FM MITSoB Capital - Budgeting Exercises)

FM MITSoB Capital - Budgeting Exercises)

Uploaded by

Saket SumanCopyright:

Available Formats

FM MITSoB Capital - Budgeting Exercises)

FM MITSoB Capital - Budgeting Exercises)

Uploaded by

Saket SumanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FM MITSoB Capital - Budgeting Exercises)

FM MITSoB Capital - Budgeting Exercises)

Uploaded by

Saket SumanCopyright:

Available Formats

Exercises on Capital Budgeting

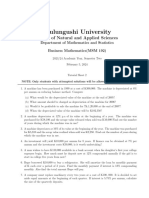

1. The following two machines are mutually exclusive and the firm would be required to

replace the same whatever machine it buys. Machine A would be replaced every 4 years,

machine B every 3 years. The cash flows associated with each machine are tabulated as

follows; all numbers are in „Rupee („0,000)‟; the relevant discount rate is 10% for both

machines.

Year M/c A M/c B

0 (80) (100)

1 50 60

2 50 60

3 50 60

4 25 -

(a) Which of the two machines is the better investment project?

(b) Reassess the better investible machine, analyzing the question under the assumption

that, whatever machine the company buys has to be reinvested in perpetuity.

(c) Suppose machine A fits current technology, whereas machine B needs a one-time re-

tooling for the company. These one-off installation costs would be Rs. 100,000 today.

What is the optimal investment decision now?

(d) Suppose the firm has an old machine in place that would serve for another two years.

They can postpone investing in either machine A or B and keep using this machine.

When should they stop using the old machine? Cash flows for the old machine are:

Year Cash Flow

1 50

2 20

3 0

(e) Suppose the investment opportunity described above lasts only for 24 years.

Recalculate your decision rule for questions (b) and (c). What is the NPV of the

optimal investment policy now?

1 MIT-SOB Batch 27 : Course ‘Financial Management’

Exercises on Capital Budgeting

2. (a) A corporation is considering purchasing a machine that has an expected eight-year

life and will generate for the firm Rs. 110,000 per year in net operating income before

taxes. The machine will be depreciated using the straight-line method to its anticipated

salvage value of Rs. 120,000. The firm has a 34% marginal tax rate and the required

return for this project is 12% p.a. If the machine costs Rs. 600,000, should it be

purchased?

(b) Another machinery salesman comes by the company's office and says that he is

willing to negotiate the purchase price of the machine described in the previous

question. What is the maximum price the firm is willing to pay for the machine?

[Hint: the price of the machine determines the level of depreciation and therefore

the taxes that the firm pays].

3. A company is trying to determine an optimal replacement policy for a piece of its

equipment. The cost of the machine is Rs. 150,000 and the annual maintenance costs

are Rs. 10,000 in the first year, Rs. 20,000 in the second year and Rs. 3,000 in the third

year. Anticipated salvage values are Rs. 60,000, Rs. 30,000 and Rs. 0 at the end of years

1 through 3, respectively. Assume that the company's revenues are unaffected by the

replacement policy and that the firm has a 34% tax rate; required return on this project

is 12% and uses a straight-line depreciation. Should the equipment be replaced every

year, every second year, or every third year? Be sure to explicitly consider the

depreciation and tax effects.

4. Better Cement Ltd. is considering an investment opportunity that requires an initial

outlay equal to Rs. 5,750,000. In years 1 and 2 the net cash flows are expected to equal

Rs. 5,000,000. The required rate of return is 25% p.a.

(a) Given that the BCL's criterion whether to invest or not is the project's internal

rate of return (IRR), should the company‟s managers invest in this project? Is

IRR criterion the correct decision rule in this case? If not, which criterion should

have been used?

(b) After observing the managers' decision, a shrewd businessman offers the

managers of BCL. the following modified project. The businessman offers that

the company will pay the initial outlay Rs. 5,750,000 only in year 2 and receive

the Rs. 5,000,000 in years 0 and 1. As a compensation for receiving this offer, the

businessman proposes that the company pay him Rs. 11,000,000 in year 3. BCL's

CFO argues that according to the IRR criterion the proposal is profitable since

the 25% required rate of return is lower than the new IRR for this investment. Is

the CFO correct in his argument that the required rate of return is lower than the

IRR? Does this decision rule lead to optimal investment by the company?

