Exploration Assets and Depletion: Theory

Exploration Assets and Depletion: Theory

Uploaded by

NooroddenCopyright:

Available Formats

Exploration Assets and Depletion: Theory

Exploration Assets and Depletion: Theory

Uploaded by

NooroddenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Exploration Assets and Depletion: Theory

Exploration Assets and Depletion: Theory

Uploaded by

NooroddenCopyright:

Available Formats

EXPLORATION ASSETS AND DEPLETION

THEORY

1. PFRS 6 applies to expenditures incurred

a. When a specific area is being developed and preparations for commercial extraction are

being made

b. In extracting mineral resources and processing the resource to make it marketable or

transportable

c. When searching for an area that may want detailed exploration, even though the entity

has not yet obtained the legal rights to explore a specific area

d. When the legal rights to explore a specific area have been obtained, but the technical

feasibility and commercial viability of extracting a mineral resource are not yet

demonstrated

2. Which of the following expenditures would never qualify as an exploration and evaluation asset?

a. Expenditure for exploratory drilling

b. Expenditure for acquisition of rights to explore

c. Expenditures related to the development of mineral resources

d. Expenditures for activities in relation to evaluating the technical feasibility and

commercial viability of extracting mineral resources

3. Does PFRS 6 require an entity to recognize exploration and evaluation expenditures as assets?

a. No, such expenditure is always expensed in profit or loss incurred

b. Yes, but only to the extent such expenditure is recoverable in future periods

c. Yes, but only to the extent required by the entity’s accounting policy for recognizing

exploration and evaluation of assets

d. Yes, but only to the extent the technical feasibility and commercial viability of extracting

the associated mineral resources have been demonstrated

4. An entity is required to consider which of the following in developing accounting policy for

exploration and evaluation activities?

a. Recent pronouncements of standard-setting bodies

b. Whether the accounting policy results in information that is relevant and reliable

c. The requirements and guidance in PFRS dealing with similar and related issues

d. The definitions, recognition criteria, and measurement concepts or assets, liabilities,

income and expenses in the Conceptual Framework

5. Which measurement model applies to exploration and evaluation assets subsequent to initial

recognition?

a. The cost model

b. The revaluation model

c. The recoverable amount model

d. Either the cost model or the revaluation model

6. Which of the following is not a disclosure requirement by PFRS 6?

a. Information about commercial reserve quantities

b. Accounting policies for exploration and evaluation expenditures including the

recognition of exploration and evaluation assets

c. Information that identifies and explains the amounts recognized in the financial

statements arising from the exploration of mineral resources

d. The amounts of assets, liabilities, income and expenses and operating and investing cash

flows arising from the exploration and evaluation of mineral resources

7. Of the following costs related to the development of mineral resources, which one should not be

included in depletable cost?

a. Acquisition cost of the mineral resource deposit

b. Exploration cost

c. Tangible equipment cost associated with machinery used to extract the mineral resource

d. Intangible development cost such as drilling cost, tunnel, and shaft

8. Depletion expense

a. Is usually part of cost of goods sold

b. Includes tangible equipment cost in the depletion base

c. Excludes intangible equipment cost from the depletion base

d. Excludes restoration cost from the depletion base

9. The most common method of recording depletion for accounting purposes is the

a. Percentage of depletion method

b. Straight line

c. Production or output method

d. Decreasing charge method

PROBLEMS

10. Shiena Corporation purchased mining property for P10,400,000 with estimated 8,000,000 tons

of ore. The residual value of the property is P800,000. Building used in mine operations costs

P800,000 and have estimated life of fifteen years with no residual value. Mine machinery costs

P1,600,000 with an estimated residual value of P320,000 after its physical life of 4 years.

Following is the summary of the company’s operations for 2021, the first year of operations.

Tons mined 800,000 tons

Tons sold 640,000 tons

Unit selling price per ton P4.40

Direct labor 640,000

Miscellaneous mining overhead 128,000

Operating expenses (excluding depreciation) 576,000

Inventories are valued on a first-in, first-out basis. Depreciation on the building is to be allocated

as follows: 20% to operating expenses, 80% to production. Depreciation on machinery is

chargeable to production.

