0 ratings0% found this document useful (0 votes)

1K viewsQuestions

The document provides comparative balance sheet data for Roadway Corporation and Rondo Corporation for the years 2015 and 2016. It includes assets, liabilities, and equity amounts. It also provides instructions to analyze the financial data through horizontal and vertical analysis for Roadway, and to calculate various financial ratios for Rondo for 2016, including current ratio, acid test ratio, inventory turnover, profit margin, asset turnover, return on assets, and debt to asset ratio.

Uploaded by

Sneha Giji SajiCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

1K viewsQuestions

The document provides comparative balance sheet data for Roadway Corporation and Rondo Corporation for the years 2015 and 2016. It includes assets, liabilities, and equity amounts. It also provides instructions to analyze the financial data through horizontal and vertical analysis for Roadway, and to calculate various financial ratios for Rondo for 2016, including current ratio, acid test ratio, inventory turnover, profit margin, asset turnover, return on assets, and debt to asset ratio.

Uploaded by

Sneha Giji SajiCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

You are on page 1/ 2

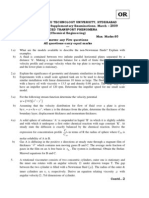

1.

The comparative Balance sheets of Roadway Corporation are presented below

Roadway Corporation

The comparative Balance sheets

December, 31

Assets and liabilities 2016(Rs.) 2015(Rs.)

Assets

Current assets 76,000 80,000

Property, plant and equipment 99,000 90,000

Intangibles 25,000 40,000

Total assets 2,00,000 2,10,000

Liabilities and Owner’s equity 40,800 48,000

Current liabilities 1,43,000 1,50,000

Long-term liabilities 16,200 12,000

Shareholder’s equiy

2,00,000 2,10,000

Total Liabilities and Owner’s equity

(a) Prepare a horizontal analysis of the balance sheet data for Roadway corporation, using 2015 as

the base

(b) Prepare a vertical analysis of the balance sheet data for Roadway corporation, for 2016

2. Rondo Corporation’s comparative Balance sheets are presented below

Rondo Corporation

The comparative Balance sheets

December, 31

Assets and liabilities 2016(Rs.) 2015(Rs.)

Cash 5,300 3,700

Accounts receivable 21,200 23,400

Inventory 9,000 7,000

Land 20,000 26,000

Buildings 70,000 70,000

Accumulated depreciation – buildings (15,000) (10,000)

1,10,500 1,20,100

Total 10,370 31,100

Accounts payable 75,000 69,000

Common stock 25,130 20,000

Retained earnings

1,10,500 1,20,100

Total

Rondo’s 2016 income statement included net sales of Rs.1,20,000, cost of goods sold of Rs.70,000 and

net income of Rs. 14,000. Compute the following ratios for 2016

(a) Current ratio,(b) acid test ratio (c ) accounts receivable turnover,(d) inventory turnover

(e) profit margin, (f) asset turnover (g) return on assets (h) return on shareholder’s equity and(i)

debt to asset ratio

You might also like

- DEMO RELIANCE Application Form - GET 2022No ratings yetDEMO RELIANCE Application Form - GET 20224 pages

- Ester Industries LTD.: Internship Training ReportNo ratings yetEster Industries LTD.: Internship Training Report18 pages

- Three Stage Model of Service Consumption PDFNo ratings yetThree Stage Model of Service Consumption PDF50 pages

- TWI CSWIP Welding Inspection - Steel (Course WIS-5)No ratings yetTWI CSWIP Welding Inspection - Steel (Course WIS-5)182 pages

- Daily Points To Recall (Day 5) : Set (R+0.6T)No ratings yetDaily Points To Recall (Day 5) : Set (R+0.6T)2 pages

- Tutorial 7: Polymers: Phy 351 (Materials Science)No ratings yetTutorial 7: Polymers: Phy 351 (Materials Science)3 pages

- Project Report on ELECTRIC SWITCHES PLUGS, SOCKETS, UCB CABLE, LAMP HOLDER ETC.No ratings yetProject Report on ELECTRIC SWITCHES PLUGS, SOCKETS, UCB CABLE, LAMP HOLDER ETC.7 pages

- FDM Process Parameters Influence Over The Mechanical Properties of Polymer SpecimenNo ratings yetFDM Process Parameters Influence Over The Mechanical Properties of Polymer Specimen10 pages

