Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Uploaded by

RCopyright:

Available Formats

Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Uploaded by

ROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018

Uploaded by

RCopyright:

Available Formats

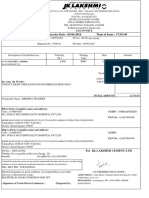

AGAINST LOA : BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.

2018

Tax Invoice

Invoice No. BCPL/19-20/0099

Invoice Date: 3/17/2020 Date of Supply: NORTH EAST ZONE-1

REVERSE CHARGE : N Place of Supply: NORTH EAST ZONE-1

Address of Delivery: NORTH EAST ZONE-1

Details of the Service Provider : Details of the Service Receipient

Name: SAR PARIVAHAN PVT. LIMITED Name: BRAHMAPUTRA CRAKER & POLYMER LTD.

Address: OM TOWER, 32 CHOWRINGHEE ROAD, Address: LEPETKATA,

3RD FLOOR, ROOM NO. : 304,KOLKATA-700071 DIBRUGARH,

GSTIN N.A. ASSAM.

State: WEST BENGAL

PAN NO. AAHCS3892C GSTIN 18AADCB2356E1ZY

GSTIN 19AAHCS3892C3Z2 State: ASSAM Code 18

VENDOR CODE : 17000029 SAC CODE : 996791

BEING THE COST OF TRANSPORTATION OF MATERIAL FROM LEPETKATA TO NORTH EAST ZONE-1

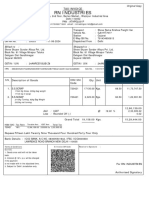

SL. NO. DATE CN NO INV.NO DOC NO. DEST. DLY DT LORRY NO PKG WEIGHT RATE / MT. Taxable IGST @12% TOTAL AMOUNT

Freight (Rs.)

1 2/3/2020 55837 192000004589 9010012816 GUWAHATI 2/5/2020 AS01DD9961 400 10.000 1620.60 16206.00 1944.72 18150.72

2 2/3/2020 55838 191000009983 7010032857 BURNIHAT 2/5/2020 AS01LC3084 800 20.000 1569.50 31390.00 3766.80 35156.80

3 2/10/2020 58472 192000004754 9010012981 GUWAHATI 2/14/2020 AS01DC9275 360 9.000 1620.60 14585.40 1750.25 16335.65

4 2/14/2020 58474 191000010198 7010032967 GUWAHATI 2/17/2020 AS01LC8603 480 12.000 1620.60 19447.20 2333.66 21780.86

5 2/14/2020 58475 191000010199 7010032968 GUWAHATI 2/17/2020 AS25EC2705 480 12.000 1620.60 19447.20 2333.66 21780.86

6 2/14/2020 58476 191000010200 7010032969 GUWAHATI 2/17/2020 AS01KC0449 LOOSE 11.970 1620.60 19398.58 2327.83 21726.41

7 2/14/2020 58477 191000010201 7000032970 GUWAHATI 2/16/2020 AS01LC3084 800 20.000 1620.60 32412.00 3889.44 36301.44

TOTAL 94.97 11293.10 152886.38 18346.37 171232.75

Total Invoice Amount in words Total Amount R/O 171233

(INCLUSIVE OF IGST@12%)

Rupees : ONE LAKH SEVENTY ONE THOUSAND TWO HUNDRED THIRTY THREE only.

CONSIGHNOR /SERVICE RECEIPIENT IS LIABLE TO PAY GST ON FCM BASIS

N.B: ALL COMPALINTS SHOULD BE REPORTED WITHIN A WEEK. IF THE BILL Certified that the particulars given above are true and correct

For SAR PARIVAHAN PVT. LTD

IS NOT PAID WITHIN 30 DAYS FROM THE DATE OF C.N INTEREST WILL BE

CHARGES @ 18% PER ANNUM

ENCLOSED SIGNED CHALLAN/G.R.NO. : AS ABOVE.

Authorised signatory

You might also like

- Global Politics Higher Level and Standard Level Paper 1: Instructions To Candidates (25 Marks)Document4 pagesGlobal Politics Higher Level and Standard Level Paper 1: Instructions To Candidates (25 Marks)Naif MeshaalNo ratings yet

- Comercial InvoiceDocument1 pageComercial Invoicepatel vimalNo ratings yet

- (Signature of Truck Driver/Conductor) (Prepared By)Document11 pages(Signature of Truck Driver/Conductor) (Prepared By)patel vimalNo ratings yet

- CervusDocument15 pagesCervusLourdes BolaosNo ratings yet

- Anushka Trading Company - TamkuhiroadDocument8 pagesAnushka Trading Company - TamkuhiroadgkpdispatchNo ratings yet

- BS-297 Date: 26/11/2024 Bill No:: Baba Naga Agro PVT LTD Unit-2Document1 pageBS-297 Date: 26/11/2024 Bill No:: Baba Naga Agro PVT LTD Unit-2aryanbhaimeraNo ratings yet

