Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDF

Uploaded by

HIMANSHU NCopyright:

Available Formats

Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDF

Uploaded by

HIMANSHU NOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDF

Uploaded by

HIMANSHU NCopyright:

Available Formats

PAPER – 5: ADVANCED ACCOUNTING

Question No.1 is compulsory.

Candidates are also required to answer any four questions from the remaining five questions.

Working notes should form part of the respective answers.

Wherever necessary, candidates are permitted to make suitable assumptions which should be

disclosed by way of a note.

Question 1

Answer the following questions:

(a) From the following information given by Sampark Ltd., Calculate Basis EPS and Diluted

EPS as per AS 20 :

`

Net Profit for the current year 2,50,00,000

No. of Equity Shares Outstanding 50,00,000

No. of 12% convertible debentures of `100 each 50,000

Each debenture is convertible into 8 Equity Shares

Interest expense for the current year 6,00,000

Tax saving relating to interest expense (30%) 1,80,000

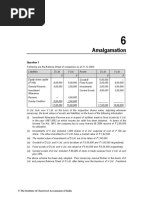

(b) On 1st April, 2018, Tina Ltd. take over the business of Rina Ltd. and discharged purchase

consideration as follows:

(i) Issued 50,000 fully paid Equity shares of ` 10 each at a premium of ` 5 per share to

the equity shareholders of Rina Ltd.

(ii) Cash payment of ` 50,000 was made to equity shareholders of Rina Ltd.

(iii) Issued 2,000 fully paid 12% Preference shares of ` 100 each at par to discharge the

preference shareholders of Rina Ltd.

(iv) Debentures of Rina Ltd. (` 1,20,000) will be converted into equal number and amount

of 10% debentures of Tina Ltd.

Calculate the amount of Purchase consideration as per AS-14 and pass Journal Entry

relating to discharge of purchase consideration in the books of Tina Ltd.

(c) Following transactions are disclosed as on 31st March, 2018:

(i) Mr. Sumit, a relative of Managing Director, received remuneration of ` 2,10,000 for

his services in the company for the period from 1st April, 2017 to 30th June, 2017. He

left the service on 1st July, 2017.

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Should the relative be identified as a related party as on closing date i.e. on

31-3-2018 for the purpose of AS-18.

(ii) Goods sold amounting to ` 50 lakhs to associate company during the 1st quarter

ended on 30th June, 2017. After that related party relationship ceased to exist.

However, goods were supplied as was supplied to any other ordinary customer.

Decide whether transactions of the entire year have to be disclosed as related party

transactions.

(d) Sagar Ltd. has issued convertible bonds for ` 65 crores which are due to mature on 30th

September, 2018.

While preparing financial statements for the year ending 31st March, 2018, company

expects that bond holders will not exercise their option of converting bonds to equity

shares. How should the company classify the convertible bonds as per the requirements

of Schedule-Ill to the Companies Act, 2013 as on 31st March, 2018?

Also state, whether classification of convertible Bonds as per Schedule-III to the

Companies Act will change if the company expects that convertible bond holders will

convert their holdings into equity shares of Sagar Ltd. (4 Parts x 5 Marks = 20 Marks)

Answer

(a) Calculation of Basic Earning Per Share

Net Profit for the current year

Basic EPS =

No. of Equity Shares

2,50,00,000

=

50,00,000

Basic EPS per share = `5

Calculation of Diluted Earning Per Share

Adjusted net profit for the current year

Diluted EPS =

Weighted average no. of Equity Shares

Adjusted net profit for the current year `

Net profit for the current year 2,50,00,000

Add: Interest expenses for the current year 6,00,000

Less: Tax saving relating to Tax Expenses (1,80,000)

2,54,20,000

No. of equity shares resulting from conversion of debentures: 4,00,000 Shares

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 3

Weighted average no. of equity shares used to compute diluted EPS: (50,00,000 +

4,00,000) = 54,00,000 Equity Shares

Diluted earnings per share: (2,54,20,000/54,00,000) = ` 4.71 (Approx.)

(b)

Particulars `

Equity Shares (50,000 x 15) 7,50,000

Cash payment 50,000

12% Preference Share Capital 2,00,000

Purchase Consideration 10,00,000

As per AS 14, consideration for the amalgamation means the aggregate of the shares and

other securities issued and the payment made in the form of cash or other assets by the

transferee company to the shareholders of the transferor company. Thus, payment to

debenture holders are not covered by the term ‘consideration’.

Journal entry relating to discharge of consideration

in the books of Tina Ltd.

Liquidation of Rina Ltd.A/c 10,00,000

To Equity share capital A/c 5,00,000

To 12% Preference share capital A/c 2,00,000

To Securities premium A/c 2,50,000

To Bank/Cash A/c 50,000

(Discharge of purchase consideration)

(c) (i) According to AS 18 ‘Related Party Disclosures’, parties are considered to be related if at

any time during the reporting period, one party has the ability to control the other party or

exercise significant influence over the other party in making financial and/or operating

decisions.

Hence, Mr. Sumit a relative of key management personnel should be identified as

related party as at the closing date i.e. on 31.3.2018 as he received remuneration

forhis services in the company from1st April,2017 to 30th June, 2017and this period

comes under the reporting period.

(ii) As per provision of AS 18, the transactions only for the period in which related party

relationships exist need to be reported.

Hence, transactions of the entity with its associate company for the first quarter

ending 30.06.2017 only are required to be disclosed as related party transactions.

Transactions of the entire year need not be disclosed as related party transactions

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

and transactions for the period (after 1st July) in which related party relationship did

not exist need not be reported.

Hence transaction of sale of goods with the associate company for first quarter ending

30th June, 2017 for ` 50 Lakhs only are required to be disclosed as related party

transaction on 31.3.18.

(d) Schedule III to the companies Act, 2013 provides that:

“A liability should be classified as current when it satisfies any of the following criteria:

(a) it is expected to be settled in the company’s normal operating cycle;

(b) it is held primarily for the purpose of being traded;

(c) it is due to be settled within twelve months after the reporting date; or

(d) the company does not have an unconditional right to defer settlement of the liability

for at least twelve months after the reporting date. Terms of a liability that could, at

the option of the counterparty, result in its settlement by the issue of equity

instruments and do not affect its classification.”

