0 ratings0% found this document useful (0 votes)

126 viewsZurita - Summary Table For PSAs

Zurita - Summary Table For PSAs

Uploaded by

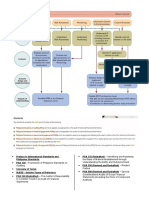

Nove Jane ZuritaThe document lists the phases of auditing and corresponding Philippine Standards on Auditing (PSAs) for a student named Zurita, Nove Jane C. in Section A3. It includes 3 phases of auditing - Planning, Fieldwork, and Reporting. For each phase, it lists the relevant PSAs by number and title, with a total of 31 PSAs covered overall.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Zurita - Summary Table For PSAs

Zurita - Summary Table For PSAs

Uploaded by

Nove Jane Zurita0 ratings0% found this document useful (0 votes)

126 views2 pagesThe document lists the phases of auditing and corresponding Philippine Standards on Auditing (PSAs) for a student named Zurita, Nove Jane C. in Section A3. It includes 3 phases of auditing - Planning, Fieldwork, and Reporting. For each phase, it lists the relevant PSAs by number and title, with a total of 31 PSAs covered overall.

Original Title

Zurita - Summary Table for PSAs

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document lists the phases of auditing and corresponding Philippine Standards on Auditing (PSAs) for a student named Zurita, Nove Jane C. in Section A3. It includes 3 phases of auditing - Planning, Fieldwork, and Reporting. For each phase, it lists the relevant PSAs by number and title, with a total of 31 PSAs covered overall.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

126 views2 pagesZurita - Summary Table For PSAs

Zurita - Summary Table For PSAs

Uploaded by

Nove Jane ZuritaThe document lists the phases of auditing and corresponding Philippine Standards on Auditing (PSAs) for a student named Zurita, Nove Jane C. in Section A3. It includes 3 phases of auditing - Planning, Fieldwork, and Reporting. For each phase, it lists the relevant PSAs by number and title, with a total of 31 PSAs covered overall.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Name of student: Zurita, Nove Jane C.

Section: A3

Phase of Auditing List of PSAs: Number and Title

1. Planning 1. PSA 200 (Revised and Redrafted) - Overall Objectives of the

Independent Auditor and the Conduct of an Audit in Accordance

with International Standards on Auditing

2. PSA 210 (Redrafted) – Agreeing the Terms of Audit Engagements

3. PSA 220 (Redrafted) – Quality Control for Audits of Historical

Financial Statements

4. PSA 230 (Redrafted) – Audit Documentation

5. PSA 240 (Redrafted) – The Auditor’s Responsibility to Consider

Fraud in an Audit of Financial Statements

6. PSA 250 (Redrafted) – Consideration of Laws and Regulations in

an Audit of Financial Statements

7. PSA 260 (Revised and Redrafted) – Communication with Those

Charged with Governance

8. PSA 265 (New) - Communicating Deficiencies in Internal Control

to Those Charged with Governance and Management

9. PSA 300 (Redrafted) – Planning an Audit of Financial Statements

10. PSA 315 (Redrafted) – Identifying and Assessing the Risks of

Material Misstatement through Understanding the Entity and Its

Environment

11. PSA 320 (Revised and Redrafted) – Materiality in Planning and

Performing an Audit

12. PSA 330 (Redrafted) – The Auditor's Responses to Assessed Risks

2. Fieldwork 1. PSA 402 (Revised and Redrafted) – Audit Considerations Relating

to Entities Using Service Organizations

2. PSA 500 (Redrafted) – Audit Evidence

3. PSA 501 (Redrafted) – Audit Evidence – Additional

Considerations on Specific Items

4. PSA 505 (Revised and Redrafted) – External Confirmations

5. PSA 510 (Redrafted) – Initial Audit Engagements-Opening

Balances

6. PSA 520 (Redrafted) – Analytical Procedures

7. PSA 530 (Redrafted) – Audit Sampling

8. PSA 540 (Revised and Redrafted) – Auditing Accounting

Estimates, Including Fair Value Accounting Estimates, and

Related Disclosures

9. PSA 550 (Revised and Redrafted) – Related Parties

10. PSA 560 (Redrafted) – Subsequent Events

11. PSA 570 (Redrafted) – Going Concern

12. PSA 580 (Revised and Redrafted)– Written Representations

13. PSA 600 (Revised and Redrafted) – Special Considerations-Audits

of Group Financial Statements (Including the Work of

Component Auditors)

