WACC Calculation Comparable Companies Unlevered Beta Capital Structure

WACC Calculation Comparable Companies Unlevered Beta Capital Structure

Uploaded by

IkramCopyright:

Available Formats

WACC Calculation Comparable Companies Unlevered Beta Capital Structure

WACC Calculation Comparable Companies Unlevered Beta Capital Structure

Uploaded by

IkramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

WACC Calculation Comparable Companies Unlevered Beta Capital Structure

WACC Calculation Comparable Companies Unlevered Beta Capital Structure

Uploaded by

IkramCopyright:

Available Formats

c

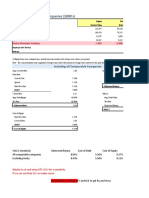

WACC Calculation Comparable Companies Unlevered Beta

Capital Structure Company Levered Beta Debt Equity Debt/Equity Tax Rate Unlevered Beta

Debt to Total Capitalization 30.00% ABC 1.1 7.5 1125 0.67% 25% 1.09

Equity to Total Capitalization 70.00% \

Debt / Equity 42.86%

Cost of Equity

Risk Free Rate 2.50% 0.67% 1.09

Equity Risk Premium 7.00%

Levered Beta 1.43

Cost of Equity 12.54%

Cost of Debt

Cost of Debt 6.00%

Tax Rate 27.5%

After Tax Cost of Debt 4.35%

WACC 10.08%

e

Total Current Value of firm

Capitalzation+ Debt-cash & cash equivalent $ 11,000,001

f

Equity Value

Firm Value - Debt $ 3,500,001

g

Value per share

$ 3.50

h

Suggestion

The firm should hold the share as the market price is $2 which is less then current prcie of share of the firm

You might also like

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument4 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument11 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook Sittiwat100% (1)

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- BSBITU313 Design and Produce Digital Text Documents: Assessment WorkbookDocument27 pagesBSBITU313 Design and Produce Digital Text Documents: Assessment WorkbookIkramNo ratings yet

- FAP T11 KuralayDocument5 pagesFAP T11 KuralayKuralay TilegenNo ratings yet

- Toys R Us LBO Model BlankDocument34 pagesToys R Us LBO Model BlankCatarina AlmeidaNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- w6 - Cost of Capital - Capital StructureDocument3 pagesw6 - Cost of Capital - Capital StructureMooqyNo ratings yet

- Exercises and Answers Chapter 3Document12 pagesExercises and Answers Chapter 3MerleNo ratings yet

- Mergers and AcquisiotnsDocument1 pageMergers and AcquisiotnssudhirNo ratings yet

- A. What Is The Company's Cost of Equity Capital?Document8 pagesA. What Is The Company's Cost of Equity Capital?thalibritNo ratings yet

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuveNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- Session 12 (Chap1, 4, 5 of Titman, 2014)Document14 pagesSession 12 (Chap1, 4, 5 of Titman, 2014)Thu Hiền KhươngNo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- Midsem Sol - WACC QuestionDocument2 pagesMidsem Sol - WACC QuestionSarthak JainNo ratings yet

- 3 6 1+Calculating+the+WACCDocument12 pages3 6 1+Calculating+the+WACCLeonardo VettorazzoNo ratings yet

- Marriott Case Analysis - FinalDocument7 pagesMarriott Case Analysis - FinalvasanthaNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered BetajeganathanNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJim MacaoNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvane rondinaNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialKnightspageNo ratings yet

- Financial Synergy Valuation TemplateDocument4 pagesFinancial Synergy Valuation TemplateAkshat PrakashNo ratings yet

- WACC CalculatorDocument4 pagesWACC CalculatormayankNo ratings yet

- A B19049 Assignment 3Document9 pagesA B19049 Assignment 3Shrey BhalaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatNo ratings yet

- Project Appraisal and FinancingDocument6 pagesProject Appraisal and Financingreanand007No ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- Weighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsDocument9 pagesWeighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsinoocentkillerNo ratings yet

- BetawaccDocument1 pageBetawaccamro_baryNo ratings yet

- Bus 5111 Financial Management Written Assignment Unit 7Document5 pagesBus 5111 Financial Management Written Assignment Unit 7Andika GintingNo ratings yet

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropNo ratings yet

- BetawaccDocument1 pageBetawaccmspanskiNo ratings yet

- BetawaccDocument1 pageBetawaccRajesh KatyalNo ratings yet

- BetawaccDocument1 pageBetawaccMuhammad Ahsan MukhtarNo ratings yet

- BetawaccDocument1 pageBetawaccNabarun BhattacharyaNo ratings yet

- BetawaccDocument1 pageBetawaccwelcome2jungleNo ratings yet

- BetawaccDocument1 pageBetawaccgraskoskirNo ratings yet

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138No ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- BetawaccDocument1 pageBetawaccOmar GhaniNo ratings yet

