Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Uploaded by

Saurav KumarCopyright:

Available Formats

Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Uploaded by

Saurav KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Instruction: Attempt Any 4 Questions. Each Question Carries Equal Marks

Uploaded by

Saurav KumarCopyright:

Available Formats

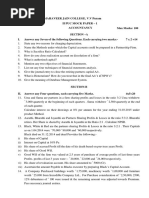

Name of course : B.

Com (P) Part-II

Scheme/Mode of Examinations: Annual

Name of the Paper: Corporate Accounting

UPC/Subject Code: B-102

Time: 2+1 hours Maximum marks 75

Instruction: Attempt any 4 questions. Each question carries equal marks.

1. X Ltd. Issued a prospectus offering 200000 equity shares of Rs 10 each on the

following terms:

On Application Re 1

On allotment (Including Premium of Rs2) Rs 3

On first call Rs 4

On Final Call Rs 4

Subscriptions were received for 317000 shares on 23 rd April and allotment made on 30th

April was as under:

Shares Allotted

Allotments in full (two applicants paid in full on allotment

in respect of 4000 shares each) 38000

Allotments of 2/3 of shares applied for 160000

Allotments of ¼ of shares applied for 2000

Cash amounting to Rs 31000 (being application money received with applications for 31000

shares upon which no allotment was made) was returned to applicants forthwith. The

amounts due were received on due dates except with the first and final call on 100 shares.

These shares were forfeited on 15th November and reissued to A on 16th November on

payment of Rs 9 per share.

You are requested to Show journal and cash book entries in the book of X Ltd.

2. The following are the balances of reliance Ltd. As on 31 st March, 2020:

Debit Rs Credit Rs

Premises 3072000 Share Capital( Rs 10 each) 4000000

Plant 3300000 12% Debentures 3000000

Stock 750000 Profit and Loss Account 262500

Debtors 870000 Bills Payable 370000

Goodwill 250000 Creditors 400000

Cash and Bank 406500 Sales 4150000

Calls in Arrear 75000 General reserve 250000

Interim Dividend Paid 392500 Bad debt provision( 1-4- 35000

Purchases 1850000 2019)

Preliminary Expenses 50000

Wages 979800

General Expenses 68350

Salaries 202250

Bad Debt 21100

Debenture interest Paid 180000

12467500 12467500

Depreciate plant by 15%

Half- debenture interest due.

Credit 5% provision on debtors for doubtful debts

Provide for income Tax @50%

Stock on 31st March, 2020 was Rs 950000

Preliminary Expenses written off in 5 years.

Proposed final dividend at 12% on paid up capital after transfer to general reserve 5%

of profit.

Prepare final Accounts of the company as per schedule III of Division I of AS 1 to the

companies Act 2013.

3. The following are the assets and liabilities of A Ltd. And B Ltd. As at 31st March, 2020;

Particulars A Ltd. B Ltd.

Equity and Liabilities

Equity Share Capital Rs 10 each 1600000 500000

9% Preference Share Capital - 200000

General Reserve 900000 180000

Statutory Reserve 150000 90000

Investment fluctuating Reserve 150000 70000

Surplus 130000 -

10% Debenture - 200000

Creditors 200000 100000

Assets

Non-current Assets

Building 930000 450000

Machinery 560000 310000

Furniture 280000 115000

Current Assets

Stock 720000 225000

Debtors 450000 160000

Cash at Bank 150000 80000

On 1st April, 2020, A Ltd. Takes overs B Ltd. On the following terms;

Building and Machinery are valued at Rs 600000 and Rs 300000

A Ltd. Will Issue 50000 equity shares of Rs 10 each at Rs 12 to the equity

shareholders of B Ltd.

A Ltd. Will issue 2000, 10% preference shares of Rs 100 each at par to the preference

shareholders of B Ltd.

A Ltd. Will issue 2000, 12% Debentures of Rs 100 each at par to the debenture

holders of B Ltd.

A Ltd. Will bear the liquidation expenses of B Ltd.

Statutory Reserve and Investment fluctuation Reserve are to be maintained for two

more years.