In the present situation, Sagar Ltd. does not have an unconditional right to defer settlement

of the liability for at least 12 months after the reporting date, hence Sagar Ltd. should

classify the FCCBs as current liabilities as on 31st March 2018.

The position will be same even when the bond holders are expected to convert their

holdings into equity shares of Sagar Ltd. Expectations cannot be called as unconditional

rights. Thus, in this situation also, Sagar Ltd. should classify the FCCBs as current

liabilities as on 31st March 2018.

Question 2

(a) Lucky Ltd. grants 100 stock options to each of its 1,500 employees on 1-4-2014 for ` 40,

depending upon the employees at the time of vesting of options. Options would be

exercisable within a year it is vested. The market price of the share is ` 70 each. These

options will vest at the end of year 1 if the earning of Lucky Ltd. is 15%, or it will vest at

the end of the year 2 if the average earning of two years is 13% or lastly it will vest at the

end of the third year if the average earning of 3 years will be 10% 8,000, unvested options

lapsed on 31-3-2015. 6,000 unvested options lapsed on 31-3-2016 and finally 4,000

unvested options lapsed on 31-3-2017.

The earnings of Lucky Ltd. for the three financial years ended on 31st March, 2015; 2016

and 2017 are 14%, 10% and 8% respectively.

1,250 employees exercised their vested options within a year and remaining options were

unexercised at the end of the contractual life.

You are required to give the necessary journal entries for the above and also prepare the

statement showing compensation expense to be recognized at the end of each year.

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 5

(b) Rakshit Ltd., issued 3,00,000 shares of ` 10 each at a premium of ` 5. The entire issue

was underwritten by P, Q and R in the ratio of 3:2:1. Their firm underwriting was as follows:

P - 35,000 shares, Q - 20,000 shares, R - 22,500 shares

The total subscriptions, excluding firm underwriting, including marked applications were

for 1,60,000 shares. Marked applications received were as follows:

P - 45,000 shares, Q - 22,500 shares, R - 17,500 shares

The underwriting contract provided that credit for unmarked applications be given to the

underwriters in proportion to the shares underwritten and benefit of firm underwriting is to

be given to individual underwriters. The underwriters were entitled to commission @ 5%.

You are required to:

(i) Compute the underwriter's liability in number of shares.

(ii) Compute the amount payable to or due from underwriters.

(iii) Pass Journal entries in the books of the company relating to underwriting.

(10+10 =20 Marks)

Answer

(a)

Date Particulars ` `

31.3.2015 Employees compensation expense A/c Dr. 21,30,000

To ESOS outstanding A/c 21,30,000

(Being compensation expense

recognized in respect of the ESOP i.e. 100

options each granted to 1,500 employees at a

discount of ` 30 each, amortised on straight

line basis over vesting years (Refer W.N.)

Profit and Loss A/c Dr. 21,30,000

To Employees compensation 21,30,000

expenses A/c

(Being expenses transferred to profit and Loss

A/c)

31.3.2016 Employees compensation expenses A/c Dr. 5,90,000

To ESOS outstanding A/c 5,90,000

(Being compensation expense recognized in

respect of the ESOP- Refer W.N.)

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Profit and Loss A/c Dr. 5,90,000

To Employees compensation 5,90,000

expenses A/c

(Being expenses transferred to profit and Loss

A/c)

31.3.2017 Employees compensation Expenses A/c Dr. 12,40,000

To ESOS outstanding A/c 12,40,000

(Being compensation expense recognized in

respect of the ESOP- Refer W.N.)

Profit and Loss A/c 12,40,000

To Employees compensation 12,40,000

expenses A/c

(Being expenses transferred to profit and Loss

A/c)

2018-19 Bank A/c (1,250 x100 x40) Dr. 50,00,000

ESOS outstanding A/c Dr. 37,50,000

[(39,60,000 x 1,25,000/ 1,32,000]

To Equity share capital (1250 x 100 x 10) 12,50,000

To Securities premium A/c [ (1250 x 100 75,00,000

x (70-10)]

(Being 1,25,000 options exercised at an

exercise price of ` 40 each)

31.3.2019 ESOS outstanding A/c Dr. 2,10,000

To General Reserve A/c 2,10,000

(Being ESOS outstanding A/c on lapse of 7,000

options at the end of exercise of option period

transferred to General Reserve A/c)

Working Note:

Statement showing compensation expense to be recognized at the end of:

Particulars Year 1 Year 2 Year 3

2014-15 2015-16 2016-17

Number of options expected 1,42,000 options 1,36,000 options 1,32,000 options

to vest*

Total compensation ` 42,60,000 ` 40,80,000 ` 39,60,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 7

expense accrued (70-40)

Compensation expense of 42,60,000 x 1/2 = 40,80,000 x 2/3

the year ` 21,30,000 = ` 27,20,000 ` 39,60,000

Compensation expense

recognized previously Nil ` 21,30,000 ` 27,20,000

Compensation expenses to

be recognized for the year ` 21,30,000 ` 5,90,000 ` 12,40,000

*It is assumed that each share is of ` 10 each and Lucky Ltd. expects all the options to be

vested after deducting actual lapses during the year.

