4.4 Tutorial Questions 5

Uploaded by

Lee Xing4.4 Tutorial Questions 5

Uploaded by

Lee XingTutorial Questions- Acc 104

Chapter V: Relevant Costs for Decision Making

ssssssssss

I- True( T) / False ( F) Questions

1- A sunk cost arises from a past decision and cannot be avoided or changed. T

2- Relevant benefits refer to the additional or incremental revenue generated by

selecting a particular course or action over another. T

3- In a make or buy decision, management should focus on costs that are the

same under the two alternatives. F

4- Incremental costs should be considered in a make or buy decision. T

5- A markup percentage equals total costs divided by desired profit. F

6- Costs already incurred in manufacturing the units of a product that do not meet

quality standards are relevant costs in a scrap or rework decision. F

II- Multiple Choice Questions

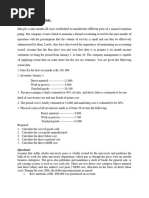

1- A company paid $200,000 ten years ago for a specialized machine that has no

salvage value and is being depreciated at the rate of $10,000 per year. The

company is considering using the machine in a new project that will have

incremental revenues of $28,000 per year and annual cash expenses of $20,000.

In analyzing the new project, the $200,000 original cost of the machine is an

example of a(n):

A. Incremental cost.

B. Opportunity cost.

C. Variable cost.

D. Sunk cost.

E. Out-of-pocket cost.

2- Product A requires 5 machine hours per unit to be produced, Product B requires

only 3 machine hours per unit, and the company’s productive capacity is limited

to 240,000 machine hours. Product A sells for $16 per unit and has variable

costs of $6 per unit. Product B sells for $12 per unit and has variable costs of $5

per unit. Assuming the company can sell as many units of either product as it

produces, the company should:

A. Produce only Product A.

B. Produce only Product B.

C. Produce equal amounts of A and B.

D. Produce A and B in the ratio of 62.5% A to 37.5% B.

E. Produce A and B in the ratio of 40% A and 60% B.

3- Minor Electric has received a special one-time order for 1,500 light fixtures

(units) at $5 per unit. Minor currently produces and sells 7,500 units at $6.00

each. This level represents 75% of its capacity. Production costs for these units

are $4.50 per unit, which includes $3.00 variable cost and $1.50 fixed cost. To

produce the special order, a new machine needs to be purchased at a cost of

$1,000 with a zero salvage value. Management expects no other changes in

costs as a result of the additional production. Should the company accept the

special order?

A. No, because net income would decrease by $1,500.

B. No, because net income would decrease by $2,000.

C. Yes, because net income would increase by $7,500.

D. Yes, because net income would increase by $2,000.

E. No, because net income would decrease by $5,500.

4- Frederick Co. is thinking about having one of its products manufactured by an

outside supplier.

Currently, the cost of manufacturing 5,000 units follows:

Direct material ............................................ $62,000

Direct labor .................................................. 47,000

Variable factory overhead……………….. 38,000

Factory overhead ......................................... 52,000

If Frederick can buy 5,000 units from an outside supplier for $130,000, it should:

A. Make the product because current factory overhead is less than $130,000.

B. Make the product because the cost of direct material plus direct labor of

manufacturing is less than $130,000.

C. Make the product because factory overhead is a sunk cost.

D. Buy the product because total fixed and variable manufacturing costs are

greater than $130,000.

E. Buy the product because the total incremental costs of manufacturing are

greater than $130,000.

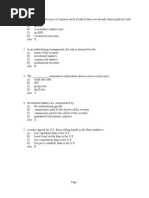

5- Soar Incorporated is considering eliminating its mountain bike division, which

reported an operating loss for the recent year of $3,000. The division sales for

the year were $1,050,000 and the variable costs were $860,000. The fixed

costs of the division were $193,000. If the mountain bike division is dropped,

30% of the fixed costs allocated to that division could be eliminated. The

impact on operating income for eliminating this business segment would be:

