VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

Uploaded by

Daniel L. Case, Sr.Copyright:

Available Formats

VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

Uploaded by

Daniel L. Case, Sr.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

VRI - Chapman Executive Summary - 031014 - Chapman Rehab Center - Carfax - Donna Doc With Dan Notes v2

Uploaded by

Daniel L. Case, Sr.Copyright:

Available Formats

. All rights reserved. Protected by the copyright laws of the United States & Canada and by international treaties.

IT IS ILLEGAL AND STRICTLY PROHIBITED TO

DISTRIBUTE, PUBLISH, OFFER FOR SELE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR

DIGITAL FORM. ALL OFFENDERS WISUED IN A COURT OF LAW.

Vanguard REIT, Inc.

Daniel L. Case, Sr.

4101 East Louisiana Avenue

Suite 300

Denver, CO 80246

Phone: 480.612.4297 Fax: 303.781.4311

Email: Dan@VanguardREIT.Com Website: www.VanguardREIT.Com

LAW.

OFLAW.

Executive Summary

COURTOF

INAACOURT

Management: Business Description: Vanguard REIT, Inc. is under contract to

acquire one hundred percent (100%) ownership interest in

Vanguard REIT, Inc. Chapman House, Inc. (“Rehab”) at 14511 and 14512 Carfax

CEO Daniel L. Case

SUEDIN

Drive and the Business operations of Chapman House, Inc.:

Richard A. Block Operating in Orange County as a 44-bed state licensed, CARF

BESUED

Timothy Chapman (Commission on Accreditation of Rehabilitation Facilities)

Bradley Malawy accredited, probation and parole approved premier social-model

AUTOMATICALLYBE

Robert H. Myers Jr. detox and recovery center for adults. This facility is currently

Kevin Knight privately owned and operated by Tim and Esther Chapman,

WILLAUTOMATICALLY

Kevin D. Curran whom have treated addictions for over 30 years. The sale

Donna L. Michaelsen includes the Chapman House name and goodwill, all business

Matthew T. Longs, Jr. interests in Orange County (i.e., insurance contracts),

specialized, copy-written workbooks, clinical organization, adult

Chapman Rehab, LLC??? treatment service marks and related websites:

CEO Timothy Chapman www.chapmanrehab.com and www.detox2day.com. The terms

Richard A. Block and conditions of the purchase and sale are as follows:

Bradley Malawy

OFFENDERSWILL

Chris Geiger Purchase Price: $20,000,000

??????? Down Payment/Equity: $ 9,000,000

ALLOFFENDERS

??????? Purchase Money Mortgage: $11,000,000

Industry: The Rehab purchase and sale includes the real estate commonly

known as 14511 and 14512 Carfax Drive, the Business

Vanguard REIT, Inc. operations of Chapman House, Inc., State Licensing, Accounts

Real Estate Investment Trust

reserved.ALL

Receivables and Client Placement Agreements with “TO BE

NAMED CHAPMAN REHAB PLACEMENT CO, LLC and

Chapman Rehab, LLC.

rightsreserved.

American Addiction Centers, Inc. The Client Placement

Mid Agreements provided for a guaranteed one hundred percent

(100%) occupancy for the next 60 months at the full month per

Number of Employees: #? bed rate of $??,???.00. The Rehab, its operating structures and

Allrights

the external rehab management agreement are all designed to

Future Auditor: provide for the segregation of qualifying and non-qualifying

Kim Fenimore, Sterling Consulting

2010.All

income under the IRS REIT tax code. Whereas, the Rehab is

Corporation leased to an interrelated company named ???????? that

Inc.2010.

operates the day to day functions of the Rehab for the sole

Law Firm(s): To Be Named purpose of maximizing profits by reducing the income tax

BiztreeInc.

liabilities. Moreover, these structure provide for a guaranteed

Amount of Financing Sought:

CopyrightBiztree

annual Net Operating Income in excess of $2,030,920 the first

$12,000,000 year, $2,424,620 the second year and $2,577,659 the third year.