You are required to pass journal entries in the books of A Ltd and prepare Balance sheet. If

Assuming that amalgamation is:

i) In the nature of Merger

ii) In the nature of Purchase

4 Prepare Cash flow statement from the following information:

Balance Sheet

Liabilities 2018-19 2019-20 Assets 2018-19 2019-20

Amounts Amounts Amounts Amounts

Creditors 40000 44000 Cash 10000 7000

25000 - Debtors 30000 50000

Loan from Bank 40000 50000 Stock 35000 25000

Capital 125000 153000 Machinery 80000 55000

Land 40000 50000

Building 35000 60000

230000 247000 230000 247000

During the year 2019-20, a Machine costing Rs 10000 (Accumulated Depreciation Rs 3000)

was sold for Rs 5000. The provision for depreciation against Machinery in the year 2018-19

and 2019-20 was Rs 25000 and Rs 40000 respectively. Net Profit for the year 2019-20

amounted to Rs 45000.

5. a) Average stock of a firm is Rs 40000.its opening stock is Rs 5000 less than the closing

stock. Calculate opening and closing stock amounts.

b) Difference between Current Ratio and Liquid Ratio?

c) Calculate Creditors Turnover Ratio and Average Payment Period/ Average age of creditors

from the following data:

Credit Purchases Rs 300000, Creditors at the beginning Rs 20000, Bills Payable at the

beginning Rs 8000, Creditors at the End Rs 12000, Bills Payable at the end Rs20000 and

reserve for discount on creditors Rs 10000.

6. a) state the provision of section 52 of the companies Act 2013

b) Write the conditions of amalgamation in nature of merger as per AS 14.

c) Explain the concepts of purchase of own debenture by the company in the open market at

Ex- Interest Price and Cum- Interest price and pass journal entries for purchase, sales and

cancellation of the own debentures.

You might also like

- Instant download (eBook PDF) Financial Accounting 9th Edition By Craig Deegan pdf all chapterDocument44 pagesInstant download (eBook PDF) Financial Accounting 9th Edition By Craig Deegan pdf all chapteresminogaoboh100% (1)

- ReSA B44 FAR First PB Exam Questions Answers SolutionsDocument17 pagesReSA B44 FAR First PB Exam Questions Answers SolutionsWesNo ratings yet

- AFAR 05 Separate and Consolidated FSDocument10 pagesAFAR 05 Separate and Consolidated FSJeremae Abellanida100% (1)

- International Financial Statement AnalysisDocument3 pagesInternational Financial Statement Analysisanita syaputriNo ratings yet

- Purchase ConsiderationDocument5 pagesPurchase ConsiderationAR Ananth Rohith BhatNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingAkshit JhingranNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- Test TB Final Ac Single EntryDocument2 pagesTest TB Final Ac Single EntryMegha BhargavaNo ratings yet

- Fa ExternalDocument3 pagesFa ExternalRahul JhaNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Screenshot 2024-12-03 at 3.06.47 PMDocument4 pagesScreenshot 2024-12-03 at 3.06.47 PMGunjan KumariNo ratings yet

- upload5Document6 pagesupload5SHRUTI CHAUHANNo ratings yet

- BC 502 Management Accounting 908088840Document8 pagesBC 502 Management Accounting 908088840Saibal SandhirNo ratings yet

- BBA-1.4-A.D.M Finance 2015 NewDocument3 pagesBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93No ratings yet

- Assignment (KMBN 103)Document8 pagesAssignment (KMBN 103)HimanshuNo ratings yet

- Problems On Ratio AnalysisDocument7 pagesProblems On Ratio AnalysisVinay H V MBA100% (1)

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Assignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022Document3 pagesAssignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022aishuNo ratings yet

- Chap 1 SumsDocument18 pagesChap 1 SumsVrinda TayadeNo ratings yet

- Karnataka II PUC Accountancy Sample Question Paper 18Document6 pagesKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreNo ratings yet

- Duration: 1 Hour Max. Marks: 20Document2 pagesDuration: 1 Hour Max. Marks: 20Khushi TanejaNo ratings yet

- Bcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Document6 pagesBcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Zakkiya ZakkuNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSharu BsNo ratings yet