A. $57,900 decrease

B. $132,100 decrease

C. $54,900 decrease

D. $190,000 increase

E. $190,000 decrease

6- Granfield Company is considering eliminating its backpack division, which

reported an operating loss for the recent year of $42,000. The division sales

for the year were $960,000 and the variable costs were $475,000. The fixed

costs of the division were $527,000. If the backpack division is dropped, 40%

of the fixed costs allocated to that division could be eliminated. The impact on

Granfield’s operating income for eliminating this business segment would be:

A. $485,000 decrease

B. $210,800 increase

C. $274,200 decrease

D. $485,000 increase

E. $274,200 increase

III- Exercises

QS 10-4 Garcia Company has 10,000 units of its product that were produced last year at a

total cost of $150,000. The units were damaged in a rainstorm because the warehouse where

they were stored developed a leak in the roof. Garcia can sell the units as is for $2 each or it

can repair the units at a total cost of $18,000 and then sell them for $5 each. Should Garcia

sell the units as is or repair them and then sell them? Explain.

QS 10-5

QS 10-7 Kando Company incurs a $9 per unit cost for Product A, which it currently

manufactures and sells for $13.50 per unit. Instead of manufacturing and selling this product,

the company can purchase it for $5 per unit and sell it for $12 per unit. If it does so, unit sales

would remain unchanged and $5 of the $9 per unit costs of Product A would be eliminated.

Should the company continue to manufacture Product A or purchase it for resale?

QS 10-9 Signal mistakenly produced 1,000 defective cell phones. The phones cost $60 each to

produce. A salvage company will buy the defective phones as they are for $30 each. It would

cost Signal $80 per phone to rework the phones. If the phones are reworked, Signal could sell

them for $120 each. Assume there is no opportunity cost associated with reworking the

phones. Compute the incremental net income from reworking the phones.

QS 10-10 Holmes Company produces a product that can be either sold as is or processed

further. Holmes has already spent $50,000 to produce 1,250 units that can be sold now for

$67,500 to another manufacturer. Alternatively, Holmes can process the units further at an

incremental cost of $250 per unit. If Holmes processes further, the units can be sold for $375

each. Compute the incremental income if Holmes processes further.

QS 10-13: A guitar manufacturer is considering eliminating its electric guitar division because

its $76,000 expenses are higher than its $72,000 sales. The company reports the following

expenses for this division. Should the division be eliminated?

QS 10-15 Rory Company has a machine with a book value of $75,000 and a remaining five-

year useful life. A new machine is available at a cost of $112,500, and Rory can also receive

$60,000 for trading in its old machine. The new machine will reduce variable manufacturing

costs by $13,000 per year over its five-year useful life. Should the machine be replaced?

-,

You might also like

- Budget Exercises - Part II (Model Answers)No ratings yetBudget Exercises - Part II (Model Answers)7 pages

- A Company Makes A Range of Products With Total BudgetedNo ratings yetA Company Makes A Range of Products With Total Budgeted2 pages

- Which of The Following Is Not An Input Device100% (1)Which of The Following Is Not An Input Device11 pages

- ACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 2No ratings yetACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 213 pages

- Excel Skills For Data Analytics and Visualization: InstructionsNo ratings yetExcel Skills For Data Analytics and Visualization: Instructions7 pages

- Comparing Adjectives: Complete Each Sentence With The Correct Form of The Adjective in The Parentheses100% (1)Comparing Adjectives: Complete Each Sentence With The Correct Form of The Adjective in The Parentheses2 pages

- Advanced Financial Accounting II Chapter Three Accounting For SalesNo ratings yetAdvanced Financial Accounting II Chapter Three Accounting For Sales50 pages

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryNo ratings yetD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process Inventory9 pages

- Daily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 DaysNo ratings yetDaily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 Days5 pages

- KH Tax Guide To Taxation in Cambodia 2020No ratings yetKH Tax Guide To Taxation in Cambodia 202030 pages

- Cambodian 2018 Tax Booklet: A Summary of Cambodian TaxationNo ratings yetCambodian 2018 Tax Booklet: A Summary of Cambodian Taxation26 pages

- Mara Lavin - Topic 003 Tutorial Questions - Consumer DecisionNo ratings yetMara Lavin - Topic 003 Tutorial Questions - Consumer Decision3 pages

