Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Uploaded by

Hemlata LodhaCopyright:

Available Formats

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Uploaded by

Hemlata LodhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Uploaded by

Hemlata LodhaCopyright:

Available Formats

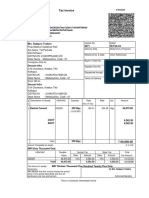

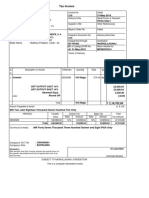

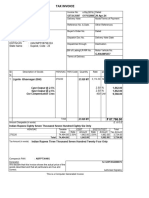

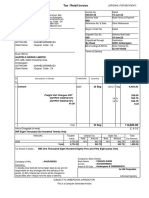

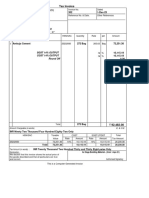

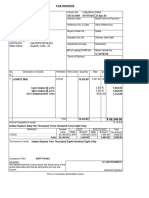

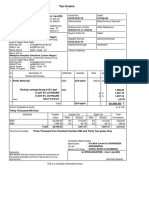

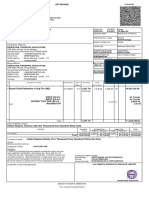

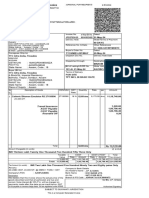

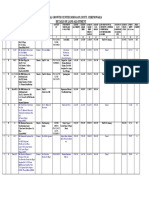

Tax Invoice (ORIGINAL FOR RECIPIENT)

THAKURDAS KHEMCHAND Invoice No. Dated

Katla Bazar, CR/205 13-Jun-2020

Jodhpur - 342 002 Delivery Note

FSSAI # 12218032000314

GSTIN/UIN: 08ADCPK9421C1ZU

Despatch Document No. Delivery Note Date

State Name : Rajasthan, Code : 08

Contact : 0291-2439720

Despatched through Destination

Buyer

Hem Tech

Jodhpur

GSTIN/UIN : 08ABGPL3664C1ZS

State Name : Rajasthan, Code : 08

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Monosodium Glutamate ( 29224220 18 % 300.000 KG 84.75 KG 25,425.00

Ajinotmoto)

Loose

12 x 25 Kgs

CGST 2,288.25

SGST 2,288.25

Round Off (+/-) 0.50

Total 300.000 KG 30,002.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Thirty Thousand Two Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

29224220 25,425.00 9% 2,288.25 9% 2,288.25 4,576.50

Total 25,425.00 2,288.25 2,288.25 4,576.50

Tax Amount (in words) : Indian Rupees Four Thousand Five Hundred Seventy Six and Fifty paise Only

Company’s Bank Details

Bank Name : Central Bank of India

A/c No. : 1299519743

Company’s PAN : ADCPK9421C Branch & IFS Code : Jalori Gate & CBIN0280450

Declaration for THAKURDAS KHEMCHAND

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

SUBJECT TO JODHPUR JURISDICTION

This is a Computer Generated Invoice

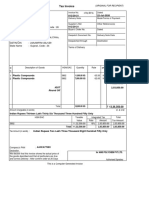

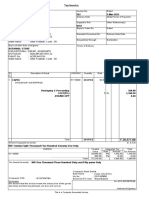

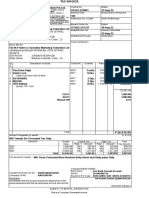

Tax Invoice (DUPLICATE FOR TRANSPORTER)

THAKURDAS KHEMCHAND Invoice No. Dated

Katla Bazar, CR/205 13-Jun-2020

Jodhpur - 342 002 Delivery Note

FSSAI # 12218032000314

GSTIN/UIN: 08ADCPK9421C1ZU

Despatch Document No. Delivery Note Date

State Name : Rajasthan, Code : 08

Contact : 0291-2439720

Despatched through Destination

Buyer

Hem Tech

Jodhpur

GSTIN/UIN : 08ABGPL3664C1ZS

State Name : Rajasthan, Code : 08

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Monosodium Glutamate ( 29224220 18 % 300.000 KG 84.75 KG 25,425.00

