ch42 t2011 Eng

ch42 t2011 Eng

Uploaded by

Bharat BajajCopyright:

Available Formats

ch42 t2011 Eng

ch42 t2011 Eng

Uploaded by

Bharat BajajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

ch42 t2011 Eng

ch42 t2011 Eng

Uploaded by

Bharat BajajCopyright:

Available Formats

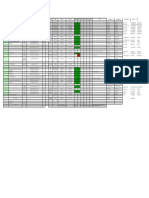

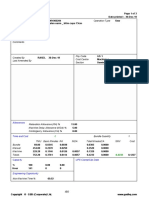

CUSTOMS TARIFF - SCHEDULE

VIII - 1

Section VIII

RAW HIDES AND SKINS, LEATHER, FURSKINS AND ARTICLES THEREOF;

SADDLERY AND HARNESS; TRAVEL GOODS, HANDBAGS

AND SIMILAR CONTAINERS; ARTICLES OF ANIMAL GUT

(OTHER THAN SILK-WORM GUT)

Issued January 1, 2011

CUSTOMS TARIFF - SCHEDULE

42 - i

Chapter 42

ARTICLES OF LEATHER; SADDLERY AND HARNESS;

TRAVEL GOODS, HANDBAGS AND SIMILAR CONTAINERS;

ARTICLES OF ANIMAL GUT (OTHER THAN SILK-WORM GUT)

Notes.

1. This Chapter does not cover:

(a) Sterile surgical catgut or similar sterile suture materials (heading 30.06);

(b) Articles of apparel or clothing accessories (except gloves, mittens and mitts), lined with furskin or artificial fur or to which

furskin or artificial fur is attached on the outside except as mere trimming (heading 43.03 or 43.04);

(c) Made up articles of netting (heading 56.08);

(d) Articles of Chapter 64;

(e) Headgear or parts thereof of Chapter 65;

(f) Whips, riding-crops or other articles of heading 66.02;

(g) Cuff-links, bracelets or other imitation jewellery (heading 71.17);

(h) Fittings or trimmings for harness, such as stirrups, bits, horse brasses and buckles, separately presented (generally

Section XV);

(ij) Strings, skins for drums or the like, or other parts of musical instruments (heading 92.09);

(k) Articles of Chapter 94 (for example, furniture, lamps and lighting fittings);

(l) Articles of Chapter 95 (for example, toys, games, sports requisites); or

(m) Buttons, press-fasteners, snap-fasteners, press-studs, button moulds or other parts of these articles, button blanks, of

heading 96.06.

2. (A) In addition to the provisions of Note 1 above, heading 42.02 does not cover:

(a) Bags made of sheeting of plastics, whether or not printed, with handles, not designed for prolonged use (heading

39.23);

(b) Articles of plaiting materials (heading 46.02).

(B) Articles of headings 42.02 and 42.03 which have parts of precious metal or metal clad with precious metal, of natural or

cultured pearls, of precious or semi-precious stones (natural, synthetic or reconstructed) remain classified in those

headings even if such parts constitute more than minor fittings or minor ornamentation, provided that these parts do not

give the articles their essential character. If, on the other hand, the parts give the articles their essential character, the

articles are to be classified in Chapter 71.

3. For the purpose of heading 42.03, the expression "articles of apparel and clothing accessories" applies, inter alia, to gloves,

mittens and mitts (including those for sport or for protection), aprons and other protective clothing, braces, belts, bandoliers

and wrist straps, but excluding watch straps (heading 91.13).

Issued January 1, 2011

42 - 1

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4201.00 Saddlery and harness for any animal (including traces, leads, knee

pads, muzzles, saddle cloths, saddle bags, dog coats and the like), of

any material.

4201.00.10 00 - - -English type saddles - 5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 3%

CRT: 5%

4201.00.90 - - -Other 7% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 7%

10 - - - - -Saddles for horses ................................................................................. -

80 - - - - -Saddlery and harness, including parts and accessories (excluding

saddles) ................................................................................................. -

90 - - - - -Other ...................................................................................................... -

42.02 Trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school

satchels, spectacle cases, binocular cases, camera cases, musical

instrument cases, gun cases, holsters and similar containers; travelling-

bags, insulated food or beverage bags, toilet bags, rucksacks,

handbags, shopping bags, wallets, purses, map-cases, cigarette-cases,

tobacco-pouches, tool bags, sports bags, bottle-cases, jewellery boxes,

powder-boxes, cutlery cases and similar containers, of leather or of

composition leather, of sheeting of plastics, of textile materials, of

vulcanized fibre or of paperboard, or wholly or mainly covered with such

materials or with paper.

-Trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school

satchels and similar containers:

4202.11.00 00 - -With outer surface of leather, of composition leather or of patent NMB 11% CCCT, LDCT, UST, MT,

leather MUST, CIAT, CT, IT, NT,

SLT, PT: Free

AUT: 6.5%

NZT: 6.5%

GPT: 7%

CRT: 11%

4202.12 - -With outer surface of plastics or of textile materials

4202.12.10 00 - - -With outer surface of textile materials, containing less than 85% by weight NMB 11% CCCT, LDCT, UST, MT,

of silk or silk waste CIAT, CT, IT, NT, SLT,

PT: Free

GPT: 7%

CRT: 11%

Issued January 1, 2011

42 - 2

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4202.12.90 00 - - -Other NMB 11% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 11%

4202.19.00 00 - -Other NMB 11% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 11%

-Handbags, whether or not with shoulder strap, including those without

handle:

4202.21.00 00 - -With outer surface of leather, of composition leather or of patent DZN 10% CCCT, LDCT, UST, MT,

leather MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 10%

4202.22 - -With outer surface of sheeting of plastics or of textile materials

4202.22.10 00 - - -With outer surface of textile materials (other than of abaca), containing DZN 10.5% CCCT, LDCT, UST, MT,

less than 85% by weight of silk or silk waste CIAT, CT, IT, NT, SLT,

PT: Free

GPT: 7%

CRT: 10.5%

4202.22.90 - - -Other 10.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 10.5%

10 - - - - -Of sheeting of plastics ............................................................................ DZN

20 - - - - -Of textile materials.................................................................................. DZN

4202.29.00 - -Other 10.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 10.5%

10 - - - - -Handbags of plastic beads, bugles or spangles ..................................... NMB

90 - - - - -Other ...................................................................................................... DZN

-Articles of a kind normally carried in the pocket or in the handbag:

4202.31.00 - -With outer surface of leather, of composition leather or of patent 8.5% CCCT, LDCT, UST, MT,

leather MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 8.5%

10 - - - - -Wallets and billfolds................................................................................ DZN

20 - - - - -Cigar, cigarette or pipe cases; tobacco pouches.................................... -

30 - - - - -Eyeglass or spectacle cases .................................................................. -

40 - - - - -Coin purses ............................................................................................ DZN

90 - - - - -Other ...................................................................................................... -

Issued January 1, 2011

42 - 3

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4202.32 - -With outer surface of sheeting of plastics or of textile materials

4202.32.10 - - -With outer surface of textile materials, containing less than 85% by weight 8% CCCT, LDCT, UST, MT,

of silk or silk waste CIAT, CT, IT, NT, SLT,

PT: Free

GPT: 5%

CRT: 8%

10 - - - - -Wallets and billfolds ............................................................................... DZN

- - - - -Cigar, cigarette or pipe cases; tobacco pouches:

21 - - - - - -Subject to customs duty based on excise duty .................................... -

29 - - - - - -Other .................................................................................................... -

30 - - - - -Eyeglass or spectacle cases.................................................................. -

40 - - - - -Coin purses ............................................................................................ DZN

90 - - - - -Other ...................................................................................................... -

4202.32.90 - - -Other 8% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 8%

10 - - - - -Wallets and billfolds ............................................................................... DZN

- - - - -Cigar, cigarette or pipe cases; tobacco pouches:

21 - - - - - -Subject to customs duty based on excise duty .................................... -

29 - - - - - -Other .................................................................................................... -

30 - - - - -Eyeglass or spectacle cases.................................................................. -

40 - - - - -Coin purses ............................................................................................ DZN

50 - - - - -Compacts ............................................................................................... -

90 - - - - -Other ...................................................................................................... -