2 MIT-SOB Batch 27 : Course ‘Financial Management’

Exercises on Capital Budgeting

5. Natural Fashions Ltd. is looking at setting up a new manufacturing plant to produce

apparel made from man-made fiber. The company bought some land six years ago for

Rs. 5,000,000 in anticipation of using it as a warehouse and distribution site, but the

company decided not to build the warehouse at that time. This seemed the right

decision at the time since they were sentenced to six years in prison for another type of

“distribution” in which they were involved. The land was appraised last week for Rs.

5,500,000. The company wants to build its new manufacturing plant on this land; The

plant will cost Rs. 17 million to build, and the site requires Rs. 2,500,000 worth of

grading before it is suitable for construction. What is the proper cash flow amount to use

as the initial investment in fixed assets when evaluating this project? Why?

Now if you are evaluating this project with the following cash flows (in „000):

CF0 CF1 CF2 CF3 CF4 CF5

(25,000) 6,000 7,000 (4,000) 15,000 10,000

(a) Assume a required rate of return of 10%. Find the NPV? Also find the Payback?

(b) Should you calculate the project‟s IRR? Why or why not? Find the MIRR?

6. A project has the following cash flows: (assume a required rate of return of 10%)

CF0 CF1 CF2 CF3 CF4 CF5

(100,000) 40,000 40,000 60,000 (20,000) 10,000

(a) Can you use IRR to determine if this is an attractive project? Why or why not?

(b) Calculate the MIRR for this project.

7. Daily Breaking News Corporation is evaluating whether to replace a printing press with

a newer model, which, owing to more efficient operation, will reduce operating costs

from Rs. 400,000 to Rs. 320,000 per year. Sales are not expected to change. The old

press cost Rs. 600,000 when purchased five years ago, had an estimated useful life of 15

years, zero salvage value at the end of its useful life and is being depreciated straight-

line. At present, its market value is estimated to be Rs. 400,000, if sold outright. The

new press costs Rs. 800,000 and would be depreciated straight-line to zero salvage over

a ten-year life. However, management expects to be able to sell the new press for Rs.

150,000 at the end of ten years. The corporation has a 40% marginal tax rate and a cost

of capital of 15%. What should management do?

3 MIT-SOB Batch 27 : Course ‘Financial Management’

You might also like

- Traders Reality Guidebook Skippers Undertanding V5Document16 pagesTraders Reality Guidebook Skippers Undertanding V5Octavio PicconeNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Corporate Financing Decisions, Spring 2016Document4 pagesCorporate Financing Decisions, Spring 2016Ashok BistaNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar50% (2)

- AL Financial Management Nov Dec 2013Document4 pagesAL Financial Management Nov Dec 2013hyp siinNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Corporate Financing Decisions, Fall 2016Document4 pagesCorporate Financing Decisions, Fall 2016Ashok BistaNo ratings yet

- Capital Budgeting (2)Document6 pagesCapital Budgeting (2)luu14948No ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- CA INTER E3Document6 pagesCA INTER E3guptaravi7540No ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- 402 - Corporate Financial ManagementDocument2 pages402 - Corporate Financial Managementmahmudhasan5051No ratings yet

- HCPM Tutorial 6 Project Finance and AppraisalDocument3 pagesHCPM Tutorial 6 Project Finance and AppraisalAjay MeenaNo ratings yet

- Ps Capital Budgeting PDFDocument7 pagesPs Capital Budgeting PDFcloud9glider2022No ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- NPV f15 Qs StuDocument10 pagesNPV f15 Qs Stumuhammadahsanriaz223No ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- Dfi 305 - DL Assg July 2012Document6 pagesDfi 305 - DL Assg July 2012jhouvanNo ratings yet

- FINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Document17 pagesFINANCIAL MANAGEMENT PAPER 2.4 Nov 2018Nana DespiteNo ratings yet

- Exercises (Capital Budgeting)Document2 pagesExercises (Capital Budgeting)bdiitNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- December 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Document5 pagesDecember 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Eashan YadavNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Additional Question Sheet LawiDocument27 pagesAdditional Question Sheet LawiPratyusha khareNo ratings yet

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyNo ratings yet

- A Mining Company Is Considering To Open A New Coal MineDocument4 pagesA Mining Company Is Considering To Open A New Coal MineD Y Patil Institute of MCA and MBANo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Capital Budgeting3Document1 pageCapital Budgeting3Avishek GhosalNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- 440 Mid 1 - Fall 2020Document21 pages440 Mid 1 - Fall 2020tanvir.ahammad01688No ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- Financial Management-P III - Nov 08Document4 pagesFinancial Management-P III - Nov 08gundapolaNo ratings yet

