Billing Policy: Last Updated: DCN

Billing Policy: Last Updated: DCN

Uploaded by

RajaCopyright:

Available Formats

Billing Policy: Last Updated: DCN

Billing Policy: Last Updated: DCN

Uploaded by

RajaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Billing Policy: Last Updated: DCN

Billing Policy: Last Updated: DCN

Uploaded by

RajaCopyright:

Available Formats

Billing Policy

Version: 2.0

Last Updated: 07/27/2020

DCN: VMD-CON-008

Confidential and Proprietary – All Rights Reserved

Approval Date: 07/27/2020

Approved By: CON

DCN: VMD-CON-008

Version: 2.0

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

Table of Contents

1 Policy Statement................................................................................................................................1

2 Purpose..............................................................................................................................................1

3 Scope.................................................................................................................................................1

4 Documentation...................................................................................................................................1

4.1 Document Control............................................................................................................................................1

4.2 Records............................................................................................................................................................. 1

4.3 Distribution and Maintenance...........................................................................................................................1

5 Privacy...............................................................................................................................................1

6 Responsibility....................................................................................................................................1

7 Policy.................................................................................................................................................2

7.1 Invoicing........................................................................................................................................................... 2

7.2 Invoice Requirements.......................................................................................................................................6

7.3 System-Generated Invoices..............................................................................................................................6

7.4 Manually Prepared Invoices.............................................................................................................................6

7.5 Invoice Approval..............................................................................................................................................7

7.6 Credit Invoices.................................................................................................................................................7

7.7 Posting of Invoices...........................................................................................................................................7

7.8 Non-billable Costs............................................................................................................................................7

7.9 Unbilled Receivable Reconciliations................................................................................................................8

7.10 Under / Overpayments......................................................................................................................................8

7.11 Refunds............................................................................................................................................................ 9

7.12 Offsets.............................................................................................................................................................. 9

7.13 Final Invoices and Closeouts............................................................................................................................9

7.14 Closeout Documentation.................................................................................................................................10

7.15 Final Approvals..............................................................................................................................................11

7.16 Final Audit......................................................................................................................................................11

7.17 Final Payment.................................................................................................................................................11

8 Data Requirements Prior to Invoicing..............................................................................................11

8.1 Briefing of Contract........................................................................................................................................11

VMD-CON-008 Confidential and Proprietary – All Rights Reserved i

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

8.2 Billing File......................................................................................................................................................11

8.3 Cost Data by Contract for the Preparation of Invoices....................................................................................12

8.4 Backup Support for Invoicing.........................................................................................................................12

8.5 Monitoring of Subcontractors and Subcontractor Invoices.............................................................................13

8.6 Billable Indirect Cost Rates............................................................................................................................14

9 System Monitoring and Training.....................................................................................................15

9.1 Authority for Policies and Procedures............................................................................................................15

9.2 Billing System Compliance Reviews..............................................................................................................15

9.3 Internal Audits................................................................................................................................................16

9.4 Training Quality and Control..........................................................................................................................16

9.5 Training Materials and Documentation...........................................................................................................16

10 Enforcement....................................................................................................................................17

Appendices................................................................................................................................................18

Appendix A: Acronyms and Key Terms.........................................................................................................................18

List of Tables

Table 1: Roles and Responsibilities..................................................................................................................................2

Table 2: Acronyms......................................................................................................................................................... 18

Table 3: Key Terms........................................................................................................................................................ 18

List of Figures

No table of figures entries found.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved ii

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

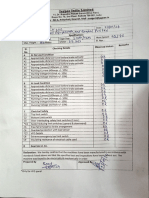

Revision History

Rev. # Release Date Author Reviewer(s) Approver Description of Change

1.0 04/19/20 J. Weiss Baseline version of document

2.0 07/27/20 S. Hyland Updated to reflect new template

VMD-CON-008 Confidential and Proprietary – All Rights Reserved iii

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

1 Policy Statement

{NEED POLICY STATEMENT}.

2 Purpose

The purpose of this Policy is to ensure that invoices are properly prepared is a key part of the overall success of

VMD Corp. (VMD). This Policy defines VMD’s billing procedures and processes

3 Scope

This Policy applies to ...

4 Documentation

The documentation shall consist of a Billing Policy and related procedures and guidelines including security

requirements stated in federal regulations.

4.1 Document Control

The Billing Policy document and all other referenced documents shall be controlled. Version control shall be used to

preserve the latest release and the previous version of any document.

4.2 Records

Records being generated as part of the Billing Policy shall be retained for a duration as identified via the VMD

Management Review Board (MRB) in accordance with corporate records management procedure. Records shall be

in hard copy or electronic media. The records shall be owned by the respective Contracts Department and shall be

audited annually.

4.3 Distribution and Maintenance

The Billing Policy document shall be made available to all concerned persons. All changes and new releases of this

document shall be made available to all concerned persons upon approval. The maintenance responsibility of the

document shall be with the Director of Contracts. Access to this policy shall be incorporated into all supplier

agreements and shall be certified to at the beginning of each relationship, and audited annually for compliance with

all legal, regulatory, and necessary security requirements.

5 Privacy

The Billing Policy document shall be considered as “non-confidential” and shall be made available to all concerned

persons. Subsequent changes and versions of this document shall be controlled.

6 Responsibility

The table below presents the roles and responsibilities required for the successful implementation of the process.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 1

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

Table 1: Roles and Responsibilities

Role Responsibilities

Preparing all invoices using the data maintained in VMD’s accounting system.

Accounting Department

Creating and maintaining billing files for each project.

Generating necessary forms (e.g., timesheet correction) and contacting the

appropriate party when adjustments are needed.

Processing invoices for payment.

Notifying the Contracts Department if any subcontractor amounts invoiced are

disputed so that they may advise the subcontractor of the issue.

Performing monthly reviews of unbilled costs in search of discrepancies between

revenue and billing.

Preparing and submitting Provisional Billing Rates.

Preparing a reconciliation of billed versus booked costs upon receipt of final audited

indirect cost rates.

Preparing, maintaining, and implementing this Billing Policy.

Reviewing and approving all invoices prepared by the Accounting Department.

Project Manager (PM)

Providing the Accounting Department with the appropriate supporting

documentation for invoices, when applicable.

Sending the approved invoice to the client.

Preparing and updating Contract Briefs.

Contracts Department

Ensuring that the invoice amount is within the contractual funding limit.

Ensuring that subcontractor invoices are submitted in accordance with the

subcontract terms and conditions.

Preparing the proper closeout documents that shall be submitted with the final

invoice, when a final invoice has been generated and approved.

Coordinating the annual review of the Billing Policy to ensure that the billing

Director of Compliance

procedures are compliant with current Government contracting regulations.

Performing quality control reviews to ensure that invoices prepared by the

Accounting Department are accurate and are timely processed.

Disseminating the final indirect cost rate letter from the Defense Contract Audit

Agency (DCAA) to the Accounting Department, Contracts Department, and

Executive Management.

Performing annual reviews to ensure that billings are prepared and that billing files

are maintained in accordance with VMD’s policies and procedures.

Work with auditors to resolve any issues that may arise during a DCAA final

closeout audit.