- hhw1Document2 pageshhw1Govind KanodiaNo ratings yet

- Questions For Unit 4 RevisionDocument3 pagesQuestions For Unit 4 RevisionDimple PatelNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- AFA Full Question Bank - ANKDocument121 pagesAFA Full Question Bank - ANKknpramodaffiliateNo ratings yet

- tally set ADocument2 pagestally set Avishal.vs088No ratings yet

- Acc.2022 Practical Exam Sample QN - Paper (Term-2)Document8 pagesAcc.2022 Practical Exam Sample QN - Paper (Term-2)bhavyaraj singhNo ratings yet

- II Puc Accountancy Mock Paper IIDocument5 pagesII Puc Accountancy Mock Paper IISAI KISHORENo ratings yet

- advanced accounting mid term paperDocument3 pagesadvanced accounting mid term paperangel.darlin.67No ratings yet

- Acc.2023 Practical Exam Sample QN - PaperDocument5 pagesAcc.2023 Practical Exam Sample QN - PaperMidhun PerozhiNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- Management AccountingDocument13 pagesManagement AccountingbhushspatilNo ratings yet

- XII BK Set 2 PrelimsDocument10 pagesXII BK Set 2 Prelimsgrv7011No ratings yet

- FRFSA Previous Year Questions 2020-2023Document29 pagesFRFSA Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Unit - 1 Consolidated Financial StatementDocument19 pagesUnit - 1 Consolidated Financial Statementpraveenam137No ratings yet

- Year - B.B.A. CBCS Pattern Semester-I Subject - UCB1C05 - Financial Accounting-IDocument6 pagesYear - B.B.A. CBCS Pattern Semester-I Subject - UCB1C05 - Financial Accounting-Iashishdhakate55No ratings yet

- Homework Financial AccuntingDocument32 pagesHomework Financial AccuntingTrương Cao ThiệnNo ratings yet

- Latihan Soal Akm 3 Asistensi UasDocument8 pagesLatihan Soal Akm 3 Asistensi UasStephanie Felicia TiffanyNo ratings yet

- Retirment of PartnerDocument30 pagesRetirment of PartnerRoozbeh ElaviaNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Faculty of Commerce & Law Department of Accounting & Auditing Bacc106: Financial Accounting 2 Assignment 2 January - June 2021 InstructionsDocument3 pagesFaculty of Commerce & Law Department of Accounting & Auditing Bacc106: Financial Accounting 2 Assignment 2 January - June 2021 Instructionsperseverance mutosvoriNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (2)

- Accounting For Managers S1 MBA May 2022 (S)Document3 pagesAccounting For Managers S1 MBA May 2022 (S)nivyaprakashcareerNo ratings yet

- Co-Operative Accounting Assignment and Case AnalysisDocument3 pagesCo-Operative Accounting Assignment and Case AnalysisTitus Clement100% (2)

- Accounting for Managers- Unit Test _I-2018 - CopyDocument3 pagesAccounting for Managers- Unit Test _I-2018 - CopyPraveen VjNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAI100% (1)

- Bits Fma QP 2024 Sep Solutions-Student UploadDocument33 pagesBits Fma QP 2024 Sep Solutions-Student UploadVishal GulatiNo ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- Screenshot 2024-12-06 at 7.40.55 AMDocument5 pagesScreenshot 2024-12-06 at 7.40.55 AMsoyetapaulm365No ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- 12 Com....Document5 pages12 Com....Advanced AcademyNo ratings yet

- Accountancy Test For 12THDocument2 pagesAccountancy Test For 12THAnuj SinghNo ratings yet

- III - B.Com.Document17 pagesIII - B.Com.kumarmuneesh1261No ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Balance Sheet For The Year Ending 31st March 2019 2020 Capital and LiabilitiesDocument1 pageBalance Sheet For The Year Ending 31st March 2019 2020 Capital and LiabilitiesPrasad GharatNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Holding Company Class Note 1Document6 pagesHolding Company Class Note 1sahir112001No ratings yet

- Project Report Final PDFDocument74 pagesProject Report Final PDFSaurav KumarNo ratings yet