(b) (i) Computation of total liability of underwriters in shares

(In shares)

P Q R Total

Gross liability 1,50,000 1,00,000 50,000 3,00,000

Less: Marked applications

(excluding firm underwriting) (45,000) (22,500) (17,500) (85,000)

1,05,000 77,500 32,500 2,15,000

Less: Unmarked applications

75,000 in the ratio of gross

liabilities of 3:2:1 (excluding firm

underwriting) (37,500) (25,000) (12,500) (75,000)

67500 52,500 20,000 1,40,000

Less: Firm underwriting (35,000) (20,000) (22,500) (77,500)

32,500 32,500 (2,500) 62,500

Less: Surplus of R adjusted in P &

Q’s in the ratio of gross liabilities of (1,500) (1,000) 2,500

3:2

Net liability 31,000 31,500 Nil 62,500

Add: Firm underwriting 35,000 20,000 22,500 77,500

Total liability 66,000 51,500 22,500 1,40,000

(ii) Calculation of amount payable to or due from underwriters

P Q R Total

Total Liability in shares 66,000 51,500 22,500 1,40,000

Amount receivable @ ` 15 from 9,90,000 7,72,500 3,37,500 21,00,000

underwriter (in `)

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Less: Underwriting Commission (1,12,500) (75,000) (37,500) (2,25,000)

payable @ 5% of ` 15 ie issue

price (in `)

Net amount receivable (in `) 8,77,500 6,97,500 3,00,000 18,75,000

(iii) Journal Entries in the books of the company (relating to underwriting)

` `

1. P Dr. 9,90,000

Q Dr. 7,72,500

R Dr. 3,37,500

To Share Capital A/c 14,00,000

To Securities Premium A/c 7,00,000

(Being allotment of shares to underwriters)

2. Underwriting commission A/c Dr. 2,25,000

To P 1,12,500

To Q 75,000

To R 37,500

(Being amount of underwriting commission

payable)

3. Bank A/c Dr. 18,75,000

To P 8,77,500

To Q 6,97,500

To R 3,00,000

(Being net amount received by underwriters

for shares allotted less underwriting

commission)*

*assuming that the net amount was settled.

Question 3

(a) Virat Ltd. furnishes the following summarized Balance Sheet as at 31 st March, 2018:

Particulars ` `

Equity and Liabilities :

(1) Shareholders Funds:

Share Capital 10,000, 12% Pref. Shares of ` 100 10,00,000

each fully paid up

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 9

1,00,000 Equity shares of ` 10 each fully paid up 10,00,000

50,000 Equity shares of ` 10 each, ` 8 paid up 4,00,000 24,00,000

(b) Reserve and Surplus

Profit & Loss A/c. (Dr. Balance) (3,50,000)

(2) Non-current Liabilities:

12% Debentures 15,00,000

Loan on Mortgage 4,50,000 19,50,000

(3) Current Liabilities:

Bank Overdraft 2,75,000

Trade Payables 7,30,000 10,05,000

Total 50,05,000

Assets:

(1) Non-current Assets:

Fixed Assets - Land & Buildings 6,00,000

(2) Current Assets : Sundry Current Assets 44,05,000

Total 50,05,000

The mortgage loan was secured against the Land & Buildings. Debentures were secured

by a floating charge on all the assets of the company. The debenture holders appointed a

Receiver. The company being voluntarily wound up, a liquidator was also appointed. The

Receiver was entrusted with the task of realising the Land & Buildings which fetched

` 7,50,000 . Receiver also took charge of Sundry current assets of value ` 30,00,000 and

sold them for ` 28,75,000. The Bank overdraft was secured by a personal guarantee of

the directors who discharged their obligations in full from personal resources. The costs of

the Receiver amounted to ` 10,000 and his remuneration ` 15,000.

The expenses of liquidator was ` 17,500 and his remuneration was decided at 2% on the value

of the assets realised by him. The remaining assets were realised by liquidator for ` 12,50,000.

Preference dividend was in arrear for 2 years. Articles of Association of the company provide

for payment of preference dividend arrears in priority to return of equity capital.

Prepare the accounts to be submitted by the Receiver and the Liquidator. (10 Marks)

(b) The summarized Balance Sheet of SK Ltd. as on 31st March, 2018 is given below.

(`in '000)

Amount

Liabilities

35,000

Equity Shares of ` 10 each

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

8%, Cumulative Preference Shares of ` 100 each 17,500

6% Debentures of ` 100 each 14,000

Sundry Creditors 17,500

Provision for taxation 350

Total 84,350

Assets

Fixed Assets 43,750

Investments (Market value ` 3325 thousand) 3,500

Current Assets (Including Bank Balance) 35,000

Profit and Loss Account 2,100

Total 84,350

The following Scheme of Internal Reconstruction is approved and put into effect on

31st March, 2018.

(i) Investments are to be brought to their market value.

(ii) The Taxation Liability is settled at ` 5,25,000 out of current Assets.

(iii) The balance of Profit and Loss Account to be written off.

(iv) All the existing equity shares are reduced to ` 4 each.

(v) All preference shares are reduced to ` 60 each.

(vi) The rate of interest on debentures is increased to 9%. The Debenture holders

surrender their existing debentures of ` 100 each and exchange them for fresh

debentures of ` 80 each. Each old debenture is exchanged for one new debenture.

(vii) Balance of Current Assets left after settlement of taxation liability are revalued at

`1,57,50,000.

(viii) Fixed Assets are written down to 80%.

(ix) One of the creditors of the Company for ` 70,00,000 gives up 50% of his claim. He is

allotted 8,75,000 equity shares of ` 4 each in full and final settlement of his claim.

Pass journal entries for the above transactions. (10 Marks)

Answer

(a) Receiver’s Receipts and Payments Account

` `

Sundry Assets realized 28,75,000 Costs of the Receiver 10,000

Surplus received from Remuneration to Receiver 15,000

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 11

Mortgage Debentures holders

Sale Proceeds of land Principal* 15,00,000

and building 7,50,000

Less: Applied to Surplus transferred

Discharge to the Liquidator 16,50,000

of mortgage loan (4,50,000) 3,00,000

31,75,000 31,75,000

Note : * Assumed that interest on debentures has already been paid before winding up

proceedings.