7 Policy

7.1 Invoicing

VMD generates invoices in an accurate and timely manner based on costs and hours incurred as recorded in the

VMD’s accounting system. Invoices must be generated in accordance with the terms of VMD’s contracts.

7.1.1 Invoicing of Cost-Plus-Fixed-Fee Contracts

Cost-Plus-Fixed-Fee (CPFF)-type contracts provide for reimbursement of all allowable incurred costs and a fixed

fee, providing the terms and conditions of the contract are followed. The contract ceiling cannot be changed unless

the Contracting Officer authorizes a modification to the contract. The fixed fee can, however, be adjusted downward

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 2

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

if the contract is negotiated as a Level of Effort (LOE) 1 type contract and the required hours are not delivered. The

fixed fee shall remain as originally negotiated in the contract unless the scope of work is increased.

CPFF contracts shall be invoiced on Standard Form 1034 – Public Voucher for Purchases and Services Other Than

Personal (SF 1034) and with supporting detail Standard Form 1035 – Public Voucher for Services Other than

Personal (Continuation Sheet) (SF 1035) when a further breakdown of cost detail is requested by the customer or

contractually required. Invoices may be prepared on a monthly or bimonthly basis as provided for in the contract.

Using the Job Status Report (JSR) to obtain costs incurred, the invoice is prepared by applying the DCAA-approved

provisional billing indirect cost rates or contract ceiling (capped) indirect cost rates, whichever are lower. The fixed

fee is billed in accordance with the terms of the contract. The actual costs claimed by the contractor are always

subject to verification by audit, as final burden indirect cost rates cannot be determined until after the close of the

accounting year. Adjustments for DCAA final audited indirect cost rates shall be performed at contract closeout,

unless otherwise directed by the customer.

CPFF contracts may be subject to a withholding clause, whereas the fixed fee amount invoiced cannot exceed the

percentage of total fixed fee as defined in Federal Acquisition Regulation (FAR) Part 52.216-8 – Fixed Fee. The

remaining percentage of the fixed fee shall be withheld and reclaimed after audit and at contract closeout. FAR Part

52.216-8 – Fixed Fee also defines the maximum withholding amount of fixed fee on a CPFF completion or delivery

order type.

It is a requirement that the current and cumulative hours be reported on the invoice. If the customer requires, costs

by year shall be provided.

7.1.2 Invoicing of Cost-Plus-Award-Fee Contracts

Cost-Plus-Award-Fee (CPAF)-type contracts are identical to CPFF contracts except for the fee. In CPAF contracts, a

minimum base fee may or may not be negotiated.

CPAF contracts shall be invoiced on a Standard Form 1034, unless specified otherwise by the contract. When a

CPAF contract provides for a base fee, the contractor may bill a base fee in the same manner as a CPFF contract.

Upon award fee determination, a modification shall be sent to the contractor stating the amount awarded for the

given award period. The Accounting Department shall invoice the customer for the balance of the award fee not

previously invoiced as base fee. If a base fee is not provided for in the contract, the customer shall be sent an award

fee modification after the award fee has been determined. The Accounting Department shall then invoice the

customer based on the modification. The award fee is billed in accordance with the contract’s specific terms and

conditions.

In LOE contracts, the contractor must deliver the hours within a minimum to maximum range of hours stated in the contract. If

the delivered hours are outside the range, a reduction in fee shall occur.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 3

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

7.1.3 Invoicing of Time and Material Contracts

Time and Material (T&M) type contracts (also referred to as labor hour type contracts) provide for payment of direct

labor hours expended at fixed hourly labor rates. The fixed hourly labor rates are fully burdened and include

salaries, indirect expenses, and profit. The fixed hourly labor rate is not subject to change irrespective of the actual

costs incurred. Materials are billed at cost plus Material Handling and/or General and Administrative (G&A) costs,

as applicable.

T&M contracts shall be invoiced on either Standard Form 1034 or Department of Defense Form 250 – Material

Inspection and Receiving Report (DD Form 250). The invoice format is determined by the contract requirements. A

typical invoice shall include labor categories, number of hours worked, hourly labor rates as specified in the

contract, materials, travel, and other direct cost (ODC) detail. The invoice shall include current and cumulative

information.

Some T&M contracts may be subject to a withholding percentage up to a certain dollar amount as defined in FAR

Part 52.232-7 – Payments Under Time-and-Materials and Labor-Hour Contracts. This withholding would apply at

the contract level. In the case of T&M delivery order-type contracts, all delivery orders would be inclusive. This

withholding is reclaimed at the completion of the contract and final audit. The burdens applied to the reimbursable

materials and ODCs are subject to DCAA-approved provisional and final audit determined indirect cost rate

adjustments unless a fixed indirect cost rate is specified in the contract. The final settlement shall be done at closeout

unless otherwise directed.

7.1.4 Invoicing of Firm-Fixed-Price Contracts

Firm-Fixed-Price Contracts (FFP) contracts are generally preferred when the type of service(s) or product(s) being

provided can be clearly defined and described. Under this type of arrangement, the agreed-upon price is paid for the

work specified without regard to the actual costs incurred by the contractor. Costs incurred are not subject to audit;

as long as the work required by the contract is completed and accepted, payment of the amount agreed upon is

assured. Fixed Price / Level of Effort (FP / LOE)-type contracts are treated as T&M, as they have fixed labor hour

rates.

FFP contracts shall be invoiced on either VMD letterhead, Standard Form 1034 Form, or DD Form 250, whichever

is required by the contract. FFP contracts are invoiced based on the invoicing terms set forth in the contract, which

may also be incorporated from the proposal by reference. Customary FFP invoicing practices include:

a. At completion of the contract;

b. Monthly at a set amount provided by the contract;

c. At a fixed amount established for the completion of each identified; and

d. Deliverable(s) or partial deliverable(s).

The PM is responsible for providing timely and regular notice to the Accounting Department about FFP invoicing

when FFP invoices are generated on a schedule that is dependent on project status. Conversely, the Accounting

Department is responsible for requesting monthly updates on the status of scheduled FFP invoices to ensure that FFP

invoices are not issued until there is assurance that the invoice can be approved and paid based on completed and

accepted performance. The billing files should contain the described communication of status updates.

With FP / LOE type contracts, the hours worked are primary factors in securing full contract value. LOE clauses can

be included in all types of contracts. The contractor is required to extend its best efforts to complete the tasks within

the total LOE limitations as specified in the contract. The typical LOE-type contract allows for a defined range of

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 4

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

hours below or above the specified hours in the contract. If the LOE requirements are not met, the funding shall be

adjusted downward.

7.1.5 Invoicing of Progress Payments

Certain contracts require invoiced amounts to be specifically related to the accomplishment of a standard of progress

(known as Progress Payments), as set forth within the contract. Examples include Work in Process and some

Milestone Billing arrangements, which occur on Fixed Price contracts. These are billed based on percentage of

completion or according to a billing or milestone schedule. Progress Payment invoices are issued upon the

achievement of a percentage of completion or a particular stage of completion, also known as a milestone.

7.1.5.1 Progress Payment Documentation

Progress Payment invoices shall be prepared on Standard Form 1443 – Contractor’s Request for Progress Payment

(SF 1443) or as specified within the contract. The PM shall invoice all amounts to be billed less the percentage to be

withheld, as stated in the contract. The withheld portion can be invoiced (liquidated) at the time of completion, upon

acceptance of the work delivered. In the event use of an alternate liquidation rate is required, coordination between

the Contracting Officer and VMD’s Contracts Department is necessary. Refer to FAR Part 32.503-9 – Liquidation

Rates – Alternate Method for guidance. The SF 1443 includes a line item requesting an estimate to complete (ETC).