Question 1: How much is the depletion for 2021?

a. P768,000

b. P192,000

c. P960,000

d. P1,040,000

You might also like

- DepletionDocument25 pagesDepletionRachelle Deleña100% (1)

- Wasting Assets LectureDocument8 pagesWasting Assets LectureJohn Carl B. EsteronNo ratings yet

- ACC107 P2-Quiz1Document7 pagesACC107 P2-Quiz1itsayuhthingNo ratings yet

- INTACC 2 - Non-KeyDocument13 pagesINTACC 2 - Non-KeybrettlegaspiNo ratings yet

- TFA - Chapter 41 - DepletionDocument3 pagesTFA - Chapter 41 - DepletionAsi Cas JavNo ratings yet

- Wasting Assets Impairment of AssetsDocument15 pagesWasting Assets Impairment of AssetsJc MarayagNo ratings yet

- Auditing - Depletion-Test BanksDocument5 pagesAuditing - Depletion-Test BanksjohnmarkvillaruelgarciaNo ratings yet

- Depletion ActivityDocument1 pageDepletion ActivityPrinx CarvsNo ratings yet

- Activity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDocument5 pagesActivity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDanna VargasNo ratings yet

- Exploration and Evaluation Assets and DepletionDocument74 pagesExploration and Evaluation Assets and DepletionEunice Lyafe PanilagNo ratings yet

- Module 7.2 - Wasting Assets (Investment in Mineral Resources) - My Benilde Students'Document5 pagesModule 7.2 - Wasting Assets (Investment in Mineral Resources) - My Benilde Students'Marjorie LopezNo ratings yet

- Part 5 - ProblemsDocument3 pagesPart 5 - ProblemsLayla MainNo ratings yet

- 12 Depreciation - DepletionDocument6 pages12 Depreciation - DepletionAllegria AlamoNo ratings yet

- Accounting 102 Depreciation, Depletion, Revaluation, Impairment Summary QuizDocument8 pagesAccounting 102 Depreciation, Depletion, Revaluation, Impairment Summary Quizjhean dabatosNo ratings yet

- Practice QuestionsDocument13 pagesPractice Questions925ff2a357No ratings yet

- Problem 27 1Document2 pagesProblem 27 1CodeSeeker50% (2)

- Wasting Assets Impairment of AssetsDocument14 pagesWasting Assets Impairment of AssetsJohn Ferd M. FerminNo ratings yet

- ACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentDocument8 pagesACCTG102 FinalsSW3 DepreciationDepletionRevaluationImpairmentAnn Marie Dela FuenteNo ratings yet

- Ap 400Document10 pagesAp 400Christine Jane AbangNo ratings yet

- FAR03 - Accounting For Property, Plant, and EquipmentDocument4 pagesFAR03 - Accounting For Property, Plant, and EquipmentDisguised owlNo ratings yet

- MOCK CFE ACC 107 With SolutionsDocument8 pagesMOCK CFE ACC 107 With SolutionssingniemwoyoNo ratings yet

- Mock Cfe Acc 107Document6 pagesMock Cfe Acc 107VILLAMIA,JAN CYRILL T.No ratings yet

- Quiz DepletionDocument5 pagesQuiz Depletionhoneyjoy salapantanNo ratings yet

- ACN002 Midterm Exam PDFDocument5 pagesACN002 Midterm Exam PDFjennie kyutiNo ratings yet

- This Study Resource Was: FAR EasyDocument9 pagesThis Study Resource Was: FAR EasyPM HauglgolNo ratings yet

- اسئلة اقتصادية باللغة الانجليزيةDocument5 pagesاسئلة اقتصادية باللغة الانجليزيةMoun DirNo ratings yet

- CH 13Document175 pagesCH 13Love FreddyNo ratings yet

- Wasting AssetsDocument9 pagesWasting AssetszosbhsjxbdbdbnxjsNo ratings yet

- Format For Project Feasibility StudyDocument4 pagesFormat For Project Feasibility StudyIjLoriaMaderaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaRaquel Villar DayaoNo ratings yet

- FAR.2910 - Wasting Assets.Document4 pagesFAR.2910 - Wasting Assets.Edmark LuspeNo ratings yet

