2020 lecture notes

ACCA DipIFR (Association of Chartered Certified Accountants)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

Course Notes

ACCA TX (FA 2019)

Taxation - United Kingdom

From June 2020 – March 2021

Tutor details

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ii Introduction ACCA TX-UK

No part of this publication may be reproduced, stored in a retrieval system

or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recording or otherwise, without the prior written permission

of First Intuition Ltd.

Any unauthorised reproduction or distribution in any form is strictly

prohibited as breach of copyright and may be punishable by law.

© First Intuition Ltd, 2020

January 2020 RELEASE

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK Introduction iii

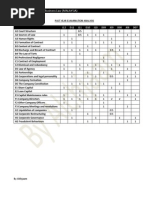

1Contents

Page

1 Your Exam vii

2 The Taxation Syllabus vii

3 Technical Articles vii

1: The UK tax system 1

1 The tax regime 1

2 The ethical professional 2

3 The scope of income tax 4

4 Residence 4

2: Income tax computation 7

1 Overview 7

2 Pro forma income tax computation 8

3 Taxable income 9

4 Computing income tax payable 11

5 Gift Aid 14

6 The marriage allowance and tax planning for couples 16

7 Steps in computing taxable income and income tax due 19

3: Income from employment 21

1 Income from employment 21

2 Basis of assessment for employees 22

3 Allowable employment income deductions 23

4 Assessable benefits 25

5 Pay as you earn (PAYE) System 32

4: Property and the accrued income scheme 35

1 Property income 35

2 The accrued income scheme 42

5: Self-employment 45

1 Basis of assessment 45

2 The badges of trade 45

3 Adjustment of profits: sole traders and companies 46

4 Cash basis for small businesses 50

6: Capital allowances 53

1 Overview 53

2 The allowances 54

3 Balancing allowances and balancing charges 58

4 Year of cessation 59

5 Approach to capital allowance questions 59

7: Commencement and cessation of trade 61

1 Basis periods 61

2 Opening year rules 62

3 Closing year rules 65

8: Partnerships 67

1 Principles 67

2 Limited liability partnerships (LLPs) 67

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

iv Introduction ACCA TX-UK

3 Approach to exam questions 68

9: Trading losses 69

1 Current year and prior year relief 69

2 Carry forward losses 70

3 Factors influencing which loss relief to use 70

4 Losses in the opening years of trade 71

5 Terminal loss relief (closing year of trade) 72

6 Cap on loss relief 74

7 Property business losses 75

8 Overview of the use of trading losses 75

10: Pensions 77

1 Types of pension scheme 77

2 Contributing to a pension scheme 77

3 Annual allowance 78

4 Receiving benefits from a pension scheme 81

11: National insurance 83

1 Class 1 NIC 83

2 Class 2 (self-employed) 84

3 Class 4 (self-employed) 85

12: Capital gains tax (CGT) 87

1 Scope of CGT 87

2 Exempt assets 88

3 Calculating gains and rates of tax 88

4 Capital losses 90

5 Part disposals 91

6 CGT on death 92

7 Inter-spouse transfers 92

8 Connected persons 92

9 Terminology 93

13: Chattels and wasting assets 95

1 Wasting chattels (life < 50 years) 95

2 Non-wasting chattels (life > 50 years) 95

3 Summary 96

4 Chattel scenarios 96

5 Wasting assets (e.g. copyright with a 20-year life) 96

14: CGT reliefs 97

1 Introduction 97

2 Principal private residence Relief 98

3 Rollover relief 100

4 Gift relief 102

5 Entrepreneurs’ relief (ER) 104

6 Investors’ relief 106

15: Shares and securities 107

1 Introduction 107

2 Gifts of quoted shares 107

3 Bonus issues 109

4 Rights issues 109

5 Re-organisations and takeovers 109

6 Gilts and qualifying corporate bonds (QCB) 110

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK Introduction v

16: Inheritance tax 111

1 The scope of inheritance tax 111

2 Persons chargeable to IHT 111

3 Transfers of value 111

4 Exempt transfers – lifetime transfers and transfers on death 112

5 Types of lifetime transfer 112

6 Calculation of lifetime tax on lifetime transfers 114

7 Tax payable on death 117

8 The residence nil rate band 120

9 Payment of IHT 122

10 Inheritance tax computation: Step by Step Guide 123

17: Corporation tax 127

1 Scope of corporation tax 127

2 Long periods of account 131

3 Corporation tax liability 132

4 Approach to corporation tax questions 133

18: Corporate gains 135

1 Introduction 135

2 Share matching for companies 136

19: Corporation tax losses 139

1 Trading losses 139

2 Current Year and Prior Year Relief 140

3 Carry forward of losses 141

4 Terminal loss relief 142

5 Capital losses 143

20: Groups of companies 145

1 Two types of group 145

2 Group relief group 146

3 Gains Group 150

21: Value added tax 151

1 The scope of VAT 151

2 Types of supply 152

3 VAT registration 152

4 Computation of VAT liabilities 154

5 VAT invoice 155

6 The valuation of supplies 155

7 Irrecoverable input VAT 156

8 Relief for impairment losses 157

9 Penalties 157

10 Special schemes 158

11 Group registration 159

12 Purchases and sales from outside of the UK 160

22: Obligations for individuals 161

1 Collection of income tax 161

2 Self-assessment 161

3 Record keeping 166

4 Compliance checks and appeals 166

5 HMRC powers 167

6 Time limits 168

7 PAYE real time reporting late filing penalty 168

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

vi Introduction ACCA TX-UK

23: Company tax administration 169

1 Self-assessment for companies 169

2 Record keeping 174

3 HMRC determinations 175

4 Compliance checks 175

5 Discovery assessments 175

6 Overpayment relief 176

Solutions to lecture examples 177

Chapter 1 177

Chapter 2 178

Chapter 3 180

Chapter 4 180

Chapter 6 182

Chapter 7 183

Chapter 8 184

Chapter 9 185

Chapter 10 186

Chapter 12 187

Chapter 14 189

Chapter 15 191

Chapter 16 191

Chapter 17 196

Chapter 18 197

Chapter 19 198

Chapter 20 199

Chapter 23 199

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK Introduction vii

1 Your Exam

Your examination is a 3-hour computer-based examination.

You will have three hours for the exam PLUS you have up to 10 minutes to familiarise yourself

with the CBE system before starting the exam.

The exam is divided into three sections:

Section A Fifteen objective test (OT) questions worth 2 marks each

Section B Three objective test (OT) cases. Each case consists of five OT questions based

around a common scenario. Each of the objective test questions is worth 2

marks

Section C One 10-mark question and two 15-mark questions

Question style

In sections A and B there are a variety of OT styles. For example, questions may be multiple response,

number entry, pull down list, hot spot, enhanced matching or fill in a table.

The two 15-mark section C questions focus on income tax and corporation tax, but may include a small

number of marks focussing on other taxes. All other questions can cover any area of the syllabus.

The exam is mainly computational and all questions are compulsory.

2 The Taxation Syllabus

Full details of the taxation syllabus can be found on the ACCA website at

https://www.accaglobal.com/content/dam/acca/global/PDF-

students/acca/f6/studyguides/TX%20UK%20-%20June%2020-Mar%2021%20-%20Final.pdf

3 Technical Articles

The ACCA publish a number of technical articles relating to Taxation on their website at

https://www.accaglobal.com/uk/en/student/exam-support-resources/fundamentals-exams-study-

resources/f6/technical-articles.html.

These provide useful additional reading, and are worth reading once you are comfortable with

material in these notes. We suggest looking at them between the tuition and revision stage of your

course.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

The UK tax system

1 The tax regime

The overall functions and purposes of taxation in a modern economy are: to raise finance, regulate

demand and guide behaviour.