This amount is obtained in writing from the PM and included on the invoice.

7.1.5.2 Estimates to Complete

ETCs are to be derived from, and reported by, appropriate Operations Department personnel, using VMD’s cost

estimating systems and controls. ETCs used in computing Progress Payments shall be less than six (6) months old,

with more frequent ETCs required if significant changes in relevant factors warrant more current estimations. If the

sum of the total costs incurred under a contract plus the ETCs shall likely exceed the contract price, the Contracting

Officer shall be promptly notified that billing adjustments may be necessary.

For further information on ETCs, please review the Estimate at Completion and Estimate to Complete Policy.

7.1.5.3 Loss Contract

Absent any contract modification, the Accounting Department shall support the Contracting Officer’s computation

of a loss ratio (by supplying the Government certain requested information) and adjust future progress payment

invoices to exclude the element of loss. Refer to FAR Part 32.503-6(g) Suspension or Reduction of Payments – Loss

Contracts for additional guidance in the unlikely event of this occurring, resulting in a “loss contract.” The Progress

Payments clause generally gives the Government title to the materials, work in process, finished goods, or any other

direct use assets leftover upon completion of work under the contract. VMD shall ensure that any property (titled

assets) that is not considered a deliverable end item, but instead is used directly in performance of contractual

obligations, is disposed of promptly upon completion of its use, and appropriate credit is applied against the contract

for disposal proceeds. VMD shall also ensure that receipt of proceeds (if any) upon disposal of subject property

results in customer billing credits equal to the proceeds.

7.1.6 Invoicing Subcontractor Invoices

When invoicing another contractor, all invoices should be “sanitized.” This is done by submitting only the total

amounts, inclusive of all direct and indirect costs and profit. Fee on a cost-type effort may be disclosed. Hours may

be reported if required; however, no indirect cost rates or profit are to be disclosed (neither percentages nor total

dollars).

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 5

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

7.2 Invoice Requirements

1. Every invoice shall include:

e. The contract number, name, address, and period of performance;

f. The name and telephone number of the individual responsible for resolving any issues or

questions regarding the invoice; and

g. An invoice number reflected on page one.

2. All invoices shall be dated to reflect the date of finalization.

3. Every invoice shall reflect the current funded value. It is the responsibility of the Contracts Department to

verify before invoicing that this information is consistent with the most recent contract modification. The

Contracts Department shall ensure that the invoice amount is within the contractual funding limit. When a

discrepancy is found, the Contracts Department shall notify the Accounting Department for correction. The

contract shall specify what detail is required to breakdown the funding data properly.

4. Invoices that must be approved by DCAA are mailed to DCAA and shall include a stamped overnight

envelope properly addressed for DCAA’s use in forwarding to the payment office.

5. Classified invoices shall be prepared by personnel with the level of clearance required to access the

information and who are cleared on that program. If the invoice is not classified, but any portion included in the

package is, the PM shall perform those duties up to the point where classified information is added.

7.3 System-Generated Invoices

All invoices shall be system-generated whenever possible. Upon receipt of a new award, the Contracts Department

shall review the contract terms and conditions and determine whether the invoice can be system-generated.

7.4 Manually Prepared Invoices

1. All invoices not prepared by the accounting system are generated manually in the format directed by the

contract, as applicable. A hard copy of the invoice, along with all documentation used to prepare and support

the invoice, must be kept in the billing file.

2. The following reports shall be used to create the billing (as applicable):

a. Job Status Report;

b. Project Labor Summary and Detail Reports;

c. Project Non-Labor Detail Report (ODC detail);

d. T&M Billing Worksheet;

e. Contract Revenue Summary; and

f. Any other contractually required reports (e.g., timesheets or direct travel vouchers).

6. During the invoice preparation process, Accounting personnel shall ensure all costs reconcile and shall

document any unmatched items. After performing the reconciliation, Accounting personnel shall finalize the

invoice and send to the appropriate PM for review and approval.

7.5 Invoice Approval

The Accounting Department shall prepare an Invoice Checklist. After the appropriate boxes are indicated, the form

must be reviewed and approved by the PM. The PM shall review the invoice and ensure all required backup

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 6

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

documentation is attached per contractual requirements. After review and approval of the invoice, the PM shall mail

or submit the invoice for payment.

7.6 Credit Invoices

When the customer returns an incorrect invoice, the Accounting Department shall conduct a review and determine

the necessary corrections. The Accounting Department can have the entire invoice cancelled (reversed) or can

prepare a correcting invoice through VMD Systems’ accounting system. The correcting invoice, when combined

with the original incorrect invoice, shall yield a correct total to be paid by the customer.

7.7 Posting of Invoices

VMD’s accounting system-generated invoices are selected and printed by the Accounting Department. These

selected invoices are in a “pre-posted” status until posting is executed. All invoices, including those prepared offline,

must be reconciled to the VMD’s accounting system.

7.8 Non-billable Costs

Potentially non-billable direct costs are, when possible, automatically coded and identified as such in the accounting

data based on programmed criteria applied to cost ledger source codes. This would include unallowable direct costs,

non-billable accrued costs, and costs subject to special approval requirements or other contract limits such as

overtime premium. All non-billable direct costs that cannot be identified to a program or job order shall be identified

and segregated. Such costs should be reclassified as billable only when required conditions have been met.

Unallowable costs pursuant to FAR Part 31 - Contract Cost Principles and Procedures, supplements to the FAR, and

other applicable regulations and contract terms are segregated, considered non-billable, and excluded from

invoicing.

Certain incurred costs may be deemed non-billable if they do not meet specified criteria for inclusion in progress

payment requests, including:

a. Accrued costs of direct materials and subcontract costs that shall not be paid in accordance with

the terms and conditions of the subcontract or invoice and ordinarily shall not be paid within 30 days of the

VMD payment request (public voucher or progress payment) to the Government;

b. Accrued costs that VMD is delinquent in paying in the normal course of business; and

c. Accrued costs of pensions, post-retirement benefits, and profit sharing or employee stock

ownership plans that have not been paid at least quarterly (costs not paid within 30 days after the end of the

quarter are not eligible for reimbursement).2

The specific clauses identifying reimbursable costs are in FAR Part 52.216-7(b) (Allowable Cost and Payment – Reimbursing

costs) for vouchers and FAR 52.232-16(a)(2) (Progress Payments – Computation of amounts) for progress payments. The criteria

are the same for both types of billings.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 7

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

VMD shall also withhold costs that are appropriate adjustments to a submission or request (e.g., costs in excess of

ceilings or liquidated progress payments).

7.9 Unbilled Receivable Reconciliations

For each billable project number, an unbilled reconciliation shall be completed monthly for all projects. Monthly

reviews of the unbilled in search of discrepancies between revenue and billing are performed by the Accounting

Department. The reviews provide a detailed itemization of the billing / revenue relationship, which explain the

reasons why certain costs and fees are not billed (e.g., mandatory withheld fee, indirect cost rate variances, and costs

over ceiling / funding).