- BPS Midterm Exam KADocument5 pagesBPS Midterm Exam KASheena CalderonNo ratings yet

- Task 1Document2 pagesTask 1Валерія ШикутаNo ratings yet

- Ifrs 6 PDFDocument8 pagesIfrs 6 PDFSanket AggarwalNo ratings yet

- Applied Auditing 2Document11 pagesApplied Auditing 2Leny Joy DupoNo ratings yet

- MOCK EXAM H2O ANSWER KEYnDocument18 pagesMOCK EXAM H2O ANSWER KEYnreyjabonite1329No ratings yet

- 41 DepletionDocument5 pages41 DepletionjsemlpzNo ratings yet

- Fixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)Document4 pagesFixed Assets (Property, Plant and Equipment Valuation, Depreciation and Disposal)sameed mateenNo ratings yet

- D. in Any of TheseDocument3 pagesD. in Any of TheseAlrac Garcia100% (1)

- Imact02 2nd LT.docxDocument9 pagesImact02 2nd LT.docxabg.lim.alNo ratings yet

- Forum s5Document6 pagesForum s5Aruni PribadiNo ratings yet

- 1 PMDocument8 pages1 PMHanbin Kim100% (1)

- Instant Download for Company Accounting 10th Edition Leo Test Bank 2024 Full Chapters in PDFDocument29 pagesInstant Download for Company Accounting 10th Edition Leo Test Bank 2024 Full Chapters in PDFmesimelay100% (3)

- Chapter 8 - Tangible Non-Current AssetsDocument23 pagesChapter 8 - Tangible Non-Current AssetsSyed Huzaifa SamiNo ratings yet

- 10 Long Lived AssetsDocument7 pages10 Long Lived AssetsPratheep GsNo ratings yet

- Ppe TheoriesDocument4 pagesPpe TheoriesxxyyzzNo ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsAndrew WongNo ratings yet

- 1stF 2nd Yr Intermediate Accounting 1 VerifiedDocument33 pages1stF 2nd Yr Intermediate Accounting 1 VerifiedMika MolinaNo ratings yet

- 20 - Wasting AssetsDocument5 pages20 - Wasting AssetsYudna YuNo ratings yet

- REO CPA Review: Revaluation and ImaprimentDocument4 pagesREO CPA Review: Revaluation and ImaprimentAdan NadaNo ratings yet

- Mayo Ining Ans Sa PrelimsDocument8 pagesMayo Ining Ans Sa PrelimsMary Rose DacuroNo ratings yet

- Acctg3 QuizDocument2 pagesAcctg3 QuizSyril SarientasNo ratings yet

- DEPLETIONDocument17 pagesDEPLETIONKylie Luigi Leynes BagonNo ratings yet

- This Study Resource Was: PPE Part 2Document8 pagesThis Study Resource Was: PPE Part 2Ms VampireNo ratings yet

- Practice Exam For Final Exam Acct301 With AnswersDocument9 pagesPractice Exam For Final Exam Acct301 With Answersalleighawilliams123No ratings yet

- 4BSA MAS SET A No Answer 1 PDFDocument9 pages4BSA MAS SET A No Answer 1 PDFLayca Clarice BrimbuelaNo ratings yet

- Chapter 34 Exploration and Evaluation of Mineral ResourcesDocument2 pagesChapter 34 Exploration and Evaluation of Mineral ResourcesEllen MaskariñoNo ratings yet

- Pas 16 (Property, Plant and Equipment) : Names: Jon Rigo Caruz Hosea Earl CollongDocument22 pagesPas 16 (Property, Plant and Equipment) : Names: Jon Rigo Caruz Hosea Earl CollongKaren Mae Oculam CerinoNo ratings yet

- Recent Trends in Valuation: From Strategy to ValueFrom EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerNo ratings yet

- Strategies for Cotton in West and Central Africa: Enhancing Competitiveness in the 'Cotton-4'From EverandStrategies for Cotton in West and Central Africa: Enhancing Competitiveness in the 'Cotton-4'No ratings yet

- Comprehensi VE: Quiz WarsDocument67 pagesComprehensi VE: Quiz WarsNooroddenNo ratings yet

- 01 ClincherDocument11 pages01 ClincherNooroddenNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocument23 pagesTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenNo ratings yet