Ajinotmoto)

Loose

12 x 25 Kgs

CGST 2,288.25

SGST 2,288.25

Round Off (+/-) 0.50

Total 300.000 KG 30,002.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Thirty Thousand Two Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

29224220 25,425.00 9% 2,288.25 9% 2,288.25 4,576.50

Total 25,425.00 2,288.25 2,288.25 4,576.50

Tax Amount (in words) : Indian Rupees Four Thousand Five Hundred Seventy Six and Fifty paise Only

Company’s Bank Details

Bank Name : Central Bank of India

A/c No. : 1299519743

Company’s PAN : ADCPK9421C Branch & IFS Code : Jalori Gate & CBIN0280450

Declaration for THAKURDAS KHEMCHAND

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

SUBJECT TO JODHPUR JURISDICTION

This is a Computer Generated Invoice

You might also like

- Policy On Revolving Fund and Petty Cash FundDocument6 pagesPolicy On Revolving Fund and Petty Cash Fundmarvinceledio100% (3)

- NationwideDocument1 pageNationwideЮлия ПNo ratings yet

- Journal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunDocument6 pagesJournal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunHemlata Lodha50% (2)

- Journal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunDocument6 pagesJournal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunHemlata Lodha50% (2)

- Accounting VoucherDocument1 pageAccounting Vouchershailesh patilNo ratings yet

- Tax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21Document1 pageTax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21talabirachp siteNo ratings yet

- Tax Invoice: Amg Polychem PVT - LTDDocument3 pagesTax Invoice: Amg Polychem PVT - LTDARPIT MAHESHWARINo ratings yet

- Tax Invoice Shree Durga Traders: E-Way Bill NoDocument1 pageTax Invoice Shree Durga Traders: E-Way Bill NoRisi Spice industriesNo ratings yet

- Sales GET 24-25 0014Document1 pageSales GET 24-25 0014Himanshu Kr. BhumiharNo ratings yet

- UGS - 119 - Petropath Fluids (India) Pvt. Ltd.Document3 pagesUGS - 119 - Petropath Fluids (India) Pvt. Ltd.Alok SinghNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Sales PT TI 24-25 88Document2 pagesSales PT TI 24-25 88jsplmeghrajNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- Sales AJ 033 24-25Document1 pageSales AJ 033 24-25A J INDUSTRIESNo ratings yet

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Document1 pageTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNo ratings yet

- Shah Tyres Pandhurna 58MTDocument1 pageShah Tyres Pandhurna 58MTliladharkhode2025No ratings yet

- 3165Document1 page3165VinayKRaiNo ratings yet

- Sales PI 167 24-25Document1 pageSales PI 167 24-25A J INDUSTRIESNo ratings yet

- BillDocument1 pageBillroysadhana821No ratings yet

- TCL BillDocument3 pagesTCL BillYoginder SinghNo ratings yet

- Inv 007-1Document1 pageInv 007-1grpsabNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- 3351 InvoiceDocument1 page3351 InvoicepkNo ratings yet

- Bill Format Gypusm BoardDocument8 pagesBill Format Gypusm BoardRamachandra SahuNo ratings yet

- Tax / Retail Invoice: 207+208, GIDC Industrial Area Umbergaon Gstin/Uin: 24AABCG0586B1Z4 State Name: Gujarat, Code: 24Document2 pagesTax / Retail Invoice: 207+208, GIDC Industrial Area Umbergaon Gstin/Uin: 24AABCG0586B1Z4 State Name: Gujarat, Code: 24Jwalant JadavNo ratings yet

- Tax Invoice: Orchid Travel OT/TI/085/24-25 30-Jul-24Document1 pageTax Invoice: Orchid Travel OT/TI/085/24-25 30-Jul-24Souvik ChakrabartyNo ratings yet

- Bill 15Document1 pageBill 15jay_p_shahNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicemanmojilo4 bharwadNo ratings yet