14. PSA 610 (Redrafted) – Using the Work of Internal Auditors

15. PSA 620 (Revised and Redrafted) – Using the Work of an Expert

3. Reporting 1. PSA 700 (Redrafted) – The Independent Auditor’s Report on a

Complete Set of General Purpose Financial Statements

2. PSA 705 (Revised and Redrafted) - Modifications to the Opinion

in the Independent Auditor's Report

3. PSA 706 (Revised and Redrafted) - Emphasis of Matter

Paragraphs and Other Matter Paragraphs in the Independent

Auditor's Report

4. PSA 710 (Redrafted)– Comparative Information-Corresponding

Figures and Comparative Financial Statements

5. PSA 720 (Redrafted) – The Auditor's Responsibilities Relating to

Other Information in Documents Containing Audited Financial

Statements

6. PSA 800 (Revised and Redrafted) – Special Considerations-Audits

of Financial Statements Prepared in Accordance with Special

Purpose Frameworks

7. PSA 805 (Revised and Redrafted) - Special Considerations-Audits

of Single Financial Statements and Specific Elements, Accounts

or Items of a Financial Statement

8. PSA 810 (Revised and Redrafted) - Engagements to Report on

Summary Financial Statements

You might also like

- Learning Objective 25-1: Chapter 25 Short-Term Business DecisionsDocument93 pagesLearning Objective 25-1: Chapter 25 Short-Term Business DecisionsMarqaz Marqaz0% (2)

- On April 1 2015 Benton Corporation Purchased 80 of TheDocument1 pageOn April 1 2015 Benton Corporation Purchased 80 of TheMuhammad Shahid0% (1)

- Hard Rock CafeDocument6 pagesHard Rock CafeNove Jane Zurita100% (2)

- 7 Steps For SAP Fixed Assets Migration - SAP ExpertDocument18 pages7 Steps For SAP Fixed Assets Migration - SAP ExpertZlatil100% (1)

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFMarie Christine RamosNo ratings yet

- Ap106 Investments and Intangible AssetsDocument5 pagesAp106 Investments and Intangible Assetsbright SpotifyNo ratings yet

- Audit of SHEDocument7 pagesAudit of SHEGille Rosa AbajarNo ratings yet

- BS Accountancy Sample ThesisDocument8 pagesBS Accountancy Sample ThesisBUENA SANGELNo ratings yet

- Audit Reviewer Sample 2Document13 pagesAudit Reviewer Sample 2ChinNo ratings yet

- Standard Unmodified Auditor ReportDocument3 pagesStandard Unmodified Auditor ReportRiz WanNo ratings yet

- PSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilDocument25 pagesPSA 505: External Confirmation: Patricia Jerimae Bensorto/ Arlene Joy Garcia/ Marle Angel PanorilARLENE GARCIANo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Ap04-01 Audit of SheDocument7 pagesAp04-01 Audit of Shenicole bancoroNo ratings yet

- Activity 1 MAS1 AnswersDocument2 pagesActivity 1 MAS1 Answersangel mae cuevasNo ratings yet

- The Custodian Is Not Authorized To Cash ChecksDocument3 pagesThe Custodian Is Not Authorized To Cash Checkselsana philipNo ratings yet

- Sample Auditing Problems Proof of Cash and Correction of Error With Solution - CompressDocument16 pagesSample Auditing Problems Proof of Cash and Correction of Error With Solution - CompressXNo ratings yet

- Which Is The Reason Why Entities Are Permitted To Change Accounting PolicyDocument1 pageWhich Is The Reason Why Entities Are Permitted To Change Accounting PolicyCharrey Leigh FormaranNo ratings yet

- CHAPTER 10 - Pre-Board ExaminationsDocument34 pagesCHAPTER 10 - Pre-Board Examinationsmjc24No ratings yet

- Ncrcup FarDocument13 pagesNcrcup FarKenneth RobledoNo ratings yet

- Audit of Current LiabilitiesDocument3 pagesAudit of Current LiabilitiesEva Dagus100% (1)

- SEPARATE and CONSOLIDATED STATEMENTSDocument4 pagesSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraNo ratings yet