Current Investors: $10,500,012

©Copyright

$1,993,716 - The Vanguard Trust Company Background: Chapman Rehab, LLC has been

$1,993,716 - The Rosenquist Trust operating addiction treatment for 34 years. We provide treatment

$3,000,006 - Timothy Chapman to those suffering from issues of addiction, and co-existing

$1,000,008 - Kevin Knight

©

disorders. We are a CARF Accredited detox, addiction recovery

VRI Executive Summary Page 1 of 3

. All rights reserved. Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO

DISTRIBUTE, PUBLISH, OFFER FOR SELE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR

DIGITAL FORM. ALL OFFENDERS WISUED IN A COURT OF LAW.

services and mental health residential treatment. Only 1% of

rehabs in the United States are CARF accredited.

Products/Services: Convey to the investor that the company

and product truly fill an unmet need in the marketplace. The

characteristics that set the product and company apart from the

competition need to be identified (competitive advantage).

Technologies/Special Know-how: In this section, highlight

whatever aspects of your product that may be protected by

current IP or patent law. Provide evidence of how your offerings

are different and will be able to develop a barrier to entry for

potential competitors.

Markets: Provide a clear description of your target market, and

any market segments that may exist within that market. Include

potential market size and growth rate. Also, mention your

revenue model in this section.

Distribution Channels: Chapman House, Inc. enjoys the luxury Client Placement agreements with “TO

BE NAMED CHAPMAN REHAB PLACEMENT CO, LLC and American Addiction Centers, Inc. which

guarantees one hundred percent (100%) occupancy at the full monthly rate of $??,??? per bed for 60

months. Additional, we have an Online presence that ???????????????????????????????????

Competition: There are currently no other luxury inpatient drug and alcohol treatment centers. Although

there are numerous drug and alcohol treatment programs that focus primarily on detox, not

simultaneously on pharmacotherapy or advanced behavioral therapy, their accommodations and activities

are minimal and are not on the same luxury level as the Chapman House, Inc. facility.

The clients that seek the level of care and services that Chapman House, Inc. provides are typically not

concerned with geographical location and are driven solely by bed space availability. Upscale facilities

that offer luxury care and effective cure services, such as ours, routinely operate at or near one hundred

percent (100%) occupancy and nearly all rehabs, including the non-luxury and/or economy facilities,

operate with an average waiting list of over 28 days.

The industry standard charges for the luxury care and service levels that Chapman House, Inc. provides

range from $40,000 to $80,000 per month. Chapman House, Inc. charges a rate up to $40,900 a month

per bed for the Chapman facility, which positions Chapman to be extremely competitive in terms of both

price and quality.

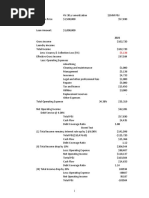

Financial Projections (Not audited):

FIVE YEAR PROJECTIONS & PRO-FORMA DATA

TWENTY-TWO (22) BEDS

Description Year 1 Year 2 Year 3 Year 4 Year 5

Revenue at 22 Beds $ 3,613,500 $ 4,015,000 $ 4,215,750 $ 4,215,750 $ 4,416,500

Cost of Goods Sold 0 0 0 0 0

Gross Profit $ 3,613,500 $ 4,015,000 $ 4,215,750 $ 4,215,750 $ 4,416,500

**Operating Costs $ 1,216,774 $ 1,213,599 $ 1,250,007 $ 1,287,508 $ 1,326,133

*Finance & Admin @ 8% $ 105,806 $ 108,981 $ 112,250 $ 115,618 $ 119,086

*Sales & Marketing $ 260,000 $ 267,800 $ 275,834 $ 284,109 $ 292,632

VRI Executive Summary Page 2 of 3

. All rights reserved. Protected by the copyright laws of the United States & Canada and by international treaties. IT IS ILLEGAL AND STRICTLY PROHIBITED TO

DISTRIBUTE, PUBLISH, OFFER FOR SELE, LICENSE OR SUBLICENSE, GIVE OR DISCLOSE TO ANY OTHER PARTY, THIS PRODUCT IN HARD COPY OR

DIGITAL FORM. ALL OFFENDERS WISUED IN A COURT OF LAW.