- 161/1, M.G.ROAD Bangar Buildung. ROOM NO.-18 Kolkata GSTIN/UIN: 19BYDPR0678H2ZZ State Name: West Bengal, Code: 19Document1 page161/1, M.G.ROAD Bangar Buildung. ROOM NO.-18 Kolkata GSTIN/UIN: 19BYDPR0678H2ZZ State Name: West Bengal, Code: 19Tripti AgrawalNo ratings yet

- Purchase 142Document16 pagesPurchase 142nitinupadhyay9821No ratings yet

- Minati HardwareDocument1 pageMinati HardwarebiswaspranabghyNo ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- Inv 004-1Document1 pageInv 004-1grpsabNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceᴘᴇᴀᴄᴏᴄᴋNo ratings yet

- Accounting Voucher 289Document1 pageAccounting Voucher 289rajesh puhanNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- VivaanDocument1 pageVivaanTapas MishraNo ratings yet

- Trio Magic InfraDocument1 pageTrio Magic Infratriomagic.7860No ratings yet

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Document1 pageTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNo ratings yet

- Isb Tripod 4370DDocument1 pageIsb Tripod 4370DBalrajNo ratings yet

- Bill No - 312 PDFDocument1 pageBill No - 312 PDFas constructionNo ratings yet

- 40 PDFDocument2 pages40 PDFAshu SinghNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- 0091Document1 page0091Abhinav NigamNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPriyanka DevghareNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1chandankaran894No ratings yet

- 275 TTCDocument3 pages275 TTCAmitabh PatraNo ratings yet

- Sachi Agency 14.09.2022Document1 pageSachi Agency 14.09.2022dheerendrapanwarNo ratings yet

- RT-CN-24 25 011 (Prolific)Document1 pageRT-CN-24 25 011 (Prolific)Souvik ChakrabartyNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- UPS InvoiceDocument1 pageUPS InvoiceMohammed NazimNo ratings yet

- 2 - P. S. Sikarwar EnterprisesDocument1 page2 - P. S. Sikarwar Enterprisespriyanka singhNo ratings yet

- Khodiyar To Bipin ParsotamDocument10 pagesKhodiyar To Bipin ParsotamparagauditNo ratings yet

- AJPL0602Document1 pageAJPL0602shrungar.ornament1No ratings yet

- Sales GST34Document1 pageSales GST34narayansdgh1993No ratings yet

- Ramji Hardware 30mayDocument2 pagesRamji Hardware 30maygaurav sharmaNo ratings yet

- Tax Invoice - Sheet1Document1 pageTax Invoice - Sheet1nonud1000No ratings yet

- Praa 2 PDFDocument1 pagePraa 2 PDFMithun Mathew KottaramkunnelNo ratings yet

- Mazgaon PiDocument1 pageMazgaon Pishan12novNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Vastu and Environment, Trees, Plants - Vastu Norms For Environment, Plants, Trees Online at AstroshastraDocument3 pagesVastu and Environment, Trees, Plants - Vastu Norms For Environment, Plants, Trees Online at AstroshastraHemlata LodhaNo ratings yet

- Industrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentDocument8 pagesIndustrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentHemlata LodhaNo ratings yet

- Delhi Test House: A-62/3, G.T.Karnal Road, Indl. Area, Azadpur, Delhi-110033 PH: 011-47075555 (30 Lines) Fax: 47075550Document3 pagesDelhi Test House: A-62/3, G.T.Karnal Road, Indl. Area, Azadpur, Delhi-110033 PH: 011-47075555 (30 Lines) Fax: 47075550Hemlata LodhaNo ratings yet

- Keshavaprasad B S - Maturity Amount Calculation For Recurring Deposit in MS ExcelDocument2 pagesKeshavaprasad B S - Maturity Amount Calculation For Recurring Deposit in MS ExcelHemlata LodhaNo ratings yet

- List of Governors of Reserve Bank of India - WikipediaDocument2 pagesList of Governors of Reserve Bank of India - WikipediaHemlata LodhaNo ratings yet

