Cabigon Problem 1 Audit

Uploaded by

Gianrie Gwyneth CabigonCabigon Problem 1 Audit

Uploaded by

Gianrie Gwyneth CabigonCabigon,Gianrie Gwyneth A.

Auditing and Assurance Concepts and Applications 1 PrE2

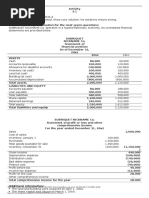

Problem 1 (Ursula Company)

This is a problem about cash and cash equivalent:

The following information has been extracted from the accounting records of Ursula Company at

December 31, 2019.

a. Cash on hand (see note below) P 230,000

b. Impukan Bank savings account (the required minimum monthly

average daily balance (MDAB) is P10,000 9,500

c. 230-day treasury bills purchased March 1, 2019 400,000

d. Petty cash fund (see note below) 20,000

e. Tipid Bank current account (see note below) 160,000

f. Time deposit placements:

Date Terms

12.15.2019 30 days 30,000

10.31.2019 90 days 40,000

11.30.2019 180 days 25,000

g. Employee travel advances 7,000

h. Cash in bond sinking fund 500,000

i. Customer's note receivable 45,000

j. Postage stamps 2,400

The following are included in cash on hand:

* A customer check for P43,000 returned by the bank on December 28, 2019. It was

redeposited and cleared by the bank on January 2, 2020.

* A customer check for P75,000 dated January 3, 2020, received December 27, 2019.

* Philpost money orders received from customers, P30,000.

The petty cash fund consists of the following:

Currency and coins P 3,500

IOUs from officers and employees 3,000

Unreplenished petty cash disbursements 1,500

Currency in envelope with the notation

"We were Bang Quay's co-workers. Words may not be

adequate to express how sorry we feel. Please accept

our heartfelt sympathies on the loss of your loved one." 1,500

__________

P 20,000

=========

The following information pertains to Tipid Bank current account:

* A check for P13,000 was dated and recorded on December 29, 2019, but was delivered to

payee on January 5, 2020.

* A check for P5,000 dated January 10, 2020, payable to a supplier was recorded and released to

payee on December 19, 2019. Tipid Bank requires current account depositors to maintain a

[monthly average daily balance of P50,000.

REQUIRED:

Prepare an audit working paper to show the correct amount of cash and cash equivalents that

Ursula Company should report Units December 31, 2019 statement of financial position.

Answer:

Cash on Hand (230,000 – 430,000 – 75,000) P 112,000

Impukan Bank Savings Account 950,000

Petty Cash Fund 3,500

Bank Current Account (160,000 + 13,000 + 5,000) 178,500

Time Deposits

30 Days 30,000

90 Days 40,000

Total Cash & Cash Equivalent P 1,314,000

You might also like

- Assume: General Company Bank Reconciliation 1st National Bank of US Bank Account September 30, 20X5No ratings yetAssume: General Company Bank Reconciliation 1st National Bank of US Bank Account September 30, 20X58 pages

- Cash and Bank Recon Illustrative ExamplesNo ratings yetCash and Bank Recon Illustrative Examples6 pages

- AUDP ROB REV-Correction of Errors Wit Ans KeyNo ratings yetAUDP ROB REV-Correction of Errors Wit Ans Key12 pages

- RAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The FollowingNo ratings yetRAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The Following2 pages

- Refresher Course: Audit of Cash and Cash Equivalents100% (1)Refresher Course: Audit of Cash and Cash Equivalents4 pages

- Arabian Company Reported The Following at YearNo ratings yetArabian Company Reported The Following at Year1 page

- Chapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSNo ratings yetChapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONS3 pages

- Problem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: Date100% (1)Problem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: Date17 pages

- Audit of Cash Consolidated Valix ProblemsNo ratings yetAudit of Cash Consolidated Valix Problems7 pages

- Use The Following Information For The Next Seven Questions:: Total LiabilitiesNo ratings yetUse The Following Information For The Next Seven Questions:: Total Liabilities7 pages

- Anne Shirley Complete 8-Book Series : Anne of Green Gables; Anne of the Island; Anne of Avonlea; Anne of Windy Poplar; Anne's House of ... Ingleside; Rainbow Valley; Rilla of InglesideFrom EverandAnne Shirley Complete 8-Book Series : Anne of Green Gables; Anne of the Island; Anne of Avonlea; Anne of Windy Poplar; Anne's House of ... Ingleside; Rainbow Valley; Rilla of InglesideNo ratings yet

- Answer in Act. 2 For Cash-receivables-InventoriesNo ratings yetAnswer in Act. 2 For Cash-receivables-Inventories10 pages

- Accounting For Cash-receivables-Inventories100% (1)Accounting For Cash-receivables-Inventories12 pages

- PAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesNo ratings yetPAULA GOZUN - Activity 2 Accounting For Cash-receivables-Inventories9 pages

- Aura College: General Model For Accounting Information SystemNo ratings yetAura College: General Model For Accounting Information System2 pages

- Intangible Asset: An: Identifiable Non-Monetary Asset Without Physical SubstanceNo ratings yetIntangible Asset: An: Identifiable Non-Monetary Asset Without Physical Substance6 pages

- GUESTRO AUTOMOTIVE CASTING Technical+Review+Workbook 2013-03-06No ratings yetGUESTRO AUTOMOTIVE CASTING Technical+Review+Workbook 2013-03-0611 pages

- Circular F No 96 1 2017 CX 1 Master Circular On Show Cause Notice Adjudication and RecovNo ratings yetCircular F No 96 1 2017 CX 1 Master Circular On Show Cause Notice Adjudication and Recov19 pages

- Cambridge Assessment International Education: Business 9609/32 May/June 2019No ratings yetCambridge Assessment International Education: Business 9609/32 May/June 201919 pages

- Hitchiner-Quick Facts and General Tolerances0% (1)Hitchiner-Quick Facts and General Tolerances2 pages

- Kasshish Shetty BlackBook TYBMS a 11359 FinalNo ratings yetKasshish Shetty BlackBook TYBMS a 11359 Final64 pages

- Completing The Tests in The Sales and Collection Cycle: Accounts ReceivableNo ratings yetCompleting The Tests in The Sales and Collection Cycle: Accounts Receivable34 pages

- Social and Economical Aspects of AdvertisingNo ratings yetSocial and Economical Aspects of Advertising2 pages

- Summary of Parcel of Land - Sally ZarragaNo ratings yetSummary of Parcel of Land - Sally Zarraga2 pages

- Alula Airport-Terminal Expansion Deliverables TrackerNo ratings yetAlula Airport-Terminal Expansion Deliverables Tracker3 pages