Liquidator’s Final Statement of Account

` `

Surplus received from Cost of Liquidation (legal exp.) 17,500

Receiver 16,50,000 Remuneration to Liquidator 25,000

Assets Realized 12,50,000 (12,50,000 x 2%)

Calls on partly paid Unsecured Creditors:

Shareholders: for Trade 7,30,000

Directors for payment of Bank O/D 2,75,000

Preferential Shareholders:

Capital 10,00,000

Arrears of Preference Dividends 2,40,000

Equity shareholders:

Return of money to contributors

to holders

1,00,000 shares at ` 4.75 4,75,000

50,000 shares at ` 2.75 1,37,500

29,00,000 29,00,000

Working Note :

Amount to be paid or received from Equity shareholders `

Total Equity share capital paid up 14,00,000

Less: Surplus before call from Equity Shares (29,00,000 — 22,87,500) (6,12,500)

Loss to be borne by 1,50,000 shares 7,87,500

Loss per share = (7,87,500/ 1,50,000 shares) 5.25

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Hence, Refund to Equity shareholders of 1,00,000 shares of ` 10 fully paid up 4.75

Refund to Equity shareholders of 50,000 shares of ` 8 paid up 2.75

(b) Journal Entries in the books of SK Ltd.

` ‘000 ` ‘000

(i) Equity share capital (` 10) A/c Dr. 35,000

To Equity Share Capital (` 4) A/c 14,000

To Capital Reduction A/c 21,000

(Being conversion of equity share capital of

` 10 each into ` 4 each as per reconstruction scheme)

(ii) 8% Cumulative Preference Share capital (` 100) A/c Dr. 17,500

To 8% Cumulative Preference Share Capital 10,500

(` 60) A/c

To Capital Reduction A/c 7,000

(Being conversion of 6% cumulative preference shares

capital of ` 100 each into ` 60 each as per reconstruction

scheme)

(iii) 6% Debentures (` 100) A/c Dr. 14,000

To 9% Debentures (` 80) A/c 11,200

To Capital Reduction A/c 2,800

(Being 9% debentures of ` 80 each issued to existing 6%

debenture holders. The balance transferred to capital

reduction account as per reconstruction scheme)

(iv) Sundry Creditors A/c Dr. 7,000

To Equity Share Capital (` 4) A/c 3,500

To Capital Reduction A/c 3,500

(Being a creditor of ` 70,00,000 agreed to surrender his

claim by 50% and was allotted 8,75,000 equity shares of

` 4 each in full settlement of his dues as per reconstruction

scheme)

(v) Provision for Taxation A/c Dr. 350

Capital Reduction A/c Dr. 175

To Liability for Taxation A/c 525

(Being conversion of the provision for taxation into liability

for taxation for settlement of the amount due)

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 13

(vi) Liability for Taxation A/c Dr. 525

To Current Assets (Bank A/c) 525

(Being the payment of tax liability)

(vii) Capital Reduction A/c Dr. 34,125

To P & L A/c 2,100

To Fixed Assets A/c 8,750

To Current Assets A/c 18,725

To Investments A/c 175

To Capital Reserve A/c (Bal. fig.) 4,375

(Being amount of Capital Reduction utilized in writing off P

& L A/c (Dr.) Balance, Fixed Assets, Current Assets,

Investments and the Balance transferred to Capital

Reserve)

Working Note:

Capital Reduction Account

To Liability for taxation A/c 175 By Equity share capital 21,000

To P & L A/c 2,100 By 8% Cumulative preferences 7,000

To Fixed Assets 8,750 Share capital

To Current assets 18,725 By 6% Debentures 2,800

To Investment 175 By Sundry creditors 3,500

To Capital Reserve (Bal. 4,375

fig.)

34,300 34,300

Question 4

(a) On 31st March, 2018 the books of Nutan Insurance Company Limited contained the

following particulars in respect of marine insurance business:

Direct Business Re-insurance

(`) (`)

Premium:

Received 35,50,000 3,75,000

Receivable - 1.4.2017 2,14,500 18,700

Receivable - 31.3.2018 1,80,000 15,500

Paid 3,00,500

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Payable - 1.4.2017 10,400

Payable - 31.3.2018 15,200

Claims:

Paid 25,10,000 2,70,800

Payable - 1.4.2017 42,500 15,000

Payable - 31.3.2018 45,800 17,500

Received 2,17,000

Receivable - 1.4.2017 18,500

Receivable - 31.3.2018 19,200

Commission:

Paid 75,800 11,600

Received 12,400

Other Expenses and Income

`

Salaries 3,75,000

Rent rates and taxes 1,21,000

Printing and Stationary 24,800

Legal expenses (Inclusive of ` 18,000 for settlement of claims) 50,000

Interest, Dividend & Rent received (net) 1,12,500

Income tax deducted at source in respect of above 12,500

Bad Debts 5,800

Balance of fund as on 1-4-2017 was ` 38,50,000 including Additional Reserve for

` 3,60,000. Provision for Unexpired Risk to be created @100% and Additional Reserve

has to be maintained at 5% of net premium of the year.

Prepare the Revenue Account for the year ended 31st March, 2018. (10 Marks)

(b) While closing its books of accounts on 31st March 2018, a Non-Banking Finance Company

has its advances classified as follows:

` (in lakhs)

Standard assets 18,400

Sub-standard assets 1,250

Secured Portion of doubtful debts:

Upto one year 300

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 15

One year to three years 90

More than three years 30

Unsecured portions of doubtful debts 92

Loss assets 47

Calculate the amount of provision which must be made against the Advances as per -

(i) The Non-banking Financial Company - Non-systematically Important Non-Deposit

taking Company (Reserve Bank) Directions, 2016; and

(ii) Non-banking Financial Company - Systematically Important Non- Deposit taking

Company (Reserve Bank) Directions, 2016. (10 Marks)

Answer

(a) Form B – RA (Prescribed by IRDA)

Revenue Account for the year ended 31st March, 2018

(Marine Insurance Business)

Schedule Current Year

`

Premiums earned (net) 1 36,70,900

Profit/(Loss) on sale/redemption of investments -

Others (to be specified) -

Interest, Dividends and Rent – Gross (Net + TDS)

(1,12,500 +12,500) 1,25,000

Total (A) 37,95,900

Claims incurred (net) 2 25,86,900

Commission 3 75,000

Operating expenses related to Insurance business 4 5,52,800

Total (B) 32,14,700

Operating Profit from Marine Insurance business (A-B) 5,81,200

Schedules forming part of Revenue Account

Current Year

Schedule –1

Premium earned

On direct business 35,15,500

On Reinsurance business 3,71,800

© The Institute of Chartered Accountants of India

16 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Total Premiums earned 38,87,300

