0 ratings0% found this document useful (0 votes)

115 viewsBasic Accounting Exercise

The document provides a list of 15 financial transactions conducted by Mr. Bean, a certified public accountant, for his new business in the month of August, including depositing start-up money, paying expenses, purchasing equipment, rendering and receiving payment for accounting services, and withdrawing cash for personal use. It requires the transactions to be journalized, posted to T-accounts, and a trial balance to be prepared.

Uploaded by

albert_malquistoCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

115 viewsBasic Accounting Exercise

The document provides a list of 15 financial transactions conducted by Mr. Bean, a certified public accountant, for his new business in the month of August, including depositing start-up money, paying expenses, purchasing equipment, rendering and receiving payment for accounting services, and withdrawing cash for personal use. It requires the transactions to be journalized, posted to T-accounts, and a trial balance to be prepared.

Uploaded by

albert_malquistoCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

You are on page 1/ 1

Basic Accounting

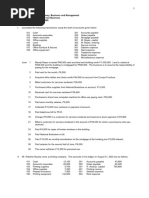

Mr. Bean, a Certified Public Accountant, opened an office on August 1 of the current year. During the

month, he completed the following transactions connected with his professional practice:

1. Mr. Bean deposited P 500,000 in the company’s bank account.

2. Paid August rent for office and workroom, P 2,500

3. Purchased computer equipments for P 60,000, paying P 30,000 cash and giving an interest-bearing

note for the remainder.

4. Paid cash for office supplies (expense), P 500.

5. Paid cash for insurance policies, P 1,000

6. Rendered accounting services to clients on account, P 50,000

7. Paid cash for miscellaneous services, P 120

8. Rendered services to client for P 35,000. The client made a down payment of P 5,000 and gave a non-

interest bearing note for the balance.

9. Received cash for services rendered, P 15,000

10. Paid installment due on note payable, P 5,000

11. Paid salary of assistant, P 10,000

12. Fees earned and billed to customers for the month, P 25,000

13. Paid repairs on computer equipments for August, P 500

14. Mr. Bean withdrew cash from the business for personal use, P 5,000

15. Purchased office supplies (expense) on credit, P 1,500

Requirements:

a) Journalize the foregoing transactions.

b) Post the transactions journalized above in the following T-accounts:

101 Cash 401 Professional Fees

102 Accounts receivable

103 Notes receivable 501 Rent expense

104 Computer equipment 502 Office Supplies Expense

503 Insurance Expense

201 Accounts payable 504 Miscellaneous Expense

202 Notes payable 505 Salaries expense

506 Repairs and Maintenance

301 Mr. Bean, Capital

302 Mr. Bean, Drawing

c) Prepare a trial balance for Mr. Bean, CPA, as of August 31 of the current year.

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeNo ratings yetChart of Accounts General Ledger General Ledger Page No. Page No. Assets Income44 pages

- Lesson Number: Dates Subject Management 1 Activity Title Learning Targets Reference (S) Source (S) AuthorsNo ratings yetLesson Number: Dates Subject Management 1 Activity Title Learning Targets Reference (S) Source (S) Authors11 pages

- Chapter 2: Accounting Equation and The Double-Entry SystemNo ratings yetChapter 2: Accounting Equation and The Double-Entry System15 pages

- Accounting: Bullae - First Bills of LadingNo ratings yetAccounting: Bullae - First Bills of Lading42 pages

- 03 The Accounting Cycle Service Business PROBLEMSNo ratings yet03 The Accounting Cycle Service Business PROBLEMS9 pages

- Module 3. Activity Sheet The Accounting EquationNo ratings yetModule 3. Activity Sheet The Accounting Equation4 pages

- Quiz 1 Introduction To Accounting Without Answer100% (2)Quiz 1 Introduction To Accounting Without Answer9 pages

- Accounting 1 Review Series Worksheet Exercises100% (2)Accounting 1 Review Series Worksheet Exercises14 pages

- Fundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABMNo ratings yetFundamentals of Accountancy: By: Win Ballada, CPA 2017 Edition For ABM15 pages

- In Final Fulfillment of The Curriculum Requirements inNo ratings yetIn Final Fulfillment of The Curriculum Requirements in56 pages

- Accounting For Training Merchandising BusinessNo ratings yetAccounting For Training Merchandising Business109 pages

- Chapter 5. Closing Entries and The Post-Closing Trial BalanceNo ratings yetChapter 5. Closing Entries and The Post-Closing Trial Balance26 pages

- Partnership: (Definition, Nature, Formation) Lucille Myschkin Flores, MBANo ratings yetPartnership: (Definition, Nature, Formation) Lucille Myschkin Flores, MBA38 pages

- Statement of Change in Equity: Aiza C. Hampton Lpt. MbaNo ratings yetStatement of Change in Equity: Aiza C. Hampton Lpt. Mba20 pages

- Fa 3 Chapter 6 Statement of Comprehensive IncomeNo ratings yetFa 3 Chapter 6 Statement of Comprehensive Income11 pages

- Alice Huerto Arrow Janitorial - Trial BalanceNo ratings yetAlice Huerto Arrow Janitorial - Trial Balance1 page

- Accounting Cycle 1 768 290 Worksheet BSNo ratings yetAccounting Cycle 1 768 290 Worksheet BS27 pages

- Accounting Principles and Concepts LectureNo ratings yetAccounting Principles and Concepts Lecture9 pages

- Chapter 5 - Assignment (Journalizaing of Transactions)No ratings yetChapter 5 - Assignment (Journalizaing of Transactions)2 pages

- Managing Human Resources and Labor Relations: Chapter OverviewNo ratings yetManaging Human Resources and Labor Relations: Chapter Overview17 pages