Numbers 36 and 37 (Installment Sales)

Numbers 36 and 37 (Installment Sales)

Uploaded by

elsana philipCopyright:

Available Formats

Numbers 36 and 37 (Installment Sales)

Numbers 36 and 37 (Installment Sales)

Uploaded by

elsana philipOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Numbers 36 and 37 (Installment Sales)

Numbers 36 and 37 (Installment Sales)

Uploaded by

elsana philipCopyright:

Available Formats

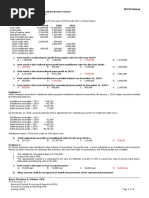

Numbers 36 and 37 ( Installment sales)

Appliance Company reports gross profit on the installment basis. The following data are

available:

2018 2019 2020

Installment sales 240,000 250,000 300,000

Cost of goods – installment sales 180,000 181,250 216,000

Gross profit 60,000 68,750 84,000

Collections

2018 installment contracts 45,000 75,000 72,500

2019 installment contracts 47,500 80,000

2020 installment contracts 62,500

Defaults

Unpaid balance of 2018 installment contracts 12,500 15,000

Value assigned to repossessed merchandise 6,500 6,000

Unpaid balance of 2019 installment contracts 16,000

Value assigned to repossessed merchandise 9,000

36. What is the realized gross profit before loss on repossession for 2020?

A. 49,775

B. 57,625

C. 48,975

D. 56,625

1. What is the loss on repossession for 2020?

A. 5,250

B. 2,600

C. 7,850

D. 9,000

Page 14

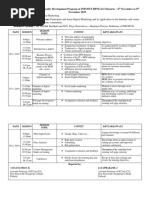

Number 38 (Installment sales)

Davao Company uses the installment method of income recognition. The entity provided the

following pertinent data:

2018 2019 2020

Installment sales 300,000 375,000 360,000

Cost of goods sold 225,000 285,000 252,000

Balance of Deferred Gross Profit at Year end

2018 52,500 15,000 -

2019 54,000 9,000

2020 72,000

What is the total balance of the Installment Accounts Receivable on December 31, 2020?

A. 270,000

B. 277,500

C. 279,000

D. 300,000

Numbers 39 and 40 (Installment Sales)

On January 1, 2018, an entity sold a car to a customer at a price of P400,000 with a production

cost of P300,000. It is the entity’s policy to employ installment method to recognize gross profit

from installment sales.

At the time of sale, the entity received cash amounting to 25% of the selling price and old car

with trade-in allowance of P50,000. The said old car has fair value of P150,000. The customer

issued a 5-year note for the balance to be payable in equal annual installments every December

31 starting 2018. The note payable is interest bearing with 10% rate due on the remaining

balance of the note.

The customer was able to pay the first annual installment and corresponding interest due.

However, after the payment of the second interest due, the customer defaulted on the second

annual installment which resulted to the repossession of the car sold with appraised value of

P110,000. On December 31, 2019, the repossessed car was resold for P140,000 after

reconditioning cost of P10,000.

You might also like

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)100% (1)AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)10 pages

- Cash Received From Customers During The YearNo ratings yetCash Received From Customers During The Year5 pages

- 7_Revenue_Recognition___Installment_Sales.docxNo ratings yet7_Revenue_Recognition___Installment_Sales.docx5 pages

- Chapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsNo ratings yetChapter 4: Installment Sales (Ias 18) : Part 1: Theory of Accounts4 pages

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)No ratings yetAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)4 pages

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)No ratings yetAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)4 pages

- Installment-Sales-Supplementary-Problems & NotesNo ratings yetInstallment-Sales-Supplementary-Problems & Notes3 pages

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)No ratings yetAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)5 pages

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)No ratings yet02 Audit of Expenditure and Disbursements Cycle (Cont.)4 pages

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceNo ratings yetAssumption College of Nabunturan: Nabunturan, Compostela Valley Province4 pages

- AP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryNo ratings yetAP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single Entry4 pages

- AFAR 3 - Quiz On Intercompany TransactionsNo ratings yetAFAR 3 - Quiz On Intercompany Transactions1 page

- Prelim Lecture 1 Assignment: Multiple ChoiceNo ratings yetPrelim Lecture 1 Assignment: Multiple Choice4 pages

- 7024 - Statement of Comprehensive IncomeNo ratings yet7024 - Statement of Comprehensive Income2 pages

- Chapter 1 Practice Test - Problems (Answers)No ratings yetChapter 1 Practice Test - Problems (Answers)12 pages

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Use The Following Information For The Next Two QuestionsNo ratings yetUse The Following Information For The Next Two Questions7 pages

- Tweak Corporation Determined The Value in Use of The Unit To Be P535No ratings yetTweak Corporation Determined The Value in Use of The Unit To Be P5356 pages

- Illustration: Bonds Issued at Premium - With Transaction CostsNo ratings yetIllustration: Bonds Issued at Premium - With Transaction Costs2 pages

- PROBLEM NO. 2 - Computation of Adjusted Cash and Cash EquivalentNo ratings yetPROBLEM NO. 2 - Computation of Adjusted Cash and Cash Equivalent1 page

- Toaz - Info Business Plan Photography Studio PR100% (1)Toaz - Info Business Plan Photography Studio PR32 pages

- Real Estate Appraisal A Review of Valuation Methods Vassilis AssimakopoulosNo ratings yetReal Estate Appraisal A Review of Valuation Methods Vassilis Assimakopoulos25 pages

- Front Office Operations Guest History: Incentives100% (1)Front Office Operations Guest History: Incentives1 page

- Successful Factors of Implementation Electronic Customer Relationship Management (e-CRM) On E-Commerce CompanyNo ratings yetSuccessful Factors of Implementation Electronic Customer Relationship Management (e-CRM) On E-Commerce Company7 pages

- Tutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of Brunei0% (1)Tutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of Brunei5 pages

- Solution - 1.: Calculation of NPV and IrrNo ratings yetSolution - 1.: Calculation of NPV and Irr5 pages

- Forum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: ServicesNo ratings yetForum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: Services5 pages

- Scraplane: A Blockchain and ML Based System To Facilitate Scrapping of CarsNo ratings yetScraplane: A Blockchain and ML Based System To Facilitate Scrapping of Cars19 pages

- Powerinvesting: Trading Your Way To Financial Freedom100% (2)Powerinvesting: Trading Your Way To Financial Freedom42 pages

- Assignment No 6 - FM Actual Summer 2020 Furqan Farooq-18292100% (1)Assignment No 6 - FM Actual Summer 2020 Furqan Farooq-1829237 pages

- Abdul Azeem: Topicwise Icap Past Paper Analysis - Cfap 4 (Bfd/Mac)0% (1)Abdul Azeem: Topicwise Icap Past Paper Analysis - Cfap 4 (Bfd/Mac)6 pages