4202.39.00 00 - -Other - 9.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 6%

CRT: 9.5%

-Other:

4202.91 - -With outer surface of leather, of composition leather or of patent

leather

4202.91.10 - - -Fitted cases for church bells; Free CCCT, LDCT, GPT, UST,

Golfbags MT, MUST, CIAT, CT,

CRT, IT, NT, SLT,

PT: Free

10 - - - - -Fitted cases for church bells .................................................................. NMB

20 - - - - -Golf bags................................................................................................ NMB

4202.91.20 - - -Tool bags, haversacks, knapsacks, packsacks and rucksacks 11% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 7%

CRT: 11%

10 - - - - -Tool bags................................................................................................ NMB

20 - - - - -Haversacks, knapsacks, packsacks and rucksacks............................... NMB

Issued January 1, 2011

42 - 4

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4202.91.90 - - -Other 7% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 7%

10 - - - - -Jewellery boxes...................................................................................... NMB

20 - - - - -Musical instrument cases ....................................................................... NMB

90 - - - - -Other ...................................................................................................... NMB

4202.92 - -With outer surface of sheeting of plastics or of textile materials

4202.92.10 - - -Fitted cases for church bells; Free CCCT, LDCT, GPT, UST,

Golf bags MT, CIAT, CT, CRT, IT,

NT, SLT, PT: Free

- - - - -Fitted cases for church bells:

11 - - - - - -With outer surface of textile materials, containing less than 85% by

weight of silk or silk waste .................................................................... NMB

19 - - - - - -Other .................................................................................................... NMB

- - - - -Golf bags:

21 - - - - - -With outer surface of textile materials, containing less than 85% by

weight of silk or silk waste .................................................................... NMB

29 - - - - - -Other .................................................................................................... NMB

4202.92.20 - - -Tool bags, haversacks, knapsacks, packsacks and rucksacks 10% CCCT, LDCT, UST, MT,

CIAT, CT, CRT, IT, NT,

SLT, PT: Free

GPT: 7%

- - - - -Tool bags:

11 - - - - - -With outer surface of textile materials, containing less than 85% by

weight of silk or silk waste .................................................................... NMB

19 - - - - - -Other .................................................................................................... NMB

- - - - -Haversack, knapsacks, packsacks and rucksacks:

21 - - - - - -With outer surface of textile materials, containing less than 85% by

weight of silk or silk waste .................................................................... NMB

29 - - - - - -Other .................................................................................................... NMB

4202.92.90 - - -Other 7% CCCT, LDCT, UST, MT,

CIAT, CT, IT, NT, SLT,

PT: Free

GPT: 5%

CRT: 7%

- - - - -With outer surface of textile materials, containing less than 85% by

weight of silk or silk waste:

11 - - - - - -Jewellery boxes.................................................................................... NMB

12 - - - - - -Musical instrument cases..................................................................... NMB

19 - - - - - -Other .................................................................................................... NMB

90 - - - - -Other ...................................................................................................... NMB

4202.99 - -Other

4202.99.10 00 - - -Fitted cases for church bells NMB Free CCCT, LDCT, GPT, UST,

MT, MUST, CIAT, CT,

CRT, IT, NT, SLT,

PT: Free

Issued January 1, 2011

42 - 5

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4202.99.90 00 - - -Other NMB 7% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 7%

42.03 Articles of apparel and clothing accessories, of leather or of

composition leather.

4203.10.00 -Articles of apparel 13% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

AUT: 6.5%

NZT: 6.5%

GPT: 8%

CRT: 13%

- - - - -Overcoats and car-coats:

11 - - - - - -Men's or boys' ...................................................................................... NMB

12 - - - - - -Women's or girls'.................................................................................. NMB

- - - - -Anoraks:

21 - - - - - -Men's or boys' ...................................................................................... NMB

22 - - - - - -Women's or girls'.................................................................................. NMB

- - - - -Wind-cheaters, wind-jackets and similar articles:

31 - - - - - -Men's or boys' ...................................................................................... NMB

32 - - - - - -Women's or girls'.................................................................................. NMB

- - - - -Suits and ensembles:

41 - - - - - -Men's or boys' ...................................................................................... NMB