7.10 Under / Overpayments

If contract overpayments by the Government are identified, VMD shall refund the Government for the overpayment

in a timely manner and offset any significant contract overpayments against contract underpayments based on the

Contracting Officer’s instructions. The Accounting Department shall identify and document the reasons for

overpayment and why certain over / underpayments were not timely liquidated, if applicable.

To identify and process over / underpayments, the Accounting Department shall:

a. Compare amounts billed to amounts received for each invoice (both delivery and final) to readily identify

contract over / underpayments;

b. Process refunds due to the Government in a timely manner; and

c. Make offsets to contract billings based on the Contracting Officer’s instructions.

The Accounting Department shall maintain the following documentation related to over/underpayments in the

appropriate billing file:

a. Notification to the Contracting Officer;

b. Documentation of significant activities during the resolution process; and

c. Documentation of compliance with the Contracting Officer’s instructions to resolve the difference.

7.11 Refunds

Contract refunds shall include funds returned to the Government due to:

a. A VMD error;

b. Contract administration adjustment;3 and

c. Response to Government demand letters.

Contract administration adjustments are payments VMD received in accordance with contract provisions but which need to be

reduced due to subsequent events or actions. For example, a contract administration adjustment may result from a contract

modification changing the alternate liquidation rate for deliveries made on a contract using progress payment financing.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 8

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

The Accounting Department shall maintain a list of refunds made to the Government, provide for timely refund of

amounts due to the Government, and identify and document the reason(s) for the refunds and, if applicable, why

certain refunds were not timely processed. If VMD Systems disputes an amount requested by a demand letter, the

Accounting Department shall provide documentation to support VMD’s position.

7.12 Offsets

VMD may offset amounts due to the Government (i.e., overpayments and refunds) against underpayments. The use

of offsets requires:

a. Significant offsets be made only after notification to and instructions from the Contracting Officer;

b. Offsets are made on a timely basis, usually within 30 days of the identification of the overpayment or

refund; and

c. Maintenance of a list of all significant offsets and documentation showing coordination with the

Government.

7.13 Final Invoices and Closeouts

7.13.1 Cost Reimbursement Contracts

Upon receipt of final audited indirect cost rates, the Accounting Department shall prepare a reconciliation of billed

versus booked costs, including audit-determined indirect cost rates. Final voucher adjustments are prepared and

submitted within 120 days of either the final audit-determined indirect cost rates or the request of the Contracting

Officer, whichever occurs first. If a final voucher cannot be completed within the said time period, a request for an

extension must be submitted to the Contracting Officer.

The Contracts Department shall compose a list of contracts that ended during the corresponding year. This list shall

be coordinated with the PM. The Contracts Department shall then retrieve the files needed to accumulate the

following data:

a. Project Status Reports by Year;

b. Copies of last invoices of the Contract;

c. Copy of the Contract and Modifications;

d. Subcontract Agreement and Subcontract Final Invoice (if applicable);

e. DCAA Rate Letters for All Applicable Years; and

f. Accounts Receivable Payment History.

For quick closeouts, VMD requires a written request to be kept in the billing file. For years with indirect cost rates

not yet finalized, the Contracting Officer shall specify indirect cost rates to be used.

Releases shall be done on quick closeouts. Contracting Officers may request interim vouchers. These are most often

done for contracts with expiring funds. Final indirect cost rates shall be used on all closed years and submitted

indirect cost rates on open years. Releases shall not be sent on interim vouchers.

The Accounting Department shall prepare a final reconciliation using the year-end JSR from VMD’s accounting

system to obtain applicable costs by year. These reports shall reflect the current year-to-date costs, revenue, and the

cumulative costs for contract-to-date. The year-end actual indirect cost rate shall be reflected on the JSR. The JSR

year-end reports are used for interim and final indirect cost rate adjustments.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 9

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

The Contracts Department shall verify whether any subcontractors worked on a contract. If a subcontractor was

used, the Contracts Department must determine whether the final invoice with releases has been received. If the final

invoice has not been received, the Contracts Department must notify the Accounting Department and send a letter to

the subcontractor(s) asking for an immediate final invoice. VMD shall accept quick closeouts on subcontractors.

Once the subcontractors(s) submit their final invoices and closeout documents to VMD for payment, the final

invoice shall be prepared using their final costs along with VMD’s final costs. Note that VMD is entitled to any

retained or withheld amount earned in performance of the contract.

7.13.2 Time and Material Contracts

T&M contracts are comprised of two components – a fixed hourly labor component and a cost reimbursement

materials component. Procedures for completing the component of final invoices pertaining to the materials

component of T&M contracts are substantially the same as those stipulated in Section 5.1 of this Policy. For the

fixed hourly labor component, all hours invoiced should be reconciled to hour information within the accounting

system to ensure total hours by employee invoiced reconciles to information within the accounting system.

Additionally, labor category bill rates should be reviewed for propriety and congruence with contractual terms and

conditions. All amounts due to VMD under T&M contracts after performing the steps noted above should be

reflected in a final invoice to the Government (inclusive of any withholding or retention owed by the Government).

7.13.3 Firm-Fixed-Price Contracts

For firm-fixed-price contracts, the final invoice should be reflective of cumulative amounts billed to the Government

compared to the fixed contract price, if the cumulative amount billed is less than the fixed price. Note that the final

invoice should include any amount retained or withheld earned in performance of the contract.

7.14 Closeout Documentation

When a final invoice has been generated and approved, the Contracts Department shall prepare the proper closeout

documents, which shall be submitted with the final invoice. The VMD designated official shall sign the closeout

documents. The proper closeout documents are as follows:

a. Contractor’s Release, Assignment of Refunds, Rebates, and Credits;

b. Property Closeout Report and Certificate (if applicable); and

c. If VMD is the subcontractor, the Subcontractor’s Release and the Subcontractor’s Assignment of Refunds,

Rebates, and Credits.

7.15 Final Approvals

The PM shall review and approve every final invoice before being submitted to the customer for payment.

7.16 Final Audit

The Director of Compliance is responsible for working with auditors to resolve any issues that may arise during

DCAA’s final closeout audit.

7.17 Final Payment

Upon submission of the final invoice, and at the request of the Contracts Department, the Accounting Department

shall review any unbilled receivables and initiate a journal entry to bring the receivable balances to zero.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 10

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

8 Data Requirements Prior to Invoicing

8.1 Briefing of Contract

Related Form: Contract Brief Template

Upon initiation of the setup of all new contract efforts, the PM shall review and discuss the setup requirements (e.g.,

contract type, billing requirements, and reporting requirements) with the Contracts Department. It is the Contracts

Department’s responsibility to complete the preparation, review, and timely update of Contract Briefs for all

contracts exceeding $500,000 and subsequent contract actions exceeding $50,000. The Contract Brief summarizes

key terms, conditions, and financial information such as the type of contract, estimated costs, period of performance,

points of contact, and scope of work. Invoices cannot be processed unless the contract brief has been completed and

approved.

All contract modifications are entered into VMD’s accounting system by the Accounting Department. The Contracts

Department shall evaluate the modification to determine if the Contract Brief should be updated. Contract

modification setup documentation, with appropriate signoffs, shall be retained in the billing file.