1.1 Types of tax

TAX SUFFERED BY

Income Tax - Chapters 1-10 and 22 Individuals – e.g.

Employees

Sole traders

Partners in a partnership

Unemployed

Retired

National Insurance - Chapter 11 Employees

Self-employed

Employers

Capital Gains Tax - Chapters 12-15 Individuals (companies pay corporation tax on capital gains)

Inheritance Tax - Chapter 16 Individuals

Corporation Tax - Chapters 17-20 & 23 Companies

Value Added Tax - Chapter 21 The consumer. Collected by businesses, both

unincorporated and companies.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

2 1: The UK tax system ACCA TX-UK

1.2 The difference between direct and indirect taxation

KEY TERMS

Indirect tax. An indirect tax, e.g. VAT, is a tax collected by an intermediary (such as a

retailer) from the person who bears the ultimate cost of the tax (the customer). The

intermediary later files a tax return and forwards the tax collected to the HMRC.

Direct tax. A direct tax is a tax collected by HMRC directly from the taxpayer, e.g.

income tax, corporation tax, capital gains tax.

1.3 Tax avoidance and tax evasion

KEY TERMS

Avoidance. Avoidance is the LEGAL utilisation of the tax regime to one’s advantage,

e.g. using tax reliefs, changing status through incorporation, living in a low tax country.

Evasion. Evasion is ILLEGAL. It involves deliberate concealment of the true state of a

taxpayer's affairs. Evasion is a crime that renders the guilty party liable to fines or

imprisonment.

Schemes

HMRC has targeted many specific tax avoidance schemes with anti-avoidance legislation to

counter the tax advantages gained by the taxpayer.

HMRC has also introduced:

– Disclosure obligations regarding anti-avoidance tax schemes requiring the declaration of

details of the scheme to HMRC.

– A general anti abuse rule (GAAR) which stops tax advantages (e.g. increased

deduction/decreased income) arising from abusive tax arrangements. Abusive

arrangements are those which cannot be regarded as a reasonable course of action and

are deliberately put in place to avoid tax.

2 The ethical professional

EXAM SMART

It is vitally important that you learn the ethical rules that you, as a qualified professional, will

be governed by.

As an accountant, you are a taxpayer’s agent.

A taxpayer may appoint an accountant to prepare and submit a tax return, but it is the taxpayer,

not the accountant, who is responsible for the return and paying tax.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 1: The UK tax system 3

In dealing with clients, the ACCA requires a member to uphold its standards. The ACCA’s code of ethics

and conduct sets out five fundamental principles that members should abide by. These are:

(i) Objectivity

(ii) Professional behaviour

(iii) Professional competence and due care

(iv) Integrity

(v) Confidentiality

It is the responsibility of an accountant who learns of a material error or omission in a

client’s tax return or of a failure to file a return, to advise the client of the situation and to

recommend disclosure to HMRC.

If a client fails to correct a material error/omission or failure, the accountant must:

(1) Cease to act for the client.

An accountant should not provide details to HMRC of why they are ceasing to act.

(2) Inform HMRC that he is no longer acting for the client.

(3) Make a money laundering report.

The money laundering report which sets out the situation is made to the Money Laundering

Reporting Officer (MLRO) within the accountancy firm.

The MLRO must decide whether to make a report to the National Crime agency (NCA).

Where a report is made the client should not be informed as this may amount to tipping off,

which is an offence.

A report to the NCA does not remove the requirement to disclose the information to HMRC.

2.1 Dishonest conduct of tax agents

There is a civil penalty of up to £50,000 for the dishonest conduct of tax agents.

In cases where the penalty exceeds £5,000, HMRC may publish details of the penalised agent.

With agreement of the Tax Tribunal, HMRC can access the working papers of a dishonest agent.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

4 1: The UK tax system ACCA TX-UK

3 The scope of income tax

Individuals are liable to income tax for a tax year.

KEY TERM

The tax year runs from 6 April to 5 April.

Individuals who are resident in the UK for a tax year are liable to UK tax on their worldwide

income.

Non-UK resident individuals are only liable to UK tax on income arising in the UK.

4 Residence

There are statutory tests to determine a person’s residence.

You must consider the tests in the ORDER set out below.

If, for example, one of the automatic non-residence tests is satisfied, then you do not consider the

remaining rules.

STATUTORY TESTS

Test 1: Automatic non-UK resident

A person is automatically NOT resident if, in the tax year, he is in the UK for less than:

16 days, or

46 days and has not been UK resident during the three previous tax years (i.e. is arriving in the

UK or is an occasional visitor), or

91 days, of which fewer than 31 days were working in the UK, and he works full-time overseas.

Test 2: Automatic UK resident

Provided test 1 is not met, a person is automatically resident in the UK in a tax year if he:

Is in the UK for 183 days or more during the year, or

He has his only home in the UK, or

He works full-time in the UK and more than 75% of his working days are in the UK.

Test 3: Sufficient ties test

If (and ONLY if) person’s residence cannot be determined using the automatic tests above, use the

sufficient ties test.

Firstly, determine whether the person is a previous UK resident:

For these purposes:

A person is a previous UK resident if he was UK resident in one or more of the 3 previous tax

years (usually someone leaving).

A person who was not UK resident in any of the 3 previous tax years, is not a previous resident

(usually someone arriving).

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 1: The UK tax system 5

Next, count how many ties the individual has with the UK:

There are four UK ties for arrivers and five UK ties for leavers:

(1) Having close family (a spouse/civil partner/cohabitee or minor child) resident in the UK.

(2) Having UK accommodation in which the individual spends at least one night in the tax year.

(3) Doing substantive work in the UK.

This means work for 3 hours or more on 40 or more days in the tax year.

(4) Being in the UK for more than 90 days during either or both of the two previous tax years.

For leavers, there is one further tie:

(5) Spending more time in the UK than in any other country during the tax year.

A day in the UK is any day on which a person is present in the UK at midnight.

Note: It is harder for a person leaving to become non-resident than it is for a person arriving to remain

non-resident.

Once you have decided a person’s previous residence status and the number of ties, determine

residence status for the tax year using the table below:

Days in the UK Previously resident Not previously resident

Less than 16 Automatically not resident Automatically not resident

16 to 45 Resident if 4 UK ties or more Automatically not resident

46 to 90 Resident if 3 UK ties or more Resident if 4 UK ties

91 to 120 Resident if 2 UK ties or more Resident if 3 UK ties or more

121 to 182 Resident if 1 UK ties or more Resident if 2 UK ties or more

183 or more Automatically resident Automatically resident

EXAM SMART

The table above will be given to you in the exam.

In practice, the rules are more complex than described above. However, your Examiner

has confirmed that the above is all that he expects you to know.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

6 1: The UK tax system ACCA TX-UK

LECTURE EXAMPLE 1.1

Jai was born in the UK and lived here until 31 March 2019 when she retired and went to live in a house

she had purchased overseas. Jai lived overseas throughout 2019/20 except for the 49 days when she

returned for her daughter’s wedding. Whilst in the UK Jai lived with her husband in the house they

jointly own. Her husband continued to work in the UK and lived in the house for 220 days in 2019/20.

To decide whether Jai is UK resident for 2019/20, look at the automatic tests and then the ties:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

Income tax computation

1 Overview

In this chapter you learn how to compute an individual’s income tax liability. In later chapters you will

learn how to compute the income included in that computation.

1.1 The personal tax computation

The personal tax computation totals all of an individual’s income.

The exception is that exempt income is not included in the tax computation.