Total Expenses $ 1,582,580 $ 1,590,380 $ 1,638,091 $ 1,687,234 $ 1,737,851

Net Income Before Tax $ 2,030,920 $ 2,424,620 $ 2,577,659 $ 2,528,516 $ 2,678,649

Less Income Tax 0 0 0 0 0

$12,000,000 Debt Service @ $

5% Interest $ 600,000 $ 600,000 $ 600,000 600,000 $ 600,000

$

Net Income $ 2,030,920 $ 2,424,620 $ 2,577,659 2,528,516 $ 2,678,649

$

Income After Debt Service $ 1,430,920 $ 1,824,620 $ 1,977,659 1,928,516 $ 2,078,649

*Reflects 3% COLA each

year

**Reflects 3% COLAs and cost allocation for 22 beds, only

VRI Executive Summary Page 3 of 3

You might also like

- 44 Bed Detox and Residential Substance Abuse Treatment Facility Proforma - Chapman TustinDocument4 pages44 Bed Detox and Residential Substance Abuse Treatment Facility Proforma - Chapman TustinDaniel L. Case, Sr.100% (2)

- Prestige Telephone Company Case StudyDocument4 pagesPrestige Telephone Company Case StudyNur Al Ahad92% (12)

- Plan Transparency Declaration Form (PTDF) - FINALDocument3 pagesPlan Transparency Declaration Form (PTDF) - FINALTimmy AlcasidNo ratings yet

- Novelty United Kingdom Bank Statement Generator - PDF SimpliDocument5 pagesNovelty United Kingdom Bank Statement Generator - PDF SimpliAlexNo ratings yet

- Rocket Scientists' Guide To Money and The Economy: Accumulation and Debt.Document137 pagesRocket Scientists' Guide To Money and The Economy: Accumulation and Debt.s1r0nNo ratings yet

- Tithing and Generosity - Practicing Faithful Stewardship Bible Lesson For Teens Malachi 3 - 10 - Youth Group MinistryDocument3 pagesTithing and Generosity - Practicing Faithful Stewardship Bible Lesson For Teens Malachi 3 - 10 - Youth Group MinistryFinlane MartinezNo ratings yet

- UI Support & Customer Service Texas Workforce Commission PO BOX 149346 AUSTIN TX 78714-9346Document2 pagesUI Support & Customer Service Texas Workforce Commission PO BOX 149346 AUSTIN TX 78714-9346Kenneth Schackai100% (1)

- Joint Venture (JV) ContractDocument3 pagesJoint Venture (JV) ContractGabe Coyne100% (2)

- EToroAccountStatement - Suryadi3103 - 01-02-2021!15!08-2021Document4 pagesEToroAccountStatement - Suryadi3103 - 01-02-2021!15!08-2021Clarence RyanNo ratings yet

- Creating A Premier Regional Banking Franchise Across Texas and The SoutheastDocument23 pagesCreating A Premier Regional Banking Franchise Across Texas and The SoutheastLourdu XavierNo ratings yet

- ESC-0456-13 Gorman and Company Bid SubmissionDocument40 pagesESC-0456-13 Gorman and Company Bid SubmissionTimothy Gibbons100% (1)

- Scotsman201610ce DLDocument101 pagesScotsman201610ce DLHelpin HandNo ratings yet

- RIOA Client WorkbookDocument49 pagesRIOA Client WorkbookDaniel L. Case, Sr.100% (2)

- 0692-5 - 2023-Edj-Statement 2Document6 pages0692-5 - 2023-Edj-Statement 2Bryan RuffNo ratings yet