- Homework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past Month100% (1)Homework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past Month3 pages

- The Karnataka Coop Socities Rules, 2013No ratings yetThe Karnataka Coop Socities Rules, 201356 pages

- En Koodave Irum O Yesuve - Tamil Christian Song Keyboard Notation Notes PDF-Kve MusicNo ratings yetEn Koodave Irum O Yesuve - Tamil Christian Song Keyboard Notation Notes PDF-Kve Music1 page

- 10th Samacheer Kalvi Maths EM Public Exam QP Sample 4 PDFNo ratings yet10th Samacheer Kalvi Maths EM Public Exam QP Sample 4 PDF4 pages

- Marine Pollution Assignment 2 Inc. Front SheetNo ratings yetMarine Pollution Assignment 2 Inc. Front Sheet2 pages

- Polisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. OtorrinolaringologíaNo ratings yetPolisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. Otorrinolaringología25 pages

- Climate Protection and Environmental Interests in Renewable Energy Law: Perspectives From Brazil and Germany Paula Galbiatti Silveira100% (2)Climate Protection and Environmental Interests in Renewable Energy Law: Perspectives From Brazil and Germany Paula Galbiatti Silveira49 pages

- Attachment 2 GRD Request and Inquiry FormRIF 2No ratings yetAttachment 2 GRD Request and Inquiry FormRIF 22 pages

- FAR 113 Organic Chemistry: Practical 1 Preparation of P-Nitroacetanilide100% (2)FAR 113 Organic Chemistry: Practical 1 Preparation of P-Nitroacetanilide10 pages

- Session 3 (Quantitative Techniques - Sample Paper 2)No ratings yetSession 3 (Quantitative Techniques - Sample Paper 2)14 pages

- A Company Makes A Range of Products With Total BudgetedA Company Makes A Range of Products With Total Budgeted

- ACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 2ACCT 2302 Summer II, 2007 Exam 3 Chapter 10-13: Answer: C Level: Easy LO: 2

- Excel Skills For Data Analytics and Visualization: InstructionsExcel Skills For Data Analytics and Visualization: Instructions

- Comparing Adjectives: Complete Each Sentence With The Correct Form of The Adjective in The ParenthesesComparing Adjectives: Complete Each Sentence With The Correct Form of The Adjective in The Parentheses

- Advanced Financial Accounting II Chapter Three Accounting For SalesAdvanced Financial Accounting II Chapter Three Accounting For Sales

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process Inventory

- Daily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 DaysDaily 500 Maximum 2500 Minimum 1000 Lead Time 15 Days EOQ 1200 Emergency Lead Time 3 Days

- Cambodian 2018 Tax Booklet: A Summary of Cambodian TaxationCambodian 2018 Tax Booklet: A Summary of Cambodian Taxation

- Mara Lavin - Topic 003 Tutorial Questions - Consumer DecisionMara Lavin - Topic 003 Tutorial Questions - Consumer Decision

- Homework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past MonthHomework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past Month

- En Koodave Irum O Yesuve - Tamil Christian Song Keyboard Notation Notes PDF-Kve MusicEn Koodave Irum O Yesuve - Tamil Christian Song Keyboard Notation Notes PDF-Kve Music

- 10th Samacheer Kalvi Maths EM Public Exam QP Sample 4 PDF10th Samacheer Kalvi Maths EM Public Exam QP Sample 4 PDF

- Polisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. OtorrinolaringologíaPolisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. Otorrinolaringología

- Climate Protection and Environmental Interests in Renewable Energy Law: Perspectives From Brazil and Germany Paula Galbiatti SilveiraClimate Protection and Environmental Interests in Renewable Energy Law: Perspectives From Brazil and Germany Paula Galbiatti Silveira

- FAR 113 Organic Chemistry: Practical 1 Preparation of P-NitroacetanilideFAR 113 Organic Chemistry: Practical 1 Preparation of P-Nitroacetanilide

- Session 3 (Quantitative Techniques - Sample Paper 2)Session 3 (Quantitative Techniques - Sample Paper 2)