1.1.1 Exempt income

In your exam, you may meet the following types of exempt income:

Betting winnings

Interest on National Savings Certificates (This is not an NSB account)

Damages for personal injury

Income from Individual Savings Accounts (ISAs) (see below)

Premium bond winnings

EXAM SMART

Beware! If you see any of these types of income in an exam question, you must state

in your answer that it is exempt income. If you do not state this, you will not

get the mark even if you treat the income as exempt by excluding it from your income tax

computation.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

8 2: Income tax computation ACCA TX-UK

Individual Savings Accounts (ISAs)

Available to UK resident individuals aged ≥ 18 (or ≥ 16 for cash ISAs).

Exempt income and capital gains tax.

May pay into a maximum of one cash ISA and one stocks and shares ISA each year.

Maximum investment is £20,000. £20,000 can be invested:

in a cash ISA or

in a stocks and shares ISA, or

in a combination of the two, in any proportion the investor wishes.

May withdraw money from a cash ISA and replace it in the same tax year without the

replacement counting towards the ISA investment limit for that year.

The savings income nil rate band (see below) removes the benefit of a cash ISA for many.

An ISA may be beneficial for additional rate (see below) and other taxpayers whose savings

income nil rate band is already used.

Similarly, the dividend nil rate band (see below) removes the advantages of a stocks and shares

ISA for many.

As chargeable gains in a stocks and shares ISA are exempt, a stocks and shares ISA is

advantageous for those who would otherwise have taxable gains (we will look at this when we

study capital gains tax).

2 Pro forma income tax computation

Income is taxed in slices according to type of income and should be put in one of three columns

in the income tax computation:

Type of income

1 Non-savings (from trading, employment and land & buildings) Bottom slice of income

2 Savings (bank/building society interest) Second slice

3 Dividends Top slice

2.1 Income Tax Pro forma

This proforma gives an overview of what an income tax computation looks like. Refer back to it as you

work through the notes.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 9

Pro forma computation of taxable income

Non-savings Savings Dividends Total

£ £ £ £

Employment income 29,500 29,500

Trading profit 15,000 15,000

Property profit 12,000 12,000

Bank interest 4,000 4,000

Dividends 6,000 6,000

Total income 56,500 4,000 6,000 66,500

Less: Qualifying interest payments (500) (500)

Less: Trading loss relief (2,000) (2,000)

Net income 54,000 4,000 6,000 64,000

Less: Personal allowance (12,500) (12,500)

Taxable income 41,500 4,000 6,000 51,500

3 Taxable income

Taxable income is arrived at by adding together all of an individual’s sources of income and

deducting the personal allowance.

Each of the three types of income, non-savings, savings and dividends is dealt with separately.

3.1 Personal allowance (PA)

All individuals (incl. children & pensioners) receive a PA of £12,500 each tax year.

For the purposes of your exam, always set against total income in the following order:

(i) Non-savings income, then

(ii) Savings income, then

(iii) Dividends.

EXAM SMART

In some circumstances it is beneficial to deduct the PA from the sources of income in a

different order to that set out above. This is NOT examinable in the TX exam.

No carry forward or carry back of unused PA.

In some circumstances (see below), part of the PA can be transferred to a spouse/civil partner.

LECTURE EXAMPLE 2.1: REBEKAH

Rebekah had earnings of £12,000 and bank interest of £10,000. Her taxable income is:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

10 2: Income tax computation ACCA TX-UK

Reduction in PA for high earning individuals

KEY TERM

Adjusted net income is total income LESS:

Loss relief,

Qualifying interest payments,

Gross pension contributions to an employers’ occupational pension scheme and

Gross Gift Aid contributions and personal pension contributions.

You look at the above items later in this chapter.

The PA is reduced by £1 for every £2 of income if adjusted net income (ANI) exceeds £100,000.

A person with ANI of £125,000 or more is not entitled to any PA (125,000 – 100,000 =

25,000/2 = £12,500).

If a person has ANI between £100,000 and £125,000, the effective marginal rate of

income tax is 60%. This is the higher rate of 40% on income plus an additional 20% as a

result of the personal allowance withdrawal.

In this situation it may be beneficial to make additional personal pension contributions

(see below) or Gift Aid donations (see below).

This point is not important in the TX exam (it will be in your ATX studies!!), but for now,

do not worry too much – most TX students find this marginal rate baffling!

LECTURE EXAMPLE 2.2

Jo has a salary of £105,400, building society interest of £2,000 and dividends of £12,600. His taxable

income is:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 11

EXAM SMART

The income limit of £100,000 and the adjusted net income limit of £125,000 are included in

the tax rates and allowances provided in the examination.

Qualifying interest payments (Eligible interest)

Deduct from total income before the personal allowance. It does not often appear in TX exams,

but be aware of it.

Deduct first from non-savings income, then from savings income and finally from dividends.

Includes interest paid on a loan used:

By a partner to invest (capital or loan) in a partnership.

By a partner or employee to purchase plant and machinery, including computers.

To invest in (or make a loan) to a close trading company. A close company is one

controlled by its directors or five or fewer shareholders.

To invest in a co-operative (in which the taxpayer works).

To invest in an unquoted employee-controlled trading company in which the employees

own ≥ 50% of the shares.

4 Computing income tax payable

Pro forma computation of tax liability

NSI Savings Dividends Total

Income tax £ £ £ £

Non-savings × 20% 37,500 7,500

Extend Basic rate band by gross personal

pension/Gift Aid × 20% 1,000 200

Excess non-savings × 40% 3,000 1,200

41,500

Savings × 0% (savings allowance) 500 0

Savings × 40% 3,500 1,400

4,000

Dividends × 0% (dividend allowance) 2,000 0

Dividends × 32.5% 4,000 1,300

6,000

Child benefit tax charge 482

Income tax liability 12,082

Less tax suffered under PAYE (6,500)

Income tax due or payable 5,582

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

12 2: Income tax computation ACCA TX-UK

Tax Band Summary

There are three columns in the pro forma, one for each type of income.

Different tax rates apply to each type of income.

To compute tax, deal with each column separately starting with non-savings, then savings and

finally dividends.

Non-Savings Savings Dividends

Additional Rate Band 45% 45% 38.1%**

£150,000

Higher Rate Band 40% 40%* 32.5%**

£37,500

Basic Rate Band 20% 20%* 7.5%**

(1) Non-savings income

The first £37,500 (basic rate band) of taxable income is taxed at 20%.

Any excess is taxed at 40% (higher rate band).

The additional rate of 45% applies to income over £150,000.

(2) Savings income

Bank and building society interest.

For the purposes of your exam, all savings income is received gross.

A starting rate of 0% applies to savings income within the first £5,000 of taxable income.

A savings income nil rate band applies to basic rate and higher rate taxpayers:

£1,000 for basic rate taxpayers

£500 for higher rate taxpayers

The savings income nil rate band counts towards the basic and higher rate thresholds.

Savings income in excess of the starting rate and savings income nil rate band is then

taxed in the same way as non-savings income (i.e. at 20% / 40% / 45%).

EXAM SMART

The rates of tax are given in tabular format, in the tax rates and allowances section of your

exam paper.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 13

LECTURE EXAMPLE 2.3

Jo has a salary of £137,500, and building society interest of £4,500. Jo’s income tax liability is:

(3) Dividend income

Dividends in the £2,000 nil rate band are taxed at 0%.

Dividends above the nil rate band but within the basic rate band are taxed at 7.5%.

Any excess is taxed at 32.5% (higher rate) or 38.1% (additional rate).

The dividend nil rate band counts towards the basic rate and higher rate thresholds.

Unlike the starting rate for savings income which only applies in certain limited

circumstances and the savings income nil rate band which depends on the tax position of

the individual, the dividend nil rate band always applies to the first £2,000 of income.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

14 2: Income tax computation ACCA TX-UK

LECTURE EXAMPLE 2.4

Karishna has a salary of £15,500, building society interest of £3,500 and dividend income of £32,000.