- Crypto 101 Creating and Managing Liquidity Pools StellarXDocument6 pagesCrypto 101 Creating and Managing Liquidity Pools StellarX90daywelthNo ratings yet

- BR Development - Hidden Vine ApartmentsDocument35 pagesBR Development - Hidden Vine ApartmentsSamuel SNo ratings yet

- Townhome Development ProjectDocument8 pagesTownhome Development ProjectFaraz MatinNo ratings yet

- Weitz Senior Living Quals - Nationwide1 012017Document12 pagesWeitz Senior Living Quals - Nationwide1 012017michael zNo ratings yet

- Contingency ContractingDocument4 pagesContingency ContractingSunny BautistaNo ratings yet

- Housing Youth White PaperDocument64 pagesHousing Youth White PaperBenjamin KerensaNo ratings yet

- Buying: Real Estate NotesDocument19 pagesBuying: Real Estate Notesrnj1230No ratings yet

- Equity Lenders Acceptance, IncDocument15 pagesEquity Lenders Acceptance, Incsirach2006No ratings yet

- Inpatient Rehab LTLD Referral GuidelinesDocument8 pagesInpatient Rehab LTLD Referral GuidelinesAdi Kurnia SandiNo ratings yet

- 545 WYN UDRB Letter of IntentDocument8 pages545 WYN UDRB Letter of IntentNone None NoneNo ratings yet

- Personal Net Worth Calculator1Document3 pagesPersonal Net Worth Calculator1Sofian SukamtoNo ratings yet

- 3 Bedroom House For Sale in Blue Mountain Village - 6 Speldebos Close - P24-109949099Document1 page3 Bedroom House For Sale in Blue Mountain Village - 6 Speldebos Close - P24-109949099trevorwoestNo ratings yet

- Top Potential Cryptocurrency Business IdeasDocument4 pagesTop Potential Cryptocurrency Business IdeasMubashirNo ratings yet

- Cost of Entry Legal Cannabis Delivery (Prop. 64)Document3 pagesCost of Entry Legal Cannabis Delivery (Prop. 64)Organic Care of California Delivery DispensaryNo ratings yet

- Deal ContractDocument4 pagesDeal ContractRocketLawyerNo ratings yet

- 166194buy Marijuana OnlineDocument9 pages166194buy Marijuana Onlinev4shfpi670No ratings yet

- UntitledDocument6 pagesUntitledLarry SoongNo ratings yet

- 5 Tools PDFDocument6 pages5 Tools PDFCarlos ManaureNo ratings yet

- Bank SBA Sample 2Document28 pagesBank SBA Sample 2BeleteNo ratings yet

- Services Invoice With Hours and RateDocument1 pageServices Invoice With Hours and RateCrichownNo ratings yet

- (Proposed Authorized Dealer of Best-Seller) : Big - Seller Nepal Private LimitedDocument18 pages(Proposed Authorized Dealer of Best-Seller) : Big - Seller Nepal Private LimitedRajan SubediNo ratings yet

- Navy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixDocument2 pagesNavy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixkwillsonNo ratings yet

- AHS Home Warranty Summary - AcceptDecline - 2014Document2 pagesAHS Home Warranty Summary - AcceptDecline - 2014Phillip KingNo ratings yet

- BC - Landlord Guidelines PDFDocument59 pagesBC - Landlord Guidelines PDFaburdeti2No ratings yet

- Credit-Card Whizzes Outsmart Banks at Their Own GameDocument24 pagesCredit-Card Whizzes Outsmart Banks at Their Own GamejaspreetsaroraNo ratings yet

- Tata Steel Financial Statement FY21Document109 pagesTata Steel Financial Statement FY21Surya SuryaNo ratings yet