- Weston Corporation Has An Internal Audit Department Operating OuDocument2 pagesWeston Corporation Has An Internal Audit Department Operating OuAmit PandeyNo ratings yet

- PSBA - GAAS and System of Quality ControlDocument10 pagesPSBA - GAAS and System of Quality ControlephraimNo ratings yet

- Far Reviewer For CpaleDocument97 pagesFar Reviewer For CpaleTsuneeNo ratings yet

- Re BPS EpsDocument4 pagesRe BPS EpsAngela MartiresNo ratings yet

- Chapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualDocument3 pagesChapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualCamille Stephan BenigaNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- Practice Exam - Part 3: Multiple ChoiceDocument4 pagesPractice Exam - Part 3: Multiple ChoiceAzeem TalibNo ratings yet

- Practice Problems With Answers - Process Costing Average MethodDocument3 pagesPractice Problems With Answers - Process Costing Average MethodAndrea ValdezNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Chapter 10Document6 pagesChapter 10KrisshaNo ratings yet

- Solution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentDocument39 pagesSolution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentCaryll Joy BisnanNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit Evidence AndTestingDocument15 pagesAudit Evidence AndTestingSigei LeonardNo ratings yet

- Auditing and Assurance Concepts and Application 2Document15 pagesAuditing and Assurance Concepts and Application 2darlene floresNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Aud Theory ReviewerDocument6 pagesAud Theory ReviewerPhia TeoNo ratings yet

- Chapter 2 AISDocument3 pagesChapter 2 AISgailmissionNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Job Order Costing Activity 2Document7 pagesJob Order Costing Activity 2RJ MonsaludNo ratings yet

- Aud ProbsDocument44 pagesAud ProbsDaoist Flemmenwerfer100% (1)

- Audit of Shareholders Equity ActivityDocument31 pagesAudit of Shareholders Equity ActivityIris FenelleNo ratings yet

- Completing The AuditDocument7 pagesCompleting The AudityebegashetNo ratings yet

- Auditing Problems Intangibles Impairment and Revaluation PDFDocument44 pagesAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaNo ratings yet

- Part 3 - Sale and LeasebackDocument11 pagesPart 3 - Sale and LeasebackPoru SenpiiNo ratings yet

- Prelims DraftDocument10 pagesPrelims DraftJoshua WacanganNo ratings yet

- Shareholder's EquityDocument10 pagesShareholder's EquityNicole Gole CruzNo ratings yet

- ACT1205 - Module 4 - Audit of Fixed AssetsDocument7 pagesACT1205 - Module 4 - Audit of Fixed AssetsIo AyaNo ratings yet

- 520-FinalllDocument38 pages520-FinalllHatake KakashiNo ratings yet

- LIA1Document5 pagesLIA1Frederick AbellaNo ratings yet

- Investment in Associates ProblemsDocument4 pagesInvestment in Associates ProblemsLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- Practical Accounting 1: I ExamcoverageDocument12 pagesPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- THESIS ACCOUNTANCY - FinalDocument69 pagesTHESIS ACCOUNTANCY - Finalgelma furing lizalizaNo ratings yet

- Auditing Chapter 3Document3 pagesAuditing Chapter 3Patricia100% (1)

- At 1 Theory Palang With Questions 1Document12 pagesAt 1 Theory Palang With Questions 1Sharmaine JoyceNo ratings yet

- Solution - IntangiblesDocument9 pagesSolution - IntangiblesjhobsNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsRonna Mae MendozaNo ratings yet

- RFBT 3 - Course Outline (Summer 2020)Document9 pagesRFBT 3 - Course Outline (Summer 2020)Ellah MaeNo ratings yet

- AICPA - Develops Standards For Audits ofDocument3 pagesAICPA - Develops Standards For Audits ofAngela PaduaNo ratings yet

- PSA ListDocument1 pagePSA ListVia Montante100% (1)

- Audit Misc. MidtermsDocument2 pagesAudit Misc. MidtermsHyacinth FNo ratings yet

- Group 4 - Audit Plan PDFDocument11 pagesGroup 4 - Audit Plan PDFNove Jane ZuritaNo ratings yet

- Zurita (Block C) - Summary Table For Audit and Other ServicesDocument2 pagesZurita (Block C) - Summary Table For Audit and Other ServicesNove Jane ZuritaNo ratings yet