Karishna’s income tax liability is:

5 Gift Aid

Gifts to a UK registered charity.

Regular or one-off.

No maximum or minimum gift.

Donor must give charity a Gift Aid declaration.

Gift must be unconditional.

Donor obtains only limited benefit from the gift (e.g. free access to National Trust properties).

Gift Aid donations are deemed paid net of 20% income tax. The amount paid is the net gift.

GROSS GIFT = net gift X 100/80 (gift × 100/80)

To give higher rate relief extend the basic rate band by the gross gift (gift × 100/80). This looks

strange, but it works!

Similarly, to give additional rate relief, the higher rate limit is increased by the gross gift.

Gift Aid makes no difference to a basic rate taxpayer’s liability, so ignore it completely if the

taxpayer is a basic rate taxpayer.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 15

ILLUSTRATION: GIFT AID DONATION

Macron earns a salary of £62,500 per annum and has no other income. He gives £8,000 (net) a year to

the Multiple Sclerosis Society (a registered charity) under the Gift Aid scheme.

Macron’s taxable income is:

£

Income from employment 62,500

Personal allowance (12,500)

50,000

His income tax payable is calculated as follows:

£

20% on £37,500 7,500

20% on extended basic rate band - £10,000 (£8,000 × 100/80) 2,000

40% on excess (£50,000 – £47,500) 1,000

10,500

5.1 Child benefit income tax charge

Child benefit is a tax-free payment that can be claimed in respect of children. In the TX exam,

you will be given the amount of any child benefit claimed.

An income tax charge applies if a taxpayer in receipt of child benefit (or whose partner is in

receipt of child benefit) has adjusted net income (ANI) of over £50,000 in a tax year.

ANI is calculated as it is for the restriction of the personal allowance on high income individuals.

The tax charge removes the benefit for those on higher incomes.

The charge is 1% of the benefit for each £100 of ANI between £50,000 and £60,000. Once ANI

reaches £60,000 the tax charge is 100% of the benefit.

The tax charge is added in at arriving at income tax liability (see pro forma above).

If both partners have income > £50,000, the partner with the higher income is liable for the charge.

However, this will not be examined in TX.

There is an option for claimants to opt not to receive child benefit in order to avoid the charge.

When the charge applies the taxpayer must complete a tax return and the charge is collected

through the self-assessment system.

EXAM SMART

The following information will be given in your exam.

Child benefit income tax charge

Where income is between £50,000 and £60,000, the charge is 1% of the amount of child benefit

received for every £100 of income over £50,000.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

16 2: Income tax computation ACCA TX-UK

LECTURE EXAMPLE 2.5

Sara Evans receives child benefit of £1,789. She has net income of £57,589, and pays gross gift aid

donations of £400. The child benefit income tax charge is:

6 The marriage allowance and tax planning for couples

Marriage allowance (MA)

A spouse/civil partner can make a marriage allowance (MA) election to transfer a fixed amount

of their personal allowance to their spouse/civil partner.

The MA is available provided neither spouse/civil partner is a higher or additional rate taxpayer.

The election is only beneficial if the transferor does not fully utilise their PA but the recipient

does, so that the total income tax liability of the couple is reduced.

If an election is made, the fixed amount of £1,250 is transferred.

Cannot transfer more or less than the fixed amount.

Full allowance available in the year of marriage.

Relief is given by adjusting the tax code of employees. Those who are not employees claim relief

through their self-assessment return.

The effect of the election is:

(i) Transferor’s PA is reduced by £1,250.

(ii) The recipient’s income tax liability is reduced by a maximum of £250 (£1,250 × 20%).

If the recipient’s income tax liability is less than £250, a tax repayment is not possible, but

the transferor’s PA is still reduced by £1,250. At best the relief reduces the recipient’s

income tax liability to £Nil.

An election can be made:

(i) In advance (by 5 April 2020 for 2019/20).

The election will remain in force for future years, unless it is withdrawn or the conditions

are no longer met.

(ii) In arrears (by 5 April 2024 for 2019/20 – 4 years after the end of the tax year).

In this case the election only applies to the tax year concerned.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 17

EXAM SMART

The transferable amount of £1,250 is given in the tax rates and allowances in the exam.

LECTURE EXAMPLE 2.6

Jeevan and Falguni are married. Jeevan has an annual salary of £11,450. Falguni has an annual salary

of £42,500. Jeevan makes an election to transfer the marriage allowance to Falguni. Neither Falguni

nor Jeevan has any other income.

Jeevan and Falguni’s income tax liabilities are:

6.1 Other tax planning for couples

Aim to ensure both partners have sufficient income to cover their respective PA’s.

Consider transferring income-producing assets to the partner with the lowest marginal tax rate.

Ownership of the asset must actually be transferred for income to be treated as

belonging to the other partner.

Treat jointly held property as if owned equally unless the couple make a joint declaration of the

actual shares of ownership.

This means that the income arising from the property is taxed as if it were shared equally

unless a declaration of actual ownership has been made.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

18 2: Income tax computation ACCA TX-UK

ILLUSTRATION: JOINTLY HELD PROPERTY

Sue owns 80% of a property which she lets out. Her husband owns the other 20%.

If no declaration of actual ownership is made, Sue and her husband will each be taxed on 50% of the

rental income.

If a declaration is made, Sue will be taxed on 80% of the rental income and her husband will be taxed on

20%.

Whether it is worth making a declaration of actual interests will depend on who is the higher

rate taxpayer.

In the above illustration, if Sue pays tax at a higher rate than her husband, it may be beneficial

NOT to make a declaration.

The availability of the savings income nil rate band and the dividend nil rate band means that it

may not always be most beneficial to transfer income to the partner paying tax at the lowest

marginal rate.

ILLUSTRATION: RUTH AND JES

Ruth and Jes are in a civil partnership. Ruth has a salary of £175,000 and savings income of

£300. Jes has a salary of £50,000 and dividends of £12,000.

Ruth, an additional rate taxpayer, is not entitled to a savings income nil rate band. Her savings

income will be taxed at 45%. Transferring savings (and therefore the associated interest income)

to Jes would enable Jes to utilise her savings income nil rate band and would save tax of £135

(£300 x 45%).

Jes has dividend income in excess of the dividend nil rate band. As a higher rate taxpayer

£10,000 of dividend income will be taxable at 32.5%. Ruth does not utilise her dividend nil rate

band. Transferring sufficient shares to Ruth such that she would be taxable on dividends of

£2,000 would save tax of £650 (£2,000 x 32.5%). The remaining £8,000 of dividends should

remain taxable on Jes as she is only a higher rate taxpayer rather than transferring the shares to

Ruth which would make the dividend income taxable at the additional rate.

ILLUSTRATION: RAVI AND JAITINDER

Ravi and Jaitinder are married. Ravi has a salary of £80,000. Jaitinder has a salary of £25,000 and building

society interest of £1,500.

Jaitinder is a basic rate taxpayer and so has a £1,000 savings nil rate band. Thereafter the next £500 of

interest would be taxed at 20%. It is better if the £500 of interest is transferred to Ravi to use his £500

savings nil rate band.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 2: Income tax computation 19

7 Steps in computing taxable income and income tax due

EXAM SMART

Once you have worked through this chapter, practise as many income tax questions as

possible. You may wish to refer to the steps below as you work through questions.

Computing taxable income

STEPS

Step 1: Put income from different sources into one of the three columns:

Non-savings income, Savings income or dividend income.

If income is exempt show this on the face of the computation.

Step 2: Add up income in each of the three columns and total to find “total income”.

Step 3: Deduct losses and qualifying interest paid to leave “net income”.

Step 4: Deduct any personal allowance to leave “taxable income”.

Computing income tax due

STEPS

Step 1: Calculate income tax at each applicable rate on the three types of income.