- Broker Program NewDocument2 pagesBroker Program NewJuan P. TestaNo ratings yet

- Roofing MarketingDocument9 pagesRoofing MarketingAlgenis FlorianNo ratings yet

- Sample Logistics PlanDocument27 pagesSample Logistics Planvinicius100% (1)

- Rental CriteriaDocument2 pagesRental CriteriatkrisingNo ratings yet

- Effects of Digital BillboardDocument19 pagesEffects of Digital Billboardmiss_mkccNo ratings yet

- Ogl 260 Module 5 Paper FubuDocument4 pagesOgl 260 Module 5 Paper Fubuapi-650422817No ratings yet

- January 2007 Newsletter Http://preservingaylenlake - Blogspot.comDocument15 pagesJanuary 2007 Newsletter Http://preservingaylenlake - Blogspot.comEnvironmental EddyNo ratings yet

- Lawsuit Against Texas Standard Construction For Hit and RunDocument13 pagesLawsuit Against Texas Standard Construction For Hit and RunTexas AttorneyNo ratings yet

- Small Business Lending by Large and Small Banks: A Survey of The LiteratureDocument49 pagesSmall Business Lending by Large and Small Banks: A Survey of The LiteratureDiego RSNo ratings yet

- AgreementDocument2 pagesAgreementreadingLizardNo ratings yet

- REAL 1005 Term Project Pro FormaDocument24 pagesREAL 1005 Term Project Pro FormaJonathan D SmithNo ratings yet

- Law Degree CourseDocument137 pagesLaw Degree CourseAdvocate jyotiNo ratings yet

- 2019 InternetRetailer EcommercePlatforms KFRDocument22 pages2019 InternetRetailer EcommercePlatforms KFRSergio Bedoya100% (1)

- (Your Name) : Business PlanDocument33 pages(Your Name) : Business PlanDanny Solvan100% (1)

- 2012 Free Information Seminar Call Scripts ManualDocument8 pages2012 Free Information Seminar Call Scripts ManualmeNo ratings yet

- The Practical Guide To Loan Processing: by Thomas A. MorganDocument14 pagesThe Practical Guide To Loan Processing: by Thomas A. MorganBittu DesignsNo ratings yet

- Loan AgreementDocument5 pagesLoan AgreementUmang BansalNo ratings yet

- Realty411 - The ONLY Free Magazine For Real Estate Investors and RE ProfessionalsDocument64 pagesRealty411 - The ONLY Free Magazine For Real Estate Investors and RE ProfessionalsRealty411100% (4)

- The Bulletproof Field Guide To Finding A BrokerDocument26 pagesThe Bulletproof Field Guide To Finding A BrokerAgostino M PintusNo ratings yet

- Aftermath Adjusters & Consulting Clarifies Burst Pipe CoverageDocument3 pagesAftermath Adjusters & Consulting Clarifies Burst Pipe CoveragePR.comNo ratings yet

- What Sapp Profit Blueprint 2Document30 pagesWhat Sapp Profit Blueprint 2David OladokunNo ratings yet

- Guide To Florida Government 2010 - Executive, Legislative, Judicial, CongressionalDocument164 pagesGuide To Florida Government 2010 - Executive, Legislative, Judicial, CongressionalForeclosure FraudNo ratings yet

- Crowdfunding in 2014 (Understanding a New Asset Class)From EverandCrowdfunding in 2014 (Understanding a New Asset Class)No ratings yet

- RIOA Employee PacketDocument26 pagesRIOA Employee PacketDaniel L. Case, Sr.No ratings yet

- Senate Bill No. 855: Legislative Counsel's DigestDocument16 pagesSenate Bill No. 855: Legislative Counsel's DigestDaniel L. Case, Sr.No ratings yet

- 2008 - 6 - 23 Bio Concepts LLC FinalDocument52 pages2008 - 6 - 23 Bio Concepts LLC FinalDaniel L. Case, Sr.No ratings yet

- Ankit SharmaDocument1 pageAnkit SharmaShubham JainNo ratings yet

- Chap 5Document23 pagesChap 5selva0% (1)