- 1.2 Significance of The StudyDocument53 pages1.2 Significance of The StudyNove Jane ZuritaNo ratings yet

- VMGO EssayDocument1 pageVMGO EssayNove Jane ZuritaNo ratings yet

- Farooq, Azantouti, Zaman 2024 - Non-Financial Information Assurance A Review of The Literature and Directions For Future ResearchDocument37 pagesFarooq, Azantouti, Zaman 2024 - Non-Financial Information Assurance A Review of The Literature and Directions For Future ResearchNathalia PereiraNo ratings yet

- BM1706 Intermediate Accounting 1Document8 pagesBM1706 Intermediate Accounting 1Mark Anthony Llovit BabaoNo ratings yet

- Basic AccountingDocument2 pagesBasic Accountingram sagarNo ratings yet

- Chapter 1 NumericalsDocument11 pagesChapter 1 Numericalssuraj banNo ratings yet

- PT Barito Pacific TBK - Fy 2020Document210 pagesPT Barito Pacific TBK - Fy 2020Muhammad MuhammadNo ratings yet

- CV - Office ManagerDocument48 pagesCV - Office ManageralfonsxxxNo ratings yet

- Corporate SecrataryshipDocument116 pagesCorporate SecrataryshipksathieshrNo ratings yet

- Chapter 3, Fundamentals of Accounting IDocument76 pagesChapter 3, Fundamentals of Accounting IMustefa Usmael100% (1)

- HeruMeireza 2140070425 Forumsession3 PDFDocument5 pagesHeruMeireza 2140070425 Forumsession3 PDFIrvan NoviantoNo ratings yet

- Test 1 Acc117Document7 pagesTest 1 Acc117nuraisha936No ratings yet

- Midterms Gov AccountingDocument72 pagesMidterms Gov AccountingEloisa JulieanneNo ratings yet

- Learning Objective 11-1: Chapter 11 Fraud AuditingDocument6 pagesLearning Objective 11-1: Chapter 11 Fraud AuditingAnnaNo ratings yet

- Positive Accounting TheoryDocument6 pagesPositive Accounting TheoryAndi IrwanNo ratings yet

- Difference Between Accounting and BookkeepingDocument3 pagesDifference Between Accounting and Bookkeepingwathiqahzainol100% (3)

- Sap Controlling Configuration SettingsDocument17 pagesSap Controlling Configuration Settingsanand chawanNo ratings yet

- Audit Documentation With Special Reference To CARO, 2003: Vijay KapurDocument41 pagesAudit Documentation With Special Reference To CARO, 2003: Vijay KapurAnand ChandrasekarNo ratings yet

- PG Representatives - Proposer-MergedDocument7 pagesPG Representatives - Proposer-MergedKathi Anil KumarNo ratings yet

- Investments and Fair Value SolutionsDocument32 pagesInvestments and Fair Value Solutionssarah zahid100% (1)

- Work For The ICRCDocument16 pagesWork For The ICRCRL GuarantorNo ratings yet

- LBR JWB Sesi 2 - CDocument12 pagesLBR JWB Sesi 2 - CAzka RainayokyNo ratings yet

- The Accounting Cycle Preparing An Annual Report. Accounting For Merchandising Activities. Financial Assets.Document8 pagesThe Accounting Cycle Preparing An Annual Report. Accounting For Merchandising Activities. Financial Assets.Talha Khan0% (1)

- Accounts Payable (J60)Document17 pagesAccounts Payable (J60)Ahmed Al-SherbinyNo ratings yet

- Ican b2 Aa Mock As 2019 v2Document15 pagesIcan b2 Aa Mock As 2019 v2demshubedada472No ratings yet

- Financial Statement AnalysisDocument21 pagesFinancial Statement AnalysisWoodsville HouseNo ratings yet

- Royce Credit and Financial Services, Inc.: MemorandumDocument11 pagesRoyce Credit and Financial Services, Inc.: MemorandumDPMC BANTAYNo ratings yet

- JAC 11th Accountancy Syllabus 2023-24Document6 pagesJAC 11th Accountancy Syllabus 2023-24Kusum singhNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Sample Problems - HOBADocument2 pagesSample Problems - HOBAManuelAngeloBernalNo ratings yet

- Accounting Principles Chapter 5Document42 pagesAccounting Principles Chapter 5Nazifa AfrozeNo ratings yet