Executive Summary - Acmr

Executive Summary - Acmr

Uploaded by

api-523877663Copyright:

Available Formats

Executive Summary - Acmr

Executive Summary - Acmr

Uploaded by

api-523877663Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Executive Summary - Acmr

Executive Summary - Acmr

Uploaded by

api-523877663Copyright:

Available Formats

Executive summary

Date: June 19, 2020 Recommendation: BUY (long) Exchange: NASDAQ

Market price: $60.43 Target price: $77.93 Sector: Technology

Ticker: ACMR Upside: 28.9% Industry: Semiconductor

Recommendation

The recommendation of this report is to take a long position on ACMR (3-year horizon).

The fundamental and qualitative analysis evaluated in this research report supports the thesis.

Investment highlights

ACM Research develops, manufactures, and distributes specialized cleaning and wet processing

technology for the progressive semiconductor industry.

The industry is supported by the long-term tailwinds of consumer demand for innovative

electronics, IoT, and other technological advancements that rely on ACMR’s technology.

ACMR controls 50% of the global market for single-wafer wet-cleaning equipment and has

secured a strategic portfolio of 285 patents.

Operations are vertically integrated, allowing it to focus on product differentiation, R&D, price

point, and offering premium products.

ACMR has experienced rapid growth with a revenue CAGR of 57.7%, significantly outperforming

the industry’s 7.1% growth. New strategic relationships and effective growth initiatives have

also led to an attractive EBITDA CAGR of 71.7% (all three-year CAGRs).

The implied share price that this report has found ($77.93), indicates that ACMR is trading below

its optimal price, offering a potential upside of 28.9%.

150 Revenue

100

107.5

50 74.6

27.4 36.5

0

2016 2017 2018 2019

300%

200%

100%

0%

-100%

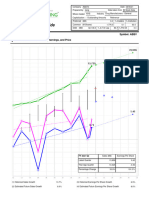

Jun-19 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20

ACM Research, Inc. (NasdaqGM:ACMR) - Share Pricing

NASDAQ Composite Index (^COMP) - Index Value

You might also like

- Next Generation Demand Management: People, Process, Analytics, and TechnologyFrom EverandNext Generation Demand Management: People, Process, Analytics, and TechnologyNo ratings yet

- Acmr Pitch DeckDocument8 pagesAcmr Pitch Deckapi-523877663No ratings yet

- Australian Engineering & Industrial Services Research Report - Edition 535Document3 pagesAustralian Engineering & Industrial Services Research Report - Edition 535LCC Asia Pacific Corporate FinanceNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- ATRO Dougherty Conference Presentation FINALDocument30 pagesATRO Dougherty Conference Presentation FINALPOPNo ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- ValuEngine Weekly: Tech Stocks, General Motors, and MoreDocument5 pagesValuEngine Weekly: Tech Stocks, General Motors, and MoreValuEngine.comNo ratings yet

- This Week in Earnings 18Q3 - Nov. 30Document21 pagesThis Week in Earnings 18Q3 - Nov. 30Anonymous RNlI6gcWNo ratings yet

- Engineering Technology and Engineering Market Research - Edition 536Document3 pagesEngineering Technology and Engineering Market Research - Edition 536LCC Asia Pacific Corporate FinanceNo ratings yet

- Financial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDDocument19 pagesFinancial Accounting: Group-1 Industry - Cement Lead Company-Ultratech Cement LTDArpita GuptaNo ratings yet

- Electra309 Avril2020 PDFDocument146 pagesElectra309 Avril2020 PDFJose CasaisNo ratings yet

- Cep MQCDocument12 pagesCep MQCMuhammad UmerNo ratings yet

- Cost Indices: Bureau of Labor Statistics (BLS)Document8 pagesCost Indices: Bureau of Labor Statistics (BLS)salehmirzaeiNo ratings yet

- Cost Indices: Bureau of Labor Statistics (BLS)Document8 pagesCost Indices: Bureau of Labor Statistics (BLS)salehmirzaeiNo ratings yet

- AbbVie 20210806 (BetterInvesting)Document5 pagesAbbVie 20210806 (BetterInvesting)professorsanchoNo ratings yet

- IMTEX2023-Retrospect-part - Single PageDocument12 pagesIMTEX2023-Retrospect-part - Single PageARUNKUMAR PMCNo ratings yet

- CIMB SG Tech TourDocument15 pagesCIMB SG Tech TourngweehockNo ratings yet

- Final FMCDDocument9 pagesFinal FMCDirisha guptaNo ratings yet

- Australian Engineering & Industrial Services Research Report - Edition 533Document3 pagesAustralian Engineering & Industrial Services Research Report - Edition 533LCC Asia Pacific Corporate FinanceNo ratings yet

- Havells India Ltd. - INDSECDocument12 pagesHavells India Ltd. - INDSECResearch ReportsNo ratings yet

- LCC Asia Pacific Weekly Australian Market Update Edition 542Document3 pagesLCC Asia Pacific Weekly Australian Market Update Edition 542LCC Asia Pacific Corporate FinanceNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- WeeK - 2 - Reading BDocument9 pagesWeeK - 2 - Reading BSheraz AhmadNo ratings yet

- New Year Portfolio Portfolio Stock 3-2025Document9 pagesNew Year Portfolio Portfolio Stock 3-2025ajkNo ratings yet