8.2 Billing File

The Accounting Department shall set up a billing file which shall include the following data:

a. Copy of the authorizing document (i.e., Contract / Subcontract, Purchase Order, and all applicable

modifications). For classified contracts this data may be maintained by authorized personnel with the level

of clearance applicable to the corresponding contract;

b. Copy of Contract Modifications;

c. Contract correspondence relevant to invoicing (if applicable);

d. Copy of each invoice and supporting documentation as submitted to the customer;

e. Invoice Checklist for each invoice; and

f. Accounting Reports (i.e., JSR, Labor Summary Reports, Labor Detailed Report, ODC Summary or Detail,

and other supporting data, as applicable).

8.3 Cost Data by Contract for the Preparation of Invoices

Cost data to support billing is accumulated within VMD’s accounting system. For each project, the accounting

system accumulates the cost source data from the General Ledger (GL), Accounts Payable (AP), and VMD’s time

and expense system. The Accounting Department must ensure that the information carried forward to the invoice is

accurate. Additionally, some costs may require specific Contracting Officer approval (e.g., special purchases and

overtime authorization).

Through the generation and review of system-generated reports, the Accounting Department shall ensure that the

cost billed reconcile to the books and records. When an error(s) is identified, the Accounting Department must take

action to correct the error(s). Therefore, when it is determined that an error(s) exists, the following applies:

a. The invoice is not submitted until corrections are reflected in VMD’s accounting system; the Accounting

Department must notify the PM when suspected errors are detected. The PM shall confirm the error(s) and

communicate the actions needed to correct the invoice.

b. The Accounting Department shall generate the necessary forms (e.g., timesheet correction) and contact the

appropriate party to initiate the adjustment and retain such documentation in the billing file. In addition, the

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 11

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

PM must take the necessary action to reduce or eliminate continuing errors or otherwise ensure that these

actions are undertaken.

8.3.1 Materials

The Government shall reimburse VMD for allowable cost of materials provided VMD:

a. Has made payments for materials in accordance with the terms and conditions of the agreement or invoice;

or

b. Ordinarily makes these payments within 30 days of the submission of VMD’s payment request to the

Government and such payments are in accordance with the terms and conditions of the agreement or

invoice.

Payment for materials is subject to FAR Part 52.216-7 – Allowable Cost and Payment.

Allocable indirect costs and ODCs may be included to the extent they are:

a. Comprised only of costs that are clearly excluded from the hourly labor rate;

b. Allocated in accordance with the VMD written or established accounting practices; and

c. Indirect costs are not applied to subcontracts that are paid at the hourly labor rates.

8.4 Backup Support for Invoicing

Some contracts require that supporting documentation be included with or attached to the invoice. The backup

support may be obtained from multiple sources including the Contracts Department and VMD’s accounting system.

In this case, the PM is responsible for assuring that the required backup is included with or attached to the invoice

and that such information is included in the billing file.

8.5 Monitoring of Subcontractors and Subcontractor Invoices

The Accounting Department shall ensure that all subcontractor invoices are reviewed, approved, and processed for

payment. If any disputed amounts are on the invoice, the Accounting Department must notify the Contracts

Department so that they may advise the subcontractors of the issue and ensure that invoices are submitted in

accordance with the subcontract terms.

Subcontractor invoices must be approved by the PM who is in a position enabling him / her to verify that the work

was performed satisfactorily, within the contract / subcontract terms.

The Contracts Department must confirm that the invoice is billed in accordance with the invoicing instructions

specified in the subcontract before the invoice is processed for payment or included in VMD’s invoice to the

customer.4 Specifically, the Contracts Department shall ensure that:

The Contracts Department shall also confirm that the terms of the subcontract are the same as FAR Part 52.232-16(j) (Progress

Payments – Financing payment to subcontractors).

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 12

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

a. The subcontractor provides timely notification(s) to identify and resolve overpayments;

b. The subcontractor provides timely refund to VMD in the event of a billing adjustment;

c. The subcontractor is notified of any contract administration adjustments affecting billings;

d. Applicable withholds (retentions) are applied to subcontractor invoices consistent with the Prime Contract

provisions and as stipulated in the subcontract;

e. The subcontractor notifies and obtains approval from VMD on any proposal to offset;

f. Accrued subcontract costs (if any) shall be excluded from VMD’s billings to the Government if such costs

shall not be paid (for whatever reason) in accordance with the terms and conditions of the subcontract and

shall therefore not be paid before the next invoice submission to the customer;

The PM shall be responsible for the following:

a. Monitoring the performance and expected profitability under subcontracts;

b. Reviewing and approving all subcontract progress payments, performance-based payments, and financing

payments;

c. Performing a monthly reconciliation of subcontractor billings and paid amount; and

d. Ensuring that no subcontractor costs shall be included in a customer invoice unless VMD has received that

subcontractor’s invoice.

If necessary, subcontractor progress payments, performance-based payments, and financing payments shall be

reduced or suspended to protect against overpayments and losses.

8.6 Billable Indirect Cost Rates

The Accounting Department is responsible for preparing invoices using the applicable DCAA-approved provisional

indirect cost rates or ceiling indirect cost rates.

For tracking and documentation purposes, VMD shall maintain an indirect cost rate file which identifies the date of

indirect cost rate changes and includes relevant supporting documentation (e.g., auditor approvals). Sections 6.6.1

through 6.6.5 provide further detail on various indirect cost rates.

8.6.1 Provisional Billing Rates

A provisional billing rate is an established temporary indirect cost rate applicable to a specified period for the

purpose of allowing interim reimbursement of incurred indirect costs. The Accounting Department is responsible for

distributing, collecting, and consolidating all budget data for VMD’s Operating Budget for the current fiscal year.

The annual submissions of Provisional Billing Rates to DCAA detail the rationale and support for the indirect cost

rates. The Accounting Department disseminates copies of the budget submissions to all appropriate personnel. The

Director of Compliance also obtains a letter from DCAA acknowledging receipt of the annual submission and the

use of the submitted indirect cost rates for provisional billing purposes. This letter can be attached to the public

vouchers when required by the Contracting Office. These provisional billing indirect cost rates are used for interim

reimbursement purposes until DCAA completes its review of the budget submissions.

Unallowable costs pursuant to FAR Part 31 – Contract Cost Principles and Procedures, supplements to the FAR, and

other applicable regulations and contract terms are identified and segregated with the budget. These costs are

excluded from the calculation of Provisional Billing Rates as these costs cannot be passed on to the Government

either directly or within an indirect cost rate.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 13

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

8.6.2 Ceiling Indirect Cost Rates

In some contracts, indirect cost rates have ceilings or are capped rates that cannot be exceeded. These indirect cost

rates are normally specified in the contract or the proposal and incorporated by reference. When the DCAA-

approved provisional or final indirect cost rates are lower than the ceiling (capped) indirect cost rates specified in the

contract, the DCAA indirect cost rates would be used to calculate invoices. When the approved provisional or final

indirect cost rates are higher than the ceiling indirect cost rates specified in the contract, the ceiling indirect cost

rates shall be used to calculate invoices.

8.6.3 Contract-Specific Rates

Some contracts are negotiated with specific fixed indirect cost rates. In these cases, the fixed indirect rates

negotiated in the contract are used. These contracts shall not be subject to DCAA-approved indirect cost rates. Fixed

indirect cost rates, by definition, always remain fixed .