- Par Value Coupon Interest N Avrage Discount Flotation Cost TaxDocument13 pagesPar Value Coupon Interest N Avrage Discount Flotation Cost TaxGhina NabilaNo ratings yet

- Infosys WACCDocument1 pageInfosys WACCsagar SamantaraNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- Equity Valuation Project: GroupDocument20 pagesEquity Valuation Project: Groupsushilgoyal86100% (1)

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Business Finance Project 2-1Document4 pagesBusiness Finance Project 2-1trabajoslaprensaNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- Case 16.2: Sunlight Paints Limited: AssumptionsDocument2 pagesCase 16.2: Sunlight Paints Limited: AssumptionsMukul KadyanNo ratings yet

- Business Valuation PDF VersionDocument13 pagesBusiness Valuation PDF VersionIvy SamsonNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelProfessorAsim Kumar MishraNo ratings yet

- WACC1 PracticeDocument12 pagesWACC1 PracticeSatyam GourNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Monetary Policy and Macroprudential Regulation with Financial FrictionsFrom EverandMonetary Policy and Macroprudential Regulation with Financial FrictionsNo ratings yet

- Subject Code & NameDocument10 pagesSubject Code & NameIkramNo ratings yet

- HI5017 Progressive Tutorial Question Assignment T2 2020 PDFDocument8 pagesHI5017 Progressive Tutorial Question Assignment T2 2020 PDFIkramNo ratings yet

- Fatiha 2020 Declaration PDFDocument3 pagesFatiha 2020 Declaration PDFIkramNo ratings yet

- Declaration4220102804067 PDFDocument5 pagesDeclaration4220102804067 PDFIkramNo ratings yet

- Naturecare Products: Risk Management PlanDocument7 pagesNaturecare Products: Risk Management PlanIkramNo ratings yet

- 101-A Bokhari Colony Nawan Shaher Street NO. 10 Hassan ShahmimDocument4 pages101-A Bokhari Colony Nawan Shaher Street NO. 10 Hassan ShahmimIkramNo ratings yet

- Finance For ManagersDocument17 pagesFinance For ManagersIkramNo ratings yet

- Assignment Projct ManagmntDocument17 pagesAssignment Projct ManagmntIkramNo ratings yet

- Course PreparationDocument6 pagesCourse PreparationIkramNo ratings yet

- BIT353 Network Architecture and Protocols Assignment 2Document19 pagesBIT353 Network Architecture and Protocols Assignment 2IkramNo ratings yet

- Georgia Certificate of Need Application: Project NumberDocument49 pagesGeorgia Certificate of Need Application: Project NumberIkramNo ratings yet

- Assessment 1Document18 pagesAssessment 1IkramNo ratings yet

- Assignment Cover Sheet: Efei Wong B2000319Document11 pagesAssignment Cover Sheet: Efei Wong B2000319IkramNo ratings yet

- Adelaide Institute of Management & Technology Diploma of Management Ensure A Safe Workplace Bsbwhs501A Learner GuideDocument96 pagesAdelaide Institute of Management & Technology Diploma of Management Ensure A Safe Workplace Bsbwhs501A Learner GuideIkramNo ratings yet

- ACCT2062 SIM Final Assessment (Sem 2 2020)Document15 pagesACCT2062 SIM Final Assessment (Sem 2 2020)IkramNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- Faculty of Business and Law: Masters in International Business ManagementDocument8 pagesFaculty of Business and Law: Masters in International Business ManagementIkramNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- Income Tax Payment Challan: PSID #: 141518891Document1 pageIncome Tax Payment Challan: PSID #: 141518891IkramNo ratings yet

- 2019 Declaration PDFDocument4 pages2019 Declaration PDFIkramNo ratings yet

- Narrative WritingDocument1 pageNarrative WritingIkramNo ratings yet

- Review Spreadsheet - FrancieleDocument6 pagesReview Spreadsheet - FrancieleIkramNo ratings yet

- Invoice 0015 2020-12-07Document1 pageInvoice 0015 2020-12-07IkramNo ratings yet

- 800 PDFDocument7 pages800 PDFIkramNo ratings yet

- Item DR CRDocument3 pagesItem DR CRIkramNo ratings yet

- Name I.DDocument1 pageName I.DIkramNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetIkramNo ratings yet

- Hermes: Student Name Student IdDocument5 pagesHermes: Student Name Student IdIkramNo ratings yet