Less: Premium on reinsurance ceded (3,05,300)

Total Premium earned (net) 35,82,000

Change in provision for unexpired risk

(Required provision – Existing reserve)

[(35,82,000 + 5% of 35,82,000 i.e. 37,61,100) – 38,50,000)] 88,900

Net Premium earned 36,70,900

Schedule – 2

Claims incurred

Claims paid( including legal expenses) 25,81,800

Add: Claims outstanding at the end of the year 44,100

Less: Claims outstanding at the beginning of the year (39,000)

25,86,900

Schedule – 3

Commission paid

Direct 75,800

Add: Re-insurance accepted 11,600

Less: reinsurance ceded (12,400)

75,000

Schedule – 4

Operating expenses related to insurance business*

Employees’ remuneration and welfare benefits 3,75,000

Rent, Rates and Taxes 1,21,000

Printing and Stationery 24,800

Legal and Professional charges 32,000

5,52,800

*Assumed to be related with Marine insurance business.

Working Notes:

1. Total Premium Income Direct Re-insurance

Received 35,50,000 3,75,000

Add: Receivable on 31st March, 2018 1,80,000 15,500

37,30,000 3,90,500

Less: Receivable on 1st April, 2017 (2,14,500) (18,700)

35,15,500 3,71,800

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 17

2. Premium Expense on reinsurance

Premium Paid during the year 3,00,500

Add: Payable on 31st March, 2018 15,200

3,15,700

Less: Payable on 1st April, 2017 (10,400)

3,05,300

3. Claims Paid

Direct Business 25,10,000

Re-insurance 2,70,800

Legal Expenses 18,000

27,98,800

Less: Re-insurance claims received (2,17,000)

25,81,800

4. Claims outstanding as on 31st March, 2018

Direct 45,800

Re-insurance 17,500

63,300

Less: Recoverable from Re-insurers on (19,200)

31st March, 2018

44,100

5. Claims outstanding as on 1st April, 2017

Direct 42,500

Re-insurance 15,000

57,500

Less: Recoverable from Re-insurers on 1st April, (18,500)

2017

39,000

(b) Calculation of provision required on advances as on 31st March, 2018 as per the

Non-Banking Financial Company – Non-Systemically Important Non-Deposit taking

Company (Reserve Bank) Directions, 2016

Amount Percentage Provision

` in lakhs of provision ` in lakhs

Standard assets 18,400 0.25 46.00

© The Institute of Chartered Accountants of India

18 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Sub-standard assets 1,250 10 125.00

Secured portions of doubtful debts−

− upto one year 300 20 60.00

− one year to three years 90 30 27.00

− more than three years 30 50 15.00

Unsecured portions of doubtful debts 92 100 92.00

Loss assets 47 100 47.00

412.00

Calculation of provision required on advances as on 31st March, 2018 as per the Non-

Banking Financial Company - Systemically Important Non-Deposit taking Company and

Deposit taking Company (Reserve Bank) Directions, 2016

Amount Percentage of Provision

` in lakhs provision ` in lakhs

Standard assets 18,400 0.40* 73.60

Sub-standard assets 1,250 10 125.00

Secured portions of doubtful debts−

− upto one year 300 20 60.00

− one year to three years 90 30 27.00

− more than three years 30 50 15.00

Unsecured portions of doubtful debts 92 100 92.00

Loss assets 47 100 47.00

439.60

*Note: For the year ending on 31st March, 2018, the provision rate for standard assets is

0.40%.

Question 5

(a) The Profit and Loss Accounts of A Ltd. and its subsidiary B Ltd. for the year ended 31st

March, 2018 are given below :

` in Lakhs

Incomes A Ltd. B Ltd.

Sales and other income 7,500 1,500

Increase in Inventory 1,500 300

Total 9,000 1,800

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 19

Expenses

Raw material consumed 1,200 300

Wages and Salaries 1,200 225

Production expenses 300 150

Administrative expenses 300 150

Selling and distribution expenses 300 75

Interest 150 75

Depreciation 150 75

Total 3,600 1,050

Profit before tax 5,400 750

Provision for tax 1,800 300

Profit after tax 3,600 450

Dividend paid 1,800 225

Balance of Profit 1,800 225

The following information is also given:

(i) A Ltd sold goods of ` 180 Lakhs to B Ltd at cost plus 25%. (1/6 of such goods were

still in inventory of B Ltd at the end of the year)

(ii) Administrative expenses of B Ltd include ` 8 Lakhs paid to A Ltd as consultancy fees.

(iii) Selling and distribution expenses of A Ltd include `15 Lakhs paid to B Ltd as

commission.

(iv) A Ltd holds 72% of the Equity Capital of B Ltd. The Equity Capital of B Ltd prior to

2016-17 is `1,500 Lakhs

Prepare a consolidated Profit and Loss Account for the year ended 31st March, 2018.

(10 Marks)

(b) The Balance sheet of Rupal Ltd. for the year ended 31st March, 2016, 2017 and 2018 are

as under:

Liabilities (` In lakhs)

31.3.2016 31.3.2017 31.3.2018

Share Capital: 160 lakhs Equity 3,500 3,500 3,500

shares of Rs 10 each (Fully paid up)

General reserve 1,200 1,480 1,650

Profit & Loss A/c 415 565 675

© The Institute of Chartered Accountants of India

20 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Secured Loans:

12% Debentures 75 75 75

Term Loan 250 230 210

Trade Payables 630 738 850

6,070 6,588 6,960

Assets

Land & Building 1,200 1,320 1,450

Plant & machinery 2,750 2,630 2,580

Inventory 1,210 1,520 1,830

Trade Receivables 760 950 1,055

Cash at bank 150 168 45

6,070 6,588 6,960

Additional information:

(i) Actual valuations were shown as under:

(` in lakhs)

2016 2017 2018

Land & Building 1,450 1,580 1,750

Plant & machinery 2,650 2,520 2,380

Inventory 1,520 1,830 2,140

Net profit (including opening balance after writing off 1,325 1,550 1,660

depreciation, tax provision and transfer to General

reserve)

(ii) On 1st April, 2015, balance in the General reserve and Profit & Loss A/c was ` 1,000

lakhs and ` 350 lakhs respectively. Capital employed in the business at market value

at the beginning of 2015-16 was ` 5,185 Iakhs.