8.6.4 Year-End Actual Rates

At the end of the fiscal year and once the accounting books and records are “closed,” the projects shall be adjusted

to reflect year-end actual indirect cost rates. These indirect cost rates shall be evaluated individually, per contract,

and adjustments shall be made. If the amounts are considered to be material, an adjustment invoice shall be issued

reflecting the overpayment or underpayment. Project costs shall be segregated by year so that indirect cost rate

adjustments can be easily made, and the indirect cost rates used can be identified.

8.6.5 Final Indirect Cost Rates

Final indirect cost rates refer to the DCAA audit-determined rates that have been audited and approved after all

actual costs for a fiscal year have been collected, analyzed, and compiled in an Incurred Cost Submission. Final

indirect cost rates may not be available for several years after the fiscal year has ended. The Director of Compliance

obtains a final indirect cost rate letter from DCAA and disseminates this final indirect cost rate letter to the

Accounting Department, Contracts Department, and Executive Management. Once approval of final audited indirect

cost rates is received, the final indirect cost rates are used during contract closeout to determine the final contract

billing. The Accounting Department is responsible for entering these final indirect cost rates in VMD’s accounting

system. Final billings should be prepared in accordance with procedures described in Section 5.0 – Final Invoices

and Closeouts.

8.6.6 Nondisclosure of Proprietary Rates

VMD’s direct costs and indirect cost rates are company proprietary for a variety of reasons. In many cases, the

information is personal to individuals (e.g., salary information). In other instances, the information could pose

competitive harm to VMD by divulging to competitors, business partners, and others information that they could use

to our disadvantage. Personnel should exercise great care and sensitivity in the handling of the billing file

documentation and invoices to protect the information from unintended disclosure. Sensitive work papers should not

be left unattended and discarded work papers should be shredded. Under no circumstances should the information be

disclosed to our Prime contractors, subcontractors, or other similar entities external to the company (except DCAA

or other Governmental auditors). In the event anyone requests these indirect cost rates or information in a manner

that would allow them to “compute” indirect cost rates, immediately notify your respective supervisor or manager.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 14

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

9 System Monitoring and Training

9.1 Authority for Policies and Procedures

It is the responsibility of the Accounting Department to prepare, maintain, and implement the Billing Policy.

Furthermore, the Director of Compliance is responsible for the dissemination of the Billing Policy to the billing

personnel and the maintenance of training records.

9.2 Billing System Compliance Reviews

The Director of Compliance coordinates the annual review of the Billing Policy with the Accounting Department.

The review shall cover the following areas:

a. Billing Policy compliance with Government contracting regulations;

b. The adequacy and consistency of application of the Billing Policy for the personnel responsible for billing;

c. Employee knowledge and compliance with the Billing Policy; and

d. Responsiveness to required corrective actions.

Each invoice prepared by the Accounting Department is subject to a quality control review by the PM to ensure

accuracy and timely processing. The Direct of Compliance shall perform annual reviews to ensure that billings are

prepared and that billing files are maintained in accordance with VMD’s policies and procedures.

All material misstatements detected during the review shall be corrected in a timely manner.

9.3 Internal Audits

The Director of Compliance shall perform audits of billing documentation prepared by the Accounting Department.

During the course of the audit, the Director of Compliance shall:

a. Ensure all outstanding over/underpayments are accurately and timely identified and the Contracting Officer

is timely notified;

b. Review Government refunds process to ensure refunds are processed in a timely manner; and

c. Review offsets to contract billings to ensure they were made based on Contracting Officer’s instructions.

9.4 Training Quality and Control

It is VMD’s policy to provide training to all the personnel involved in the billing process to ensure that bills are

prepared correctly and submitted timely.

Formal training on specific topics shall also be provided on an annual basis, which shall mainly focus on the training

needs of the billing personnel.

The training program shall be reviewed annually to ensure current Government rules and regulations are covered.

The Director of Compliance shall maintain training records with course materials and attendance sheets to document

employee training.

Billing personnel working on certain Government billings, like labor-based contracts, may need special

qualifications prior to beginning the billing process. As necessary, VMD shall provide opportunities for the

appropriate personnel to take additional internal training courses or take outside educational courses.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 15

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

9.5 Training Materials and Documentation

The training program shall include, at a minimum, the following:

a. An overview of VMD’s accounting system;

b. Information on specific billing procedures (automated or manual);

c. An overview of written policies and procedures;

d. Instructions on briefing contracts;

e. A description on the review and approval process;

f. Information on penalties associated with the statutes on false claims and false statements acts;

g. Guidance on applicable FAR, supplemental FAR, and contract clauses; and

h. Information on the contract closeout process.

The Billing Policy is available at any time in the Accounting Department. All managers and PMs have access to

these documents as a reference guide for billing-related issues. Billing Policy updates and training materials are the

responsibility of the Accounting Department, with assistance from the Director of Compliance.

Personnel involved in the billing process are expected to read the Billing Policy and adhere to the indicated

requirements. All significant updates to the Billing Policy shall be circulated to all billing personnel with an

acknowledgement form. All billing personnel are expected to review these updates and sign the

acknowledgement/receipt form. the Accounting Department shall retain these forms as evidence for audit purposes.

Sources of more generalized training and professional development include in-house training led by the Direct of

Compliance or Human Capital (HC) personnel.

Additional knowledge can be obtained from Government contracting oriented websites including websites for:

Defense Contract Audit Agency (DCAA); and

Federal Acquisition Regulations (FAR).

10 Enforcement

The VMD Contracts Department verifies compliance to this Policy through various methods, including but not

limited to, periodic internal and external audits, reviews and acquiring certifications from suppliers.

Any exception to the policy must be approved by the Director of Contracts in advance.

A relationship or agreement not in compliance with the guidelines set out in this policy risks being terminated is

immediate corrective action is not taken.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 16

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

Appendices

Appendix A: Acronyms and Key Terms

The following tables present the definitions for acronyms and key terms used in this document.

Table 2: Acronyms

Acronym Definition

CMMC Cybersecurity Maturity Model Certification

CMMI Capability Maturity Model Integration

CPAF Cost-Plus-Award-Fee

CPFF Cost-Plus-Fixed-Fee

DCAA Defense Contract Audit Agency

EAC Estimate at Completion

ETC Estimate to Complete

FAR Federal Acquisition Regulation

FCI Federal Contract Information

FFP Firm-Fixed Price

FP / LOE Fixed Price / Level of Effort

ISO International Organization for Standardization

JSR Job Status Report

MRB Management Review Board

ODC Other Direct Cost

T&M Time and Materials

VMD VMD Corp.

Table 3: Key Terms

Acronym Definition

Cost-Plus-Award-Fee (CPAF) A cost-plus-award-fee (CPAF) contract is a cost-reimbursement contract that provides

for a fee consisting of: (a) a base amount (which may be zero) fixed at inception of the

contract; and (b) an award amount, based upon a judgmental evaluation by the

Government, sufficient to provide motivation for excellence in contract performance.

CPAF contracts are covered in subpart 16.4, Incentive Contracts. See 16.401(e) for a

more complete description and discussion of the application of these contracts. See

16.301-3 and 16.401(e)(5) for limitations.