Step 2: Deduct any marriage allowance and add back any child benefit tax charge.

Step 3: Finally, deduct tax suffered on employment income to find income tax due or outstanding.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

20 2: Income tax computation ACCA TX-UK

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

21

Income from employment

1 Income from employment

EXAM SMART

This chapter covers core exam topics which will be examined.

The benefits section is the most important.

1.1 Employment v self-employment

Employees Self-employed

Have a contract of service with their employer Enter into a contract for services

Receive taxable earnings Pay tax on profits for a tax year

Pay tax under PAYE system

HMRC apply “multiple tests” to determine the status of a taxpayer to prevent employees from

claiming to be self-employed when they are employees, including:

Control over the worker

Obligation to accept work

Who decides when the work is done

Hiring of subordinates

Financial risk/reward, for example finish work early or late

Who provides equipment

Wording of contract, (obey orders, obligation to appear, rights etc.)

Sick pay, holiday pay

Uniform, (but Tesco insist agency drivers must wear Tesco jacket)

Job title

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

22 3: Income from employment ACCA TX-UK

2 Basis of assessment for employees

KEY TERM

Taxable earnings means salaries, wages, bonuses, gratuities, tips, benefits, reimbursed

expenses, pensions, including state retirement benefits, whether paid in money or

money’s worth, or ANYTHING ELSE WHICH IS A REWARD OF EMPLOYMENT.

Directors and employees are taxed when earnings are received.

The amount received between 6 April 2019 and 5 April 2020 is taxable in 2019/20.

The exception is that earnings are taxable when an individual becomes entitled to payment, if

earlier than the date of receipt. A bonus receivable on 25 March 2019, is taxed in 2018/19 even

if it is paid after 5 April 2019.

Certain expenses paid or reimbursed by employers are exempt, i.e. not included in earnings,

provided they would be fully allowed as deductions from employment income (see section 2.1).

Employers do not report such expenses as benefits via the P11D form which means the

employee does not claim the expense as a deduction in his tax return.

ILLUSTRATION: TAXATION OF BONUS

Josh, a salesman receives a basic monthly salary of £3,000 and a bonus which is paid in April each year

and relates to the sales made by Josh in the year to the previous 31 December. Josh becomes entitled

to the bonus on the date it is received.

Recent bonuses are as follows:

Bonus in respect of: Paid Amount

Year to 31 December 2018 30 April 2019 £5,000

Year to 31 December 2019 30 April 2020 £7,500

What is Josh’s employment income for 2019/20?

SOLUTION

£

Salary (£3,000 × 12) 36,000

Bonus (received April 2019) 5,000

Employment income 41,000

In the case of directors, who are in a position to manipulate the timing of payments, there are

extra rules. Directors are deemed to receive earnings on the earliest of four dates:

(i) The two dates set out above

(ii) When earnings are credited in the company’s accounts

(iii) When earnings are determined:

– Before the end of the period of account = the end of that period

– After the end of a period of account = date the earnings are determined

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 23

3 Allowable employment income deductions

In general, expenses can be deducted from employment income if:

The employee is obliged to incur and pay the expense as the holder of the employment, and

The expense is incurred wholly, exclusively and necessarily for the purposes of employment.

These words are strictly interpreted and few costs are allowable under this rule.

Examples:

Disallowed Allowed

Examination fees for a trainee solicitor. Business calls from private phone (not line rental).

Smart work clothes. Annual deductions for protective clothing.

Newspapers/magazines for journalists. Costs of working at home, if required to work at

home.

Text books for employee required by employer to £4 per week to cover light and heat etc. if working

study. from home.

Travel to and from evening classes.

Golf club membership for bank manager who used

the club to entertain customers and build his

network of contacts. It is not necessary to belong to

a golf club.

There are many specific rules (see below), which override the general rule.

3.1.1 Travel expenses

Relief is not given for ordinary commuting costs from home to a permanent workplace.

Relief is given for an employee’s cost of travelling to a client provided the travel is integral to

the performance of duties. This includes the travel costs of employees who have to move from

place to place during the day (e.g. service engineers).

There is no relief for travelling between two employments. However, if an employee performs

duties in more than one place for one employer, then relief is given for the cost of travelling

between those places.

Relief is given if an employee travels directly from home to a temporary workplace.

– A work place is not temporary if an employee works there for a period that lasts, or is

expected to last, more than 24 months.

– Relief is available if an employee passes his permanent workplace on the way to the

temporary workplace provided that any stop at the permanent workplace is only

incidental (e.g. to pick up papers).

Statutory approved mileage allowances

If an employee makes business journeys in his own vehicle, the employer can pay a tax-free

allowance of up to a statutory amount.

In addition, an employer can pay up to 5p per mile for each fellow employee who is a passenger

on the same trip.

If payments received (if any) are less than the statutory amount, an allowable deduction is

available on the shortfall. An allowable deduction is not available in respect of passenger

payments if the employer rate is less than 5p per mile.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

24 3: Income from employment ACCA TX-UK

If payments received exceed the statutory amount, the employee is taxable on the excess.

Statutory amounts, (the rates for cars are given to you in the exam), are:

Cars Motor cycles Bicycles

45 pence per mile (up to 10,000 miles) 24 pence per mile 20 pence per mile

25 pence per mile (on miles in excess of 10,000)

For NIC purposes a flat rate of 45 ppm is used irrespective of actual mileage, with no allowable

deduction if the employer rate is less than this.

LECTURE EXAMPLE 3.1

In the tax year Dave drove 11,000 miles in the performance of his duties.

His employer paid an allowance of 32 pence per mile.

Calculate Dave’s taxable benefit or allowable expense as follows:

3.1.2 Pension contributions and contributions under the payroll deduction scheme

Deduct employee contributions to an occupational pension scheme and employee contributions

under the payroll deduction scheme from gross salary.

3.1.3 Professional subscriptions

A subscription to a professional body, e.g. ACCA subscription, is deductible if relevant to the

duties of the employment.

3.1.4 Employment related insurance premiums

Deductible if paid by employee.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 25

4 Assessable benefits

4.1 Taxing benefits

Benefits are taxed when the benefit is provided to the employee.

If a car is first provided on 1 January, the benefit is 3/12 × full year benefit for that tax year. (See

below for more details on cars.)

4.2 Valuing benefits

Employment income includes salary and the value of benefits.

The value of a benefit is usually the marginal or direct cost to the employer of providing that benefit.

Private school teachers, pilots, train drivers etc. who use employer resources are taxed on the

marginal or “direct” cost of providing the resource. (So, train drivers can ride tax free on their day off.)

EXAM SMART

This is an important rule, learn it.

There are special rules for valuing many benefits (see below) which override the above rules.

4.3 Presentation for employment income

EXAM SMART

Presentation is important in the TX exam, so it is worth pausing here, to think about

how you will present your employment income working.

List employment income in a working and show one line in the income tax computation (See Ch 2).

£

Salary 15,000

Car benefit (calculated in a separate working, W3) 4,000

Fuel benefit (£24,100 × 16%) 3,856

Loan benefit (calculated in a separate working, W4) 620

Accommodation benefit (calculated in a separate working, W5) 3,500

Employment income (put the total in the income tax computation: Ch 2) 26,976

4.4 Cars

Employees with a company car are taxed on a % of:

(i) the list price, plus

(ii) any optional accessories originally provided with the car, and

(iii) any further accessories costing £100 or more provided at a later date.

Ignore discounts.

Capital contributions of up to £5,000 by the employee reduce list price.

Cost of adapting the car to run on road fuel gas is excluded.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

26 3: Income from employment ACCA TX-UK

EXAM SMART

Don’t confuse capital contributions with contributions towards running costs. The latter

reduce the annual benefit.