- MILLP 48Document2 pagesMILLP 48abhisekmaj351No ratings yet

- 1102596624Document1 page1102596624gopalchoudharychakNo ratings yet

- Accounting VoucherDocument4 pagesAccounting Voucherkrishanarora1994No ratings yet

- Rudra Enterprises - KanpurDocument2 pagesRudra Enterprises - KanpurgkpdispatchNo ratings yet

- Shreyansh Traders (RKSK) - VaranasiDocument8 pagesShreyansh Traders (RKSK) - VaranasigkpdispatchNo ratings yet

- Bipl 670Document3 pagesBipl 670Amitabh PatraNo ratings yet

- Sri Ram Traders - AyodhyaDocument8 pagesSri Ram Traders - AyodhyagkpdispatchNo ratings yet

- 017 HCDocument3 pages017 HCAmitabh PatraNo ratings yet

- 1502 DacDocument3 pages1502 DacAmitabh PatraNo ratings yet

- Swadeshi Agro - MadhoganjDocument1 pageSwadeshi Agro - MadhoganjgkpdispatchNo ratings yet

- Urvish Traders - BhagalpurDocument8 pagesUrvish Traders - BhagalpurgkpdispatchNo ratings yet

- Montage Enterprises PVT LTD.: Tax InvoiceDocument1 pageMontage Enterprises PVT LTD.: Tax Invoicewasu sheebuNo ratings yet

- Spf to Kissan Steels Pvt LtdDocument2 pagesSpf to Kissan Steels Pvt LtdPawan KadyanNo ratings yet

- Bipl 671Document3 pagesBipl 671Amitabh PatraNo ratings yet

- SalesBill GT 930Document1 pageSalesBill GT 930pkNo ratings yet

- 217 JKMDocument3 pages217 JKMAmitabh PatraNo ratings yet

- 24735631Document3 pages24735631rahulmaghade777637No ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- RSB InvoiceDocument1 pageRSB InvoiceHardik JaiswalNo ratings yet

- 019 HCDocument3 pages019 HCAmitabh PatraNo ratings yet

- SalesBill GT 316Document1 pageSalesBill GT 316Ideally VisionNo ratings yet

- Tax Invoice: 33aebe412fd94f90e17Document2 pagesTax Invoice: 33aebe412fd94f90e17tejasviNo ratings yet

- 1498 OaDocument3 pages1498 OaAmitabh PatraNo ratings yet

- 218 TDDocument3 pages218 TDAmitabh PatraNo ratings yet

- M.d.packers - AgraDocument2 pagesM.d.packers - AgragkpdispatchNo ratings yet

- Screenshot 2020-03-18 at 11.13.01 AM PDFDocument2 pagesScreenshot 2020-03-18 at 11.13.01 AM PDFKartik MathukiyaNo ratings yet

- 125 JKMDocument3 pages125 JKMAmitabh PatraNo ratings yet

- RSB Invoice 3Document1 pageRSB Invoice 3Hardik JaiswalNo ratings yet

- 0573Document3 pages0573office.wardhanextrusionsNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicecometprinterNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- GRRB 6034Document3 pagesGRRB 6034Amitabh PatraNo ratings yet

- Pure Plastic - KolkataDocument4 pagesPure Plastic - KolkatagkpdispatchNo ratings yet

- Tarit Kr Sinha InvoiceDocument1 pageTarit Kr Sinha InvoiceKanhaiya TiwaryNo ratings yet

- Abhinandan Traders - NichlaulDocument4 pagesAbhinandan Traders - NichlaulgkpdispatchNo ratings yet

- RN - Sales RN 24 25 10Document1 pageRN - Sales RN 24 25 10rntradingco145No ratings yet

- Tax Invoice Cum Delivery ChallanDocument2 pagesTax Invoice Cum Delivery ChallanLazzieey RahulNo ratings yet

- Chhappan Bhog - LucknowDocument4 pagesChhappan Bhog - LucknowgkpdispatchNo ratings yet

- 126 JKMDocument3 pages126 JKMAmitabh PatraNo ratings yet

- 021 OaDocument3 pages021 OaAmitabh PatraNo ratings yet

- 664 ApDocument3 pages664 ApAmitabh PatraNo ratings yet

- SalesBill GT 1020Document1 pageSalesBill GT 1020pkNo ratings yet

- SUPHAL CH PAL INVOICEDocument1 pageSUPHAL CH PAL INVOICEKanhaiya TiwaryNo ratings yet

- 1505 OaDocument3 pages1505 OaAmitabh PatraNo ratings yet

- Tax Invoice: 470a320452e533ab8fDocument2 pagesTax Invoice: 470a320452e533ab8ftejasviNo ratings yet

- Delivery Challan: DI No.: DI Date: Order No.: L26943RJ1979PLC001935Document1 pageDelivery Challan: DI No.: DI Date: Order No.: L26943RJ1979PLC001935perfectdanish1604No ratings yet