(iii) The normal annual return on average capital employed in the same line of business

is 10%.

Find out the average capital employed in each year and value of goodwill at 4 year's

purchase of Super profits (simple average method). (10 Marks)

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 21

Answer

(a) Consolidated Profit & Loss Account of A Ltd. and its subsidiary B Ltd.

for the year ended on 31st March, 2018

Particulars Note No. ` in Lacs

I. Revenue from operations 1 8,797

II. Total revenue 8,797

III. Expenses

Cost of Material purchased/Consumed 3 1,770

Changes of Inventories of finished goods 2 (1,794)

Employee benefit expense 4 1,425

Finance cost 6 225

Depreciation and amortization expense 7 225

Other expenses 5 802

Total expenses 2,653

IV. Profit before Tax(II-III) 6,144

V. Tax Expenses 8 2,100

VI. Profit After Tax 4,044

Notes to Accounts

` in Lacs ` in Lacs

1. Revenue from Operations

Sales and other income

A Ltd. 7,500

B Ltd. 1,500

9,000

Less: Inter-company Sales (180)

Consultancy fees received by A Ltd. from B Ltd. (8)

Commission received by B Ltd. from A Ltd. (15) 8,797

2. Increase in Inventory

A Ltd. 1,500

B Ltd. 300

1,800

© The Institute of Chartered Accountants of India

22 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Less: Unrealised profits ` 180×1/6 x 25/125 (6) 1,794

3. Cost of Material purchased/consumed

A Ltd. 1,200

BLtd. 300

1,500

Less: Purchases by B Ltd. from A Ltd. (180) 1,320

Direct Expenses

A Ltd. 300

BLtd. 150 450

1,770

4. Employee benefits and expenses

Wages and Salaries:

A Ltd. 1,200

B Ltd. 225 1,425

5. Other Expenses

Administrative Expenses

A Ltd. 300

B Ltd. 150

450

Less: Consultancy fees received by A Ltd. from BLtd. (8) 442

Selling and Distribution Expenses:

A Ltd. 300

B Ltd. 75

375

Less: Commission received from B Ltd. from A Ltd. (15) 360

802

6. Finance Cost

Interest:

A Ltd. 150

B Ltd. 75 225

7. Depreciation and Amortisation

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 23

Depreciation:

A Ltd. 150

B Ltd. 75 225

8. Provision for tax

A Ltd. 1800

B Ltd. 300 2100

Note: it is assumed that dividend adjustment has not be done in sales & other income of A Ltd

i.e. dividend received from B Ltd is not included in other income of A Ltd. Alternative answer is

possible considering is otherwise.

(b) Capital Employed at the end of each year (` In lakhs)

31.3.2016 31.3.2017 31.3.2018

` ` `

Land &Building (Revalued) 1,450 1,580 1,750

Plant & machinery 2,650 2,520 2,380

Inventory (Revalued) 1,520 1,830 2,140

Trade Receivables 760 950 1,055

Cash at Bank 150 168 45

Total Assets 6,530 7,048 7,370

Less: Trade Payables (630) (738) (850)

Term loan (250) (230) (210)

12% debentures (75) (75) (75)

Closing Capital employed 5,575 6,005 6,235

Add: Opening Capital employed 5,185 5,575 6,005

Total 10,760 11,580 12,240

Average Capital employed 5,380 5,790 6,120

Valuation of Goodwill (` In lakhs)

(i) Future Maintainable Profit 31.3.2016 31.3.2017 31.3.2018

Net Profit as given 1,325 1,550 1,660

Less: Opening Balance (350) (415) (565)

Adjustment for Valuation of Opening Inventory (310) (310)

Add: Adjustment for Valuation of closing 310 310 310

inventory

© The Institute of Chartered Accountants of India

24 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

Transferred to General Reserve 200 280 170

Future Maintainable Profit 1,485 1,415 1265

Less: 10% Normal Return on Avg. Capital

Employed 538 579 612

(ii) Super Profit 947 836 653

(i) Average Super Profit = ` (947+836+653)÷3 = ` 812 Lakh

(ii) Value of Goodwill at four years’ purchase= ` 812 lakh × 4 = ` 3248 lakh

Question 6

Answer any four of the following:

(a) Equity capital is held by L, M, N and O in the proportion of 30:40:20:10. A, B, C and D hold

Preference share capital in the proportion of 40:30:10:20. If the paid up Equity Share

capital of the company is ` 60 lakhs and Preference share capital is ` 30 lakhs, find the

voting rights of shareholders (in percentage) in case of resolution of winding up of the

company.

(b) What are the initial disclosure requirements of AS 24 for discontinuing operations?

(c) A Mutual Fund raised funds on 1st April, 2018 by issuing 10 lakhs units @ ` 20 per unit.

Out of this Fund, ` 180 lakhs invested in several capital market securities. The initial

expenses amount to ` 9 lakhs. During June, 2018, the fund sold certain securities of cost

` 140 lakhs for ` 175 lakhs and it bought certain securities for ` 125 lakhs. The Fund

Management expenses amounted to ` 5 lakhs per month and ` 0.75 lakh was in arrear.

The dividend earned was ` 4.50 lakhs 80% of the realized earnings were distributed among

the unit holders. The market value of the portfolio was ` 225 lakhs. Determine the Net

Asset Value (NAV) per unit as on 30th June, 2018.

(d) Forward Bank Ltd furnishes the following information as on 31 st March, 2018.