% depends on car’s CO2 emissions

EXAM SMART

The following information will be given in the tax rates and allowances section of your exam paper.

The base level of CO2 emissions is 95 grams per kilometre. The %s for petrol cars (and diesel cars

meeting the RDE2 standard) with CO2 emissions below this are:

Emissions % applying to petrol cars

50g per kilometre or less 16 %

51g to 75g per kilometre 19 %

76g to 94g per kilometre 22 %

95g per kilometre 23 %

For every 5g/km over 95g/km (round down to the nearest 5g/km), add 1%.

Add a further 4% for diesel cars which do not meet the real driving emissions 2 (RDE2)

standard. Diesel cars meeting the standard are treated as though they are petrol cars.

Max percentage = 37%.

Contributions towards running costs reduce the taxable benefit.

Time apportion benefit for less than 12 months’ availability including being unavailable for more

than 30 days continuously.

Insurance, repairs, road tax etc. are included in the benefit above, so these costs are tax-free

and can be ignored in questions.

The cost of a chauffeur, however, is an additional benefit.

LECTURE EXAMPLE 3.2

S Ltd provided Cowell with a diesel car with a list price of £52,000. The car cost S Ltd £49,500, and it

has an official CO2 emission rate of 154 grams per kilometre. The car does not meet the RDE2

standard. Cowell was incapacitated for a week in March so the company provided him with a

chauffeur at a cost of £1,000. Cowell’s taxable benefit is:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 27

4.5 Fuel

If an employee is provided with any fuel for private journeys in a company car, he is taxed on the car

percentage (see above) multiplied by a base figure of £24,100. The base figure is given in the tax rates

and allowances in your exam.

Time apportion benefit for less than 12 months availability (as for cars).

Unlike all other benefits, an employee contribution toward the fuel cost does NOT reduce the

taxable amount.

Planning: contribute toward the running cost of the car, not the fuel.

In the example above, if S Ltd provides Cowell with fuel, the fuel benefit is 37% × £24,100 = £8,917.

Vans

Benefit if the employee has private use of a van.

NO benefit if private use is insignificant.

Travel from home to work does not count as private use.

Fixed taxable benefit £3,430 per annum. (Additional £655 if private fuel available.)

The benefit figures for vans and van fuel are NOT given to you in your exam.

Accommodation (e.g. living in company flat)

A benefit arises if an employee is provided with living accommodation unless the accommodation is

job related.

(i) If the employer OWNS the property, the employee is taxed on the annual value (the

deemed rent that would have been earned had the property been let to a third party).

EXAM SMART

The Examiner will give you the annual value.

(ii) If employer RENTS from a 3rd party, the taxable benefit is the greater of:

the rent paid by the employer, OR

the annual value.

Additional charge

Additional charge if cost > £75,000 (i.e. can only apply where employer owns the property).

(Cost – £75,000) × official rate of interest (2.5% - this will be provided to you in the exam).

Cost is the total cost of acquiring and improving the property prior to the start of the tax year.

Ignore improvements in the current tax year.

Don’t confuse improvements & repairs. Treat repairs as living expenses (see below).

Use the market value when first provided plus improvements:

If acquired > 6 years before its first use by the employee, AND

Cost plus improvements exceeds £75,000.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

28 3: Income from employment ACCA TX-UK

Job related accommodation

Accommodation is NOT a taxable benefit if it is job related, i.e.

Necessary (e.g. caretaker), or

Improves performance and customary to provide, e.g. nurse, or

Provided for personal security (e.g. Government Minister).

Directors can only claim the first two exemptions above if:

(i) They do not have more than a 5% interest in the company, AND

(ii) Either they are full time working directors or the company is non-profit making or a charity.

Living expenses (electricity, phone, TV licence etc. AND repairs)

Taxable benefits. Decorating is taxable in the year the work is done.

If accommodation is job related, the benefit is restricted to a maximum of 10% of the

employee’s earnings and other (non-accommodation) benefits.

LECTURE EXAMPLE 3.3

X Ltd provided Pururavas with an apartment in February 2013. The property was purchased in June

2005 for £150,000 and was valued at £250,000 in February 2013. X Ltd spent £10,000 on

improvements in December 2018 and £1,200 redecorating in June 2019. It has an annual value of

£14,000. The official rate of interest is 2.5%.

Pururavas ’s taxable benefit for 2019/20 is:

Vouchers

E.g. Marks & Spencer vouchers

Taxable benefit = Cash equivalent

This is also subject to employee & employer NIC, (See Chapter 11).

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 29

Loans (including amounts written off and “cheap” loans)

Taxable benefit = loan × (official rate of interest (2.5 %)) – actual interest paid in the year

Method When Used

Average Opening loan (or loan when first provided) + closing loan The average method

method 2 applies unless an election is

made for the strict method.

Strict Calculate interest on a monthly basis Used if taxpayer or HMRC

method wish.

In the exam calculate using both methods and choose the lower result (unless told otherwise).

Time apportion benefit if loan outstanding for only part of the tax year.

Not a taxable benefit if loan ≤ £10,000 throughout the tax year.

If loan exceeds £10,000 at any time in the tax year, whole benefit (not just the excess over

£10,000) is taxable.

Write off of all loans whether above or below £10,000, is always taxable in full.

ILLUSTRATION: LOAN BENEFIT

Raj borrowed £15,000 interest free from his employer on 1 June. He repaid £4,000 on 31 December.

Raj’s benefit for the tax year is:

15k+11k 10

Average method: ( ) x 0.025 x = £271

2 12

Strict method £

7/12 × 2.5% × £15,000 219

3/12 × 2.5% × £11,000 69

288

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

30 3: Income from employment ACCA TX-UK

Other assets for private use (boat, furniture, TV etc.)

Taxable benefit = 20% of the market value (MV) when first provided

Exclusion: bicycles provided for journeys to and from work are tax free.

If employee subsequently acquires the asset the taxable benefit is the greater of:

MV at time of employee acquisition, OR

Original MV less the cumulative taxable benefit to date of employee acquisition (think of

this as “net book value”).

LECTURE EXAMPLE 3.4

Sarah’s employer provided her with a television costing £1,800 for her private use on 1 January 2018.

The television was given to Sarah on 1 July 2019 when its market value was £400.

Sarah’s taxable benefit for 2019/20 is:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 31

Exempt benefits

EXEMPT EXEMPT

Employer pension contributions. Bikes/safety equipment for travel to/from work.

≤ £5 (£10 overseas) a night for incidental expenses £4 a week or £1 8 a m on th towards household

incurred whilst working away from home. costs if working from home.

If the amount exceeds the limit, full amount chargeable.

One mobile phone. If 2nd provided, benefit is cost of Medical cover for overseas business trips (UK

running 2nd phone to employer. cover taxable).

Pensions advice (up to £500). Canteen meals available to all staff.

First £8,000 of relocation expenses. Work place nursery.

Job related accommodation. Workplace parking.

Annual staff parties ≤ £150 per head. Employer liability insurance, death in service

If cost per head > £150 then whole amount taxable. benefits and PHI.

£150 per head is for the whole year.

The full cost of the party, even if more than £150 per

employee, is fully allowable for the employer.

Awards of up to £5,000 under staff suggestion schemes. Long service awards provided cost not more than

Excess over £5,000 is taxable. £50 per year of service and, if service was at least 20

years, there was no similar award in past 10 years.

Bikes to enable employees to get to and from work or Entertainment provided by genuine 3rd parties

from one workplace to another. (e.g. seats at sporting events).

Buses and minibuses used for journeys to work or Gifts of goods by 3rd parties provided the cost of

between workplaces. all gifts by the same donor to the same employee

does not exceed £250 a year.

If the limit is exceeded the full amount is taxable.