42 - - - - - -Women's or girls'.................................................................................. NMB

- - - - -Jackets and blazers:

51 - - - - - -Men's or boys' ...................................................................................... NMB

52 - - - - - -Women's or girls'.................................................................................. NMB

- - - - -Trousers, bib or brace overalls, and breeches:

61 - - - - - -Men's or boys' ...................................................................................... NMB

62 - - - - - -Women's or girls'.................................................................................. NMB

70 - - - - -Skirts ...................................................................................................... NMB

- - - - -Other:

91 - - - - - -Industrial aprons .................................................................................. NMB

92 - - - - - -Other safety or protective clothing ....................................................... -

99 - - - - - -Other .................................................................................................... NMB

-Gloves, mittens and mitts:

4203.21 - -Specially designed for use in sports

4203.21.10 00 - - -Gloves for cricket NMB 7% AUT, NZT, CCCT, LDCT,

GPT, UST, MT, MUST,

CIAT, CT, IT, NT, SLT,

PT: Free

CRT: 7%

Issued January 1, 2011

42 - 6

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4203.21.90 - - -Other 15.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT: Free

AUT: 8.5%

NZT: 8.5%

GPT: 10%

CRT: 15.5%

PT: 8.5%

10 - - - - -Golf......................................................................................................... NMB

20 - - - - -Baseball.................................................................................................. NMB

30 - - - - -Hockey ................................................................................................... NMB

90 - - - - -Other ...................................................................................................... NMB

4203.29 - -Other

4203.29.10 - - -Gloves of kid 7% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 7%

10 - - - - -Men's or boys' ........................................................................................ PAR

20 - - - - -Women's or girls' .................................................................................... PAR

4203.29.90 - - -Other 15.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

AUT: 8.5%

NZT: 8.5%

GPT: 10%

CRT: 15.5%

10 - - - - -Work or special purpose......................................................................... PAR

- - - - -Other:

91 - - - - - -Men's or boys' ...................................................................................... PAR

92 - - - - - -Women's or girls'.................................................................................. PAR

4203.30.00 00 -Belts and bandoliers - 9.5% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 6%

CRT: 9.5%

4203.40.00 00 -Other clothing accessories - 8% CCCT, LDCT, UST, MT,

MUST, CIAT, CT, IT, NT,

SLT, PT: Free

GPT: 5%

CRT: 8%

4205.00.00 Other articles of leather or of composition leather. Free CCCT, LDCT, GPT, UST,

MT, MUST, CIAT, CT,

CRT, IT, NT, SLT,

PT: Free

10 - - - - -Leather welting for footwear ................................................................... -

20 - - - - -Belts for occupational use, for example, for electricians ........................ -

90 - - - - -Other ...................................................................................................... -

4206.00 Articles of gut (other than silk-worm gut), of goldbeater's skin, of

bladders or of tendons.

Issued January 1, 2011

42 - 7

CUSTOMS TARIFF - SCHEDULE

Tariff Unit of MFN Applicable

SS Description of Goods

Item Meas. Tariff Preferential Tariffs

4206.00.10 00 - - -Catgut - Free CCCT, LDCT, GPT, UST,

MT, MUST, CIAT, CT,

CRT, IT, NT, SLT,

PT: Free

4206.00.90 00 - - -Other - 6.5% CCCT, LDCT, GPT, UST,

MT, MUST, CIAT, CT, IT,

NT, SLT, PT: Free

CRT: 6.5%

Issued January 1, 2011

You might also like

- Desmontadora Ammco740Document16 pagesDesmontadora Ammco740DonosoManuel100% (1)

- Romane de DragosteDocument35 pagesRomane de Dragosteralucutza0264% (14)

- TsoDocument256 pagesTsoMatthew Edwards92% (12)

- BOM-speeduino v0.4.3 Compatible PCB For m40 Rev1.0Document1 pageBOM-speeduino v0.4.3 Compatible PCB For m40 Rev1.0Randol Rafael Reyes Rodriguez50% (2)

- Abs. Booty. Total Body.: Starter GuideDocument8 pagesAbs. Booty. Total Body.: Starter GuidedoneitwellNo ratings yet