Cost-Plus-Fixed-Fee (CPFF) A cost-plus-fixed-fee contract (CPFF) is a cost-reimbursement contract that provides

for payment to the contractor of a negotiated fee that is fixed at the inception of the

contract. The fixed fee does not vary with actual cost but may be adjusted because of

changes in the work to be performed under the contract. This contract type permits

contracting for efforts that might otherwise present too great a risk to contractors, but it

provides the contractor only a minimum incentive to control costs.

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 17

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

Billing Policy

Version: 2.0

Approved By: OWNER, 07/27/2020

Firm-Fixed Price (FFP) A firm-fixed-price (FFP) contract provides for a price that is not subject to any

adjustment based on the contractor’s cost experience in performing the contract. This

contract type places upon the contractor maximum risk and full responsibility for all

costs and resulting profit or loss. It provides maximum incentive for the contractor to

control costs and perform effectively and imposes a minimum administrative burden

upon the contracting parties. The contracting officer may use a FFP contract in

conjunction with an award-fee incentive (see 16.404) and performance or delivery

incentives (see 16.402-2 an 16.402-3) when the award fee or incentive is based solely

on factors other than cost. The contract type remains FFP when used with these

incentives.

Time and Materials (T&M) A time-and-materials (T&M) contract provides for acquiring supplies or services on the

basis of: (1) Direct labor hours at specified fixed hourly rates that include wages,

overhead, general and administrative expenses, and profit; and (2) Actual cost for

materials (except as provided for in 31.205-26(e) and (f)).

VMD-CON-008 Confidential and Proprietary – All Rights Reserved 18

Printed copy valid for 24 hours from time of printing unless otherwise indicated “CONTROLLED COPY”.

Date printed 2/18/21 1:03 a2/p2

You might also like

- GuidelinesDocument14 pagesGuidelinesEinalial Arravan100% (5)

- 2016 GSTD - BDA TrainingDocument87 pages2016 GSTD - BDA TrainingRaja100% (6)

- Simphony FreedomPay MARRIOTT Implementation Guide v1.1Document91 pagesSimphony FreedomPay MARRIOTT Implementation Guide v1.1adnautadigitalNo ratings yet

- RosettaNet PIPsDocument117 pagesRosettaNet PIPsSanjoy Dey100% (1)

- 7 Procurement Best Practices HandbookDocument44 pages7 Procurement Best Practices HandbookRaja100% (1)

- ELM 361 RS 5E Instructional Model TemplateDocument7 pagesELM 361 RS 5E Instructional Model TemplateBrittany AndersonNo ratings yet

- Accounts Receivable SOP Apr'22Document237 pagesAccounts Receivable SOP Apr'22AndyTanNo ratings yet

- Nestlé Continuous Excellence: Goal AlignmentDocument38 pagesNestlé Continuous Excellence: Goal AlignmentRajaNo ratings yet

- Dmaic: Focused Improvement Nestlé Continuous ExcellenceDocument21 pagesDmaic: Focused Improvement Nestlé Continuous ExcellenceRajaNo ratings yet

- Oracle Financials (GL, AP, AR, CE, FA)Document11 pagesOracle Financials (GL, AP, AR, CE, FA)manukleo100% (1)

- FP&A IntroDocument13 pagesFP&A Introruchirvatsal7731No ratings yet

- Chain of Custody PolicyDocument7 pagesChain of Custody PolicyRajaNo ratings yet

- 2-Pre-Qualification of Contractor & Types of Contract - PPTDocument19 pages2-Pre-Qualification of Contractor & Types of Contract - PPTHannan FarooqiNo ratings yet

- PreambleDocument18 pagesPreambleJayrold Catandijan LertidoNo ratings yet

- Gray G B - Studies in Hebrew Proper Names - 1896Document365 pagesGray G B - Studies in Hebrew Proper Names - 1896Vassilis LaspiasNo ratings yet

- Dispute Between A Man and His Ba - TranscribedDocument12 pagesDispute Between A Man and His Ba - TranscribedCarrie Arbuckle100% (1)

- Accounts Receivable and Collections Policy APPROVED April 19 2017Document37 pagesAccounts Receivable and Collections Policy APPROVED April 19 2017Aleli Manimtim-CorderoNo ratings yet

- Procurement PolicyDocument30 pagesProcurement PolicyRajaNo ratings yet

- PICKRR - Vendor OnboardingDocument2 pagesPICKRR - Vendor OnboardingPrashant KurseNo ratings yet

- Performance Improvement Plan (Citillion) - Alisa EditDocument6 pagesPerformance Improvement Plan (Citillion) - Alisa EditPaul André OfianaNo ratings yet

- SAP BI - Delivery Note - v1.0Document5 pagesSAP BI - Delivery Note - v1.0keneithNo ratings yet

- Inventory Master File: Lecture Topic: During The Lecture, Take Notes Here. Insert A Sub-Page For Each Lecture TopicDocument3 pagesInventory Master File: Lecture Topic: During The Lecture, Take Notes Here. Insert A Sub-Page For Each Lecture TopicpalaviyaNo ratings yet

- Fixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDocument164 pagesFixed Asset Accounting and Management Procedures Manual: Revised December 2005 IDessie TarekegnNo ratings yet

- Account Criteria For Restructured IT ScriptsDocument92 pagesAccount Criteria For Restructured IT ScriptsvenugopalNo ratings yet

- CTP Candidate Handbook: Certified Treasury ProfessionalDocument28 pagesCTP Candidate Handbook: Certified Treasury ProfessionalAparnaBhattNo ratings yet

- Supplier Payment GuideDocument8 pagesSupplier Payment Guidekhanusman7788No ratings yet

- Purpose: Fiscal Procedure F525 - Petty CashDocument6 pagesPurpose: Fiscal Procedure F525 - Petty CashVictor TucoNo ratings yet

- CFO Policies and ProceduresDocument4 pagesCFO Policies and ProceduresMuhammad Adnan RanaNo ratings yet

- Finance Department Accounts Payable SOPDocument51 pagesFinance Department Accounts Payable SOPsamatajoilNo ratings yet

- Financial and Business Process Review 2022 - 2Document11 pagesFinancial and Business Process Review 2022 - 2Justine Jay Chatto AlderiteNo ratings yet

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Account AccountDocument12 pagesAccount AccountblackghostNo ratings yet

- 96byte SpecDocument166 pages96byte Specakv_oracleNo ratings yet

- How To Run Sap Code Inspector To Do Static Abap Performance CheckDocument20 pagesHow To Run Sap Code Inspector To Do Static Abap Performance CheckHuseyn IsmayilovNo ratings yet

- Mrs Terri Williams TynerDocument3 pagesMrs Terri Williams Tynerapi-255253557No ratings yet

- One SiteDocument2 pagesOne SiteVanessa Burbano AyalaNo ratings yet

- APDocument6 pagesAPprasana devi babu raoNo ratings yet

- Sop For Manual DaybookDocument2 pagesSop For Manual DaybookAudit helpNo ratings yet

- Fixed Assets - RevisedDocument6 pagesFixed Assets - RevisedPiyush MundadaNo ratings yet

- Depreciation Schedule ExampleDocument8 pagesDepreciation Schedule ExampleJenelyn PontiverosNo ratings yet