Employer payment of up to £500 for medical treatment Trivial benefits if cost less than £50; not cash/cash

provided to an employee to assist a return to work after voucher; and not provided in recognition of

a period of absence due to ill-health or injury. services.

Loans < £10,000. Sports and recreation facilities available to

employees, but not the general public.

EXAM SMART

If there is an exempt benefit in the exam, identify it as exempt. Don’t ignore it.

This is VITAL: you will not gain the marks for recognising an exempt benefit if you ignore it!

EXAM SMART

The best way of really getting to know which benefits are exempt is to practise lots of

questions, where you will find that certain exempt benefits get tested again and again.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

32 3: Income from employment ACCA TX-UK

5 Pay as you earn (PAYE) System

Employers administer PAYE which:

(i) aims to deduct the correct amount of tax & national insurance from employee earnings.

(ii) ensures that taxable non-cash benefits are reported by the employer to HMRC.

(iii) applies to all cash payments made to employees (e.g. salaries, bonuses), to certain assets

which can be readily converted into cash (e.g. gold bars, wine) and, in various ways, to

taxable benefits.

Employers may opt to collect and pay to HMRC the tax on various benefits through the PAYE

system in the same way as salary (voluntary payrolling). Otherwise benefits are recorded on

form P11D and the tax code adjusted for HMRC to recover the tax. See below.

How PAYE works

The employer calculates the correct amount of tax & NI to deduct.

The system works cumulatively.

The employer calculates total tax & NI due from the beginning of the tax year to the end of the

month, deducts the amount collected to date and withholds the difference from pay.

PAYE is withheld from employee pay on pay day. (Maximum deduction 50%.)

Large employers (> 250 employees) pay PAYE electronically to HMRC. Others can pay

electronically by choice.

If electronic payment is made, the payment deadline is the 22nd of the month following the tax

month concerned. Tax months run from 6th to next 5th.

EXAM SMART

The electronic pay day (22nd) should be used in the exam. You do not need to be aware of

the payment deadline for non-electronic payments.

Can pay quarterly (on 22 July, October, January & April) if average monthly employer PAYE

liability does not exceed £1,500.

HMRC can require employers to provide security where amounts due under PAYE are seriously

at risk.

HMRC require security from employers who try to defraud the government by deliberately

choosing not to pay PAYE, who build up large debts or who do not respond to HMRC’s attempts

to contact them.

Real time information (RTI)

Employers must submit income tax and NIC information to HMRC electronically when or before

employees are paid each week or month.

A year end summary of all the tax and NICs deducted must be provided with the final RTI

submission for the tax year.

Penalties are charged on a monthly basis if RTI submissions are late (see Chapter 22).

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 3: Income from employment 33

PAYE codes

'Tax codes' are used to calculate tax due under PAYE. The tax code computation is as follows:

Allowances £ Deductions £

Personal allowance X Taxable benefits reported on P11D X

Allowable expenses X Adjustment for underpaid tax X

Adjustment for overpaid tax X

X X

(i) If total allowances minus deductions gives a positive figure create the code by replacing

the last digit with a letter.

The letter L shows that the employee is entitled to the basic personal allowance.

(ii) If total allowances minus deductions is a negative figure, rather than adding a suffix to

the code number, add the prefix K. A K code is calculated by removing the last digit and is

then decreased by 1.

The K prefix is used when allowances are less than benefits, i.e. to increase taxable pay.

PAYE codes may also include income tax on the taxpayer's estimated savings and dividend

income.

ILLUSTRATION: TAX CODE

Tayyeba is a 37-year old who earns £62,190 per annum and has taxable benefits of £2,930 each year

reported on the P11D. Underpaid tax for last year was £100.

The PAYE code is:

£

Personal allowance 12,500

Benefits (2,930)

Underpaid tax from last year £100 × 100/40* (250)

9,320

The tax code for 2019/20 is 932L.

* Reducing the tax free allowance by £250 increases taxable income by £250. As Tayyeba pays tax at

40%, an extra £100 of tax is due on £250 of taxable income.

PAYE forms

HMRC use various forms to administer PAYE:

P60 To employee by 31 May Total taxable pay

Total tax deducted

PAYE code

National Insurance number

Employer’s name and address

P11D To employee and HMRC by 6 July Cash equivalent of all benefits

P45 Given to employee on leaving PAYE code

Income paid and tax deducted from start of tax year to

date of leaving

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

34 3: Income from employment ACCA TX-UK

PAYE settlement agreement (PSA)

Employers may enter a PSA and make a single payment by 22 October (19 Oct for postal

payment), after the tax year, to cover income tax & NIC on small or irregular benefits (e.g.

Christmas gifts, staff parties costing > £150).

Items in a PSA do not have to be put on an employee’s P11D or tax return.

Treatment of benefits

Taxable benefits may be reported to HMRC on a P11D at the end of the tax year.

HMRC adjust the PAYE code by deducting the value of the benefit. The next year, as the PAYE

code is used to collect tax, it will ensure that tax is collected on both cash payments and

previously reported benefits. However, as benefits may vary from year to year the amount

collected may not be correct.

Employers may process certain benefits e.g. car, van, fuel, medical insurance and subscriptions

directly through payroll – payrolling of benefits.

Employers who opt for this must report the value of the benefits under the RTI system.

The cash equivalent of the benefit is treated as PAYE income (like salary) of the employee, and

the relevant tax deducted from their actual salary payment and paid across to HMRC with PAYE.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

35

Property income and the

accrued income scheme

1 Property income

EXAM SMART

For your TX exam, you need to be able to deal with:

Profits arising from the rental/lease of a property

The rent a room scheme

Furnished holiday lets

The premium received on the grant of a short lease

1.1 Profits arising from the rental/lease of a property

Individuals/partnerships are taxed on property income (rent - expenses) arising in a tax year.

The cash basis is the default method for calculating income: rent and expenses are accounted

for when cash is received and paid.

For 2019/20, rent received/expenses paid between 6 April 2019 and 5 April 2020 are used to

calculate property income.

Under the cash basis the period to which an expense/receipt relates is irrelevant.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

36 4: Property income and the accrued income scheme ACCA TX-UK

EXAM SMART

The TX examining team has said that in a question involving property income for individuals

or partnerships, the cash basis should be used unless you are specifically told the contrary.

If a landlord lets more than one property, the assessable amount in a tax year is the aggregate

of net income from all properties, excluding furnished holiday lettings (see below).

ILLUSTRATION: RENTAL INCOME

Peter lets two properties. Neither qualify as a furnished holiday let.

Property 1 was first let on 1 July 2019 at an annual rent of £12,000 per annum paid on time, quarterly

in advance.

Property 2 was let unfurnished for £500 a calendar month, payable on 8th of each month. The tenant

moved out in January owing rent from December. This rent is irrecoverable. The property was empty

from January to March, but a new tenant moved in on 8 April 2020 having paid the first month’s rent

of £600 on 1 April 2020.

Expenses incurred in respect of the two properties in the last tax year were:

Property 1 Property 2

£ £

Advertising for the new tenant – paid 10 April 2020 720

Bookkeeping and insurance – annual amounts but paid monthly 2,000 1,350

throughout the year at the end of every calendar month

Peter’s assessable rental income is:

£

Rent received (12,000 + 8 × 500 + 600) 16,600

Advertising (not paid in year) (0)

Bookkeeping and insurance (2,000 + 1,350) - paid in year (3,350)

Property income 13,250

Property income is included in the income tax computation as non-savings income, see Chapter 2.

The rules for property income received by a company are different and are covered later in

these notes. (Take care not to confuse them!)

1.1.1 Allowable deductions

Expenses incurred wholly and exclusively for a property business are allowable. These include:

(i) Insurance

(ii) Agent’s fees and other management expenses

(iii) Repairs

(iv) Interest on a loan to acquire or improve a non-residential property

The normal pre-trading expenditure rules apply to expenses incurred before the let

commences.