- Castament FS 20: Technical Data SheetDocument2 pagesCastament FS 20: Technical Data SheetHemlata LodhaNo ratings yet

- Cetex Micro-SilicaDocument1 pageCetex Micro-SilicaHemlata LodhaNo ratings yet

- WWW - Punjab.bsnl - Co.in Bandhan bb1.htmDocument7 pagesWWW - Punjab.bsnl - Co.in Bandhan bb1.htmHemlata LodhaNo ratings yet

- Dealer Wise Stock Availability in Kgs (Tamil Nadu) With Last Updated DateDocument1 pageDealer Wise Stock Availability in Kgs (Tamil Nadu) With Last Updated DateHemlata LodhaNo ratings yet

- Castament FS 20: Technical Data SheetDocument2 pagesCastament FS 20: Technical Data SheetHemlata LodhaNo ratings yet

- Requirement Minimum Maximum Testing MethodDocument4 pagesRequirement Minimum Maximum Testing MethodHemlata LodhaNo ratings yet

- "Celite" 545: Physical Properties, Composition and DataDocument1 page"Celite" 545: Physical Properties, Composition and DataHemlata LodhaNo ratings yet

- Matigo Pre Mocks 2024 Uce MTC 1Document5 pagesMatigo Pre Mocks 2024 Uce MTC 1madrinenaggawa0100% (9)

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Faq of Banking WebsiteDocument74 pagesFaq of Banking Websitemoney coxNo ratings yet

- Checks ManagementDocument3 pagesChecks ManagementnorthepirNo ratings yet

- Circular No 12 2022Document7 pagesCircular No 12 2022shantXNo ratings yet

- Town of Madison Proposed FY24 BudgetDocument3 pagesTown of Madison Proposed FY24 BudgetChuck JacksonNo ratings yet

- Dr. S.S SodhaDocument5 pagesDr. S.S SodhaHaripriya VNo ratings yet

- Request For Replacement Certificate FormDocument1 pageRequest For Replacement Certificate FormCef LeCefNo ratings yet

- Wells Fargo Essential CheckingDocument3 pagesWells Fargo Essential Checking123No ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- National Development Company V CIR (1987)Document2 pagesNational Development Company V CIR (1987)BernadetteGaleraNo ratings yet

- Domestic: Soumitra Roy & Tusi RoyDocument2 pagesDomestic: Soumitra Roy & Tusi RoyAnonymous t5MrKaXDNo ratings yet

- Business Blue Print - ProjectDocument228 pagesBusiness Blue Print - ProjectThakkarSameerNo ratings yet

- Corporate Tax in DubaiDocument10 pagesCorporate Tax in DubaishayanNo ratings yet

- NOTES Income Taxation Cheat SheetDocument2 pagesNOTES Income Taxation Cheat SheetMARGARETTE ANGULONo ratings yet

- Service Tax Registration - Form ST-2Document2 pagesService Tax Registration - Form ST-2benedictprasadNo ratings yet

- 30 Arduino™ Projects For The Evil Genius - Department of Control (PDFDrive)Document37 pages30 Arduino™ Projects For The Evil Genius - Department of Control (PDFDrive)eNo ratings yet

- 1 MRP PROJECT - Impect of Demonitisationdigital MRPDocument53 pages1 MRP PROJECT - Impect of Demonitisationdigital MRPRuchi Kashyap50% (2)

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficeNo ratings yet

- Chapter 1 General Principles and Concepts of TaxationDocument40 pagesChapter 1 General Principles and Concepts of TaxationArjay AlleraNo ratings yet

- MT100Document349 pagesMT100Hari NNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummarySanjeev KumarNo ratings yet

- Taxation Affecting Tourism Industry in The PhilippinesDocument33 pagesTaxation Affecting Tourism Industry in The Philippinesrheaangelique_triasNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Form HDocument1 pageForm HIqram MeonNo ratings yet

- Sample 1673514368545Document2 pagesSample 1673514368545Sonm NegiNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- PBT 01 EFT OverviewDocument72 pagesPBT 01 EFT Overviewsatya narayana murthyNo ratings yet