- HF3 Diagnostic TestDocument5 pagesHF3 Diagnostic TestPope100% (1)

- Customs Tariff - Schedule 96Document15 pagesCustoms Tariff - Schedule 96reme moNo ratings yet

- Canon Duty ChartDocument33 pagesCanon Duty Chartjagrat_pNo ratings yet

- Chapter 82Document22 pagesChapter 82Benn ClarkeNo ratings yet

- Harmonized Tariff Schedule of The United States (2023)Document23 pagesHarmonized Tariff Schedule of The United States (2023)dipok banerjeeNo ratings yet

- Custom Hs Code 3Document11 pagesCustom Hs Code 3RezzoNo ratings yet

- Section Xiii: CN Code Description Conventional Rate of Duty (%) Supplementary Unit 1 2 3 4Document15 pagesSection Xiii: CN Code Description Conventional Rate of Duty (%) Supplementary Unit 1 2 3 4Toni D.No ratings yet

- Main Contents: Technical SpecificationsDocument20 pagesMain Contents: Technical SpecificationsPricopNo ratings yet

- Chapter 95Document13 pagesChapter 95Jason BryantNo ratings yet

- Indirect Tensile Stiffness Modulus and Fatigue Measurement Test SystemDocument1 pageIndirect Tensile Stiffness Modulus and Fatigue Measurement Test Systems pradhanNo ratings yet

- Chapter 95Document13 pagesChapter 95diggNo ratings yet

- 37 D - Focused Product SchemeDocument38 pages37 D - Focused Product SchemeSaurabh SharmaNo ratings yet

- Fibre Testing by ITRUDocument24 pagesFibre Testing by ITRUDhasaratahi JayaramanNo ratings yet

- Toyota XM Satellite RadioDocument17 pagesToyota XM Satellite RadioVictor SanchezNo ratings yet

- G.S.D. Operation: AllowancesDocument3 pagesG.S.D. Operation: AllowancesJahangir Alam Sohag100% (1)

- v0.4.3 BomDocument1 pagev0.4.3 BomfenixjanNo ratings yet

- UF-ETNA SeriesDocument2 pagesUF-ETNA SeriesLalit VashistaNo ratings yet

- G.S.D. Operation: AllowancesDocument3 pagesG.S.D. Operation: AllowancesJahangir Alam SohagNo ratings yet

- G.S.D. Operation: AllowancesDocument3 pagesG.S.D. Operation: AllowancesJahangir Alam SohagNo ratings yet

- ROW Permission NewDocument10 pagesROW Permission NewsaraswatNo ratings yet

- Live Animals Animal Products Notes: Section IDocument56 pagesLive Animals Animal Products Notes: Section IToni D.No ratings yet

- RT - Duroid 5880 Rogers Corp - Double Side Laminate With PTFE Fiberglass Dielectric - Buy On-Line PDFDocument4 pagesRT - Duroid 5880 Rogers Corp - Double Side Laminate With PTFE Fiberglass Dielectric - Buy On-Line PDFUtpal SarmaNo ratings yet

- tt300 Ultrasonic Wall Thickness Material Thickness Gauge Instruction Manual PDFDocument24 pagestt300 Ultrasonic Wall Thickness Material Thickness Gauge Instruction Manual PDFIrza AzaNo ratings yet

- Radiant Packs Broadcasters Wise 2Document1 pageRadiant Packs Broadcasters Wise 2Praveen VirasNo ratings yet

- FQ-43731-22 Quote - Ver 1Document5 pagesFQ-43731-22 Quote - Ver 1deepak pcmNo ratings yet

- Manual Life Fitness 95T-InTHX-XXDocument32 pagesManual Life Fitness 95T-InTHX-XXOliver SilvaNo ratings yet

- FiberHome Antenna&Filter Technical Manual V1.0Document30 pagesFiberHome Antenna&Filter Technical Manual V1.0Gigih Hadi100% (1)

- UF RC SeriesDocument2 pagesUF RC SeriesLalit VashistaNo ratings yet

- MT System - Load Tada For MT ChannelsDocument32 pagesMT System - Load Tada For MT ChannelscedricNo ratings yet