If the property is owner-occupied for any part of a year, expenses relating to this private use are

not allowable.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 4: Property and the accrued income scheme 37

There are special rules for capital expenditure (see below).

1.1.2 Finance costs

In general, finance costs incurred to buy or improve property are deductible. This includes

interest payable and the incidental costs of obtaining the finance, e.g. bank fees.

A restriction is being phased in, so that tax relief for finance costs in respect of residential

property (e.g. mortgage interest) is only at the basic rate.

For 2019/20, 75% of finance costs are subject to the basic rate restriction:

(i) 25% of finance costs are an allowable deduction when calculating property income.

(ii) Tax relief is given on the remaining 75% of costs at the basic rate of 20% by deduction

from the taxpayer’s income tax liability.

The restriction does not apply where the finance costs relate to a furnished holiday letting (see

below), to non-residential property (e.g. an office or warehouse), or to a company.

LECTURE EXAMPLE 4.1

Faizal let a furnished house throughout 2019/20 at a monthly rent of £1,000. The house is subject to a

repayment mortgage and Faizal paid mortgage interest of £12,000 during 2019/20. Other allowable

expenditure on the property in this tax year was £1,300.

Faizal had a salary of £90,000 in 2019/20.

Faizal’s income tax liability is:

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

38 4: Property income and the accrued income scheme ACCA TX-UK

EXAM SMART

Details of the finance cost restriction will be given in the tax rates and allowances section of

your exam.

1.1.3 Capital expenditure

Most purchases of equipment are allowable. Exceptions are:

(i) Cars.

(ii) Assets used in a residential property (but see replacement furniture relief below).

(iii) Capital expenditure on improving land and buildings. (Improvements are capital and not

allowable.)

Repairs are not capital, and are allowable.

1.1.4 Cars

Capital allowances available.

Actual motoring costs, (e.g. petrol / insurance) also deductible.

Alternatively, HMRC’s approved mileage allowances can be claimed instead of capital

allowances and actual motoring costs.

EXAM SMART

Approved mileage allowances are included in the tax rates and allowances section of the

exam.

1.1.5 Replacement furniture relief

Relief available to company landlords (see later) and to individual landlords.

Initial cost of assets used in residential property, not allowable. No capital allowances.

Replacement cost of domestic items deductible in residential let.

The property need NOT be fully furnished.

Furnishings include beds, TVs, fridges, freezers, carpets, floor coverings, crockery and cutlery.

Fixtures fixed to the property e.g. radiators and boilers do not qualify for relief.

No relief for the costs of improvement.

E.g. if a washing machine is replaced with a washer drier, only the cost of an equivalent washing

machine qualifies for relief.

Relief is reduced by proceeds from the sale of the old asset.

Relief does not apply to furnished holiday lettings or to accommodation where rent a room

relief claimed. Furniture and furnishings in such properties qualifies for capital allowances.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 4: Property and the accrued income scheme 39

LECTURE EXAMPLE 4.2

Rohan lets a furnished house for £1,000 a month. All rent is received on time.

At the start of the last tax year Rohan purchased:

£

Fridge 600

Washing machine 400

Carpets 2,000

In the last tax year the fridge was sold for £320 and replaced with a similar model costing £620. Also,

the washing machine was scrapped with nil proceeds. It was replaced with an upgraded model costing

£480, although the cost of a similar machine would have been £410.

Other allowable expenditure on the property amounted to £3,000.

Rohan’s property income is:

1.1.6 Property income – accruals basis

EXAM SMART

In the TX exam, only use the accruals basis if the question tells you to do so.

An individual/partnership:

(i) can opt to use the accruals basis.

(ii) must use the accruals basis if property income receipts exceed £150,000.

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

40 4: Property income and the accrued income scheme ACCA TX-UK

Rental income and related expenses are assessable/deductible on accruals basis in the year to

which they relate.

If a tenant leaves without paying rent, under the cash basis the amount owed is never taxed.

Under the accruals basis the amount owed is a deductible expense. The irrecoverable debt is

called an impairment loss.

Expenditure on plant and machinery is not an allowable expense using the accruals basis, but

capital allowances may be available.

Other rules on allowable expenditure operate in the same way as the cash basis.

ILLUSTRATION: PROPERTY INCOME , CASH V ACCRUALS

Kajel let a property from 1 July 2019 for a rent of £12,000 per annum paid on time, quarterly in advance.

Kajel paid allowable expenses of £200 in December 2019 relating to a burst water pipe and insurance of

£1,400 was paid in July 2019 for the year to 30 June 2020.

Property profits under the cash basis and under the accruals basis are as follows:

Cash basis Accruals basis

£ £

Rental income 12,000 9,000

Less: Allowable expenses (200) (200)

Insurance (1,400) (1,050)

Property income 10,400 7,750

1.1.7 Property losses

In a tax year profits and losses are netted against each other.

If there is an overall loss, the property income for that tax year is £NIL.

A loss is carried forward to set against the first available property profits.

1.2 Rent a room

Rent of ≤ £7,500 in a tax year from letting furnished rooms in a main residence is tax free.

Cannot be a self-contained flat in a house.

If rental income > £7,500 the taxpayer can choose to be taxed:

(i) On gross receipts less £7,500, OR

(ii) Under the normal rental income rules (i.e. rent – expenses).

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

ACCA TX-UK 4: Property and the accrued income scheme 41

LECTURE EXAMPLE 4.3

Tara rented out a furnished room in her home throughout the last tax year. She received rent of

£8,500 and incurred allowable expenditure of £2,000 in respect of this room.

Calculate Tara’s property income if:

(i) She claims rent a room relief

(ii) She does not claim rent a room relief

1.3 Furnished holiday lettings (FHL)

Treat as a trade with profits calculated for tax years.

Losses can only be carried forward against future FHL profits.

Capital allowances available on furniture (no replacement furniture relief):

100% AIA then WDA.

Income is net relevant earnings for personal pension relief (see Chapter 10).

Capital gains rollover, entrepreneurs’ and gift reliefs are available (see Chapter 14).

Conditions

Location UK/EEA property only

Available ≥ 210 days in the tax year

Occupied Actually let ≥ 105 days (if > 1 furnished holiday let, an average of 105 days qualifies all

properties)

Occupation Property not let for periods of longer-term occupation for > 155 days

pattern Longer-term occupation is > 31 days

Can let to the same person more than once if each let is not more than 31 days

Downloaded by mili sarkar (milisarkar94@gmail.com)

lOMoARcPSD|3616636

42 4: Property income and the accrued income scheme ACCA TX-UK

1.4 Lease premiums (capital sums paid to secure a lease)

If lease < 50 years part of the premium is treated by the landlord as rent received in advance.

51−D

Rent = Premium × (D = duration of lease).

50

The balance of the premium is treated as a capital disposal. This is not in the syllabus, so ignore

the balance of the premium.

ILLUSTRATION: RENT ON LEASE

Rachman granted Nick a 40-year lease for a premium of £100,000 plus an annual rent of £3,000.

Rachman’s rental income is as follows:

51−40

(1) One-off (Note) £100,000 × = £22,000

50

(2) Annual £3,000

Note: This arises in the tax year in which the lease is granted.

1.4.1 Premiums paid by traders

If traders pay a premium for a lease they can deduct a proportion of the premium each year from

taxable trading income.

Amount assessed on landlord

The annual deduction is:

Life of the lease

EXAM SMART

Remember this deduction in exam questions. Seeing traders paying lease premiums should

trigger something in your mind!

In the illustration above, Nick (the lessee, or tenant), would be allowed the rent of £3,000 per

annum as an expense and £22,000/40 = £550 per annum in respect of the premium.