Amount in `

Bills Discounted 82,23,000

Rebate on bills discounted as on 1st April, 2017 1,32,960

Discount received 6,33,990

Details of bills discounted is as given below:

Value of Bills (`) Due Date Rate of Discount

10,95,000 15th June, 2018 14%

30,00,000 25th June, 2018 12%

16,92,000 5th July, 2018 16%

24,36,000 15th July, 2018 16%

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 25

(i) Calculate the rebate on bills discounted as on 31st March, 2018.

(ii) Pass necessary Journal Entries.

(e) Mutual fund has launched a new scheme “All Purpose Scheme”. The Mutual Fund Asset

Management Company wishes to Invest 25% of the NAV of the scheme in an unrated debt

instrument of a company Zed Ltd., which has been paying above average returns for the

past many years. The promoters of the company seek advice in light of the regulations of

SEBI. Will the position change in case the debt instruments of the company Zed Ltd. are

rated. (4 x 5 = 20 Marks)

Answer

(a) L, M, N and O hold Equity capital is held by in the proportion of 30:40:20:10 and A, B, C

and D hold preference share capital in the proportion of 40:30:10:20. As the paid up equity

share capital of the company is `60 Lakhs and Preference share capital is ` 30 Lakh (2:1),

then relative weights in the voting right of equity shareholders and preference shareholders

will be 2/3 and 1/3.

The respective voting right of various shareholders will be

L = 2/3X30/100 = 3/15 = 20%

M = 2/3X40/100 = 4/15 = 26.67%

N = 2/3X20/100 = 2/15 = 13.33%

O = 2/3X10/100 = 1/15 = 6.67%

A = 1/3X40/100 = 4/30 = 13.33%

B = 1/3X30/100 = 3/30 = 10%

C = 1/3X10/100 = 1/30 = 3.33%

D = 1/3X20/100 = 2/30 = 6.67%

(b) An enterprise should include the following information relating to a discontinuing operation

in its financial statements beginning with the financial statements for the period in which

the initial disclosure event occurs:

A. A description of the discontinuing operation(s)

B. The business or geographical segment(s) in which it is reported as per AS 17

C. The date and nature of the initial disclosure event.

D. The date or period in which the discontinuance is expected to be completed if known

or determinable

E. The carrying amounts, as of the balance sheet date, of the total assets to be disposed

of and the total liabilities to be settled

F. The amounts of revenue and expenses in respect of the ordinary activities attributable

to the discontinuing operation during the current financial reporting period

© The Institute of Chartered Accountants of India

26 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

G. The amount of pre-tax profit or loss from ordinary activities attributable to the

discontinuing operation during the current financial reporting period, and the income

tax expense related thereto

H. The amounts of net cash flows attributable to the operating, investing, and financing

activities of the discontinuing operation during the current financial reporting period

(c)

` in lakhs ` in lakhs

Opening bank balance [` (200 – 180 - 9) lakhs] 11

Add: Proceeds from sale of securities 175

Dividend received 4.50

190.5

Less: Cost of securities 125

Fund management expenses

[` (15–0.75) lakhs] 14.25

Capital gains distributed

[80% of ` (175 – 140) lakhs] 28

Dividends distributed (80% of ` 4.5 lakhs) 3.6

(170.85)

Closing bank balance 19.65

Closing market value of portfolio 225

244.65

Less: Arrears of expenses (0.75)

Closing net assets(A) 243.9

Number of units (B) 10,00,000

Closing Net Assets Value (NAV) per unit (A/B) ` 24.39

(d) In order to determine the amount to be credited to the Profit and Loss A/c it is necessary

to first ascertain the amount attributable to the unexpired portion of the period of the

respective bills. The workings are as given below:

Value (`) Due Date Days after 31-03-2018 Discount % Discount

Amount `

10,95,000 15-06-2018 (30+31 + 15) = 76 14% 31,920

30,00,000 25-06-2018 (30 + 31 + 25) = 86 12% 84,822

16,92,000 05-07-2018 (30 + 31 + 30 + 5) = 96 16% 71,203

24,36,000 15-07-2018 (30 + 31 + 30 + 15) = 106 16% 1,13,191*

Rebate on bills discounted

as on 31.3.2018 3,01,136

© The Institute of Chartered Accountants of India

PAPER – 5 : ADVANCED ACCOUNTING 27

The journal entries will be as follows :

Dr. Cr.

` `

Rebate on Bills Discounted A/c Dr. 1,32,960

To Discount on Bills A/c 1,32,960

(Being the transfer of Rebate on Bills Discounted

on 1.4.2017 to Discount on Bills Account)

Discount on Bills A/c Dr. 3,01,136

To Rebate on Bills Discounted A/c 3,01,136

(Being the transfer of rebate on bills discounted

required on 1.4.2018 from discount on Bills

Account)

Discount on Bills A/c Dr. 4,65,814

To Profit and Loss A/c 4,65,814

(Being the amount of discount on Bills transferred

to Profit and Loss Account)

Working Note:

The amount of discount to be credited to the Profit and Loss Account will be:

`

Transfer from Rebate on bills

discount as on 1.4.17 1,32,960

Add: Discount received during

the year ended 31-3-2018 6,33,990

7,66,950

Less: Rebate on bills discounted

as on 31.3.2018 (3,01,136)

4,65,814

(e) The Seventh Schedule of SEBI (Mutual funds) Regulations, 1996 states that a mutual fund

scheme shall not invest more than 10% of its NAV in unrated debt instruments issued by

a single issuer and the total investment in such instruments shall not exceed 25% of the

NAV of the scheme. All such investments shall be made with the prior approval of the

Board of Trustees and the Board of Asset Management Company.

© The Institute of Chartered Accountants of India

28 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2018

It also states that a mutual fund scheme shall not invest more than 10% of its NAV in debt

instruments issued by a single issuer which are rated not below investment grade by an

authorized credit rating agency. Such investment limit may be extended to 12% of the NAV

of the scheme with the prior approval of the Board of Trustees and the Board of Asset

Management Company.

Accordingly, if the debts instruments of Zed Ltd. are unrated then Mutual Fund Asset

Management Company (AMC) cannot invest more than 10% of its NAV in those

instruments. If the debts instruments of Zed Ltd. are rated, even then, Mutual Fund Asset

Management Company cannot invest more than 12% of its NAV in those instruments.