- Module 03 - Income Tax ConceptsDocument34 pagesModule 03 - Income Tax ConceptsLEON JOAQUIN VALDEZNo ratings yet

- Public Procurement AuditDocument6 pagesPublic Procurement AuditCOT Management Training Insitute100% (2)

- LeaP UCSP Q4 Weeks 3 To 5 (JGF)Document7 pagesLeaP UCSP Q4 Weeks 3 To 5 (JGF)Jay FabellonNo ratings yet

- 1 Working Capital: Lecture Example 1Document6 pages1 Working Capital: Lecture Example 1Cvetozar MilanovNo ratings yet

- Peer To Peer Lending: Business Model Analysis and Platform DilemmaDocument12 pagesPeer To Peer Lending: Business Model Analysis and Platform Dilemmasid100% (1)

- MECS Candidate Classification - International TeamDocument2 pagesMECS Candidate Classification - International Teamjono gantengNo ratings yet

- Ziad's BitcoinDocument8 pagesZiad's BitcoinZiad SobhiNo ratings yet

- Specification: Civ18R372-Estimating and CostingDocument19 pagesSpecification: Civ18R372-Estimating and CostingDr. C. Ramesh Babu KLU-CIVIL-STAFFNo ratings yet

- FIN515 W5 Problem SetDocument3 pagesFIN515 W5 Problem Sethy_saingheng_7602609No ratings yet

- FVR Curriculum UpdatedDocument3 pagesFVR Curriculum UpdatedprathapNo ratings yet

- Tree Plantation ProjectDocument7 pagesTree Plantation ProjectSAI ConsultancyNo ratings yet

- Theory and Concepts in MicrofinanceDocument30 pagesTheory and Concepts in MicrofinancePurity NjueNo ratings yet

- Comprehensive Exercise For IAS 16 PPE (Updated)Document1 pageComprehensive Exercise For IAS 16 PPE (Updated)Huyền TrangNo ratings yet

- Human Resource ManagementDocument5 pagesHuman Resource ManagementMit BakhdaNo ratings yet

- Cost of Capital: - Concept & SignificanceDocument23 pagesCost of Capital: - Concept & SignificancenawabrpNo ratings yet

- Deposits ManagementDocument17 pagesDeposits Managementbilal khan100% (1)

- Manday Rate REV.03 .JUL.2017 ..TADocument7 pagesManday Rate REV.03 .JUL.2017 ..TAEngFaisal AlraiNo ratings yet

- E.Skills 3Document8 pagesE.Skills 3lamfo6811No ratings yet

- SEBI's Informal Guidance On Investment Conditions For AIFs - Vinod Kothari ConsultantsDocument4 pagesSEBI's Informal Guidance On Investment Conditions For AIFs - Vinod Kothari ConsultantsRajesh AroraNo ratings yet

- CEO Agenda - Tips, Actions and Insights For CEOs - EY - GlobalDocument9 pagesCEO Agenda - Tips, Actions and Insights For CEOs - EY - GlobalLesley Lonely ShiriNo ratings yet

- Amazon & Aldeas InfantilesDocument17 pagesAmazon & Aldeas InfantilesSantiago Gil ZarNo ratings yet

- Colgate Research and Design StrategyDocument41 pagesColgate Research and Design StrategyHuy Hoàng NguyễnNo ratings yet

- 2.1 Macroeconomic Indicators GDP 10 11 Nov PDFDocument56 pages2.1 Macroeconomic Indicators GDP 10 11 Nov PDFIvan MedićNo ratings yet

- Meta 2023 Environmental Data IndexDocument17 pagesMeta 2023 Environmental Data Indexfacebook facebookNo ratings yet

- The WalMart StoryDocument2 pagesThe WalMart StoryAbhishek PuriNo ratings yet

- SM AssignmentDocument12 pagesSM AssignmentSameera RanasingheNo ratings yet