- TriSoft CPM68K TRS-80 Users Guide 1984Document65 pagesTriSoft CPM68K TRS-80 Users Guide 1984jairNo ratings yet

- PD 2+0 OMT370-ZT-ZT Omt SpecificationsDocument2 pagesPD 2+0 OMT370-ZT-ZT Omt Specificationsali richeNo ratings yet

- Sta 8089 GatDocument33 pagesSta 8089 Gattom.tomqwe19801980No ratings yet

- tps628502 q1Document43 pagestps628502 q1Adlan MessaoudNo ratings yet

- Fusible Reseteable Usados en UsbDocument6 pagesFusible Reseteable Usados en UsbBabobrillNo ratings yet

- G.S.D. Operation: AllowancesDocument3 pagesG.S.D. Operation: AllowancesJahangir Alam SohagNo ratings yet

- G.S.D. Operation: AllowancesDocument3 pagesG.S.D. Operation: AllowancesJahangir Alam SohagNo ratings yet

- Smart Car List - Friday OkystarDocument30 pagesSmart Car List - Friday Okystarrichardppz124No ratings yet

- Datacom Report: Global ResultsDocument1 pageDatacom Report: Global ResultsmeddouNo ratings yet

- UntitleddroneeeDocument4 pagesUntitleddroneeejudas tadeuNo ratings yet

- SIUI CTS-49, 59 User ManualDocument91 pagesSIUI CTS-49, 59 User ManualRusdi BaccoNo ratings yet

- FT-2200 Serv F6DBL 1993Document125 pagesFT-2200 Serv F6DBL 1993Marcos DanilaviciusNo ratings yet

- M95 AT Commands Manual V1.2 PDFDocument241 pagesM95 AT Commands Manual V1.2 PDFjuanNo ratings yet

- Audio CD Changer in Dash and Hide Away LHDDocument23 pagesAudio CD Changer in Dash and Hide Away LHDMariusz SikoraNo ratings yet

- Advanced NDT Services PDFDocument1 pageAdvanced NDT Services PDFChandrashekhar ThiramdasuNo ratings yet

- ODR PM 05 TGL 01 Jan 2024Document5 pagesODR PM 05 TGL 01 Jan 2024Indra GunawanNo ratings yet

- Instrument MTO Rev. 24-08-2023Document4 pagesInstrument MTO Rev. 24-08-2023iqtm36No ratings yet

- M71 (NTSC) Service Manual: Model 14Dn3Wyd-By Li ChangzhengDocument56 pagesM71 (NTSC) Service Manual: Model 14Dn3Wyd-By Li ChangzhengEdilberto Avila100% (1)

- Summary Project Pengadaan Barang Dan Jasa Out Site Plan Roll Out Residential My Republik Jakarta Utara, Jakarta Barat & Jakarta PusatDocument14 pagesSummary Project Pengadaan Barang Dan Jasa Out Site Plan Roll Out Residential My Republik Jakarta Utara, Jakarta Barat & Jakarta PusatSetiawan RustandiNo ratings yet

- 32me303v F7 PDFDocument53 pages32me303v F7 PDFAnonymous 6eRSBm6yZu0% (1)

- Yaesu FT-11R Service Manual (En)Document64 pagesYaesu FT-11R Service Manual (En)maoNo ratings yet

- AHTN2022 CHAPTER14 wNOTESDocument2 pagesAHTN2022 CHAPTER14 wNOTESdoookaNo ratings yet

- Tailieuxanh TCN 2068 214 2593Document90 pagesTailieuxanh TCN 2068 214 2593ĐTVT CLC-D12No ratings yet

- Abattoir Proposal - Mobile SheepDocument7 pagesAbattoir Proposal - Mobile Sheepsolar.suria.sdn.bhdNo ratings yet

- 32PFL3508 F4Document42 pages32PFL3508 F4memedelarosa100% (1)

- ATI FT CatalogDocument42 pagesATI FT CatalogAgenor BarbosaNo ratings yet

- Matam Multifiber MILLS LTD. (Denim Unit-2) : Quality Control DepartmentDocument1 pageMatam Multifiber MILLS LTD. (Denim Unit-2) : Quality Control DepartmentTowfic Aziz KanonNo ratings yet