- CAIRN-TSG-L-SP-0011-B2-Specification For Application of Torque For Flange JointsNo ratings yetCAIRN-TSG-L-SP-0011-B2-Specification For Application of Torque For Flange Joints13 pages

- Production of Furfural: Overview and Challenges: January 2012No ratings yetProduction of Furfural: Overview and Challenges: January 201211 pages

- Construction of 1 X 1000 MT MSV at Jabalpur (M.P.), HPCLNo ratings yetConstruction of 1 X 1000 MT MSV at Jabalpur (M.P.), HPCL17 pages

- Steels: Ii Beng (Hons) Mech Eng (Well Eng) Metallurgy & Manufacturing ScienceNo ratings yetSteels: Ii Beng (Hons) Mech Eng (Well Eng) Metallurgy & Manufacturing Science39 pages

- 1) Provide Examples of "Vertical Transfer" and "Horizontal Transfer"No ratings yet1) Provide Examples of "Vertical Transfer" and "Horizontal Transfer"5 pages

- Congratulations! You Passed!: Wind Data AnalysisNo ratings yetCongratulations! You Passed!: Wind Data Analysis3 pages

- Reliability and Asset Management Strategy of IOCL: by Implementation of RBI & RCMNo ratings yetReliability and Asset Management Strategy of IOCL: by Implementation of RBI & RCM56 pages

- API 653 - ASME Section V - NDE Practice Questions - 68 TermsNo ratings yetAPI 653 - ASME Section V - NDE Practice Questions - 68 Terms7 pages

- Financial Statements Analysis Practice ProblemsNo ratings yetFinancial Statements Analysis Practice Problems7 pages

- Problem Set 1:: (National Income Accounting)No ratings yetProblem Set 1:: (National Income Accounting)12 pages

- Guidelines For The Written / Individual Assignment.: Performance ManagementNo ratings yetGuidelines For The Written / Individual Assignment.: Performance Management2 pages

- Supply Chain Management (SCM) : Module-4 Part-3No ratings yetSupply Chain Management (SCM) : Module-4 Part-311 pages

- Case Analysis: Capital Budgeting: Submitted by Nikon Madhu Kevin Southil Snaha Giji Saji Tanuja VargheseNo ratings yetCase Analysis: Capital Budgeting: Submitted by Nikon Madhu Kevin Southil Snaha Giji Saji Tanuja Varghese10 pages

- Installment Sales-: Loss On Repossession XXX Gain On Repossession XXXNo ratings yetInstallment Sales-: Loss On Repossession XXX Gain On Repossession XXX5 pages

- Projected& Estimated - Ms Patanjali Arogya KendraNo ratings yetProjected& Estimated - Ms Patanjali Arogya Kendra18 pages

- Problem 3 - Adjusting Entries General Journal: Date Particulars F DebitNo ratings yetProblem 3 - Adjusting Entries General Journal: Date Particulars F Debit4 pages

- Unique Aspects of Accounting - Non-Profit and Healthcare OrganizationsNo ratings yetUnique Aspects of Accounting - Non-Profit and Healthcare Organizations28 pages

- AFU 08501 - Tutorial Set-2021 - DemosntrationNo ratings yetAFU 08501 - Tutorial Set-2021 - Demosntration5 pages

- Session 6-7 - Basic Procedures - HandoutNo ratings yetSession 6-7 - Basic Procedures - Handout32 pages

- Company - Presentation - Sep - 2023 ABMMNo ratings yetCompany - Presentation - Sep - 2023 ABMM18 pages

- Interpretation of Financial Statements - Ratio Analysis100% (1)Interpretation of Financial Statements - Ratio Analysis10 pages

- Chapter 03 - Adjusting The Accounts: Multiple Choice QuestionsNo ratings yetChapter 03 - Adjusting The Accounts: Multiple Choice Questions11 pages

- Installment Liquidation: Schedule of Safe PaymentsNo ratings yetInstallment Liquidation: Schedule of Safe Payments22 pages

- Accounting 2 (Admission &withdrawal of Partners)No ratings yetAccounting 2 (Admission &withdrawal of Partners)6 pages

- Class 11 Notes CBSE Accountancy Chapter 7 - Depreciation, Provisions and ReservesNo ratings yetClass 11 Notes CBSE Accountancy Chapter 7 - Depreciation, Provisions and Reserves19 pages

- IND AS 105 - Bhavik Chokshi - FR Shield V3 PDFNo ratings yetIND AS 105 - Bhavik Chokshi - FR Shield V3 PDF5 pages