- Sworn Statement For Retired UnemployedDocument1 pageSworn Statement For Retired UnemployedNooroddenNo ratings yet

- Chapter 26Document1 pageChapter 26Neta-Li LustigNo ratings yet

- Danh Sách TVTKDocument45 pagesDanh Sách TVTKLợi TrầnNo ratings yet

- The Third Wave of FeminismDocument2 pagesThe Third Wave of FeminismHammad IftikharNo ratings yet

- Uts Group 2Document8 pagesUts Group 2che.villaflor28No ratings yet

- Mid-Year Review Form (MRF) For Teacher I-IiiDocument11 pagesMid-Year Review Form (MRF) For Teacher I-IiiAling Alena100% (3)

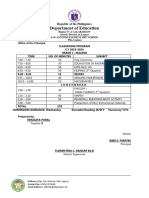

- Classroom Program Sy2023-2024Document2 pagesClassroom Program Sy2023-2024Verzie PuralNo ratings yet

- An1nouncement No. 2 - BCLTE - 23oct2022Document8 pagesAn1nouncement No. 2 - BCLTE - 23oct2022Jurist Anthony CanguilanNo ratings yet

- GiveWell JD Research AnalystDocument4 pagesGiveWell JD Research Analystpingpong playerNo ratings yet

- Lekha Shastra (483) Class 12Document483 pagesLekha Shastra (483) Class 12mrvijayyadav7781No ratings yet

- Overview of The Lam-RimDocument14 pagesOverview of The Lam-RimMartin SeidenstickerNo ratings yet

- Suntech JustroofDocument8 pagesSuntech JustroofbojolaliNo ratings yet

- 2) Hospital and Healthcare ServicesDocument18 pages2) Hospital and Healthcare ServicesAMIN BUHARI ABDUL KHADERNo ratings yet

- Garceau, I Call The PeopleDocument18 pagesGarceau, I Call The PeopleInmaculada Melón JuncosaNo ratings yet

- ComparisonDocument2 pagesComparisonSian BarnesNo ratings yet

- Uganda Contingent Commander Brigadier General Sam Kavuma Concludes One Year Tour of Duty in SomaliaDocument3 pagesUganda Contingent Commander Brigadier General Sam Kavuma Concludes One Year Tour of Duty in SomaliaAMISOM Public Information ServicesNo ratings yet

- Complete ResearchDocument50 pagesComplete Researchnouman100% (1)

- Oec Margin Fee SlipDocument2 pagesOec Margin Fee SliphafizgNo ratings yet

- Timor-Leste Vs Australia - SummaryDocument17 pagesTimor-Leste Vs Australia - Summarybebs CachoNo ratings yet

- RCS MediaGroup - WikipediaDocument8 pagesRCS MediaGroup - WikipediaLorenzo E.MNo ratings yet

- Drug Addiction and YouthDocument3 pagesDrug Addiction and YouthHussain Mohi-ud-Din QadriNo ratings yet

- Master Thesis Lmu EconomicsDocument9 pagesMaster Thesis Lmu Economicsihbjtphig100% (1)

- Activity Submission GuidelinesDocument9 pagesActivity Submission GuidelinesVarun BhosaleNo ratings yet

- Sri Gopala Bhatta GoswamiDocument8 pagesSri Gopala Bhatta GoswamispshankarjpsNo ratings yet

- NovartisDocument14 pagesNovartisRahul KumarNo ratings yet

- 7 armors of GodDocument75 pages7 armors of Godmatawaransharmaine7No ratings yet

- Delhi Sultanate Conquest and ConsolidationDocument36 pagesDelhi Sultanate Conquest and ConsolidationDiplina SahariaNo ratings yet

- Week2 NPTELDocument2 pagesWeek2 NPTELPriya SundarNo ratings yet

- Pre-Trial SPA W/ AcknowledgementDocument2 pagesPre-Trial SPA W/ AcknowledgementN.A. BrualNo ratings yet

- Mastering Public RelationsDocument4 pagesMastering Public RelationsOneeba MalikNo ratings yet

- Week 1 - SCIENCE 10Document35 pagesWeek 1 - SCIENCE 10Menard Licuanan RosalesNo ratings yet