- Finance AccountsDocument13 pagesFinance AccountsVishal ChaudharyNo ratings yet

- Standard Business Credit Vetting FormDocument1 pageStandard Business Credit Vetting FormJade Clarke-MackintoshNo ratings yet

- Accounting Department ManualDocument11 pagesAccounting Department Manualapi-491139136No ratings yet

- SOP - Credit Control ManagmentDocument5 pagesSOP - Credit Control ManagmentNika PheanaNo ratings yet

- Chapter+11 Transactional+CycleDocument35 pagesChapter+11 Transactional+Cyclemohazka hassan100% (1)

- Capital Authorization Request PolicyDocument19 pagesCapital Authorization Request PolicySaikumar SelaNo ratings yet

- Public Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionFrom EverandPublic Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionNo ratings yet

- EBS Payroll-E13514Document240 pagesEBS Payroll-E13514rviryantharaNo ratings yet

- Offshore Accounting Outsourcing The Case of IndiaDocument66 pagesOffshore Accounting Outsourcing The Case of IndiaPeter ThomasNo ratings yet

- Online STMTDocument7 pagesOnline STMTdjk765No ratings yet

- Supplier ChecklistDocument12 pagesSupplier Checklisttushar.sasaneNo ratings yet

- AP Invoice Interface TableDocument12 pagesAP Invoice Interface TablegvsekarNo ratings yet

- Chap12 Purchases Cash Disbursements TransactionsDocument111 pagesChap12 Purchases Cash Disbursements TransactionsStefany Mie MosendeNo ratings yet

- AcumaticaERP Self-Service Portal UserDocument140 pagesAcumaticaERP Self-Service Portal UsercrudbugNo ratings yet

- Implementation ProcessDocument5 pagesImplementation ProcessBharat SahniNo ratings yet

- Create A Project Expense Journal in D365Document3 pagesCreate A Project Expense Journal in D365Dynamic Netsoft TechnologiesNo ratings yet

- PPE Impairment MemoDocument1 pagePPE Impairment MemowidyawatiNo ratings yet

- PayrollDocument73 pagesPayrollKamran KhanNo ratings yet

- EBPP Proposal Ver6 (AMEX)Document56 pagesEBPP Proposal Ver6 (AMEX)Jessie SokhiNo ratings yet

- Audit of Account ReceivablesDocument18 pagesAudit of Account ReceivablesnaniappoNo ratings yet

- Process Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008Document28 pagesProcess Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008barbarabolognesiNo ratings yet

- Purple Beetle Café Daily InventoryDocument3 pagesPurple Beetle Café Daily InventorykrizylNo ratings yet

- What Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingDocument12 pagesWhat Is Meant by R2R? R2R Plays A Vital Role in The Company, Collecting Data and PostingRAM SUBBAREDDYNo ratings yet

- Financial Statements ChecklistDocument1 pageFinancial Statements ChecklistAsis KoiralaNo ratings yet

- Export Price List EBMDocument2 pagesExport Price List EBMJam Fezan50% (2)

- SOP Accounts Payable v3Document16 pagesSOP Accounts Payable v3CA Sanjay SapkalNo ratings yet

- Conversion Plan ReportDocument8 pagesConversion Plan Reportbvital100% (1)

- Coindirect CDD Form - Filled - NN 2Document7 pagesCoindirect CDD Form - Filled - NN 2ginaNo ratings yet

- Cash Receipt Process Flowchart2Document8 pagesCash Receipt Process Flowchart2nongmckeyNo ratings yet

- StatementDocument10 pagesStatementt2586917No ratings yet

- Line 9 Bottle Quality DMAICDocument44 pagesLine 9 Bottle Quality DMAICRajaNo ratings yet

- Executive Search & Recruiting Firm - SagencyDocument13 pagesExecutive Search & Recruiting Firm - SagencyRajaNo ratings yet

- 10 Reasons Why Companies Use Staffing Agencies - Apollo TechnicalDocument10 pages10 Reasons Why Companies Use Staffing Agencies - Apollo TechnicalRajaNo ratings yet

- Digital - Ezra Firestone - Google SearchDocument2 pagesDigital - Ezra Firestone - Google SearchRajaNo ratings yet

- Adaptive Decision Support Systems: Fazlollahi, Parikh, Verma/ 1Document49 pagesAdaptive Decision Support Systems: Fazlollahi, Parikh, Verma/ 1RajaNo ratings yet

- Efine Mprove Nalyse: Project/ProblemDocument4 pagesEfine Mprove Nalyse: Project/ProblemRaja100% (1)

- Efficient Decision Support Systems PractDocument471 pagesEfficient Decision Support Systems PractRajaNo ratings yet

- Parallel Optimization Theory AlgorithmsDocument21 pagesParallel Optimization Theory AlgorithmsRajaNo ratings yet

- Incident Log - TemplateDocument10 pagesIncident Log - TemplateRajaNo ratings yet

- Nageswar Rao 3Document194 pagesNageswar Rao 3RajaNo ratings yet

- On-Premise SQL Server To Azure SQL Data Warehouse, Using Data Platform Studio. (PDFDrive)Document22 pagesOn-Premise SQL Server To Azure SQL Data Warehouse, Using Data Platform Studio. (PDFDrive)RajaNo ratings yet

- Strategic Planning ProcessDocument9 pagesStrategic Planning ProcessRajaNo ratings yet

- Supplier Evaluation ProcessDocument9 pagesSupplier Evaluation ProcessRajaNo ratings yet

- Subcontracting ProcessDocument11 pagesSubcontracting ProcessRaja100% (1)

- VMD Corp IMS Policies PosterDocument1 pageVMD Corp IMS Policies PosterRajaNo ratings yet

- Curriculum Guide: Artificial Intelligence and Machine Learning: Business ApplicationsDocument8 pagesCurriculum Guide: Artificial Intelligence and Machine Learning: Business ApplicationsRajaNo ratings yet

- VMD Operations ProcessDocument9 pagesVMD Operations ProcessRajaNo ratings yet

- Employee HandbookDocument77 pagesEmployee HandbookRajaNo ratings yet

- Employee Referral Program Slick SheetDocument1 pageEmployee Referral Program Slick SheetRajaNo ratings yet

- Montgomery Co Urgent Care Testing CovidDocument5 pagesMontgomery Co Urgent Care Testing CovidRajaNo ratings yet

- PQA Audit Template - ProjectsDocument39 pagesPQA Audit Template - ProjectsRajaNo ratings yet

- 3 HACCP Complex FoodDocument4 pages3 HACCP Complex FoodAssumta RamosNo ratings yet

- International Law Glossary:: A Non Liquet A Titre de Souverain The Blue ListDocument4 pagesInternational Law Glossary:: A Non Liquet A Titre de Souverain The Blue ListRIDWAN ARIFINNo ratings yet

- Amelita Constantino and Michael Constantin VS Ivan Mendez GR 57227 May 14 J 1992Document1 pageAmelita Constantino and Michael Constantin VS Ivan Mendez GR 57227 May 14 J 1992Abdullah JulkanainNo ratings yet

- Quality Circle CivilDocument15 pagesQuality Circle CivilPrashant PatilNo ratings yet

- Read The Following Text To Answer Questions Number 1 and 2Document4 pagesRead The Following Text To Answer Questions Number 1 and 2chefa foreverNo ratings yet