Therefore, investment of 25% of its NAV of the scheme in debts instrument of Zed Ltd. by

Mutual Fund Asset Management Company is not permissible as per the SEBI (Mutual

Fund) Regulations, 1996.

© The Institute of Chartered Accountants of India

You might also like

- CA Inter Accounts - Cash Flow Statement by CA Nitin Goel100% (3)CA Inter Accounts - Cash Flow Statement by CA Nitin Goel32 pages

- Introduction To Cost and Management Accounting: Question-1No ratings yetIntroduction To Cost and Management Accounting: Question-132 pages

- Capital Structure and Firms Performance On Listed Oil and Gas Company in Nigeria100% (2)Capital Structure and Firms Performance On Listed Oil and Gas Company in Nigeria56 pages

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaNo ratings yetPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of India31 pages

- CA Inter Cost Important Questions For CA Nov'22No ratings yetCA Inter Cost Important Questions For CA Nov'2293 pages

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of India100% (1)Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of India53 pages

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On Fixed100% (1)Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On Fixed6 pages

- Unit - 4: Amalgamation and ReconstructionNo ratings yetUnit - 4: Amalgamation and Reconstruction54 pages

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesNo ratings yetDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials Issues5 pages

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFNo ratings yetGroup - I Paper - 1 Accounting V2 Chapter 13 PDF13 pages

- CA Ipcc Costing Suggested Answers For Nov 20161No ratings yetCA Ipcc Costing Suggested Answers For Nov 2016112 pages

- 15-Mca-Nr-Accounting and Financial Management0% (2)15-Mca-Nr-Accounting and Financial Management4 pages

- Non-Integrated, Integrated & Reconciliation of Cost and Financial Accounts67% (3)Non-Integrated, Integrated & Reconciliation of Cost and Financial Accounts107 pages

- Chapter 3 Employee Cost and Direct ExpensesNo ratings yetChapter 3 Employee Cost and Direct Expenses68 pages

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesNo ratings yetChapter - 7 Departmental Accounting: Mark-Up Accounting Journal Entries17 pages

- Chapter 6 - Profits and Gains From Business or Profession - Notes100% (1)Chapter 6 - Profits and Gains From Business or Profession - Notes66 pages

- Chap 11 Hire Purchase and Instalment Sale Transactions PDFNo ratings yetChap 11 Hire Purchase and Instalment Sale Transactions PDF41 pages

- Chapter 9 Accounting For Branches Including Foreign Branches PDF100% (1)Chapter 9 Accounting For Branches Including Foreign Branches PDF61 pages

- Paper - 3: Cost and Management Accounting Questions Material CostNo ratings yetPaper - 3: Cost and Management Accounting Questions Material Cost31 pages

- Chapter 2 - Income From House Property - Notes50% (2)Chapter 2 - Income From House Property - Notes27 pages

- Adv - AccountsNew Nov18 Suggested Ans CA InterNo ratings yetAdv - AccountsNew Nov18 Suggested Ans CA Inter28 pages

- Effect of Corporate Social Responsibility On Financial Performance of Listed Oil and Gas Firms in NigeriaNo ratings yetEffect of Corporate Social Responsibility On Financial Performance of Listed Oil and Gas Firms in Nigeria8 pages

- The Church and The Tax Law: Keeping Church and State SeparateNo ratings yetThe Church and The Tax Law: Keeping Church and State Separate19 pages

- Doctora (Worksheet Evangelista) CompleteNo ratings yetDoctora (Worksheet Evangelista) Complete3 pages

- COST AND MANAFEMENT ACCOUNTING Final ExamNo ratings yetCOST AND MANAFEMENT ACCOUNTING Final Exam9 pages

- Aarti Industries Limited: Raj Kumar SarrafNo ratings yetAarti Industries Limited: Raj Kumar Sarraf25 pages

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckNo ratings yetJun Zen Ralph V. Yap BSA - 3 Year Let's Check5 pages

- Presentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir IqbalNo ratings yetPresentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir Iqbal20 pages

- Far 410 Tutorial Chapter 2 Part B QuestionNo ratings yetFar 410 Tutorial Chapter 2 Part B Question2 pages

- (Diagnostic Exam) Advanced Studies in TaxationNo ratings yet(Diagnostic Exam) Advanced Studies in Taxation25 pages

- Growth Leaders Fund - Series 2 - PPT-Investor PDFNo ratings yetGrowth Leaders Fund - Series 2 - PPT-Investor PDF30 pages

- CA Inter Accounts - Cash Flow Statement by CA Nitin GoelCA Inter Accounts - Cash Flow Statement by CA Nitin Goel

- Introduction To Cost and Management Accounting: Question-1Introduction To Cost and Management Accounting: Question-1

- Capital Structure and Firms Performance On Listed Oil and Gas Company in NigeriaCapital Structure and Firms Performance On Listed Oil and Gas Company in Nigeria

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of India

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of India

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On Fixed

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials Issues

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsNon-Integrated, Integrated & Reconciliation of Cost and Financial Accounts

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal Entries

- Chapter 6 - Profits and Gains From Business or Profession - NotesChapter 6 - Profits and Gains From Business or Profession - Notes

- Chap 11 Hire Purchase and Instalment Sale Transactions PDFChap 11 Hire Purchase and Instalment Sale Transactions PDF

- Chapter 9 Accounting For Branches Including Foreign Branches PDFChapter 9 Accounting For Branches Including Foreign Branches PDF

- Paper - 3: Cost and Management Accounting Questions Material CostPaper - 3: Cost and Management Accounting Questions Material Cost

- Effect of Corporate Social Responsibility On Financial Performance of Listed Oil and Gas Firms in NigeriaEffect of Corporate Social Responsibility On Financial Performance of Listed Oil and Gas Firms in Nigeria

- The Church and The Tax Law: Keeping Church and State SeparateThe Church and The Tax Law: Keeping Church and State Separate

- Presentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir IqbalPresentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir Iqbal