- Techniques To Crack CAT New Pattern: Click Now To RegisterDocument1 pageTechniques To Crack CAT New Pattern: Click Now To RegisterSaurav KumarNo ratings yet

- R M Viva ListDocument2 pagesR M Viva ListSaurav KumarNo ratings yet

- Innovation - Productivity - Optimization: Client Guidelines Example Name of Client: Nordic ConsultingDocument3 pagesInnovation - Productivity - Optimization: Client Guidelines Example Name of Client: Nordic ConsultingSaurav KumarNo ratings yet

- Campus Ambassador - Internship - CertificateDocument1 pageCampus Ambassador - Internship - CertificateSaurav KumarNo ratings yet

- Saurav Kumar Hired Certificate PDFDocument1 pageSaurav Kumar Hired Certificate PDFSaurav KumarNo ratings yet

- Fa-May-June 2011Document16 pagesFa-May-June 2011xodic49847No ratings yet

- Financial Statement Analys Lecture 1stDocument16 pagesFinancial Statement Analys Lecture 1stSaeed UllahNo ratings yet

- July 2023 (Published FS)Document4 pagesJuly 2023 (Published FS)Nur Alya DamiaNo ratings yet

- Mid Sem Notes FINA2222Document1 pageMid Sem Notes FINA2222zdoug1No ratings yet

- The AuditorsDocument1 pageThe AuditorsHenry L BanaagNo ratings yet

- Engineering Economy ReviewerDocument7 pagesEngineering Economy ReviewerPaolo MontesinesNo ratings yet

- Lcif 2nd Semester 2022Document23 pagesLcif 2nd Semester 2022Ivy Marie EstreraNo ratings yet

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- CER3054 T1.4 - Worksheet 1 AnswersDocument1 pageCER3054 T1.4 - Worksheet 1 AnswersCharlene MontebelloNo ratings yet

- Urc 2020 FSDocument138 pagesUrc 2020 FSRose DumadaugNo ratings yet

- By-Raghu Ram RajuDocument15 pagesBy-Raghu Ram RajuNänį RøÿalNo ratings yet

- Principles of Book KeepingDocument78 pagesPrinciples of Book KeepingKaneNo ratings yet

- Chapter 2 - Investment Property (MFRS 140)Document35 pagesChapter 2 - Investment Property (MFRS 140)SITI NUR WARDINA WAFI ROMLINo ratings yet

- Reckitt Benckiser Bangladesh Annual Report 2009Document4 pagesReckitt Benckiser Bangladesh Annual Report 2009dbjhtNo ratings yet

- Partnership QuestionDocument2 pagesPartnership QuestionPhebieon MukwenhaNo ratings yet

- Using Financial Statement Information: Electronic Presentations For Chapter 3Document47 pagesUsing Financial Statement Information: Electronic Presentations For Chapter 3Rafael GarciaNo ratings yet

- Chapter 17Document76 pagesChapter 17waleedtanvirNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- Chapter 5 Advanced AccountingDocument19 pagesChapter 5 Advanced AccountingMarife De Leon VillalonNo ratings yet

- Financial Accounting Ch17Document54 pagesFinancial Accounting Ch17Diana FuNo ratings yet

- Computation of Taxable Income of A Company: Four HeadsDocument3 pagesComputation of Taxable Income of A Company: Four HeadsMrigendra MishraNo ratings yet

- Reviewer Pfrs 3 Business CombinationsDocument4 pagesReviewer Pfrs 3 Business CombinationsKryzzel Anne JonNo ratings yet

- ICAEW - Valuing A BusinessDocument4 pagesICAEW - Valuing A BusinessMyrefNo ratings yet

- Required: Method A Method B Method CDocument109 pagesRequired: Method A Method B Method CNavindra JaggernauthNo ratings yet

- NFP Assignment SolutionDocument2 pagesNFP Assignment SolutionHabte DebeleNo ratings yet

- Test 1 - Test On IND As 16, 38, 40 - Suggested AnsDocument11 pagesTest 1 - Test On IND As 16, 38, 40 - Suggested Ansbhallavishal.socialmediaNo ratings yet