- UMTS (xx.05) : UTRA FDD, Spreading and Modulation DescriptionDocument15 pagesUMTS (xx.05) : UTRA FDD, Spreading and Modulation DescriptionAdarsh T JNo ratings yet

- Knitting: Products and Services For The Flat Knitting SectorDocument16 pagesKnitting: Products and Services For The Flat Knitting SectorAbhinav GuptaNo ratings yet

- The Fourth Terminal: Benefits of Body-Biasing Techniques for FDSOI Circuits and SystemsFrom EverandThe Fourth Terminal: Benefits of Body-Biasing Techniques for FDSOI Circuits and SystemsSylvain ClercNo ratings yet

- MrsaDocument11 pagesMrsaStefanus Erdana PutraNo ratings yet

- Absolute PhraseDocument2 pagesAbsolute Phrasewaqarali78692No ratings yet

- PIIT 1.0 E-BookDocument42 pagesPIIT 1.0 E-BookmravanblarcumNo ratings yet

- Shadow Slave Light Novel PubDocument9 pagesShadow Slave Light Novel PubamanlakhujaNo ratings yet

- Bơm Cosmic 3Document3 pagesBơm Cosmic 3Bui TruongNo ratings yet

- Entrapment Neuropathies Conversion-GateDocument76 pagesEntrapment Neuropathies Conversion-GateRam ReddyNo ratings yet

- Ultimate Frisbee WorksheetDocument6 pagesUltimate Frisbee Worksheetapi-234710562No ratings yet

- CookiesDocument21 pagesCookieskartikkeyyanNo ratings yet

- Giselle The BalletDocument3 pagesGiselle The Balletpeaches.100% (1)

- DR Dave Course Outline BilliardDocument2 pagesDR Dave Course Outline BilliardedrescanoyNo ratings yet

- M03-Car Regn by MakeDocument5 pagesM03-Car Regn by MakeDomain Admin100% (1)

- Procedure Changing Piston RingDocument12 pagesProcedure Changing Piston RingAdhitya WisnuNo ratings yet

- Kalendar Takmičenja Srpskog Atletskog Saveza Za - Godinu: JanuarDocument3 pagesKalendar Takmičenja Srpskog Atletskog Saveza Za - Godinu: JanuarJovan StanicicNo ratings yet

- Service Checks and Adjustments: Telephone: Fax: VAT Registration No.Document2 pagesService Checks and Adjustments: Telephone: Fax: VAT Registration No.Adrian MacayaNo ratings yet

- News Kaakbay 1475477224 PDFDocument116 pagesNews Kaakbay 1475477224 PDFKDNo ratings yet

- Bahasa Inggeris Tahun 6: (Vocabulary)Document22 pagesBahasa Inggeris Tahun 6: (Vocabulary)Azizah JamaluddinNo ratings yet

- Rekapitulasi Absensi Karyawan Pt. Permata Panca Utama: Bulan 1 TAHUN 2022 Hari/TanggalDocument1 pageRekapitulasi Absensi Karyawan Pt. Permata Panca Utama: Bulan 1 TAHUN 2022 Hari/TanggalLafitaNo ratings yet

- EV Resource Magazine, March 2020Document12 pagesEV Resource Magazine, March 2020EV ResourceNo ratings yet

- Adventure 292Document2 pagesAdventure 292jmatcobNo ratings yet

- Chapter 2 Test (Newton's Laws A)Document3 pagesChapter 2 Test (Newton's Laws A)Marija CvetkovicNo ratings yet

- Today's Fallen Heroes Monday 22 October 1917Document28 pagesToday's Fallen Heroes Monday 22 October 1917MickTierneyNo ratings yet

- Position Training Attack: Marcel Lucassen, DFB TrainersDocument10 pagesPosition Training Attack: Marcel Lucassen, DFB Trainersadu rawdiNo ratings yet

- Interview With Marc JossDocument5 pagesInterview With Marc JossiLearnermmNo ratings yet

- Cheats Fire Emblem Sacred StoneDocument20 pagesCheats Fire Emblem Sacred Stonedeath killerNo ratings yet

- Basketball Basic RulesDocument10 pagesBasketball Basic RulesMohan ArumugavallalNo ratings yet