- S&P 500 Earnings Dashboard - Dec. 6Document11 pagesS&P 500 Earnings Dashboard - Dec. 6Anonymous V7Ozz1wnNo ratings yet

- Fundamentals of SCMDocument111 pagesFundamentals of SCMSuyash KarnNo ratings yet

- Math Q2 W6Document46 pagesMath Q2 W6Rose Amor Mercene-LacayNo ratings yet

- Analog Devices T 02233009Document14 pagesAnalog Devices T 02233009cordacoNo ratings yet

- Jaipuria Institute of Management, Vineet Khand, Gomti Nagar Lucknow - 226 010Document6 pagesJaipuria Institute of Management, Vineet Khand, Gomti Nagar Lucknow - 226 010Avantika SaxenaNo ratings yet

- ValuEngine Weekly Newsletter July 23, 2010Document15 pagesValuEngine Weekly Newsletter July 23, 2010ValuEngine.comNo ratings yet

- Daily Market Sheet 12-18-09Document2 pagesDaily Market Sheet 12-18-09chainbridgeinvestingNo ratings yet

- Monthly 25 Stocks For October 2014Document10 pagesMonthly 25 Stocks For October 2014Stephen CastellanoNo ratings yet

- SSRN Id1930018Document6 pagesSSRN Id1930018Brian LoNo ratings yet

- ValuEngine Weekly Newsletter April 22, 2011Document11 pagesValuEngine Weekly Newsletter April 22, 2011ValuEngine.comNo ratings yet

- Cap Goods Comparison Spark - Dec 19Document29 pagesCap Goods Comparison Spark - Dec 19Sn SubramanyaNo ratings yet

- ValuEngine Weekly December 10, 2010Document9 pagesValuEngine Weekly December 10, 2010ValuEngine.comNo ratings yet

- Tata Elxsi - Initiating Coverage - HSIE-202103161136119562073Document26 pagesTata Elxsi - Initiating Coverage - HSIE-202103161136119562073Deepak JayaramNo ratings yet

- The Future of Passenger Data A Journey or A Destination IATA, Aviation Data Symposium, Miami (PDFDrive)Document92 pagesThe Future of Passenger Data A Journey or A Destination IATA, Aviation Data Symposium, Miami (PDFDrive)tediNo ratings yet

- SCOR Primer: Overview of Model Structure Revision 3.0Document80 pagesSCOR Primer: Overview of Model Structure Revision 3.0syamsu dhuhaNo ratings yet

- Student Comp Report 2020Document4 pagesStudent Comp Report 2020abhinavNo ratings yet

- Frost&Sullivan EMDS ReportDocument11 pagesFrost&Sullivan EMDS ReportzehratmuzaffarNo ratings yet

- ARC Market Research - Process Simulation & OptDocument1 pageARC Market Research - Process Simulation & OptKokil JainNo ratings yet

- SBI Technology Opportunities FundDocument14 pagesSBI Technology Opportunities FundArmstrong CapitalNo ratings yet

- SiTime - 회사소개서 Investor Presentation - 2023Document29 pagesSiTime - 회사소개서 Investor Presentation - 2023천일계전No ratings yet

- Accountancy JoanDocument6 pagesAccountancy Joansalimsaihan6No ratings yet

- Update On Edelweiss ERLI-Q3-2023-24 06112023 121806 PMDocument4 pagesUpdate On Edelweiss ERLI-Q3-2023-24 06112023 121806 PMpurushottam achamwadNo ratings yet

- Vdocuments - MX Chiraigh Din 1Document8 pagesVdocuments - MX Chiraigh Din 1muhamaad.ali.javedNo ratings yet

- Equity Research ExampleDocument7 pagesEquity Research ExamplenfjfhfhtbtjfmfmgngjgjNo ratings yet

- CHAPTER 3 originalDocument28 pagesCHAPTER 3 originalunilofibeatsNo ratings yet

- Commentary: Composite Indices SubsectorsDocument6 pagesCommentary: Composite Indices SubsectorsCalvin YeohNo ratings yet

- S&P 500 Earnings Scorecard: Proprietary ResearchDocument11 pagesS&P 500 Earnings Scorecard: Proprietary ResearchWill AdefehintiNo ratings yet

- Operations Management Case Study On South West AirlinesDocument2 pagesOperations Management Case Study On South West AirlinesvinodbalaNo ratings yet

- ValuEngine Weekly Newsletter May 27, 2011Document10 pagesValuEngine Weekly Newsletter May 27, 2011ValuEngine.comNo ratings yet

- Market Opportunity PDFDocument5 pagesMarket Opportunity PDFRahul AgnihotriNo ratings yet

- Security Risk Management - Market - Industry ForcesDocument53 pagesSecurity Risk Management - Market - Industry Forcesalbinchristopher.delica88No ratings yet

- Question # 1: What Capital Mix Do You Recommend For Each Project? DefinitionDocument8 pagesQuestion # 1: What Capital Mix Do You Recommend For Each Project? DefinitionFirzam AzizNo ratings yet

- Techno Funda Report - Accelya Solutions LTD - 091023Document9 pagesTechno Funda Report - Accelya Solutions LTD - 091023ritikshanuNo ratings yet

- ES I AssDocument12 pagesES I AssRohitSurya100% (1)

- Study Oilfield Operations Management SystemsDocument1 pageStudy Oilfield Operations Management SystemsCarlos LoboNo ratings yet