- Adfm Iii 2015-17Document3 pagesAdfm Iii 2015-17Nithyananda PatelNo ratings yet

- Unit IiDocument15 pagesUnit IiSamuNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- 06.08.24 - FM Full CourseDocument4 pages06.08.24 - FM Full Coursepulkitmansinghka2631No ratings yet

- CF Assignment 2Document2 pagesCF Assignment 2Ambika SharmaNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Agreement Estate Agent Commission CC SaleDocument2 pagesAgreement Estate Agent Commission CC SaleJazel Tulabing100% (1)

- Toa Quizzer 1: Multiple ChoiceDocument18 pagesToa Quizzer 1: Multiple ChoiceRukia KuchikiNo ratings yet

- Trailer Station USA - Your Ultimate Destination For Premium Trailers in The USADocument6 pagesTrailer Station USA - Your Ultimate Destination For Premium Trailers in The USAShira CarrollNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document30 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)swapnil deokarNo ratings yet

- AEA Architecrts Fee ScaleDocument3 pagesAEA Architecrts Fee Scalek100% (1)

- Job Order CostingDocument63 pagesJob Order CostingGhillian Mae GuiangNo ratings yet

- Dell Inc: By-Group 8 Surbhi Swarnim Swati VivekDocument13 pagesDell Inc: By-Group 8 Surbhi Swarnim Swati VivekDicky FirmansyahNo ratings yet

- Compendium of Customs ValuationDocument122 pagesCompendium of Customs ValuationJerzy OzNo ratings yet

- PFRDocument31 pagesPFRadiadzzNo ratings yet

- Afzal ReceiptDocument2 pagesAfzal Receiptakhil gargNo ratings yet

- Research Newsletter 2017 FinalDocument82 pagesResearch Newsletter 2017 FinalS mukherjeeNo ratings yet

- MAN704 - Relative Valuation ExercisesDocument2 pagesMAN704 - Relative Valuation Exercises3945305No ratings yet

- Junsea Perfume Collection: Business PlanDocument9 pagesJunsea Perfume Collection: Business PlanMirasol ManaoatNo ratings yet

- Module 1 Case 6 Supersonic Stereo Certified Millennial AccountantsDocument4 pagesModule 1 Case 6 Supersonic Stereo Certified Millennial AccountantsKrystel Joie Caraig ChangNo ratings yet

- Lesson 9. Describe An ObjectDocument10 pagesLesson 9. Describe An ObjectNT Thanh HằngNo ratings yet

- RIL IR2022 FinancialPerformanceDocument10 pagesRIL IR2022 FinancialPerformanceMansiNo ratings yet

- Group 1 American Greetings ReportDocument13 pagesGroup 1 American Greetings Reportshershah hassan100% (1)

- Gillette Dry IdeaDocument12 pagesGillette Dry IdeaShruti PandeyNo ratings yet

- Econ 201 Microeconomic Theory Problem Set #1 Due March 1Document3 pagesEcon 201 Microeconomic Theory Problem Set #1 Due March 1Usman HussainNo ratings yet

- Accounting For Inventory - General Concepts (Including Idle Capacity)Document7 pagesAccounting For Inventory - General Concepts (Including Idle Capacity)Eunice WongNo ratings yet

- Activity Answer Unit 1Document34 pagesActivity Answer Unit 1owiangNo ratings yet

- FI-MM Integration ConfigurationDocument20 pagesFI-MM Integration ConfigurationKashif IhsanNo ratings yet

- FY - IB, PE&VC PrimerDocument17 pagesFY - IB, PE&VC PrimerAkash MenonNo ratings yet

- CA Inter Adv Account A MTP 1 Nov23 Castudynotes ComDocument16 pagesCA Inter Adv Account A MTP 1 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- Ratio Analysis Mini Case ModelDocument3 pagesRatio Analysis Mini Case ModelSammir MalhotraNo ratings yet

- Daniel F Spulber-The Theory of The Firm - Microeconomics With Endogenous Enterprises, Firms, Markets and Organizations-Cambridge University Press (2009) PDFDocument540 pagesDaniel F Spulber-The Theory of The Firm - Microeconomics With Endogenous Enterprises, Firms, Markets and Organizations-Cambridge University Press (2009) PDFmirianalbertpires100% (1)

- NAME: - Score: - GRADE & SECTION - TeacherDocument2 pagesNAME: - Score: - GRADE & SECTION - TeacherJessel CarilloNo ratings yet

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- Supply Chain in Retail IndustryDocument56 pagesSupply Chain in Retail IndustrySrinivas ThotaNo ratings yet