- JJP 668Document3 pagesJJP 668Amitabh PatraNo ratings yet

- Salem AutoDocument1 pageSalem AutosalemautotirupurNo ratings yet

- 667 MpaDocument3 pages667 MpaAmitabh PatraNo ratings yet

- COAL BILL AML MGR (RHSTPP) - CN - Sept To Nov'20 - 29092021Document9 pagesCOAL BILL AML MGR (RHSTPP) - CN - Sept To Nov'20 - 29092021VIKASH TIWARYNo ratings yet

- Anandeshwar Enterprises - KanpurDocument8 pagesAnandeshwar Enterprises - KanpurgkpdispatchNo ratings yet

- BillDocument1 pageBillchethan sharmabgNo ratings yet

- 5424INVDocument1 page5424INVindrajitsbs1994No ratings yet

- Star Rope Store - ShazadpurDocument4 pagesStar Rope Store - ShazadpurgkpdispatchNo ratings yet

- Tax Invoice: 827e98c13423a519e7dcDocument2 pagesTax Invoice: 827e98c13423a519e7dctejasviNo ratings yet

- Kode TerbilangDocument3 pagesKode Terbilangsukra wardiNo ratings yet

- Solution To Poultry FarmDocument291 pagesSolution To Poultry Farmbankole100% (3)

- The 2016 Hays Asia Salary GuideDocument112 pagesThe 2016 Hays Asia Salary GuidekevinjunNo ratings yet

- NITI AayogDocument11 pagesNITI AayogRajesh YenugulaNo ratings yet

- BDP Express Car Service CentreDocument39 pagesBDP Express Car Service CentreKiran ShresthaNo ratings yet

- Praveen Kumar Policing The Police Quota SystemDocument3 pagesPraveen Kumar Policing The Police Quota Systemapi-3764705No ratings yet

- Rajasthan Micro Finance Report 2010Document96 pagesRajasthan Micro Finance Report 2010Pranay BhargavaNo ratings yet

- OSU ListDocument6 pagesOSU ListyogitaanosalesNo ratings yet

- 2023 Intern Guide 1685796236Document17 pages2023 Intern Guide 1685796236Krishan SapariaNo ratings yet

- No: DMRC/Elect/Tender/Kochi/KE14 Date:24 April'2014: (Modified)Document3 pagesNo: DMRC/Elect/Tender/Kochi/KE14 Date:24 April'2014: (Modified)2011kumarNo ratings yet

- 2 The Scope and Potential of Services Trade in Developing CountriesDocument1 page2 The Scope and Potential of Services Trade in Developing CountriesArun muraliNo ratings yet

- Theoretical Framework of E-Business Competitiveness: SciencedirectDocument6 pagesTheoretical Framework of E-Business Competitiveness: SciencedirectAnonymous JmeZ95P0No ratings yet

- Sri Lanka Tourist Board Annual Statistical Report 2006Document56 pagesSri Lanka Tourist Board Annual Statistical Report 2006rockstarlk100% (5)

- IDBIDocument10 pagesIDBIsplhuf19No ratings yet

- Towards Urban Design ManifestoDocument9 pagesTowards Urban Design ManifestodawsonNo ratings yet

- 421 IFM NotesDocument55 pages421 IFM NotesJ.M Sai TejaNo ratings yet

- Peasants Movement A Social RevolutionDocument9 pagesPeasants Movement A Social RevolutionSUBHASISH DASNo ratings yet

- Sustainability in Energy Buildings - MowittDocument1,091 pagesSustainability in Energy Buildings - MowittLeonardo Ramirez0% (1)

- Problems and Prospects of Exporting Jute From BangladeshDocument25 pagesProblems and Prospects of Exporting Jute From BangladeshNurul Absar RashedNo ratings yet

- The Causal Relationship Between Financial Decisions and Their Impact On Financial PerformanceDocument2 pagesThe Causal Relationship Between Financial Decisions and Their Impact On Financial PerformancececepNo ratings yet

- All Data, Dates & Events. Sunil Panda Sir - 35100146 - 2024 - 05!08!16 - 52Document7 pagesAll Data, Dates & Events. Sunil Panda Sir - 35100146 - 2024 - 05!08!16 - 52Saksham AgarwalNo ratings yet

- Checklist For All Loan TypesDocument2 pagesChecklist For All Loan TypesSedaka DonaldsonNo ratings yet

- Factors Affecting Tax Complianceof MSMEsin Dipolog CityDocument15 pagesFactors Affecting Tax Complianceof MSMEsin Dipolog CityMANZANO, Isaiah Keith C.No ratings yet

- The Trakas Plan - Energy Policy - FinalDocument6 pagesThe Trakas Plan - Energy Policy - FinalwmdtvmattNo ratings yet

- Relative Resource EfficiencyDocument19 pagesRelative Resource EfficiencyNathaniel RemendadoNo ratings yet

- ETOP Unit IIIDocument35 pagesETOP Unit IIIAditya KumarNo ratings yet

- User ManualDocument3 pagesUser ManualCheema HnpsNo ratings yet

- Master Nilai in Class TAS Batch 15-6Document21 pagesMaster Nilai in Class TAS Batch 15-6YUSRON RAMADANINo ratings yet